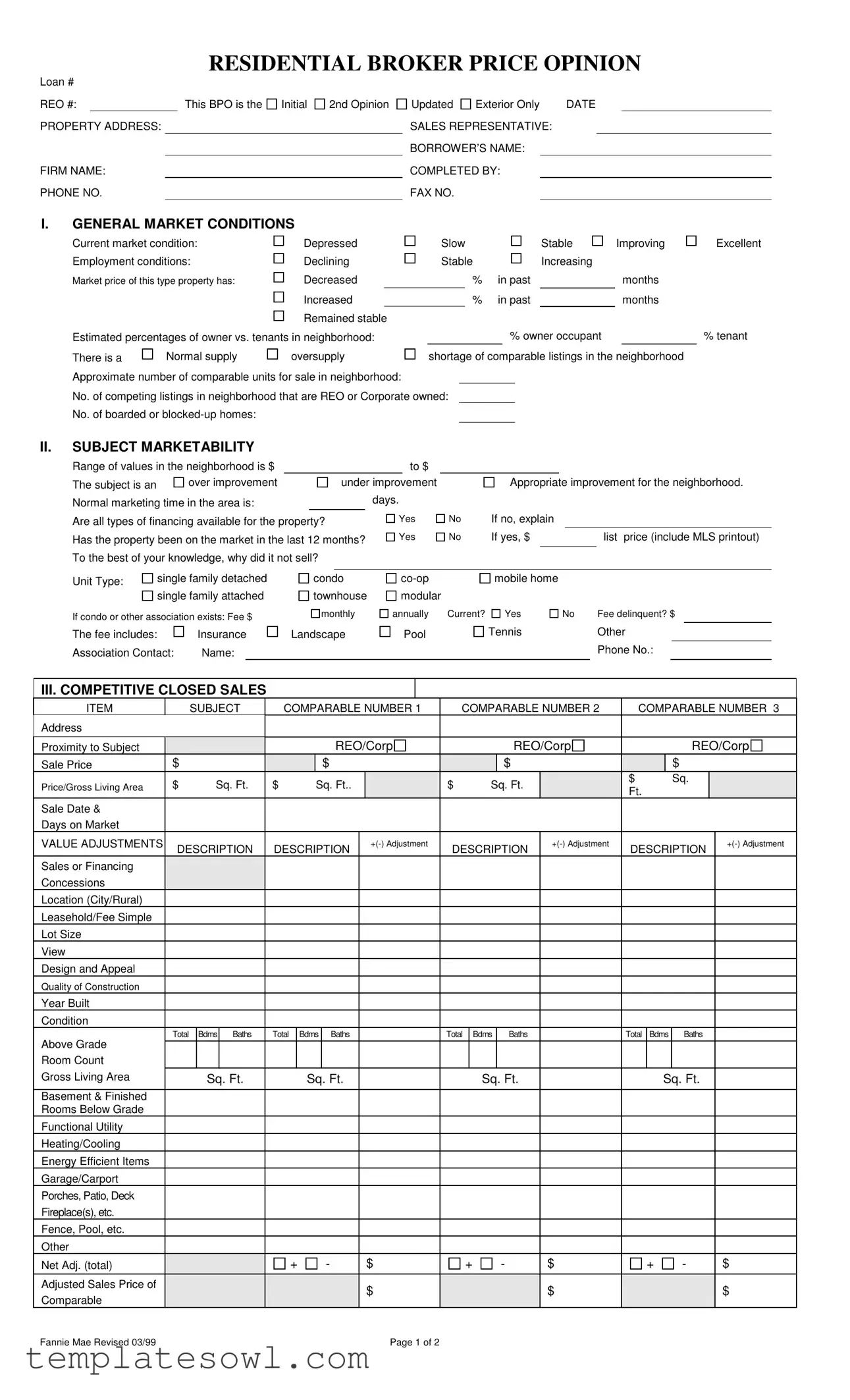

Fill Out Your Broker Price Opinion Form

The Broker Price Opinion (BPO) form serves as an essential tool for real estate professionals engaged in pricing properties. This comprehensive document captures various elements pertinent to assessing a property's value in the current market landscape. It includes fields for the property's address, market conditions, and employment statistics, allowing for thoughtful evaluation of residential and competitive properties. Additionally, the BPO examines the subject property’s marketability by detailing aspects such as its condition, approximation of comparable listings, and occupancy status. The form also provides insights into the competitive landscape through analysis of closed sales and current listings, highlighting relevant adjustments. It encompasses a section dedicated to necessary repairs, which can influence market perception and pricing. At its core, the BPO culminates in establishing a market value along with a suggested list price, ensuring that stakeholders have a clear, actionable understanding of the property’s worth and market potential.

Broker Price Opinion Example

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Broker Price Opinion (BPO) is an estimate of a property's value, often used by lenders for properties in foreclosure or REO situations. |

| Purpose | This form assists lenders in determining the market value of a property without requiring a full appraisal. |

| Components | The BPO form includes sections on market conditions, property details, comparable sales, and necessary repairs. |

| Market Conditions | Evaluating the current market conditions, such as whether it is stable or depressed, is a key part of the BPO process. |

| Repair Considerations | The form requires a list of repairs needed to bring the property to average marketable condition. |

| Comparative Analysis | It involves comparing the subject property with similar properties recently sold in the area to establish an accurate value. |

| Governing Laws | BPO practices can vary by state; consult local regulations to understand specific requirements, such as those in California's Business and Professions Code. |

| Marketing Strategy | The BPO form helps determine the best marketing strategy for the property, whether "as-is" or after repairs. |

| Limitations | While BPOs provide valuable insights, they are not as comprehensive as appraisals and are meant for quick assessments. |

| Completed By | The form must be filled out by a licensed real estate broker or agent with experience in the local market. |

Guidelines on Utilizing Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form is an important task that requires attention to detail. After completing this form, you'll provide an evaluation that can help in making informed decisions regarding property value. The steps outlined below will guide you through the process, ensuring that all necessary information is accurately recorded.

- Begin with the header: Enter the Loan #, REO #, property address, firm name, your phone number, and the date.

- Sales Representative Information: Fill in the sales representative's name, the borrower's name, and your own name. Include your fax number.

- General Market Conditions: Assess the current market condition and fill in the employment conditions. Indicate the market price change over the past months and the estimated percentage of owner-occupants versus tenants in the neighborhood.

- List any oversupply or shortage: Indicate the approximate number of comparable units for sale and any boarded-up homes.

- Subject Marketability: Enter the range of values for the neighborhood, describe the property's improvement status, and estimate normal marketing time.

- Financing Availability: State whether financing types are available and address any exceptions. Note if the property has been on the market in the last 12 months, listing the price if applicable.

- Unit Type: Select the type of property and any condominiums or associations that exist. Include fees and contact information.

- Competitive Closed Sales: For up to three comparable properties, provide details such as address, sale price, sale date, and necessary adjustments.

- Marketing Strategy: Indicate whether to market the property as-is or if minimal or lender-required repairs are needed.

- Repairs Section: Specify occupancy status and detail the repairs needed, including their total cost.

- Competitive Listings: List comparable properties, their prices, and relevant adjustments.

- Market Value: Suggest a market value and list price for both as-is and repaired conditions.

- Comments Section: Document any specific positives or negatives about the property, along with any concerns or issues. Sign and date the form.

Once filled out, review the entire BPO form for any errors or omissions. Having accurate information is crucial to ensure that the final opinion is reliable and useful.

What You Should Know About This Form

What is a Broker Price Opinion (BPO) form?

The Broker Price Opinion form is a document used by real estate professionals to provide an estimate of a property's market value. It includes detailed information about the property, the surrounding market conditions, and comparable sales. This form is commonly utilized by lenders, investors, and real estate agents to assess the value of properties, especially in situations such as foreclosure or short sales.

What information is included in a BPO form?

A BPO form typically contains various sections including general market conditions, subject marketability, competitive closed sales, and marketing strategy. Each section gathers information about the property, such as its condition, location, and recent sale prices of comparable properties. Additionally, it may provide insights on repairs needed, potential marketing strategies, and the estimated market value based on recent data.

How is a Broker Price Opinion different from an appraisal?

A Broker Price Opinion is generally less formal than a home appraisal. While both provide an estimated market value, a BPO is often completed by a real estate agent or broker who uses their local market expertise. An appraisal, on the other hand, is conducted by a licensed appraiser and follows strict regulations. BPOs are typically quicker and less expensive, making them suitable for preliminary assessments.

When might a Broker Price Opinion be needed?

Common mistakes

When filling out a Broker Price Opinion (BPO) form, many individuals make mistakes that can affect the accuracy and effectiveness of the report. Understanding these common errors is vital for anyone involved in real estate transactions. Here are nine mistakes to watch out for.

1. Ignoring Market Conditions – Failing to accurately assess the current market conditions can lead to incorrect pricing recommendations. It's essential to note whether the market is depressed, stable, or improving. If you overlook these factors, your evaluation may not reflect the property's true potential.

2. Overlooking Comparable Listings – When identifying comparable properties, it's crucial to select those that are truly similar to the subject property. Avoid using properties that differ significantly in size, location, or condition. Inaccurate comparables can skew the property's perceived market value.

3. Neglecting to Document Repairs Needed – Not itemizing necessary repairs can be a significant oversight. A detailed list of repairs needed can provide crucial context for both prospective buyers and lenders. This ensures that everyone involved understands the additional investments required to make the property marketable.

4. Failing to Include Accurate Financial Details – Purchasing decisions often hinge on financial data. If you incorrectly enter financing availability or the list price from previous listings, this can mislead all parties. Double-check these figures to ensure they are up to date and accurate.

5. Not Considering the Occupancy Status – The occupancy status of the property can dramatically affect its marketability. Be sure to consider whether the property is occupied, vacant, or unknown, and indicate this clearly in the form. Ignoring this element can impact the buyer's decision-making process.

6. Underestimating the Importance of Comments – Leaving the comments section blank or vague can rob the report of valuable context. Use this area to highlight specific positives, negatives, or special concerns related to the property. Comments provide insights that aren't captured in numerical data alone.

7. Misrepresenting Property Condition – Assessing the property's condition inaccurately can level substantial consequences. Whether you categorize it as "excellent," "fair," or "poor," your assessment must align with reality. Inconsistent evaluations can lead to market miscalculations.

8. Missing Data Verification Sources – Providing clear sources for your data strengthens the credibility of the BPO. Not including these sources can lead skeptics to question the validity of your conclusions. Ensure that you cite where the information was obtained to support your findings.

9. Overlooking Adjustment Calculations – Adjustments for comparable sales prices must be carefully calculated and documented. If you fail to make or miscalculate these adjustments, the final adjusted sales price may be inaccurate, misleading buyers and sellers. Always review your math before submission.

Avoiding these mistakes can enhance the quality and reliability of your Broker Price Opinion. By paying attention to details, you'll help ensure that the property is represented accurately in the market.

Documents used along the form

When preparing a Broker Price Opinion (BPO), several additional documents can support the process and provide a comprehensive view of the property’s value. Each of these forms plays a crucial role, guiding real estate professionals and clients through the evaluation and pricing of properties. Below is a list of commonly used forms that often accompany a BPO.

- Comparative Market Analysis (CMA): This document compares the subject property to similar properties that have recently sold in the area. It provides insight into current market trends and serves as a basis for determining an appropriate listing price.

- Listing Agreement: This legal document outlines the terms between a property owner and a real estate broker. It includes details about the broker’s commission, marketing strategy, and the duration of the listing.

- Sales Contract: This is a legally binding agreement between a buyer and seller detailing the terms and conditions for the sale of a property. It ensures that both parties understand their obligations.

- Property Condition Report: Often used by inspectors, this report details the physical condition of a property. It highlights any repairs needed and can significantly influence a buyer's decision-making process.

- Inspection Report: Similar to the Property Condition Report, this document focuses on any specific issues found during a property inspection. It examines aspects like structural integrity, plumbing, electrical systems, and other key factors.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an expert opinion on the property’s value based on various factors, including location, condition, and comparable properties.

- Title Report: This document reviews the legal ownership of the property. It confirms whether there are any liens, disputes, or encumbrances that could affect the sale.

- Disclosure Statements: These announcements inform potential buyers of any known defects or issues related to the property. They ensure transparency and protect all parties involved in the transaction.

Each of these documents serves an important purpose and can greatly assist in the thorough evaluation of a property’s worth and marketability. By combining a Broker Price Opinion with these additional forms, real estate professionals can provide a more complete picture for buyers and sellers, ultimately supporting informed decisions.

Similar forms

- Comparative Market Analysis (CMA): A CMA evaluates recent sales of similar properties to estimate a home's value. Like the Broker Price Opinion (BPO), it analyzes market conditions and property features to determine pricing strategies.

- Appraisal: An appraisal provides a formal assessment of a property's worth conducted by a licensed appraiser. Both appraisals and BPOs aim to ascertain value, although appraisals often carry more weight and are used for official financing purposes.

- Real Estate Listing Agreement: This agreement outlines the terms under which a property will be marketed for sale. Similar to a BPO, it also considers market conditions and the property’s characteristics, assisting agents in pricing the home correctly.

- Investment Analysis: This document helps investors assess potential returns on a property. It shares similarities with the BPO in evaluating market trends and property status to aid decision-making.

- Foreclosure Valuation: Used primarily in foreclosure situations, this document estimates the value of a distressed property. Both it and the BPO assess property conditions and market factors, but foreclosure valuations focus more on risk and recovery for lenders.

- Market Analysis Report: This report examines various local market indicators, influencing property prices. Like a BPO, it draws from current market trends and comparable sales to inform pricing and marketing strategies.

- Property Inspection Report: This report details the condition of a property, including necessary repairs. While the BPO considers repairs needed for marketability, the inspection report offers a deeper dive into the property's physical state.

- Market Memorandum: Often used by lenders and investors to summarize market conditions and property insights, this memo functions similarly to a BPO by providing an overview of the property’s potential value and market position.

Dos and Don'ts

When filling out the Broker Price Opinion form, consider the following dos and don’ts to ensure accuracy and effectiveness:

- Do provide accurate and up-to-date information regarding market conditions.

- Do specify the financing options available for the property.

- Do clarify why a property did not sell in the past if applicable.

- Do include detailed information on comparable properties in the market.

- Don’t leave sections blank; ensure all relevant fields are filled out.

- Don’t exaggerate the value or condition of the property.

- Don’t overlook important repairs that may impact marketability.

- Don’t forget to mention any special concerns or unique characteristics of the property.

By following these guidelines, you can help ensure that the Broker Price Opinion reflects the true value of the property.

Misconceptions

When it comes to understanding the Broker Price Opinion (BPO) form, several misconceptions can cloud the process. Here is a list of six common misunderstandings:

- 1. A BPO is the same as an appraisal. Many people believe that a BPO and an appraisal serve identical purposes. In reality, a BPO is generally less comprehensive and is often completed more quickly. While both give an estimated value of a property, an appraisal typically involves a more thorough inspection and analysis.

- 2. BPOs are only useful for banks and lenders. This is a misconception. Although lenders frequently use BPOs for decision-making, real estate agents and homeowners can also benefit from this tool. It can provide valuable insights into market conditions and property values, aiding sellers in pricing their homes appropriately.

- 3. A BPO reflects a property's exact market value. Many assume that the figure provided on a BPO is the definitive market value of a property. However, the BPO offers an estimate based on comparative analysis and market trends. The actual sale price can vary based on numerous factors, such as buyer demand and property condition.

- 4. A BPO includes a physical inspection of the property. Some individuals think that BPOs always require an on-site visit. However, there are instances—specifically, exterior-only BPOs—where the agent only assesses the property's exterior. This can limit the accuracy of the valuation.

- 5. A BPO can be completed by anyone. While it seems plausible that anyone could fill out a BPO form, it actually requires specific expertise. A qualified real estate agent or broker familiar with local market trends is crucial to ensure that the evaluation is reliable and accurate.

- 6. BPOs are unnecessary in a hot real estate market. Just because the market may be experiencing rapid growth does not diminish the value of a BPO. Even in competitive environments, understanding a property's potential value can help sellers set reasonable expectations and avoid overpricing or underpricing.

By addressing these misconceptions, individuals can navigate the complexities of real estate transactions more effectively.

Key takeaways

Filing out the Broker Price Opinion (BPO) form can seem overwhelming, but it’s an essential tool for evaluating residential properties. Here are some key takeaways to guide you through the process:

- Understand the Purpose: The BPO form helps determine the market value of a property by comparing it with similar properties in the area, also known as comparables.

- Gather Accurate Data: When filling out the form, it's crucial to provide precise information about the property, such as its address, condition, and any recent sales or market activity.

- Market Conditions Matter: Evaluate the current market conditions, such as whether the local market is stable, improving, or depressed. Employment conditions also play a significant role in property values.

- Comparable Sales: Make sure to identify at least three comparable properties. Analyzing their sale prices and conditions can provide a well-rounded perspective on your property’s value.

- Document Necessary Repairs: Clearly itemize any repairs the property requires. This helps provide a realistic view of the property’s condition and potential costs for prospective buyers.

- Sales and Financing Concessions: Be aware of any concessions made during sales in the area. These can impact perceived value and marketability.

- Determine Suggested Price Ranges: Calculate a suggested list price based on the gathered data. This price should fall within the range indicated by the comparable closed sales.

- Provide Detailed Comments: Use the comments section to elaborate on specific positives or negatives regarding the property. This could include issues like encroachments, easements, or environmental concerns.

By keeping these key points in mind, navigating the Broker Price Opinion form becomes more manageable and provides valuable insights into the property in question.

Browse Other Templates

Policy Loans Life Insurance - If you change your address close to your loan request, additional steps may be required.

The Three Stages of Driver Licensing in New York State Are - The optional update card serves as a convenient document while waiting for a new physical license.