Fill Out Your Mississippi Resale Certificate Form

When engaging in retail transactions within Mississippi, the Resale Certificate form plays a crucial role in ensuring compliance with sales tax regulations. This important document serves as a declaration by a purchaser, confirming that the goods or services being acquired are intended for resale rather than personal use. By completing the form, business owners assert their commitment to the proper tax obligations, acknowledging their responsibility for any applicable sales or use taxes. The certificate not only protects sellers from unexpected tax liabilities but also serves as a safeguard for the purchaser, who gains the legal backing to purchase goods tax-free for resale purposes. It is essential to understand that this certification is not a one-time requirement; it provides a blanket statement that remains in effect for all future orders until formally rescinded in writing. Proper completion and signing of the form are vital, as a warning clearly indicates that neglecting these steps may render the certificate invalid. Therefore, both buyers and sellers must be diligent in their responsibilities to ensure smooth transactions. In this article, you'll discover everything you need to know about the Mississippi Resale Certificate form, including its significance, necessary details, and best practices to guarantee compliance in all your resale dealings.

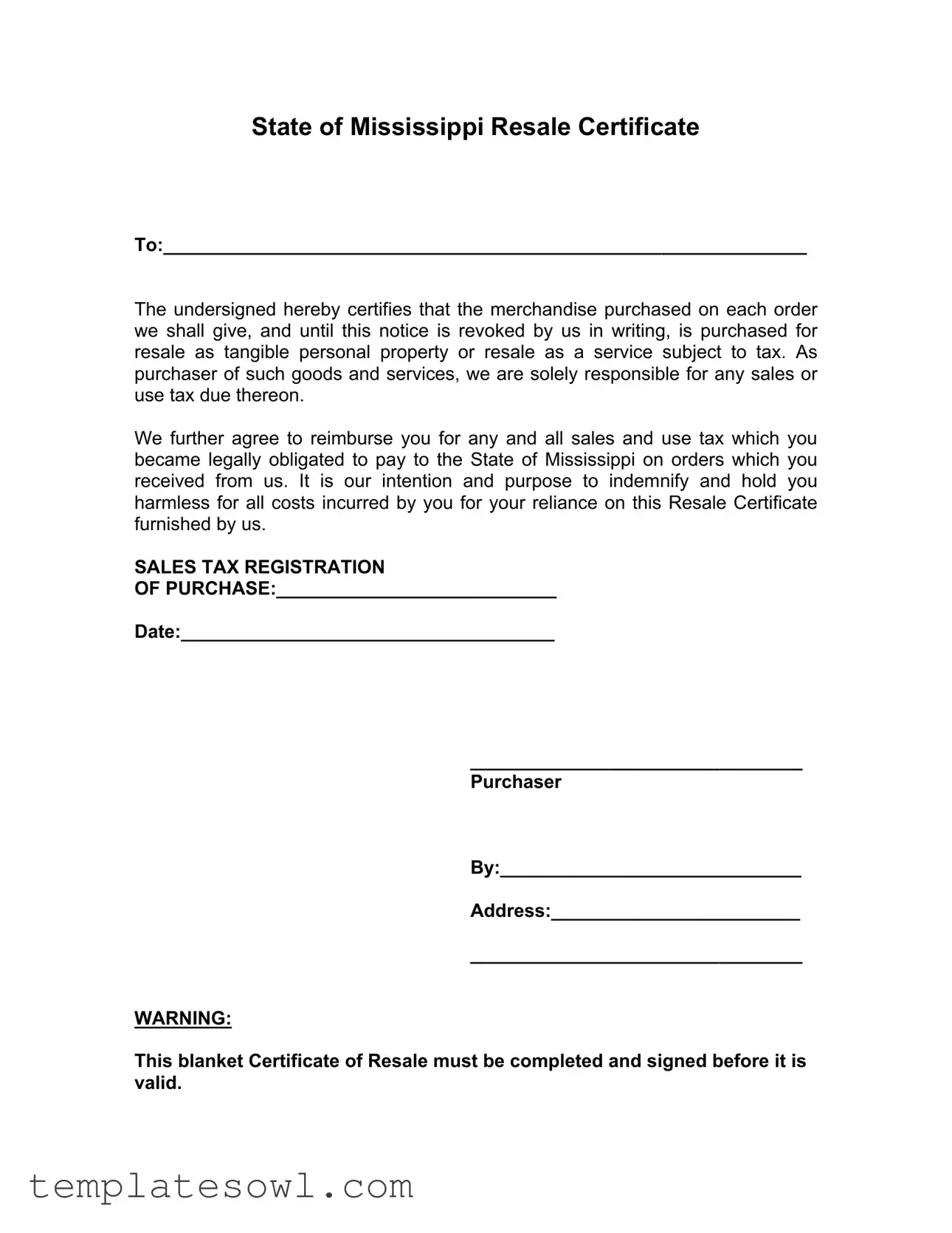

Mississippi Resale Certificate Example

State of Mississippi Resale Certificate

To:______________________________________________________________

The undersigned hereby certifies that the merchandise purchased on each order we shall give, and until this notice is revoked by us in writing, is purchased for resale as tangible personal property or resale as a service subject to tax. As purchaser of such goods and services, we are solely responsible for any sales or use tax due thereon.

We further agree to reimburse you for any and all sales and use tax which you became legally obligated to pay to the State of Mississippi on orders which you received from us. It is our intention and purpose to indemnify and hold you harmless for all costs incurred by you for your reliance on this Resale Certificate furnished by us.

SALES TAX REGISTRATION

OF PURCHASE:___________________________

Date:____________________________________

________________________________

Purchaser

By:_____________________________

Address:________________________

________________________________

WARNING:

This blanket Certificate of Resale must be completed and signed before it is valid.

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The Mississippi Resale Certificate is used by businesses to purchase goods or services without paying sales tax, as long as these items are intended for resale. |

| Governing Law | The use and requirements of the Mississippi Resale Certificate are governed by the Mississippi Sales and Use Tax Law, specifically Mississippi Code Annotated Section 27-65-27. |

| Indemnification Clause | The certificate includes a provision that the purchaser will indemnify the seller for any sales or use tax liabilities that arise from the sales made with this certificate. |

| Validity Requirements | For the certificate to be valid, it must be completed and signed by the purchaser before any tax exemption can apply. |

Guidelines on Utilizing Mississippi Resale Certificate

Once you have the Mississippi Resale Certificate form, the next steps involve entering specific information and signing the form to validate it. Ensure that all provided details are accurate, as discrepancies could lead to issues in the future.

- At the top of the form, locate the section labeled "To:" and fill in the name of the seller or business from whom you are purchasing the merchandise.

- In the following paragraph, confirm that you are purchasing the merchandise for resale. This part of the form is usually already provided for you, but you should review it to make sure it aligns with your intentions.

- Next, find the line labeled "SALES TAX REGISTRATION OF PURCHASER:" and enter your sales tax registration number.

- Then, go to the section labeled "Date:" and insert the current date.

- Following the date, you will need to sign the form. Sign your name on the line marked "Purchaser By:" to indicate your agreement with the information provided.

- In the last section, provide the address of your business or personal address underneath the signature line.

Make sure to double-check all entries before submitting the form. Once completed, keep a copy for your records, and deliver the original to the seller. Remember, this form must be signed to be valid.

What You Should Know About This Form

What is a Mississippi Resale Certificate?

A Mississippi Resale Certificate is a document that allows businesses to purchase goods and services for resale without paying sales tax at the time of purchase. This certificate is used by retailers and wholesalers to provide documentation to suppliers, indicating that the items will not be subject to sales tax due to the intention to resell the merchandise.

Who can use the Mississippi Resale Certificate?

Only businesses registered for sales tax in Mississippi can utilize this certificate. The purchaser must intend to resell the items as tangible personal property or services. It is essential to have a valid sales tax registration number to ensure compliance with state tax laws.

How do I complete the Mississippi Resale Certificate?

To complete the Mississippi Resale Certificate, provide the name and address of the purchaser and include the sales tax registration number. The certificate must be signed and dated by an authorized representative of the purchasing business. Full details ensure its validity when presented to suppliers.

Does using a Resale Certificate mean I do not owe sales tax on purchases?

While a Resale Certificate allows businesses to avoid paying sales tax up front, the purchaser is still responsible for any sales or use tax that may apply once the items are sold. If products are not resold, the business must remit the applicable taxes to the State of Mississippi.

Can the Resale Certificate be used for multiple purchases?

Yes, the Mississippi Resale Certificate can serve as a blanket certificate for multiple purchases. The form must be completed and signed, and it remains valid until revoked in writing by the purchaser. Businesses should communicate with their suppliers regarding any changes to their resale status.

What happens if I misuse the Resale Certificate?

If a business misuses the Resale Certificate — for example, by buying items for personal use instead of for resale — it may be subject to penalties. This misuse leads to potential legal and financial consequences involving back taxes and fines, as sellers may hold businesses liable for unpaid sales tax.

How can I revoke a Resale Certificate?

To revoke a Mississippi Resale Certificate, a business must provide written notice to the suppliers who have accepted the certificate. This notice should clearly state the intent to terminate the certificate's validity and must be signed by an authorized representative. Maintaining clear communication with suppliers helps avoid confusion.

Common mistakes

Many individuals experience confusion when completing the Mississippi Resale Certificate form, leading to potential errors. One common mistake is failing to provide complete information in the designated fields. The form requires detailed information such as the purchaser's name, address, and sales tax registration number. Omitting or incorrectly entering any of these details can invalidate the certificate. This, in turn, can create complications for the seller regarding tax obligations.

Another frequent error occurs when individuals neglect to date the form properly. The date on the Mississippi Resale Certificate is crucial because it signals when the form is effective. A missing or incorrectly recorded date raises questions about the validity of the resale claim, and it can lead to misunderstandings with the tax authorities. Such oversights can result in unexpected liability for the seller if an audit uncovers the incomplete documentation.

Signatures often pose another challenge. Some purchasers mistakenly believe that a printed name suffices. However, the form clearly states that a handwritten signature is required. Without a valid signature, the certificate lacks authenticity and cannot serve its intended purpose. This oversight may not only affect transactions at the time of sale but can also impact ongoing business relationships between buyers and sellers.

Lastly, there is often confusion over the purpose of the resale certificate. Purchasers may misinterpret it as a blanket exemption for all purchases. However, it is essential to understand that the certificate only applies to items intended for resale. Misuse of the form could lead to unintentional tax liabilities should the state determine that the goods were for personal use rather than professional resale. Clear communication about the intent behind the purchase can help avoid this pitfall.

Documents used along the form

The Mississippi Resale Certificate serves as a vital document for businesses engaging in the resale of tangible goods. However, several other forms and documents are frequently used alongside it to ensure compliance with state tax laws and facilitate smooth transactions. Here are some important documents to consider.

- Sales Tax Permit: This document allows a business to legally collect sales tax from customers on taxable sales. It is issued by the state and verifies that the business is registered for sales tax purposes.

- Vendor’s License: This license permits a business to sell goods or services to consumers. Obtaining a vendor's license is often a legal requirement prior to selling any products or services in a specific jurisdiction.

- Purchase Order: A purchase order is an official document issued by a buyer to a seller, outlining the details of a purchase, including quantities and agreed prices. It serves as a formal confirmation of the buyer's intent to purchase.

- Invoice: An invoice is a document sent by a seller to a buyer requesting payment for goods or services provided. It lists the items sold, their quantities, and the total amount due, including applicable taxes.

- Exempt Use Certificate: In some cases, certain items or services may be exempt from sales tax under specific circumstances. This certificate allows purchasers to claim such exemptions legally.

- Supplier’s Certificate: This document is provided by suppliers to certify that the goods being sold are intended for resale, helping buyers substantiate their resale claims.

- Transaction Records: Comprehensive records of all transactions are essential for tracking purchases and sales over time. These records offer a history of business activity, which can be necessary for audits or tax purposes.

Utilizing these supporting documents alongside the Mississippi Resale Certificate helps ensure that businesses maintain compliance with tax regulations and streamlines operations. Careful attention to documentation can prevent misunderstandings and disputes related to sales and use tax obligations.

Similar forms

The Mississippi Resale Certificate form serves a specific purpose in sales tax processes. It is similar to several other documents used in different contexts or states. Here's a list that outlines the similarities:

- Purchase Order: A purchase order is a document issued by a buyer to request goods or services. Like the resale certificate, it specifies that the items ordered are for resale, and it outlines the terms of the transaction.

- Sales Tax Exemption Certificate: This certificate certifies that the buyer is exempt from paying sales tax on specific purchases. Both documents require a justification for tax exemption, focusing on resale intentions.

- Wholesale Certificate: A wholesale certificate allows a buyer to purchase goods at a lower rate, intending to sell them to consumers. Similar to the resale certificate, it highlights the buyer's intent to resell the purchased items.

- Tax-Exempt Form: This form allows certain organizations or individuals to make purchases without paying sales tax. Like the resale certificate, it demonstrates the buyer's status that qualifies them for exemption from sales tax.

- Consignment Agreement: This agreement outlines terms under which goods are provided to a seller for resale. It shares the essence of resale as described in the resale certificate, noting that the items will be sold rather than consumed.

- Retail Sales Tax License: This license allows a business to collect sales tax from customers. While different in application, both documents confirm that the parties involved recognize and comply with sales tax regulations regarding resale activities.

Dos and Don'ts

When completing the Mississippi Resale Certificate form, it is crucial to follow specific guidelines to ensure everything is in order. Below are seven important things to do and avoid:

- Do accurately fill in the name and address of the purchaser.

- Do include the sales tax registration number of the purchaser.

- Do ensure the form is signed by an authorized person from the purchasing organization.

- Do clearly specify the type of merchandise or services purchased for resale.

- Don't forget to date the form when submitting it.

- Don't leave any required fields blank, as incomplete forms can lead to compliance issues.

- Don't use the resale certificate for purchases that are not intended for resale.

Ensuring that you follow these instructions can help you avoid potential issues with tax compliance and streamline your purchasing process.

Misconceptions

Understanding the Mississippi Resale Certificate can prevent confusion and streamline sales processes. Here are seven common misconceptions about this form:

- Misconception 1: The resale certificate is only needed for large purchases.

- Misconception 2: Businesses can use a resale certificate for personal purchases.

- Misconception 3: A completed resale certificate guarantees tax-exempt status.

- Misconception 4: All sellers must accept resale certificates.

- Misconception 5: Resale certificates expire quickly.

- Misconception 6: Only certain types of merchandise can be purchased with a resale certificate.

- Misconception 7: A verbal agreement is enough to use a resale certificate.

Many believe that the resale certificate is only necessary for bulk transactions. In reality, any purchase made for resale, regardless of size, requires this certificate.

This is false. The resale certificate is strictly for goods meant for resale. Personal purchases must be handled differently and do not qualify.

While a completed certificate can exempt a buyer from paying sales tax at the time of purchase, it does not guarantee that all transactions will always remain tax-free. Buyers must adhere to applicable laws.

Sellers are not required to accept a resale certificate. Each seller has the right to establish their own policies regarding resale certificates.

This is not accurate. The certificate remains valid until it is revoked in writing. However, businesses should keep their information updated to avoid any issues.

This is incorrect. A resale certificate can be used for tangible personal property, and in certain cases, services subject to tax. It's not limited to specific categories.

This is simply not true. The law requires a written and signed certificate for it to be considered valid.

Key takeaways

When utilizing the Mississippi Resale Certificate form, there are several important points to consider. Understanding these aspects can help ensure compliance and facilitate smooth transactions.

- Complete all required information: Ensure that the form is filled out fully, including the name of the purchaser, sales tax registration number, and address. Incomplete forms may lead to complications.

- Understand the purpose: This form certifies that the items being purchased will be resold rather than used personally. Misuse of the certificate can lead to legal and financial repercussions.

- Keep records: Maintain copies of all resale certificates issued and received. These records can be crucial if any tax authority questions the validity of a sale.

- Annual review: Periodically review resale certificates to confirm that they remain current and accurate. This practice helps avoid potential issues with sales tax authorities.

- Signing the form: Remember, the certificate is not valid unless it is signed by an authorized person. Ensure that signatures are updated as personnel changes occur.

- Revocation of certificate: If the purchaser’s status changes or if the certificate is no longer valid, written notice must be provided to the seller. Without revocation, prior transactions can still be viewed as exempt from tax.

By observing these guidelines, businesses can efficiently navigate the requirements of the Mississippi Resale Certificate and reduce the risk of potential tax liabilities.

Browse Other Templates

St108 - Importantly, detailed trade-in information is required when applicable.

Voyager Credit Card - Read and retain the Commercial Fleet Card Terms and Conditions for your records.