Fill Out Your Bright Start Withdrawal Request Form

The Bright Start Withdrawal Request form is an essential tool for account holders looking to access savings for educational expenses. This form enables the account owner to specify the type of withdrawal—whether for qualified educational expenses or other uses—as well as to provide key account and beneficiary information. The form requires the account number, legal names, Social Security numbers, and contact details to ensure accurate processing. Additionally, it guides users through the choice between qualified and non-qualified withdrawals, explaining the potential tax implications associated with each option. Instructions for payment methods are also included, offering flexibility in how funds are received. Whether opting for a check or electronic funds transfer, the form accommodates various needs, all while emphasizing the importance of consulting tax advisors for guidance. Submitting this form correctly is vital for ensuring that funds are allocated appropriately and in a timely manner for educational costs.

Bright Start Withdrawal Request Example

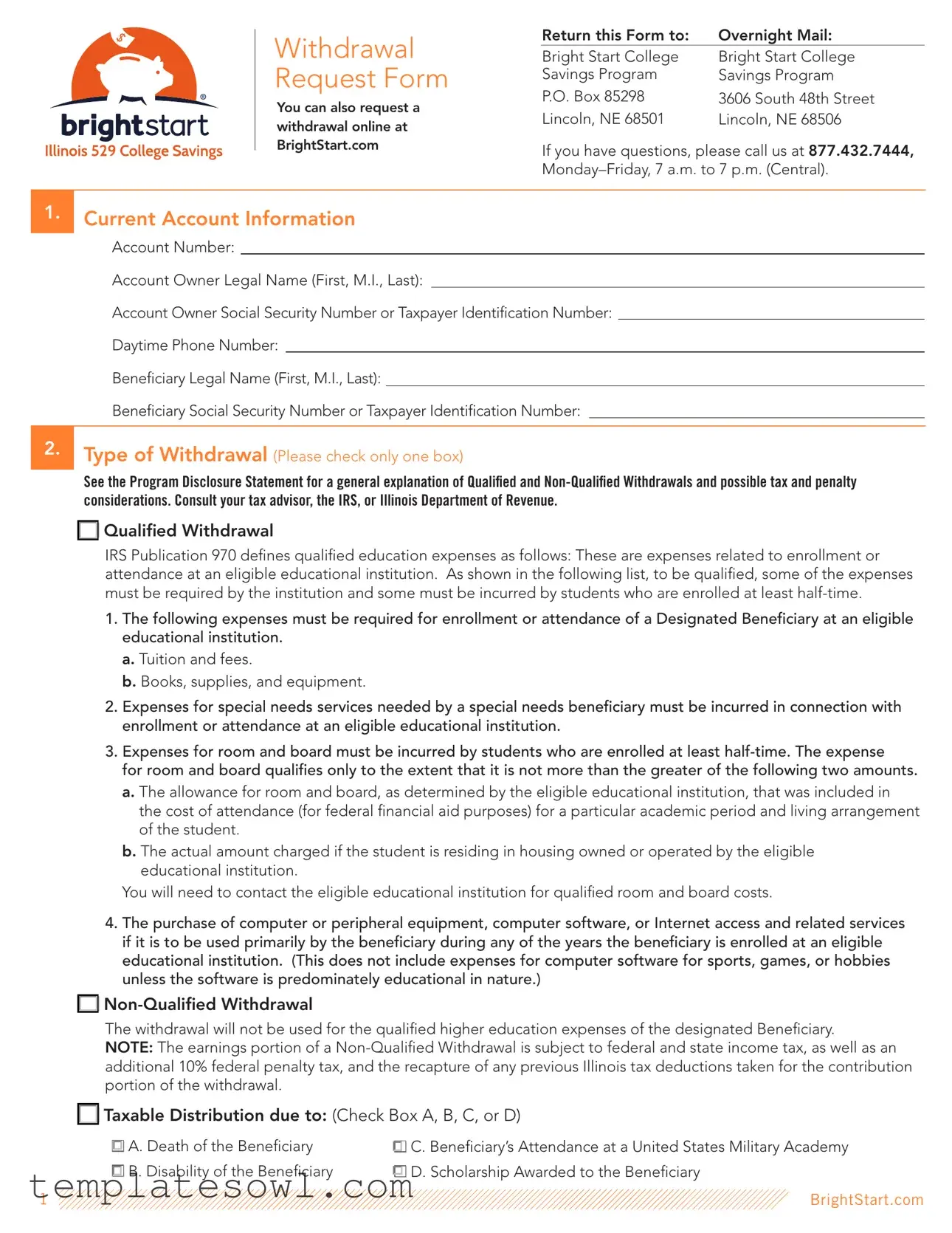

Withdrawal Request Form

You can also request a withdrawal online at BrightStart.com

Return this Form to: |

Overnight Mail: |

Bright Start College |

Bright Start College |

Savings Program |

Savings Program |

P.O. Box 85298 |

3606 South 48th Street |

Lincoln, NE 68501 |

Lincoln, NE 68506 |

If you have questions, please call us at 877.432.7444,

1.Current Account Information

Account Number:

Account Owner Legal Name (First, M.I., Last):

Account Owner Social Security Number or Taxpayer Identification Number:

Daytime Phone Number:

Beneficiary Legal Name (First, M.I., Last):

Beneficiary Social Security Number or Taxpayer Identification Number:

2.Type of Withdrawal (Please check only one box)

See the Program Disclosure Statement for a general explanation of Qualified and

Qualified Withdrawal

Qualified Withdrawal

IRS Publication 970 defines qualified education expenses as follows: These are expenses related to enrollment or attendance at an eligible educational institution. As shown in the following list, to be qualified, some of the expenses must be required by the institution and some must be incurred by students who are enrolled at least

1.The following expenses must be required for enrollment or attendance of a Designated Beneficiary at an eligible educational institution.

a.Tuition and fees.

b.Books, supplies, and equipment.

2. Expenses for special needs services needed by a special needs beneficiary must be incurred in connection with |

|

enrollment or attendance at an eligible educational institution. |

|

3. Expenses for room and board must be incurred by students who are enrolled at least |

|

for room and board qualifies only to the extent that it is not |

more than the greater of the following two amounts. |

a. The allowance for room and board, as determined by the eligible educational institution, that was included in |

|

the cost of attendance (for federal financial aid purposes) for |

a particular academic period and living arrangement |

of the student. |

|

b. The actual amount charged if the student is residing in housing owned or operated by the eligible |

|

educational institution. |

|

You will need to contact the eligible educational institution for qualified room and board costs. |

|

4.The purchase of computer or peripheral equipment, computer software, or Internet access and related services if it is to be used primarily by the beneficiary during any of the years the beneficiary is enrolled at an eligible educational institution. (This does not include expenses for computer software for sports, games, or hobbies unless the software is predominately educational in nature.)

|

|

The withdrawal will not be used for the qualified |

higher education expenses of the designated Beneficiary. |

NOTE: The earnings portion of a |

Withdrawal is subject to federal and state income tax, as well as an |

additional 10% federal penalty tax, and the recapture of any previous Illinois tax deductions taken for the contribution |

|

portion of the withdrawal. |

|

Taxable Distribution due to: (Check Box A, B, C, or D)

Taxable Distribution due to: (Check Box A, B, C, or D)

A. Death of the Beneficiary |

C. Beneficiary’s Attendance at a United States Military Academy |

B. Disability of the Beneficiary |

D. Scholarship Awarded to the Beneficiary |

1 |

BrightStart.com |

3.Amount of Withdrawal

Total Account Balance |

|

Total Account Balance and Close Account |

Partial Liquidation: (Check Box A or B)

Partial Liquidation: (Check Box A or B)

A. Partial Liquidation in the Amount of $

A. Partial Liquidation in the Amount of $

(This withdrawal amount will be liquidated

B. Partial Liquidation from Specific Portfolios

B. Partial Liquidation from Specific Portfolios

529 Portfolio

Total Withdrawal Amount:

4.Payment Instructions (Check Box A or B)

A. Check Payable to: (Check one)

A. Check Payable to: (Check one)

Account Owner (check sent to the address on record)

Account Owner (check sent to the address on record)

Proceeds of this withdrawal will be used at an institution of higher education: (Check one)

Yes Name of School:City, State:

Yes Name of School:City, State:

No

No

Beneficiary – A check payable to the Designated Beneficiary listed in Section 1 will be mailed to the following address: Street Address:

Beneficiary – A check payable to the Designated Beneficiary listed in Section 1 will be mailed to the following address: Street Address:

City, State, ZIP:

Institution of Higher Education (please attach copy of invoice or billing statement from institution) Name of Institution:

Institution of Higher Education (please attach copy of invoice or billing statement from institution) Name of Institution:

Department or Office:

Street Address:

City, State, ZIP:

Student ID Number:

2 |

BrightStart.com |

4.Payment Instructions (continued from previous page)

B. Electronic Funds Transfer: (Check one)

B. Electronic Funds Transfer: (Check one)

To Account Owner’s Bank Account on File

To Account Owner’s Bank Account on File

Bank Name:

Bank Account Number:

To Account Owner’s Bank Account Not on File with Bright Start (complete below bank information)

To Account Owner’s Bank Account Not on File with Bright Start (complete below bank information)

• Please have your signature

Name(s) on Bank Account: |

|

|

|

If this bank account is a joint account, please |

|

|

|

Your Name |

1234 |

||

list the 529 account owner. |

|||

|

|

Account Type: |

|

|

Checking |

|

|

Savings |

|

|

|

||||

|

|

|

|

• This bank account will be linked to your Bright Start College Savings Program Account for telephone and website purchase and redemption/ withdrawal transactions.

the order of |

|

|

|

|

|

|

Date |

|

|

|

|

||

|

|

|

PREPRINTED$ |

|

|||||||||

Pay to |

|

YOUR |

|

|

|

|

|

|

|

|

|||

|

|

TAPE |

|

|

OR |

SAVINGSDollars |

|||||||

|

|

|

|

CHECK |

|

|

|

. |

|||||

Sample |

|

|

|

SLIP |

HERE |

||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

BankVOIDEDName and Address |

DEPOSIT |

|

|

||||||||||

|

|

|

|

|

|||||||||

ACCOUNT |

|

|

|

|

|

|

|

|

|||||

Memo |

|

|

|

|

|

|

|

|

|

|

|

|

|

:123456789: |

|

34568: |

|

|

|

|

|

|

|

|

|||

NOTE: Distributions to a Beneficiary or Institution of Higher Education for the benefit of on IRS Form

the Beneficiary will be reported of the Beneficiary. All other Number of the Account Owner.

5.Authorization

I understand that the tax treatment of a withdrawal needs to be coordinated with the American Opportunity and Lifetime Learning Credits, the Tuition and Fees Deduction, Coverdell Education Savings Account distributions, and all other education related benefits. For specific tax guidance, I will consult with my tax professional.

By signing this form, I certify that I am the Account Owner of the Account indicated in Section I and that the information contained on this withdrawal form is true, complete, and correct. I authorize the Program Manager to make this distribution from my Account as indicated. I assume sole responsibility for the tax consequences of the above election and understand that the earnings portion of a

By selecting the electronic transfer service in Section 4, I acknowledge that the bank account in Section 4 will be linked to my Bright Start Account, and I hereby authorize Union Bank & Trust Company to initiate debit and/or credit entries to the bank account indicated above, and the bank indicated above to debit the same amount. I acknowledge that the referenced bank account will be linked to my Bright Start College Savings Program Account so that I may purchase or sell shares by telephone or online at BrightStartSavings.com. This authority is to remain in full force and effect until Union Bank & Trust Company has received notification from me of its modification or termination in such time as to afford Union Bank & Trust Company reasonable time to act on it. I understand that if a transaction cannot be made because of insufficient funds or because either account has been closed, this service will be cancelled by Union Bank & Trust Company. I acknowledge that the origination of Automated Clearing House (“ACH”) transactions to my account must comply with the provisions of applicable law. I further agree that if my draft is dishonored for any reason, with or without cause, Union Bank & Trust Company will not bear any liability. Union Bank & Trust Company may correct any transaction errors with a debit or credit to my financial institution account and/or my Bright Start College Savings Program Account. (Please retain a copy of this authorization for your records.)

I understand that it is my responsibility to maintain accurate records as may be required by the IRS to substantiate this distribution for tax purposes.

3 |

BrightStart.com |

6.Authorization (continued from previous page)

Signature and Date Required

X

Signature of Account Owner, Custodian (UGMA/UTMA Accounts), or Trustee |

Date |

Print Name Here

Title (if other than an individual is establishing the Account)

If the Account Owner is a trust and there is more than one trustee, the additional trustee must sign here.

X

Signature of

Print Name Here |

Date |

7.Medallion Signature Guarantee

Medallion Signature Guarantee is Required if:

• The address of record has changed within 15 days of the withdrawal request.

• The bank account information in Section 5 is not already on file with the Bright Start College Savings Program. • The withdrawal request is greater than $50,000

MEDALLION SIGNATURE GUARANTEE |

Signature must be stamped with a Medallion |

|

Signature Guarantee by a qualified financial |

||

|

||

|

institution, such as a commercial bank, |

|

|

savings and loan, U.S. stock broker and |

|

|

security dealer, or credit union, that is |

|

|

participating in an approved Medallion |

|

|

Signature Guarantee program. |

|

|

(A NOTARY PUBLIC CANNOT PROVIDE A |

|

|

SIGNATURE GUARANTEE) |

Note to Guarantor:

Medallion imprints must be fully legible and must not be dated or annotated.

Trustee & Administrator |

Program Manager |

June 2019

4 |

BrightStart.com |

Form Characteristics

| Fact Name | Details |

|---|---|

| Withdrawal Request Options | Individuals can request a withdrawal either by submitting the form or online at BrightStart.com. |

| Returning the Form | The form should be sent to Bright Start College Savings Program at the specified Lincoln, NE address. |

| Contact Information | For assistance, individuals can call the customer service line at 877.432.7444, available Monday to Friday, from 7 a.m. to 7 p.m. (Central). |

| Types of Withdrawals | Withdrawals can be categorized as either Qualified or Non-Qualified, each with different tax implications as per IRS regulations. |

| Qualified Expenses | Qualified withdrawals cover expenses for tuition, fees, books, and certain living costs related to eligible educational institutions. |

| Non-Qualified Withdrawals | The earnings from Non-Qualified Withdrawals face federal and state taxes, plus an additional 10% federal penalty tax. |

| Signature Guarantee Requirement | A Medallion Signature Guarantee is necessary in several scenarios, including changes in address, banking information, or if the withdrawal exceeds $50,000. |

Guidelines on Utilizing Bright Start Withdrawal Request

After submitting your Bright Start Withdrawal Request form, the processing team will review the information to ensure accuracy and compliance with regulations. Following this review, you can expect to see the requested funds disbursed to the specified account or address within a reasonable timeframe. If any issues arise, the Bright Start team will contact you for clarification.

- Begin by locating the Current Account Information section at the top of the form. Fill in the following details:

- Your Account Number.

- Account Owner Legal Name (First, M.I., Last).

- Social Security Number or Taxpayer Identification Number.

- Daytime Phone Number.

- Beneficiary Legal Name (First, M.I., Last).

- Beneficiary Social Security Number or Taxpayer Identification Number.

- In the Type of Withdrawal section, check only one box. Decide between a Qualified Withdrawal and a Non-Qualified Withdrawal. Review the definitions and implications of each carefully.

- If applicable, indicate any reason for a Taxable Distribution by checking Box A, B, C, or D.

- For the amount of withdrawal, specify an amount in the Amount of Withdrawal section. Select from:

- Total Account Balance.

- Total Account Balance and Close Account.

- Partial Liquidation (choose between options A or B).

- Next, move to the Payment Instructions section. Here, check either Box A or B based on how you wish to receive your funds:

- Box A for a paper check payable to either the Account Owner or the Beneficiary.

- Box B for an Electronic Funds Transfer to the specified bank account.

- Complete the Authorization section. Sign and date the form, confirming that all information provided is accurate.

- If necessary, include a Medallion Signature Guarantee. This is required under specific conditions outlined in the form.

What You Should Know About This Form

What is the Bright Start Withdrawal Request form used for?

The Bright Start Withdrawal Request form is designed for account owners to request funds from their Bright Start College Savings Program account. This form allows for both qualified and non-qualified withdrawals, providing specific instructions for each type. Additionally, the form facilitates the withdrawal process and ensures all necessary information is collected to process the request efficiently.

How do I submit the Bright Start Withdrawal Request form?

You can submit the completed form by mailing it to the provided address. For overnight mail, send it to Bright Start College Savings Program at P.O. Box 85298, Lincoln, NE 68501. For regular mail, use the address at 3606 South 48th Street, Lincoln, NE 68506. Ensure that all required sections are filled out accurately to avoid delays.

Are there any tax implications associated with withdrawals?

Yes, there are potential tax implications depending on the type of withdrawal. Qualified withdrawals for educational expenses generally are not subject to federal income tax. However, non-qualified withdrawals may incur income tax on the earnings portion, along with a 10% federal penalty tax. It is advisable to consult a tax professional to understand personal tax situations fully before requesting a withdrawal.

What information do I need to provide on the form?

You will need to include several details on the form, such as your account number, your legal name, and the beneficiary's name and Social Security number. Additionally, specify the type of withdrawal and the amount you wish to withdraw. Accurate information ensures that your request is processed correctly and in a timely manner.

What if I have questions while filling out the form?

If you have questions regarding the form or the withdrawal process, you can call Bright Start at 877.432.7444. Customer service representatives are available Monday through Friday, from 7 a.m. to 7 p.m. Central time, to assist with any inquiries you may have.

Common mistakes

Filling out the Bright Start Withdrawal Request form can be straightforward, yet many individuals make mistakes that delay or complicate the process. One common error occurs in the section requesting current account information. Applicants often overlook accurately entering their account number or fail to match it with the name provided. This discrepancy can lead to significant delays in processing the withdrawal. Ensuring all information is consistent and correct is crucial for a smooth transaction.

Another frequent mistake relates to the type of withdrawal. The form includes both qualified and non-qualified withdrawal options, but individuals sometimes select the wrong box. Without careful consideration of these categories, applicants might inadvertently incur unnecessary tax penalties or fail to qualify for certain benefits. It's advised to read the definitions and implications carefully before making a selection.

Errors also arise regarding the payment instructions. Many individuals neglect to check the correct box or fail to provide complete information about where the funds should be sent. This can be especially problematic for electronic funds transfers. If the bank account information is incorrect or not properly listed, processing might be halted until the information is rectified. Double-checking this section can prevent unnecessary delays.

Finally, individuals frequently overlook the requirement for a signature medallion guarantee. This is necessary under specific circumstances, such as when the withdrawal amount exceeds $50,000 or if there have been recent changes to account information. Failing to secure this guarantee or misunderstanding when it is needed can result in the withdrawal request being rejected. Understanding these requirements is essential for all those filling out the form.

Documents used along the form

The Bright Start Withdrawal Request form is just one part of the process for managing a Bright Start College Savings Program account. Several other forms and documents may be used in conjunction with this withdrawal request to ensure that all transactions are processed correctly and efficiently. Below is a list of these documents, which helps clarify the requirements for different situations.

- Program Disclosure Statement: This document provides essential information on the Bright Start College Savings Program. It outlines the terms, conditions, and implications of using the account, including tax benefits and penalties for non-qualified withdrawals.

- Tax Form 1099-Q: Issued annually, this tax form details the distributions made from the Bright Start account. It reflects earnings and returns on investments, crucial for tax filing purposes.

- Change of Beneficiary Form: This form allows account owners to update or change the designated beneficiary of the account. Proper documentation is necessary to ensure compliance with program rules.

- Account Ownership Transfer Form: If the ownership of the account needs to be transferred to another individual, this form must be completed. It facilitates a smooth transition while adhering to legal requirements.

- Withdrawal Confirmation Form: This document serves as a record of the completion of a withdrawal request. It confirms the details of the transaction for both the account owner and the program manager.

- Medallion Signature Guarantee: Required for larger withdrawals or changes to account settings, this guarantee ensures that the signature on forms is valid and prevents unauthorized transactions.

- Tuition Bill or Invoice: When making a withdrawal for payment of educational expenses, an invoice from the educational institution may be required to confirm the validity of qualified expenses.

- Documentation for Special Needs Services: If withdrawals are for a special needs beneficiary, additional documentation may be necessary to verify that the funds will cover qualified expenses.

- Federal Tax Returns: Previous years' tax returns may be requested to evaluate eligibility for certain types of withdrawals or claims regarding tax benefits.

- Power of Attorney Document: If someone else is managing the account on behalf of the account owner, a power of attorney form may be required to authorize actions on the account.

Using the correct documents alongside the Bright Start Withdrawal Request form is essential for a seamless withdrawal process. Confirm that all relevant forms are completed accurately and submitted in a timely manner to avoid any delays or complications.

Similar forms

- Loan Application Form: Similar to the Bright Start Withdrawal Request form, this document also requires personal information about the applicant, including Social Security Number and contact details. Both documents serve as formal requests for withdrawing funds, with specific purposes outlined.

- Account Closure Request Form: Like the withdrawal request, this form captures essential account details and the reason for the closure. It ensures that all necessary information is gathered before processing the final transaction.

- Change of Beneficiary Form: This form requires information about the current and new beneficiaries, mirroring the need for identification in the withdrawal form. Both documents facilitate updates in account management.

- Distribution Request Form for IRA: This document shares similarities in structure, asking for information regarding the account holder, distribution type, and associated tax implications, much like the withdrawal request for Bright Start.

- Tuition Reimbursement Request Form: Both forms help in requesting funds tied to education expenses. They collect similar data about the payer and the educational institution.

- Health Savings Account (HSA) Withdrawal Request Form: This document also includes personal and beneficiary information while detailing the type of expenses being withdrawn for qualified medical expenses, paralleling educational expenses in the withdrawal request.

- Benefit Claim Form: This form requires personal identification and other supporting documents. Similar to the Bright Start form, it necessitates proof of eligibility for the requested benefit.

- Scholarship Application Form: Just like the withdrawal request, it includes sections to detail the applicant's information and intended use of funds, emphasizing educational purposes.

- Grant Application Form: This form, like the withdrawal request form, gathers comprehensive information about the applicant and proposed usage of funds, usually for educational or developmental purposes.

- Financial Aid Request Form: Similar to the Bright Start Withdrawal Request form, this document collects personal information and outlines the purpose of the aid. It supports the financial planning surrounding education costs.

Dos and Don'ts

When filling out the Bright Start Withdrawal Request form, there are several important actions to take and avoid. Here are key dos and don'ts:

- Do provide accurate account information, including your account number and legal names.

- Do consult the Program Disclosure Statement to understand what constitutes qualified versus non-qualified withdrawals.

- Do ensure that any withdrawal is clearly marked as a qualified or non-qualified distribution based on the beneficiary’s educational expenses.

- Do verify that your payment instructions specify the correct recipient and banking details for electronic transfers.

- Don't overlook the requirement for a Medallion Signature Guarantee if necessary, particularly for larger withdrawals or recent address changes.

- Don't submit the form without double-checking for accuracy, as mistakes can lead to delays or misdirected funds.

- Don't forget to consult with a tax advisor regarding potential tax implications of your withdrawal.

- Don't assume that all expenses associated with the beneficiary’s education are qualified; confirm eligibility with the institution if unsure.

Misconceptions

Here are some common misconceptions about the Bright Start Withdrawal Request form:

- The form can only be submitted by mail. Many people believe they can only submit the form via mail, but you can also request a withdrawal online at BrightStart.com.

- All withdrawals are tax-free. Not all withdrawals are tax-free. Non-qualified withdrawals can be subject to taxes and penalties.

- I can withdraw any amount at any time. While you can withdraw funds, there are rules about how much and under what circumstances. It’s important to review these rules.

- Any expense related to education qualifies for withdrawal. Only specific qualified education expenses are eligible. Familiarize yourself with what qualifies before making a withdrawal.

- I don’t need a medallion signature guarantee for any withdrawal. A medallion signature guarantee is required under certain conditions, such as when the address has changed recently or for large withdrawals over $50,000.

- The institution determines all qualified expenses. While institutions do provide guidance, certain criteria from the IRS define which expenses qualify.

- Scholarship funds make my entire withdrawal taxable. Withdrawals due to scholarships might be able to avoid taxes, but it depends on various factors.

- I don’t need to keep records after withdrawal. It’s essential to maintain accurate records to substantiate withdrawals for tax purposes, as the IRS requires documentation.

- Withdrawal requests can be processed instantly. Withdrawal requests may take time to process, so plan accordingly to avoid delays in accessing funds.

Key takeaways

- Completing the Form: Fill out the Bright Start Withdrawal Request form completely and accurately. This includes providing personal information for both the account owner and the beneficiary.

- Withdrawal Type: Select only one type of withdrawal. Choose between qualified and non-qualified withdrawals, as this can significantly impact tax obligations.

- Consultation Recommended: Before making a withdrawal, consider speaking with a tax advisor. They can help you understand any potential tax implications associated with your withdrawal choice.

- Payment Options: Multiple payment options are available. You can choose to receive your funds via a check or through electronic funds transfer to your bank account.

- Documentation:** If using the funds for educational purposes, submit the necessary documentation, such as an invoice or billing statement from the educational institution.

- Signature Guarantee: A Medallion Signature Guarantee may be required under certain circumstances. This includes changes in address or bank account information, or if the withdrawal amount exceeds $50,000.

- Tax Consequences: Be aware that non-qualified withdrawals incur federal and state income taxes, as well as a potential 10% penalty on earnings. Understanding these consequences is critical for effective financial planning.

Browse Other Templates

Wade College Dallas - If you need an official transcript, you must submit your request in writing.

Illinois Unemployment Refund Application,UI Overpayment Refund Request,UI-28 Refund Submission Form,Illinois Direct Deposit Refund Request,Unemployment Contribution Refund Form,Refund Processing Application,Illinois Employment Security Refund Form,Cl - Employers can manage various tax functions via MyTax Illinois beyond just refund requests.