Fill Out Your Business Debt Schedule Form

The Business Debt Schedule form provides critical financial information for businesses seeking to clearly outline their debt obligations. This structured document includes details such as loans, notes payable, and lines of credit, while intentionally excluding accounts payable and accrued liabilities. Essential components of the form feature sections for the company's name and date, as well as for each creditor's name and address. Additionally, it requires the original loan date, amount, terms or maturity date, present balance, interest rate, monthly payment, collateral or security, and the purpose of the loan. A total present balance must be calculated, ensuring it aligns with the figures reported on the interim balance sheet. This measurement promotes accuracy and consistency in financial reporting. With these elements combined, the Business Debt Schedule offers a comprehensive snapshot of a company's current financial obligations, enabling better decision-making for lenders, investors, and management alike.

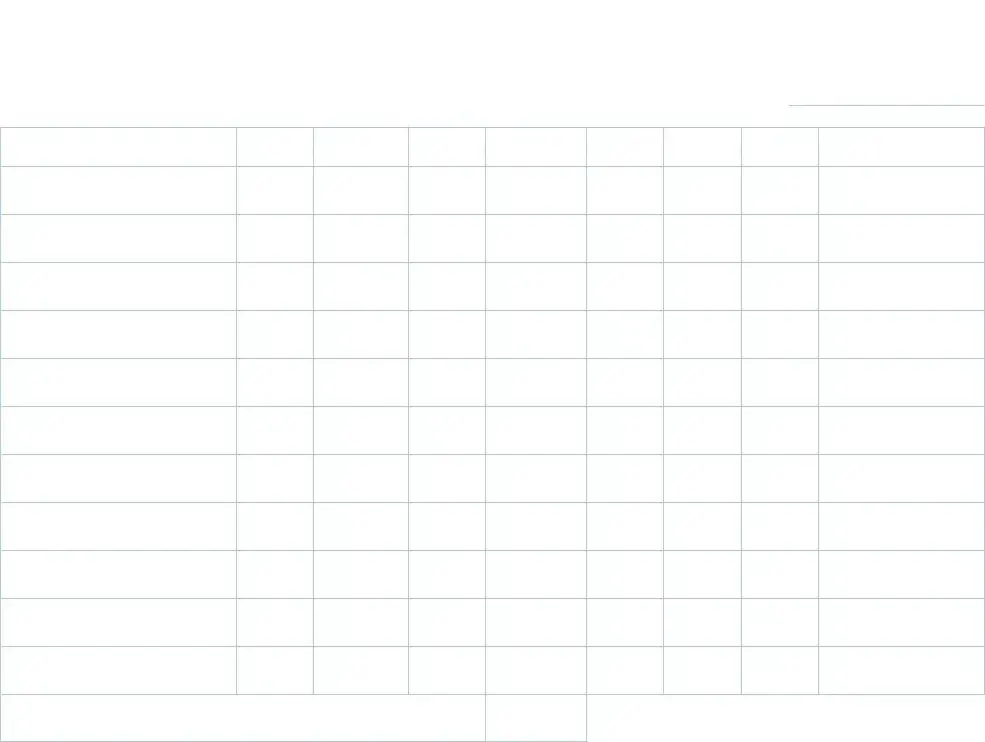

Business Debt Schedule Example

Business Debt Schedule

The schedule should include loans for contracts/notes payable and lines of credit, not accounts payable or accrued liabilities.

Company Name |

|

Date |

CREDITOR |

Name/Address |

Original

Date

Original Amount

Term or Maturity Date

Present Balance

Interest

Rate

Monthly Payment

Collateral

or

Security

WHAT WAS LOAN FOR?

|

|

TOTAL PRESENT BALANCE: |

|

|

(Total must agree with balance |

Signature |

Date |

shown on Interim Balance Sheet.) |

20

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Business Debt Schedule form is designed to list loans and other types of debt specifically for businesses. |

| Debt Types | This schedule includes loans for contracts/notes payable and lines of credit, explicitly excluding accounts payable or accrued liabilities. |

| Required Information | Information needed includes the company name, date, creditor details, original loan information, present balance, and monthly payment. |

| Collateral | Debts must also provide details about collateral or security tied to the loan. |

| Loan Purpose | It is important to indicate what each loan was used for as part of the schedule. |

| Total Balance | The total present balance listed must match the balance shown on the Interim Balance Sheet. |

| Interest Rate | Interest rates for each loan should be clearly stated in the form. |

| Governing Laws | Specific state forms may be governed by state business or contract law relevant to business debts. |

| Signature Requirement | A signature is needed on the form, along with the date, verifying the accuracy of the information provided. |

Guidelines on Utilizing Business Debt Schedule

Completing the Business Debt Schedule form is an important step in managing your company's finances. After gathering all necessary information, you will be ready to provide a clear overview of your business debts. This information will facilitate financial planning and assist in building transparency in financial reporting.

- Gather Necessary Information: Collect details about all business loans, including lines of credit and contracts. Exclude accounts payable and accrued liabilities.

- Fill in the Company Name: Write the official name of your business at the top of the form.

- Record the Date: Write today’s date next to the company name.

- Complete Creditor Information: For each creditor, provide the name and address.

- List Original Date: Enter the date when each loan was originated.

- Enter Original Amount: Fill in the initial amount borrowed for each loan.

- Specify Term or Maturity Date: Indicate when the loan is due to be fully paid.

- Present Balance: Input the current balance owed for each loan.

- Interest Rate: Fill in the applicable interest rate for each debt.

- Monthly Payment: Provide the amount you are obligated to pay each month towards the debt.

- Collateral or Security: If applicable, specify what the loan is secured against.

- Describe Loan Purpose: Briefly explain what each loan was used for.

- Total Present Balance: Calculate and record the total present balance for all debts. Ensure this total aligns with the balance shown on the Interim Balance Sheet.

- Signature and Date: Sign the form and date it at the bottom.

What You Should Know About This Form

What is a Business Debt Schedule form?

The Business Debt Schedule form is an essential document used to list out all the outstanding debts of a business, including loans, lines of credit, and contracts. It helps in summarizing a company's financial obligations and provides a clear picture of what is owed to various creditors.

What information is required on the form?

The form requires details such as the company name, date of the report, creditor's name and address, original loan amount, term or maturity date, present balance, interest rate, monthly payment, collateral or security, and the purpose of the loan.

Why is it important to specify what the loan was for?

Specifying the purpose of the loan provides transparency and context for the debt incurred. It helps stakeholders understand the business's financial decisions and how the borrowed funds contribute to its operations or growth.

What debts should not be included in the Business Debt Schedule?

Accounts payable and accrued liabilities should not be included in this schedule. The focus is strictly on loans, contracts, notes payable, and lines of credit to ensure accurate representation of long-term financial obligations.

How do I calculate the total present balance?

The total present balance is calculated by adding up all outstanding balances from individual loans and credit lines listed in the schedule. Make sure this total matches the balance shown on the Interim Balance Sheet.

Is there a specific format for the Business Debt Schedule?

While there may not be a mandated format, it’s crucial to present the information clearly. Each debt entry should follow a structured layout that includes all required fields, making it easy to read and understand for anyone reviewing the document.

Do I need to sign the Business Debt Schedule?

A signature is typically required to validate the information provided. Signing confirms that the details are accurate and that you take responsibility for the entries made in the schedule.

How often should I update the Business Debt Schedule?

It is recommended to update the Business Debt Schedule regularly, ideally every quarter or whenever there are significant changes in your debts. Keeping the information current is vital for effective financial management and reporting.

Can I use this form for personal debts as well?

This form is specifically designed for business debts and should not be used for personal debts. If you need to document personal debts, consider using a separate and appropriate form tailored for individual financial obligations.

Common mistakes

When filling out the Business Debt Schedule form, many individuals make common mistakes that can lead to inaccuracies or even complications down the line. One primary error occurs when people include accounts payable or accrued liabilities in the schedule. The guidelines are clear: the form should only account for loans, contracts, notes payable, and lines of credit. Mixing these different types of debts can distort the financial picture and may raise questions during financial assessments.

Another frequent mistake relates to the presentation of the creditor's information. It is crucial to provide accurate names and addresses for all creditors involved. If this information is incorrect or incomplete, it could create challenges in establishing communication or understanding debt obligations in the future. Proper documentation helps ensure that all parties maintain a clear and consistent understanding of the financial commitments.

Many people also struggle with the section concerning the "Present Balance." It is essential that this figure matches up with the balance shown on the Interim Balance Sheet. If the totals do not agree, discrepancies can result in confusion and might lead to audits or requests for additional clarification. Accuracy is key; checking calculations and ensuring consistency between documents should be a priority.

Finally, individuals often overlook the necessity of providing sufficient detail regarding what the loan was for. Simply stating “business loan” does not convey enough information. Instead, a clear description of the purpose—whether it's for inventory, equipment, or operational expenses—will enhance the transparency of the financial report. Detail adds context, which is vital for stakeholders who may need to assess the viability and health of the business.

Documents used along the form

When managing business finances, particularly when dealing with loans and credit, it is not uncommon to come across several essential documents that can aid in the assessment of your current financial obligations. The Business Debt Schedule form is a vital tool for this purpose. However, it often works in conjunction with other documents for a comprehensive overview. Below are some commonly used forms and documents that you should be aware of.

- Balance Sheet: This document provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and equity. It can serve as a fundamental reference point for the total financial health of a business.

- Income Statement: Also known as a profit and loss statement, this form summarizes revenues, costs, and expenses over a specified period. It helps business owners evaluate business performance and profitability.

- Cash Flow Statement: This document tracks the flow of cash in and out of the business. It helps in understanding how cash is generated and utilized, thus offering insights into operational efficiency and liquidity.

- Loan Agreement: A legal document outlining the terms of the loan between a borrower and a lender. It includes details such as interest rate, repayment terms, and any collateral involved. Understanding this document is crucial for managing debt effectively.

- Credit Report: This report provides a detailed history of a business's credit activity, including payment history and outstanding debts. It is important for assessing creditworthiness and securing future loans.

- Personal Guarantee: Sometimes, lenders require a personal guarantee from business owners, meaning they are personally liable for the debt. This document outlines the owner's commitment and can impact personal finances if the business defaults.

- Financial Forecast: This is a prediction of a company's future financial performance, based on historical data and anticipated market conditions. It is an essential tool for planning and can influence future borrowing needs.

Familiarizing yourself with these documents can significantly enhance your understanding of your business's financial landscape. Collectively, they provide a holistic view that aids in making informed decisions about your business's debt management and financial strategy. Ensure that you have these documents readily available and reviewed timely, especially when considering new loans or negotiating terms with lenders.

Similar forms

The Business Debt Schedule form serves a distinct purpose in summarizing a company's financial obligations. However, there are several other documents that share similarities in their format or function. Below are four such documents:

- Personal Debt Schedule: Similar to the Business Debt Schedule, the Personal Debt Schedule lists individual debts, including loans and credit lines, detailing the creditor, original amount, current balance, and payment terms. Both documents focus on a clear snapshot of outstanding liabilities.

- Loan Amortization Schedule: This document outlines the repayment plan for a specific loan, breaking down monthly payments between principal and interest. Like the Business Debt Schedule, it includes crucial financial information such as interest rates and total amounts owed.

- Balance Sheet: While providing a broader overview of a company's financial position, the Balance Sheet categorizes debts as liabilities, similar to how the Business Debt Schedule itemizes loans. Both documents are essential for assessing financial health at a given point in time.

- Credit Report: A Credit Report compiles data on an individual or company's borrowing history, including debts and repayment behavior. Both this report and the Business Debt Schedule reveal outstanding amounts and help evaluate creditworthiness.

Dos and Don'ts

When filling out the Business Debt Schedule form, keeping a clear and organized approach is essential. Below are ten things to consider:

- Do include all relevant loans for contracts, notes payable, and lines of credit.

- Don’t report accounts payable or accrued liabilities on this form.

- Do provide the complete name and address of each creditor.

- Don’t leave any fields blank; fill in all required information completely.

- Do double-check the original amounts and balances for accuracy.

- Don’t forget to indicate the purpose of each loan clearly.

- Do specify the term or maturity date for each loan.

- Don’t enter incorrect interest rates; accuracy is crucial.

- Do ensure the total present balance matches the balance shown on the interim balance sheet.

- Don’t forget to sign and date the form after completing it.

Following these guidelines will help ensure that the Business Debt Schedule form is completed correctly, leading to a smoother financial review process.

Misconceptions

Understanding the Business Debt Schedule form is crucial for accurately reporting a company's financial obligations. However, there are several misconceptions that can lead to confusion. Here are four common ones:

- All debts can be included in the schedule. Some people believe that any form of debt should be included in the Business Debt Schedule. In reality, only loans for contracts, notes payable, and lines of credit should be documented. Accounts payable and accrued liabilities do not belong on this schedule.

- Present balance and original amount are the same. Another misconception is that the present balance of a loan equals its original amount. This is not accurate. Over time, businesses make payments which reduce the balance. Therefore, the present balance often differs significantly from the original loan amount.

- Interest rates don’t need to be reported. Some users think that it is unnecessary to include interest rates in the Business Debt Schedule. However, recording the interest rate for each loan is essential for understanding the cost of borrowing and for financial analysis.

- A separate form is needed for collateral. There is a belief that collateral or security information must be reported on a different form. This is incorrect. The Business Debt Schedule allows for the inclusion of collateral details directly within the same document, ensuring it all stays together for ease of reference.

By clarifying these misconceptions, businesses can ensure their financial documents are accurate and complete, promoting better financial management.

Key takeaways

Filling out and using the Business Debt Schedule form is crucial for understanding your company's financial obligations. Here are some key takeaways to keep in mind:

- Include Relevant Debts: The form should only list loans related to contracts, notes payable, and lines of credit. Do not include accounts payable or accrued liabilities.

- Complete Information: Make sure to fill in all required fields, including the creditor’s name, address, original loan amount, and current balance.

- Verify Totals: Ensure that the total present balance matches the amount shown on the interim balance sheet. Accuracy here is vital for a clear financial picture.

- Know Your Terms: Pay attention to the interest rates, maturity dates, and monthly payments listed. This information is essential for understanding your repayment obligations.

Browse Other Templates

Personal Representative Probate - Personal representatives must keep all receipts for potential court review.

Usda Dti - It includes spaces to record essential applicant information and credit scores for evaluation.

Terrys Job Application,Terry's Candidate Information Form,Terry's Employment Inquiry,Terry's Recruit Form,Terry's Workforce Application,Terry's Job Seeker Form,Terry's Hiring Questionnaire,Terry's Employment Request,Terrys Job Candidate Application,T - List the years you attended each educational institution so Terry's can assess your educational background.