Fill Out Your Broker Fee Agreement Form

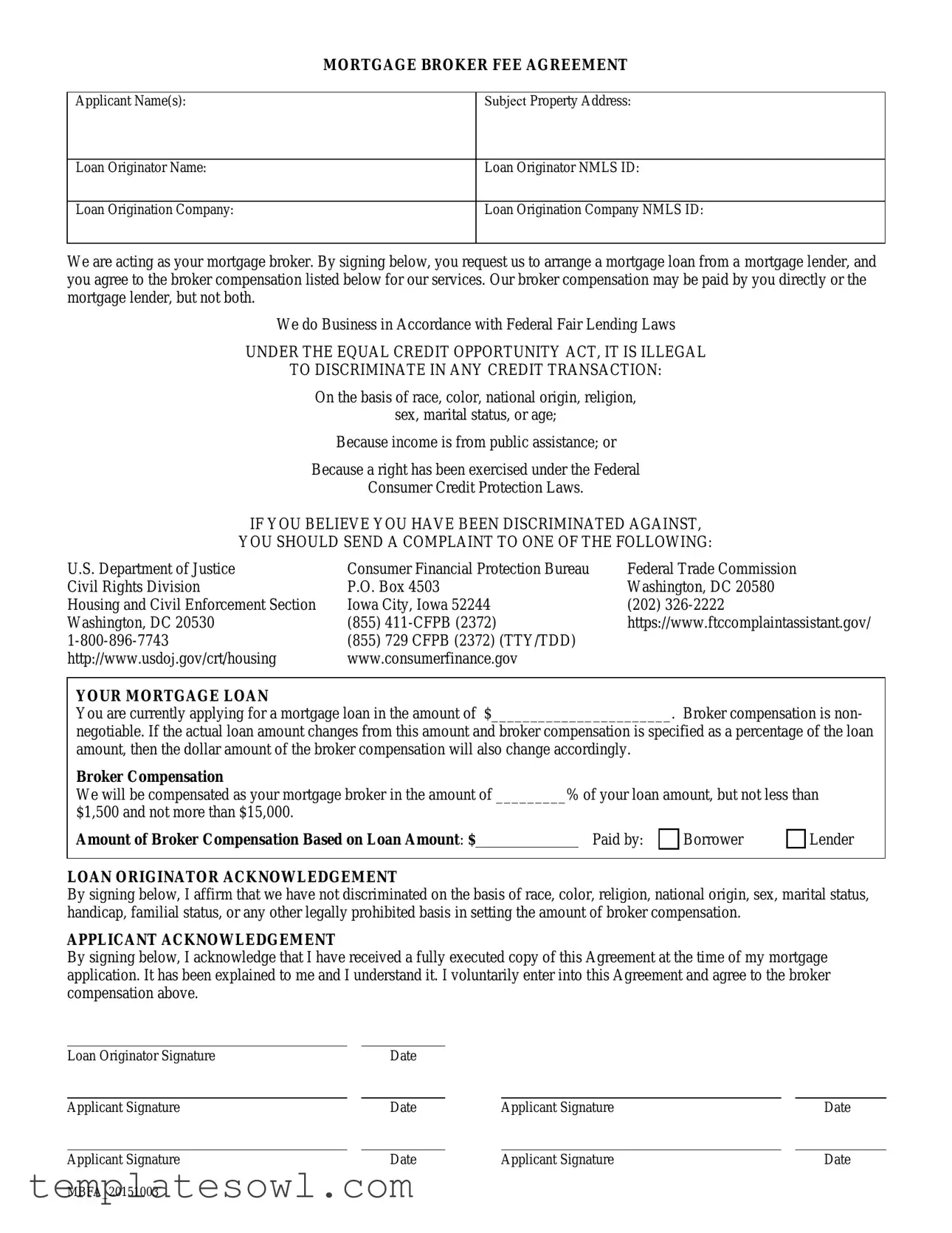

The Broker Fee Agreement form serves as a crucial document in the mortgage loan process, detailing the roles and responsibilities of the mortgage broker and the applicant. It includes essential information such as the names of the applicant(s), the property address, the loan originator's name, and their National Mortgage License System (NMLS) identification numbers. This form establishes the mortgage broker's function in assisting the applicant in arranging a mortgage loan and outlines the broker's compensation for their services. Importantly, compensation can either be paid directly by the applicant or through the lender, ensuring transparency in how fees are handled. The agreement emphasizes compliance with federal fair lending laws, prohibiting discrimination based on race, color, national origin, religion, sex, marital status, or age. In cases of suspected discrimination, the document directs individuals to report complaints to various federal agencies, ensuring that applicants are aware of their rights. The form also specifies the loan amount being applied for and outlines the non-negotiable nature of broker compensation, which can vary based on the loan size. This compensation is capped at $15,000 and cannot be less than $1,500, fostering a clear understanding of the financial obligations involved. Both the loan originator and the applicant must acknowledge their agreement by signing the document, thus solidifying the terms and reinforcing the mutual understanding of the mortgage lending process.

Broker Fee Agreement Example

|

MORTGAGE BROKER FEE AGREEMENT |

|

|

|

|

Applicant Name(s): |

|

Subject Property Address: |

|

|

|

Loan Originator Name: |

|

Loan Originator NMLS ID: |

|

|

|

Loan Origination Company: |

|

Loan Origination Company NMLS ID: |

|

|

|

We are acting as your mortgage broker. By signing below, you request us to arrange a mortgage loan from a mortgage lender, and you agree to the broker compensation listed below for our services. Our broker compensation may be paid by you directly or the mortgage lender, but not both.

We do Business in Accordance with Federal Fair Lending Laws

UNDER THE EQUAL CREDIT OPPORTUNITY ACT, IT IS ILLEGAL

TO DISCRIMINATE IN ANY CREDIT TRANSACTION:

On the basis of race, color, national origin, religion,

sex, marital status, or age;

Because income is from public assistance; or

Because a right has been exercised under the Federal

Consumer Credit Protection Laws.

IF YOU BELIEVE YOU HAVE BEEN DISCRIMINATED AGAINST,

YOU SHOULD SEND A COMPLAINT TO ONE OF THE FOLLOWING:

U.S. Department of Justice |

Consumer Financial Protection Bureau |

Federal Trade Commission |

|

Civil Rights Division |

P.O. Box 4503 |

Washington, DC 20580 |

|

Housing and Civil Enforcement Section |

Iowa City, Iowa 52244 |

(202) |

|

Washington, DC 20530 |

(855) |

https://www.ftccomplaintassistant.gov/ |

|

(855) |

729 CFPB (2372) (TTY/TDD) |

|

|

http://www.usdoj.gov/crt/housing |

www.consumerfinance.gov |

|

|

YOUR MORTGAGE LOAN

You are currently applying for a mortgage loan in the amount of $_______________________. Broker compensation is non-

negotiable. If the actual loan amount changes from this amount and broker compensation is specified as a percentage of the loan amount, then the dollar amount of the broker compensation will also change accordingly.

Broker Compensation

We will be compensated as your mortgage broker in the amount of _________% of your loan amount, but not less than

$1,500 and not more than $15,000.

Amount of Broker Compensation Based on Loan Amount: $ |

|

Paid by: |

Borrower |

Lender |

LOAN ORIGINATOR ACKNOWLEDGEMENT

By signing below, I affirm that we have not discriminated on the basis of race, color, religion, national origin, sex, marital status, handicap, familial status, or any other legally prohibited basis in setting the amount of broker compensation.

APPLICANT ACKNOWLEDGEMENT

By signing below, I acknowledge that I have received a fully executed copy of this Agreement at the time of my mortgage application. It has been explained to me and I understand it. I voluntarily enter into this Agreement and agree to the broker compensation above.

Loan Originator Signature |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

Applicant Signature |

|

Date |

|

Applicant Signature |

|

Date |

|

|

|

|

|

|

|

Applicant Signature |

|

Date |

|

Applicant Signature |

|

Date |

MBFA_20151003

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Broker Fee Agreement outlines the terms of compensation for the mortgage broker's services. |

| Broker Role | The broker serves as an intermediary between the borrower and the lender to facilitate the loan process. |

| Compensation Structure | Broker compensation is typically a percentage of the loan amount, with specified minimum and maximum amounts. |

| Payment Responsibility | Broker fees may be paid directly by the borrower, by the lender, or through a combination of both, but not by both parties. |

| Discrimination Policy | The agreement emphasizes compliance with the Equal Credit Opportunity Act, prohibiting discrimination in lending. |

| Complaint Information | It provides details on how and where to file complaints related to discrimination in credit transactions. |

| Acknowledgment Requirement | Both the loan originator and the applicant must sign the agreement to acknowledge their understanding and acceptance. |

| Loan Amount Disclosure | The borrower must disclose the loan amount for which they are applying, impacting the broker's compensation. |

| State Specificity | Some states may have specific regulations governing broker fee agreements that must be adhered to. |

| Validity of Agreement | The agreement is valid only when signed by all parties involved in the mortgage process. |

Guidelines on Utilizing Broker Fee Agreement

Completing the Broker Fee Agreement form requires careful attention to detail. This document acts as a contractual agreement between you and the mortgage broker, outlining the compensation for services rendered. Follow these steps to ensure you fill out the form correctly.

- Begin by entering the Applicant Name(s). List all individuals applying for the mortgage loan.

- Provide the Subject Property Address. This is the address of the property for which you are seeking the mortgage.

- Fill in the Loan Originator Name. This should be the name of the mortgage broker or individual originating the loan.

- Include the Loan Originator NMLS ID. This is the National Mortgage Licensing System identification number for the loan originator.

- Enter the Loan Origination Company name. This refers to the company that the loan originator works for.

- Provide the Loan Origination Company NMLS ID. Similar to the loan originator, this is the NMLS ID for the company.

- Specify the amount of the mortgage loan you are applying for. Write the dollar amount clearly in the designated space.

- Indicate the percentage for Broker Compensation based on your loan amount. This can be a specific percentage or dollar range as specified.

- Mark whether the Broker Compensation will be Paid by the Borrower or the Lender. Choose one option only.

- Both the Loan Originator and applicants must sign and date at the bottom of the form. Ensure all parties sign appropriately.

What You Should Know About This Form

What is a Broker Fee Agreement?

A Broker Fee Agreement is a document that outlines the relationship between a mortgage broker and a borrower. It indicates that the broker will assist the borrower in obtaining a mortgage loan. By signing this agreement, the borrower acknowledges the broker's service and agrees to the compensation structure for those services.

Why do I need to sign a Broker Fee Agreement?

Signing a Broker Fee Agreement formalizes your relationship with the mortgage broker. It ensures that both parties understand their roles and the associated costs. This clarity can help to prevent misunderstandings as you navigate the mortgage application process.

How is the broker compensation determined?

Broker compensation is typically determined as a percentage of the total loan amount. The agreement specifies this percentage, which cannot be negotiated. The amount received by the broker must also fall within a minimum of $1,500 and a maximum of $15,000, regardless of the total loan amount.

Who pays the broker compensation?

Broker compensation can be paid by either the borrower or the lender, but not both. This means it is essential to understand who will be responsible for these fees before proceeding with the mortgage application. Your broker will clarify this point based on your specific situation.

What if the loan amount changes?

If the loan amount changes after the Broker Fee Agreement is signed and if the broker's compensation is a percentage of that amount, the actual dollar amount of compensation will also change. It is important to stay informed of any adjustments to the loan amount as this could affect the overall fees.

What laws protect me from discrimination in lending?

Federal laws, particularly the Equal Credit Opportunity Act, protect borrowers from discrimination in any credit transaction. Discrimination cannot occur based on various prohibited bases, including race, color, national origin, sex, and marital status. Understanding these protections is crucial for all borrowers.

What should I do if I believe I have experienced discrimination?

If you feel you have been discriminated against during the mortgage process, it is imperative to take action. You can file a complaint with the U.S. Department of Justice, the Consumer Financial Protection Bureau, or the Federal Trade Commission. Each of these organizations provides specific channels to address such grievances.

What does the Applicant Acknowledgement section mean?

The Applicant Acknowledgement section indicates that you have received a copy of the Broker Fee Agreement. By signing this section, you confirm that the terms have been explained to you and that you understand your responsibilities and the broker's compensation. This acknowledgement is important for ensuring transparency in the transaction.

Is broker compensation negotiable?

No, broker compensation is non-negotiable as outlined in the Broker Fee Agreement. Thus, it is crucial to understand these terms upfront, as they will apply regardless of any discussions about the loan amount or other fees.

What happens if I do not sign the Broker Fee Agreement?

If you choose not to sign the Broker Fee Agreement, the mortgage broker will not be authorized to proceed in assisting you with the mortgage application. This step is necessary for them to provide their services legally, so it is essential to review and sign if you wish to move forward.

Common mistakes

When filling out the Broker Fee Agreement form, attention to detail is crucial. One common mistake is neglecting to include the applicant name(s). This step is essential as it identifies who is involved in the agreement and protects both parties involved.

Another frequent error is failing to specify the loan amount. The form requires the desired mortgage loan amount to accurately calculate broker compensation. Without this information, both the borrower and broker may face confusion or disputes down the line.

Many people also overlook the importance of providing the loan originator's NMLS ID. This identification number validates the broker’s credentials and ensures compliance with regulations. Not including it could lead to complications regarding your mortgage processing.

Additionally, some applicants mistakenly ignore the requirement to indicate whether the broker compensation will be paid by the borrower or lender. Clarity here is vital, as it establishes financial responsibilities and expectations from both parties.

Another oversight involves the broker compensation percentage. Applicants often fill in the amount without confirming that it adheres to the specified ranges. The agreement states that broker compensation cannot be less than $1,500 or more than $15,000, so it’s important to ensure your entry falls within this limit.

A common mistake is not obtaining a fully executed copy of the agreement. Applicants should always request and keep a signed copy for their records. This documentation serves as proof of the terms agreed upon during the mortgage process.

Lastly, many individuals fail to understand the significance of the loan originator’s acknowledgement regarding discrimination. By signing the agreement, it is acknowledged that the broker adhered to fair lending laws. Lack of awareness about this provision might undermine the applicant's rights under federal regulations.

Documents used along the form

The Broker Fee Agreement is a critical document in the mortgage lending process, outlining the compensation arrangement between the applicant and the broker. To facilitate a smooth transaction, several other forms and documents are commonly used alongside this agreement. Understanding these documents is essential for both applicants and brokers to ensure clarity and compliance throughout the mortgage journey.

- Loan Application: This form collects essential information from the borrower, including personal details, employment history, and financial status. It serves as the foundation for the mortgage approval process.

- Good Faith Estimate (GFE): This document provides borrowers with a clear estimate of the loan terms, including interest rates, monthly payments, and closing costs. It allows applicants to compare different offers from various lenders.

- Truth in Lending Act (TILA) Disclosure: Required by federal law, this disclosure outlines the terms of the loan, including the Annual Percentage Rate (APR) and other costs associated with borrowing. It ensures borrowers understand the cost of credit.

- Loan Origination Agreement: This agreement specifies the terms under which the loan is originated. It includes details about the loan amount, terms, and conditions, along with any fees associated with originating the loan.

- Credit Report Authorization: By signing this document, applicants give lenders permission to access their credit history. This information is crucial for assessing creditworthiness and determining loan eligibility.

- Title Commitment: This document outlines the title insurance coverage for the property, ensuring there are no liens or disputes over ownership. It is a critical part of the closing process.

- Loan Closing Disclosure: Provided at least three days before closing, this document details all final loan terms and closing costs. Borrowers must review it carefully before signing any documents at closing.

Connecting with these forms and documents is vital in navigating the mortgage process effectively. Asking questions and seeking clarification whenever necessary is always encouraged, as these steps help protect your interests and ensure a successful transaction.

Similar forms

The Broker Fee Agreement form shares similarities with several other financial and legal documents. Below is a list of such documents and how they relate to the Broker Fee Agreement.

- Loan Estimate: This document outlines the estimated costs associated with a mortgage loan. Like the Broker Fee Agreement, it specifies amounts that the borrower will owe and reflects the terms and fees that must be acknowledged by the applicant.

- Good Faith Estimate: This form summarizes the expected costs of obtaining a mortgage. Similar to the Broker Fee Agreement, it requires borrower acknowledgment and includes details about broker compensation and closing costs.

- Closing Disclosure: This document provides a final overview of all costs associated with the mortgage before closing. It is closely related to the Broker Fee Agreement in that it highlights broker compensation as part of the total expense.

- Brokerage Agreement: This document establishes the relationship between a broker and a client. The similarities lie in the agreements made regarding compensation for services rendered, which is also a key component of the Broker Fee Agreement.

- Contract for Sale: This agreement outlines the terms of a property transaction. Like the Broker Fee Agreement, it requires signatures from all parties and is legally binding, detailing payment obligations.

- Service Agreement: This document defines the terms under which services will be provided, including fees. It parallels the Broker Fee Agreement by detailing the compensation agreed upon for specific services, ensuring clarity on expectations.

- Disclosure of Compensation: This involves informing clients how much and in what manner the broker will be compensated. It shares the same objective as the Broker Fee Agreement by ensuring transparency and clarity regarding fees related to the broker's services.

Dos and Don'ts

- Do: Read the entire form carefully before filling it out. Understanding all sections will help prevent mistakes.

- Don't: Ignore the broker compensation details. Make sure you understand how much you will be paying.

- Do: Fill in all required fields, such as your name and the property address, completely and accurately.

- Don't: Use incorrect or outdated information for the Loan Originator's name or NMLS ID.

- Do: Ask questions if anything is unclear, either about the terms or the process itself.

- Don't: Rush through the signing process. Take your time to ensure all information is correct.

- Do: Keep a copy of the signed agreement for your records after signing.

Misconceptions

Understanding the Broker Fee Agreement form is essential for anyone applying for a mortgage loan. Here are ten common misconceptions about this form:

- It's optional to sign the Broker Fee Agreement. Many people believe they can skip this form. However, signing it is necessary to formalize the relationship between the borrower and the mortgage broker.

- The broker fee is negotiable. Some applicants think they can negotiate the broker's compensation after signing. In reality, the terms laid out in the agreement are non-negotiable once signed.

- All broker fees are paid by the lender. It's a common belief that lenders always cover broker fees. In fact, these fees can be paid either by the borrower or the lender, but not both.

- The broker only gets paid when the loan closes. Applicants may assume brokers only receive payment upon closing. However, fees may be structured differently depending on the agreement.

- This agreement covers all loan types. Some people think this Broker Fee Agreement is applicable for every loan type. This isn't always true, as specific agreements might apply to different loan programs.

- Broker fees are not regulated. There is a misconception that brokers can charge any fee. In reality, broker compensation is governed by regulations that ensure fairness and transparency.

- Signing means the borrower has to use that broker. Many assume that signing the agreement locks them into working with that particular broker. Borrowers can choose to work with another broker, but they should be mindful of any fees incurred.

- Broker fees are the same across the board. It’s wrong to think all brokers charge the same fees. Rates and fees can vary based on many factors, including the broker’s experience and services offered.

- Broker Fee Agreements provide no protection for borrowers. Some applicants overlook the protective measures within the agreement. It contains clauses that ensure compliance with fair lending laws to help protect the borrower.

- I can disregard other terms once I have signed. Lastly, many people assume they can ignore the rest of the loan terms after signing the agreement. Each section of the Broker Fee Agreement and associated loan documents is important and should be understood fully before signing.

Being informed about these misconceptions can help borrowers make better decisions when applying for a mortgage loan. Understanding the details of the Broker Fee Agreement is crucial for a smooth loan process.

Key takeaways

When filling out and using the Broker Fee Agreement form, it’s important to keep a few key points in mind. This form outlines the relationship between you and your mortgage broker, detailing compensation and responsibilities.

- Clear Identification: Ensure that all names and identifying details, such as the applicant name(s), subject property address, and loan originator information, are correctly filled out. Accuracy in this section is crucial for a smooth process.

- Understanding Broker Compensation: The form specifies how much you will pay your broker for their services. Remember, this compensation isn’t negotiable and is based on a percentage of your loan amount, with a minimum and maximum limit.

- Payment Source: Understand who will pay the broker fee. It can be you (the borrower) or the lender but not both. Know this information upfront to budget accordingly.

- Equal Credit Opportunity: Be aware that the agreement includes provisions to protect against discrimination in credit transactions. Know your rights in case of any unfair treatment.

- Signatures Matter: Ensure that everyone involved—both applicants and the loan originator—signs the form. Keep a executed copy for your records. This shows that you acknowledge and agree to the terms outlined.

Taking these aspects into account can help ensure a smooth mortgage application process and protect your interests throughout.

Browse Other Templates

Annual Activity Consent Form,Girl Scout Participation Approval,Troop Engagement Permission Slip,Comprehensive Parent Authorization,Yearly Scout Activity Release,All-in-One Girl Scout Consent Form,Troop Activity Agreement,Parent/Guardian Event Permiss - Troop leaders will keep a copy of this form for three years for record-keeping purposes.

Best Western Cancellation Policy - Specify if charges include all costs or just room and tax.