Fill Out Your Business Income Worksheet Form

The Business Income Worksheet form is an essential tool designed to help businesses accurately assess their income and extra expenses over a 12-month period. By capturing critical financial data, this form serves as a guide for calculating business income loss and additional expenses that might arise due to unexpected interruptions. Key elements of this form include the calculation of net income before taxes, a comprehensive list of all business expenses (including payroll), and the projected growth factor over the next year. Businesses will input their gross sales and total payroll to ensure a complete picture of their financial health. Moreover, understanding the maximum expected recovery period in the event of a loss is vital, as this time frame influences the overall strategy for insurance coverage. As businesses navigate through potential disruptions, the worksheet also emphasizes additional costs incurred for temporary operations, ensuring that they are financially prepared for any situation. Completing this form accurately is crucial in determining the appropriate limits for Business Income Insurance, which may extend up to 24 months in certain cases. Consulting with an insurance professional can provide invaluable insights tailored to your specific needs.

Business Income Worksheet Example

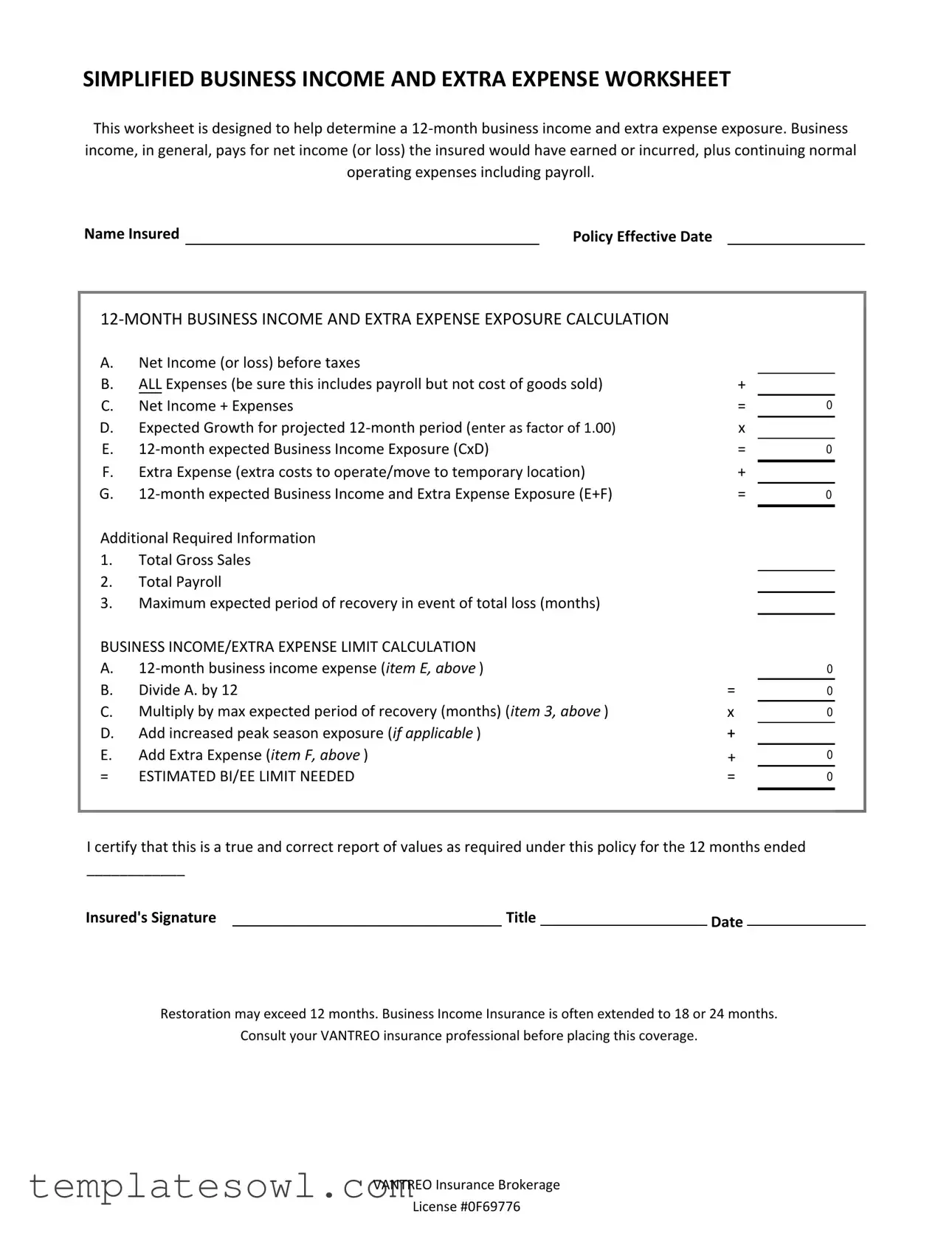

SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET

This worksheet is designed to help determine a

Name Insured |

|

Policy Effective Date |

A.Net Income (or loss) before taxes

B. |

ALL Expenses (be sure this includes payroll but not cost of goods sold) |

+ |

|

C. |

Net Income + Expenses |

= |

0 |

D. |

Expected Growth for projected |

x |

|

E. |

= |

0 |

|

F. |

Extra Expense (extra costs to operate/move to temporary location) |

+ |

|

G. |

= |

0 |

Additional Required Information

1.Total Gross Sales

2.Total Payroll

3.Maximum expected period of recovery in event of total loss (months)

BUSINESS INCOME/EXTRA EXPENSE LIMIT CALCULATION |

|

|

|

A. |

|

0 |

|

B. |

Divide A. by 12 |

= |

0 |

C. |

Multiply by max expected period of recovery (months) (item 3, above ) |

x |

0 |

D. |

Add increased peak season exposure (if applicable ) |

+ |

|

E. |

Add Extra Expense (item F, above ) |

+ |

0 |

= |

ESTIMATED BI/EE LIMIT NEEDED |

= |

0 |

I certify that this is a true and correct report of values as required under this policy for the 12 months ended

____________

Insured's Signature |

|

Title |

|

Date |

|

|

Restoration may exceed 12 months. Business Income Insurance is often extended to 18 or 24 months.

Consult your VANTREO insurance professional before placing this coverage.

VANTREO Insurance Brokerage

License #0F69776

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This worksheet is used to calculate a business's income and additional expenses over a 12-month period. |

| Components | It includes net income calculations, operating expenses, and extra costs required for a temporary location. |

| Gross Sales | The table prompts for total gross sales and payroll to accurately assess financial exposure. |

| Recovery Period | The worksheet helps estimate the maximum expected period of recovery after a total loss, measured in months. |

| Limit Calculation | It provides a formula to compute the estimated business income and extra expense limit needed. |

| Policy Considerations | Business income insurance may extend coverage up to 24 months; it’s crucial to consult your insurance professional. |

Guidelines on Utilizing Business Income Worksheet

Filling out the Business Income Worksheet is a key step in ensuring you have a comprehensive understanding of your business's financial exposure over the next year. This guide will detail the necessary steps, providing clarity in each part of the process.

- Start by entering the Name Insured and the Policy Effective Date at the top of the worksheet.

- For the 12-MONTH BUSINESS INCOME AND EXTRA EXPENSE EXPOSURE CALCULATION section:

- Calculate your Net Income (or loss) before taxes and write it in box A.

- Add all of your Expenses (including payroll but excluding cost of goods sold) in box B.

- In box C, add your Net Income from box A to Expenses from box B.

- Determine your Expected Growth for the upcoming 12 months and enter this factor in box D.

- Multiply the total from box C by the expected growth factor in box D to find your 12-month expected Business Income Exposure for box E.

- Estimate any Extra Expense (extra costs to operate or move to a temporary location) and write it in box F.

- Finally, add the expected Business Income Exposure from box E to the Extra Expense from box F to get the total in box G.

- In the Additional Required Information section:

- Provide your Total Gross Sales.

- Indicate your Total Payroll.

- Specify the Maximum expected period of recovery in the event of a total loss (in months).

- For the BUSINESS INCOME/EXTRA EXPENSE LIMIT CALCULATION:

- Enter the 12-month business income expense from box E into box A.

- Divide the amount in box A by 12 and write it in box B.

- Multiply box B by the maximum expected period of recovery (from item 3) and enter the result in box C.

- If applicable, add any increased peak season exposure in box D.

- Include any Extra Expense from item F in box E.

- Add all of these figures together to get your ESTIMATED BI/EE LIMIT NEEDED in the final box.

- Lastly, certify your report by signing in the field provided. Include your title and the date.

After completing the form, it’s essential to review your entries for accuracy. This information is crucial for adequately assessing your insurance needs and financial planning for the year ahead. Don’t hesitate to reach out to a professional if you have questions about any specific section.

What You Should Know About This Form

What is the purpose of the Business Income Worksheet?

The Business Income Worksheet is designed to help businesses determine their financial exposure over a 12-month period. This includes calculating the net income they would have gained or lost, along with the ongoing operating expenses they would incur during that time, such as payroll. It's a valuable tool for assessing risk and ensuring proper coverage in case of a business interruption.

How is the 12-month expected Business Income Exposure calculated?

The 12-month expected Business Income Exposure is derived by first calculating the sum of net income and expenses. This total is then adjusted using a growth factor to reflect potential increases in income over the next year. The formula essentially combines the business’s current financial situation with anticipated growth, providing a clearer picture of future income exposure.

What types of expenses should be included in the worksheet?

All operating expenses should be included in the worksheet, encompassing payroll, utilities, rent, and other ongoing costs necessary for business operations. However, it’s important to exclude the cost of goods sold, as the worksheet focuses on fixed and variable operating expenses rather than direct production costs.

What information is required beyond the financial calculations?

In addition to financial calculations, the worksheet requires key information such as total gross sales, total payroll, and the maximum expected period of recovery in the event of a total loss. This additional context helps in determining the coverage needed and ensuring a comprehensive risk assessment.

Why is it important to consider the maximum expected period of recovery?

The maximum expected period of recovery is crucial because it estimates how long the business might take to resume normal operations after a loss. This timeframe can greatly influence the amount of insurance coverage needed, helping ensure that the business can sustain itself financially during recovery.

How does the worksheet accommodate for peak season exposure?

If a business experiences fluctuations in income due to seasonal peaks, the worksheet allows for adjustments to the estimated limit by adding increased peak season exposure. This consideration ensures that the insurance coverage adequately reflects the potential income variations throughout the year.

What should I do if I have questions or need assistance while filling out the worksheet?

If you encounter questions or seek further guidance while completing the worksheet, reaching out to a knowledgeable insurance professional, such as those at VANTREO, is highly recommended. They can provide valuable insights and help tailor your coverage to meet your specific business needs, ensuring you are adequately protected.

Common mistakes

Filling out the Business Income Worksheet form accurately is essential for determining your business income and extra expense exposure. However, many individuals make common mistakes that can lead to inaccurate calculations and potential issues with their coverage. One frequent error is failing to include all necessary expenses. Business owners might think that only direct costs, such as payroll, are relevant. It is important to remember that all expenses must be documented, including utilities and regular operating costs, excluding the cost of goods sold.

Another mistake occurs when individuals underestimate their expected growth rate during the 12-month period. Entering an inaccurate growth factor can significantly impact the final calculations. If the expected growth is undervalued, the resulting business income exposure might not be sufficient to cover future needs. Business owners should evaluate historical trends, market conditions, and forecasted growth before determining this factor.

Additionally, people often overlook the section that requires them to report the maximum expected period of recovery in case of a total loss. Failing to provide this information can complicate the determination of the necessary coverage limits. It is essential to think about recovery times and consult with experts or industry standards to estimate this accurately.

Many also do not double-check the calculations within the worksheet. Multiplying the wrong figures or adding incorrectly can lead to significant discrepancies in the final amounts. It is advisable to review each step to ensure that all entries are correct and that calculations align with the provided data.

Lastly, individuals might neglect to include any potential increased peak season exposure. During busy periods, businesses might experience higher-than-normal income or expenses. If this factor is omitted from the calculations, it could result in underinsurance during critical times. Business owners should assess their cyclical business needs closely and incorporate them into their estimates.

Documents used along the form

The Business Income Worksheet is a vital document for determining the financial impact of a business interruption. However, it usually accompanies other essential forms and documents that help ensure a complete understanding of your business's financial health and insurance needs. Below is a list of common documents often used alongside the Business Income Worksheet.

- Loss of Income Insurance Policy: This policy outlines coverage specifics, including limits, exclusions, and conditions pertaining to business income during a disruption.

- Business Interruption Insurance Application: An application form that collects necessary details about the business, its operations, and its revenue, helping to set the stage for coverage assessment.

- Financial Statements: These documents provide a snapshot of the business’s financial status, including balance sheets and profit and loss statements, which are crucial for accurate income assessments.

- Payroll Reports: Detailed reports of employee wages and salaries that are essential for calculating the continuing expenses the business may incur during a loss.

- Sales Forecasts: Projected sales figures over a specific period which help estimate the expected income and growth, contributing to more precise coverage calculations.

- Extra Expense Worksheet: A document designed to evaluate anticipated costs that a business may incur to keep operations running or to relocate temporarily during a disruption.

- Certificate of Insurance: This document serves as proof of insurance coverage, detailing the types and limits of coverage in place for the business.

- Business Overview Document: A summary that outlines critical aspects of the business operations, including key management staff, organizational structure, and overall business strategy.

Each of these documents plays an important role in painting a complete picture of a business’s income potential and risk exposure. By gathering and carefully completing these forms, business owners can better equip themselves to navigate the complexities of insurance claims and recover from interruptions more effectively.

Similar forms

Profit and Loss Statement: This document summarizes a company's revenues, costs, and expenses during a specific period. Like the Business Income Worksheet, it provides insights into financial performance, allowing businesses to determine net income and assess operational efficiency.

Cash Flow Projection: This tool forecasts the inflow and outflow of cash within a business over a set timeframe. Similar to the worksheet, it helps assess the ability to maintain operations while estimating expenses, offering a clear financial outlook.

Budgeting Template: A budgeting template outlines planned revenues and expenses over a designated period. It shares the worksheet’s purpose of managing financial resources and ensuring the business remains on track financially.

Financial Forecasting Report: This report predicts future financial outcomes based on historical data and market trends. It aligns with the Business Income Worksheet by evaluating expected growth and providing a strategic view of potential income and expenses.

Dos and Don'ts

When filling out the Business Income Worksheet form, clarity and accuracy are essential. Here’s a list of things you should and shouldn’t do.

- Do carefully review all entries before submission. Ensure that calculations are accurate.

- Do include all necessary expenses, especially payroll. Missing details can lead to problems later.

- Do project your expected growth realistically. Overestimating can distort your financial outlook.

- Do consult with an insurance professional if unsure. They can provide essential guidance.

- Don't rush through the form. Taking your time can prevent mistakes.

- Don't forget to include the maximum expected recovery period. It's crucial for accurate calculations.

- Don't overlook any extra expenses you might incur. These can significantly affect your total exposure.

- Don't leave blank spaces. If a section doesn’t apply, indicate that clearly.

Misconceptions

Understanding the Business Income Worksheet form is crucial for business owners navigating their insurance needs. However, there are several misconceptions that can lead to confusion. Here are four common myths about the worksheet, along with clarifications.

- Misconception 1: The worksheet only considers profits.

- Misconception 2: All expenses must include cost of goods sold.

- Misconception 3: Expected growth is irrelevant.

- Misconception 4: The worksheet is only for businesses with steady income.

This is not true. While net income is a significant factor, the worksheet also takes into account continuing operating expenses, including payroll. This comprehensive approach ensures that all financial aspects are considered when calculating business income exposure.

In fact, the worksheet specifically instructs users to exclude the cost of goods sold from the total expenses. It focuses solely on ongoing operational expenses, which helps provide a clearer picture of the income situation.

Expected growth plays a pivotal role in the worksheet. The form requires an input of expected growth as a multiplier, which affects the overall business income exposure over the next 12 months. This factor allows businesses to plan for potential future revenues accurately.

This misconception is misleading. The worksheet can be beneficial for businesses with fluctuating income patterns as well. It accounts for peak seasons and provides a mechanism to incorporate increased exposure during these times, ensuring businesses are sufficiently covered.

By dispelling these misconceptions, business owners can more effectively utilize the Business Income Worksheet to ensure adequate coverage and financial planning. Always consult with a knowledgeable insurance professional for guidance specific to your situation.

Key takeaways

When filling out and using the Business Income Worksheet form, keep these key takeaways in mind:

- Understand the Purpose: This worksheet helps you assess your business's income and expenses over a 12-month period.

- Net Income Matters: You need to consider both net income and any losses before taxes when calculating your figures.

- Include All Expenses: Be thorough in listing expenses. Don’t forget payroll, as it plays a crucial role in ongoing operations.

- Project Growth Wisely: Factor in expected growth for the upcoming year. Enter this as a multiplier (e.g., 1.00).

- Calculate Exposure Carefully: To find your expected Business Income Exposure, multiply your total from step C by your growth factor.

- Estimate Extra Expenses: Include additional costs that may arise if you need to operate from a temporary location.

- Gather Required Information: You’ll need total gross sales, total payroll, and the maximum expected recovery time after a total loss.

- Set Your Limits: Calculate your Business Income/Extra Expense limit by considering all components, including any peak season needs.

- Sign and Certify: Ensure your report is accurate and sign your name along with your title and date.

- Stay Informed: Recovery might take longer than 12 months. Consider discussing coverage with your insurance professional for added protection.

Browse Other Templates

Vaccination Documentation Form,Panel Physician Vaccination Worksheet,U.S. Vaccination Compliance Form,Immigrant Health Verification Document,Vaccination Requirement Checklist,Panel Physician Immunization Record,U.S. Department of State Immunization F - Confidentiality is emphasized; all information is used strictly for immigration purposes.

Incident Report Form,Complaint Submission Form,Internal Affairs Report,Law Enforcement Feedback Form,Incident Documentation Form,Allegation Report Form,Police Accountability Report,Law Enforcement Complaint Form,Single Incident Report,Citizen Complai - Incorporates an open-ended comment section for detailed feedback.

Ca Llc Formation,700 - The framework for providing notices between the parties ensures clear communication throughout the process.