Fill Out Your Boe 410 D Form

The BOE 410 D form is an essential document for individuals looking to participate in swap meets, flea markets, or special events in California. This form ensures that vendors comply with the state’s seller permit regulations. Generally, if you intend to sell merchandise, securing a seller's permit is necessary unless you fall under specific exemptions. For instance, occasional sellers who make no more than two sales within a year or those selling items that aren’t taxable at retail may not need a permit. The BOE 410 D form requires you to provide vital event details and information about your business. Each vendor must certify their status concerning permit requirements, ensuring transparency in sales and compliance with tax laws. Completion of this form is straightforward, but accuracy is crucial as it aids the Board of Equalization in verifying your seller status. By utilizing this form correctly, vendors can enjoy a smoother selling experience while adhering to legal obligations.

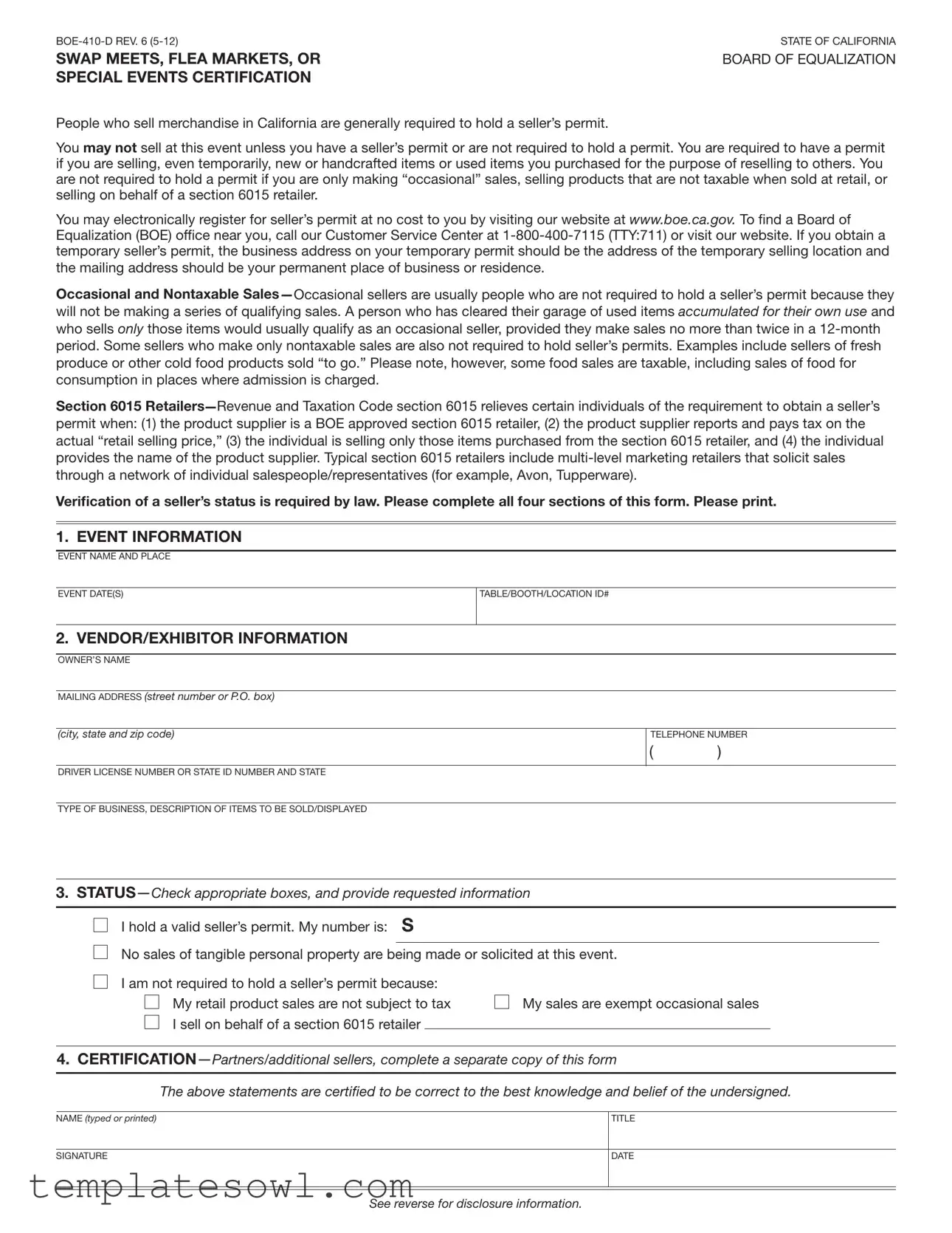

Boe 410 D Example

STATE OF CALIFORNIA |

|

SWAP MEETS, FLEA MARKETS, OR |

BOARD OF EQUALIZATION |

SPECIAL EVENTS CERTIFICATION |

|

People who sell merchandise in California are generally required to hold a seller’s permit.

You may not sell at this event unless you have a seller’s permit or are not required to hold a permit. You are required to have a permit if you are selling, even temporarily, new or handcrafted items or used items you purchased for the purpose of reselling to others. You are not required to hold a permit if you are only making “occasional” sales, selling products that are not taxable when sold at retail, or selling on behalf of a section 6015 retailer.

You may electronically register for seller’s permit at no cost to you by visiting our website at www.boe.ca.gov. To ind a Board of Equalization (BOE) ofice near you, call our Customer Service Center at

Occasional and Nontaxable

Section 6015

Verification of a seller’s status is required by law. Please complete all four sections of this form. Please print.

1. EVENT INFORMATION

EVENT NAME AND PLACE

EVENT DATE(S) |

TABLE/BOOTH/LOCATION ID# |

|

|

2. VENDOR/EXHIBITOR INFORMATION

OWNER’S NAME

MAILING ADDRESS (street number or P.O. box)

(city, state and zip code) |

TELEPHONE NUMBER |

|

|

( |

) |

|

|

|

DRIVER LICENSE NUMBER OR STATE ID NUMBER AND STATE

TYPE OF BUSINESS, DESCRIPTION OF ITEMS TO BE SOLD/DISPLAYED

3.

I hold a valid seller’s permit. My number is: S

No sales of tangible personal property are being made or solicited at this event.

I am not required to hold a seller’s permit because:

My retail product sales are not subject to tax I sell on behalf of a section 6015 retailer

My sales are exempt occasional sales

4.

The above statements are certified to be correct to the best knowledge and belief of the undersigned.

NAME (typed or printed)

TITLE

SIGNATURE

DATE

See reverse for disclosure information.

STATE OF CALIFORNIA |

BOARD OF EQUALIZATION

Privacy Notice

This is not a request for you to provide information. This is an informational notice according to the requirements of the Information Practices Act (Civil Code §1798.17). No action is required.

We ask you for information so that the BOE can administer the state’s tax and fee laws. The BOE will use the information to determine whether you are paying the correct amount of tax and to collect any amounts you owe. You must provide all information requested, including your social security number (used for identiication purposes [see Title 42 U.S. Code sec.405(c)(2)(C)(i)]). A list of authorized agencies, among others, who the BOE may disclose information to, and a complete list of the California Revenue and Taxation Codes is available on our website at www.boe.ca.gov/pdf/boe324gen.pdf, then scroll to the second page.

What happens if I don’t provide the information?

If your registration information is incomplete, the BOE may not issue your permit, certiicate, or license. If you do not ile complete returns, you may have to pay penalties and interest. Penalties may also apply if you do not provide other information the BOE requests or that is required by law, or if you provide fraudulent information. In some cases, you may be subject to criminal prosecution.

In addition, if you do not provide the requested information to support your exemptions, credits, exclusions, or adjustments, they may not be allowed. You may owe more tax or fees or receive a smaller refund.

Can anyone else see my information?

Your records are covered by state laws that protect your privacy. However, the BOE may share information regarding your account with speciic state, local, and federal government agencies. The BOE may also share speciic information with companies authorized to represent local governments.

Under some circumstances, the BOE may release the information printed on your permit, certiicate, or license, such as account start and closeout dates, and names of business owners or partners, to the public. When you sell a business, the BOE may give the buyer or other involved parties information regarding your outstanding tax liability.

With your written permission, the BOE can release information regarding your account to anyone you designate.

Can I review my records?

Yes. Requests should be made in writing to your closest BOE ofice. A complete listing of BOE locations can be found at www.boe.ca.gov. Additional information regarding your records can be found in publication

Disclosure Oficer, MIC:82

State Board of Equalization

PO Box 942879

Sacramento, CA

Who is responsible for maintaining my records?

The oficials listed below are responsible for maintaining your records.

Sales and Use Tax Department |

Property and Special Taxes Department |

Board of Equalization |

Board of Equalization |

Deputy Director, SUTD, MIC:43 |

Deputy Director, PSTD, MIC:63 |

PO Box 942879 |

PO Box 942879 |

Sacramento, CA |

Sacramento, CA |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The BOE-410 D form is used for certification by vendors participating in swap meets, flea markets, or Board of Equalization special events in California. |

| Seller’s Permit Requirement | Individuals selling merchandise generally must hold a seller’s permit unless they qualify for an exemption, such as making "occasional" sales or selling nontaxable items. |

| Occasional Sales Definition | Occasional sellers in California may sell personal items without a permit if their sales do not exceed two instances within a 12-month period. |

| Use of Section 6015 Retailers | Under Revenue and Taxation Code section 6015, certain individuals may avoid the permit requirement if they sell items obtained from a BOE-approved retailer that reports sales tax. |

| Submission and Verification | All four sections of the form must be completed for validation. Accurate information is necessary to prevent penalties related to incomplete tax registrations. |

Guidelines on Utilizing Boe 410 D

Completing the BOE 410 D form can seem daunting, but by following the steps below, individuals can ensure that their application is filled out correctly and efficiently. This form is necessary for those looking to sell at swap meets, flea markets, or similar special events in California.

- Gather Required Information: Before starting the form, collect necessary information such as the event name, dates, your contact details, and specifics about the items you will be selling.

- Fill Out Event Information: In the first section, write down the name of the event, its location, and the event date(s). Also, fill in your table or booth location ID number if applicable.

- Provide Vendor/Exhibitor Information: Enter your owner’s name, mailing address (including street number or P.O. box, city, state, and zip code), and your telephone number. You will also need to include your driver’s license number or state ID number, along with your type of business and a description of the items you plan to sell or display.

- Status Section: In the next part of the form, check the boxes that apply to your sales status. You must either provide your valid seller's permit number or select the option that explains why you do not need a permit. Ensure you indicate if your sales are non-taxable, if you are selling for a section 6015 retailer, or if your sales qualify as exempt occasional sales.

- Certification: Finally, certify the information by typing or printing your name, your title, and provide your signature and date. If there are additional partners or sellers, ensure they complete separate copies of the form.

After filling out the form, double-check all entries for accuracy and completeness. Once verified, you can submit it according to the instructions provided or as appropriate for the event. Ensuring everything is in order will help facilitate a smoother application process.

What You Should Know About This Form

What is the BOE 410 D form?

The BOE 410 D form is a certification document required for individuals and vendors who wish to sell merchandise at swap meets, flea markets, or special events in California. This form ensures compliance with state regulations regarding seller’s permits, allowing the Board of Equalization to verify the seller's status and determine their tax obligations.

Who needs to fill out the BOE 410 D form?

What happens if I sell without a seller’s permit?

Can I file the BOE 410 D form electronically?

What information is required when filling out the form?

Are there exemptions from needing a seller’s permit?

What if I provide incomplete information on the form?

Who can assist me if I have questions about the BOE 410 D form?

Common mistakes

Filling out the BOE-410-D form can be a straightforward process if done correctly. However, mistakes can occur, leading to issues with approval or compliance. One common mistake is leaving sections blank. Each of the four sections must be completed fully, and any omissions may delay processing or result in rejection. Ensure that all required information, such as the event details and vendor information, is filled in accurately.

Another frequent error involves incorrect identification numbers. Vendors often forget to include their seller’s permit number or provide the wrong identification number. It is essential to verify that the information you enter matches the documentation you possess. This applies equally to the driver's license or state ID number, which should be accurate and up to date.

Misunderstanding the requirements for seller’s permits is also a common pitfall. Some people think they do not need a seller's permit when they do, while others mistakenly believe they need one when they qualify for an exemption. Take the time to read the guidelines carefully and determine your status as a seller. This includes recognizing what constitutes occasional sales or tax-exempt sales.

Failing to include the correct business address can create problems when registering for events. The address on the temporary seller’s permit must reflect the location where the sale will occur, while the mailing address should represent your permanent business or home address. Ensuring these addresses are accurate prevents potential discrepancies.

Many sellers also neglect to provide a description of the items being sold or displayed. This section is critical and should be as detailed as possible, as the type of goods sold can determine the permit requirements applicable to each vendor.

Checking the appropriate boxes for status declarations can be easily overlooked. Ensure that all relevant boxes are marked to reflect your sales situation accurately. Not indicating the correct status may lead to misunderstandings or penalties regarding your obligation for seller’s permits.

It is also important to remember to sign and date the form. A signature signifies that the information provided is truthful and correct to the best of your knowledge. A missing signature could result in the form being returned due to incompleteness.

Oftentimes, applicants forget to review the information before submission. Taking a moment to double-check everything can help catch errors, ensuring that all details align correctly. This simple step can save time and prevent delays.

Some may assume that electronic submission is permissible when it is not allowed. Understand the specific submission guidelines for the BOE-410-D form. If submitting electronically, confirm that this method meets all necessary requirements outlined on the form.

Lastly, individuals might not retain a copy of the submitted form for their records. Keeping a copy ensures that there is a reference for any future inquiries or issues that may arise regarding your seller's permit or event participation. This simple habit can provide clarity and protection in the long run.

Documents used along the form

When engaging in sales activities at swap meets, flea markets, or special events in California, the BOE 410 D form is essential for vendors. It helps verify compliance with seller permit requirements and provides a structured way to document your business activities. Alongside this form, several other documents may be necessary. Here’s a brief overview of these forms and their purposes.

- Seller’s Permit: This document serves as proof that a seller is authorized to sell taxable goods in California. It must be obtained before participating in events where merchandise is sold. If you plan to sell new or used items, you will need this permit.

- Temporary Seller's Permit Application: For those selling temporarily, this application allows you to acquire a seller’s permit specific to your event. It is designed for short-term sellers who do not have a regular seller's permit.

- BOE-410-A Form: This form is used when reporting sales made during events. It details the types of goods sold and is crucial for accurate tax reporting.

- Resale Certificate: Vendors may use this certificate to purchase goods without paying sales tax, as they intend to resell these items. It is vital for maintaining compliance with tax laws when acquiring inventory.

- Event Organizer's Contract: This agreement outlines the terms and conditions set by the event organizer. It typically includes details such as booth location, event hours, and fees associated with participation.

Understanding these documents is key to ensuring a smooth and compliant selling experience at events in California. Each form has its specific use, and together, they help to properly manage sales and tax obligations.

Similar forms

The BOE 410 D form is important for individuals selling at swap meets, flea markets, or special events in California. There are several other documents that share similarities with the BOE 410 D form in terms of purpose and requirements. Below is a list of four similar documents:

- Seller’s Permit Application: Like the BOE 410 D form, the seller’s permit application is essential for individuals planning to sell goods in California. Both documents require information about the seller, and they establish the legal basis for sales tax obligations.

- Temporary Seller’s Permit: This permit is specifically designed for sellers who wish to sell goods temporarily and need formal authorization for a short duration. Similar to the BOE 410 D, it outlines the seller’s responsibilities and verifies their compliance with tax regulations.

- Business License Application: Sellers must often apply for a business license to operate legally in their local jurisdiction. This application shares the need for identification and basic business information just like the BOE 410 D form, ensuring that the seller is registered and compliant with local laws.

- Event Vendor Registration Form: Many events require vendors to complete a registration form before participating. This document works alongside the BOE 410 D, as both serve to certify the seller’s identity and ensure compliance with event-specific regulations, including tax obligations.

Dos and Don'ts

When filling out the BOE 410 D form, here are some important dos and don'ts to keep in mind:

- Keep your information accurate. Ensure all details are correct to avoid delays or issues.

- Use clear handwriting. If you’re filling the form out by hand, print legibly.

- Check all four sections of the form. Each part is crucial for proper processing.

- Provide a valid seller’s permit number if you have one. This is required for verification purposes.

- Review the form before submission. Double-check for any missed fields or errors.

- Include your permanent mailing address. This helps in receiving important communications.

- Sign and date the form. An unsigned form may not be processed.

- Don't leave any sections blank. Every box must have the necessary information.

- Avoid using incorrect identification numbers. This can lead to confusion and delays.

- Don’t forget to read the instructions thoroughly. Understanding the guidelines is vital.

- Refrain from providing false information. This could result in penalties or legal issues.

- Don't submit the form without reviewing any additional requirements. Check for any additional documentation you may need.

- Avoid using doodles or messy corrections. Keep it professional and clear.

- Don’t wait until the last minute to file. Early submission ensures you have ample time to correct any issues.

Misconceptions

Understanding the BOE 410 D form is crucial for anyone participating in swap meets or flea markets in California. However, there are several misconceptions that may lead to confusion among vendors. The following list clarifies these misconceptions.

- A seller's permit is not necessary for all sellers. Many believe they can sell without a permit. However, anyone selling new or handcrafted items, or reselling used items, generally needs a seller’s permit unless exempted.

- Occasional sales do not require a seller's permit. It is true that occasional sellers making no more than two sales in a 12-month period do not need a permit. But, this only applies to personal items cleared from their own use.

- All food sales are considered nontaxable. Some food sales are taxable. For instance, food sold where admission fees are charged may incur sales tax.

- Sales under a section 6015 retailer don’t require a permit. While some sellers can be exempt if they sell items from an approved section 6015 retailer, they must still provide the retailer's information and ensure the supplier reports tax correctly.

- The BOE 410 D form is optional for participants. Completing the BOE 410 D form is mandatory for event participation to verify compliance with permit requirements.

- The BOE does not require personal information. In fact, the BOE requires personal information, like your social security number, for identification purposes to manage tax and fee laws.

- Your information is always private. While the BOE protects records, they may share certain information with government agencies and could disclose some account details to the public under specific circumstances.

Being informed about these common misconceptions can help vendors navigate the requirements more effectively and ensure compliance with California’s regulations.

Key takeaways

When filling out and using the BOE-410 D form, keep the following key takeaways in mind:

- Seller’s Permit Requirement: In California, if you plan to sell merchandise at swap meets or flea markets, a seller’s permit is generally required. Without this permit, you cannot legally sell your items at the event.

- Occasional Sales: Occasionally, you may not need a permit if your sales are infrequent. Selling personal items from your home is usually acceptable if it happens no more than twice in a year.

- Section 6015 Retailers: If you are selling items from a BOE approved retailer, you might not need a seller's permit, provided certain conditions are met, including that the supplier pays taxes on the sales.

- Complete All Sections: It’s important to fill out all sections of the BOE-410 D form completely and accurately. Information like your seller's permit number or the reason you don’t need a permit must be included.

- Privacy and Records: Your information is protected under state laws, but the BOE can share certain details with authorized agencies. You can also review your records by making a written request to a BOE office.

Browse Other Templates

Homeschooling in Arizona - The form highlights the need for compliance with local educational laws, providing peace of mind.

How to Authenticate Birth Certificate - Payment for services is based on the number of documents submitted for authentication.

Hunting Access Agreement,Landowner Hunting Authorization,Hunting Consent Form,Property Access Hunting Release,Hunting Authorization Document,Landowner's Hunting Permit,Hunter Access Permission Slip,Hunting Land Use Agreement,Permission to Hunt Form,H - Copies of this signed form should be kept handy during the hunting excursion.