Fill Out Your Boe 392 Form

The BOE 392 form serves as a crucial tool for taxpayers seeking representation in matters related to California's Board of Equalization (BOE) and the California Department of Tax and Fee Administration (CDTFA). Designed primarily as a power of attorney, it allows individuals or entities to appoint authorized representatives to act on their behalf regarding tax-related issues, including property tax assessments and other specific tax matters. The form requires detailed information about both the taxpayer and the appointed representative, including names, addresses, and contact details. Taxpayers must indicate which division of the BOE they are addressing, as a separate form is needed for each division involved. Additionally, the BOE 392 outlines the specific powers granted to the appointee, which can range from general authorization for all acts to specific permissions for certain actions, such as resolving tax claims or attending hearings. Importantly, this document also revokes any previous power of attorney concerning the same tax matters, ensuring clarity and preventing conflicting authorities. Overall, understanding the nuances of the BOE 392 is essential for effective tax representation and compliance with California's tax regulations.

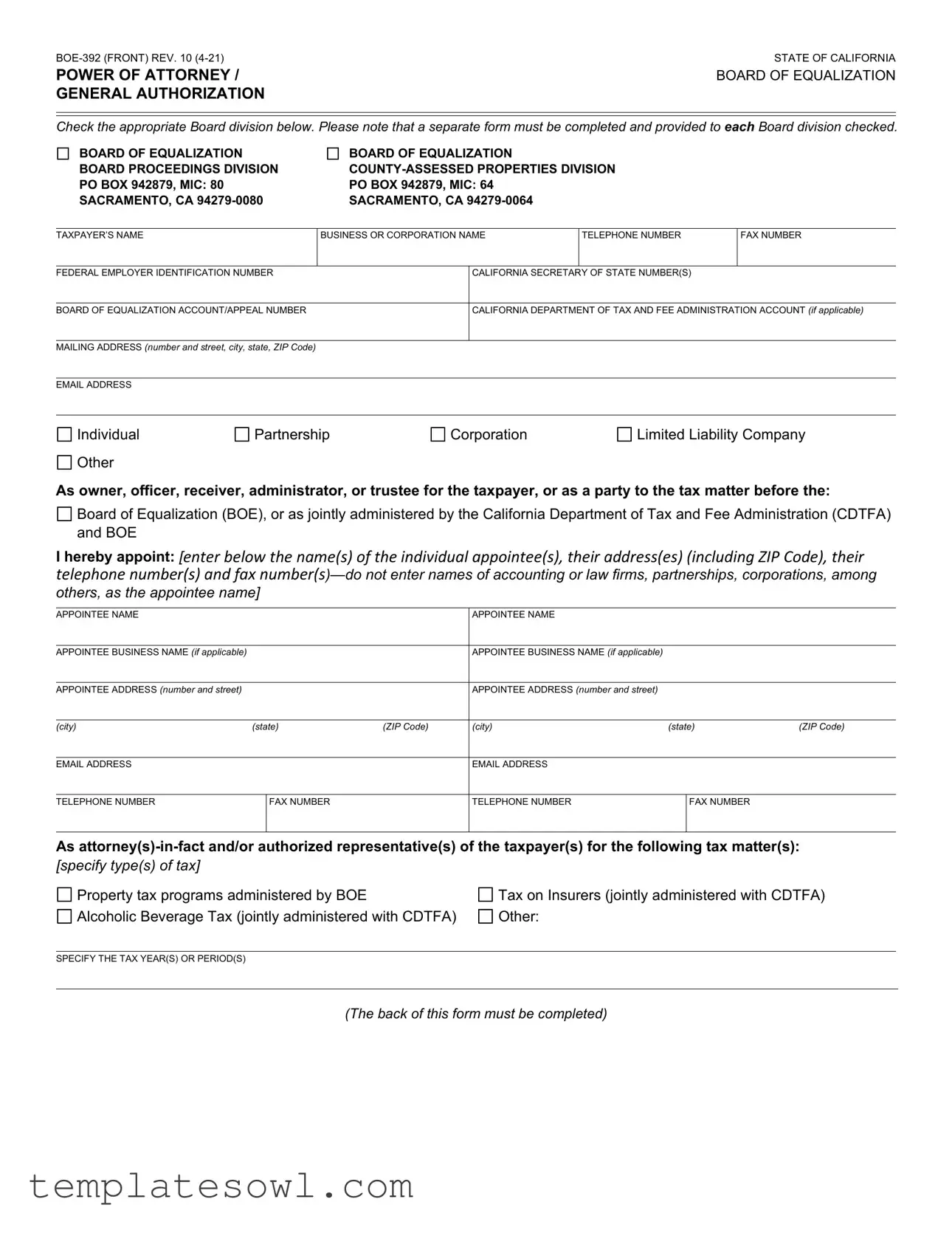

Boe 392 Example

STATE OF CALIFORNIA |

|

POWER OF ATTORNEY / |

BOARD OF EQUALIZATION |

GENERAL AUTHORIZATION |

|

Check the appropriate Board division below. Please note that a separate form must be completed and provided to each Board division checked.

BOARD OF EQUALIZATION BOARD PROCEEDINGS DIVISION PO BOX 942879, MIC: 80 SACRAMENTO, CA

BOARD OF EQUALIZATION

TAXPAYER’S NAME

BUSINESS OR CORPORATION NAME

TELEPHONE NUMBER

FAX NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

CALIFORNIA SECRETARY OF STATE NUMBER(S)

BOARD OF EQUALIZATION ACCOUNT/APPEAL NUMBER

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION ACCOUNT (if applicable)

MAILING ADDRESS (number and street, city, state, ZIP Code)

EMAIL ADDRESS

Individual |

Partnership |

Corporation |

Limited Liability Company |

Other |

|

|

|

As owner, officer, receiver, administrator, or trustee for the taxpayer, or as a party to the tax matter before the:

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

I hereby appoint: [enter below the name(s) of the individual appointee(s), their address(es) (including ZIP Code), their telephone number(s) and fax

others, as the appointee name]

APPOINTEE NAME

APPOINTEE NAME

APPOINTEE BUSINESS NAME (if applicable)

APPOINTEE BUSINESS NAME (if applicable)

APPOINTEE ADDRESS (number and street)

APPOINTEE ADDRESS (number and street)

(city) |

(state) |

(ZIP Code) |

(city) |

(state) |

(ZIP Code) |

EMAIL ADDRESS

EMAIL ADDRESS

TELEPHONE NUMBER

FAX NUMBER

TELEPHONE NUMBER

FAX NUMBER

As

Property tax programs administered by BOE |

Tax on Insurers (jointly administered with CDTFA) |

Alcoholic Beverage Tax (jointly administered with CDTFA) |

Other: |

SPECIFY THE TAX YEAR(S) OR PERIOD(S)

(The back of this form must be completed)

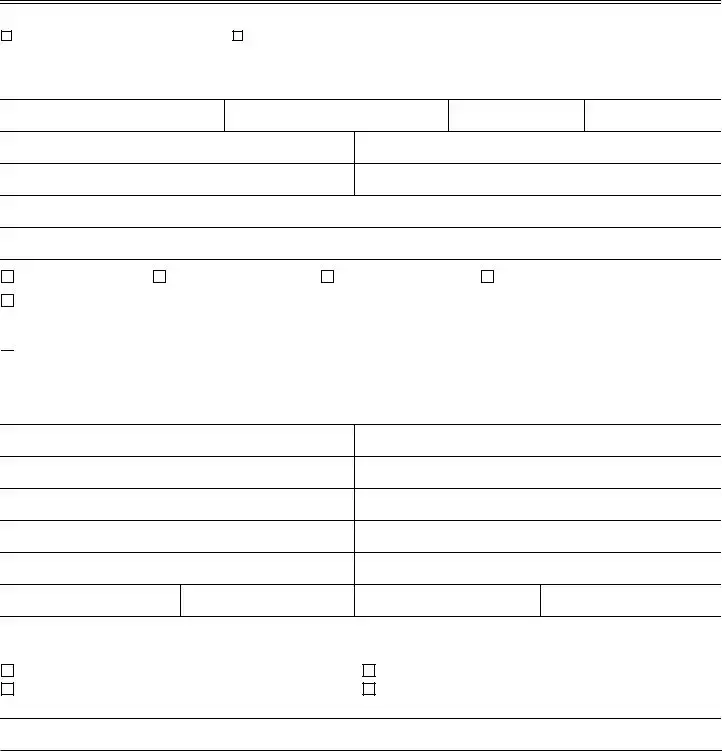

The

[check the box(es) for the power(s) granted]

General authorization (including all acts described below).

Specific authorization (selected acts described below).

To confer and resolve any assessment, claim, or collection of a deficiency or other tax matter pending before the identified Board division and attend any meetings or hearings thereto for the specified matter(s) identified above.

To receive, but not to endorse and collect, checks in payment of any refund of taxes, penalties, or interest. To execute petitions, claims for refund, and/or amendments thereto.

To execute consents extending the statutory period for assessment or determination of taxes. To delegate authority or to substitute another representative.

Other (specify):

This power of attorney/general authorization revokes all earlier power(s) of attorney/general authorizations on file with the Board of Equalization as identified above for the same matters and years or periods covered by this form, except for the following: [specify to whom granted, date and address, or refer to attached copies of earlier power(s)]

NAME

DATE POWER OF ATTORNEY/GENERAL AUTHORIZATION GRANTED

ADDRESS (number and street, city, state, ZIP Code)

Unless limited, this power of attorney will remain in effect until the final resolution of all tax matters specified herein.

(specify expiration date if limited term)

TIME LIMIT/EXPIRATION DATE (for Board of Equalization purposes)

Signature of

►IF THIS POWER OF ATTORNEY/GENERAL AUTHORIZATION IS NOT SIGNED AND DATED BY AN AUTHORIZED INDIVIDUAL, IT WILL BE RETURNED AS INVALID.

SIGNATURE |

TITLE (if applicable) |

DATE |

|

|

|

PRINT NAME |

|

TELEPHONE NUMBER |

|

|

|

SIGNATURE |

TITLE (if applicable) |

DATE |

|

|

|

PRINT NAME |

|

TELEPHONE NUMBER |

|

|

|

|

|

|

CLEAR

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The BOE-392 is a Power of Attorney form specific to the State of California for tax matters. |

| Governing Authority | This form is governed by California Revenue and Taxation Code, specifically sections applicable to the Board of Equalization. |

| Divisions Covered | It allows authorization for various divisions of the Board of Equalization, including the Board Proceedings and County-Assessed Properties divisions. |

| Tax Types | The form covers multiple tax matters including property tax and taxes administered jointly with the California Department of Tax and Fee Administration. |

| Confidentiality | Authorized representatives may receive confidential tax information related to the taxpayer's matters. |

| Revocation | Filing a BOE-392 form revokes all previous powers of attorney related to the same tax matters unless stated otherwise. |

| Duration | This Power of Attorney remains in effect until all matters are resolved, or a specified expiration date is provided. |

| Signature Requirement | If the form is not signed and dated by an authorized person, it will be deemed invalid. |

| Appointee Restrictions | Names of accounting or law firms cannot be listed as appointees; only individual names are permitted. |

Guidelines on Utilizing Boe 392

Filling out the BOE-392 form requires careful attention to detail. This form is a crucial step in granting authority to an appointee regarding tax matters in California. Once you have completed the form, submit it to the appropriate Board division as indicated at the beginning of the document.

- Start by selecting the appropriate Board division. Mark the box next to either the Board of Equalization, Board Proceedings Division, or County-Assessed Properties Division.

- Fill in the taxpayer's name, along with the business or corporation name if applicable. Include the telephone number, fax number, federal employer identification number, and California Secretary of State number(s).

- Provide the Board of Equalization account or appeal number. If relevant, add the California Department of Tax and Fee Administration account.

- Complete the mailing address section with the number and street, city, state, and ZIP code. Include the email address.

- Select the type of entity: Individual, Partnership, Corporation, Limited Liability Company, or Other.

- Enter the name(s) of the appointee(s) below, along with their addresses—including ZIP codes—and telephone and fax numbers. Ensure not to list accounting or law firms as appointees.

- Specify the types of tax the appointee(s) are being authorized to handle. Examples include property tax programs or the Alcoholic Beverage Tax.

- Identify the tax year(s) or period(s) relevant to this authorization.

- On the back of the form, indicate the specific powers granted to the appointee(s). Choose either general authorization or specific acts.

- State if this authorization will revoke any prior power(s) of attorney. Provide details of previous powers if applicable.

- Sign and date the form. If the taxpayer is part of a joint return, both partners must sign.

- Print your name and contact telephone number beneath your signature.

What You Should Know About This Form

What is the BOE-392 form used for?

The BOE-392 form is a Power of Attorney and General Authorization used in California for matters involving the Board of Equalization (BOE). Taxpayers can utilize this form to appoint an individual or individuals to act on their behalf regarding various tax matters. This includes property tax programs or other tax-related issues administered by both the BOE and the California Department of Tax and Fee Administration (CDTFA).

Who can complete the BOE-392 form?

The form can be completed by individuals who hold a position of authority related to the taxpayer, such as an owner, corporate officer, administrator, or trustee. Individuals representing partnerships, corporations, or limited liability companies can also complete the form. It is important to accurately fill out the information required for both the taxpayer and the appointed representative(s).

How long is the authorization valid once submitted?

The authority granted through the BOE-392 form remains effective until the final resolution of all specified tax matters. If the taxpayer wishes to impose a time limit on the authorization, that can be specified directly on the form. If no expiration is noted, the general authorization continues indefinitely.

Can multiple divisions of the Board of Equalization be designated on one form?

No, a separate BOE-392 form must be completed for each Board division that the taxpayer intends to authorize. The form clearly allows for checking of appropriate divisions; however, it explicitly requires a distinct submission for each checked division to ensure proper handling of the tax matters involved.

What happens if the form is not signed correctly?

If the BOE-392 form is not signed and dated by an authorized individual, it will be returned as invalid. It's crucial that the person completing the form has the right authority to do so as stipulated in the document, and that both taxpayers involved in a joint return sign the form if joint representation is desired.

Common mistakes

Filling out the BOE-392 form can be a straightforward process, but mistakes are common. One major error involves failing to select the appropriate Board division. Each division serves distinct purposes, and it is essential to indicate the right one. A separate form is required for each division checked, so skipping this crucial step can result in unnecessary delays.

Another common mistake is incomplete or inaccurate contact information. Providing details like the taxpayer's name, business name, and contact numbers is vital. If any of these fields are left blank or incorrectly filled, communication from the Board regarding your submission may be hindered. Always double-check that this information is correct before submitting.

Many individuals overlook the section regarding the appointee's details. It is important to specify who is being given the power of attorney. Only individuals should be named—organizations such as law firms or corporations cannot be appointed. Failing to adhere to this requirement complicates the authorization process.

Some individuals mistakenly select multiple tax matters without specifying the exact type of tax. This section requires clarity to ensure that the appointee can act effectively on behalf of the taxpayer. Failure to detail the tax matters could result in confusion and disrupt the resolution process.

People also forget to complete both sides of the form. The back of the BOE-392 contains critical information, and an incomplete form may be returned as invalid. Remembering to fill out both the front and back sections can prevent unnecessary setbacks.

Another error is neglecting the signature requirement. Each taxpayer must sign the form, and if it's a joint return, both spouses must provide their signatures. If the form is submitted without the required signatures, the Board will reject it.

Individuals often miscalculate the time limit or expiration date for the power of attorney. Specifying how long the authorization remains in effect is essential. If this detail is missed or incorrectly filled in, it could lead to future discrepancies regarding the appointee's authority.

Some errors stem from providing outdated power of attorney information. If a previous authorization exists, it must be specified in the form to avoid confusion. Failing to address earlier grants can create ambiguity surrounding the authority granted.

Finally, rushing through the process can lead to overlooked details, such as typos or errors in addresses and contact information. Taking the time to review the completed form ensures that every section is properly addressed and reduces the likelihood of mistakes.

Being mindful of these common pitfalls can simplify the process of completing the BOE-392 form. While the form may seem daunting, careful attention and thoroughness can lead to a smoother experience with the Board of Equalization.

Documents used along the form

The BOE-392 form, used for granting power of attorney to representatives for tax matters in California, often requires several other documents to support the process. Here’s a concise overview of other forms and documents typically associated with the BOE-392. Understanding these documents can enhance your efficiency in addressing tax issues.

- BOE-28 Form: This form is used to request the release of recorded liens against a property. It is essential for resolving issues related to property tax debts.

- BOE-277 Form: This document serves as a claim for refund of taxes collected erroneously. Taxpayers utilize it to recover funds mistakenly paid to tax authorities.

- BOE-601 Form: This is the application for a basic business license. It may be required for companies engaging in commercial activities subject to tax regulations.

- BOE-410 Form: This form pertains to the assessment of property tax for machinery and equipment. It is crucial for businesses that utilize substantial equipment.

- BOE-500 Form: This document requests the property tax assessment reduction. Taxpayers looking for relief after an increase in property taxes will typically file this form.

- BOE-19 Form: This form allows a taxpayer to designate an authorized representative for property tax purposes. It simplifies communication regarding tax assessments and disputes.

- CDTFA-401: Known as the Application for a Seller's Permit, this form is vital for businesses selling taxable goods or services, ensuring compliance with sales tax regulations.

- BOE-112: This form is utilized to report changes in ownership of a property which can impact property tax assessments. Timely reporting helps avoid penalties.

- CDTFA-1: This application form allows businesses to register with the California Department of Tax and Fee Administration, establishing the business's tax account.

Each of these documents plays a vital role in tax compliance and coordination with the Board of Equalization. It’s important to prepare all necessary paperwork thoroughly to ensure smooth processing of your tax matters. Accurate and timely submissions can significantly reduce complications and assist in achieving favorable outcomes.

Similar forms

The BOE-392 form serves as a power of attorney for specific tax matters in California. It has similarities with several other documents used in legal and tax-related processes. Here are seven documents that share similarities with the BOE-392 form:

- Power of Attorney (General Form): This form allows an individual to authorize another person to act on their behalf in legal and financial matters, similar to how the BOE-392 provides authority for tax-related issues.

- IRS Form 2848 (Power of Attorney and Declaration of Representative): This IRS form grants authority to a representative for tax issues, mirroring the purpose of the BOE-392 in authorizing action before a tax authority.

- California Form FTB 3520 (Power of Attorney): This state-specific form is used to appoint someone to represent a taxpayer in dealings with the Franchise Tax Board, akin to the role of the BOE-392 with the Board of Equalization.

- IRS Form 8821 (Tax Information Authorization): This form allows a designated person to receive confidential tax information but does not grant the authority to act on behalf of the taxpayer, unlike the BOE-392.

- California Form BOE-530 (Change of Address Notification): While primarily used for notifying changes in address, this form can accompany the BOE-392 when updating contact information for tax-related matters.

- Trustee or Executor Authorization: Documents that grant authority to a trustee or executor can be likened to the BOE-392 because they enable one person to act for another in managing tax obligations.

- Durable Power of Attorney: This document authorizes someone to handle the financial affairs of an individual, similar to the BOE-392’s role in allowing representatives to manage tax matters.

Dos and Don'ts

Filling out the BOE-392 form requires attention to detail. Here are ten important guidelines to follow.

- Do: Enter all information clearly. Use legible handwriting or print.

- Do: Double-check the accuracy of the taxpayer's name and contact information.

- Do: Clearly indicate the Board division you are addressing.

- Do: Provide a specific expiration date if the power of attorney is for a limited term.

- Do: Ensure that all required signatures are present; missing signatures can lead to delays.

- Don't: Leave any required fields blank. All sections must be filled out completely.

- Don't: Use vague terms like "various" in describing tax matters; be specific.

- Don't: Enter business or law firm names as appointees; only individuals can be designated.

- Don't: Forget to sign and date the form; an unsigned form will be considered invalid.

- Don't: Submit the form without attaching any necessary supporting documentation.

By following these guidelines, you can ensure a smoother process when submitting the BOE-392 form.

Misconceptions

Understanding the BOE-392 form can be tricky, and there are some common misconceptions that can lead to confusion. Let’s clear those up:

- It's only for individuals. Many people think the BOE-392 form is exclusively for individuals. In reality, this form can also be used by partnerships, corporations, and limited liability companies.

- You can submit one form for all divisions. Another misconception is that one form is enough for all Board divisions. Each division requires a separate BOE-392 form, so make sure to complete one for each division you want to address.

- Only attorneys can be appointees. Some believe that only licensed attorneys can be named as representatives in this form. While attorneys can be appointed, you can also designate any individual who has your authority to act on your behalf.

- It's a one-time submission. Another common misconception is that if you submit the BOE-392 once, you’re set for life. This is not true. The form revokes previous authorizations, and it remains valid until you cancel it or a matter is resolved, so it may need to be updated.

- All powers of attorney last forever. Many people think that all powers of attorney last indefinitely. However, the BOE-392 is specifically designed to be valid until the final resolution of the tax matters specified on the form, or until you specify a termination date.

- The information is not confidential. Some individuals assume that the information shared on the BOE-392 is public. However, you are granting your appointee access to confidential tax information, so it's essential to choose someone you trust.

By understanding these misconceptions about the BOE-392 form, you can navigate the process more confidently and make informed decisions regarding your tax matters.

Key takeaways

Here are key takeaways regarding the BOE-392 form, which serves as a Power of Attorney and General Authorization for tax matters in California:

- The form must be filled out with utmost accuracy to prevent delays in processing.

- Make sure to check the appropriate Board division that will handle your request; a separate form is required for each division.

- Provide complete details regarding the taxpayer, including their business name, contact information, and relevant identification numbers.

- Identify the appointee clearly; do not list accounting or law firms. Include the appointee's name, address, and contact information.

- Specify the tax matters involved, including the types of taxes and the applicable periods or years.

- Grant adequate authority to the appointee, choosing between general or specific authorization as necessary.

- Remember to revoke any prior Power of Attorney by indicating previous appointments on the form.

- For joint tax matters, signatures from both spouses are mandatory if seeking joint representation.

- Ensure that the form is signed and dated by an authorized individual, or it will be considered invalid and returned.

Taking the time to carefully complete the BOE-392 can help ease your tax-related processes. It puts you in a better position to navigate any issues that may arise with the Board of Equalization.

Browse Other Templates

Icici Pay Direct Card Balance Check - The ICICI Bank requires access to your employment information for verification before approval.

Bid Assistance Request Form,Dealer Discount Assistance Form,Stihl Pricing Support Document,Agency Bid Support Claim,Dealer Marketing Assistance Form,Stihl Direct Bid Rebate Form,Assistance Claim for Bids,Bid Support Submission Form,Agency Purchase As - A sales invoice reflecting the proper discount must be included with this form.

Mcs-150 Form - New entrants in the transportation sector must familiarize themselves with the MCS-150 as part of their setup process.