Fill Out Your Business To Employee Example Form

For employers, navigating the intricacies of labor law compliance is crucial, and the Business To Employee Example form serves as an essential tool in this process. This form must detail substantial information about the employer and employee, including the employee's name, start date, and the legal name of the hiring employer. An important aspect of the form is identifying whether the hiring employer operates as a staffing agency or similar business. Additionally, wage information is fundamental, outlining pay rates and overtime policies, while employers must specify if there exists a written agreement detailing these pay rates. It also addresses allowances claimed under minimum wage laws. Worker’s compensation insurance details are required, ensuring employees know how to access benefits if needed. Moreover, the form highlights paid sick leave entitlements, emphasizing rights against retaliation for employees exercising these rights. The optional acknowledgment of receipt serves to document the employee's awareness of this information. Employers are also obligated to communicate any changes to this information promptly, further underscoring the form's importance as a compliance measure. Understanding these components can ultimately strengthen the employer-employee relationship while ensuring adherence to legal requirements.

Business To Employee Example Example

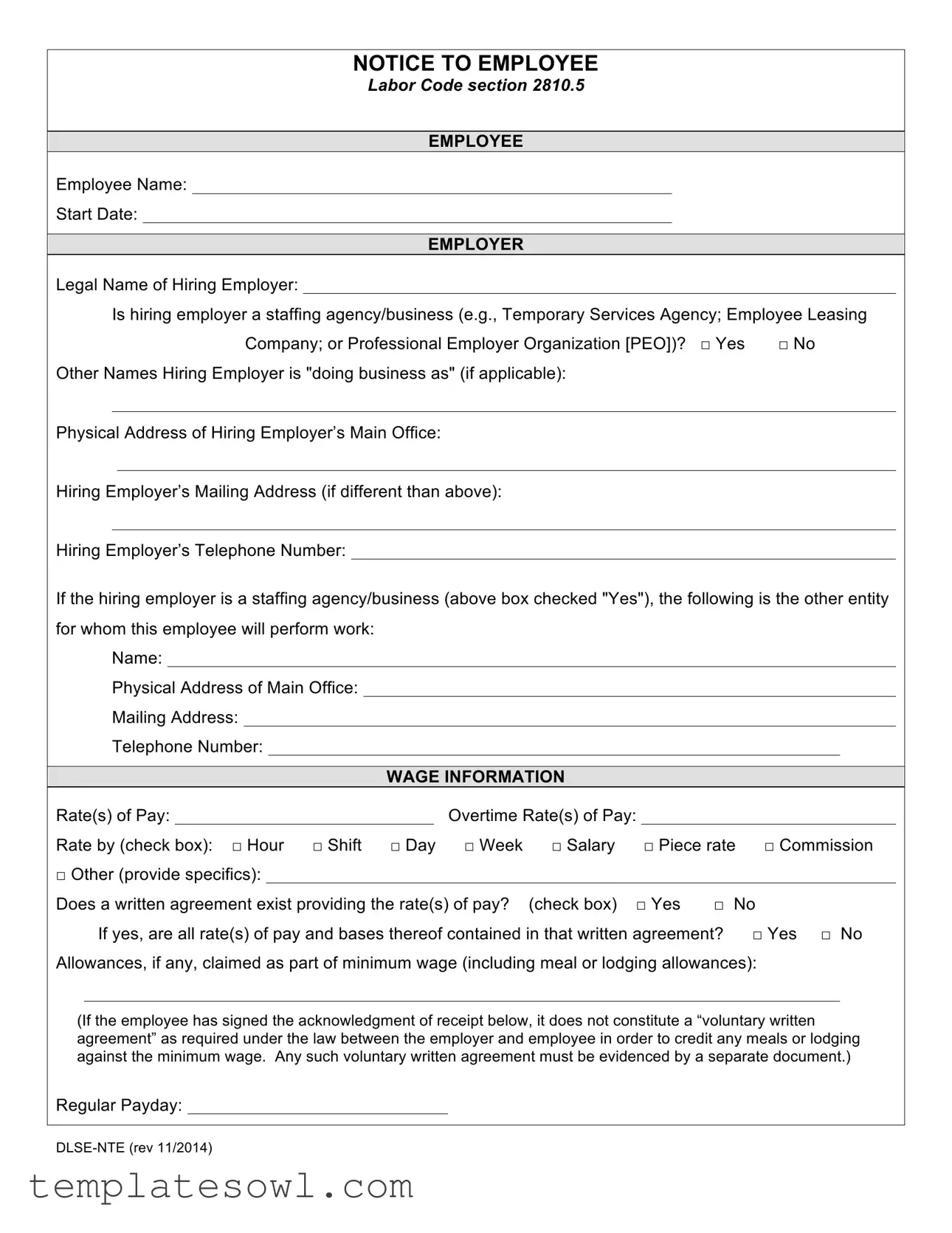

NOTICE TO EMPLOYEE

LABOR CODE SECTION 2810.5

EMPLOYEE

Employee Name:

Start Date:

EMPLOYER

Legal Name of Hiring Employer:

Is hiring employer a staffing agency/business (e.g., Temporary Services Agency; Employee Leasing Company; or Professional Employer Organization [PEO])? □ Yes □ No

Other Names Hiring Employer is "doing business as" (if applicable):

Physical Address of Hiring Employer’s Main Office:

Hiring Employer’s Mailing Address (if different than above):

Hiring Employer’s Telephone Number:

If the hiring employer is a staffing agency/business (above box checked "Yes"), the following is the other entity for whom this employee will perform work:

Name:

Physical Address of Main Office:

Mailing Address:

Telephone Number:

|

|

|

WAGE INFORMATION |

|

||

Rate(s) of Pay: |

|

|

Overtime Rate(s) of Pay: |

|

|

|

Rate by (check box): □ Hour |

□ Shift □ Day □ Week □ Salary □ Piece rate □ Commission |

|||||

□ Other (provide specifics): |

|

|

|

|

|

|

Does a written agreement exist providing the rate(s) of pay? (check box) □ Yes |

□ |

No |

If yes, are all rate(s) of pay and bases thereof contained in that written agreement? |

□ Yes □ No |

|

Allowances, if any, claimed as part of minimum wage (including meal or lodging allowances):

(If the employee has signed the acknowledgment of receipt below, it does not constitute a “voluntary written agreement” as required under the law between the employer and employee in order to credit any meals or lodging against the minimum wage. Any such voluntary written agreement must be evidenced by a separate document.)

Regular Payday:

WORKER’S COMPENSATION

Insurance Carrier’s Name: _________________________________________________________________

Address: ______________________________________________________________________________

Telephone Number: _____________________________________________________________________

Policy No.: ____________________________

□

PAID SICK LEAVE

Unless exempt, the employee identified on this notice is entitled to minimum requirements for paid sick leave under state law which provides that an employee:

a.May accrue paid sick leave and may request and use up to 3 days or 24 hours of accrued paid sick leave per year;

b.May not be terminated or retaliated against for using or requesting the use of accrued paid sick leave; and

c.Has the right to file a complaint against an employer who retaliates or discriminates against an employee for

1.requesting or using accrued sick days;

2.attempting to exercise the right to use accrued paid sick days;

3.filing a complaint or alleging a violation of Article 1.5 section 245 et seq. of the California Labor Code;

4.cooperating in an investigation or prosecution of an alleged violation of this Article or opposing any policy

or practice or act that is prohibited by Article 1.5 section 245 et seq. of the California Labor Code.

The following applies to the employee identified on this notice: (Check one box)

□1. Accrues paid sick leave only pursuant to the minimum requirements stated in Labor Code §245 et seq. with no other employer policy providing additional or different terms for accrual and use of paid sick leave.

□2. Accrues paid sick leave pursuant to the employer’s policy which satisfies or exceeds the accrual, carryover, and use requirements of Labor Code §246.

□3. Employer provides no less than 24 hours (or 3 days) of paid sick leave at the beginning of each

□4. The employee is exempt from paid sick leave protection by Labor Code §245.5. (State exemption and specific subsection for exemption):_________________________________________________________________

ACKNOWLEDGEMENT OF RECEIPT

(Optional)

_______________________________________ |

______________________________________ |

(PRINT NAME of Employer representative) |

(PRINT NAME of Employee) |

_______________________________________ |

______________________________________ |

(SIGNATURE of Employer Representative) |

(SIGNATURE of Employee) |

_______________________________________ |

______________________________________ |

(Date) |

(Date) |

The employee’s signature on this notice merely constitutes acknowledgement of receipt.

Labor Code section 2810.5(b) requires that the employer notify you in writing of any changes to the information set forth in this Notice within seven calendar days after the time of the changes, unless one of the following applies: (a) All changes are reflected on a timely wage statement furnished in accordance with Labor Code section 226; (b) Notice of all changes is provided in another writing required by law within seven days of the changes.

Form Characteristics

| Fact Name | Description |

|---|---|

| Employee Notification Requirement | Employers must notify employees in writing about specifics such as pay rates and rights concerning paid sick leave. |

| Paid Sick Leave Accrual | Employees may accrue paid sick leave under California Labor Code §245 et seq., which allows for at least 3 days or 24 hours annually. |

| Employee Rights | Employees cannot be terminated or retaliated against for using accrued sick leave or for filing complaints related to sick leave violations. |

| Written Agreement | If a written agreement exists regarding pay rates, it must clearly state all rates and their bases as required by California Labor Code §2810.5. |

| Change Notification | Changes to the information provided in the notice must be communicated to the employee in writing within seven calendar days, unless specific conditions are met. |

Guidelines on Utilizing Business To Employee Example

Filling out the Business To Employee Example form requires attention to detail and accurate information. Following these steps carefully will help ensure that all necessary details are included and that the process proceeds smoothly.

- Employee Information: Start by entering the employee's name and their start date in the designated fields.

- Employer Information: Fill in the legal name of the hiring employer. Indicate whether the employer is a staffing agency by checking "Yes" or "No." If applicable, list any other names that the hiring employer is operating under.

- Addresses and Contact: Provide the physical and mailing addresses of the hiring employer’s main office. Make sure to include the hiring employer’s telephone number as well.

- Staffing Agency Details: If the employer is a staffing agency, fill out the additional entity information where the employee will be performing work. Include the entity's name, physical address, mailing address, and telephone number.

- Wage Information: Record the rate(s) of pay along with the overtime rate(s). Select the appropriate method of payment by checking the relevant box (hourly, salary, etc.).

- Written Agreement: Indicate whether a written agreement exists regarding the rate(s) of pay and confirm if all details are included in that agreement.

- Allowances: If applicable, state any allowances claimed as part of minimum wage, such as meal or lodging allowances.

- Regular Payday: Specify the regular payday for the employee.

- Worker’s Compensation: Provide the name of the insurance carrier, their address, telephone number, and the policy number. If self-insured, include the certificate number as well.

- Paid Sick Leave: Check one box to indicate the employee's entitlement regarding paid sick leave based on the different options provided.

- Acknowledgement of Receipt: If desired, fill out the optional acknowledgment section by printing and signing the names of both the employer and employee, along with the dates.

What You Should Know About This Form

What is the purpose of the Business To Employee Example form?

This form serves as a written notice to employees about their wages, benefits, and rights under California law. It ensures that employees are informed about their pay rates, sick leave entitlements, and other important workplace information, all in accordance with Labor Code Section 2810.5.

Who is required to provide this notice to employees?

Employers in California must provide this notice to all employees, including those hired through staffing agencies or temporary services. If an employer is a staffing agency or similar business, they must also include the details of the entity for which the employee will work.

What information must be included in the form?

The form must contain essential details such as the employee's name, start date, employer name, contact information, rate(s) of pay, overtime rates, and information about paid sick leave. It is designed to ensure transparency regarding the employee's employment terms.

What are the rights of employees concerning paid sick leave?

Employees are entitled to a minimum amount of paid sick leave under California law. They can accrue up to three days or 24 hours of paid sick leave per year and cannot be retaliated against for using this leave. Additionally, employees have the right to file a complaint if they experience retaliation due to requesting or using accrued sick days.

What should I do if the information on the form changes?

If there are any changes to the information provided on the form, the employer is obligated to notify the employee in writing within seven calendar days of the change. This notification can be included in an updated wage statement or another required writing.

Is employee acknowledgment required?

Common mistakes

One common mistake people make when filling out the Business To Employee Example form is forgetting to complete all required fields. Each section, including the employee’s name, start date, and employer’s information, must be accurately filled in. Omitting this information can lead to delays in processing or even legal complications. It is essential to cross-check that no important detail is missing before submission.

Another frequent error involves checking the wrong box regarding the employer type. If the hiring employer is a staffing agency or similar entity, this must be marked correctly. Misclassification can result in misunderstandings about the nature of employment, impacting wage calculations and employees’ rights under the law. Therefore, review and confirm the accurate selection before proceeding.

People also sometimes neglect to provide a clear understanding of wage information. Specifically, this includes failing to specify the rate(s) of pay, overtime rates, and the basis for compensation. Each of these elements is crucial for transparency and for ensuring compliance with state regulations. Ensure that all relevant information regarding pay is straightforward and clearly documented.

A significant oversight occurs when individuals do not check if a written agreement exists regarding the pay rate. This agreement is necessary for the employee's protection, and without it, there may be disputes regarding compensation. Confirm whether an agreement exists and ensure all rate(s) of pay are thoroughly and accurately represented in that document.

Finally, another mistake involves misunderstanding or inaccurately conveying the employee's rights regarding paid sick leave. Each box must be carefully considered and checked according to the employee's specific situation. If wrong information is recorded, it can lead to noncompliance with labor laws and ultimately affect employee satisfaction and retention. Pay careful attention to the sick leave policies to avoid these potential pitfalls.

Documents used along the form

When completing the Business To Employee Example form, several other documents are often necessary for a comprehensive processing of employment information. Below is a list of commonly used forms that can facilitate this process and ensure that both parties are well-informed.

- Employee Handbook: This document outlines the policies, procedures, and expectations that govern employee behavior and company standards. It serves as a guide for employees regarding company culture, disciplinary measures, and employee rights.

- W-4 Form: Used by employees to indicate their tax situation to the employer. This form helps employers withhold the correct federal income tax from employees’ wages, considering factors like marital status and number of allowances claimed.

- Direct Deposit Form: This document allows employees to authorize their employer to deposit wages directly into their bank accounts. It simplifies payroll processes and ensures timely payment for employees.

- Non-Disclosure Agreement (NDA): This agreement protects confidential information shared between the employer and the employee. By signing, the employee commits to keeping proprietary information and trade secrets private during and after their employment.

- Emergency Contact Form: This form gathers essential contact information in case of an emergency involving the employee. It ensures that the employer can quickly reach family members or other designated individuals if needed.

- I-9 Form: This is a federal form that employers must complete to verify the identity and employment authorization of their employees. It is a crucial part of complying with immigration laws and helps prevent employment of individuals who are not legally authorized to work in the U.S.

Collecting these documents alongside the Business To Employee Example form helps lay a solid foundation for employee engagement and compliance with legal requirements. It's important to ensure all paperwork is completed accurately to foster a smooth employment relationship.

Similar forms

- Employee Handbook: Similar to the Business To Employee Example form, an employee handbook contains essential information regarding employee rights and benefits, job responsibilities, and workplace policies. It serves as a comprehensive guide for employees to understand the company’s expectations, just as the notice informs employees about their employment terms and conditions.

- Offer Letter: An offer letter outlines the terms of employment, including salary, benefits, and job responsibilities. In many ways, it parallels the Business To Employee Example form by formalizing the employer-employee relationship and providing necessary details about compensation and roles within the company.

- Payroll Information Form: This document collects employees' personal and financial information for accurate payroll processing. Like the Business To Employee Example form, it includes details about wage rates, pay periods, and deductions, ensuring that employees are informed about their compensation structure.

- Payslip or Wage Statement: A payslip provides a detailed breakdown of an employee's earnings for a specific pay period, including straight-time and overtime wages. It complements the Business To Employee Example form by offering transparency on how wages are calculated and ensuring employees are notified of any changes in their compensation.

Dos and Don'ts

When filling out the Business To Employee Example form, it is essential to proceed with care. This document will impact the employee's rights and the employer's obligations. Here’s a guideline of things you should and shouldn’t do:

- Be accurate in providing the employee's name and start date. Mistakes can lead to confusion and issues down the line.

- Check all relevant boxes regarding employment status, pay rates, and agency information. Omissions can create misunderstandings regarding the role.

- Clearly state wage information. Include accurate rates, including overtime rates, and ensure any allowances are well-documented.

- Keep copies of the completed form for both employer and employee records. It is important to have documentation of what was agreed upon.

- Don’t rush through the form. Taking your time reduces the likelihood of errors.

- Don’t leave any sections blank unless absolutely necessary. Each piece of information contributes to a complete understanding of the employment terms.

- Don’t assume the employee understands all policies. Provide explanations if needed, especially regarding paid sick leave rights and employer obligations.

- Don’t neglect to notify the employee of any changes to the information provided within the required seven days. This ensures compliance with the law.

Completing this form with attention to detail promotes clarity and protects the rights of all parties involved.

Misconceptions

Misconceptions about the Business To Employee Example form can lead to misunderstandings regarding employee rights and employer obligations. The following is a list of common misconceptions, along with clarifications to help shed light on each point.

- The form is not legally required. Many believe that completing this form is optional. However, according to Labor Code Section 2810.5, employers must provide written notice to employees about specific terms of their employment.

- Only salaried employees need this form. This form applies to all employees, whether they are hourly or salaried. Regardless of compensation type, understanding terms of employment is crucial for every worker.

- Acknowledgment of receipt constitutes agreement. Some think that signing this form means they agree with all terms outlined. In fact, signing only confirms receipt, not acceptance of specific conditions.

- Paid sick leave entitlement is fixed. It is a misconception that employees only have a single option for paid sick leave. There are various provisions under state law that may apply, allowing for different accrual and usage policies.

- The employer cannot change information after issuance. Employees often assume that the information provided in this notice is set in stone. In reality, employers are required to notify workers of any changes within seven days.

- All staffing agencies provide the same terms. Many believe the form's requirements are uniform across staffing agencies. However, terms vary significantly by employer, necessitating careful review of the specific form used.

- Overtime pay details are optional. Some employees think that employers can neglect to mention overtime rates. In fact, this information must be explicitly outlined in the form if applicable.

- Discrimination or retaliation claims must be filed immediately. There is a notion that retaliation claims lose validity with time. Employees have the right to report issues, but it is advisable to act promptly to ensure the best possible outcome.

Understanding these misconceptions is essential for both employees and employers. Properly navigating the Business To Employee Example form ensures that rights are respected and obligations fulfilled. Awareness can prevent potential legal complications and foster a positive workplace environment.

Key takeaways

Filling out the Business To Employee Example form is a crucial process for both employers and employees. Here are some key takeaways to understand its importance and use:

- Complete Information is Essential: Ensure that all sections of the form are filled out accurately. This includes employee details, employer name, and contact information. Missing information can lead to confusion or legal issues later on.

- Wage Information Clarity: Clearly state the pay rate and structures involved. Employers should specify how the pay is calculated, whether by hour, shift, or any other method. A well-defined wage structure helps prevent disputes.

- Legal Obligations: Be aware that this form fulfills requirements under Labor Code Section 2810.5. Employers are legally obligated to notify employees of their rights regarding wages and sick leave.

- Paid Sick Leave Rights: The form outlines paid sick leave entitlements under state law, including details on accrual and usage. Employees should understand these rights to protect themselves from potential employer retaliation.

- Acknowledgment of Receipt: The employee’s signature on the form signifies that they have received the information. This does not imply agreement with the terms, but it is an essential step for both parties.

- Update Notifications: Employers are required to notify employees of any changes to the information on the form within seven days. This ensures that employees remain informed about their working conditions and employer obligations.

Browse Other Templates

Army Slrrt - Continuous monitoring of performance ensures Soldiers are supported adequately.

Final Expense Claim Form,Life Insurance Benefit Claim Form,Insurance Benefits Request Form,Claim Application for Deceased Insured,Insurance Death Benefit Submission Form,Posthumous Benefit Claim Form,Decedent's Claims Application,Bereavement Insuranc - The claim form should be filled out clearly, with no ambiguous information.

Virginia Llc Application - Members should consult the state’s help pages for additional support if needed.