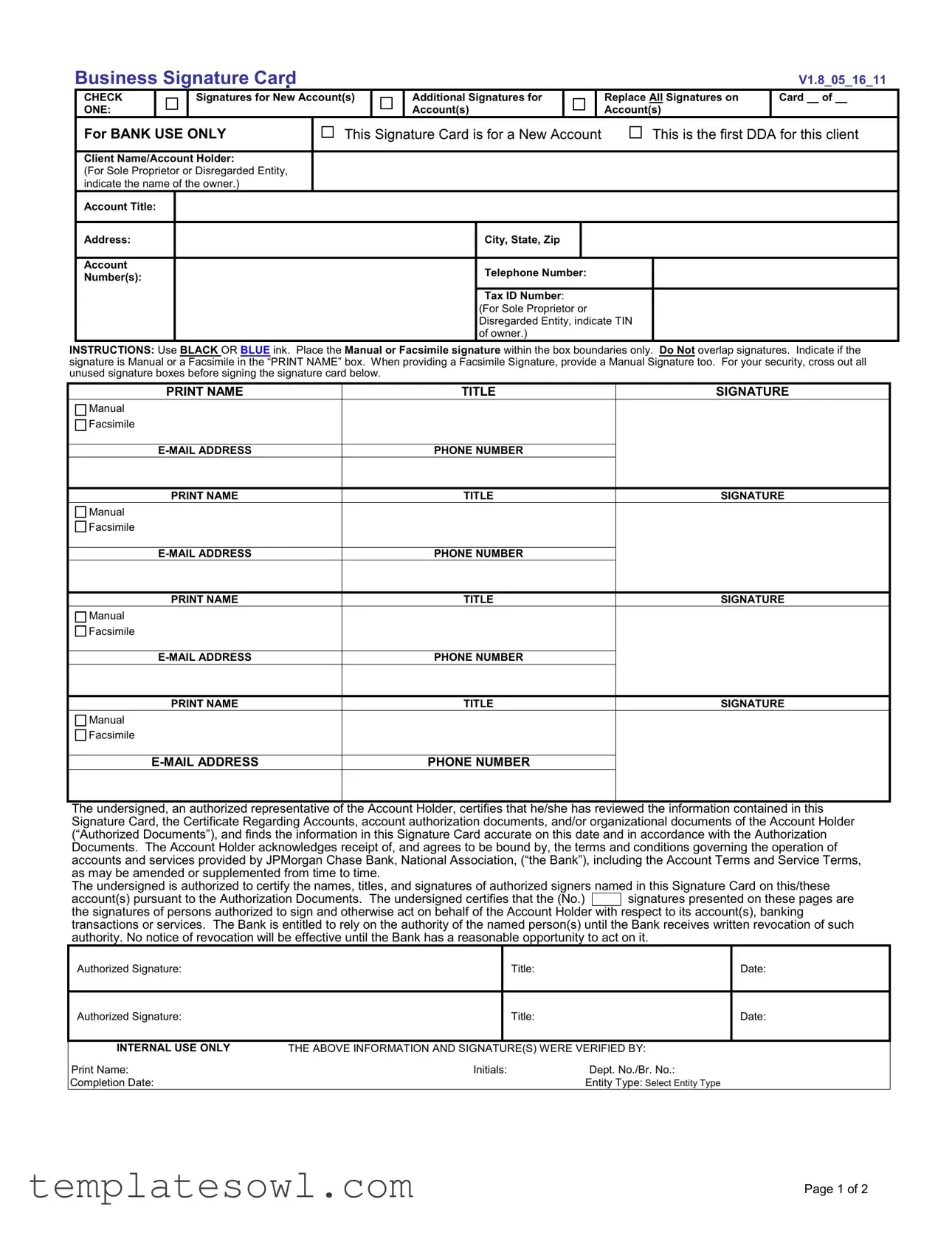

Fill Out Your Business Signature Card Form

The Business Signature Card form is a crucial document for businesses looking to establish banking relationships and access numerous banking services. A key function of this form is to designate authorized signers for the account, ensuring that the bank knows who can act on behalf of the business. When filling out the form, it’s important to provide the client name, account title, and related details accurately. The card accommodates both manual and facsimile signatures, and it includes clear instructions for ensuring signatures fit within designated boxes. For added security, any unused signature spaces should be crossed out, preventing unauthorized use. Each authorized signer must confirm their signature’s authenticity, and they must agree to the bank's terms and conditions. With the right information and proper execution, the Business Signature Card effectively manages account access and streamlines banking operations for companies large and small.

Business Signature Card Example

Business Signature Card

|

CHECK |

|

Signatures for New Account(s) |

|

|

ONE: |

|

|

|

Additional Signatures for Account(s)

|

|

V1.8_05_16_11 |

|

|

|

|

Replace All Signatures on |

Card __ of __ |

|

Account(s) |

|

For BANK USE ONLY |

This Signature Card is for a New Account |

This is the first DDA for this client |

Client Name/Account Holder:

(For Sole Proprietor or Disregarded Entity, indicate the name of the owner.)

Account Title:

Address:

Account

Number(s):

City, State, Zip

Telephone Number:

Tax ID Number:

(For Sole Proprietor or Disregarded Entity, indicate TIN of owner.)

INSTRUCTIONS: Use BLACK OR BLUE ink. Place the Manual or Facsimile signature within the box boundaries only. Do Not overlap signatures. Indicate if the signature is Manual or a Facsimile in the “PRINT NAME” box. When providing a Facsimile Signature, provide a Manual Signature too. For your security, cross out all unused signature boxes before signing the signature card below.

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

The undersigned, an authorized representative of the Account Holder, certifies that he/she has reviewed the information contained in this Signature Card, the Certificate Regarding Accounts, account authorization documents, and/or organizational documents of the Account Holder (“Authorized Documents”), and finds the information in this Signature Card accurate on this date and in accordance with the Authorization Documents. The Account Holder acknowledges receipt of, and agrees to be bound by, the terms and conditions governing the operation of accounts and services provided by JPMorgan Chase Bank, National Association, (“the Bank”), including the Account Terms and Service Terms, as may be amended or supplemented from time to time.

The undersigned is authorized to certify the names, titles, and signatures of authorized signers named in this Signature Card on this/these

account(s) pursuant to the Authorization Documents. The undersigned certifies that the (No.)

signatures presented on these pages are the signatures of persons authorized to sign and otherwise act on behalf of the Account Holder with respect to its account(s), banking transactions or services. The Bank is entitled to rely on the authority of the named person(s) until the Bank receives written revocation of such authority. No notice of revocation will be effective until the Bank has a reasonable opportunity to act on it.

signatures presented on these pages are the signatures of persons authorized to sign and otherwise act on behalf of the Account Holder with respect to its account(s), banking transactions or services. The Bank is entitled to rely on the authority of the named person(s) until the Bank receives written revocation of such authority. No notice of revocation will be effective until the Bank has a reasonable opportunity to act on it.

Authorized Signature:

Authorized Signature:

Title: |

Date: |

Title: |

Date: |

|

|

INTERNAL USE ONLY |

THE ABOVE INFORMATION AND SIGNATURE(S) WERE VERIFIED BY: |

|

Print Name: |

Initials: |

Dept. No./Br. No.: |

Completion Date: |

|

Entity Type: Select Entity Type |

Page 1 of 2

Client Name/Account Holder:

Account Title: |

|

Tax ID Number: |

|

Card __ of __ |

|

|

|

|

|

Account |

|

Telephone Number: |

Date: |

|

Number(s): |

|

|

|

|

|

|

|

|

|

ADDITIONAL SIGNATURES

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

Page 2 of 2

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Business Signature Card is used to establish authorized signers for new bank accounts. |

| Identification | It requires the client's name, account title, address, and tax identification number. |

| Signature Requirements | All signatures must be provided in black or blue ink within designated boxes, and should not overlap. |

| Manual and Facsimile Signatures | Both a manual and a facsimile signature are required for each signer to enhance security. |

| Authority | The undersigned certifies the accuracy of the information and that they are authorized to act on behalf of the account holder. |

| Revocation of Authority | The bank must receive written notice to revoke any signature authority, and revocation is not effective until the bank has had a reasonable opportunity to act on it. |

| Governing Laws | The use of this form is governed by the laws related to bank accounts and corporate governance specific to each state. |

Guidelines on Utilizing Business Signature Card

Filling out the Business Signature Card is an essential step for establishing banking services under your business name. Once you have completed the form, it is crucial to review all information thoroughly to ensure accuracy. This ensures that authorized signers can operate accounts without any administrative hitches.

- Use black or blue ink to fill out the form.

- Start by entering the Client Name/Account Holder. If you are a sole proprietor, include your name here.

- Next, write the Account Title next to the appropriate label.

- Fill in your Address, including city, state, and zip code.

- Provide the Account Number(s) as requested.

- Enter the Telephone Number for the account.

- Write your Tax ID Number (or the TIN of the owner for sole proprietors).

- Indicate if you’re providing a Manual or Facsimile Signature in the PRINT NAME box.

- In the signature boxes, sign your name by placing it within the box boundaries. Avoid overlapping signatures.

- If you have additional signers, repeat the printing and signing process in the designated areas for each new signer.

- Cross out any unused signature boxes to enhance security.

- Have an authorized representative sign and date the bottom of the form, certifying all information is accurate.

What You Should Know About This Form

What is the purpose of the Business Signature Card form?

The Business Signature Card form is used to establish authorized signers for new business accounts. This form ensures that the bank knows who is allowed to sign on behalf of the business. It provides a record of the authorized signatures, all of which can be verified by the bank when conducting transactions. Having accurate signatures helps prevent unauthorized access to the account and ensures compliance with banking regulations.

How should I fill out the Business Signature Card form?

When completing the form, make sure to use either black or blue ink. It is important to write signatures within the designated box areas without overlapping them. Clearly indicate whether each signature is a manual one or a facsimile. For security reasons, cross out any unused signature boxes before signing. Ensure that all information provided is accurate and aligns with the documentation related to the account holder.

Who needs to sign the Business Signature Card?

The form requires signatures from individuals who are authorized representatives of the business. These could include owners, partners, or designated officers who have the legal authority to manage the business's banking needs. Each person signing should also provide their title and contact information. This verification of authority is crucial to ensure that the bank recognizes and accepts the signatures of those authorized to operate the account.

What happens if I need to change or revoke a signature?

If a change or revocation of a signature is necessary, it must be conducted in writing. The bank requires that written notification of any changes be provided to ensure the records are up-to-date. Until the bank receives this written revocation, it is allowed to rely on the existing authority of the named signers. It is wise to allow the bank some reasonable time to act on such changes.

What do I need to know about security when using the Business Signature Card?

Protecting your business banking information is crucial. Only authorized individuals should fill out the Business Signature Card. Additionally, make sure to cross out any unused signature boxes to prevent fraudulent use. Keep all copies of this form secure and confidential. Review the terms and conditions provided by the bank to understand your rights and obligations regarding account security.

Common mistakes

Filling out a Business Signature Card form can seem straightforward, but many individuals make errors that may cause delays or complications. Understanding common mistakes can help ensure a smoother process when opening a new account. Below are nine frequent pitfalls to avoid.

1. Failing to Use the Correct Ink Color: The form specifically instructs users to utilize either black or blue ink. Using other colors can lead to processing issues or the need for resubmission.

2. Overlapping Signatures: Another common error is overlapping signatures in the provided boxes. Signatures must remain within the designated space to be valid. Overlapping can compromise clarity and authenticity.

3. Neglecting to Cross Out Unused Boxes: For security reasons, it is imperative to cross out any unused signature boxes. Failing to do so may raise concerns and create complications for the bank.

4. Not Indicating Signature Type: Each signature must be categorized as either a manual or facsimile signature in the “PRINT NAME” box. Without this designation, the bank may hesitate to accept the signatures.

5. Omitting Initials or Signature Reviews: Review of the signature card and organizational documents is crucial, and the authorized representative must certify that the information provided is accurate. Omitting this step may compromise the integrity of the application.

6. Inaccurate Tax ID Information: Entering incorrect tax identification numbers is a significant mistake. This number is vital for verification and must reflect the owner’s official information.

7. Missing Contact Information: Providing thorough contact information, including phone numbers and email addresses, ensures the bank can reach representatives quickly. Leaving this out can hinder communication and problem resolution.

8. Poorly Written Names: Clearly printing names is essential. Illegible handwriting can lead to confusion and further complications in processing accounts.

9. Ignoring Internal Use Sections: Some might overlook the internal use sections of the form, thinking they are not relevant. However, ensuring all parts of the form are completed contributes to a complete application and facilitates quicker processing.

By paying attention to these common mistakes, individuals can enhance their chances of a smooth and efficient application process. Each detail matters, and careful completion of the Business Signature Card form is crucial for establishing a professional banking relationship.

Documents used along the form

The Business Signature Card form is a crucial document for establishing who can manage a business account. However, several other forms and documents often accompany it to ensure proper account management and compliance. Here are seven commonly used forms that work hand-in-hand with the Business Signature Card:

- Certificate of Authority: This document certifies that the individuals listed are authorized to act on behalf of the business. It provides legal backing for the decisions and transactions related to the account.

- Bylaws or Operating Agreement: For corporations or LLCs, these internal documents outline how the business is run. They often specify who has authority to make financial decisions, which helps clarify signing authority.

- Corporate Resolution: This formal document records the decisions made by the board of directors or members regarding the opening or management of bank accounts. It often details the authorized signers.

- Tax Identification Number (TIN) Application: A TIN is necessary for tax purposes. It identifies the business to the IRS and is required for opening a bank account.

- Personal Identification Documents: These include driver's licenses or passports of the authorized signers. Banks require these to verify the identities of individuals who will have access to the account.

- Account Application Form: This document gathers essential information about the business and its owners. It's required by banks to assess eligibility for opening an account.

- Bank Account Terms and Conditions: This document outlines the rights and responsibilities of both the bank and the account holder. It includes information about fees, services, and account management.

Using these forms and documents alongside the Business Signature Card helps establish clear protocols for managing business accounts. Ensuring all necessary documentation is in order protects both the business and the bank.

Similar forms

-

Corporate Resolution: A corporate resolution is an official document that records decisions made by a corporation's board of directors. Similar to the Business Signature Card form, it authorizes specific individuals to act on behalf of the corporation in banking matters. Both documents require a list of authorized signers and formal acknowledgment of their authority to perform certain actions regarding the account.

-

Partnership Agreement: A partnership agreement outlines the terms and responsibilities of partners within a partnership. Like the Business Signature Card, it requires details about the partners and can specify who has signing authority on behalf of the partnership. Both documents facilitate clear communication regarding who can engage in banking activities and other legal matters.

-

Operating Agreement: An operating agreement for an LLC represents the structure and governing rules of the entity. This document, akin to the Business Signature Card, often lists authorized representatives who can make decisions or open bank accounts. Both establish a clear line of authority, reducing potential conflicts in business operations.

-

Account Authorization Form: An account authorization form provides banks with the necessary information about who is authorized to access and manage the account. Similar to the Business Signature Card, it includes the names and signatures of authorized individuals. Both ensure that the bank recognizes the person’s authority to conduct transactions on the account.

-

Fiduciary Agreement: A fiduciary agreement designates an individual or entity to act on behalf of another, usually in financial matters. This document shares commonality with the Business Signature Card as both emphasize the responsibilities of the authorized signers and their obligation to act in the best interests of the entity they represent.

Dos and Don'ts

When filling out the Business Signature Card form, keep the following tips in mind:

- Use black or blue ink only. Other colors may be rejected.

- Ensure that all signatures fit within the designated box boundaries. Overlapping can create confusion.

- Clearly indicate whether each signature is manual or a facsimile in the “PRINT NAME” box.

- Cross out all unused signature boxes to enhance security before signing.

Avoid these common mistakes:

- Don't leave any signature box blank. This can lead to delays.

- Never use pencil or any non-permanent ink. Only permanent ink is acceptable.

- Don’t mix up manual and facsimile signatures. Each must be clearly labeled.

- Avoid cutting off parts of the signature. Make sure all signs remain fully visible.

Misconceptions

Understanding the Business Signature Card can help smooth the process of opening a new account for

Key takeaways

Filling out a Business Signature Card form is an essential step in establishing a business bank account. Here are some key takeaways to ensure accuracy and compliance:

- Use the Correct Ink: Always fill out the form using black or blue ink to maintain clarity and compliance with banking practices.

- Signature Placement: Signatures must be placed within the designated boxes. Avoid overlapping signatures to prevent confusion or complications.

- Identify Signature Type: Indicate whether the signature is manual or facsimile in the designated print name box. This distinction is crucial for verification purposes.

- Cross Out Unused Boxes: For security reasons, all unused signature boxes should be crossed out before submitting the form. This helps prevent unauthorized use.

- Review Authorized Documents: The individual completing the form must verify that the information aligns with the authorized documents of the Account Holder.

- Signature Verification: The bank is entitled to rely on the signatures provided until a written revocation of authority is received and acted upon.

- Multiple Signers: If the account has multiple authorized signers, ensure that all names, titles, and signatures are clearly printed and signed as required.

- Submit Complete Information: Ensure that all fields, including address, telephone number, and tax ID, are completed accurately to avoid delays in processing.

- Internal Use Verification: The form requires an internal verification by bank personnel. The completed form will often contain initials and department numbers for accountability.

By keeping these points in mind, businesses can effectively navigate the process of setting up their accounts and ensure that their banking needs are met smoothly.

Browse Other Templates

Elements of a Press Release - Volunteers are welcome to assist during the Vacation Bible School.

Ps Form 8125 - USPS employees verify PVDS mailings for accuracy, which is recorded on this form for accountability.

Real Estate Referral Agreement - Include fields for monthly payments to ensure affordability.