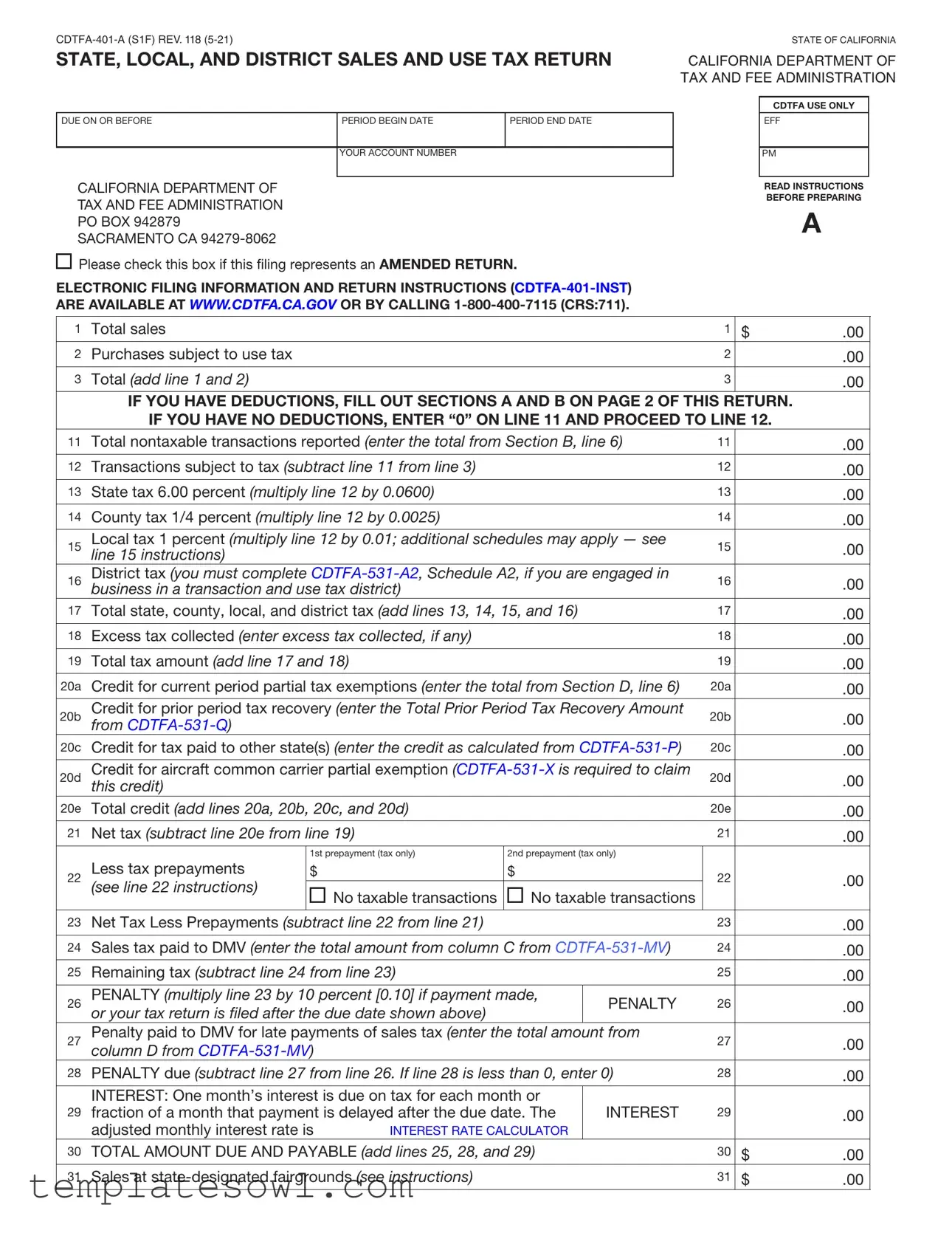

Fill Out Your Boe 401 A2 Form

The CDTFA-401-A2 form, also known as the State, Local, and District Sales and Use Tax Return, plays a crucial role in California's tax reporting framework. This form is specifically tailored for businesses to report their sales and use tax obligations to the California Department of Tax and Fee Administration (CDTFA). Among its major components, the form allows taxpayers to report total sales and any purchases subject to use tax, and it requires the computation of various tax rates including state, local, and district taxes. Depending on a business’s specific situation, the form includes sections to account for deductions of non-taxable transactions, such as sales for resale and certain exemptions. It also facilitates the reporting of any tax credits applicable to the current reporting period. Filers must also consider any penalties and interest that might accrue due to late filing or payment, thereby ensuring compliance with state tax regulations. Completing and submitting the CDTFA-401-A2 by its due date is essential for avoiding penalties and maintaining good standing with tax authorities.

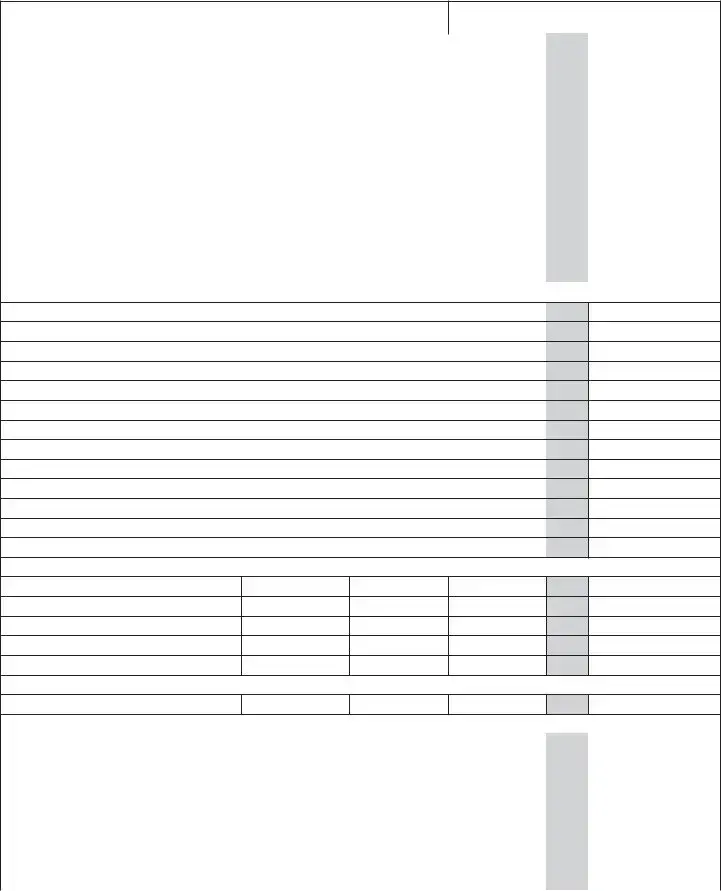

Boe 401 A2 Example

STATE, LOCAL, AND DISTRICT SALES AND USE TAX RETURN

DUE ON OR BEFORE |

PERIOD BEGIN DATE |

PERIOD END DATE |

YOUR ACCOUNT NUMBER

CALIFORNIA DEPARTMENT OF

TAX AND FEE ADMINISTRATION PO BOX 942879 SACRAMENTO CA

Please check this box if this filing represents an AMENDED RETURN.

STATE OF CALIFORNIA

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

CDTFA USE ONLY

EFF

PM

READ INSTRUCTIONS

BEFORE PREPARING

A

ELECTRONIC FILING INFORMATION AND RETURN INSTRUCTIONS

ARE AVAILABLE AT WWW.CDTFA.CA.GOV OR BY CALLING

1 |

Total sales |

|

|

|

|

1 |

$ |

.00 |

2 |

Purchases subject to use tax |

|

|

|

|

2 |

|

.00 |

3 |

Total (add line 1 and 2) |

|

|

|

|

3 |

|

.00 |

|

IF YOU HAVE DEDUCTIONS, FILL OUT SECTIONS A AND B ON PAGE 2 OF THIS RETURN. |

|

||||||

|

IF YOU HAVE NO DEDUCTIONS, ENTER “0” ON LINE 11 AND PROCEED TO LINE 12. |

|

||||||

11 |

Total nontaxable transactions reported (enter the total from Section B, line 6) |

11 |

|

.00 |

||||

12 |

Transactions subject to tax (subtract line 11 from line 3) |

|

|

12 |

|

.00 |

||

13 |

State tax 6.00 percent (multiply line 12 by 0.0600) |

|

|

13 |

|

.00 |

||

14 |

County tax 1/4 percent (multiply line 12 by 0.0025) |

|

|

14 |

|

.00 |

||

15 |

Local tax 1 percent (multiply line 12 by 0.01; additional schedules may apply — see |

15 |

|

.00 |

||||

|

line 15 instructions) |

|

|

|

|

|

|

|

16 |

District tax (you must complete |

16 |

|

.00 |

||||

|

business in a transaction and use tax district) |

|

|

|

|

|

||

17 |

Total state, county, local, and district tax (add lines 13, 14, 15, and 16) |

|

17 |

|

.00 |

|||

18 |

Excess tax collected (enter excess tax collected, if any) |

|

|

18 |

|

.00 |

||

19 |

Total tax amount (add line 17 and 18) |

|

|

|

19 |

|

.00 |

|

20a |

Credit for current period partial tax exemptions (enter the total from Section D, line 6) |

20a |

|

.00 |

||||

20b |

Credit for prior period tax recovery (enter the Total Prior Period Tax Recovery Amount |

20b |

|

.00 |

||||

|

from |

|

|

|

|

|

|

|

20c |

Credit for tax paid to other state(s) (enter the credit as calculated from |

20c |

|

.00 |

||||

20d |

Credit for aircraft common carrier partial exemption |

20d |

|

.00 |

||||

|

this credit) |

|

|

|

|

|

|

|

20e |

Total credit (add lines 20a, 20b, 20c, and 20d) |

|

|

20e |

|

.00 |

||

21 |

Net tax (subtract line 20e from line 19) |

|

|

|

21 |

|

.00 |

|

|

|

1st prepayment (tax only) |

2nd prepayment (tax only) |

|

|

|

||

22 |

Less tax prepayments |

$ |

|

$ |

|

22 |

|

.00 |

(see line 22 instructions) |

|

|

|

|

|

|||

No taxable transactions |

No taxable transactions |

|

||||||

|

|

|

|

|||||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

23 |

Net Tax Less Prepayments (subtract line 22 from line 21) |

|

|

23 |

|

.00 |

||

24 |

Sales tax paid to DMV (enter the total amount from column C from |

24 |

|

.00 |

||||

25 |

Remaining tax (subtract line 24 from line 23) |

|

|

25 |

|

.00 |

||

26 |

PENALTY (multiply line 23 by 10 percent [0.10] if payment made, |

PENALTY |

26 |

|

.00 |

|||

|

or your tax return is filed after the due date shown above) |

|

|

|

|

|

||

27 |

Penalty paid to DMV for late payments of sales tax (enter the total amount from |

27 |

|

.00 |

||||

|

column D from |

|

|

|

|

|

|

|

28 |

PENALTY due (subtract line 27 from line 26. If line 28 is less than 0, enter 0) |

28 |

|

.00 |

||||

|

INTEREST: One month’s interest is due on tax for each month or |

|

|

|

|

|||

29 |

fraction of a month that payment is delayed after the due date. The |

INTEREST |

29 |

|

.00 |

|||

|

adjusted monthly interest rate is |

INTEREST RATE CALCULATOR |

|

|

|

|

||

30 |

TOTAL AMOUNT DUE AND PAYABLE (add lines 25, 28, and 29) |

|

30 |

$ |

.00 |

|||

31 |

Sales at |

|

|

31 |

$ |

.00 |

||

|

STATE OF CALIFORNIA |

|||

|

|

|

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

|

|

|

|

|

|

|

I hereby certify that this return, including any accompanying schedules and statements, has been examined by me |

|||

|

and to the best of my knowledge and belief is a true, correct, and complete return. |

|||

|

|

|

|

|

SIGNATURE |

|

PRINT NAME AND TITLE |

|

DATE |

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

TELEPHONE |

|

|

|

|

|

PAID PREPARER’S |

PAID PREPARER’S NAME |

|

PAID PREPARER’S TELEPHONE NUMBER |

|

|

|

|

|

|

USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check or money order payable to California Department of Tax and Fee Administration.

Write your account number on your check or money order. Make a copy of this document for your records.

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA

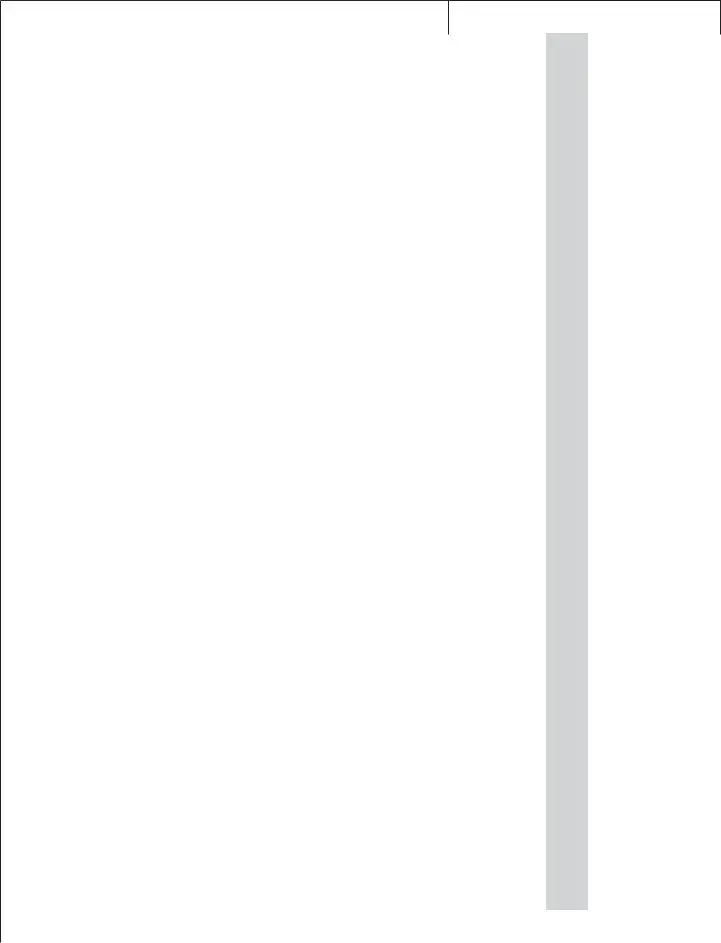

STATE OF CALIFORNIA |

|

|

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

STATE, LOCAL, AND DISTRICT SALES AND USE TAX RETURN

YOUR ACCOUNT NUMBER

REPORTING PERIOD

SECTION A. Nontaxable Sales (deductions)

4 |

Sales to other retailers for purposes of resale |

32 |

$ |

.00 |

5 |

Nontaxable sales of food products |

33 |

|

.00 |

6 |

Nontaxable labor (repair and installation) |

34 |

|

.00 |

7 |

Sales to the United States government |

35 |

|

.00 |

8 |

Sales in interstate or foreign commerce |

36 |

|

.00 |

9 |

Sales tax included on line 1 (if any) |

37 |

|

.00 |

10 |

Other (clearly explain) |

38 |

|

.00 |

11 |

Total Section A (add lines 4 through 10) |

39 |

$ |

.00 |

SECTION B. Current Period Tax Recoveries and Deductions The amount reported is for the current period only. The original transaction needs to be included in line 1 on page 1. (To claim a credit for all other prior period tax recovery items, complete

1 |

Bad debt losses on taxable sales |

40 |

$ |

.00 |

2 |

Cost of |

41 |

|

.00 |

3 |

Returned taxable merchandise |

42 |

|

.00 |

4 |

Cash discounts on taxable sales (see instructions on how to calculate this deduction) |

43 |

|

.00 |

5 |

Total Section B (add lines 1 through 4) |

44 |

|

.00 |

6 |

Total nontaxable transactions (add the total from Section A, line 11, and Section B, |

45 |

$ |

.00 |

|

line 5, and enter total here and on page 1, line 11) |

|

|

|

SECTION C. Current Period Partial Tax Exemptions at .05 Partial Exemption Rate (do not include partial |

|

|||

exemptions in Section A, line 11) |

|

|

|

|

|

|

|

|

|

1 |

Teleproduction equipment |

46 |

$ |

.00 |

2 |

Farm equipment and machinery |

47 |

|

.00 |

3 |

Diesel fuel used in farming and food processing |

48 |

|

.00 |

4 |

Timber harvesting equipment and machinery |

49 |

|

.00 |

5 |

Racehorse breeding stock |

50 |

|

.00 |

6 |

Subtotal Section C (add lines 1 through 5) |

51 |

|

.00 |

7 |

Partial exemption rate |

52 |

|

.05 |

|

|

|

|

|

8 |

Total Section C (multiply line 6 by line 7) |

53 |

$ |

.00 |

SECTION D. Current Period Partial Tax Exemptions at .039375 Partial Exemption Rate (do not include partial exemptions in Section A, line 11)

1 |

Manufacturing and research & development equipment |

54 |

$ |

.00 |

2 |

55 |

|

.00 |

|

3 |

Subtotal Section D (add line 1 and 2) |

56 |

|

.00 |

4 |

Partial exemption rate |

57 |

|

.039375 |

|

|

|

|

|

5 |

Total Section D (multiply line 3 by line 4) |

58 |

$ |

.00 |

|

|

|

|

|

6 |

Total Current Period Partial Exemptions (add the total from Section C, line 8 and |

59 |

$ |

.00 |

|

Section D, line 5, and enter here and on page 1, line 20a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF CALIFORNIA |

|||

|

|

|

|

|

|

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

|||||||

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUE ON OR BEFORE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR ACCOUNT NUMBER |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

A1 |

ENTER amount from line 12 on |

|

$ |

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

A2/A3 |

ENTER all transactions subject to only the state rate of 7.25% (see instructions) |

|

– |

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

A4 |

SUBTRACT line A2/A3 from line A1 |

|

|

|

|

|

$ |

|

|

|

.00 |

||

(Allocate this amount to the correct district tax areas in column A5.) |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||

|

PLEASE READ THE INSTRUCTIONS ON PAGE 12 BEFORE COMPLETING THIS SCHEDULE |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A5 |

|

A6/A7 |

|

A8 |

A9 |

|

|

A10 |

|

|

|

|

|

|

ADD ( + ) / |

|

|

||||||

|

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

|

|

TAXABLE AMOUNT |

TAX |

|

|

DISTRICT TAX DUE |

|||

|

|

|

DEDUCT ( - ) |

|

|

||||||||

|

|

|

|

CORRECT DISTRICT(S) |

|

|

A5 plus/minus A6/A7 |

RATE |

|

|

Multiply A8 by A9 |

||

|

|

|

|

|

ADJUSTMENTS |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALAMEDA COUNTY |

(Exp. |

378 |

Discontinued |

|

|

|

|

|

.02 |

|

|

$ .00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALAMEDA COUNTY |

(Eff. |

927 |

|

|

|

|

|

|

.03 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Alameda |

(Exp. |

648 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Alameda |

(Eff. |

928 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Albany |

(Exp. |

429 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Albany |

(Eff. |

929 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Emeryville |

(Exp. |

772 |

Discontinued |

|

|

|

|

|

.0225 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Emeryville |

(Eff. |

930 |

|

|

|

|

|

|

.0325 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Hayward |

(Exp. |

430 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Hayward |

(Eff. |

931 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Newark |

(Exp. |

451 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Newark |

(Eff. |

932 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of San Leandro |

(Exp. |

380 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of San Leandro |

(Eff. |

933 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Union City |

(Exp. |

428 |

Discontinued |

|

|

|

|

|

.025 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Union City |

(Eff. |

934 |

|

|

|

|

|

|

.035 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMADOR COUNTY |

|

194 |

|

|

|

|

|

|

.005 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUTTE COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Oroville |

(Eff. |

649 |

|

|

|

|

|

|

.01 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Town of Paradise |

|

381 |

|

|

|

|

|

|

.005 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL A11a (Add amounts in column A10 on this page. Enter the total here and on line A11a below.) |

|

$ |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued on page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

||

A11a |

SUBTOTAL DISTRICT TAX (Page 1, enter the total from line A11a above.) |

|

|

|

|

$ |

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

A11b |

SUBTOTAL DISTRICT TAX (Page 2, enter the total from line A11b on page 2.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11c |

SUBTOTAL DISTRICT TAX (Page 3, enter the total from line A11c on page 3.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11d |

SUBTOTAL DISTRICT TAX (Page 4, enter the total from line A11d on page 4.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11e |

SUBTOTAL DISTRICT TAX (Page 5, enter the total from line A11e on page 5.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11f |

SUBTOTAL DISTRICT TAX (Page 6, enter the total from line A11f on page 6.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11g |

SUBTOTAL DISTRICT TAX (Page 7, enter the total from line A11g on page 7.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11h |

SUBTOTAL DISTRICT TAX (Page 8, enter the total from line A11h on page 8.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11i |

SUBTOTAL DISTRICT TAX (Page 9, enter the total from line A11i on page 9.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11j |

SUBTOTAL DISTRICT TAX (Page 10, enter the total from line A11j on page 10.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11k |

SUBTOTAL DISTRICT TAX (Page 11, enter the total from line A11k on page 11.) |

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11 |

TOTAL DISTRICT TAX (Add lines A11a, A11b, A11c, A11d, A11e, A11f, A11g, A11h, A11i, A11j, and A11k. |

|

|

||||||||||

Enter here and on line 16 of |

|

|

$ |

.00 |

|||||||||

|

|

|

|||||||||||

Page 1

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

DISTRICT TAX AREAS

A5

ALLOCATE LINE A4 TO CORRECT DISTRICT(S)

A6/A7

ADD ( + ) /

DEDUCT ( - )

ADJUSTMENTS

A8

TAXABLE AMOUNT A5 plus/minus A6/A7

A9

TAX

RATE

A10

DISTRICT TAX DUE

Multiply A8 by A9

CALAVERAS COUNTY

City of Angels Camp |

(Eff. |

|

|

|

.005 |

$ |

.00 |

|

|

|

|

|

|

COLUSA COUNTY

City of Williams |

|

139 |

|

|

|

.005 |

CONTRA COSTA COUNTY (Exp. |

025 |

Discontinued |

|

|

.01 |

|

CONTRA COSTA COUNTY |

(Eff. |

816 |

|

|

|

.015 |

City of Antioch |

(Exp. |

350 |

Discontinued |

|

|

.015 |

City of Antioch |

(Exp. |

652 |

Discontinued |

|

|

.02 |

City of Antioch |

(Eff. |

817 |

|

|

|

.025 |

City of Concord |

(Exp. |

242 |

Discontinued |

|

|

.015 |

City of Concord |

(Eff. |

819 |

|

|

|

.025 |

City of El Cerrito |

(Exp. |

383 |

Discontinued |

|

|

.025 |

City of El Cerrito |

(Eff. |

820 |

|

|

|

.03 |

City of Hercules |

(Exp. |

286 |

Discontinued |

|

|

.015 |

City of Hercules |

(Eff. |

821 |

|

|

|

.02 |

City of Martinez |

(Exp. |

453 |

Discontinued |

|

|

.015 |

City of Martinez |

(Exp. |

654 |

Discontinued |

|

|

.02 |

City of Martinez |

(Eff. |

822 |

|

|

|

.025 |

Town of Moraga |

(Exp. |

301 |

Discontinued |

|

|

.02 |

Town of Moraga |

(Eff. |

823 |

|

|

|

.025 |

City of Orinda |

(Exp. |

303 |

Discontinued |

|

|

.015 |

City of Orinda |

(Eff. |

825 |

|

|

|

.025 |

City of Pinole |

(Exp. |

385 |

Discontinued |

|

|

.02 |

City of Pinole |

(Eff. |

826 |

|

|

|

.025 |

City of Pittsburg |

(Exp. |

288 |

Discontinued |

|

|

.015 |

City of Pittsburg |

(Eff. |

827 |

|

|

|

.02 |

City of Pleasant Hill |

(Exp. |

455 |

Discontinued |

|

|

.015 |

City of Pleasant Hill |

(Eff. |

828 |

|

|

|

.02 |

City of Richmond |

(Exp. |

387 |

Discontinued |

|

|

.02 |

City of Richmond |

(Eff. |

829 |

|

|

|

.025 |

City of San Pablo |

(Exp. |

609 |

Discontinued |

|

|

.015 |

City of San Pablo |

(Eff. |

830 |

|

|

|

.02 |

DEL NORTE COUNTY |

(Exp. |

388 |

Discontinued |

|

|

.0025 |

DEL NORTE COUNTY |

(Eff. |

832 |

|

|

|

.0125 |

City of Crescent City |

(Eff. |

834 |

|

|

|

.0125 |

EL DORADO COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

City of Placerville |

|

457 |

|

|

|

.01 |

City of So. Lake Tahoe |

(Exp. |

097 |

Discontinued |

|

|

.005 |

City of So. Lake Tahoe |

(Eff. |

836 |

|

|

|

.015 |

FRESNO COUNTY |

|

099 |

|

|

|

.00725 |

City of Fresno |

(Eff. |

961 |

|

|

|

.011 |

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

SUBTOTAL A11b (Add amounts in column A10 on this page. Enter the total here and on line A11b on |

|

|

page 1 of Schedule A2.) |

$ |

.00 |

|

|

|

|

|

Continued on page 3 |

Page 2

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

|

|

|

A5 |

A6/A7 |

A8 |

A9 |

|

A10 |

|

|

|

ADD ( + ) / |

|

||||

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

TAXABLE AMOUNT |

TAX |

|

DISTRICT TAX DUE |

||

|

DEDUCT ( - ) |

|

||||||

|

|

|

CORRECT DISTRICT(S) |

A5 plus/minus A6/A7 |

RATE |

|

Multiply A8 by A9 |

|

|

|

|

ADJUSTMENTS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Coalinga |

(Eff. |

656 |

|

|

|

.01725 |

$ |

.00 |

|

|

|

|

|

|

|

||

City of Fowler |

(Eff. |

658 |

|

|

|

.01725 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Huron |

|

352 |

|

|

|

.01725 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Kerman |

(Eff. |

660 |

|

|

|

.01725 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Kingsburg |

|

636 |

|

|

|

.01725 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Parlier |

(Eff. |

756 |

|

|

|

.01725 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Reedley |

(Exp. |

177 |

Discontinued |

|

|

.01225 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Reedley |

(Eff. |

778 |

|

|

|

.01975 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Sanger |

|

179 |

|

|

|

.01475 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Selma |

|

169 |

|

|

|

.01225 |

|

.00 |

|

|

|

|

|

|

|

|

|

GLENN COUNTY |

|

|

|

|

|

|

|

|

City of Orland |

|

458 |

|

|

|

.005 |

HUMBOLDT COUNTY |

|

389 |

|

|

|

.005 |

City of Arcata |

|

425 |

|

|

|

.0125 |

City of Eureka |

(Exp. |

427 |

Discontinued |

|

|

.0125 |

City of Eureka |

(Eff. |

936 |

|

|

|

.02 |

City of Fortuna |

|

460 |

|

|

|

.0125 |

City of Rio Dell |

|

391 |

|

|

|

.015 |

City of Trinidad |

|

426 |

|

|

|

.0125 |

IMPERIAL COUNTY |

|

029 |

|

|

|

.005 |

City of Calexico |

|

230 |

|

|

|

.01 |

City of El Centro |

|

462 |

|

|

|

.01 |

INYO COUNTY |

|

014 |

|

|

|

.005 |

City of Bishop |

(Eff. |

838 |

|

|

|

.015 |

KERN COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

City of Arvin |

198 |

City of Bakersfield |

(Eff. |

City of Delano |

170 |

City of Ridgecrest |

463 |

City of Wasco |

464 |

KINGS COUNTY |

|

.01

.01

.01

.01

.01

.00

.00

.00

.00

.00

City of Corcoran |

603 |

LAKE COUNTY |

|

.01

.00

City of Clearlake |

|

468 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Lakeport |

|

466 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

LOS ANGELES COUNTY |

|

594 |

|

|

|

.0225 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Alhambra |

(Eff. |

780 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Arcadia |

(Eff. |

754 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Avalon |

|

595 |

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Azusa |

(Eff. |

782 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Bell Gardens |

(Eff. |

840 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

SUBTOTAL A11c (Add amounts in column A10 on this page. Enter the total here and on line A11c on |

|

|

|

|||||

page 1 of Schedule A2.) |

|

|

|

|

|

|

$ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued on page 4 |

Page 3

SCHEDULE A2 — COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

|

|

|

A5 |

|

A6/A7 |

A8 |

A9 |

|

A10 |

|

|

|

|

ADD ( + ) / |

|

||||

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

|

TAXABLE AMOUNT |

TAX |

|

DISTRICT TAX DUE |

||

|

|

DEDUCT ( - ) |

|

||||||

|

|

|

CORRECT DISTRICT(S) |

|

A5 plus/minus A6/A7 |

RATE |

|

Multiply A8 by A9 |

|

|

|

|

|

ADJUSTMENTS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Bellflower |

(Eff. |

842 |

|

|

|

|

.03 |

$ |

.00 |

|

|

|

|

|

|

|

|

||

City of Burbank |

(Eff. |

662 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Carson |

(Eff. |

844 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Commerce |

(Exp. |

596 |

Discontinued |

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Commerce |

(Eff. |

846 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Compton |

|

589 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Covina |

(Eff. |

664 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Cudahy |

(Eff. |

678 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Culver City |

(Exp. |

597 |

Discontinued |

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Culver City |

(Eff. |

666 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Downey |

|

598 |

|

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Duarte |

(Eff. |

784 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of El Monte |

|

599 |

|

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Gardena |

(Eff. |

786 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Glendale |

(Eff. |

674 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Glendora |

(Eff. |

752 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Hawaiian Gardens |

(Eff. |

788 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Hawthorne |

|

611 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Huntington Park |

|

638 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Inglewood |

|

600 |

|

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Irwindale |

(Eff. |

764 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Lakewood |

(Eff. |

792 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Lancaster |

(Eff. |

848 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of La Puente |

(Eff. |

670 |

|

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of La Verne |

(Eff. |

790 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Lawndale |

(Eff. |

676 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Lomita |

(Eff. |

850 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Long Beach |

|

588 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Lynwood |

|

590 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Monrovia |

(Eff. |

758 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Montebello |

(Eff. |

794 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Norwalk |

(Eff. |

796 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Palmdale |

(Eff. |

852 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Paramount |

(Eff. |

798 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Pasadena |

(Eff. |

680 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Pico Rivera |

|

582 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Pomona |

(Eff. |

668 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of San Fernando |

(Exp. |

602 |

Discontinued |

|

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of San Fernando |

(Eff. |

854 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of San Gabriel |

(Eff. |

800 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Santa Fe Springs |

(Eff. |

672 |

|

|

|

|

.0325 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Santa Monica |

|

591 |

|

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

SUBTOTAL A11d (Add amounts in column A10 on this page. Enter the total here and on line A11d on |

|

|

|

||||||

page 1 of Schedule A2.) |

|

|

|

|

|

|

|

$ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 |

|

|

|

Continued on page 5 |

|

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

|

|

|

A5 |

A6/A7 |

A8 |

A9 |

|

A10 |

|

|

|

ADD ( + ) / |

|

||||

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

TAXABLE AMOUNT |

TAX |

|

DISTRICT TAX DUE |

||

|

DEDUCT ( - ) |

|

||||||

|

|

|

CORRECT DISTRICT(S) |

A5 plus/minus A6/A7 |

RATE |

|

Multiply A8 by A9 |

|

|

|

|

ADJUSTMENTS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Sierra Madre |

(Eff. |

760 |

|

|

|

.03 |

$ |

.00 |

|

|

|

|

|

|

|

||

City of Signal Hill |

(Eff. |

856 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of So. El Monte |

(Exp. |

601 |

Discontinued |

|

|

.0275 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of So. El Monte |

(Eff. |

858 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of South Gate |

|

580 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of South Pasadena |

(Eff. |

762 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Vernon |

(Eff. |

812 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of West Hollywood |

(Eff. |

860 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Whittier |

(Eff. |

802 |

|

|

|

.03 |

|

.00 |

|

|

|

|

|

|

|

|

|

MADERA COUNTY |

|

144 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Chowchilla |

(Eff. |

682 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Madera |

|

476 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

MARIN COUNTY |

|

311 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

Town of Corte Madera |

|

640 |

|

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

Town of Fairfax |

|

478 |

|

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Larkspur |

|

613 |

|

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Novato |

|

434 |

|

|

|

.0125 |

|

.00 |

|

|

|

|

|

|

|

|

|

Town of San Anselmo |

|

358 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Rafael |

(Exp. |

360 |

Discontinued |

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Rafael |

(Eff. |

862 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Sausalito |

|

393 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

MARIPOSA COUNTY |

|

103 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

MENDOCINO COUNTY |

|

615 |

|

|

|

.00625 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Fort Bragg |

|

616 |

|

|

|

.01625 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Point Arena |

|

617 |

|

|

|

.01125 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Ukiah |

|

618 |

|

|

|

.01625 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Willits |

(Exp. |

619 |

Discontinued |

|

|

.01125 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Willits |

(Eff. |

864 |

|

|

|

.01875 |

|

.00 |

|

|

|

|

|

|

|

|

|

MERCED COUNTY |

|

481 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Atwater |

|

485 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Gustine |

|

484 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Los Banos |

(Exp. |

482 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Los Banos |

(Eff. |

684 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Merced |

|

483 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

MONO COUNTY |

|

|

|

|

|

|

|

|

Town of Mammoth Lakes |

|

183 |

|

|

|

.005 |

MONTEREY COUNTY |

|

487 |

|

|

|

.005 |

City of |

(Exp. |

495 |

Discontinued |

|

|

.015 |

City of |

(Eff. |

804 |

|

|

|

.02 |

|

|

|

|

|

|

|

.00

.00

.00

.00

SUBTOTAL A11e (Add amounts in column A10 on this page. Enter the total here and on line A11e on |

|

|

page 1 of Schedule A2.) |

$ |

.00 |

|

|

|

Page 5 |

|

Continued on page 6 |

|

|

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

|

|

|

A5 |

A6/A7 |

A8 |

A9 |

|

A10 |

|

|

|

ADD ( + ) / |

|

||||

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

TAXABLE AMOUNT |

TAX |

|

DISTRICT TAX DUE |

||

|

DEDUCT ( - ) |

|

||||||

|

|

|

CORRECT DISTRICT(S) |

A5 plus/minus A6/A7 |

RATE |

|

Multiply A8 by A9 |

|

|

|

|

ADJUSTMENTS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Del Rey Oaks |

|

490 |

|

|

|

.02 |

$ |

.00 |

|

|

|

|

|

|

|

||

City of Gonzales |

(Exp. |

498 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Gonzales |

(Eff. |

866 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Greenfield |

|

494 |

|

|

|

.0225 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of King City |

(Exp. |

496 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of King City |

(Eff. |

686 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Marina |

(Exp. |

492 |

Discontinued |

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Marina |

(Eff. |

688 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Monterey |

(Exp. |

497 |

Discontinued |

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Monterey |

(Eff. |

806 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Pacific Grove |

|

491 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Salinas |

|

489 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Sand City |

|

499 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Seaside |

|

605 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Soledad |

(Exp. |

493 |

Discontinued |

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Soledad |

(Eff. |

868 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

NAPA COUNTY |

|

631 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of St. Helena |

|

632 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

NEVADA COUNTY |

|

502 |

|

|

|

.0025 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Grass Valley |

|

642 |

|

|

|

.0125 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Nevada City |

|

630 |

|

|

|

.01125 |

|

.00 |

|

|

|

|

|

|

|

|

|

Town of Truckee |

|

503 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

ORANGE COUNTY |

|

037 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Fountain Valley |

|

512 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Garden Grove |

(Eff. |

696 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of La Habra |

|

204 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of La Palma |

|

508 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Los Alamitos |

(Eff. |

870 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Placentia |

(Eff. |

690 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Santa Ana |

(Eff. |

692 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Seal Beach |

(Eff. |

694 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Stanton |

|

414 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Westminster |

|

510 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

PLACER COUNTY |

|

|

|

|

|

|

|

|

Town of Loomis |

|

513 |

|

|

|

.0025 |

City of Roseville |

(Eff. |

697 |

|

|

|

.005 |

RIVERSIDE COUNTY |

|

026 |

|

|

|

.005 |

City of Blythe |

(Eff. |

814 |

|

|

|

.015 |

City of Cathedral City |

|

232 |

|

|

|

.015 |

City of Coachella |

|

416 |

|

|

|

.015 |

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

SUBTOTAL A11f (Add amounts in column A10 on this page. Enter the total here and on line A11f on |

|

|

page 1 of Schedule A2.) |

$ |

.00 |

|

|

|

|

|

Continued on page 7 |

Page 6

SCHEDULE A2 – COMPUTATION SCHEDULE FOR DISTRICT TAX — Long Form

ACCOUNT NUMBER

REPORTING PERIOD

|

|

|

A5 |

A6/A7 |

A8 |

A9 |

|

A10 |

|

|

|

ADD ( + ) / |

|

||||

DISTRICT TAX AREAS |

|

ALLOCATE LINE A4 TO |

TAXABLE AMOUNT |

TAX |

|

DISTRICT TAX DUE |

||

|

DEDUCT ( - ) |

|

||||||

|

|

|

CORRECT DISTRICT(S) |

A5 plus/minus A6/A7 |

RATE |

|

Multiply A8 by A9 |

|

|

|

|

ADJUSTMENTS |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of Corona |

(Eff. |

938 |

|

|

|

.015 |

$ |

.00 |

|

|

|

|

|

|

|

||

City of Hemet |

|

515 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Indio |

|

517 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Lake Elsinore |

(Eff. |

872 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of La Quinta |

|

521 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Menifee |

|

525 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Murrieta |

(Eff. |

701 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Norco |

(Eff. |

699 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Palm Springs |

|

621 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Riverside |

|

519 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Jacinto |

(Eff. |

874 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Temecula |

|

523 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Wildomar |

(Eff. |

703 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

SACRAMENTO COUNTY |

|

023 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Galt |

|

206 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Isleton |

(Exp. |

527 |

Discontinued |

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Isleton |

(Eff. |

962 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Rancho Cordova |

(Exp. |

418 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Rancho Cordova |

(Eff. |

876 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Sacramento |

(Exp. |

322 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Sacramento |

(Eff. |

705 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

SAN BENITO COUNTY |

(Eff. |

706 |

|

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Hollister |

(Exp. |

171 |

Discontinued |

|

|

.01 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Hollister |

(Eff. |

707 |

|

|

|

.02 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Juan Bautista |

(Exp. |

106 |

Discontinued |

|

|

.0075 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Juan Bautista |

(Eff. |

708 |

|

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

SAN BERNARDINO COUNTY |

031 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

City of Barstow |

(Eff. |

710 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Montclair |

(Exp. |

108 |

Discontinued |

|

|

.0075 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Montclair |

(Eff. |

878 |

|

|

|

.0175 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Redlands |

(Eff. |

880 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Bernardino |

(Exp. |

149 |

Discontinued |

|

|

.0075 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of San Bernardino |

(Eff. |

882 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Victorville |

(Eff. |

884 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

Town of Yucca Valley |

|

530 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

SAN DIEGO COUNTY |

|

013 |

|

|

|

.005 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Chula Vista |

|

644 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

City of Del Mar |

|

534 |

|

|

|

.015 |

|

.00 |

|

|

|

|

|

|

|

|

|

SUBTOTAL A11g (Add amounts in column A10 on this page. Enter the total here and on line A11g on |

|

|

page 1 of Schedule A2.) |

$ |

.00 |

|

|

|

|

|

Continued on page 8 |

Page 7

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The CDTFA-401-A2 form is used to report state, local, and district sales and use tax in California. |

| Filing Frequency | Businesses typically file this form on a quarterly or monthly basis, depending on their total sales. |

| Due Date | The tax return is due on or before the end of the reporting period, which varies based on the filing frequency. |

| Amended Return | Taxpayers can indicate if the filing is an amended return by checking a specific box on the form. |

| Penalties for Late Filing | If the return is filed late, a penalty of 10% of the tax due might be incurred. |

| Interest Charges | Interest may accrue on unpaid tax amounts. One month’s interest is applied for each month of delay. |

| Exemptions and Deductions | Taxpayers can claim deductions for nontaxable transactions and report them in designated sections of the form. |

| Local Tax Rates | Local tax rates can vary by city and county, requiring careful allocation when completing the form. |

| Governing Laws | This form is governed by California’s sales and use tax laws as implemented by the California Department of Tax and Fee Administration (CDTFA). |

| Where to Submit | Returns and payments must be mailed to the California Department of Tax and Fee Administration at a specified P.O. Box in Sacramento. |

Guidelines on Utilizing Boe 401 A2

Once you have gathered all required information, you can proceed to fill out the BOE 401-A2 form. Below are the steps that guide you through the process, ensuring you provide all necessary details correctly. Each step helps in gathering and organizing your information efficiently.

- Account Information: Write your account number at the top of the form. Make sure this number is accurate to avoid processing delays.

- Period Dates: Fill in the period begin date and period end date. These dates should define the reporting period for which you are filing the return.

- Filing Type: If you're amending a return, check the box indicating an amended return. Otherwise, leave it unchecked.

- Total Sales: Enter your total sales amount on line 1. Be sure to confirm this figure is correct to reflect accurate earnings.

- Purchases Subject to Use Tax: Fill in line 2 with the total of any purchases that are subject to use tax.

- Calculate Total: Add the amounts from lines 1 and 2, entering the result on line 3.

- Nontaxable Transactions: If you have any deductions, complete sections A and B on page 2. If not, enter "0" on line 11 and proceed to line 12.

- Transactions Subject to Tax: Calculate this by subtracting line 11 from line 3, and then enter the result on line 12.

- State, County, Local, and District Taxes: Calculate each of the tax amounts on lines 13-16 by applying the specified multipliers to line 12. Add these amounts together and enter the total on line 17.

- Excess Tax Collected: If there were any excess tax amounts collected, enter them on line 18. Add line 17 and line 18 to determine the Total Tax Amount, which you will put on line 19.

- Credits: Complete the credit sections on lines 20a through 20d by entering any amounts applicable. Then, calculate the total credit and enter it on line 20e.

- Net Tax Calculation: Subtract the total credit on line 20e from the total tax amount on line 19. Record this amount on line 21.

- Prepayments: Indicate any tax prepayments on line 22. Subtract this from line 21 to find the Net Tax Less Prepayments on line 23.

- Remaining Tax: Enter any sales tax paid to DMV on line 24. Subtract this from line 23 to establish the Remaining Tax on line 25.

- Penalties: Calculate any penalties applicable on line 26, and enter any late payment penalties on line 27. Finally, determine the total penalty due for line 28.

- Interest: If any interest is due, calculate it on line 29 as specified in the instructions. Add lines 25, 28, and 29 to find the Total Amount Due on line 30.

- Fairground Sales: If applicable, report any sales at state-designated fairgrounds on line 31.

- Certification: Sign and date the form, providing your title, email address, and phone number for contact purposes. Be sure to include any preparer's information if a paid preparer helped complete the form.

- Payment Submission: Make a check or money order payable to the California Department of Tax and Fee Administration. Write your account number on the payment, and send it with a copy of the completed form to the specified address.

What You Should Know About This Form

What is the purpose of the CDTFA 401 A2 form?

The CDTFA 401 A2 form is used by businesses in California to report state, local, and district sales and use taxes. This tax return allows businesses to calculate their total sales, applicable taxes, and any tax deductions they may be eligible for. It helps ensure compliance with state tax laws and accurately captures the taxes owed to the California Department of Tax and Fee Administration (CDTFA).

Who is required to file the CDTFA 401 A2 form?

All businesses involved in selling tangible personal property or providing taxable services in California must file the CDTFA 401 A2 form. This applies to both sole proprietors and larger companies. Additionally, businesses making purchases subject to use tax in California will need to submit this form to report their transactions.

How often must businesses file the CDTFA 401 A2 form?

Businesses must file the CDTFA 401 A2 form regularly, typically on a quarterly or annual basis. The specific frequency depends on the sales volume and tax liabilities of the business as determined by the CDTFA. The due date for filing is usually set to coincide with the close of the reporting period, which is indicated on the form.

What information is required to complete the form?

When completing the CDTFA 401 A2 form, businesses will need to provide details such as total sales, purchases subject to use tax, deductions for nontaxable transactions, and calculations for state, county, local, and district taxes. It also requires information on any prepayments made, as well as any penalties or interest if applicable.

What should a business do if they made an error on their CDTFA 401 A2 form?

If a business discovers an error after submission, they must file an amended return. This can be done by checking the box for "Amended Return" on the form and providing the corrected information. It's essential to do this promptly to avoid potential penalties for incorrect reporting.

Where can businesses find instructions for completing the CDTFA 401 A2 form?