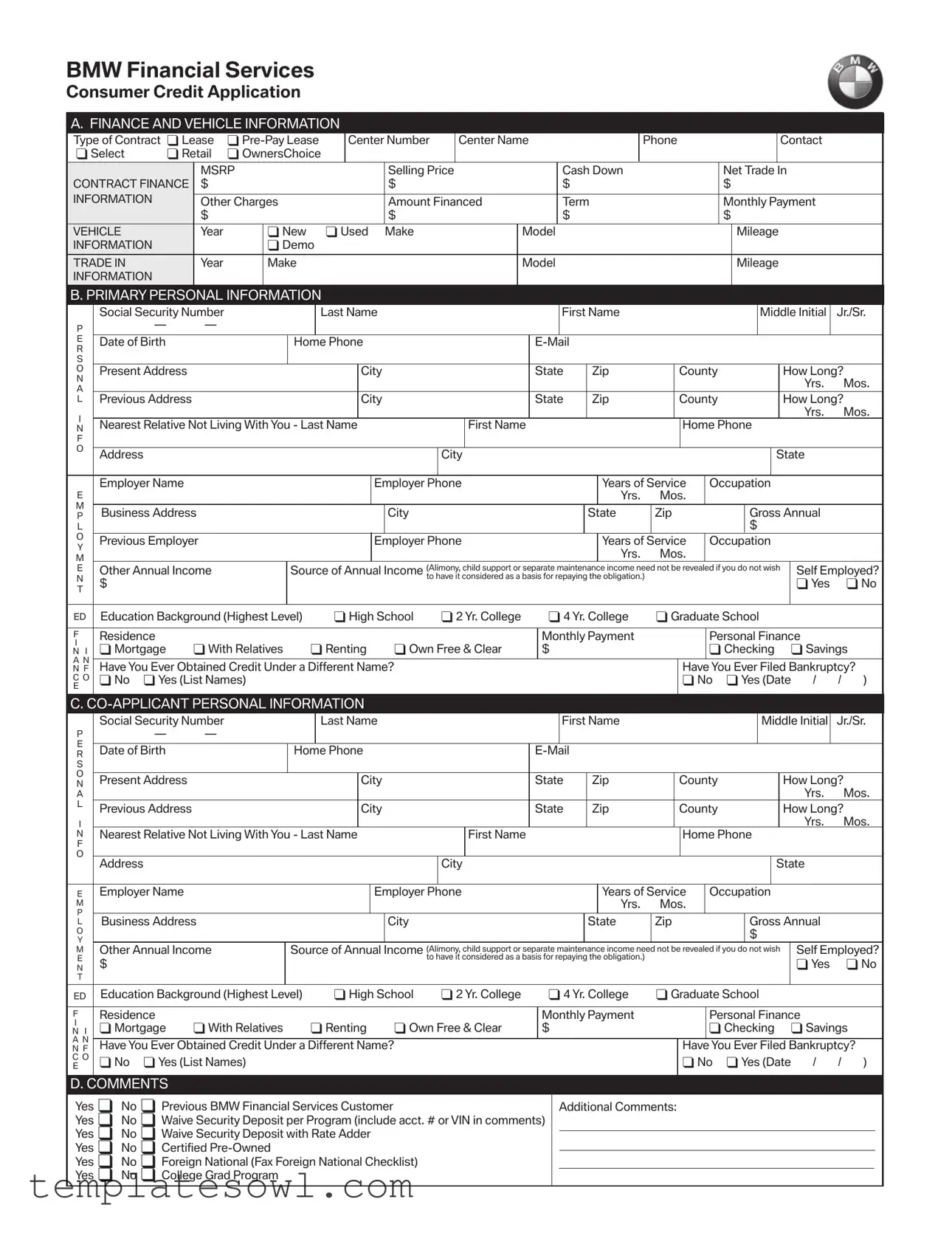

Fill Out Your Bmw Credit Application Form

Applying for a BMW credit is an important step for many potential car owners, and the BMW Credit Application form is designed to make this process as straightforward as possible. This comprehensive form collects key details, starting with finance and vehicle information, where applicants indicate whether they’re leasing or purchasing, alongside vehicle specifics such as make, model, and price. Personal information is next, including social security numbers and current addresses, which help establish the applicant’s identity and financial background. The form also includes sections for employment details and income sources, allowing potential lenders to assess creditworthiness. Additionally, it addresses trade-in vehicles, which many buyers consider. Special notices tailored for residents of various states ensure compliance with local financial regulations. The form culminates in an authorization section, permitting BMW Financial Services to evaluate the provided information during the credit approval process. By understanding these aspects, applicants can approach the credit application with confidence, knowing that it’s a straightforward gateway to owning a luxury vehicle.

Bmw Credit Application Example

BMW Financial Services

Consumer Credit Application

A. FINANCE AND VEHICLE INFORMATION

|

Type of Contract Lease |

|

Center Number |

|

Center Name |

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

Contact |

|

|

|

|||||||||||||||||||

|

Select |

Retail |

OwnersChoice |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSRP |

|

|

|

|

|

|

|

|

Selling Price |

|

|

|

Cash Down |

|

|

|

|

|

Net Trade In |

|

|

|

|

|||||||||||||

|

CONTRACT FINANCE |

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Other Charges |

|

|

|

|

Amount Financed |

|

|

|

Term |

|

|

|

|

|

Monthly Payment |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

VEHICLE |

|

|

Year |

|

New |

Used |

Make |

|

|

|

Model |

|

|

|

|

|

|

|

|

|

Mileage |

|

|

|

|

||||||||||||||||

|

INFORMATION |

|

|

|

|

Demo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

TRADE IN |

|

|

Year |

|

Make |

|

|

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

|

|

Mileage |

|

|

|

|

|||||||||||||

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

B. PRIMARY PERSONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

Middle Initial |

Jr./Sr. |

|||||||||||||||

|

P |

|

|

— |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

Date of Birth |

|

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

Present Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

County |

|

|

|

|

|

How Long? |

|

|

|||||||||||||

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

||

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

L |

|

Previous Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

County |

|

|

|

|

|

How Long? |

|

|

|||||||||||||

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

||

|

N |

|

Nearest Relative Not Living With You - Last Name |

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|

|

|||||||||||||||||||||

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Employer Name |

|

|

|

|

|

|

|

|

Employer Phone |

|

|

|

|

|

Years of Service |

|

Occupation |

|

|

|

|

||||||||||||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

Zip |

|

|

|

|

Gross Annual |

|

|

|

||||||||||||

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

O |

|

Previous Employer |

|

|

|

|

|

|

|

|

Employer Phone |

|

|

|

|

|

Years of Service |

|

Occupation |

|

|

|

|

||||||||||||||||||

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

E |

|

Other Annual Income |

|

|

Source of Annual Income (Alimony, child support or separate maintenance income need not be revealed if you do not wish |

|

Self Employed? |

||||||||||||||||||||||||||||||||||

|

N |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

to have it considered as a basis for repaying the obligation.) |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

ED |

|

Education Background (Highest Level) |

|

High School |

|

2 Yr. College |

|

|

|

4 Yr. College |

Graduate School |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

F |

|

Residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Payment |

|

|

|

|

Personal Finance |

|

|

|

|||||||||||||||

|

I |

|

Mortgage |

With Relatives |

Renting |

Own Free & Clear |

|

$ |

|

|

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

||||||||||||||||||||

|

N I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

A N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have You Ever Obtained Credit Under a Different Name? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Have You Ever Filed Bankruptcy? |

|

|

||||||||||||||||||||||||

|

N F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

C O |

|

No |

Yes (List Names) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

Yes (Date |

/ |

/ |

) |

|

||||||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

Middle Initial |

Jr./Sr. |

|||||||||||||||

|

P |

|

|

— |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

Date of Birth |

|

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

County |

|

|

|

|

|

How Long? |

|

|

||||||||||||||

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

||

|

L |

|

Previous Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

County |

|

|

|

|

|

How Long? |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

||

|

N |

|

Nearest Relative Not Living With You - Last Name |

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|

|

|||||||||||||||||||||

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

E |

|

Employer Name |

|

|

|

|

|

|

|

|

Employer Phone |

|

|

|

|

|

Years of Service |

|

Occupation |

|

|

|

|

||||||||||||||||||

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. |

Mos. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

Business Address |

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

Zip |

|

|

|

|

Gross Annual |

|

|

|

|||||||||||

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

M |

|

Other Annual Income |

|

|

Source of Annual Income (Alimony, child support or separate maintenance income need not be revealed if you do not wish |

|

Self Employed? |

||||||||||||||||||||||||||||||||||

|

E |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

to have it considered as a basis for repaying the obligation.) |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

||||||||||||

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

ED |

|

Education Background (Highest Level) |

|

High School |

|

2 Yr. College |

|

|

|

4 Yr. College |

Graduate School |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

F |

|

Residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Payment |

|

|

|

|

Personal Finance |

|

|

|

|||||||||||||||

|

I |

|

Mortgage |

With Relatives |

Renting |

Own Free & Clear |

|

$ |

|

|

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

||||||||||||||||||||

|

N I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

A N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have You Ever Obtained Credit Under a Different Name? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Have You Ever Filed Bankruptcy? |

|

|

||||||||||||||||||||||||

|

N F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

C O |

|

No |

Yes (List Names) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

Yes (Date |

/ |

/ |

) |

|

||||||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

D. COMMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

Previous BMW Financial Services Customer |

|

|

|

|

|

|

|

Additional Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Yes |

No |

Waive Security Deposit per Program (include acct. # or VIN in comments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Yes |

No |

Waive Security Deposit with Rate Adder |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Yes |

No |

Certified |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Yes |

No |

Foreign National (Fax Foreign National Checklist) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Yes |

No |

College Grad Program |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Center Name

Applicant’s Name

SPECIAL NOTICES:

CALIFORNIA RESIDENTS: A married applicant may apply for an individual ac- count.

OHIO RESIDENTS: Ohio laws against discrimination require that all creditors make credit equally available to all credit worthy customers and that credit report- ing agencies maintain separate credit histories on each individual upon request. The Ohio civil rights commission administers compliance with this law.

NEW YORK RESIDENTS: Upon your request, you will be informed whether or not a consumer report was requested, and if so, the name and address of the agency that furnished such report.

MARRIED WISCONSIN RESIDENTS: Wisconsin law provides that no provision of any marital property agreement, or unilateral statement or court order applying to marital property will adversely affect a creditor’s interests unless, prior to the time that the credit is granted, the creditor is furnished with a copy of the agreement, statement or decree, or has actual knowledge of the adverse provi- sion.

If you are making this application individually, and not jointly with your spouse, please be sure that the full name and current address of your spouse is properly disclosed in Section B on the front cover of this application.

MASSACHUSETTS RESIDENTS: Massachusetts law prohibits discrimination on the basis of marital status or sexual orientation.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT

Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

LIST ALL OPERATORS IN ORDER OF MOST FREQUENT USE:

%of

Vehicle Use

Birth Dates

Mo. Day Yr.

Operator’s License

Number

State

Years

Licensed

The information in this application is true and correct to the best of my knowledge. I authorize BMW Financial Services (“you”), a group that includes BMW Financial Services NA, LLC, BMW Bank of North America, and Financial Services Vehicle Trust, to request information from me and to make whatever inquiries you consider necessary and appropriate (including requesting a consumer report from consumer reporting agencies) in considering granting me credit and for the purpose of any updates, renewals, extensions of credit, reviewing or collecting my account, offering me other products and services or for any other lawful purpose. You will rely on this information in deciding whether to grant the credit requested. My application will be considered by the appropriate creditor in the BMW Financial Services group depending on the type of credit I request. If I change the type of credit that I am requesting, I hereby request that a second creditor in your group offering the requested type of credit consider my application; and I consent to both creditors reviewing my credit report. I understand that various communications from the creditor to me may be conducted under your group name of BMW Financial Services. I understand that you will retain this application whether or not credit is approved. I understand you use automatic telephone dialing systems, prerecorded/artificial voice messages and text messages to communicate with your customers. I expressly consent to receive autodialed calls, prerecorded/artificial voice messages, and text messages from you or third parties that work for you, using any telephone number I have provided to you, including any number provided on this application, even if that number is for a wireless telephone and/or using that number results in charges to me.

NOTICE TO APPLICANT(S): BY SIGNING BELOW, APPLICANT(S) AUTHORIZE SUBMISSION OF THIS CONSUMER CREDIT APPLICATION TO BMW FINANCIAL SERVICES, 5550 BRITTON PARKWAY, HILLIARD, OH

|

|

|

|

|

|

|

Applicant Signature |

|

Date |

|

Date |

||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Purpose | The BMW Credit Application form is designed for individuals seeking financing options for vehicles through BMW Financial Services. |

| Sections Included | The form is divided into four sections: Finance and Vehicle Information, Primary Personal Information, Co-Applicant Personal Information, and Comments. |

| Personal Information Requirement | Applicants must provide detailed personal information including social security number, address, and employment history. |

| Co-Applicant Information | A co-applicant can be included in the application, requiring similar personal details to those of the primary applicant. |

| Bankruptcy Disclosure | Both applicants must disclose if they have ever filed for bankruptcy, which impacts creditworthiness. |

| Residency Specific Notices | The application contains specific legal notices relevant to residents of California, Ohio, New York, Wisconsin, and Massachusetts regarding their rights. |

| Electronic Communication Consent | Applicants consent to receive communications via autodialed calls and text messages related to their credit application. |

| Financing Options | The form allows applicants to choose between financing options such as leases or loans for either new or used vehicles. |

| Verification Requirement | Federal law mandates financial institutions, including BMW Financial Services, to verify the identity of applicants before opening an account. |

Guidelines on Utilizing Bmw Credit Application

Filling out the BMW Credit Application form is an essential step if you are considering financing a BMW vehicle. The application collects vital information about your financial status and personal details. It helps streamline the process of obtaining credit. Here’s how to fill it out effectively.

- Begin with the Finance and Vehicle Information section. Indicate the type of contract you prefer by selecting either "Lease" or "Pre-Pay Lease". Fill in the Center Number and Center Name if applicable. Provide the contact phone number for the dealership.

- Enter the MSRP and **Selling Price** of your desired vehicle. If applicable, include the amount of cash down and the net trade-in value. Next, fill out the Amount Financed, Term, and Monthly Payment fields.

- In the Vehicle Information section, list details such as the Year (New or Used), Make, Model, and current Mileage.

- If you have a trade-in vehicle, fill out the Trade-In Information with the Year, Make, Model, and Mileage.

- Proceed to the Primary Personal Information section. Fill in your Social Security Number, full name (Last, First, Middle Initial), and date of birth. Include your home phone number and email address.

- Provide your current address, including city, state, zip, and county. Indicate how long you have lived there in years and months. If you have a previous address, fill that section with the same details.

- List a nearest relative not living with you, including their last name, first name, and home phone. Then, provide your employer's name, phone, years of service, and occupation.

- In the employment details, include the business address, gross annual income, and any gross income from other sources. Don’t forget to indicate if you are self-employed.

- The Education Background section asks you to choose the highest level you have completed (e.g., High School, 2 Yr. College, etc.).

- Fill out details about your residence and monthly payments, such as mortgage and personal financing details.

- Indicate whether you have ever obtained credit under a different name or filed for bankruptcy.

- If a co-applicant exists, repeat the above steps in the Co-Applicant Personal Information section.

- Lastly, navigate to the Comments section. Here, you can indicate if you are a previous BMW Financial Services customer or provide any additional comments. Make selections regarding security deposit waivers or programs that apply to you.

After completing all sections, double-check your entries for accuracy. Signing the application is the last step before submission. By ensuring that all information is correct, you facilitate a smoother review process. Good luck with your application!

What You Should Know About This Form

What is the BMW Credit Application form?

The BMW Credit Application form is a document that allows individuals to apply for financing through BMW Financial Services. It collects personal, employment, income, and vehicle information necessary to assess creditworthiness and determine eligibility for credit products offered by BMW.

What information do I need to provide on the application?

Applicants must provide various details, including their name, Social Security Number, contact information, current and previous addresses, employment details, income information, and vehicle details such as make, model, and selling price. Co-applicants will also need to provide similar information.

What types of credit can I apply for using this form?

The application is intended for various types of credit, including leases or retail loans for purchasing a new or used BMW vehicle. Specific programs, such as the College Grad Program or Certified Pre-Owned offerings, can also be accessed through this application.

How does BMW Financial Services use my information?

BMW Financial Services uses the submitted information to evaluate creditworthiness. They may request a consumer report and conduct inquiries into the applicant's credit history. This process helps determine whether to grant the requested credit and enables the appropriate creditor to assess the application.

What happens if my credit application is denied?

If the application is denied, the applicant will receive a notice explaining the reasons for the denial. Applicants are encouraged to check their credit reports for any inaccuracies and may ask for clarification on the decision-making process used by BMW Financial Services.

Do I need to disclose all sources of income?

While applicants should provide their gross annual income, they are not required to disclose sources such as alimony, child support, or separate maintenance income unless they choose to have that income considered in the approval process.

Is there a way to waive the security deposit?

Yes, the application includes options to waive the security deposit. However, applicants should provide the relevant account number or VIN within the comments section if they wish to take advantage of this option.

What should I do if I have filed for bankruptcy in the past?

Applicants who have filed for bankruptcy should answer the question related to previous bankruptcies truthfully. It is essential to provide the date of filing if applicable. Reporting this information allows BMW Financial Services to assess the overall creditworthiness accurately.

Common mistakes

When filling out the BMW Credit Application, people often make mistakes that can delay the process or impact their approval. Understanding these common pitfalls can lead to a smoother experience.

One frequent mistake is leaving out crucial financial information. Applicants sometimes forget to include their gross annual income or other sources of income. This omission can raise red flags, potentially leading to delays in processing or unfavorable terms.

An inaccurate Social Security Number is another common error. Entering the wrong number can result in identity verification issues, leading to significant delays. Always double-check this number to ensure it matches official documentation.

Applicants sometimes neglect their previous addresses. The form asks for your present and previous addresses, and failing to list a complete history can create confusion. Make sure to provide all addresses, including details of how long you've lived at each location.

Another mistake occurs when individuals do not fully disclose their credit history. For example, questions about past bankruptcies or credit obtained under a different name must be answered honestly. Incomplete or misleading information can undermine trust and lead to application denial.

Some applicants rush through the section about employment history. It’s easy to overlook providing details about your employer, occupation, and years of service. This information is vital, so take your time to fill it out completely.

Lastly, individuals may forget to sign and date the application. This simple step is often overlooked, but without a signature, the application is incomplete. Remember, a signed application indicates your agreement with the information provided.

By avoiding these common mistakes, applicants can improve their chances of a smooth and successful credit application process with BMW Financial Services.

Documents used along the form

When applying for credit with BMW Financial Services, several other forms and documents typically accompany the BMW Credit Application. These documents provide crucial information and help streamline the decision-making process. Below are some of the common forms that applicants may need to submit.

- Proof of Income: This document verifies an applicant's ability to repay the loan. It may include recent pay stubs, tax returns, or statements from employers. Providing accurate proof of income can significantly enhance the application’s credibility, showcasing financial stability.

- Identification Documents: These can include a driver’s license or passport. They are essential for verifying the applicant's identity and preventing fraud. Ensuring that the identification matches the applicant's information is vital for a smooth approval process.

- Vehicle Title or Registration: For trade-in vehicles, submitting the title or registration is necessary. This document confirms ownership and helps establish the vehicle’s condition and value in the financing process.

- Credit Report Authorization: This form allows BMW Financial Services to check the applicant's credit history. Understanding an applicant’s creditworthiness is crucial for determining the terms of financing, including interest rates.

- Insurance Information: Proof of insurance, such as an insurance card or policy summary, is often required. It protects both the lender and the borrower, ensuring that the financed vehicle is adequately covered while in use.

In conclusion, preparing these supporting documents can expedite the credit application process and improve the likelihood of a favorable outcome. By providing comprehensive and accurate information, applicants can demonstrate their financial responsibility and readiness to take on new credit obligations.

Similar forms

-

Auto Loan Application: Similar to the BMW Credit Application, an auto loan application collects personal and financial information to evaluate the applicant's creditworthiness for financing a vehicle. Both documents require details about the applicant’s income, employment history, and personal background.

-

Lease Application Form: This document serves a similar purpose by gathering information necessary for leasing a vehicle. Like the BMW Credit Application, it includes sections on personal details and financial status, as well as vehicle information and lease terms.

-

Personal Loan Application: This application also assesses an individual's ability to repay borrowed funds. It shares similarities with the BMW Credit Application in that both documents request information about income, assets, debts, and personal identification to ensure a responsible lending decision.

-

Mortgage Application: Just like the BMW Credit Application, a mortgage application evaluates an individual's financial and personal background to determine eligibility for a loan. Both require extensive disclosure of financial obligations, employment history, and personal information to assess risk.

Dos and Don'ts

When filling out the BMW Credit Application form, there are important guidelines to follow to ensure a smooth process. Below is a list of things you should and shouldn't do.

- Do double-check all personal information for accuracy, including your name, address, and Social Security number.

- Do provide complete employment and income details to give a clear picture of your financial status.

- Do include contact information for your employer and previous employers when applicable.

- Do disclose any prior bankruptcies or credit history if asked.

- Do read all sections carefully, especially regarding special notices specific to your state.

- Don't leave any required fields blank, as incomplete forms may delay the application process.

- Don't provide false or misleading information, as this can result in denial of credit.

- Don't forget to sign and date the application before submission.

- Don't share your application details with anyone else for security and privacy reasons.

- Don't overlook additional comments that may help clarify your situation or needs.

Misconceptions

The BMW Credit Application form has several misconceptions. Understanding these can help clarify the process.

- Only those with perfect credit can apply. Many individuals believe that only those with excellent credit scores can be approved. However, BMW Financial Services considers a variety of factors when reviewing applications.

- Applying will negatively impact my credit score. While applying for credit may result in a hard inquiry, this is a standard part of the process. Multiple applications over a short period can have a cumulative effect, but a single application has minimal impact.

- Only new vehicles can be financed. This is a common belief, but the form accommodates both new and used vehicles. Applicants can apply for financing on various types of vehicles.

- Co-applicants are always needed. Some applicants think they need a co-applicant to be approved. This is not true as individuals can apply for credit on their own.

- Personal information is optional. The belief that all fields are optional can be misleading. Certain information, like Social Security numbers, is critical for the application to be processed.

- Income from child support must be disclosed. While you should disclose your income, you are not required to include child support or alimony unless you wish it to be considered.

- There are no special considerations for different states. Some applicants think the application requirements are the same everywhere. In fact, specific rules apply in different states, like Ohio and California, which may affect how applications are handled.

- The application is only for existing BMW customers. New customers can also fill out the form. Past experience with BMW is not a requirement to apply.

- I cannot change my application type after submission. This is a misconception. Applicants can ask to change the type of credit they request, and both requests can be reviewed.

- Ignoring the disclaimer sections will not have consequences. Many people skim over disclaimers, believing they are optional. However, understanding these sections is important as they contain crucial information about your rights and obligations.

Being informed about these misconceptions can ease the anxiety often associated with filling out a credit application.

Key takeaways

When filling out the BMW Credit Application form, ensure all personal information is accurate and up-to-date. This includes your full name, Social Security Number, address, and contact details.

Be prepared to provide detailed financial information. This includes your income, employment history, and any existing debts. Accurate reporting helps in assessing your creditworthiness.

If you have a co-applicant, make sure they complete their section of the form as thoroughly as you do. Both parties' financial histories will be considered in the evaluation.

Familiarize yourself with specific state regulations that may apply during the credit application process. For example, certain states have unique laws regarding discrimination and credit reporting.

After submitting the application, you may receive communication from BMW Financial Services regarding your credit status. Be attentive to any requests for additional information.

Understand that submitting the application authorizes BMW Financial Services to conduct necessary inquiries regarding your credit. This may include checking your credit report.

Browse Other Templates

How to Cancel Carefirst Insurance - Your request may take time, so plan accordingly for your health insurance needs.

Pennsylvania Corporate Estimated Tax Payments - Comprehending the total gross income figure will impact overall tax obligations.