Fill Out Your Boe 106 Form

The BOE 106 form is an essential document used in California for obtaining a use tax clearance, enabling individuals to register their vehicles or vessels without immediately paying the use tax. This form, issued by the California Department of Tax and Fee Administration (CDTFA), collects key information about both the current owner and the previous owner of the vehicle or vessel. Applicants must provide personal details, including their name, identification number, contact information, and address, as well as date-related entries such as when they applied for registration and their residency in California. Information regarding the vehicle or vessel itself is also required, including its make, model, and purchase details. There is an opportunity for the applicant to explain why they are requesting a tax clearance, and by signing the form, they affirm that the provided information is correct to the best of their knowledge. For those seeking assistance, additional resources on required documentation and submission methods are readily available on the CDTFA website, ensuring that the process is as smooth as possible for users.

Boe 106 Example

Information Update

Information Update

You may now apply for a use tax clearance using CDTFA’s online services at onlineservices.cdtfa.ca.gov by selecting Request Use Tax Clearance for Registration with DMV/HCD

STATE OF CALIFORNIA |

|

VEHICLE/VESSEL USE TAX |

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

CLEARANCE REQUEST |

|

|

|

|

|

CURRENT OWNER INFORMATION (as it will appear on the registration) |

|

|

|

NAME |

|

IDENTIFICATION NUMBER (driver license number, EIN number)

TELEPHONE NUMBER

EMAIL ADDRESS

ADDRESS (street, city, state, ZIP Code)

DATE YOU APPLIED FOR CALIFORNIA REGISTRATION

DATE YOU BECAME A RESIDENT OF CALIFORNIA

DATE EMPLOYED IN CALIFORNIA

FORMER OWNER INFORMATION

NAME OF SELLER OR TRANSFEROR

TELEPHONE NUMBER

EMAIL ADDRESS

ADDRESS (street, city, state, ZIP Code)

PROPERTY INFORMATION

Vehicle |

Vessel |

Mobilehome |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LICENSE PLATE/CF/SERIAL NUMBER(S) |

|

VIN/HIN/SERIAL NUMBER(S) |

MAKE |

|

YEAR |

||||

|

|

|

|

|

|

|

|

|

|

LOCATION OF PURCHASE/TRANSFER |

|

DATE VEHICLE/VESSEL ENTERED CALIFORNIA |

PURCHASE OR TRANSFER DATE |

|

PURCHASE PRICE |

||||

|

|

|

|

|

|

|

|

|

|

WAS VEHICLE/VESSEL PREVIOUSLY REGISTERED TO YOU OUTSIDE THE STATE OF CALIFORNIA? IF YES, WHERE? |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||

FOR MOBILEHOMES ONLY: |

MODEL |

MOBILEHOME MANUFACTURER |

YEAR |

|

SIZE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

HELD FOR PICKUP |

OFFICE LOCATION |

|

|

|

|

||

IF APPROVED, MY CERTIFICATE |

|

|

MAILED |

|

|

||||

(for office locations see back of this |

|

|

|

|

|||||

SHOULD BE: |

|

|

(to the above address) |

||||||

form or visit www.cdtfa.ca.gov) |

|

|

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

I hereby request a Certificate of Use Tax Clearance to allow completion of registration at DMV/HCD without payment of the California use tax for the following reason:

I hereby certify that the above statements, to the best of my knowledge and belief, are true and correct.

SIGNATURE

DATE

Please refer to California Department of Tax and Fee Administration (CDTFA) publication 52, Vehicles and Vessels: Use Tax, available at www.cdtfa.ca.gov, for information about the required documentation to submit with this request. Additional information is available on our website at

CLEAR

PRINT

PRINT

OFFICE LOCATIONS AND ADDRESSES

OFFICES |

ADDRESS |

TELEPHONE/EMAIL |

FAX NUMBER |

|

|

|

|

Bakersfield |

1800 30th Street, Suite 380 |

FAX |

|

Bakersfield, CA |

BakersfieldInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Cerritos |

12750 Center Court Drive South, Suite 400 |

FAX |

|

Cerritos, CA |

CerritosInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Culver City |

5901 Green Valley Circle, Suite 200 |

FAX |

|

Culver City, CA |

CulverCityInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

|

1550 West Main Street |

FAX |

|

El Centro* |

El Centro, CA |

ElCentroInquiries@cdtfa.ca.gov |

|

*Same day pick up not available. Call for additional information.

Fairfield |

2480 Hilborn Road, Suite 200 |

FAX |

|

Fairfield, CA |

FairfieldInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Fresno |

8050 N. Palm Avenue, Suite 205 |

FAX |

|

Fresno, CA |

FresnoInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Glendale |

505 North Brand Boulevard, Suite 700 |

FAX |

|

Glendale, CA |

GlendaleInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Irvine |

16715 Von Karman Avenue, Suite 200 |

FAX |

|

Irvine, CA |

IrvineInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Oakland |

1515 Clay Street, Suite 303 |

FAX |

|

Oakland, CA |

OaklandInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Rancho Mirage |

FAX |

||

Rancho Mirage, CA |

RanchoMirageInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Redding |

2881 Churn Creek Road, Suite B |

FAX |

|

Redding, CA |

ReddingInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Riverside |

3737 Main Street, Suite 1000 |

FAX |

|

Riverside, CA |

RiversideInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Sacramento |

3321 Power Inn Road, Suite 210 |

FAX |

|

Sacramento, CA |

SacramentoInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Salinas |

Temporary location. Please call for details. |

FAX |

|

|

SalinasInquiries@cdtfa.ca.gov |

|

|

|

|

|

|

|

|

|

|

San Diego |

15015 Avenue of Science, Suite 200 |

FAX |

|

San Diego, CA |

SanDiegoInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

San Jose |

250 South Second Street |

FAX |

|

San Jose, CA |

SanJoseInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Santa Clarita |

25360 Magic Mountain Parkway, Suite 330 |

FAX |

|

Santa Clarita, CA |

SantaClaritaInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Santa Rosa |

50 D Street, Room 230 |

FAX |

|

Santa Rosa, CA |

SantaRosaInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Ventura |

4820 McGrath Street, Suite 260 |

FAX |

|

Ventura, CA |

VenturaInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

West Covina |

1521 West Cameron Avenue, Suite 300 |

FAX |

|

West Covina, CA |

WestCovinaInquiries@cdtfa.ca.gov |

|

|

|

|

||

|

|

|

|

Consumer Use |

450 N Street |

FAX |

|

Tax Section |

Sacramento, CA |

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The BOE 106 form is used to request a clearance for use tax when registering a vehicle, vessel, or mobile home in California. |

| Governing Law | This form operates under California Revenue and Taxation Code § 6201 et seq., which details use tax regulations. |

| Online Application | California residents can apply for a use tax clearance using the CDTFA’s online services for convenience. |

| Information Required | Completing the form requires personal details, prior ownership information, purchase data, and vehicle specifications. |

| Signature Requirement | A signature and date are essential to certify that the information provided is true to the best of the applicant's knowledge. |

| Use Tax Exemption | The clearance allows for vehicle registration without the immediate payment of California use tax under certain conditions. |

| Submission Options | Applicants can submit the form and necessary documents by mail or in person at specific CDTFA locations. |

Guidelines on Utilizing Boe 106

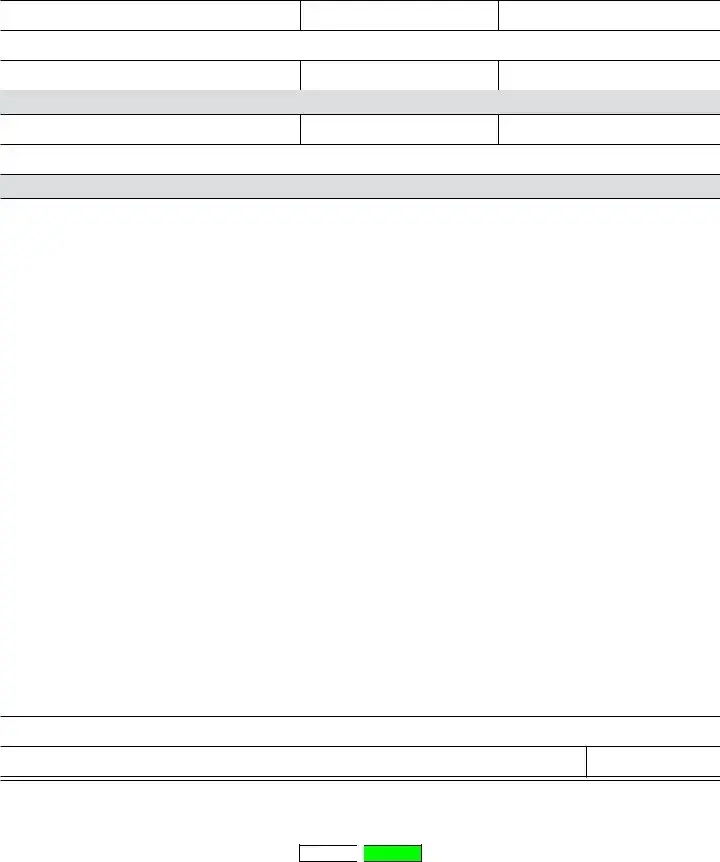

Completing the CDTFA-106 form is essential for individuals applying for a use tax clearance in California. Once the form is filled out accurately, it will enable the completion of registration with the DMV or HCD without the immediate requirement for use tax payment. Please follow the steps below to ensure the form is completed correctly.

- Begin by entering your name as it will appear on the registration.

- Provide your identification number, which can be your driver's license number or EIN number.

- Include your telephone number and email address.

- Fill in your address with street, city, state, and ZIP Code.

- Enter the date you applied for California registration.

- Specify the date you became a resident of California.

- Provide the date you were employed in California.

- For former owner information, enter the name of the seller or transferor.

- Include the former owner's telephone number and email address.

- Provide the former owner's address with street, city, state, and ZIP Code.

- Specify the type of property (vehicle, vessel, or mobilehome).

- Enter the license plate/CF/serial number(s).

- Fill in the VIN/HIN/serial number(s).

- Specify the make and year of the vehicle or vessel.

- Provide the location of purchase or transfer.

- Enter the date when the vehicle or vessel entered California.

- Specify the purchase or transfer date.

- Indicate the purchase price.

- Answer whether the vehicle or vessel was previously registered to you outside of California. If yes, specify where.

- For mobilehomes only: provide the model, manufacturer, year, and size.

- If desired, indicate the held for pickup office location upon approval.

- Fill in the address where you want the certificate mailed.

- State the reason for your request for a Certificate of Use Tax Clearance.

- Sign and date the form, certifying that all information is true and correct to the best of your knowledge.

After completing the CDTFA-106 form, it should be submitted along with any required documentation to a CDTFA office. For more information on necessary documents and submission options, visit the California Department of Tax and Fee Administration website.

What You Should Know About This Form

What is the Boe 106 form used for?

The Boe 106 form, also known as the Clearance Request for Vehicle/Vessel Use Tax, is utilized in California to request a Certificate of Use Tax Clearance from the California Department of Tax and Fee Administration (CDTFA). This certificate allows individuals to register their vehicles, vessels, or mobile homes with the Department of Motor Vehicles (DMV) or Housing and Community Development (HCD) without having to pay the California use tax upfront.

Who should complete the Boe 106 form?

Individuals who have purchased a vehicle, vessel, or mobile home and are looking to register it in California should complete the Boe 106 form. This request is necessary if the property was previously registered outside of California and meets specific residency or purchase criteria.

What information is required to fill out the Boe 106 form?

The form requires information about the current owner, including name, identification number (such as a driver's license number), contact details, and address. Additionally, details about the former owner, property information (type of vehicle or vessel), and purchase dates, along with applicable identification numbers, must be provided. Specific questions regarding prior registration and purchase price also need answers.

How can I submit the Boe 106 form?

The Boe 106 form can be submitted either by mail or in person at a CDTFA office. Individuals should take or mail all required forms and supporting documents to the nearest CDTFA location. A list of office locations is available on the CDTFA website.

Is there a fee associated with processing the Boe 106 form?

There is no fee to submit the Boe 106 form specifically. However, individuals need to be aware that other costs may apply when finalizing registration with the DMV or HCD. It is also important to check for any associated fees for the services provided by those departments.

How long does it take to receive the Certificate of Use Tax Clearance?

The processing time for the Boe 106 form can vary. Generally, individuals are encouraged to allow sufficient processing time to avoid potential delays in their vehicle or vessel registration. For accurate estimates, contacting the local CDTFA office directly may provide more specific information.

Can I apply for a Use Tax Clearance online?

Yes, applicants may now apply for a Use Tax Clearance online through the CDTFA's online services. By selecting the “Request Use Tax Clearance for Registration with DMV/HCD” option, individuals can complete their request quickly and conveniently.

What should I do if my application is denied?

If the application for the Certificate of Use Tax Clearance is denied, the applicant should receive a notification explaining the reasons for the denial. They may then take necessary actions to remedy the situation, including providing additional information or appealing the decision based on guidelines set by the CDTFA.

Where can I find additional information about the Boe 106 form?

For more detailed information regarding the Boe 106 form and its requirements, individuals can refer to the CDTFA's official website. Additional resources, including the CDTFA publication 52, are available on their site to assist with understanding the use tax implications on vehicles and vessels.

Common mistakes

When filling out the CDTFA-106 form, it's essential to pay close attention to detail. One common mistake occurs when individuals provide their current owner information. If the name or the identification number is incorrect or does not match other documents, it can lead to delays in processing. It's advisable to verify that all information matches what is on official documentation.

Another frequent error lies in the omission or incorrect entry of the property information. This includes the vehicle identification number (VIN) or serial numbers. Ensuring this information is accurate is crucial, as it directly associates the use tax clearance with the specific vehicle or vessel in question. Any discrepancies can complicate or even jeopardize the registration process.

People often overlook the significance of the purchase or transfer date. This date is not only important for tax purposes, but it also establishes the timeline for residency in California. Providing an inaccurate date might lead to complications regarding tax liabilities. It's advisable to double-check the dates to align with purchase contracts or transfer agreements to avoid any potential misunderstandings.

Finally, signatures are a critical component of this form. Some people submit the form without a signature or date, assuming it is unnecessary. This oversight can result in the application being deemed incomplete. Always ensure that the form is properly signed and dated before submission to prevent unnecessary delays in receiving the Certificate of Use Tax Clearance.

Documents used along the form

When applying for vehicle or vessel registration in California, the CDTFA-106 form is an essential document. However, there are several other forms and documents that you may need to consider. These documents complement the use tax clearance process and facilitate smoother registration. Below is a list of relevant forms to assist you further.

- CDTFA-111: This is the actual request form for the use tax clearance. You must complete and submit this form through CDTFA online services to initiate your application for vehicle or vessel registration with DMV/HCD.

- DMV Form REG 343: This is used for vehicle bill of sale. You will need it to document the purchase details of your vehicle or vessel when registering.

- DMV Form REG 31: Vehicle/Vessel Transfer and Reassignment Form. This form is necessary when ownership of a vehicle is transferred, particularly in private sales.

- DMV Form REG 5056: This form is the Application for Duplicate Title. If the title to your vehicle is lost or stolen, you will need this document to obtain a duplicate.

- CDTFA Form 301: The claim for refund of overpaid use tax. This form allows an individual to request a refund if they have overpaid their use tax in California.

- IRS Form 1099: If you received income from the sale of the vehicle, this form may be needed to report the income and ensure compliance for tax purposes.

- DMV Form REG 262: This form is required to report the sale or transfer of a vehicle. It’s essential for both the seller and buyer for legal documentation.

- Proof of Insurance: Valid proof of insurance is needed to register a vehicle in California. This document must meet state requirements.

- Vehicle Title: The original title serves as the ownership proof of your vehicle and is vital for any registration process.

- California Residency Documentation: This includes any document that verifies the address you claim as your residence for tax purposes, such as utility bills or lease agreements.

Completing your registration efficiently requires understanding the related documents necessary for the application process. Gathering these forms ahead of time will expedite your experience and ensure compliance with California's regulations.

Similar forms

The BOE-106 form, also known as the Use Tax Clearance request, is a key document in the process of vehicle and vessel registration in California. Several other forms serve similar purposes within the realm of tax clearance and vehicle registration. Here is a list of ten documents that share similarities with the BOE-106 form:

- CDTFA-111: This form is used to request a use tax clearance specifically for registration with the DMV or HCD. It helps applicants secure tax clearance online, streamlining the process.

- Form BOE-288: This is a tax exemption claim form for vessels and vehicles. Like BOE-106, it requires detailed information about the property and the owner.

- Form BOE-401-A: This form is utilized for claiming a California sales tax exemption for certain vehicle purchases, similar to the use tax exemptions covered by BOE-106.

- Form DMV 14: This document is for reporting vehicle transfers in California. It collects information about ownership, much like the BOE-106's focus on current and former owners.

- Form HCD 410: This form is for mobile home registration, requiring use tax clearance similar to the vehicle and vessel registration handled by the BOE-106.

- Form 1094: This form is for vehicle use tax returns and allows taxpayers to report taxes due on vehicles that were not previously registered in California.

- Form BT-18: Used to request an exemption from use tax on agricultural vehicles, this form parallels the use tax considerations found in the BOE-106.

- Form BOE-502: This is an application for sales and use tax registration. It is similar as it gathers detailed business and tax-related information from the applicant.

- Form CDTFA-400: This form reports sales and use tax information, paralleling the financial disclosures required in the BOE-106 for tax clearance.

- Form HCD 1: This is a mobile home registration application that, like the BOE-106, requires details about ownership and property for tax clearance.

Dos and Don'ts

Things to Do:

- Ensure all personal information is accurate, including your name and address.

- Provide your correct identification number, such as your driver's license number or EIN.

- Double-check that the vehicle or vessel information is complete and matches your documentation.

Things Not to Do:

- Do not leave any required fields blank. Incomplete forms may cause delays.

- Avoid submitting false information. This can lead to serious penalties.

- Do not forget to sign and date the form. An unsigned form will not be processed.

Misconceptions

-

Misconception 1: The Boe 106 form only applies to vehicles.

This form actually covers a variety of property types, including vessels and mobilehomes. It's important for anyone purchasing these items to be aware of the requirements.

-

Misconception 2: You can submit the Boe 106 form in any format.

In reality, the form must be submitted as a physical paper document or through the designated online services provided by the California Department of Tax and Fee Administration (CDTFA).

-

Misconception 3: You do not need to provide any additional documentation with the Boe 106 form.

Contrary to this belief, you must include specific documents along with your request. These can include proof of purchase and residency, among other items.

-

Misconception 4: The Boe 106 form guarantees a tax exemption.

Completing the form does not automatically grant an exemption from the use tax. It only requests a certificate for clearance, which may or may not be granted based on your circumstances.

-

Misconception 5: You can apply for use tax clearance at any time.

Applications must align with certain timelines related to registration and residency. Ensure you meet the necessary deadlines for a smooth process.

-

Misconception 6: You need to complete the registration process before filing the Boe 106 form.

This is incorrect. You can apply for use tax clearance concurrently with your registration application, streamlining your experience at the DMV or HCD.

-

Misconception 7: All CDTFA offices can process the Boe 106 form on the same day.

Not all offices are equipped for same-day processing. It’s advisable to check in advance to understand each office's capabilities and any potential delays.

Key takeaways

When filling out the BOE 106 form for California vehicle or vessel use tax clearance, here are some important points to consider:

- The form is essential for registering vehicles or vessels with the DMV or HCD in California.

- Make sure to provide accurate current owner information; any discrepancies could delay processing.

- Identification numbers, such as a driver’s license number or EIN, are necessary for verification.

- List former owner information clearly to avoid any confusion about the vehicle’s history.

- It's crucial to include specific property information like the VIN or serial number.

- Ensure that you indicate whether the vehicle or vessel was previously registered outside of California.

- Remember to state the date you became a California resident, as it may affect tax obligations.

- Review all entries for completeness and correctness before submitting the form.

- Submit the form along with any required documentation to the appropriate CDTFA office.

- You can now apply for use tax clearance online through the CDTFA's services, which may save time.

Completing the BOE 106 form accurately will facilitate the registration process and ensure compliance with state tax requirements. If you have further questions about the process, consider reaching out to your local CDTFA office for assistance.

Browse Other Templates

Tax Transcript Online - The total payments made towards taxes are $1,000.

Virginia Real Estate Contract for Sale by Owner - Delivery methods for important notices and documents are specified to ensure compliance.

Cosmetology License Renewal California - Review the processing times outlined to manage your expectations effectively.