Fill Out Your Bmo Direct Deposit Form

When it comes to managing your finances efficiently, setting up direct deposit can be a significant step forward. The BMO Direct Deposit form plays a crucial role in this process, allowing you to authorize your employer or a third party to deposit funds directly into your BMO Harris Bank account. This form not only facilitates easier access to your paycheck but also enhances security, as it minimizes the need for physical checks. To complete the form, you'll need to include various pieces of information, such as your Employee ID number, Social Security number, and specific account details. You can designate one or two checking accounts for direct deposit, specifying the amount to be deposited into each. It's also important to provide your customer's name, phone number, and contact information for clarity and communication. Before finalizing your application, remember to attach either a voided check or a pre-printed deposit slip. This ensures that your account information is accurate and helps avoid any potential errors in processing. Once all details are filled out, mere submission to your human resources or payroll processing department can set your direct deposit into motion, providing a more streamlined approach to receiving your payments.

Bmo Direct Deposit Example

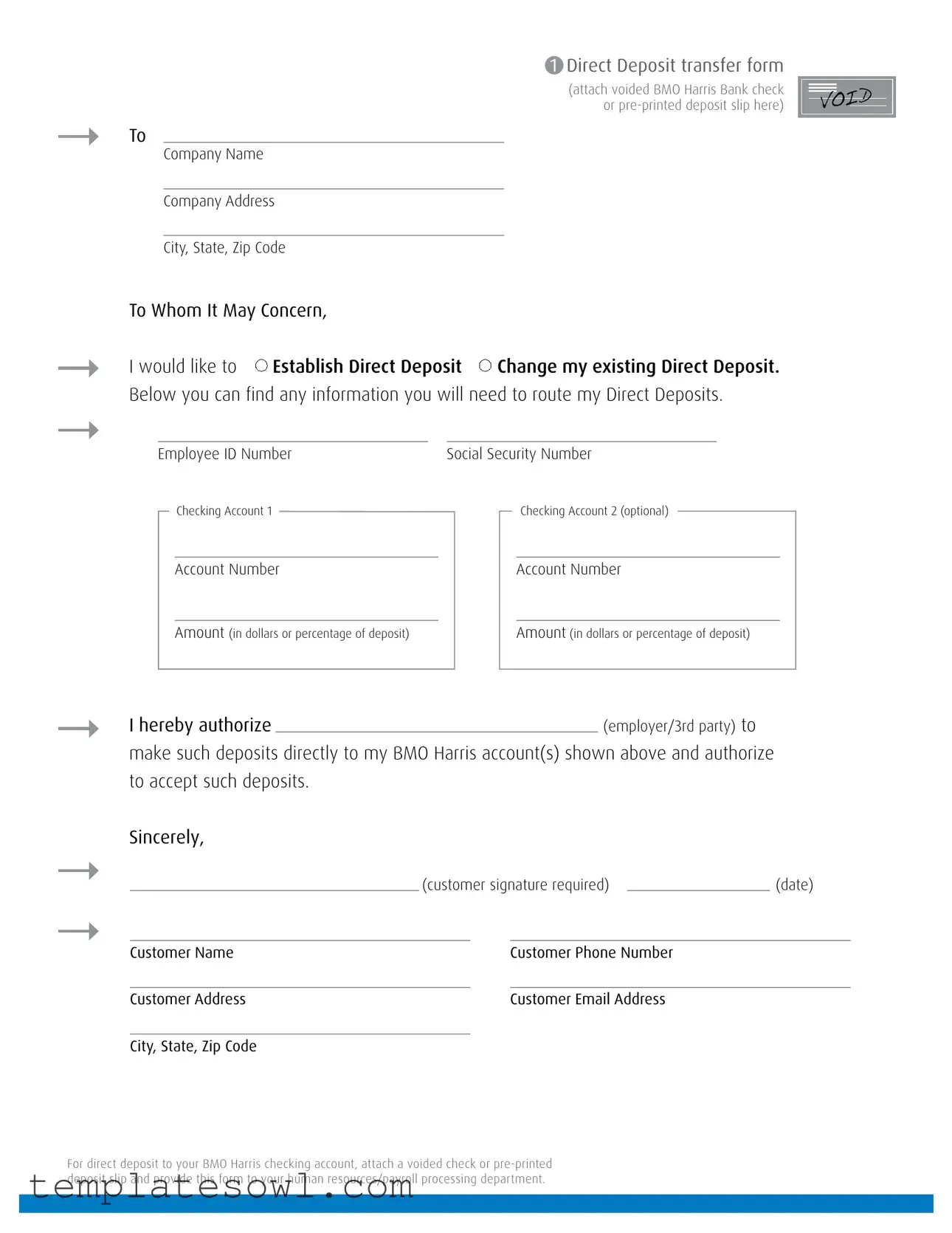

1 Direct Deposit transfer form

(attach voided BMO Harris Bank check or

To

Company Name

Company Address

City, State, Zip Code

To Whom It May Concern, |

|

|

|

|

||

I would like to |

Establish Direct Deposit |

Change my existing Direct Deposit. |

||||

Below you can find any information you will need to route my Direct Deposits. |

||||||

|

|

|

|

|

||

|

Employee ID Number |

|

Social Security Number |

|||

Checking Account 1

Checking Account 2 (optional)

Account Number

Account Number

Amount (in dollars or percentage of deposit)

Amount (in dollars or percentage of deposit)

I hereby authorize |

|

|

|

|

(employer/3rd party) to |

|

||

make such deposits directly to my BMO Harris account(s) shown above and authorize |

|

|||||||

to accept such deposits. |

|

|

|

|

|

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

(customer signature required) |

|

|

(date) |

|||

|

|

|

|

|

||||

Customer Name |

|

|

Customer Phone Number |

|

||||

|

|

|

|

|

||||

Customer Address |

|

|

Customer Email Address |

|

||||

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

|

|

|

|

|

|

|

For direct deposit to your BMO Harris checking account, attach a voided check or

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used to either establish or change direct deposit arrangements for employees at BMO Harris Bank. |

| Required Attachments | A voided check or a pre-printed deposit slip from a BMO Harris Bank checking account must be attached to the form. |

| Employee Identification | The form requires the employee’s ID number and Social Security number to process the direct deposit. |

| Account Information | Employees can designate up to two checking accounts for direct deposits, specifying an amount or percentage for each. |

| Authorization | By signing the form, the employee authorizes the employer or a third party to make direct deposits into their specified BMO Harris accounts. |

| Human Resources Submission | The completed form, along with the required attachment, must be submitted to the employee's human resources or payroll department. |

| Contact Information | Employees need to provide their contact information, including phone number and email address, to ensure smooth communication. |

| Legal Compliance | BMO Harris Bank direct deposit procedures are governed by the laws of the state where the employee is employed, which may include regulations surrounding direct deposit practices. |

Guidelines on Utilizing Bmo Direct Deposit

Filling out the BMO Direct Deposit form is straightforward. Gather the necessary information and follow these steps to ensure your form is complete and accurate. After submitting the form, your employer will process your request for direct deposit into your BMO Harris account.

- Attach a voided BMO Harris Bank check or a pre-printed deposit slip to the form.

- Write your company's name and address in the designated sections at the top of the form.

- Address the letter to "To Whom It May Concern."

- Select whether you want to establish a new direct deposit or change an existing one by marking the appropriate box.

- Provide your Employee ID Number and Social Security Number in the specified fields.

- Fill in the account numbers for your checking accounts (up to two accounts can be provided).

- Indicate the amount for each deposit (either in dollars or as a percentage of the total deposit) in the appropriate fields.

- Authorize your employer or third party to make direct deposits by signing the form in the signature section.

- Write the date of completion next to your signature.

- Fill in your name, phone number, email address, and home address, including city, state, and zip code.

- Submit the completed form and attached documentation to your human resources or payroll processing department.

What You Should Know About This Form

What is the BMO Direct Deposit form used for?

The BMO Direct Deposit form is used to set up or change direct deposit arrangements for your paycheck or other payments. This allows funds to be deposited directly into your BMO Harris Bank account, simplifying your banking experience.

What information do I need to complete the form?

You will need to provide several pieces of information, including your employee ID number, Social Security number, account numbers for the checking accounts where you want the funds deposited, and any specified amounts or percentages for the deposits. Additionally, you must include your name, contact information, and a signature to authorize the setup.

How do I attach my banking information?

You are required to attach a voided BMO Harris Bank check or a pre-printed deposit slip. This is necessary to ensure accurate routing of the deposits to your account.

Can I distribute my direct deposit across multiple accounts?

Yes, you can split your direct deposit across multiple accounts by indicating the amounts or percentages allocated to each account on the form. This allows flexibility in managing your finances.

Where do I submit the completed form?

After filling out the form and attaching the necessary documentation, submit it to your human resources or payroll processing department. They will handle the processing and ensure your direct deposits are set up correctly.

Is my personal information secure?

Yes, your personal information is treated with confidentiality. The form is used internally to facilitate your direct deposits, but always ensure you hand it directly to authorized personnel to maintain your privacy and security.

What if I encounter issues with my direct deposit after submitting the form?

If you experience problems with your direct deposit, such as a missing payment or incorrect amounts, contact your human resources or payroll department promptly. They will assist you in resolving any issues and, if necessary, direct you to BMO Harris Bank for further support.

Common mistakes

When filling out the BMO Direct Deposit form, individuals often make several mistakes that can delay or prevent the successful establishment of direct deposit. One common error is providing inaccurate personal information. This includes discrepancies in names, addresses, or contact details, which may lead to confusion and processing issues. Ensuring that the information matches what is on record with the bank is crucial.

Another frequent mistake is neglecting to attach a voided check or pre-printed deposit slip. This attachment is essential for verifying account details. Without it, the form may be incomplete, which could result in delays in processing or failure to set up the direct deposit entirely. Individuals should double-check that this document is included before submission.

Additionally, many people overlook the importance of accurately entering account and routing numbers. A simple transposition of digits can lead to deposits being sent to the wrong account. It is advisable to verify these numbers against bank documents before submitting the form.

Another critical error involves failing to specify the correct deposit amounts. Some individuals may mistakenly indicate either a percentage or a dollar amount without clear instruction on how to divide funds between multiple accounts, if applicable. Clarity in this section ensures that funds are allocated correctly according to the individual’s preferences.

Lastly, omitting the required customer signature can invalidate the entire form. The signature confirms authorization for the direct deposit to occur. Individuals should be mindful to include their signature and ensure the date is current. Checking the form for completeness can save time and ensure a smooth transition to direct deposit.

Documents used along the form

When setting up or changing a direct deposit with BMO Harris Bank, several other forms and documents may be required. Each of these documents serves a specific purpose in ensuring a smooth processing experience. Below is a list of commonly used forms along with brief descriptions.

- Voided Check: A check that has been canceled, usually by writing "VOID" across the front. This provides necessary account information required for direct deposit.

- Pre-printed Deposit Slip: A slip provided by the bank displaying the account number and the bank's routing number. It is an alternative to a voided check.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences to their employer. The information here can affect the amount deposited into their accounts after taxes are taken out.

- Employment Verification Letter: A document from an employer that confirms an employee’s job status, salary, and employment dates. Required sometimes for identity and income confirmation.

- Employee Direct Deposit Agreement: This is an agreement between the employee and employer that outlines the terms of the direct deposit arrangement. It typically includes the employee's consent to the arrangement.

- Setting Beneficiary Form: A document that allows an employee to designate a beneficiary for their direct deposits in case of death or disability.

- Change of Address Form: If an employee moves, this form updates the personal information on file with the employer, ensuring direct deposits continue to reach the correct account.

- Authorization for Automatic Deposits: This form gives permission to a bank or employer to automatically deposit funds directly into an employee's account without further action on their part.

These documents collectively ensure that the direct deposit process is handled correctly and efficiently. Having all required forms on hand can help minimize delays and ensure that deposits occur smoothly and on time.

Similar forms

-

Payroll Authorization Form: This document enables employees to authorize their employer to deposit their salary directly into their bank account. Similar to the BMO Direct Deposit form, it requires personal information such as the employee’s name, account number, and bank details, ensuring that payments are processed efficiently and securely.

-

ACH Payment Authorization Form: This form allows individuals or businesses to authorize electronic transfers from their bank account. Like the BMO Direct Deposit form, it typically includes account numbers and routing information, facilitating seamless transfers for various payments, including bills and services.

-

Direct Debit Authorization Form: A direct debit form grants permission to a third party, such as a utility company, to withdraw funds from a bank account automatically. This document aligns closely with the BMO Direct Deposit form as both require detailed banking information to ensure accurate processing of payments.

-

Check Authorization Form: This document allows customers to authorize a vendor or service provider to issue checks for payment directly from their account. Its similarity to the BMO Direct Deposit form lies in the requirement for banking details and consent for the transfer of funds, ensuring that financial transactions are documented and controlled.

Dos and Don'ts

When filling out the BMO Direct Deposit form, keep the following tips in mind:

- Do attach a voided BMO Harris Bank check or a pre-printed deposit slip.

- Do clearly include your complete company name and address.

- Do use your correct Social Security number and Employee ID number.

- Do specify the correct account numbers for each checking account.

- Don't forget to sign and date the form before submission.

- Don't provide incomplete or inaccurate information, as it may delay processing.

Misconceptions

When it comes to the BMO Direct Deposit form, there are several misconceptions that can lead to confusion. Understanding the correct information can streamline the process of setting up or changing your direct deposit. Here are nine common misunderstandings:

- Direct deposit is only for full-time employees. Many people think that only full-time employees are eligible for direct deposit, but this is not true. Part-time employees and even contractors can often set up direct deposits with their employers.

- You need to have a BMO Harris account to use the direct deposit form. This form is specifically for BMO Harris accounts. However, other banks also have their own forms for direct deposit. It's essential to use the correct form for your specific bank.

- Submitting the form alone is enough for direct deposit setup. While completing and submitting the form is important, don’t forget to attach a voided check or a pre-printed deposit slip. This step is crucial for ensuring accurate processing.

- You can split your deposit in any way you want. Though you can choose to direct part of your deposit to multiple accounts, employers may have restrictions on how this can be done. Check with your HR or payroll department for their specific policies.

- Changing an existing direct deposit is a quick process. Changing your direct deposit can take time, especially during payroll cycles. It’s a good idea to submit changes well in advance of your next deposit date.

- Your employer cannot see your account information. While employers do not see your full account numbers, they will have access to information necessary to execute deposits. Ensure your information is accurate to avoid delays.

- Direct deposit eliminates the need for payroll records. Even with direct deposit, you should still keep records of your pay stubs and any other payroll information. This documentation is vital for personal record-keeping and tax purposes.

- You only need to fill in the employee ID and Social Security number. In addition to those details, you must provide account numbers and amounts for deposits. Every field on the form is important for accurate processing.

- It’s unnecessary to inform your HR department of changes. Regardless of changes made through the direct deposit form, notifying your HR or payroll department is crucial. They need to process your request for your changes to take effect.

Understanding these misconceptions can help clear up confusion surrounding the BMO Direct Deposit form. Always verify your understanding with HR to ensure the process goes smoothly.

Key takeaways

When filling out the BMO Direct Deposit form, it is essential to follow certain guidelines to ensure smooth processing.

- Please attach a voided check or pre-printed deposit slip. This is necessary to verify the account information.

- Clearly indicate whether you are establishing a new direct deposit or changing an existing one.

- Fill in your employee ID number and Social Security number accurately to avoid delays.

- Provide details for the checking accounts. You can include one or two accounts, depending on your needs.

- Specify the amount of the deposit, either in dollars or as a percentage of the total deposit.

- Ensure your signature is included on the form. It is a crucial step in authorizing the direct deposit.

- Contact information is vital. Include your phone number and email address for any follow-up communication.

- Submit the completed form to your human resources or payroll department promptly.

- Keep a copy of the filled-out form for your records. It may be useful for future reference.

Following these steps will help facilitate a successful activation of your direct deposit with BMO Harris Bank.

Browse Other Templates

Publx - Prioritize clarity when listing your skills and abilities.

California Sales Tax Exemption - Ensure compliance with California’s Revenue & Taxation Code when using this.