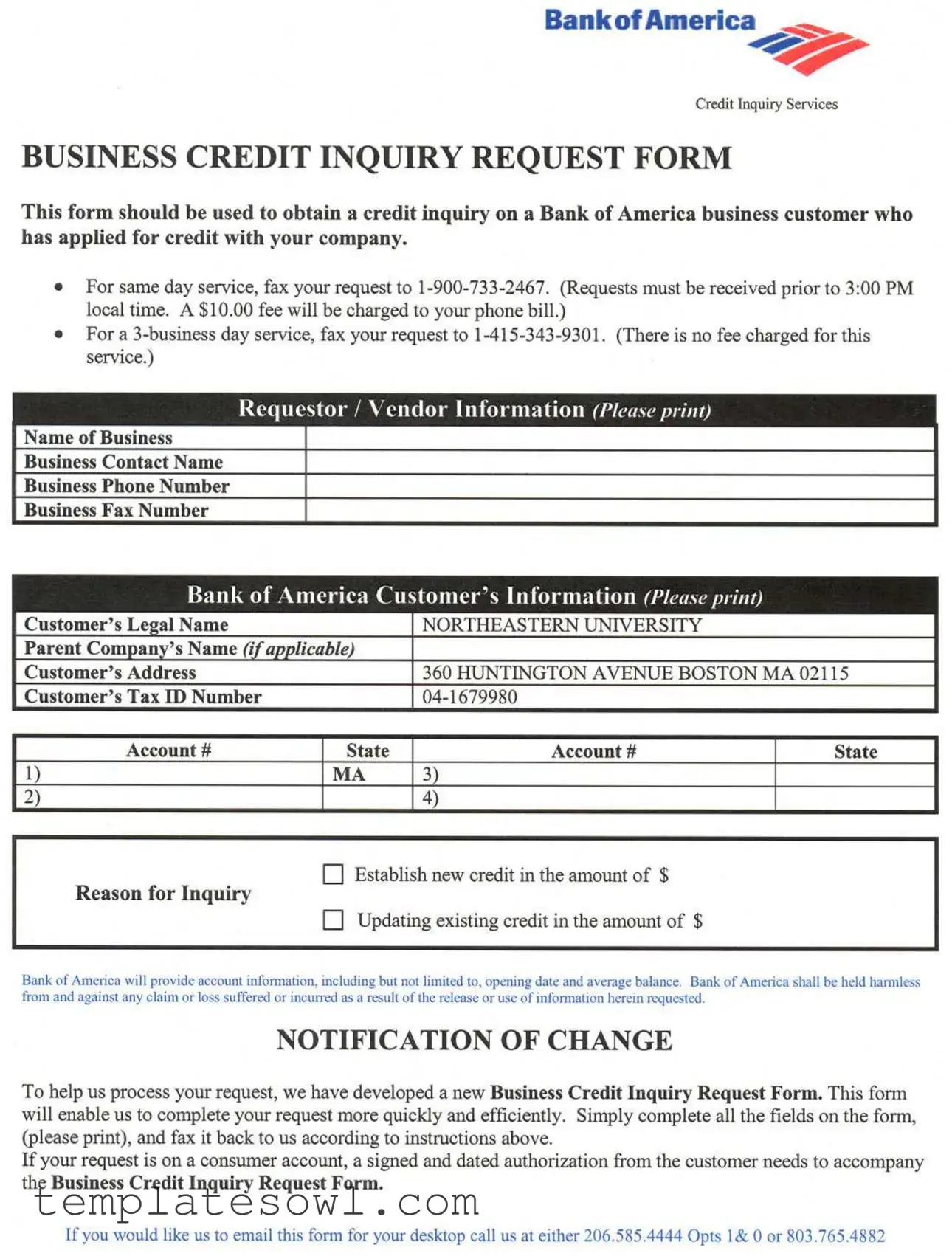

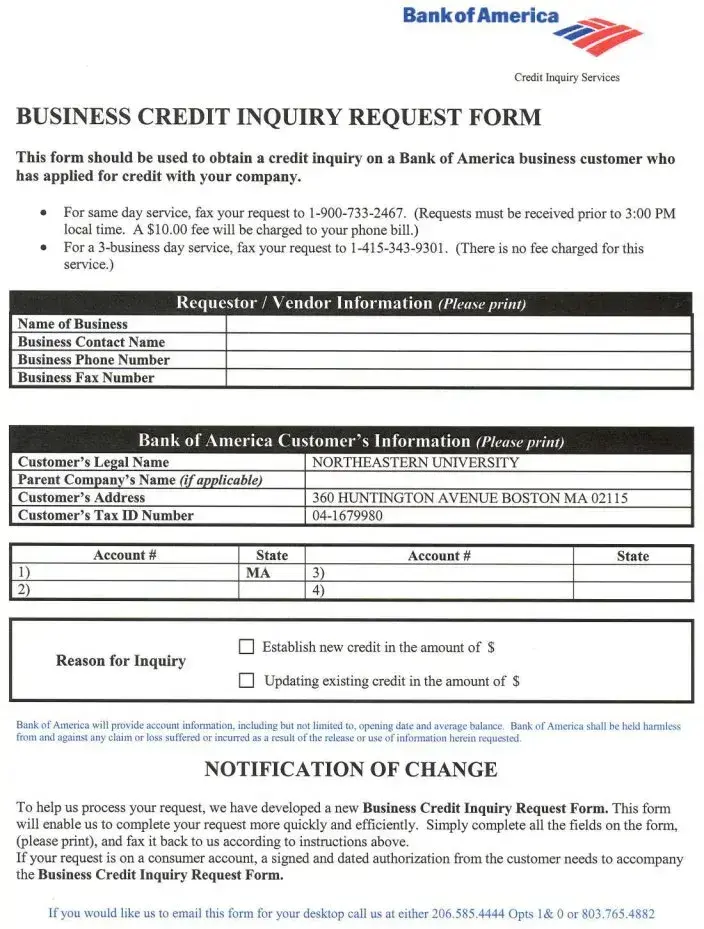

Fill Out Your Business Credit Inquiry Request Form

The Business Credit Inquiry Request Form is a vital tool for obtaining essential credit information about Bank of America’s business customers. This form is specifically designed for companies that have received credit applications from potential clients. To ensure a timely response, requests can be faxed for same-day processing to a designated number, but they must arrive before 3:00 PM local time. A fee will be applied for this expedited service. Alternatively, a standard three-business day processing option is available at no cost. It is crucial for requestors to provide thorough and accurate details, including both their business information and that of the Bank of America customer, in order to facilitate an efficient inquiry. Each inquiry can be motivated by various purposes, such as establishing new credit or updating existing credit information. Bank of America commits to providing relevant account details, including the account's opening date and average balance, while also ensuring that they are protected from any claims or losses arising from the release of the requested information. Additionally, to enhance processing speed, a new form has been introduced, which should be completed in full and submitted according to the specified instructions. For those needing the form sent directly to their desktop, a contact number is provided for convenience.

Business Credit Inquiry Request Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is used to request a credit inquiry on a Bank of America business customer applying for credit with a vendor. |

| Same Day Service | For same day service, requests must be faxed to 1-900-733-2467 before 3:00 PM local time. A fee of $10.00 will be added to your phone bill. |

| Three Business Day Service | Requests can also be faxed to 1-415-343-9301 for a three-business day service. This option does not incur any fees. |

| Consumer Account Authorization | If the inquiry relates to a consumer account, a signed and dated authorization from the customer is required along with the form. |

Guidelines on Utilizing Business Credit Inquiry Request

After completing the Business Credit Inquiry Request form, you'll need to send it to Bank of America for processing. Depending on your urgency, you can choose same-day service or a more standard, 3-business day service. Make sure to follow the guidelines provided to ensure your request is handled efficiently.

- Complete the Requestor/Vendor Information section: Fill in the name of your business, your contact name, phone number, and fax number. Please print clearly.

- Provide Bank of America Customer’s Information: Enter the customer’s legal name, parent company name if applicable, customer’s address, and tax ID number. Ensure all information is accurate.

- Indicate the Account Information: Fill in the account number(s) and state. If necessary, include multiple accounts in separate entries.

- Select the Reason for Inquiry: Check the appropriate box for either establishing new credit or updating existing credit, and specify the amount involved.

- Review the form: Double-check all entries for completeness and accuracy to prevent any processing delays.

- Fax the completed form: Depending on your need for speed, fax it to either 1-900-733-2467 for same-day service or 1-415-343-9301 for 3-business day service.

- Include authorization if needed: If the inquiry is on a consumer account, ensure you attach a signed and dated authorization from the customer.

Once you have sent your request, wait for Bank of America to process it and provide the necessary information. Make sure to keep a copy of the submitted form and any related documents for your records.

What You Should Know About This Form

What is the purpose of the Business Credit Inquiry Request form?

This form is specifically designed for businesses seeking to obtain credit information on a Bank of America business customer. Whether you want to establish new credit or update existing credit, this request will help you get relevant account details, such as opening dates and average balances.

How do I submit the form for same-day service?

If you need your request processed the same day, make sure to fax your completed form to 1-900-733-2467. Keep in mind that your fax must arrive before 3:00 PM local time. Please note that a $10.00 fee will appear on your phone bill for this service.

What is the process for a standard inquiry?

For a standard service option that takes three business days, send your form to 1-415-343-9301 via fax. This service does not incur any fees, making it a suitable choice for those who can wait a little longer for the results.

What information do I need to provide on the form?

To complete the Business Credit Inquiry Request form, you must fill in several fields, including your business name, contact details, and the Bank of America customer's legal name and address. Additionally, include the customer’s Tax ID number and account details. Ensure that all sections are clearly filled out to avoid delays.

Do I need authorization from the customer?

If your request pertains to a consumer account, you must include a signed and dated authorization from the customer. This step is crucial to ensure compliance and protect the privacy of the customer information being requested.

How can I get a copy of the Business Credit Inquiry Request form?

If you would like to receive the form electronically for easy access and completion on your desktop, you can simply call Bank of America at either 206.585.4444 (Options 1 & 0) or 803.765.4882 to request it.

Common mistakes

Filling out the Business Credit Inquiry Request form requires attention to detail. One common mistake is failing to print information clearly. Illegible handwriting can result in miscommunication and delays in processing the request.

Another frequent error occurs when individuals neglect to provide complete information in the requestor or vendor information section. Missing details such as the business phone number or contact name may impede the inquiry process.

Inadequate information regarding the Bank of America customer can also lead to complications. Omitting crucial data like the customer's legal name or tax ID number can delay the request, as Bank of America needs this information to verify the identity of the business.

Submitting the form without properly identifying the reason for the inquiry is another oversight. The requestor must select from the given options, whether to establish new credit or update existing credit. Missing this step could lead to confusion and improper processing of the request.

Choosing the incorrect fax number for the requested service time frame is a mistake that can easily be avoided. For instance, submitting a request meant for same-day service to the three-business-day fax number can result in a longer wait for the necessary information.

Another issue arises when individuals forget to include the customer’s account number. This number is essential for processing the inquiry accurately; without it, there may be delays or difficulties in retrieving the requested information.

Failure to provide any required accompanying documents, such as a signed authorization for consumer accounts, is also a mistake. This oversight can invalidate the request, requiring resubmission and additional review time from Bank of America.

Individuals may sometimes rush and submit the form without reviewing it thoroughly. This can lead to multiple errors, highlighting the importance of a careful review before sending the completed form.

Finally, neglecting to keep a copy of the submitted form can create problems for the requestor. In case of any follow-up or discrepancies with Bank of America, having a record of what was submitted is essential for effective communication.

Documents used along the form

When applying for business credit, you may encounter several forms and documents alongside the Business Credit Inquiry Request form. Each of these documents plays a crucial role in the credit assessment process, helping businesses and financial institutions make informed decisions. Below is a list of commonly used forms and documents that support the credit inquiry process.

- Credit Application: This document provides a detailed history and context of the business applying for credit. It typically includes financial statements, descriptions of business operations, and ownership details.

- Personal Guarantee: A signed document where an individual agrees to take personal responsibility for the debt if the business defaults. This helps lenders assess risk by ensuring there’s a secondary recourse for repayment.

- Financial Statements: Most lenders require recent financial statements, such as balance sheets and income statements, to understand the business's financial health and ability to repay borrowed funds.

- Tax Returns: Recent business tax returns provide insight into revenue, expenses, and profit, offering a clearer picture of the company’s financial performance over the previous years.

- Business Plan: A comprehensive document outlining the business’s goals, strategies, and projected financial performance. This is often requested for larger financing needs.

- Trade References: Contact details for vendors or suppliers that extend credit to the business. These references help lenders gauge the business's creditworthiness based on its payment history with other companies.

- Authorization Agreement: A signed document that gives permission to a third party to obtain credit information on the business from credit reporting agencies, ensuring compliance with regulations.

- Insurance Certificates: Proof of insurance coverage can be requested by lenders, as this indicates the business's commitment to risk management and financial stability.

Collectively, these documents streamline the credit assessment process, allowing lenders to make more informed decisions. Understanding the purpose of each document can help facilitate a smoother application and inquiry experience for businesses seeking credit.

Similar forms

- Credit Application Form: This document is utilized by businesses to apply for credit services. It collects essential information about the applicant's business identity, financial background, and the amounts requested, similar to how the Business Credit Inquiry Request form seeks relevant business details for a credit assessment.

- Authorization to Release Information Form: This form allows a business to grant permission for a financial institution to disclose specific information regarding their credit history. It parallels the inquiry request form as both require the applicant's consent to share sensitive financial information.

- Business Loan Application: A business loan application is submitted by companies seeking funding. It encompasses information about the business, its financial health, and the purpose of the loan, much like the credit inquiry form that gathers similar financial data to evaluate creditworthiness.

- Personal Guaranty Form: This document is signed by individuals who agree to be responsible for a business loan or credit if the business cannot repay. It shares a connection with the Business Credit Inquiry Request form regarding obligations tied to financial assessments and responsibilities.

- Credit Report Request Form: This form is used to obtain a credit report for a business, providing comprehensive details about its credit history and status. Similar to the Business Credit Inquiry Request, this form is focused on gathering necessary information to evaluate the business's financial credibility.

Dos and Don'ts

When filling out the Business Credit Inquiry Request form, follow these guidelines to ensure your request is processed efficiently.

- Do ensure all fields on the form are completed accurately.

- Do fax your request to the correct number based on your service preference.

- Do submit the request before the 3:00 PM deadline for same-day service.

- Do include a signed and dated authorization if the inquiry is for a consumer account.

- Don't leave any fields blank; incomplete forms may cause delays.

- Don't forget to print the information legibly to avoid miscommunication.

- Don't send your request to an outdated fax number.

- Don't assume all inquiries require payment; check the instructions first.

Misconceptions

Understanding the Business Credit Inquiry Request form can be challenging due to various misconceptions. Below are six common misunderstandings about this form and clarifications to help clear things up.

- Only large businesses can use the form. Many believe that only large corporations or established companies can request a credit inquiry. In reality, any business, regardless of size, can use this form to assess credit worthiness.

- You need to pay for every inquiry. While there is a $10 fee for same-day requests, businesses can utilize the three-business-day service option at no charge. This often leads to confusion regarding the costs associated with the service.

- All requests are processed on the same day. It's a misconception that every request submitted will be processed immediately. The timing for processing depends on the method chosen, with same-day service available only if the request is made before 3:00 PM local time.

- You cannot update existing credit inquiries. Some users think that the form is solely for establishing new credit. However, it can also be used for updating or modifying existing credit accounts, which should not be overlooked.

- Authorization from the customer is not needed. It's incorrect to assume that requests related to consumer accounts do not require any authorization. A signed and dated authorization from the customer is essential to accompany the request for consumer accounts.

- The form is complicated to fill out. While the form may seem daunting, it contains clear fields that require basic information. By following the instructions carefully and ensuring all fields are filled in accurately, completion can be straightforward.

Being aware of these misconceptions can help streamline the process for businesses looking to utilize the Business Credit Inquiry Request form effectively.

Key takeaways

Filling out the Business Credit Inquiry Request form accurately is essential for a smooth application process. Here are key takeaways to consider:

- Same-Day Requests Require Timeliness: To receive immediate service, submit your request by fax before 3:00 PM local time. Be aware of the associated $10.00 fee.

- Three-Business Day Service Option: If the inquiry isn't urgent, utilize the three-business day service. This option is free, with no additional charges.

- Complete All Fields: Ensure that every field on the form is filled out accurately. Incomplete or illegible forms can lead to delays.

- Authorization for Consumer Accounts: If the inquiry pertains to a consumer account, it's necessary to include a signed and dated authorization from the customer.

- Contact Information is Crucial: Provide precise contact details, including business contact name, phone number, and fax number. This ensures efficient communication.

- Be Prepared for Information Release: Once submitted, Bank of America will provide account details. However, you must acknowledge that they are not liable for any claims or losses resulting from the information provided.

Using this form effectively can streamline your credit inquiry process. Pay careful attention to the details and follow the instructions closely to avoid any potential pitfalls.

Browse Other Templates

Virginia Medicaid Provider Enrollment - By submitting this application, organizations are expressing their dedication to fostering a positive impact on the community.

How Much Is Unemployment Taxed - An email address for open records requests is provided for individuals.