Fill Out Your Business Registration Certificate Form

Starting a business can be an exciting endeavor, but it also requires adherence to specific regulations to ensure compliance with local laws. One essential component in this process is obtaining a Business Registration Certificate, particularly in Barry County, Michigan. This form is vital for anyone wishing to operate under an assumed name and signifies the formal acknowledgment of your business within the community. The certificate captures important details, such as the business and mailing addresses, the type of business being conducted, and key contact information like phone and fax numbers. Additionally, it requires the name and address of the person responsible for managing the business. Verification of the information is crucial; thus, a notary public must witness the signature, giving your registration official status. As you fill out this form, it’s important to pay attention to the legal requirements, including the expiration date and compliance with the provisions set forth by the state. Understanding these aspects can help set a solid foundation for your business and keep you informed as you navigate the registration process.

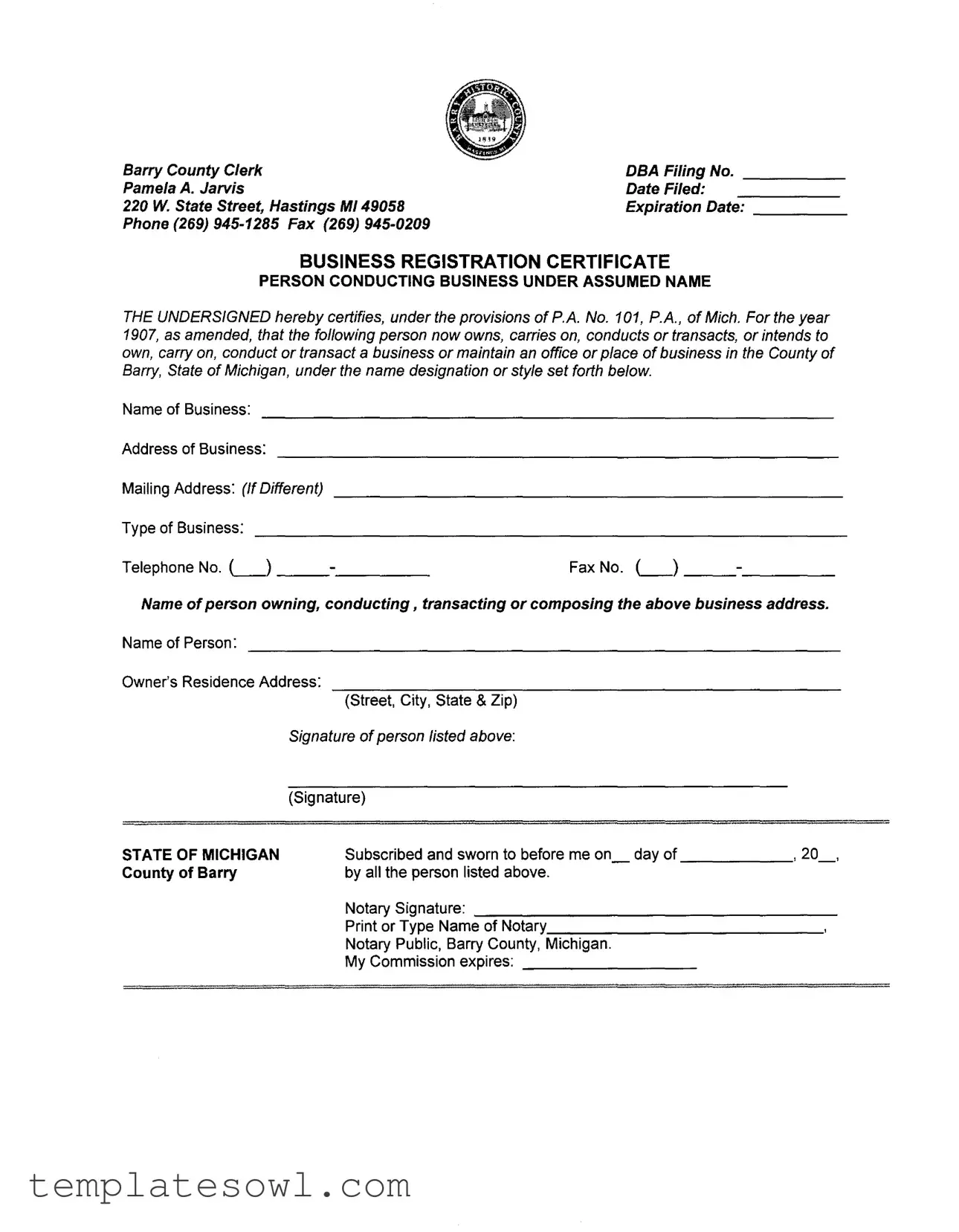

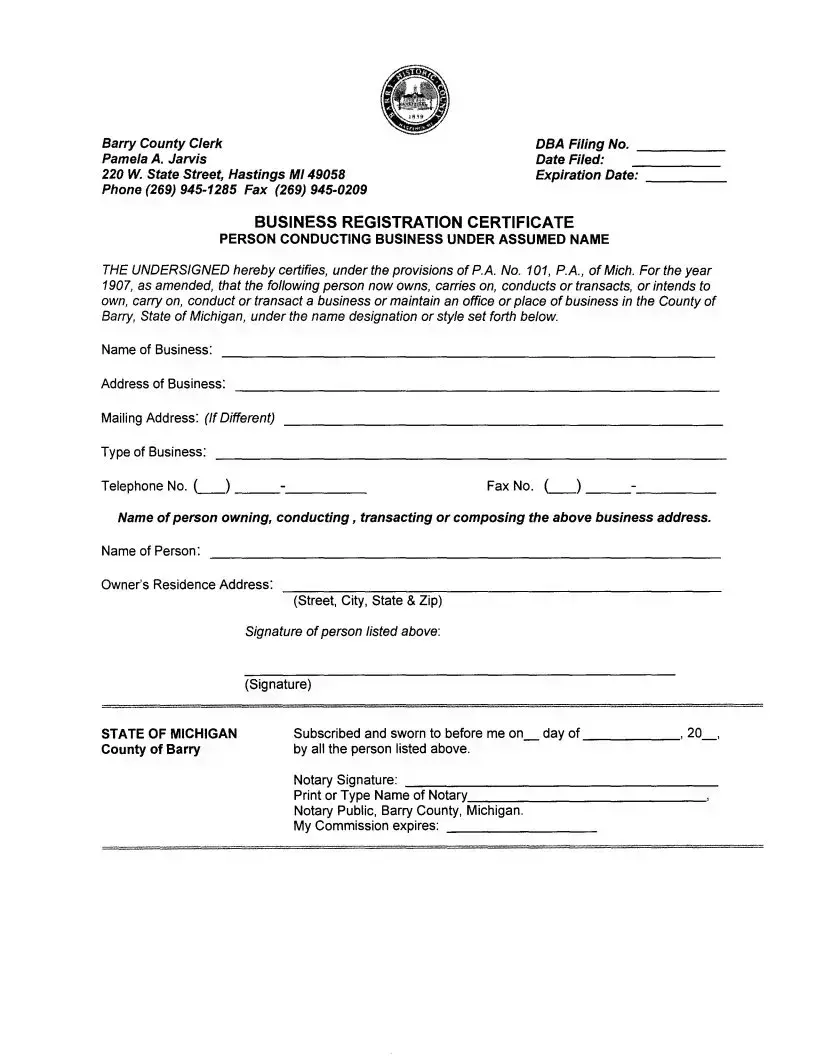

Business Registration Certificate Example

Barry County Clerk |

DBA Filing No. _____ |

Pamela A. Jarvis |

Date Filed: |

220 W. State Street, Hastings MI49058 |

Expiration Date: _____ |

Phone (269) |

|

BUSINESS REGISTRATION CERTIFICATE

PERSON CONDUCTING BUSINESS UNDER ASSUMED NAME

THE UNDERSIGNED hereby celtifies, under the provisions of P.A. No. 101, P.A., of Mich. For the year 1907, as amended, that the fol/owing person now owns, carries on, conducts or transacts, or intends to own, carry on, conduct or transact a business or maintain an office or place of business in the County of Barry, State of Michigan, under the name designation or style set folth below.

Name of Business:

Address of Business:

Mailing Address: (If Different)

Type of Business:

Telephone No. セI@ |

_ |

Fax No. セI@ |

_ |

Name of person owning, conducting, transacting or composing the above business address.

Name of Person:

Owner's Residence Address:

(Street, City, State & Zip)

STATE OF MICHIGAN County of Barry

Signature of person listed above:

(Signature)

Subscribed and sworn to before me on_ day of ______, 20_,

by all the person listed above.

Notary Signature: ⦅セ@ |

_ |

Print or Type Name of nッエ。イケZMZMZMセ@ |

_ |

Notary Public, Barry County, Michigan. |

|

My Commission expires: |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Business Registration Certificate allows individuals to legally conduct business under an assumed name in Barry County, Michigan. |

| Governing Law | This certificate falls under the provisions of P.A. No. 101, P.A. of Michigan, 1907, as amended. |

| Filing Location | Completed forms must be filed at the Barry County Clerk's office located at 220 W. State Street, Hastings, MI 49058. |

| Expiration Date | The certificate includes an expiration date, which establishes the duration for which the registration is valid. |

| Information Required | The form requires details such as the business name, type of business, addresses, and contact information. |

| Signature Requirement | A signature from the person conducting the business is mandatory before filing. |

| Notary Requirement | The certificate must be notarized, affirming the authenticity of the signatory's declaration. |

| Owner's Information | Details about the owner, including their residence address, must be provided on the form. |

| Fees | There may be a fee associated with filing the Business Registration Certificate in Barry County. |

| Renewal Process | Business owners should ensure they are aware of the renewal process, as the certificate may need to be refiled upon expiration. |

Guidelines on Utilizing Business Registration Certificate

After gathering the necessary information, you are ready to fill out the Business Registration Certificate form. Be precise with each entry to ensure the application is processed smoothly.

- Begin by locating the section at the top of the form, where it says BARRY COUNTY CLERK DBA FILING NO.. Enter your filing number if you have one.

- In the DATE FILED section, write today’s date.

- Next, find the ADDRESS section. Fill in your business's registered address at 220 W. State Street, Hastings, MI 49058.

- Record the EXPIRATION DATE if applicable; otherwise, leave it blank.

- Complete the PHONE section with your phone number, making sure to include the area code.

- If you have a fax number, write it in the FAX section. Otherwise, this can be left blank.

- In the NAME OF BUSINESS section, enter the business name you are registering.

- Provide the ADDRESS OF BUSINESS (if different from the registered address), ensuring accuracy.

- If your mailing address differs from the business address, enter it in the MAILING ADDRESS section.

- Indicate the TYPE OF BUSINESS by specifying the nature of your business activities.

- List your TELEPHONE NUMBER here as well.

- Fill in the FAX NUMBER if applicable. Otherwise, leave this section blank.

- Next, in the section labeled NAME OF PERSON, enter the name of the individual owning or conducting the business.

- Provide the OWNER'S RESIDENCE ADDRESS in the format of street, city, state, and zip code.

- Sign in the indicated area next to the SIGNATURE OF PERSON LISTED ABOVE.

- Locate the notary section at the bottom. A notary public must witness your signature. Fill out the date as required.

- Provide the name of the notary public in the PRINT OR TYPE NAME OF NOTARY PUBLIC section.

- Finally, confirm the MY COMMISSION EXPIRES section if necessary and leave it blank if it does not apply.

What You Should Know About This Form

What is a Business Registration Certificate?

A Business Registration Certificate is an official document that allows individuals or organizations to conduct business under a specific assumed name in Barry County, Michigan. This certificate ensures that the business operates legally within the county and serves as proof of registration for any associated legal or financial transactions. Obtaining this certificate is an important step for anyone looking to establish a legitimate business presence in the area.

Who needs to fill out the Business Registration Certificate form?

Any individual or entity planning to operate a business under an assumed name in Barry County must complete the Business Registration Certificate form. This includes sole proprietors, partnerships, and corporations. Anyone conducting business activities that differ from their legal name is required to file this form to ensure compliance with local regulations.

Where can I obtain the Business Registration Certificate form?

The Business Registration Certificate form can be obtained from the Barry County Clerk's office. Alternatively, it may also be available on the county's official website. Be sure to check for any specific instructions or downloadable forms that may be provided for convenience.

What information is required on the Business Registration Certificate form?

The form requires several pieces of information, including the name and address of the business, a mailing address if different, the type of business, and contact details like a phone number and fax number. Additionally, the name of the individual or entity owning the business must be included, along with their residence address. It is essential that all information is accurate and complete.

How long is the Business Registration Certificate valid?

The Business Registration Certificate generally has an expiration date that will be indicated on the form. It is important for business owners to be aware of this date, as the certificate must be renewed periodically to maintain compliance. Failure to renew might result in penalties or the inability to conduct business legally under the assumed name.

What should I do if my business information changes?

If there are any changes to your business information, such as a new address, name change, or alterations in ownership, it is crucial to update the Business Registration Certificate. This can often be done by filing an amendment with the Barry County Clerk's office. Keeping your records current helps avoid potential legal issues down the line.

Is there a fee for filing the Business Registration Certificate form?

Yes, there is typically a fee associated with filing the Business Registration Certificate form. The amount varies and may be subject to change, so it is advisable to confirm the current fee with the Barry County Clerk's office before submitting your application.

Do I need to have my form notarized?

Yes, the Business Registration Certificate form must be notarized. This step is crucial, as it adds a layer of authenticity and verifies that the information provided is accurate. Be sure to sign the form in the presence of a licensed notary public to maintain the validity of your registration.

Common mistakes

Filling out a Business Registration Certificate is an essential step for anyone looking to establish a business. However, common mistakes can lead to delays or even rejected applications. One frequent error is leaving sections blank. This includes vital information like the name of the business or the owner's residence address. Each field should be filled out completely. Omitting details may result in the entire application being sent back.

Another misstep occurs when individuals choose an outdated or incorrect name for their business. The business name must reflect what will actually be used in operations. A name that does not match or is already in use can cause confusion and hinder the registration process. Before filing, it’s crucial to ensure that the desired name is unique and compliant with local regulations.

Failing to provide accurate contact information is a problem that can sometimes go unnoticed until it is too late. This means ensuring that both the telephone and fax numbers are correct. If there are any errors, it can prevent the county clerk’s office from reaching the applicant for any follow-up questions or issues. Miscommunication can stall the registration or lead to complications down the line.

Inaccurate dates are often overlooked. When filling out the signature section, applicants should pay close attention to the date they are signing. It’s easy to mistakenly enter the wrong year or date, particularly in a busy moment. This can cause confusion regarding the application timeline and potentially postpone the processing of the certificate.

Finally, many neglect the notary requirements. An unsigned or improperly notarized form invalidates the application. All signatures need to be completed, and the notary section must be filled out correctly. Before submitting, double-checking that every signature is in place and that the notary has properly executed their role can save a great deal of time and frustration.

Documents used along the form

When starting a business, obtaining a Business Registration Certificate is just one of the necessary steps. Several other documents may also be required to ensure compliance with state and local regulations. Here’s a breakdown of some commonly used forms that often accompany the Business Registration Certificate.

- Operating Agreement: This document outlines the management structure and operational procedures of a limited liability company (LLC). It helps clarify roles and responsibilities among members and can prevent disputes down the line.

- Employer Identification Number (EIN): Issued by the IRS, this number allows businesses to operate legally and hire employees. It’s essential for tax purposes and can be used to open a business bank account.

- Business License: Depending on the nature of the business and its location, obtaining a local or state business license may be necessary. This license permits the business to operate legally within a particular jurisdiction.

- Sales Tax Permit: If the business sells products or services subject to sales tax, a sales tax permit may be required. This document enables the collection of sales tax on behalf of the state.

- Zoning Permit: To ensure that the business location complies with local zoning laws, a zoning permit may be required. This is particularly important for physical storefronts or operations that may impact the surrounding area.

- Fictitious Name Certificate: Also known as a "Doing Business As" (DBA) certificate, this document allows a business to operate under a name different from its legal business name. It’s often necessary if the business wants to market itself under a unique name.

- Partnership Agreement: For businesses formed as partnerships, this agreement outlines the terms of the partnership. It details each partner's contributions, responsibilities, and how profits and losses will be shared.

- Bylaws: Nonprofits and corporations often require bylaws. These rules govern the organization’s operations, including how meetings are conducted and how decisions are made.

- Resale Certificate: This certificate allows a business to purchase goods for resale without paying sales tax. It's crucial for businesses that buy products to sell to customers.

Gathering all necessary forms and documents can seem overwhelming, but understanding the requirements can make the process smoother. Each of these documents plays a vital role in establishing and maintaining a lawful business operation.

Similar forms

- Articles of Incorporation: This document serves as the foundation for establishing a corporation. Similar to a Business Registration Certificate, it requires detailed information about the business, such as its name, principal address, and the name of its owners or directors. Both documents must be filed with a government authority to ensure legal recognition of the business entity.

- Assumed Name Certificate (DBA Filing): When a business operates under a name different from its legal name, it files an Assumed Name Certificate, or "Doing Business As" (DBA) filing. Like the Business Registration Certificate, this document includes details about the business owner and the name under which the business will operate. Both documents help protect consumers by ensuring they know who they are dealing with.

- Business License: A Business License grants permission to operate within a particular jurisdiction. While the Business Registration Certificate announces the existence of the business and its operational scope, the Business License permits the business to engage in activities governed by local regulations. Each document is essential for compliance with legal requirements and often has a similar application process.

- Operating Agreement (for LLCs): This document outlines the management structure and operating procedures of a limited liability company (LLC). Like the Business Registration Certificate, it is vital for establishing the legitimacy of the business and involves key information regarding ownership and management. Both documents play a role in defining the rights and responsibilities of those involved in the business.

Dos and Don'ts

Filling out the Business Registration Certificate form correctly is essential for ensuring your business is legally recognized. Here are ten things to keep in mind.

- Do: Use clear and legible handwriting or type the form to avoid any misinterpretations.

- Do: Check all relevant boxes and provide all requested information to ensure completeness.

- Do: Double-check the name of the business and make sure it matches with your planned business operations.

- Do: Include both your business address and mailing address, if they differ, for accurate communication.

- Do: Sign the form where indicated, as an unsigned document will not be valid.

- Don't: Leave any fields blank; incomplete forms can delay the registration process.

- Don't: Use abbreviations or informal names that could confuse the registration office.

- Don't: Forget to include your personal information, as it is necessary to identify the owner.

- Don't: Submit the form without reviewing it for any spelling or grammatical errors.

- Don't: Neglect to obtain the notary's signature; this is a required step for validation.

Misconceptions

Understanding the Business Registration Certificate form can prevent confusion and ensure compliance. Here are five common misconceptions:

- It's only for new businesses. Many believe the form is necessary only for brand-new enterprises. However, even existing businesses must file if they operate under a different name.

- Filing guarantees legal protection of the business name. While registering helps establish your business name, it does not provide trademark protection. Separate trademark registration is needed for that.

- All businesses need a Business Registration Certificate. Not all businesses are required to register. Sole proprietorships without a distinct name may not need to file this certificate.

- The certificate lasts indefinitely. Misunderstanding can occur regarding the expiration date. The certificate must be renewed periodically, as it does not remain valid forever.

- Anyone can notarize the form. It's a common mistake to think any notary can validate the application. Ensure the notarization is done by someone authorized in the jurisdiction where your business operates.

Key takeaways

Filling out the Business Registration Certificate form accurately is essential for ensuring your business operates legally and efficiently. Here are some key takeaways to consider when completing and utilizing this form:

- Accurate Information is Crucial: Ensure that all the details—such as the business name, address, and type of business—are filled out correctly. Any discrepancies could lead to delays in processing.

- Review the Expiration Date: Pay close attention to the expiration date noted on the form. Knowing this will help you manage timely renewals and keep your business compliant.

- Required Signatures: The individual who owns or operates the business must sign the form. This verifies that the information provided is accurate and true.

- Understand Notarization: The signature on the form must be notarized for it to be valid. This step helps authenticate the identity of the signer and adds credibility to the document.

- Keep Copies: It’s wise to retain copies of the completed form and any associated documents. These records will be beneficial for future reference and may be required for other applications or registrations.

- Stay Informed About Local Regulations: Check for any specific local requirements in Barry County. Certain businesses might have additional filing needs or regulations that must be followed.

- Utilize Contact Information: Use the provided contact details if you have questions or need assistance while filling out the form. The office of the Barry County Clerk can offer guidance and support.

Following these takeaways will promote a smoother registration process, helping to ensure that your business is properly established and runs without unnecessary hiccups.

Browse Other Templates

Requirements for Open Work Permit in Canada - A separate work permit is required for each job a minor takes.

Trucking Companies With Lease Purchase - This agreement is designed to protect the interests of both the Carrier and the Owner Operator.

Proof Approval Form - Return forms in a timely manner to avoid delays.