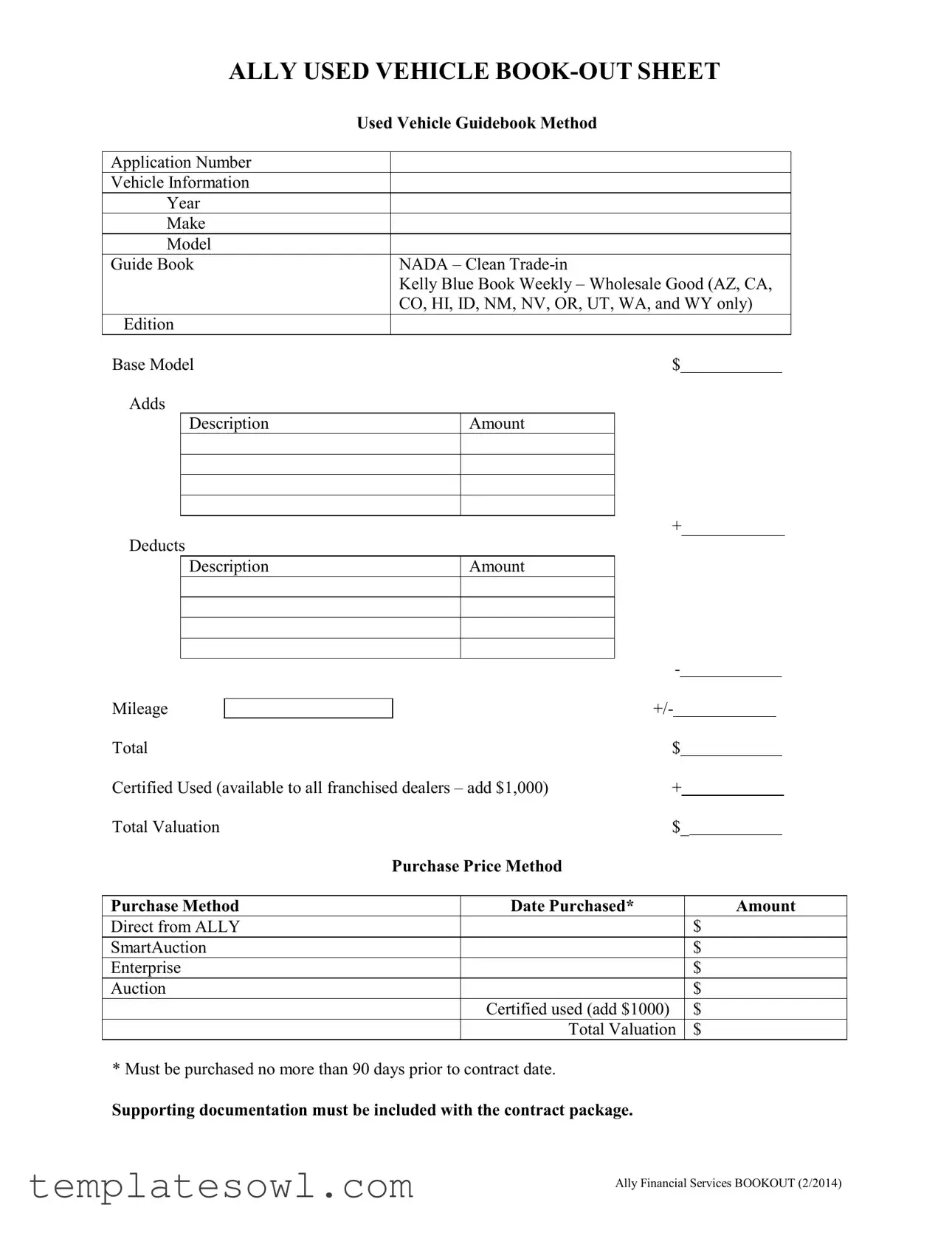

Fill Out Your Book Out Sheet Form

The Book Out Sheet form serves as an essential tool for dealerships handling used vehicles, streamlining the process of vehicle valuation and purchase transactions. Critical information like the year, make, and model of the vehicle is front and center, enabling dealers to quickly assess the worth using various reputable guides such as NADA and Kelley Blue Book. Additionally, it incorporates methods for calculating trade-in values, specifically for certain states, producing a comprehensive financial overview with both additional and deductive amounts clearly laid out. Mileage and other essential metrics compute a total valuation, while a separate section for purchase price outlines the methods through which a dealer may acquire the vehicle. Support for certified used vehicles, along with clear requirements for documentation and purchase dates, ensures that dealers align with industry standards. This form is not merely a reference; it’s a vital framework that drives efficiency and accuracy in the selling and trading process of used vehicles.

Book Out Sheet Example

ALLY USED VEHICLE

Used Vehicle Guidebook Method

Application Number |

|

Vehicle Information |

|

Year |

|

Make |

|

Model |

|

Guide Book |

NADA – Clean |

|

Kelly Blue Book Weekly – Wholesale Good (AZ, CA, |

|

CO, HI, ID, NM, NV, OR, UT, WA, and WY only) |

Edition |

|

Base Model

Adds

Description

$

Amount

+

Deducts

Description

Amount

-

Mileage

+/-

Total |

$ |

|

|

|

|

Certified Used (available to all franchised dealers – add $1,000) |

+ |

|

|

|

|

Total Valuation |

$_ |

|

|

||

Purchase Price Method

Purchase Method |

Date Purchased* |

Amount |

Direct from ALLY |

|

$ |

SmartAuction |

|

$ |

Enterprise |

|

$ |

Auction |

|

$ |

|

Certified used (add $1000) |

$ |

|

Total Valuation |

$ |

* Must be purchased no more than 90 days prior to contract date.

Supporting documentation must be included with the contract package.

Ally Financial Services BOOKOUT (2/2014)

Form Characteristics

| Fact Name | Description |

|---|---|

| Document Purpose | The Book Out Sheet is used by car dealerships to determine the value of used vehicles based on established guidebooks. |

| Applicable States | For certain methods, the form is relevant in states like Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, and Wyoming. |

| Valuation Methods | The sheet allows for valuations based on several methods including NADA, Kelly Blue Book, and purchase price methods, which may add value for certified used cars. |

| Documentation Requirement | Supporting documentation must be included with the contract package, and vehicles must be purchased within 90 days prior to the contract date. |

Guidelines on Utilizing Book Out Sheet

After gathering all necessary vehicle information and ensuring you have the appropriate documentation, it's time to fill out the Book Out Sheet. This process will help you accurately report the details related to the used vehicle you’re selling or trading in.

- Enter the Application Number: Write down the unique identifier for the vehicle transaction at the top of the form.

- Fill in Vehicle Information: Record the Year, Make, and Model of the vehicle in the designated spaces.

- Select the Guide Book: Choose the applicable valuation guide—NADA, Kelly Blue Book, etc. Make sure to indicate the correct edition.

- Input $ Amount for Clean Trade-in: Based on the guide selected, write in the amount for the clean trade-in value.

- List Adds and Deducts: If there are any additional features or deductions to consider, fill in their descriptions and associated amounts.

- Record Mileage: Accurately state the vehicle’s mileage and note whether it’s an increase or decrease.

- Calculate Total: Sum up the amounts and enter the total vehicle valuation at the bottom of this section.

- Move to Purchase Price Method: Indicate the method used for the purchase (Direct from ALLY, SmartAuction, etc.) and provide the date of purchase.

- Input Total Valuation: Write in the total amount from the valuation calculations here again to ensure accuracy.

Once you have filled out all required fields, double-check for accuracy and completeness. You’ll need to include supporting documentation with your submission to create a smooth process for the transaction ahead.

What You Should Know About This Form

What is the purpose of the Book Out Sheet form?

The Book Out Sheet form serves as a standardized method for dealerships to assess the value of used vehicles. It provides a structured format to input vehicle details, including year, make, and model, as well as valuation references from recognized guides like NADA and Kelley Blue Book. This helps dealers determine a fair price for the vehicle, ensuring they are competitive in the market while also protecting their interests.

Which valuation guides are referenced in the Book Out Sheet?

The form allows the use of multiple reputable appraisal guides, including NADA for clean trade-in values and Kelley Blue Book for wholesale valuations. Depending on the region, the sheet accommodates various conditions, allowing for adjustments based on the vehicle's state and specific additions or deductions. This multifaceted approach aids dealers in making informed decisions about inventory pricing.

What additional cost is associated with certified used vehicles?

If a dealership is offering certified used vehicles, an additional charge of $1,000 must be included in the total valuation. This adjustment reflects the enhanced quality and inspected status of certified vehicles, which often come with guarantees that can entice buyers.

Are there restrictions on the purchase date for vehicles recorded on the Book Out Sheet?

Yes, vehicles must be purchased within 90 days of the contract date to be included in this evaluation process. This restriction ensures that the data reflects the current market conditions and prevents outdated valuations from affecting sales. Supporting documentation must also accompany the contract package to validate the purchase details.

How should mileage be recorded on the Book Out Sheet?

Mileage should be recorded accurately, in the specified section of the form. This figure can have a significant impact on the total valuation, as lower mileage typically increases the value of the vehicle. Adjustments can be made in the form to reflect how the mileage affects the overall price.

What purchase methods can be used with this form?

Several purchase methods can be documented on the Book Out Sheet, including direct purchases from Ally, SmartAuction, Enterprise, or auctions. Each method listed may have different implications for pricing and valuation, and specifying the method helps maintain clarity in records and transactions.

Common mistakes

When filling out the Book Out Sheet form, individuals can sometimes make mistakes that may affect the valuation of the vehicle. One common error is failing to accurately enter the vehicle information. Information such as the year, make, and model must be correct. If there are typos or incorrect details, it can lead to misvaluations.

Another frequent mistake involves neglecting to include supporting documentation. This form requires certain documents that need to accompany it, especially if the purchase was made directly from Ally Financial Services or through a specific method. Not attaching these documents can delay the processing of the form.

Additionally, individuals often make the mistake of miscalculating the total valuation. The total amount can be impacted by various factors, including deductions and additional fees for certified vehicles. Taking these calculations lightly may result in an incorrect final figure.

Another important aspect is the mileage entry. Some people enter mileage incorrectly, whether it is a typographical error or overlooking the correct reading altogether. Accurate mileage is essential, as it can significantly influence the vehicle’s value.

Completing the purchase date incorrectly is also a common pitfall. The purchase date must reflect a transaction that occurred no more than 90 days before submitting the form. If an individual inadvertently lists an incorrect date, it can lead to complications, including disallowance of the valuation.

People sometimes forget to indicate added features or deductions accurately. When listing adds and deducts, it's important to provide precise descriptions and amounts. Incomplete or vague entries can obscure the vehicle's true value.

Finally, individuals occasionally overlook the certification fee because it can be an additional charge seen as an afterthought. For certified used vehicles, including this fee is crucial, as it enhances the vehicle's market value.

Documents used along the form

The Book Out Sheet is an important tool for those involved in the buying and selling of used vehicles. Often, it is used alongside several other forms and documents that help streamline the sales process and ensure that all necessary information is accurately captured. Below is a list of commonly used documents that accompany the Book Out Sheet.

- Vehicle Purchase Agreement: This document outlines the terms of the sale between the buyer and the seller. It details the conditions under which the vehicle will be sold, including the purchase price, payment method, and any warranties or guarantees related to the vehicle.

- Trade-In Valuation Report: When a customer trades in a vehicle, this report assesses the trade-in's worth and provides a fair market value. It takes into account the vehicle's condition, mileage, and market demand, helping ensure that both the dealer and the customer are satisfied with the trade-in deal.

- Title Transfer Document: This is necessary for transferring ownership of the vehicle from the seller to the buyer. It includes details about the vehicle, the names of both parties, and is usually signed by both the buyer and the seller at the time of sale. This document is essential for registering the vehicle in the new owner's name.

- Odometer Disclosure Statement: Federal and state laws require sellers to provide an odometer reading at the time of sale to protect buyers from fraud. This sworn statement verifies the mileage on the vehicle and helps prevent odometer rollback scams, ensuring transparency in the transaction.

Each of these documents plays a crucial role in the process of purchasing and selling used vehicles. By having them prepared and available, all parties can ensure a smoother transaction and greater peace of mind throughout the process.

Similar forms

The Book Out Sheet form serves as a valuable tool for documenting the appraisal and valuation of used vehicles. There are several other documents that share similar functions or purposes. Here’s a look at nine of those documents:

- Sales Agreement: This document outlines the terms of sale between the buyer and seller, covering price, vehicle details, and any conditions attached to the sale.

- Trade-In Valuation Sheet: Similar to the Book Out Sheet, this form evaluates the worth of a vehicle being traded in towards the purchase of another vehicle, often including market analysis.

- Vehicle History Report: This report provides details about a vehicle's past, including accidents, previous owners, and service history, which can affect its value.

- Dealer Appraisal Form: Used by dealers to assess the condition and value of a vehicle based on specific criteria, akin to the valuation processes in the Book Out Sheet.

- Inspection Report: A detailed account of the physical and mechanical condition of a vehicle, this document supports the valuation by providing insights into necessary repairs or issues.

- Title Transfer Document: This paperwork is essential when ownership of a vehicle changes, ensuring the new owner receives a clear title, similar to how the Book Out Sheet records ownership transition processes.

- Financing Application: This application is completed by buyers seeking financing for a vehicle purchase. It assesses creditworthiness and can relate to the Book Out Sheet's valuation considerations.

- Contract Purchase Agreement: This legally binding document includes details of the purchase like price and payment terms, linking closely to the pricing information found on the Book Out Sheet.

- Warranty Registration Form: Upon purchase, buyers often fill out this form to register their warranty, providing additional assurance of the vehicle's condition and value.

Understanding these documents helps clarify the entire vehicle sales process and ensures that both buyers and sellers are on the same page regarding valuations and transactions.

Dos and Don'ts

When filling out the Book Out Sheet form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here are seven recommendations to keep in mind:

- Do: Double-check the vehicle's information for accuracy, including the year, make, and model.

- Do: Include all supporting documentation with your submission. This might include valuation reports or purchase confirmations.

- Do: Use reliable resources, like the NADA or Kelley Blue Book, to determine the vehicle's value.

- Do: Make sure the purchase date is within the allowed 90-day window prior to the contract date.

- Don't: Leave any sections of the form blank. Each part must be filled out completely.

- Don't: Forget to account for adds and deducts when calculating the total valuation.

- Don't: Omit the mileage information. This is crucial for an accurate assessment of the vehicle's value.

Misconceptions

Here are ten common misconceptions about the Book Out Sheet form associated with vehicle transactions:

- The Book Out Sheet is only for new vehicles. In reality, it is specifically designed for used vehicles, providing essential valuation data.

- You can use any appraisal guide for the Book Out Sheet. It's important to note that the form specifically references NADA and Kelly Blue Book as the accepted sources.

- The mileage section is optional. Mileage is actually a critical piece of information and must be included for accurate valuation.

- All dealerships can use the same purchase price method. Different dealerships may have different available methods depending on their contracts and agreements with Ally Financial Services.

- The form does not require supporting documents. Supporting documentation must indeed be included with the contract package for the form to be valid.

- Any price can be added for certified used vehicles. A standardized amount of $1,000 must be added to the valuation for certified vehicles as per the guidelines.

- You can purchase a vehicle and use the form anytime. The vehicle must be purchased no more than 90 days prior to the contract date to qualify for this form.

- It’s only necessary for high-value vehicles. The Book Out Sheet is applicable for all used vehicles, regardless of their market value.

- Completing the form can be done without attention to detail. Accurate completion is essential, as any errors can lead to financial discrepancies and issues with the transaction.

- Once submitted, the form cannot be changed. If needed, adjustments can be made, but they must be properly documented and processed through the correct channels.

Key takeaways

When it comes to effectively filling out and utilizing the Book Out Sheet form, understanding the essential components is critical. Here are ten key takeaways to keep in mind:

- Accurate Information is Essential: Ensure that all vehicle information, such as the year, make, and model, is filled out accurately. Accuracy impacts the valuation significantly.

- Familiarize Yourself with Valuation Sources: The form mentions several sources for vehicle valuation, including NADA and Kelley Blue Book. Understanding how each source calculates value will aid in determining the right amount.

- Incorporate Adds and Deducts: Be mindful of any additional features or conditions of the vehicle. Clearly list any adds (like upgraded audio systems) and deducts (like previous damage) to reflect true market value.

- Understand Mileage Impacts: Mileage can significantly influence a vehicle’s valuation. Note how mileage affects the total value, as high mileage often leads to lower trade-in offers.

- Certified Used Vehicle Benefits: If applicable, remember that certified used vehicles come with an additional $1,000 value. Ensure this is accurately represented in your calculations.

- Choose Your Purchase Method Wisely: The form provides options for different purchase methods. Select the appropriate one to reflect where the vehicle was sourced, whether it was from Ally, SmartAuction, or other means.

- Documentation is Key: Supporting documentation must accompany your Book Out Sheet, especially if the vehicle was purchased within 90 days of the contract date. This documentation is crucial for validation.

- Review Before Submission: Take the time to review the entire form before submitting. Errors or omissions can create delays or mismatches in vehicle valuation.

- Keep Up with Market Changes: Vehicle valuations can fluctuate based on market trends. Staying updated with the latest market data will help ensure accurate valuations.

- Utilize the Guidebook Effectively: The guidebook referenced in the form should be consulted for additional insights on valuation and market standards. Familiarize yourself with it to ensure proper application of the information.

By taking these factors into account, you can enhance your proficiency in using the Book Out Sheet, ultimately leading to more accurate vehicle valuations and smoother transactions.

Browse Other Templates

FSPS Annuity Earnings Declaration,Earnings Assessment for Annuity Supplement,Annuity Supplement Income Report,Earnings Exemption Submission Form,FSPS Income Reporting Document,Annuity Supplement Earnings Validation,Income Disclosure for Annuity Benef - Always keep a copy of the submitted form for your records.

Resumed Work Date - Employers must describe the nature of their business operations in the form.