Fill Out Your Boe 400 Spa Form

The BOE 400 Spa form serves as a critical tool for businesses seeking to comply with California's regulations on selling tangible personal property. This application, officially titled the California Seller's Permit Application for Individuals, Partnerships, Corporations, and Organizations, is essential for those who wish to legally sell or lease merchandise, vehicles, or other items subject to sales tax within the state. The form distinguishes between "Regular" permits for ongoing sales and "Temporary" permits for sales lasting 90 days or less. Information required on the form includes details about the business operation, ownership structure, and projected sales figures. Applicants must also disclose whether they plan to sell specific items, such as tires or tobacco, which may carry additional licensing requirements. Additionally, the form mandates the personal identification of the owners, promoting accountability in business practices. It is crucial to complete the application accurately to avoid delays and ensure timely approval of the seller’s permit, enabling businesses to operate within California law.

Boe 400 Spa Example

California Seller’s Permit Application

for Individuals/Partnerships/Corporations/Organizations

(Regular or Temporary)

State Board of Equalization

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION • SELLER’S PERMIT

APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •

SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT

APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •

BOARD MEMBERS

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT

Betty T. Yee

A |

|

• SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’ActingS P |

MemberA |

• |

|||||||

|

PPLICATION |

|

|

ERMIT |

PPLICATION |

|

|||||

|

|

|

|

First District |

|

||||||

|

|

|

|

San Francisco |

|

||||||

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION |

• SELLER’S PERMIT |

||||||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

Bill Leonard |

• |

||||||

APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT |

APPLICATION |

||||||||||

|

|

|

|

Second District |

|

||||||

|

|

|

Sacramento/Ontario |

|

|||||||

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION |

•SELLER’S |

PERMIT |

|||||||||

|

|

|

|

Claude Parrish |

|

||||||

|

|

|

|

Third District |

|

||||||

APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT |

APPLICATION • |

||||||||||

|

|

|

|

Long Beach |

|

||||||

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT A |

John•S |

Chiang’ P |

|

||||||||

|

|

|

|

PPLICATION |

|

|

ELLER S |

ERMIT |

|||

|

|

|

|

Fourth District |

|

||||||

|

|

|

|

Los Angeles |

|

||||||

APPLICATION •SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT |

APPLICATION • |

||||||||||

|

|

|

|

Steve Westly |

|

||||||

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATIONState •ControllerSELLER’S PERMIT |

|||||||||||

APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION • |

SELLER’S PERMIT APPLICATION • |

||||||||||

|

|

|

EXECUTIVE DIRECTOR |

|

|||||||

|

|

|

|

Ramon J. Hirsig |

|

||||||

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION |

•SELLER’S |

PERMIT |

|||||||||

APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •

SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION • SELLER’S PERMIT

APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •

SELLER’S PERMIT APPLICATION • SELLER’S PERMIT APPLICATION •SELLER’S PERMIT APPLICATION •SELLER’S PERMIT

2

Frequently Asked Questions

Who must have a permit?

You are generally required to obtain a California seller’s permit if you sell or lease merchandise, vehicles, or other tangible personal property in California. A seller’s permit allows you to sell items at the wholesale or retail level. If your sales are ongoing, you should apply for a “Regular” permit. If your sales are of a temporary nature (90 days or less), apply for a “Temporary” permit. You cannot legally sell taxable items in California until you have been issued a seller’s permit.

Do I need more than one permit?

Each location where sales of taxable items are made requires, and must display, a seller’s permit. If you have more than one selling location, attach a list that includes the address for each location, and we will issue the permits needed. If your application is for a temporary permit, one permit will be enough, but you need to display a copy of that permit at each tempo- rary location.

Is there a charge for a permit?

No. However, we may require a security deposit. Deposits are used to cover any unpaid taxes that may be owed at the time a business closes.

Is information about my account subject to public disclosure?

State laws that protect your privacy generally cover your records. Some records are subject to public disclosure, such as the information on your seller’s permit, names of owners or partners, your business address, and your permit status. See the disclosure information on the back page.

Why do you need a copy of my driver license?

When it is required, it is used to ensure the accuracy of the information provided and to protect against fraudulent use of your identification.

Why am I being asked if I sell tires, covered electronic devices, or tobacco products at retail?

Effective January 1, 2001, California retailers of new tires began collecting a tire fee (currently $1.75)

for each new tire sold to consumers. Beginning January 1, 2005, retailers must collect a recycling fee on the retail sale or lease of certain new or refurbished video display devices that have a screen size of more than four inches measured diagonally. Video display devices subject to the fee are called “covered elec-

tronic devices” (CEDs). They include televisions, computer monitors, or any other product that contains a cathode ray tube, including “bare” cathode ray tubes, computer monitors, and laptop computers that use a liquid crystal display. For more information on the Electronic Recycling Fee Program or CEDs, visit: www.boe.ca.gov/sptaxprog/ewaste.htm. Effective June 30, 2004, if you sell cigarettes and/or tobacco products, you must obtain a license (separate from a seller’s permit) for each location you intend to sell these products. Depending on your response to each ques- tion and the type of business, the Board will send you information about these license and fee programs.

What are my rights and responsibilities as a seller?

When you obtain a seller’s permit, you acquire certain rights and responsibilities.

•You may buy property for resale without paying tax to your supplier. By providing the vendor a completed resale certificate, you are not required to pay sales tax on property you are buying for resale. You cannot use a resale certificate to buy property for your own use (even if you plan to sell it after its use).

•You must keep records to substantiate your sales, purchases, and return deductions and keep them for four years.

•You must file returns according to the Board’s instructions for the filing basis that we determine from your application. You must file a return even if you have no tax to report.

•You must pay the sales tax due on your retail sales in California. You may be reimbursed by collecting the amount of tax from your customers.

•You must notify the Board of any business changes. A permit is issued only to the owner and address listed on the permit. If you change owner- ship, address, add another location, sell or close your business, add or drop a partner, you must notify the Board by calling or in writing. Your notification will help us close your account and return any security on deposit. If you do not, you could be held liable for continuing business taxes. Note: Notify us immediately if you drop or add a partner in order to protect former partners from tax liabilities incurred by the business after the partner- ship changes.

Seller’s Permit Application ■ Individuals/Partnerships/Corporations/Organizations (Regular or Temporary)

3

INFORMATION CENTER

FOR TDD ASSISTANCE

From TDD phones:

From voice phones:

FIELD OFFICES

CALL FOR ADDRESSES

City |

Area |

Number |

|

Code |

|

Bakersfield |

661 |

|

Culver City |

310 |

|

El Centro |

760 |

|

Eureka* |

707 |

|

Fresno |

559 |

|

Kearny Mesa |

858 |

|

Laguna Hills |

949 |

|

Long Beach |

562 |

|

Norwalk |

562 |

|

Oakland |

510 |

|

Rancho Mirage |

760 |

|

Redding |

530 |

|

Riverside |

951 |

|

Sacramento |

916 |

|

Salinas |

831 |

|

San Diego |

619 |

|

San Francisco |

415 |

|

San Jose |

408 |

|

San Marcos |

760 |

|

Santa Ana |

714 |

|

Santa Rosa |

707 |

|

Suisun City |

707 |

|

Van Nuys |

818 |

|

Ventura |

805 |

|

West Covina |

626 |

Business Located

*Office closed June 30, 2005. For dates and times of services in the Eureka area, please visit our website at www.boe.ca.gov or call the Information Center at

How Do I Apply for

My Seller’s Permit?

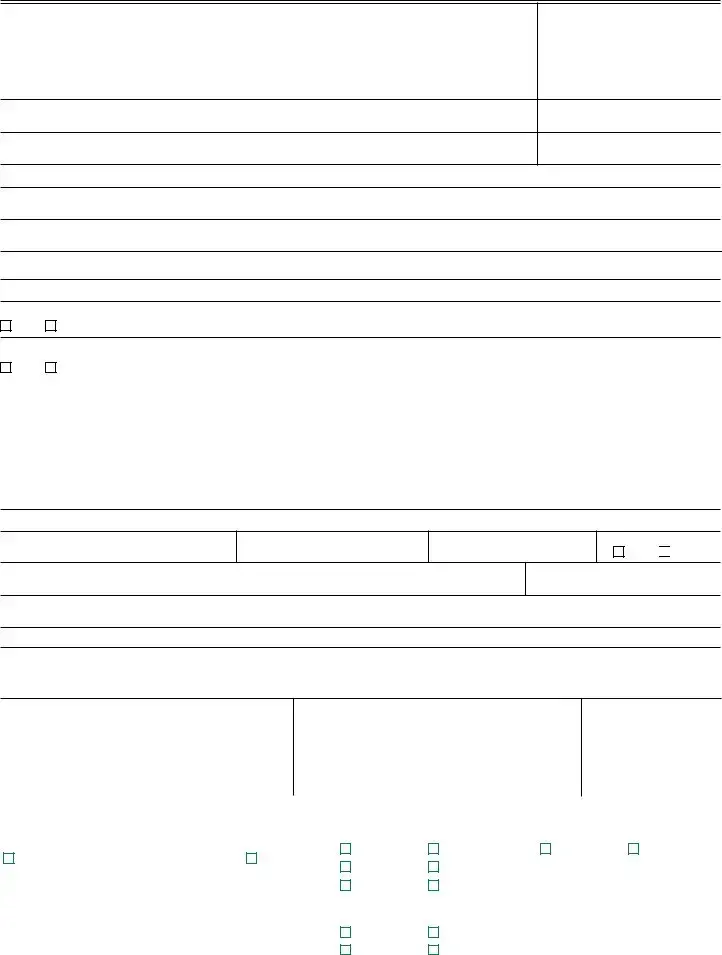

Step 1: Complete Your Application

Complete the application on page 5. If your business is an ongoing opera- tion, check permit type “Regular.” If your business will operate at the location(s) for 90 days or less, check “Temporary.” Please provide all the information requested on the application. If you do not, this will delay the issuance of your permit. Refer to the “Tips” on page 4. If you need assis- tance, please call your local Board office or the Information Center at

Note: If your business is located outside California, you also need to complete form

For information regarding whether or not your

Step 2: Send Your Application for Processing

Send or take your application to the district office nearest your place of business. If you plan to apply in person, contact the local office to find out when they are open. Note: A permit is required before you begin making sales. Advise the Board if you have an urgent need for a permit.

Step 3: After Your Application Is Approved

If your application is complete, you should receive your permit in about two weeks. Based on the information in your application, the Board will provide you with regulations, forms, and other publications that may help you with your business. Or, you may choose to view and download information from our website at www.boe.ca.gov. You will also be informed as to when to file tax returns: monthly, quarterly, fiscal or calendar yearly. You will also start receiving tax returns for reporting and paying the taxes due on your sales and purchases. If you do not receive a return, download one from our website, or call the district office nearest you. You may also be eligible to

Post your permit at your place of business in a location easily seen by your customers.

Seller’s Permit Application ■ Individuals/Partnerships/Corporations/Organizations (Regular or Temporary)

4

Tips for Filling Out Your Application

Item 1: Permit Type

Check whether you are applying for a regular or temporary permit. You may apply for a temporary permit if you intend to make sales for a period of 90 days or less. Otherwise, you must apply for a regular permit.

Items

Check your type of ownership and provide all of the information requested. Partnerships should provide a copy of their written partnership agreement, if one exists. If it is filed with us at the time you apply for a permit and it specifies that all business assets are held in the name of the partnership, we will attempt to collect any delinquent tax liability from the partnership’s assets before we attempt to collect from the partners’ personal assets. The “Registered Domestic Partnership” ownership box should only be checked if both persons are registered as domestic partners with the Office of the Secretary of State.

Items

Indicate whether those listed are owners, partners, etc., and enter their driver license or California Identification Card number and, except in the case of corporate officers, their social security number. Also, provide a reference for each person, who does not live with that person. This information will be kept in strict confi- dence. If mailing your application, you must provide

a photocopy of your driver license or California Identification Card.

Items

Check whether the business is a retailer, wholesaler, etc., and whether the business is full time or part time. Describe the types of items you will sell. Avoid using broad descriptions, such as “general merchandise.” Instead, list specific examples such as sports equipment or garden supplies. Indicate the number of selling locations, the address, telephone number, website and email address of the business, as well as the landlord’s name, address, and telephone number. If there are multiple selling locations, additional addresses can be

listed on the reverse side (Item 66). Tax returns and other materials will be sent to the business address unless a different mailing address is specified (Item 42).

Items

Indicate your projected monthly gross and taxable sales. If unsure, provide an estimate. Your projection helps to determine how often you will need to file a return. If your actual sales vary, we may adjust your filing frequency.

Items

Provide your Alcoholic Beverage Control license number, if applicable. Indicate if you will be selling new tires, covered electronic devices, or tobacco products. We will contact you to determine if you need to register for any of these other programs.

Items

Identify the person maintaining your records, your bank, and if you accept credit cards, your merchant card account. Also, identify major

Items

If you are purchasing a business, or changing from one type of business organization to another, provide the previous owner’s name and seller’s permit num- ber. If you are purchasing a business, you should request a tax clearance in advance to assure that you won’t have to pay any taxes owed by the previous owner.

Items

Applicants for a temporary permit must complete each item in this section.

Certification

Each owner,

Seller’s Permit Application ■ Individuals/Partnerships/Corporations/Organizations (Regular or Temporary)

— tear at perforation —

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF CALIFORNIA |

||||||||

APPLICATION FOR SELLER’S PERMIT |

|

|

|

|

|

|

|

|

|

BOARD OF EQUALIZATION |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. PERMIT TYPE: (check one) |

Regular |

Temporary |

|

|

|

FOR BOARD USE ONLY |

|

|

|

|||||||||||

2. TYPE OF OWNERSHIP (check one) |

|

* Must provide partnership agreement |

TAX |

|

IND |

OFFICE |

|

|

|

PERMIT NUMBER |

||||||||||

Sole Owner |

|

|

Husband/Wife |

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Corporation |

|

|

Limited Liability Company (LLC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Unincorporated Business Trust |

NAICS CODE |

BUS CODE |

A.C.C. |

REPORTING BASIS |

|

TAX AREA CODE |

|||||||||||

General Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Limited Liability Partnership (LLP) * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Limited Partnership (LP) * |

|

|

|

|

|

RETURN TYPE |

|

|

|

|

|

|||||||||

(Registered to practice law, accounting or architecture) |

PROCESSED BY |

PERMIT ISSUE |

|

|

(1) |

|

(2) |

|||||||||||||

|

|

|

||||||||||||||||||

Registered Domestic Partnership |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

DATE |

|

VERIFICATION |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other (describe) |

|

|

|

|

|

|

|

|

___ / ___ / ___ |

|

|

DL |

|

PA |

|

|

Other |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3. NAME OF SOLE OWNER, CORPORATION, LLC, PARTNERSHIP, OR TRUST |

|

|

|

4. STATE OF INCORPORATION OR ORGANIZATION |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5. BUSINESS TRADE NAME / “DOING BUSINESS AS” [DBA] (if any) |

|

|

|

|

|

6. DATE YOU WILL BEGIN BUSINESS ACTIVITIES (month, day, and year) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. CORPORATE, LLC, LLP OR LP NUMBER FROM CALIFORNIA SECRETARY OF STATE |

|

|

|

8. FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

CHECK ONE |

Partners |

Registered Domestic |

Corp. Officers |

LLC Officers/Managers/ |

|

|

Trustees/ |

|||||||||||||

|

|

|

|

|

Partners |

|

|

|

|

Members |

|

|

|

|

Beneficiaries |

|||||

Use additional sheets to include information for more than three individuals.

9. FULL NAME (first, middle, last) |

|

|

|

|

|

|

|

|

|

10. TITLE |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

12. DRIVER LICENSE NUMBER (attach copy) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

13. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

14. HOME TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

15. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

16. ADDRESS (street, city, state, zip code) |

|

|

17. REFERENCE TELEPHONE NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

18. FULL NAME OF ADDITIONAL PARTNER, OFFICER, OR MEMBER (first, middle, last) |

|

|

|

|

|

19. TITLE |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

21. DRIVER LICENSE NUMBER (attach copy) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

22. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

23. HOME TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

24. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

25. ADDRESS (street, city, state, zip code) |

|

|

26. REFERENCE TELEPHONE NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

27. FULL NAME OF ADDITIONAL PARTNER, OFFICER, OR MEMBER (first, middle, last) |

|

|

|

|

|

28. TITLE |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

29. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

30. DRIVER LICENSE NUMBER (attach copy) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

31. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

32. HOME TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

33. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

34. ADDRESS (street, city, state, zip code) |

|

|

35. REFERENCE TELEPHONE NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

36. TYPE OF BUSINESS (check one that best describes your business) |

|

|

|

|

|

|

37. NUMBER OF SELLING LOCATIONS |

|||||||||

Retail |

Wholesale |

Mfg. |

Repair |

Service |

Construction |

Contractor |

|

Leasing |

|

|

(if 2 or more, see Item No. 66) |

|||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

38. WHAT ITEMS WILL YOU SELL? |

|

|

|

|

|

|

|

|

|

39. CHECK ONE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Time |

Part Time |

||

|

|

|

|

|

|

|

|

|

|

|

||||||

40. BUSINESS ADDRESS (street, city, state, zip code) [do not list P.O. Box or mailing service] |

|

|

|

|

|

41. BUSINESS TELEPHONE NUMBER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

42. MAILING ADDRESS (street, city, state, zip code) [if different from business address] |

|

|

|

|

|

43. BUSINESS FAX NUMBER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

44. BUSINESS WEBSITE ADDRESS |

|

|

45. BUSINESS EMAIL ADDRESS |

|

|

|

|

46. DO YOU MAKE INTERNET SALES? |

||||||||

www. |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

47. NAME OF BUSINESS LANDLORD |

|

|

48. LANDLORD ADDRESS (street, city, state, zip code) |

|

|

49. LANDLORD TELEPHONE NUMBER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

50. PROJECTED MONTHLY GROSS SALES |

|

51. PROJECTED MONTHLY TAXABLE SALES |

|

52. ALCOHOLIC BEVERAGE CONTROL LICENSE NUMBER (if applicable) |

||||||||||||

$ |

|

|

|

$ |

|

|

|

|

___ ___ - ___ ___ ___ ___ ___ ___ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

53. SELLING NEW TIRES? |

|

|

54. SELLING COVERED ELECTRONIC DEVICES? |

|

|

55. SELLING TOBACCO AT RETAIL? |

||||||||||

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(continued on reverse)

56. NAME OF PERSON MAINTAINING YOUR RECORDS |

57. ADDRESS (street, city, state, zip code) |

58. TELEPHONE NUMBER |

|

|

|

59. NAME OF BANK OR OTHER FINANCIAL INSTITUTION (note whether business or personal) |

60. BANK BRANCH LOCATION |

|

|

|

|

61. NAME OF MERCHANT CREDIT CARD PROCESSOR (if you accept credit cards) |

|

62. MERCHANT CARD ACCOUNT NUMBER |

63. NAMES OF MAJOR |

64. ADDRESSES (street, city, state, zip code) |

65. PRODUCTS PURCHASED

ADDITIONAL SELLING LOCATIONS (List All Other Selling Locations)

66. PHYSICAL LOCATION OR STREET ADDRESS (attach separate list, if required)

OWNERSHIP AND ORGANIZATIONAL CHANGES (Do Not Complete for Temporary Permits)

67. ARE YOU BUYING AN EXISTING BUSINESS?

Yes |

No If yes, complete items 70 through 74. |

68.ARE YOU CHANGING FROM ONE TYPE OF BUSINESS ORGANIZATION TO ANOTHER (FOR EXAMPLE, FROM A SOLE OWNER TO A CORPORATION OR FROM A PARTNERSHIP TO A LIMITED LIABILITY COMPANY, ETC.)?

Yes |

No If yes, complete items 70 and 71. |

|

|

|

|

69. OTHER OWNERSHIP CHANGES (please describe): |

|

|

|

|

|

70. FORMER OWNER’S NAME |

71. SELLER’S PERMIT NUMBER |

|

|

|

|

72. PURCHASE PRICE |

73. VALUE OF FIXTURES & EQUIPMENT |

|

$ |

|

$ |

|

|

|

74. IF AN ESCROW COMPANY IS REQUESTING A TAX CLEARANCE ON YOUR BEHALF, PLEASE LIST THEIR NAME, ADDRESS, TELEPHONE NUMBER, AND THE ESCROW NUMBER

TEMPORARY PERMIT EVENT INFORMATION

75. PERIOD OF SALES

FROM: ___ / ___ / ___ THROUGH: ___ / ___ / ___

76. ESTIMATED EVENT SALES

$

77. SPACE RENTAL COST (if any)

$

78. ADMISSION CHARGED?

Yes

No

No

79. ORGANIZER OR PROMOTER OF EVENT (if any) |

80. ADDRESS (street, city, state, zip code) |

81. TELEPHONE NUMBER

( )

82.ADDRESS OF EVENT (If more than one, use line 66, above. Attach separate list, if required.)

CERTIFICATION

All Corporate Officers, LLC Managing Members, Partners, or Owners must sign below.

I am duly authorized to sign the application and certify that the statements made are correct to the best of my knowledge and belief. I also represent and acknowledge that the applicant will be engaged in or conduct business as a seller of tangible personal property.

NAME (typed or printed) |

SIGNATURE |

DATE |

|

|

|

|

|

✍ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

NAME (typed or printed) |

|

|

|

SIGNATURE |

|

|

|

|

DATE |

|

|

|

||||||

|

|

|

|

|

✍ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME (typed or printed) |

|

|

|

SIGNATURE |

|

|

|

|

DATE |

|

|

|

||||||

|

|

|

|

|

✍ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR BOARD USE ONLY |

|

|

|

|

|

|

|

|

|||||

|

|

SECURITY REVIEW |

|

|

|

|

FORMS |

|

|

|

|

PUBLICATIONS |

||||||

|

|

) or |

|

|

|

|

|

|

|

|

PUB 73 |

|

PUB DE 44 |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

REQUIRED BY |

APPROVED BY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

REGULATIONS |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

RETURNS |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

REG. 1668 |

|

|

REG. 1698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

REG. 1700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

Where Can I Get Help?

No doubt you will have questions about how the Sales and Use Tax Law applies to your business

operations. For assistance, you may take advantage of the resources listed below.

INTERNET

www.boe.ca.gov

You can log onto our website for additional infor- mation. For example, you can find out what the tax rate is in a particular county, or you can download numerous publications — such as laws, regulations, pamphlets, and policy manuals — that will help you understand how the law applies to your business. You can also verify sellers’ permit numbers online, read about upcoming Taxpayers’ Bill of Rights hearings, and obtain information on Board field office addresses and telephone numbers.

Another good resource — especially for starting businesses — is the California Tax Information Center at www.taxes.ca.gov.

CLASSES

You may enroll in a basic sales and use tax class offered by some local Board offices. You should call ahead to find out when your local office conducts classes for beginning sellers.

WRITTEN TAX ADVICE

It is best to get tax advice from the Board in writing. You may be relieved of tax, penalty, or interest charges if we determine you did not correctly report tax because you reasonably relied on our written advice regarding a transaction.

For this relief to apply, your request for advice must be in writing, identify the taxpayer to whom the advice applies, and fully describe the facts and circumstances of the transaction.

Send your request for written advice to:

State Board of Equalization; Audit and Information Section, MIC:44; PO Box 942879, Sacramento, CA

INFORMATION CENTER

FOR TDD ASSISTANCE

From TDD phones:

From voice phones:

Customer service representatives are available from

8a.m. through 5 p.m.,

Faxback Service. To order fax copies of selected forms and notices, call

Translator Services. We can provide bilingual ser- vices for persons who need assistance in a language other than English.

TAXPAYERS’ RIGHTS

ADVOCATE OFFICE

If you would like to know more about your rights as a taxpayer or if you are unable to resolve an issue with the Board, please contact the Taxpayers’ Rights Advocate office for help at

(or

If you prefer, you can write to: State Board of Equaliza- tion; Taxpayers’ Rights Advocate, MIC:70; PO Box 942879; Sacramento, CA

To obtain a copy of publication 70, The California Taxpayers’ Bill of Rights, you may visit our website or call our Information Center.

FIELD OFFICES

See page 3.

Seller’s Permit Application ■ Individuals/Partnerships/Corporations/Organizations (Regular or Temporary)

Sales and Use Tax Privacy Notice

Information Provided to the Board of Equalization

We ask you for information so that we can administer the state’s sales and use tax laws (Revenue and Taxation Code sections

What happens if I don’t provide the information?

If your application is incomplete, we may not issue your seller’s permit or use tax certificate. If you do not file complete returns, you may have to pay penalties and interest. Penalties may also apply if you don’t provide other information we request or that is required by law, or if you give us fraudulent information. In some cases, you may be subject to criminal prosecution.

In addition, if you don’t provide information we request to support your exemptions, credits, exclusions, or adjust- ments, we may not allow them. You may end up owing more tax or receiving a smaller refund.

Can anyone else see my information?

Your records are covered by state laws that protect your privacy. However, we may share information regarding your account with certain government agencies. We may also share certain information with companies authorized to represent local governments.

Under some circumstances we may release to the public the information printed on your permit, account start and closeout dates, and names of business owners or partners. When you sell a business, we can give the buyer or other involved parties information regarding your outstanding tax liability.

With your written permission, we can release information regarding your account to anyone you designate.

We may disclose information to the proper officials of the following agencies, among others:

•United States government agencies: U.S. Attorney’s Office; Bureau of Alcohol, Tobacco and Firearms; Depts. of Agriculture, Defense, and Justice; Federal Bureau of Investigation; General Accounting Office; Internal Revenue Service; Interstate Commerce Commission

•State of California government agencies and offi- cials: Air Resources Board; Dept. of Alcoholic Beverage Control; Auctioneer Commission; Dept. of Motor Vehicles; Employment Development Depart- ment; Energy Commission; Exposition and Fairs; Dept. of Food and Agriculture; Board of Forestry; Forest Products Commission; Franchise Tax Board; Dept. of Health Services; Highway Patrol; Dept. of Housing and Community Development; California Parent Locator Service

•State agencies outside of California for tax enforce- ment purposes

•City attorneys and city prosecutors; county district attorneys, police and sheriff departments.

Can I review my records?

Yes. Please contact your closest Board office (see the white pages of your phone book). If you need more information, you may contact our Disclosure Officer in Sacramento by calling

Who is responsible for maintaining my records?

The deputy director of the Sales and Use Tax Depart- ment, whom you may contact by calling

Deputy Director

Sales and Use Tax Department MIC:43

450 N Street

Sacramento, CA 95814

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Title | BOE-400-SPA Rev. 1 (7-05) |

| Purpose | This form serves as the California Seller’s Permit Application for individuals, partnerships, corporations, and organizations. |

| Governing Body | State Board of Equalization regulates the issuance of seller’s permits in California. |

| Permit Types | Applicants can apply for either a regular permit for ongoing sales or a temporary permit for sales lasting 90 days or less. |

| Record Keeping | Holders of a seller’s permit must keep records of sales, purchases, and tax returns for a minimum of four years. |

| Application Requirement | To apply, all requested information must be provided. Incomplete applications can delay permit issuance. |

| Cost of Permit | No fee is required for obtaining a seller’s permit; however, a security deposit may be mandated. |

| Public Disclosure | Certain information about the seller’s permit is publicly available, including business address and owner's names. |

| Contact Information | For assistance, applicants can contact the Information Center at 800-400-7115. |

Guidelines on Utilizing Boe 400 Spa

Filling out the BOE-400 Spa form is an important step for individuals, partnerships, corporations, or organizations in California seeking a seller's permit. After completing the form, you will submit it for review and processing. Once approved, you will receive your seller’s permit in approximately two weeks. It is essential to follow each step carefully to ensure timely approval and compliance.

- Complete the application on page 5. Choose between “Regular” for ongoing sales or “Temporary” for short-term sales (90 days or less).

- Provide all necessary information in the application. Missing information can delay your application.

- If your business is based out of state, fill out form BOE-403-B, Registration Information for Out-of-State Account. Request this form via mail or fax if needed.

- Send or deliver your completed application to the nearest district office. Confirm their hours if you plan to apply in person.

- Wait for your permit, which should arrive in about two weeks if the application is complete.

- Once you receive your permit, post it where customers can see it.

- Prepare for your tax reporting responsibilities, including receiving tax returns and information about filing frequency.

What You Should Know About This Form

Who must have a permit?

If you are selling or leasing tangible personal property in California, you generally need a seller's permit. This applies to merchandise, vehicles, and other goods. The permit permits both wholesale and retail sales. If your sales will be ongoing, you should apply for a "Regular" permit. If your sales will last 90 days or fewer, apply for a "Temporary" permit. Until you receive your seller's permit, you cannot sell taxable items legally in California.

Do I need more than one permit?

Is there a charge for a permit?

No, obtaining a seller's permit is free. However, a security deposit may be requested. This deposit protects against any unpaid taxes that could arise if your business closes. It's important to understand that while you won't pay for the permit itself, the deposit acts as a safeguard for the state.

Is information about my account subject to public disclosure?

Common mistakes

When filling out the BOE 400 Spa form, it’s easy to make mistakes that could delay your application or lead to complications down the road. One common error is overlooking the necessary permit type. Applicants might not fully understand the distinction between a “Regular” and a “Temporary” permit. If you plan on making sales for more than 90 days, you must apply for a Regular permit. However, if your sales are meant to last only a temporary period, choosing the wrong option can cause delays in getting the appropriate permit.

Another frequent mistake involves incomplete or incorrect business identification information. Filling out the section related to ownership and business type often presents challenges. Applicants sometimes check the wrong ownership type or fail to provide all requested details, such as the address of the business. A partial application may cause unnecessary hold-ups in processing, ultimately affecting your ability to conduct business legally.

Additionally, many people struggle with accurately estimating their projected monthly sales. It’s crucial to provide reasonable figures rather than overly optimistic or inaccurate estimations. Underestimating or overestimating these sales can affect your tax reporting timelines, possibly resulting in fines or audits. If you're unsure, it is always better to provide a conservative estimate rather than guess wildly.

Finally, failing to include the required documentation can be a significant setback. When submitting the form, applicants often forget to attach necessary documents, such as a copy of their driver’s license or partnership agreements. Such omissions can lead to the application being returned for corrections, slowing down the entire process. Taking the time to check for missing paperwork can make all the difference in ensuring a smooth application experience.

Documents used along the form

When applying for a seller’s permit, several forms and documents complement the BOE-400 Spa form to ensure a smooth application process. Here is a brief overview of nine commonly used forms often associated with this application.

- BOE-403-B: Registration Information for Out-of-State Account - This form is used by businesses located outside of California that wish to obtain a seller’s permit in California. It collects information on the type of business and its activities within the state.

- BOE-105: Seller's Permit Application - Similar to the BOE-400, this application is for businesses seeking a seller's permit. However, it’s primarily for vendors that sell goods at temporary events, trade shows, or similar venues.

- BOE-400-A: Seller’s Permit Application for Additional Locations - If a business has multiple locations selling taxable items, this form is used to apply for additional seller’s permits for those locations.

- BOE-410: Seller’s Permit Supplemental Application - This document gathers additional details not covered in the initial application, such as income projections and the nature of merchandise sold. It's particularly useful for businesses with unique operational features.

- BOE-64: Resale Certificate - A resale certificate is provided by sellers to their suppliers to purchase items without paying sales tax. This form is critical for businesses engaging in the resale of products.

- BOE-77: Sales Tax Exemption Certificate - Businesses may use this certificate to claim exemptions from sales tax for specific purchases, such as manufacturing equipment or other qualifying purchases.

- BOE-400-SPA: Seller's Permit Application (Spanish Version) - For Spanish-speaking applicants, this form provides a translated option to apply for a seller’s permit, ensuring accessibility for all business owners.

- BOE-865: Taxpayer Information Request - This form helps clarify taxpayer status and ensures compliance with tax regulations. Businesses may submit this form to get specific inquiries resolved.

- BOE-605: General Information for Sellers - This informational document outlines essential details regarding seller’s permits, tax collection responsibilities, and filing instructions to assist new business owners in understanding their obligations.

Having these forms and documents at hand can streamline the application process for a seller's permit and help ensure compliance with state regulations. Ensuring all information is accurate and complete will facilitate quicker approval and enable a smoother business operation.

Similar forms

The BOE-400 Spa form is a key document in the process of obtaining a seller's permit in California. However, it shares similarities with other important documents related to business operations. Here are four such documents:

- BOE-403-B: Registration Information for Out-of-State Account - This form is used by businesses located outside of California that wish to obtain a seller's permit. Like the BOE-400, it gathers essential business information and requires a thorough review of ownership details.

- California Seller's Permit (Regular or Temporary) - This is essentially a permit itself that the BOE-400 form applies for. Both documents outline the requirements and responsibilities of vendors operating within California, such as tax collection and reporting obligations.

- California Business License Application - This application is also necessary for businesses operating within California. Similar to the BOE-400, it seeks identification and operational details of the business, establishing a legal presence in the state where taxes and regulations are applicable.

- DBA (Doing Business As) Registration - This document is crucial for businesses that want to operate under a name other than their legal business name. It parallels the BOE-400 in terms of identifying the business owner(s) and the business's operational structure.

Dos and Don'ts

When filling out the BOE 400 Spa form, it's essential to ensure everything is done correctly to avoid unnecessary delays or complications. Here's a simple list of things to do and avoid during the process.

- Do double-check your permit type.

- Do provide all requested identification and contact information.

- Do describe your business activities clearly and specifically.

- Do ensure each owner signs the application.

- Do keep a copy of your completed application for your records.

- Don’t leave out any sections of the application.

- Don’t forget to include your driver’s license copy when mailing.

Taking a few extra moments to follow these guidelines can help streamline your application process, eliminating potential headaches down the line.

Misconceptions

Misconceptions about the BOE 400 Spa form can lead to confusion. Here are seven common misunderstandings:

- It's only for businesses selling physical goods. While primarily for tangible items, services and certain leases also require a seller's permit.

- Only large businesses need a seller's permit. Any business, regardless of size, selling taxable items in California must have a permit.

- A seller’s permit costs money. There’s no fee for the permit itself, although a security deposit may be required.

- If I apply for a temporary permit, I don’t need to display it. Even with a temporary permit, you must show a copy at every temporary selling location.

- Your personal information is not protected. Certain information is public, but most records enjoy privacy protections under state law.

- Once I get the permit, I won’t have any responsibilities. A permit brings rights but also duties, like filing tax returns and paying sales taxes on time.

- Only new businesses need to apply. Businesses changing ownership, name, or location also need to update or obtain a new permit.

Understanding these points can make the application process smoother and help avoid unnecessary issues later on.

Key takeaways

Understanding the BOE-400 Spa form is essential for compliance and successful operation of a business in California. The following key takeaways can aid in the process of filling out and using the form:

- The BOE-400 Spa form is the California Seller’s Permit Application, necessary for individuals, partnerships, corporations, and organizations.

- Businesses must obtain a seller’s permit if they sell or lease tangible personal property in California.

- Two types of permits exist: a Regular permit for ongoing sales and a Temporary permit for sales lasting 90 days or less.

- Each location with taxable sales requires its permit, which must be displayed prominently.

- While there is no fee for a seller’s permit, a security deposit may be required to cover potential unpaid taxes.

- Some information in the application may be subject to public disclosure, but privacy protections exist for certain records.

- A driver’s license copy is required to validate identity and prevent fraud.

- Answering questions regarding selling specific goods, like tires or tobacco, helps the Board ensure compliance with additional regulations.

- Recordkeeping is crucial; businesses must maintain sales and purchase records for at least four years.

- Permits must be posted at the business location, and businesses must notify the Board of any changes in ownership, address, or operations.

By adhering to these takeaways, applicants can facilitate a smoother application process and work towards compliance in commercial activities within California.

Browse Other Templates

Birth Plans - Utilize this form to prioritize your experiences and choices in childbirth.

Harvard Notes Template - Multiple business purposes can be listed, particularly for travel or entertainment expenses.