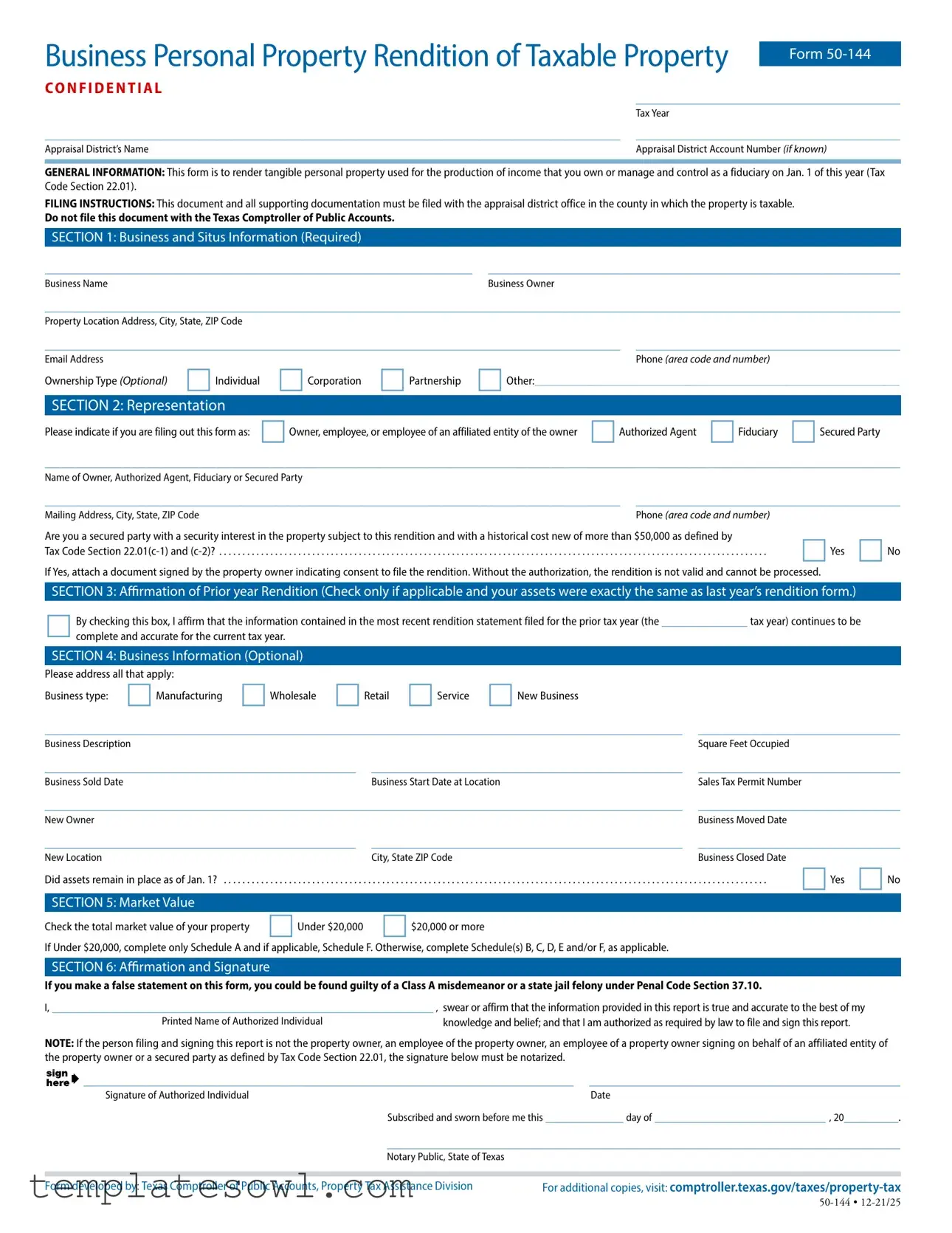

Fill Out Your Business Personal Rendition Form

The Business Personal Rendition form serves as a crucial document for businesses in Texas, playing a significant role in the realm of property taxation. Designed for those who own or manage tangible personal property utilized for income generation, this form must be completed and submitted by January 1st of each tax year. It requires essential information about the business, including its name, ownership type, and the location of the taxable property. The form guides users through multiple sections, including representation options, which clarify whether the filer is the property owner, an employee, a fiduciary, or an authorized agent. Understanding the market value of the property is central to completing the form accurately. Depending on the property's value, filers might need to provide detailed schedules outlining inventories, supplies, or leased equipment. This process not only ensures compliance with local tax codes but also safeguards the rights and responsibilities of property owners against potential penalties for late or inaccurate submissions. Overall, the Business Personal Rendition form is an essential tool for business owners aiming to navigate property taxation effectively while maintaining transparency in their financial dealings.

Business Personal Rendition Example

Business Personal Property Rendition of Taxable Property |

|

||

Form |

|||

|

|

||

C O N F I D E N T I A L |

__________________________________ |

||

|

|||

|

Tax Year |

|

|

__________________________________________________________________________ |

__________________________________ |

||

Appraisal District’s Name |

Appraisal District Account Number (if known) |

||

GENERAL INFORMATION: This form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01).

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable.

Do not file this document with the Texas Comptroller of Public Accounts.

SECTION 1: Business and Situs Information (Required)

_______________________________________________________ |

_____________________________________________________ |

Business Name |

Business Owner |

______________________________________________________________________________________________________________

Property Location Address, City, State, ZIP Code

__________________________________________________________________________ __________________________________

Email Address |

Phone (area code and number) |

Ownership Type (Optional) Individual |

Corporation Partnership Other:___________________________________________________________________ |

SECTION 2: Representation |

|

Please indicate if you are filing out this form as: Owner, employee, or employee of an affiliated entity of the owner Authorized Agent Fiduciary Secured Party

______________________________________________________________________________________________________________

Name of Owner, Authorized Agent, Fiduciary or Secured Party

__________________________________________________________________________ |

__________________________________ |

||

Mailing Address, City, State, ZIP Code |

Phone (area code and number) |

|

|

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than $50,000 as defined by |

Yes |

No |

|

Tax Code Section |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

If Yes, attach a document signed by the property owner indicating consent to file the rendition. Without the authorization, the rendition is not valid and cannot be processed.

SECTION 3: Affirmation of Prior year Rendition (Check only if applicable and your assets were exactly the same as last year’s rendition form.)

By checking this box, I affirm that the information contained in the most recent rendition statement filed for the prior tax year (the ___________ tax year) continues to be complete and accurate for the current tax year.

SECTION 4: Business Information (Optional)

Please address all that apply: |

|

|

|

|

|

Business type: |

Manufacturing |

Wholesale |

Retail |

Service |

New Business |

__________________________________________________________________________________ |

__________________________ |

|

Business Description |

|

Square Feet Occupied |

________________________________________ |

________________________________________ |

__________________________ |

Business Sold Date |

Business Start Date at Location |

Sales Tax Permit Number |

__________________________________________________________________________________ |

__________________________ |

|

New Owner |

|

Business Moved Date |

________________________________________ |

________________________________________ |

__________________________ |

New Location |

City, State ZIP Code |

Business Closed Date |

Did assets remain in place as of Jan. 1? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . Yes No |

SECTION 5: Market Value |

|

|

Check the total market value of your property Under $20,000 |

$20,000 or more |

|

If Under $20,000, complete only Schedule A and if applicable, Schedule F. Otherwise, complete Schedule(s) B, C, D, E and/or F, as applicable.

SECTION 6: Affirmation and Signature

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.10.

I, _________________________________________________ , swear or affirm that the information provided in this report is true and accurate to the best of my

Printed Name of Authorized Individual |

knowledge and belief; and that I am authorized as required by law to file and sign this report. |

NOTE: If the person filing and signing this report is not the property owner, an employee of the property owner, an employee of a property owner signing on behalf of an affiliated entity of the property owner or a secured party as defined by Tax Code Section 22.01, the signature below must be notarized.

_______________________________________________________________ ________________________________________

_______________________________________________________________ ________________________________________

Signature of Authorized Individual |

Date |

Subscribed and sworn before me this __________ day of ______________________ , 20_______. |

|

__________________________________________________________________ |

|

Notary Public, State of Texas |

|

|

|

|

|

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division |

For additional copies, visit: |

Business Personal Property Rendition of Taxable Property |

|

|

Form |

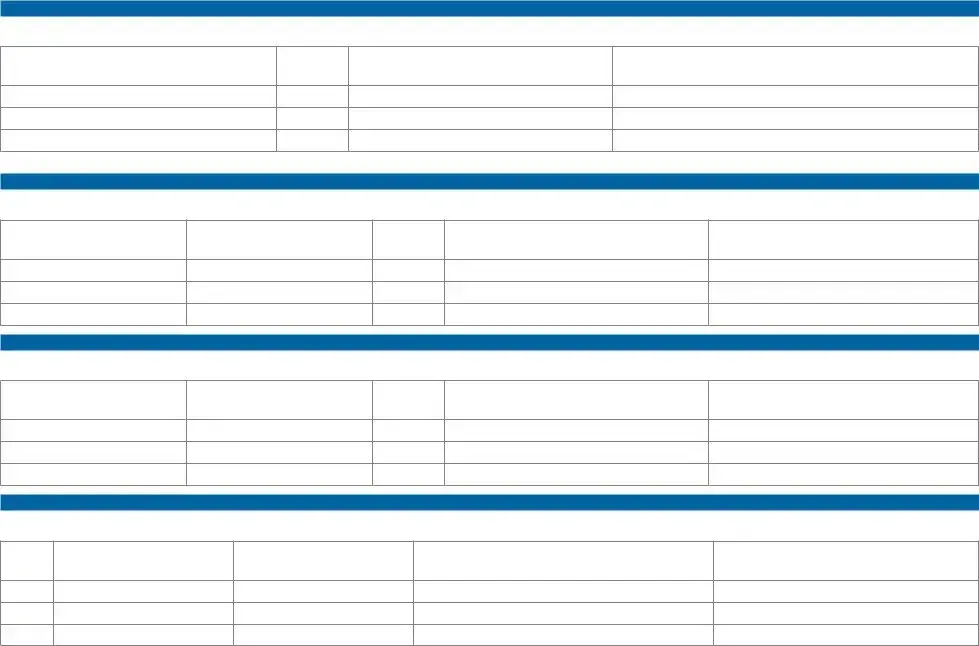

Did you timely apply for a Sept. 1 inventory date? (Optional) |

Yes |

No |

|

Does your inventory involve interstate/foreign commerce issues? (Optional) |

Yes |

No |

|

Does your inventory involve freeport goods? (Optional) |

Yes |

No |

Account Number _____________________________ |

SCHEDULE A: PERSONAL PROPERTY VALUED LESS THAN $20,000

List all taxable personal property by type/category of property (See Definitions and Important Information). If needed, you may attach additional sheets OR a

General Property Description by Type/Category

Estimate of

Quantity of

Each Type

Good Faith |

|

|

Historical |

|

|

|

OR |

AND |

|

||||

Estimate of |

Cost |

Year |

||||

Market Value* |

|

|

When New* |

|

|

Acquired* |

|

|

|

|

|||

|

|

|

|

|

|

|

Property Owner Name/Address

(if you manage or control property as a fiduciary)

PERSONAL PROPERTY VALUED AT $20,000 OR MORE

SCHEDULE B: INVENTORY, RAW MATERIALS AND WORK IN PROCESS

List all taxable inventories by type of property. If needed, attach additional sheets OR a

Property Description by Type/Category

Property Address or

Address Where Taxable

Estimate of

Quantity of

Each Type

Good Faith |

|

|

Historical |

|

|

|

Estimate of |

OR |

Cost |

AND |

Year |

||

Market Value* |

|

|

When New* |

|

|

Acquired* |

|

|

|

|

|||

|

|

|

|

|

|

|

Property Owner Name/Address

(if you manage or control property as a fiduciary)

SCHEDULE C: SUPPLIES

List all supplies by type of property. If needed attach additional sheets OR a computer generated copy listing the information below. If you manage or control property as a fiduciary on Jan. 1, also list the names and addresses of each property owner.

Property Description by Type/Category

Property Address or

Address Where Taxable

Estimate of

Quantity of

Each Type

Good Faith |

|

|

Historical |

|

|

|

Estimate of |

OR |

Cost |

AND |

Year |

||

Market Value* |

|

|

When New* |

|

|

Acquired* |

|

|

|

|

|||

|

|

|

|

|

|

|

Property Owner Name/Address

(if you manage or control property as a fiduciary)

SCHEDULE D: VEHICLES AND TRAILERS AND SPECIAL EQUIPMENT

List only vehicles that are licensed in the name of the business as shown on Page 1. Vehicles disposed of after Jan. 1 are taxable for the year and must be listed below. If needed, attach additional sheets OR a computer generated listing of the information below. Report leased vehicles under Schedule F. Leased vehicles must be reported showing the name and address of the owner.

Year

(optional)

Make

(optional)

Model

(optional)

Vehicle Identification Number (VIN)

(optional)

Good Faith |

|

|

Historical Cost |

|

|

|

OR |

AND |

|

||||

Estimate of |

When New* |

Year |

||||

Market Value* |

|

|

(Omit Cents) |

|

|

Acquired* |

|

|

|

|

|

|

|

* Provide an amount for either the good faith estimate of market value, or a historical cost when new and year acquired. If you provided an historical cost when new and year acquired, you need not provide a good faith estimate of market value.

For additional copies, visit: |

Page 2 |

Business Personal Property Rendition of Taxable Property |

Form |

|

|

Account Number _____________________________ |

|

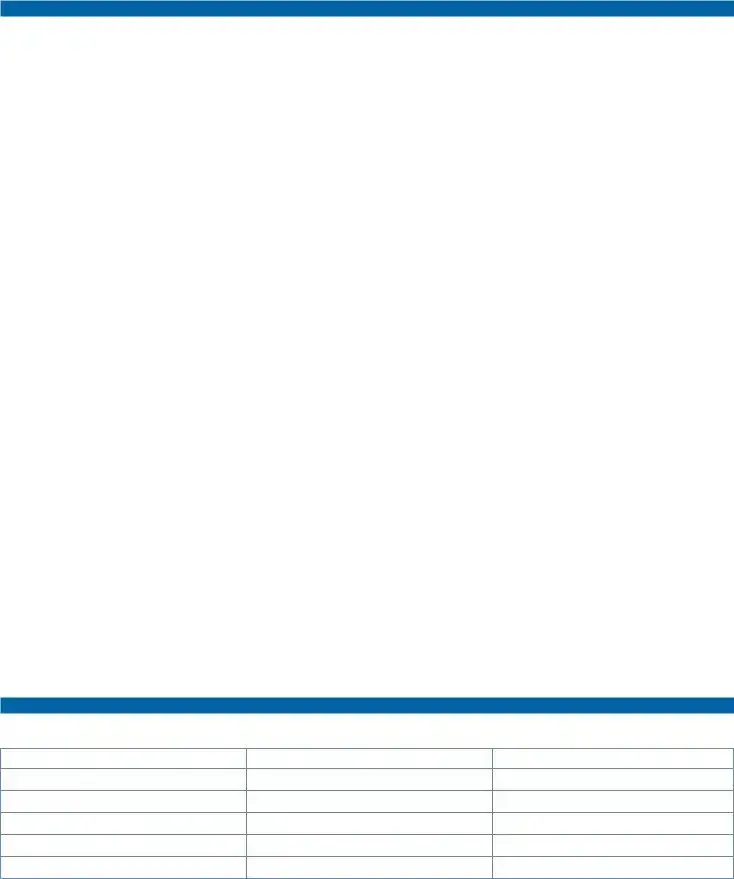

SCHEDULE E: FURNITURE, FIXTURES, MACHINERY, EQUIPMENT, COMPUTERS

Total (by year acquired) all furniture, fixtures, machinery, equipment and computers (new or used) still in possession on Jan. 1. List items received as gifts in the same manner. Attach additional sheets OR a computer generated listing of the information below, as needed.

|

|

Furniture and Fixtures |

|

|

|

|

|

Machinery and Equipment |

|

|

|

Office Equipment |

|

|

|||||||||||||||||||||

|

|

Historical Cost |

|

|

|

|

Good Faith |

|

|

Historical Cost |

|

|

|

|

Good Faith |

|

|

Historical Cost |

|

|

|

|

|

Good Faith |

|||||||||||

Year |

When New* |

|

|

|

OR |

|

Estimate of |

|

Year |

|

When New* |

OR |

|

|

Estimate of |

|

Year |

When New* |

|

OR |

|

|

Estimate of |

||||||||||||

Acquired |

(Omit Cents) |

|

|

|

|

|

|

Market Value* |

|

Acquired |

|

(Omit Cents) |

|

|

|

Market Value* |

|

Acquired |

|

(Omit Cents) |

|

|

|

|

|

Market Value* |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

|

|

|

2008 |

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Computer Equipment |

|

|

|

POS/Servers/Mainframes |

|

|

|

|

|

|

Other (any other items not listed in other schedules) |

||||||||||||||||||||||

|

|

Historical Cost |

|

|

|

|

Good Faith |

|

|

Historical Cost |

|

Good Faith |

|

|

|

|

|

|

Historical Cost |

|

|

Good Faith |

|||||||||||||

Year |

|

When New* |

|

OR |

|

|

Estimate of |

Year |

When New* |

|

OR |

Estimate of |

|

Year |

|

|

|

|

When New* |

|

OR |

|

Estimate of |

||||||||||||

Acquired |

|

(Omit Cents) |

|

|

Market Value* |

Acquired |

(Omit Cents) |

|

Market Value* |

|

Acquired |

|

|

Description |

|

(Omit Cents) |

|

|

Market Value* |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

2021 |

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

& Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE F: PROPERTY UNDER BAILMENT, LEASE, CONSIGNMENT OR OTHER ARRANGEMENT

List the name and address of each owner of taxable property that is in your possession or under your management on Jan. 1 by bailment, lease, consignment or other arrangement. If needed, attach additional sheets OR a

Property Owner’s Name

Property Owner’s Address

General Property Description

*Provide an amount for either the good faith estimate of market value, or a historical cost when new and year acquired. If you provided an historical cost when new and year acquired, you need not provide a good faith estimate of market value.

For additional copies, visit: |

Page 3 |

Business Personal Property Rendition of Taxable Property

Important Information

GENERAL INFORMATION: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year. This report is confidential and not open to public inspection; disclosure is permitted pursuant to the terms of Tax Code Section 22.27.

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable. Do not file this document with the Texas Comptroller of Public Accounts. Contact information for appraisal district offices may be found on the Comptroller’s website.

DEADLINES: Rendition statements and property report deadlines depend on property type. The statements and reports must be delivered to the chief appraiser after Jan. 1 and no later than the deadline indicated below. On written request by the property owner, the chief appraiser shall extend a deadline for filing a rendition statement or property report to May 15. The chief appraiser may further extend the deadline an additional 15 days upon good cause shown in writing by the property owner.

Rendition Statements and Reports |

Deadlines |

Allowed Extension(s) |

|

|

|

|

|

|

|

|

|

|

• May 15 upon written |

|

Property generally |

April 15 |

request |

|

• Additional 15 days for |

|||

|

|

||

|

|

good cause shown |

|

|

|

|

|

Property regulated by the Public Utility |

|

• May 15 upon written |

|

Commission of Texas, the Railroad Commission |

April 30 |

request |

|

of Texas, the federal Surface Transportation |

• Additional 15 days for |

||

Board or the Federal Energy Regulatory |

|

||

Commission. Tax Code Section 22.23(d). |

|

good cause shown |

|

|

|

|

EXEMPTION: A person is entitled to an exemption from taxation of the tangible per- sonal property that is held or used for the production of income if it has less than $2,500 of taxable value (Tax Code Section 11.145).

If an exemption is denied or terminated on a property, the owner must render it for taxation within 30 days from the denial or termination. (Tax Code sections 21.01(a) and 22.02)

PENALTIES: The chief appraiser must impose a penalty on a person who fails to timely file a required rendition statement or property report in an amount equal to 10 percent of the total amount of taxes imposed on the property for that year by taxing units participating in the appraisal district. The chief appraiser must impose an additional penalty on the person equal to 50 percent of the total amount of taxes imposed on the property for the tax year of the statement or report by the taxing units participating in the appraisal district if it is finally determined by a court that:

(1)the person filed a false statement or report with the intent to commit fraud or to evade the tax; or

(2)the person alters, destroys or conceals any record, document or thing, or presents to the chief appraiser any altered or fraudulent record, document or thing, or otherwise engages in fraudulent conduct, for the purpose

of affecting the course or outcome of an inspection, investigation, determination or other proceeding before the appraisal district.

Form

Definitions

Address Where Taxable: In some instances, personal property that is only temporarily at its current address may be taxable at another location (taxable situs). If you know that this is the case, please list the address where taxable.

Consigned Goods: Personal property owned by another person that you are selling by arrangement with that person. If you have consigned goods, report the name and address of the owner in the appropriate blank.

Estimate of Quantity: For each type or category listed, the number of items or other relevant measure of quantity (e.g., gallons, bushels, tons, pounds, board feet).

Fiduciary: A person or institution who manages property for another and who must exercise a standard of care in such management activity imposed by law or contract.

Good Faith Estimate of Market Value: Your best estimate of what the property would have sold for in U.S. dollars on Jan. 1 of the current tax year if it had been on the market for a reasonable length of time and neither you nor the purchaser was forced to buy or sell. For inventory, it is the price for which the property would have sold as a unit to a purchaser who would continue the business.

Historical Cost When New: What you paid for the property when it was new or, if you bought the property used, what the original buyer paid when it was new. If you bought the property used and do not know what the original buyer paid, state what you paid with a note that you purchased it used.

Inventory: Personal property that is held for sale in the ordinary course of a trade or business.

Personal Property: Every kind of property that is not real property; generally, property that is movable without damage to itself or the associated real property.

Property Address: The physical address of the personal property on Jan. 1 of the current tax year. Normally, the property is taxable by the taxing unit where the property is located.

Secured Party: A person in whose favor a security interest is created or provided for under a security agreement; see Business and Commerce Code Section 9.102 for further details.

Security Interest: An interest in personal property or fixtures which secured payment or performance of an obligation see Business and Commerce Code Section 1.201 for further details.

Type/Category: Functionally similar personal property groups. Examples are: furniture, fixtures, machinery, equipment, vehicles and supplies. Narrower groupings such as personal computers, milling equipment, freezer cases and forklifts should be used, if possible. A person is not required to render for taxation personal property appraised under Tax Code Section 23.24.

Year Acquired: The year that you purchased the property, or otherwise acquired.

For additional copies, visit: |

Page 4 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Business Personal Property Rendition of Taxable Property Form 50-144 is designed for reporting tangible personal property used for income production that you own or manage as of January 1st of the tax year. |

| Confidentiality | This form is confidential and not open to public inspection, as per Tax Code Section 22.27, providing privacy for sensitive information. |

| Filing Location | You need to file this form with the appraisal district office in the county where the property resides, not with the Texas Comptroller of Public Accounts. |

| Fiduciary Responsibility | Individuals managing or controlling property on behalf of someone else as fiduciaries must report this on the form under specific sections. |

| Penalties for Late Filing | Failing to file timely results in penalties, including a 10% charge of the total tax imposed for that year, and potentially 50% for fraudulent filings. |

| Exemption Threshold | Property valued below $2,500 can qualify for a tax exemption according to Tax Code Section 11.145. |

| Verification of Information | By signing the form, you affirm that the information provided is accurate and that you're authorized to submit it. |

| Deadline for Submission | Rendition statements must be submitted after January 1st, but no later than April 15th, with extensions available upon request. |

| Sections for Reporting | The form includes multiple sections for reporting various categories of property, such as furniture, machinery, and vehicles, ensuring detailed disclosures. |

Guidelines on Utilizing Business Personal Rendition

Completing the Business Personal Rendition form is essential for reporting tangible personal property that is owned or controlled for income production. Following these steps carefully will ensure your submission is accurate and meets all requirements. Below are the necessary steps to fill out the form effectively.

- Begin with the Tax Year. At the top of the form, fill in the relevant tax year.

- Next, provide the name of your Appraisal District along with the account number, if available.

- In Section 1, enter your Business Name and Business Owner's name. Make sure to provide the complete Property Location address, including City, State, and ZIP Code.

- Include your Email Address and Phone number for easy communication.

- If applicable, select the Ownership Type you wish to report (Individual, Corporation, Partnership, etc.).

- Proceed to Section 2 to indicate how you are representing the property (Owner, Authorized Agent, Fiduciary, or Secured Party). Fill in the Name and Mailing Address of the person filing.

- Specify if you have a security interest in the property with a new cost exceeding $50,000. If yes, attach the required consent document from the property owner.

- If your situation reflects the prior year’s submission exactly, mark the affirmation checkbox in Section 3. Otherwise, leave it blank.

- Section 4 invites you to provide optional Business Information. Include business type, description, and other details relevant to your operations.

- In Section 5, select the total market value of your property, indicating whether it is under or over $20,000. This choice dictates which schedules you will need to complete.

- Complete Section 6 by affirming the accuracy of your information. Sign and date the form. If you are not the property owner, ensure your signature is notarized.

- If applicable, respond to additional questions regarding inventory and usage that may help clarify your reporting. This step is optional but helpful for transparency.

- Once completed, submit the form with any supporting documents to the appropriate appraisal district office. Do not send it to the Texas Comptroller's office.

Following these steps will simplify the process of completing the form and help you fulfill your reporting obligations correctly. Ensure you meet the submission deadlines to avoid any penalties, and retain copies of your documents for your records.

What You Should Know About This Form

What is the Business Personal Rendition Form?

The Business Personal Rendition Form is a document used in Texas to declare the tangible personal property you own or manage for income generation as of January 1 of the current year. It helps the local appraisal district know about the assets you have so they can assess property taxes correctly. This form must be submitted to the appraisal district office in the county where your property is located, not to the Texas Comptroller of Public Accounts.

Who needs to file this form?

If you own or manage tangible personal property for business purposes as of January 1, you need to file this form. This includes individuals, corporations, partnerships, and fiduciaries. If you control property on behalf of someone else, like a trustee, you also have to file. Make sure to complete the form accurately to avoid issues with your tax assessment.

What happens if I don’t file the form on time?

Failing to file the Business Personal Rendition Form by the deadline can lead to penalties. If you don't file on time, a 10 percent penalty of the total taxes due may be added to your bill. If a court finds that you deliberately made a false statement or tried to evade tax, the penalty could increase to 50 percent of the taxes owed. So, it's important to file on time!

Can I get an extension to file the form?

Yes, you can request an extension. The chief appraiser may grant an extension until May 15 if you make a written request. Additionally, they can offer up to 15 more days if you provide a good reason. Always check with your local appraisal district for their specific procedures, as they can vary.

Is the information I provide confidential?

Yes, the information on the Business Personal Rendition Form is confidential. It is not open to public inspection. However, there are circumstances outlined in Texas law that allow for the information to be shared under specific conditions. This ensures that your business assets remain private while still enabling the appraisal district to perform its duties.

Common mistakes

Completing the Business Personal Property Rendition form can be straightforward, but many individuals make common mistakes that may lead to complications. One frequent error is neglecting to provide accurate contact details. It’s essential to fill out your email address and phone number correctly. Inaccurate information can hinder communication with the appraisal district, delaying any necessary follow-ups or clarifications. Ensure your contact information is current to prevent unnecessary obstacles.

Another mistake involves omitting required fields in Section 1, specifically the business name and property location. All critical information needs to be included, as missing or incomplete data may result in the rejection of your submission. Every box must be filled to facilitate a smooth processing of your form. Take the time to review this section thoroughly before submission to avoid unnecessary delays.

Individuals frequently fail to check whether they need to provide additional authorization documents, especially if they are not the property owner but are filing as an authorized agent or fiduciary. If the form is submitted without the necessary consent from the property owner, the appraisal district cannot process it. This oversight can cause significant delays and adds to the burden of filing correctly. Always ensure that you attach required documentation when necessary.

Finally, many people underestimate the importance of adhering to deadlines. Filing deadlines vary, depending on the type of property. Failing to file on time can result in penalties that complicate your tax situation further. Be proactive and mark deadlines on your calendar. Don’t wait until the last minute to send in your form. Completing these steps accurately and on time is crucial for a successful filing experience.

Documents used along the form

The Business Personal Property Rendition form is just one of the documents that business owners and fiduciaries may need to complete when managing tax obligations. To successfully navigate property taxes, several related forms and documents can help clarify asset management and valuation. Here’s a brief overview of these essential documents.

- Texas Sales and Use Tax Permit Application: This document registers a business for sales and use tax collection. It indicates to the state the business's intent to collect taxes on sales made.

- Franchise Tax Report: Required for businesses operating in Texas, this report details the revenue and taxes due for the operation of that business, allowing the state to assess the franchise tax owed.

- Property Tax Exemption Application: This form is used to request an exemption for certain types of personal property, including items that may not exceed a specific value threshold.

- Business License Application: Most businesses need a license to operate legally. This application ensures the business complies with local regulations and zoning laws.

- Certificate of Formation: This document officially establishes a business entity in Texas. It includes important details such as the business name, address, and ownership structure.

- Warranty Deed: If real property is involved, this legal document transfers ownership from one party to another and is critical for defining any property used for business operations.

- Lease Agreement: This document outlines the terms under which a property is rented. Business owners often use it to clarify responsibilities between landlords and tenants.

- Equipment Financing Agreement: This contract is essential if a business acquires equipment through financing. It details the terms of the loan and the responsibilities of each party.

- Annual Financial Statements: These statements provide a financial picture of the business, including income, expenses, and assets. They are often necessary for loans or investment applications.

Understanding the related forms and documents is crucial for any business. Properly completing and submitting these documents not only keeps a business compliant but also helps avoid potential penalties associated with property tax issues. By being thorough and timely, business owners can better manage their obligations and focus on growth.

Similar forms

The Business Personal Rendition form is important for businesses to report their personal property for tax purposes. It has similarities with several other documents commonly used in business and tax processes. Here’s a look at four documents that share similar characteristics with the Business Personal Rendition form:

- Property Tax Exemption Application: Like the Business Personal Rendition, this form is submitted to local appraisal districts. Both documents aim to determine property values and assess eligibility for tax exemptions. They require detailed information about the property owner and the assets being declared.

- Business Personal Property Tax Return: This return is filed annually and outlines the value of personal property owned by a business, similar to the rendition form. Both documents require a listing of tangible personal property, including descriptions, costs, and current values.

- Inventory Report: Much like the rendition form, an inventory report documents the quantity and value of goods held for sale. It provides an in-depth view of the company’s assets, helping assess their financial standing, similar to how the rendition aids in tax assessments.

- Sales Tax Permit Application: This document requires details about the business and its ownership. Similarly, the rendition form captures crucial business information for tax purposes. Both are essential for maintaining compliance with state tax laws, ensuring proper reporting and potential exemptions.

Dos and Don'ts

When filling out the Business Personal Rendition form, it's crucial to get it right to avoid any errors that could lead to penalties or delays. Here’s a list to guide you. Follow these dos and don’ts to ensure smooth sailing.

- Do provide accurate and complete information to avoid penalties.

- Do file the form with the appropriate appraisal district office.

- Do double-check your contact details for any errors.

- Do confirm your business ownership type and include any partners or authorized agents.

- Do wait until after January 1 to file your form, considering any property changes.

- Don't submit this document to the Texas Comptroller of Public Accounts.

- Don't forget to attach any required consent documents if you're filing on behalf of someone else.

- Don't leave any sections blank unless explicitly stated as optional.

- Don't underestimate your property’s value; a miscalculation can lead to serious penalties.

By keeping these points in mind, you can navigate the process with confidence. Filing your Business Personal Rendition accurately not only preserves your business's integrity but also keeps you in good standing with the tax authorities.

Misconceptions

- Misconception 1: The Business Personal Rendition form is not necessary if my business is small.

- Misconception 2: Filing this form is the same as filing taxes.

- Misconception 3: The information I provide will be publicly accessible.

- Misconception 4: It's fine to submit the form late without consequences.

- Misconception 5: I can file this form with the state instead of the local appraisal district.

Many believe that if their business operates on a small scale or has minimal assets, filing this form is unnecessary. However, any business with tangible personal property used for income production must file, regardless of size. Ignoring this requirement can lead to penalties.

Some individuals think that submitting the Business Personal Rendition form is equivalent to filing their annual tax return. In reality, this form specifically details the business’s assets, while tax returns involve income, deductions, and overall tax liability.

Many worry about the privacy of their business information. Contrary to this belief, the details submitted on the Business Personal Rendition form are confidential. They are protected by law, and only authorized personnel may view them according to specified regulations.

Some assume that late submissions will not incur any penalties. In fact, missing the deadline can result in significant financial penalties, potentially impacting the business’s budget and future plans. Timely filing is crucial to avoid these drawbacks.

A common mistake is thinking that the form can be sent to the Texas Comptroller of Public Accounts. In truth, it must be filed with the local appraisal district in the county where the property is taxable. Sending it elsewhere will delay processing and lead to complications.

Key takeaways

Filling out the Business Personal Rendition form accurately is essential for compliance with tax regulations. Here are some key takeaways to consider:

- Purpose of the Form: This form is used to report tangible personal property that generates income as of January 1 of the tax year.

- Who Should File: Owners, employees, authorized agents, fiduciaries, or secured parties may submit this form.

- Filing Location: Submit the completed form to your county's appraisal district office, not the Texas Comptroller.

- Deadlines: The filing must occur by designated deadlines. Generally, this is after January 1 and no later than April 15, unless an extension has been granted.

- Market Value Assessment: Determine the total market value of your property, noting if it's under or over $20,000, which affects the schedules you need to complete.

- Secure Proper Consent: If filing as a secured party, obtain and attach the property owner’s consent to validate the rendition.

- Rendition Accuracy: Ensure that the information provided is true and accurate. False statements may lead to serious legal penalties.

- Property Exemptions: If the property held for income production is valued at less than $2,500, it may be exempt from taxation.

- Keep Records: Maintain documentation related to your personal property for reference and potential audits.

- Legal Consequences: Be aware of the penalties associated with late filing or inaccurate reporting, which can result in significant fines.

By understanding these key points, individuals can effectively navigate the requirements of the Business Personal Rendition form and ensure compliance with relevant tax laws.

Browse Other Templates

General Excise Tax Reconciliation Form,Hawaii Business Tax Summary,Annual Tax Return for Hawaii Businesses,Hawaii General Excise Reporting,Tax Year Reconciliation Form,Excise and Use Tax Annual Submission,Hawaii Tax Reconciliation Statement,Business - If no activities occurred, taxpayers must still report zero income on the form.

Uniform Custody - Each child's circumstances are considered independently and thoroughly.