Fill Out Your Business License Renewal Form

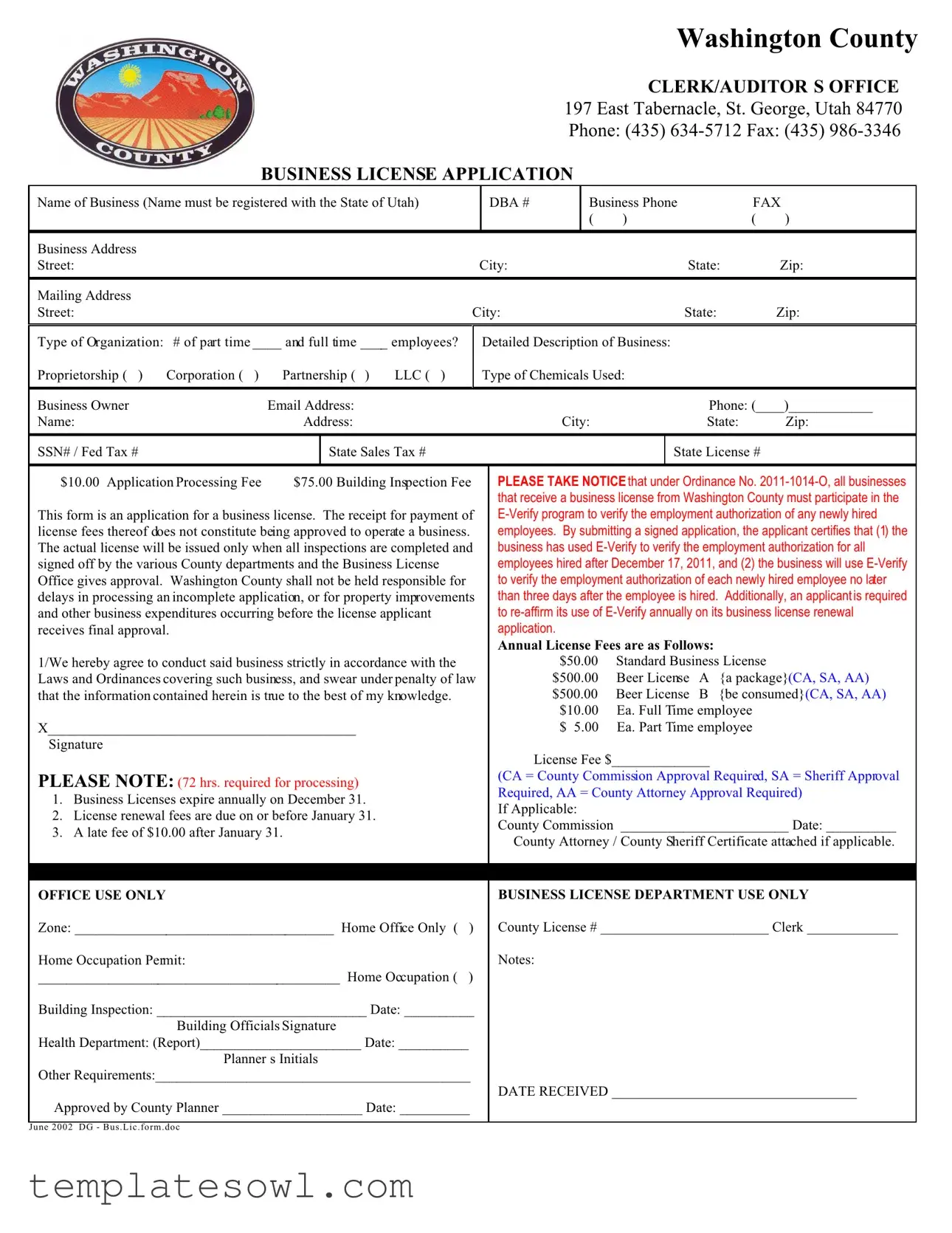

Renewing your business license in Washington County involves a straightforward yet vital process encapsulated in the Business License Renewal form. This document serves as an application that requires essential information about your business, such as its name (which must match state registration), type of organization, and a detailed description of operations. Alongside this, applicants must indicate the number of full-time and part-time employees and provide contact details for the business owner, including an email address and phone number. The form also inquires about any chemicals used in the business and mandates participation in the E-Verify program—a requirement that ensures employment authorization for newly hired workers. Fees associated with both the application processing and building inspection are integral to the submission, and timely payment is crucial to avoid late penalties. Completed renewals are subject to review and approvals from various county departments, which is essential to legally operate within the county. Remember, licenses expire annually on December 31, and renewal fees must be submitted no later than January 31 to prevent delays.

Business License Renewal Example

Washington County

CLERK/AUDITOR S OFFICE

197 East Tabernacle, St. George, Utah 84770

Phone: (435)

BUSINESS LICENSE APPLICATION

Name of Business (Name must be registered with the State of Utah) |

|

|

|

DBA # |

|

Business Phone |

|

FAX |

|||||||

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

City: |

|

|

|

State: |

|

Zip: |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

City: |

|

|

|

State: |

|

Zip: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Type of Organization: |

# of part time ____ and full time ____ employees? |

|

|

Detailed Description of Business: |

|

|

|

||||||||

Proprietorship ( ) |

Corporation ( ) |

Partnership ( ) |

LLC ( ) |

|

|

Type of Chemicals Used: |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Business Owner |

|

Email Address: |

|

|

|

|

|

|

|

|

|

Phone: (____)____________ |

|||

Name: |

|

Address: |

|

|

|

|

|

City: |

|

|

State: |

|

Zip: |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

SSN# / Fed Tax # |

|

|

State Sales Tax # |

|

|

|

|

|

|

|

State License # |

|

|||

|

|

|

|

|

|

||||||||||

' Q $10.00 Application Processing Fee |

' Q$75.00 Building Inspection Fee |

|

PLEASE TAKE NOTICE that under Ordinance No. |

||||||||||||

|

|

|

|

|

|

|

|

that receive a business license from Washington County must participate in the |

|||||||

This form is an application for a business license. The receipt for payment of |

|

||||||||||||||

license fees thereof does not constitute being approved to operate a business. |

|

employees. By submitting a signed application, the applicant certifies that (1) the |

|||||||||||||

The actual license will be issued only when all inspections are completed and |

|

business has used |

|||||||||||||

signed off by the various County departments and the Business License |

|

|

|

employees hired after December 17, 2011, and (2) the business will use |

|||||||||||

Office gives approval. Washington County shall not be held responsible for |

|

|

|

to verify the employment authorization of each newly hired employee no later |

|||||||||||

delays in processing an incomplete application, or for property improvements |

|

than three days after the employee is hired. Additionally, an applicant is required |

|||||||||||||

and other business expenditures occurring before the license applicant |

|

|

|

to |

|||||||||||

receives final approval. |

|

|

|

|

|

|

application. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Annual License Fees are as Follows: |

|

|

|||||

1/We hereby agree to conduct said business strictly in accordance with the |

|

|

|

|

' Q $50.00 |

Standard Business License |

|

||||||||

Laws and Ordinances covering such business, and swear under penalty of law |

|

|

' Q$500.00 |

Beer License |

A {a package}(CA, SA, AA) |

||||||||||

that the information contained herein is true to the best of my knowledge. |

|

|

|

|

' Q$500.00 |

Beer License |

B {be consumed}(CA, SA, AA) |

||||||||

|

|

|

|

|

|

|

|

|

' Q $10.00 |

Ea. Full Time employee |

|

||||

X____________________________________________ |

|

|

|

|

|

' Q $ 5.00 |

Ea. Part Time employee |

|

|||||||

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License Fee $______________ |

|

|

||||

PLEASE NOTE: (72 hrs. required for processing) |

|

|

|

|

(CA = County Commission Approval Required, SA = Sheriff Approval |

||||||||||

|

|

|

|

Required, AA = County Attorney Approval Required) |

|||||||||||

1. Business Licenses expire annually on December 31. |

|

|

|

|

|||||||||||

|

|

|

|

If Applicable: |

|

|

|

|

|

||||||

2. License renewal fees are due on or before January 31. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

County Commission ________________________ Date: __________ |

|||||||||||

3. A late fee of $10.00 after January 31. |

|

|

|

|

|||||||||||

|

|

|

|

' QCounty Attorney / County Sheriff Certificate attached if applicable. |

|||||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

OFFICE USE ONLY |

|

|

|

|

|

|

|

BUSINESS LICENSE DEPARTMENT USE ONLY |

|||||||

Zone: _____________________________________ Home Office Only ( |

) |

|

|

County License # ________________________ Clerk _____________ |

|||||||||||

Home Occupation Permit: |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|||

___________________________________________ Home Occupation ( |

) |

|

|

|

|

|

|

|

|

|

|

||||

Building Inspection: ______________________________ Date: __________ |

|

|

|

|

|

|

|

|

|

||||||

|

Building Officials Signature |

|

|

|

|

|

|

|

|

|

|

|

|

||

Health Department: (Report)_______________________ Date: __________ |

|

|

|

|

|

|

|

|

|

||||||

|

Planner s Initials |

|

|

|

|

|

|

|

|

|

|

|

|

||

Other Requirements:_____________________________________________ |

|

|

|

|

|

|

|

|

|

||||||

' QApproved by County Planner ____________________ Date: __________ |

|

DATE RECEIVED ___________________________________ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 2002 DG - Bus . Lic . form . doc

Form Characteristics

| Fact | Description |

|---|---|

| Business License Application | This form is used to apply for a business license in Washington County, Utah. |

| Expiration | Business licenses expire annually on December 31. |

| Renewal Deadline | License renewal fees must be paid on or before January 31 each year. |

| Late Fee | A late fee of $10.00 will apply if fees are not paid by January 31. |

| Application Processing Fee | The application processing fee is $10.00. |

| Building Inspection Fee | A building inspection fee of $75.00 is required. |

| E-Verify Participation | All businesses must participate in the E-Verify program for new hires. |

| Governing Law | Businesses must comply with Ordinance No. 2011-1014-O during operation. |

Guidelines on Utilizing Business License Renewal

Completing the Business License Renewal form accurately is essential to ensure a smooth renewal process for your business. After submitting the form along with any required fees, the appropriate county departments will evaluate your application. Once reviewed and approved, your business license will be renewed, allowing you to continue your operations without interruption.

- Begin by filling out the Name of Business section at the top of the form, ensuring that it matches the name registered with the State of Utah.

- If applicable, enter the DBA (Doing Business As) name.

- Provide the Business Phone number, and fax number if necessary.

- Complete the Business Address, including the street, city, state, and zip code.

- For correspondence purposes, fill out the Mailing Address section with the proper details.

- Select the Type of Organization by marking the appropriate box for proprietorship, corporation, partnership, or LLC.

- Indicate the number of part-time and full-time employees working at your business.

- Provide a Detailed Description of Business that includes what your business does or offers.

- List the Type of Chemicals Used by your business if applicable.

- Enter the Business Owner Email Address and phone number, followed by the owner's name and address.

- Fill in the City, State, and Zip for the owner's address.

- Include the Social Security Number or Federal Tax ID, along with the State Sales Tax Number and State License Number.

- Mark the appropriate boxes for any applicable fees, including the $10.00 Application Processing Fee and the $75.00 Building Inspection Fee.

- Sign and date the application to indicate your agreement with the terms and conditions outlined in the form.

- Review the entire form for accuracy and completeness before submission.

What You Should Know About This Form

1. What is the process for renewing a business license in Washington County?

To renew a business license in Washington County, you need to complete the Business License Renewal form. This form requires information such as your business name, address, type of organization, and the number of employees. Once you fill out the form, submit it along with the applicable renewal fee. Completed applications should be submitted before January 31 to avoid late fees. Remember, the renewal fee is due each year to keep your business license valid.

2. What happens if I miss the January 31 deadline for renewal?

If you miss the January 31 deadline for renewing your business license, you will incur a late fee of $10. It’s important to get your renewal submitted as soon as possible to avoid further penalties or potential interruptions in being legally able to conduct business.

3. Do I need to provide any additional documentation with my renewal?

In most cases, the basic renewal form and fee are sufficient. However, if applicable, you may need to attach other documents such as a County Attorney or County Sheriff Certificate. Make sure to check any specific requirements that may apply to your business type or circumstances.

4. How often do I need to affirm my use of E-Verify?

As part of the renewal process, applicants are required to re-affirm their use of the E-Verify program annually. This means confirming that you continue to verify the employment authorization of all newly hired employees within the specified timeframe, as mandated by local ordinances.

5. When can I expect to receive my renewed business license?

The processing time for business license renewals is approximately 72 hours, but this may vary based on the completeness of your application and any inspections that may be required. It's advisable to submit your renewal well in advance of your expiration date to ensure you maintain compliance without interruptions.

Common mistakes

When filling out the Business License Renewal form, many individuals make common mistakes that can lead to delays or even denials. One major error is providing incorrect or incomplete information regarding the business name. The name used on the form must match the name registered with the State of Utah. Failure to do so may result in the application being rejected or requiring additional clarifications, which can lengthen the renewal process.

Another frequent mistake involves omitting crucial contact details. Applicants often forget to include a business phone number and an email address for the owner. This oversight can make it difficult for the clerk's office to communicate about any issues with the application. Timely communication is essential, as delays may cause further complications.

A third error commonly seen is not accurately reporting the type of organization. Applicants might leave out the number of part-time and full-time employees or incorrectly check the box designating the type of business structure, such as Proprietorship, Corporation, or LLC. This section must be carefully filled out to ensure compliance and correct categorization.

Furthermore, some applicants neglect to include the required fees, which can halt the processing of the application. It’s vital to double-check that all applicable fees, such as the application processing fee and any building inspection fees, are clearly stated and included. Leaving out even a minor fee could lead to a significant delay in receiving the renewed license.

Lastly, many people fail to reaffirm their use of the E-Verify program as required by the application. This requirement is not simply a suggestion; it is a legal mandate that must be acknowledged and addressed upon renewal. Omitting this declaration could not only delay the license approval but also attract unwanted legal scrutiny. Always ensure compliance with all sections of the form to avoid any unnecessary issues.

Documents used along the form

When renewing a business license, several additional forms and documents may be necessary to ensure compliance with local regulations. Each document plays a crucial role in the overall process, helping streamline communication between business owners and county officials.

- Business License Renewal Application: This is the primary form needed for renewal. It includes updated information on the business and its owner, ensuring all details are current.

- Certificate of Good Standing: This document verifies that the business is compliant with state regulations and has not been dissolved or is in the process of being dissolved.

- Tax Clearance Certificate: This certificate shows that the business is up-to-date with its tax obligations, providing assurance to the county that the business is tax compliant.

- Building Inspection Report: If there have been any changes or updates to the business premises, this report confirms that inspections have been completed and the space adheres to local building codes.

- Health Department Permit: For businesses involved in food service or health-related activities, this permit certifies compliance with health and safety regulations.

- Home Occupation Permit (if applicable): This permit is necessary for businesses operating from residential properties, ensuring that these operations meet local zoning requirements.

- Proof of E-Verify Compliance: Because E-Verify use is required, proof must be provided annually to demonstrate that the business is verifying the employment eligibility of its employees.

Incorporating these documents into the business license renewal process can prevent delays and ensure that all necessary regulations are met. By staying organized and informed, business owners can navigate the renewal process more efficiently and focus on what truly matters: their business.

Similar forms

- Business License Application: Like the renewal form, this document also collects essential information about the business, including ownership structure and location.

- Operating Agreement: This document outlines the structure and management of a business, similar to how the renewal form details the operating conditions of a license.

- Employer Identification Number (EIN) Application: Both forms require business identification details, such as the owner’s name and business structure, to establish legal standing.

- Sales Tax License Application: The sales tax application details business operations related to sales, akin to how the renewal form addresses business activities and compliance.

- Business Registration Certificate: Each document confirms the legality of operating a business in its respective jurisdiction and requires accurate information about the business structure.

- Home Occupation Permit: Similar to the renewal form, a home occupation permit confirms compliance with local regulations and the nature of the business conducted from home.

- Certificate of Good Standing: This document shows that a business is properly registered and compliant, paralleling the renewal form’s certification of compliance with laws and ordinances.

- Insurance Certificate: Both documents may require proof of liability coverage, ensuring the business meets safety and risk management standards.

Dos and Don'ts

When filling out the Business License Renewal form, it is important to be thorough and accurate. Here is a list of do’s and don’ts to guide you.

- Do ensure that the business name matches the name registered with the State of Utah.

- Do include your business phone number and any additional contact information.

- Do provide a detailed description of your business activities.

- Do confirm your business ownership structure, such as LLC or corporation.

- Don’t leave any fields blank; incomplete applications can delay the renewal process.

- Don’t forget to sign your application; your signature is a legal requirement.

- Don’t ignore the deadline; submit your renewal before January 31 to avoid late fees.

- Don’t neglect to reaffirm your use of E-Verify on your renewal application each year.

By following these guidelines, you help ensure a smoother renewal process for your business license.

Misconceptions

Misconception 1: Submitting the application means you can start your business immediately.

Many people believe that once they submit the Business License Renewal form, they are automatically approved to operate. However, this is not the case. To start your business legally, you must wait until your application is fully processed, approved, and you have received your business license.

Misconception 2: All businesses have the same renewal fee.

It’s easy to assume that every business pays the same amount for the license renewal. This is not true. Renewal fees vary depending on the type of business and its specifics, like the number of employees or special licenses required, such as a beer license.

Misconception 3: Once your license is approved, you don’t need to worry about E-Verify anymore.

Some applicants think that using E-Verify for employment authorization is a one-time requirement. In reality, businesses must re-affirm their use of E-Verify every year when renewing their business license. It’s crucial to stay compliant and keep up with this requirement.

Misconception 4: There’s no penalty for submitting late.

Another common misunderstanding is that there are no consequences for submitting your renewal late. In fact, if you miss the renewal deadline of January 31, a late fee of $10 will be applied. This can add extra costs to your business operation, so it's wise to keep track of important dates.

Key takeaways

When filling out and utilizing the Business License Renewal form for Washington County, the following key takeaways can enhance understanding and compliance:

- Accurate Information: Ensure that the name of the business matches its registration with the State of Utah. This is crucial for the application to be processed.

- Timely Submission: The renewal form must be submitted by January 31 to avoid late fees. Plan ahead to gather all necessary information.

- Payment Obligations: Be prepared to include the appropriate renewal fees. A late fee of $10.00 applies after the January 31 deadline.

- E-Verify Compliance: Applicants must confirm participation in the E-Verify program, which is designed for verifying the employment authorization of newly hired employees.

- Understanding Fees: Familiarize yourself with all fees associated with the renewal process, including inspection fees that may be relevant to your business type.

- Inspections Required: The actual business license will not be issued until all required inspections are completed. This step should not be overlooked.

- License Validity Period: All business licenses expire annually on December 31, making it essential to renew well in advance.

- Annual Affirmation: Each year, businesses must reaffirm their use of E-Verify on the renewal application, ensuring ongoing compliance with employment verification laws.

Browse Other Templates

Da Form 2408-12 - This form helps to establish a thorough audit trail for aircraft operations over time.

Puppy Application - If you plan to compete with your dog, this section will capture that intent.

Academy of Art University Transcript - Students must provide a valid card number if paying by credit card.