Fill Out Your Boe 245 Oye Form

The BOE 245 Oye form is a critical document for individuals and businesses seeking a waiver from electronic filing requirements imposed by the California State Board of Equalization. As part of the state's effort to streamline tax collection and compliance, this form provides an avenue for those who face challenges in completing electronic filings. Understanding the essential aspects of this form is paramount for applicants. For instance, a thorough completion of the form is vital; any missing information can lead to automatic denial of the request. This means that clarity and attention to detail are essential in documenting your reasons for seeking an exemption. In addition, applicants must provide their full name, as well as their address, and contact information to ensure that the request can be processed efficiently. The form also requires a solid explanation of why electronic filing may impose an undue hardship, allowing the applicant to elaborate as necessary. Lastly, the form mandates a signature from the owner or authorized officer, affirming the validity of the request. Complete adherence to these guidelines is crucial for successful processing and approval of the exemption request.

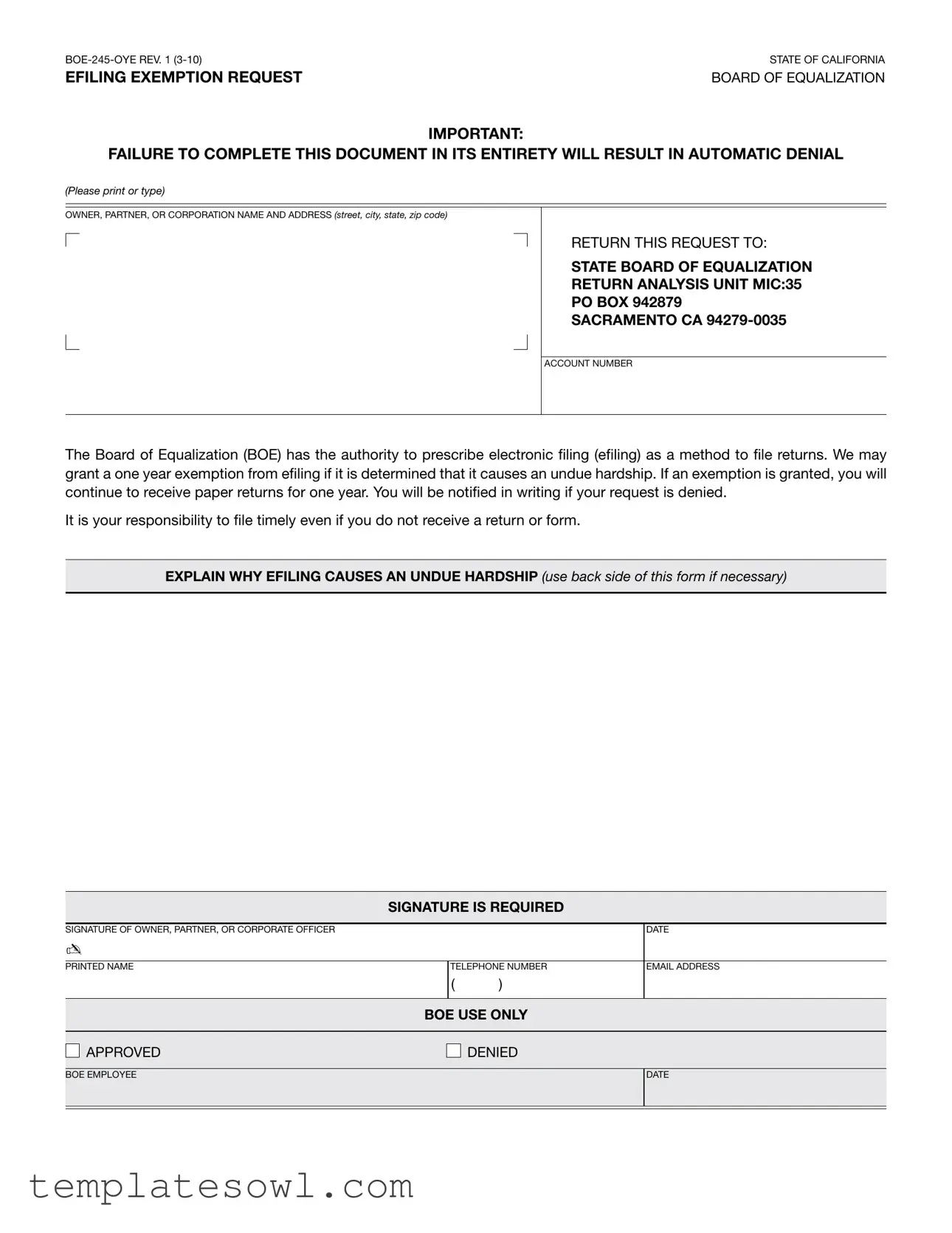

Boe 245 Oye Example

STATE OF CALIFORNIA |

|

EFILING EXEMPTION REQUEST |

BOARD OF EQUALIZATION |

IMPORTANT:

FAILURE TO COMPLETE THIS DOCUMENT IN ITS ENTIRETY WILL RESULT IN AUTOMATIC DENIAL

(Please print or type)

OWNER, ARTNER, OR CORTION NA |

(street, city, state, zip code) |

RETURN T

STATE BOARD OF EQUALIZATION

RETURN ANALYSIS UNIT MIC:35

PO BOX 942879

SACRAMENTO CA

ACCOUNT NU

TBE(BOE) i( i W

I

.Y

I

EXPLAIN WHY EFILING CAUSES AN UNDUE HARDSHIP (use back side of this form if necessary)

|

SIGNATURE IS REQUIRED |

|

|

||

|

|

|

|

|

|

SITURE OF OWNER, ARTNER, OR CORTE OFFICER |

|

|

DATE |

||

✍ |

|

|

|

||

|

|

|

|

|

|

|

|

TELE |

E |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

BOE USE ONLY |

|

|

||

|

|

|

|

|

|

|

A |

|

DENIED |

|

|

|

|

|

|

||

|

|

|

|

|

|

BOE E |

|

|

DATE |

||

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | BOE-245-OYE (E-Filing Exemption Request) |

| Governing Authority | California Board of Equalization |

| Purpose | To request an exemption from e-filing due to undue hardship. |

| Consequences of Incompletion | Failure to complete the form entirely results in automatic denial. |

| Submission Address | State Board of Equalization, Return Analysis Unit, PO Box 942879, Sacramento, CA 94279-0035 |

| Contact Requirement | A signature from the owner, partner, or corporate officer is required. |

| Date Requirement | The applicant must provide the date of submission. |

| Denial Notification | The form indicates that denial will be communicated by BOE. |

Guidelines on Utilizing Boe 245 Oye

When preparing to submit the BOE 245 Oye form, it's important to follow each step carefully. This ensures the form is filled out completely, which can help avoid delays in processing. Below are detailed instructions to assist in accurately completing the form.

- Obtain the BOE 245 Oye form. It is advisable to print a clean copy.

- In the designated section, enter the owner’s, partner’s, or corporation's name. It should be clearly printed or typed.

- Fill in the address section, including street address, city, state, and zip code.

- Locate and enter your account number or BOE ID in the provided space.

- In the explanation section, clearly describe why e-filing causes an undue hardship. Use the back side of the form if more space is needed.

- Sign the form to confirm accuracy and authenticity. The signature should be from the owner, partner, or corporate officer.

- Include the date of signing next to your signature.

- Provide a contact telephone number, including area code, in the specified box.

- Review the completed form for any missing information or errors.

- Mail the completed form to the address indicated: STATE BOARD OF EQUALIZATION, RETURN ANALYSIS UNIT, MIC:35, PO BOX 942879, SACRAMENTO CA 94279-0035.

What You Should Know About This Form

What is the BOE 245 Oye form?

The BOE 245 Oye form is an official document used in California for requesting an exemption from e-filing requirements set by the State Board of Equalization (BOE). This form is specifically aimed at individuals or entities who believe that e-filing will cause them undue hardship.

Who should fill out the BOE 245 Oye form?

This form should be completed by the owner, partner, or corporate officer of a business that is seeking an exemption from e-filing. If you are responsible for managing the business's tax obligations and have valid reasons to request an exemption, this form is meant for you.

What information is required on the form?

You will need to provide your name, business address, and account number with the BOE. Additionally, you'll need to explain the reasons why e-filing presents an undue hardship for you. Make sure to complete the entire form as any missing information can lead to automatic denial of your request.

Is there a deadline for submitting the BOE 245 Oye form?

What happens if I don’t fill out the form completely?

Not completing the form in its entirety will result in automatic denial of your exemption request. It is crucial to ensure that every necessary section is filled out accurately to avoid any issues.

Who should I contact if I have more questions about the form?

If you have further questions or need assistance, you can contact the Board of Equalization directly. They have resources and helplines available for business owners facing challenges with the e-filing process.

Common mistakes

When filling out the BOE-245 OYE form, many individuals make common mistakes that can lead to delays or automatic denials. One significant error is failing to complete all required sections. Each part of the form must be filled out accurately. Incomplete forms are often immediately rejected.

Another frequent mistake involves providing incorrect contact information. This includes not only the owner's name but also the address and telephone number. If the contact information is wrong, the Board of Equalization may have difficulty reaching you for any follow-up questions or clarifications.

Some individuals overlook the importance of clearly explaining their situation. The section for detailing why e-filing causes undue hardship must be thorough and persuasive. A vague explanation can result in a denial, as the board needs to understand the specific challenges presented.

Additionally, users sometimes forget to sign the form. A missing signature is an easy, yet serious oversight. The Board requires an official signature to validate the application; without it, the form will not be accepted.

Another mistake involves the date on the form. Providing an outdated or incorrect date will likely cause issues. It is essential to ensure that the date of signing is accurate, serving to confirm the validity of the request.

Some applicants fail to provide necessary documentation. Any additional materials that support the application should be included. Without supplementary evidence, the application may lack the necessary context for approval.

Misunderstanding instructions regarding the mailing process is also common. Applicants must ensure they send the form to the correct address specified in the instructions. Sending it to the wrong office can lead to significant delays.

Many individuals do not check their calculations where applicable. If there are any fees or qualifiers involved in the exemption request, confirming these figures is crucial. An error here can affect the overall request.

A final mistake often seen is the neglect of proper formatting. The form should be printed or typed neatly. Illegible handwriting can hinder the processing of the form, as important information may be misread or ignored.

By avoiding these common pitfalls when completing the BOE-245 OYE form, individuals can enhance their chances of approval and ensure a smoother process. Careful attention to detail is essential.

Documents used along the form

When working with the BOE-245-OYE form, certain additional documents and forms might be necessary to ensure the exemption request is complete and accurate. Below is a list of commonly used forms along with a brief description of each. Having these documents prepared can help streamline the process and minimize potential delays.

- BOE-267 - This form is used for Property Tax Rule 139 exemptions. It provides detailed information about the criteria for exemption from e-filing.

- BOE-126 - A claim for exemption application that outlines specific exemptions related to property taxes, which should be submitted when exemptions are requested.

- BOE-79 - This form serves as an application for a property tax exemption for veterans and is often required to establish eligibility.

- BOE-64 - A declaration of an appeal, which is necessary if there are disagreements regarding the valuation or exemption determinations made by the Board of Equalization.

- BOE-114 - A form used to assess the tax status for property acquired by non-profits and organizations seeking tax exemption.

- Property Tax Exemption Application - Generally, this document may require the submission of supporting documents that confirm the property's eligibility for tax exemption based on state guidelines.

- BOE-283 - This form specifically addresses the eligibility criteria and provides necessary details when filing for a property tax exemption related to government entities.

- Supporting Documentation - This may include financial statements, previous tax returns, or organizational charters to bolster the case for exemption.

Having this list of forms at hand is essential for ensuring that your submission regarding the BOE-245-OYE request is thorough. Preparation can make a significant difference in the outcome of your application, thereby alleviating undue stress during this process.

Similar forms

- Form 450 - This form is used to request a waiver for electronic filing mandates. Similar to the BOE 245 Oye form, it requires justification for why electronic filing is not feasible.

- Form 501 - This document allows businesses to appeal electronic filing requirements based on unique circumstances. Both forms require detailed explanations from the owner or partner.

- Form 557 - This form serves as an exemption request from certain reporting requirements. Like the BOE 245 Oye, it demands a full account of the reasons for the exemption.

- Form 670 - Used for requesting an extension on electronic filing deadlines, this form parallels the BOE 245 Oye by requiring a signature and a rationale for the request.

- Form 726 - This document requests a waiver from mandatory electronic payments. It shares the need for a thorough explanation of the hardships involved.

- Form 850 - This is a general hardship exemption form from the State Board of Equalization. It requires the submission of evidence just like the BOE 245 Oye form.

- Form 956 - Used for requesting permission to file paper returns, this form emphasizes the need to explain undue hardship, mirroring the requirements of the BOE 245 Oye.

- Schedule D - This form is for those who need to detail specific reasons for not filing electronically. It demands similar information regarding circumstances as the BOE 245 Oye.

Dos and Don'ts

When filling out the BOE 245 OYE form, there are important steps to keep in mind to ensure successful submission and approval. Below is a list of things you should and shouldn’t do.

- Do read the instructions carefully before starting the form.

- Do print or type your responses clearly.

- Do explain thoroughly why e-filing causes you undue hardship.

- Do check your information for accuracy before sending.

- Don’t forget to sign the form to validate it.

- Don’t leave any required fields blank; incomplete forms are automatically denied.

Following these guidelines can help avoid unnecessary setbacks in processing your exemption request.

Misconceptions

Misconceptions about the BOE-245-OYE form can lead to confusion and errors in the exemption request process. Here are eight common misconceptions clarified:

- Only businesses can use this form. Many people think the BOE-245-OYE is only for businesses. In reality, individuals can also submit this form for exemption requests.

- You do not need to explain your hardship. Some believe that just submitting the form is enough. However, you must explain why e-filing causes you undue hardship to be considered for an exemption.

- There are no penalties for incomplete forms. A common misconception is that submitting an incomplete form is harmless. In fact, failure to complete it fully will result in automatic denial.

- You can submit the form at any time. Many think they can file the BOE-245-OYE whenever they want. However, it must be submitted within specific timeframes related to the tax filing.

- The form is not needed if you file on paper. Some believe that if they file taxes on paper, they do not need to submit this exemption request. This is incorrect; the exemption request is necessary regardless of the filing method.

- You don’t need to provide contact information. People often think personal contact information is optional. This information is crucial for the Board of Equalization to process the request.

- Signatures are not that important. A misconception exists that signatures can be overlooked. The form requires a signature to validate the request.

- It is easy to make changes after submission. Many assume they can easily modify details post-submission. Changes are complicated and must be communicated to the Board of Equalization.

Understanding these misconceptions can help streamline the process and improve the chances of a successful exemption request.

Key takeaways

Here are some key takeaways regarding the BOE-245-OYE form for requesting an e-filing exemption:

- Understand the Purpose: The BOE-245-OYE form is specifically designed for individuals or entities seeking an exemption from e-filing requirements with the California State Board of Equalization.

- Complete the Form Fully: It's crucial to fill out the form completely. Incomplete submissions will lead to an automatic denial of your request.

- Provide Accurate Information: Ensure that the name of the owner, partner, or corporate officer is clearly printed or typed. Accuracy is key to successful processing.

- Address Requirements: Include your full address, including street, city, state, and zip code. Missing or incorrect address details can complicate matters.

- Account Number: Be prepared to input your relevant account number (BOE number) in the designated space on the form.

- Articulate Hardship: Clearly explain why e-filing creates an undue hardship for you. This justification is necessary and may require additional space on the back of the form.

- Signature Requirement: The form must be signed by the owner, partner, or corporate officer. A signature affirms the accuracy of the information provided.

- Date Your Submission: Remember to include the date when you sign the form. This helps in processing and tracking your request.

- Contact Information: Provide your telephone number. This will enable the Board of Equalization to reach you for any clarifications or follow-ups.

- Follow-Up: After submission, keep an eye out for any communications from the Board, especially to confirm whether your request has been approved or denied.

Keep this information handy to ensure a smooth application process. Taking these steps will enhance your chances of obtaining the exemption you seek.

Browse Other Templates

Firefighter Rehab Checklist - A checklist of required documents is included with the form.

Asset Distribution Record,Equipment Transfer Acknowledgment,Property Accountability Statement,Material Receipt Confirmation,Inventory Control Form,Government Property Hand Receipt,Item Management Documentation,Supply Chain Receipt Form,Inventory Trac - It outlines the responsibilities of individuals managing government property.