Fill Out Your Bwc 7578 Form

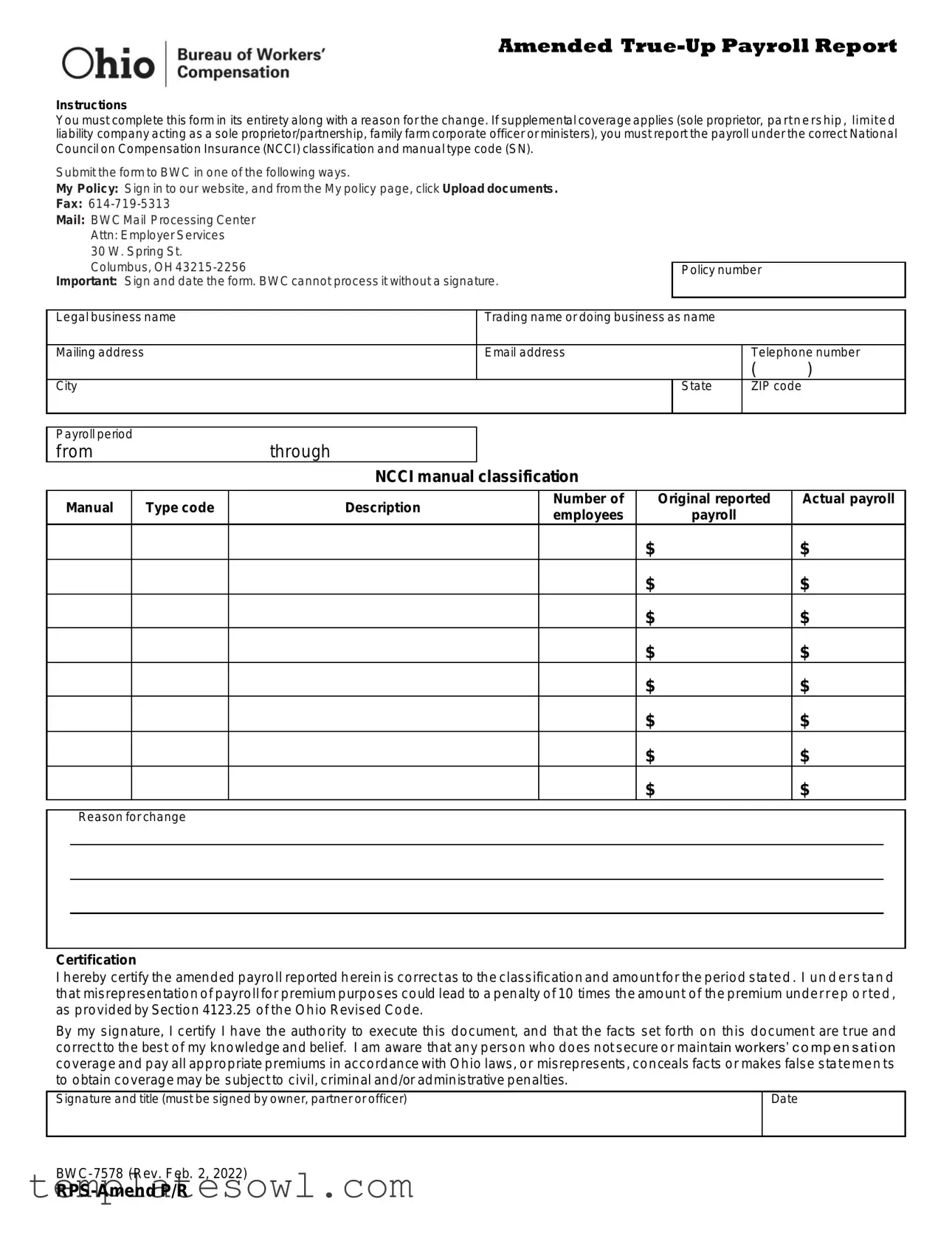

The BWC 7578 form, known as the Amended True-Up Payroll Report, plays a noteworthy role in the administration of workers' compensation insurance in Ohio. This form must be completed fully and accurately whenever there are changes to previously reported payroll figures. To ensure compliance, it is essential to provide a reason for any changes made. The form requires employers to report payroll under the correct classification based on guidelines set by the National Council on Compensation Insurance (NCCI). For certain types of businesses, such as sole proprietorships, partnerships, limited liability companies, family farm corporate officers, or ministers, specific supplemental coverage requirements must be adhered to as well. Submitting the form can be done through various means, including online uploads via the BWC website, fax, or traditional mail. It is crucial to remember that the form must be signed and dated for processing to occur, as any submission lacking a signature will not be accepted. Furthermore, the accuracy of the reported payroll is vital; misrepresentation can lead to significant penalties, underscoring the importance of careful record-keeping and compliance with Ohio's workers' compensation laws.

Bwc 7578 Example

Amended

Instructions

You must complete this form in its entirety along with a reason for the change. If supplemental coverage applies (sole proprietor, pa rt n e rship , limit e d liability company acting as a sole proprietor/partnership, family farm corporate officer or ministers), you must report the payroll under the correct National

Council on Compensation Insurance (NCCI) classification and manual type code (SN).

Submit the form to BWC in one of the following ways.

My Policy: Sign in to our website, and from the My policy page, click Upload documents.

Fax:

Mail: BWC Mail Processing Center

Attn: Employer Services 30 W. Spring St.

Columbus, OH

Important: Sign and date the form. BWC cannot process it without a signature.

Policy number

Legal business name |

|

Trading name or doing business as name |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

Email address |

|

|

Telephone number |

||||||

|

|

|

|

|

|

|

|

|

|

( |

) |

|

City |

|

|

|

|

|

|

State |

ZIP code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll period |

|

|

|

|

|

|

|

|

|

|

||

from |

|

through |

|

|

|

|

|

|

|

|

||

|

|

|

|

NCCI manual classification |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

Manual |

|

Type code |

Description |

|

Number of |

|

Original reported |

Actual payroll |

||||

|

|

employees |

|

|

payroll |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Reason for change |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification

I hereby certify the amended payroll reported herein is correct as to the classification and amount for the period stated . I un d er s tan d that misrepresentation of payroll for premium purposes could lead to a penalty of 10 times the amount of the premium under r ep o r ted , as provided by Section 4123.25 of the Ohio Revised Code.

By my signature, I certify I have the authority to execute this document, and that the facts set forth on this document are t rue and correct to the best of my knowledge and belief. I am aware that any person who does not secure or maintain workers’ c o mp en s ati on coverage and pay all appropriate premiums in accordance with Ohio laws, or misrepresents, conceals facts or makes false statemen ts to obtain coverage may be subject to civil, criminal and/or administrative penalties.

Signature and title (must be signed by owner, partner or officer)

Date

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The BWC 7578 form is used to report changes to payroll for workers' compensation purposes in Ohio. |

| Submission Methods | This form can be submitted online, via fax, or through the mail. Specific instructions are provided for each method. |

| Signature Requirement | The form must be signed and dated by an authorized individual, as it cannot be processed without a signature. |

| Governing Law | Ohio Revised Code Section 4123.25 outlines penalties for misrepresentation of payroll and failure to maintain workers' compensation coverage. |

Guidelines on Utilizing Bwc 7578

Once you have gathered the necessary information, follow these steps to fill out the Bwc 7578 form. Ensure that all sections are completed correctly and that you provide a valid reason for the changes made. Remember, your submission needs to be signed for processing.

- Enter your policy number in the designated field.

- Input the legal business name as registered.

- Write your trading name or "doing business as" name, if applicable.

- Fill in your mailing address, including street address, city, state, and ZIP code.

- Provide an email address for communication.

- List a telephone number for contact purposes.

- Specify the payroll period by entering dates in the "from" and "through" sections.

- Provide the NCCI manual classification number for your business.

- Enter the manual type code for the classification.

- Describe the actual payroll reported for employees in the designated fields.

- State the reason for the change clearly.

- In the certification section, read and confirm the statements to certify accuracy.

- Sign and date the form at the bottom. Ensure the signature is from an authorized individual such as the owner, partner, or officer.

Once completed, you can submit the form via the BWC website, by fax, or by mail. Choose the method that works best for you to ensure timely processing.

What You Should Know About This Form

What is the purpose of the BWC 7578 form?

The BWC 7578 form, known as the Amended True-Up Payroll Report, is used to report adjustments to previously reported payroll figures for workers' compensation. If changes occur—whether due to an increase or decrease in payroll—this form ensures the Bureau of Workers' Compensation (BWC) has the correct information for premium calculations. Accurate reporting is crucial for compliance and to avoid potential penalties.

How do I submit the BWC 7578 form?

You can submit the BWC 7578 form in a few ways. First, you can log into the BWC website and navigate to the "My Policy" section to upload your documents directly. If you prefer to fax, send it to 614-719-5313. You also have the option to mail the completed form to the BWC Mail Processing Center, specifically to Employer Services at 30 W. Spring St., Columbus, OH 43215-2256. Regardless of the submission method, ensure that you sign and date the form—it cannot be processed without a signature.

What information is required on the BWC 7578 form?

The form requires several key pieces of information to ensure proper processing. You will need to provide your policy number, legal business name, trading name (if applicable), mailing address, email address, and telephone number. Additionally, you must include details such as the payroll period, NCCI manual classification, manual type code, and a breakdown of the reported payroll for various employee categories. Lastly, a reason for the change must be included, along with your certification that the information provided is accurate.

What are the consequences of misreporting payroll on the BWC 7578 form?

Accurate reporting on the BWC 7578 form is serious. If you misrepresent payroll figures for premium purposes, penalties can be severe. The Ohio Revised Code outlines that penalties may reach ten times the amount of the underreported premium. This means that honesty is crucial when filling out the form. Misrepresentation can also lead to additional civil, criminal, or administrative penalties, which underscores the importance of accurate and truthful reporting.

Common mistakes

Completing the BWC 7578 form, the Amended True-Up Payroll Report, requires careful attention to detail. Many individuals encounter challenges that can delay processing or result in penalties. Here are eight common mistakes to avoid when filling out this crucial form.

First and foremost, failing to provide a reason for the change is an oversight that can lead to significant consequences. The BWC specifically requires this information to understand why amendments are being made. Ensure that your reason is clearly stated and directly tied to the payroll adjustments.

Another frequent error is neglecting to include the full business information. When inputting your policy number, legal business name, and trading name, double-check these details for accuracy. Misinformation can result in delays in your submission. It’s essential that this section is complete and precise.

Individuals often forget to sign and date the form. Without a signature, the BWC cannot process the document. This simple step can save you from unnecessary complications. Make it a priority to review the form before submission to ensure all required signatures are included.

The payroll period section is another area where mistakes frequently occur. Indicating an incorrect timeframe can affect premium calculations and compliance. Always verify that the dates listed accurately reflect the payroll period for which you are reporting.

Misreporting the NCCI manual classification and manual type code can result in inaccurate premium calculations. Ensure you are using the correct classification for your business activity. If you are unsure, consult with a knowledgeable source or refer to NCCI guidelines before submission.

Completing the section on actual payroll can be tricky. Errors in the totals can lead to significant issues down the line, including possible penalties. Take time to review your calculations meticulously. It’s better to double-check your numbers than to deal with corrections later.

Additionally, it is crucial to submit the form through the correct channels. Whether you choose to upload it online, fax it, or mail it, ensure you follow the specified instructions. Using the wrong method can lead to delayed processing and unwanted complications.

Finally, individuals often overlook the importance of maintaining accurate records supporting the information provided in the BWC 7578. Keep all documentation organized and accessible in case of audits or further inquiries. Accurate record-keeping can prevent misunderstandings and potential penalties.

By acknowledging these mistakes and ensuring that you avoid them, you position yourself for smoother processing of the BWC 7578 form. Taking the time to complete the form carefully can save you from future headaches.

Documents used along the form

The BWC 7578 form, known as the Amended True-Up Payroll Report, is essential for businesses to correct and report changes in payroll information. Along with this form, a few additional documents are often required or useful in the context of workers' compensation reporting. Here are five documents that can complement the BWC 7578 form:

- Payroll Records: These include detailed reports of payroll for the specified period. They provide evidence of the actual payroll figures used to compute premiums and assist in validating the information reported on the BWC 7578 form.

- NCCI Classification Codes: These codes categorize the type of business and the risk associated with various job roles. Accurate classification is crucial, as it impacts premium calculations. This document helps ensure compliance with BWC's regulations.

- Certificate of Coverage: Issued by the BWC, this certificate confirms that the business has the required workers' compensation coverage in place. This document may be necessary to accompany the BWC 7578 form for assurance of compliance.

- Owner's Affidavit: Sometimes requested, this document affirms that the business owner is reporting truthful payroll numbers. It serves as a declaration of the accuracy of the information provided on the BWC 7578 form.

- Correspondence Documentation: Any letters or notices received from BWC regarding previously filed reports or policies. This documentation can provide context for the changes reported on the BWC 7578 form, especially if it relates to previous discrepancies that need clarification.

These documents serve different but complementary purposes, ensuring that businesses correctly report payroll changes and remain in compliance with Ohio's workers' compensation laws. Maintaining accurate records not only simplifies filing but also protects against potential penalties.

Similar forms

- Form I-9: This form verifies the identity and employment eligibility of individuals hired for employment in the U.S. Similar to the BWC 7578, it requires specific information about the employee and must be completed and signed by both the employer and employee to be valid.

- W-2 Form: This document reports an employee's annual wages and the amount of taxes withheld. Like the BWC 7578, it requires accurate reporting of financial data over a specified period and must be submitted to the appropriate authorities after signatures are obtained.

- 1099 Form: Used to report income received by non-employees, such as independent contractors. This form shares similarities with the BWC 7578 in that it must include specific detailed income information, and if inaccuracies exist, penalties may apply.

- Payroll Tax Returns: Employers use these to report wages, tips, and other compensation and calculate payroll taxes owed. Both documents (BWC 7578 and Payroll Tax Returns) necessitate precise payroll data to facilitate correct contributions to state or federal programs.

- Employer's Quarterly Tax Form (Form 941): This form is used to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. Similar to BWC 7578, it requires reporting of payroll information for a defined period and mandates accurate completion to avoid penalties.

Dos and Don'ts

When filling out the BWC 7578 form, it’s crucial to follow specific guidelines to ensure your submission is processed efficiently. Here’s a list of what you should and shouldn’t do:

- Do read the form instructions carefully to understand all requirements.

- Do complete each section of the form accurately and entirely.

- Do include a clear reason for the change you are reporting.

- Do provide your correct National Council on Compensation Insurance (NCCI) classification.

- Do ensure that your signature and date are on the form.

- Don't leave any required fields blank; this may delay processing.

- Don't submit the form without verifying all information is correct.

- Don't forget to use the appropriate method of submission (upload, fax, or mail).

- Don't misrepresent payroll amounts, as this could lead to severe penalties.

- Don't underestimate the importance of retaining a copy of the submitted form for your records.

Following these guidelines helps safeguard your compliance with regulations and supports timely processing of your amendment. Act promptly to avoid complications or penalties.

Misconceptions

- Misconception 1: The BWC 7578 form is optional.

- Misconception 2: Only large businesses need to file this form.

- Misconception 3: You can submit the form without any supporting explanation.

- Misconception 4: There's no need to sign the form.

Many believe that completing the BWC 7578 form is not necessary. In reality, this form is crucial for accurately reporting payroll changes and is required by the Bureau of Workers' Compensation to update records.

This form is often perceived as only relevant for large employers. However, any business, regardless of size, that experiences changes in payroll or classifications must submit the BWC 7578 form.

Some think they can submit the BWC 7578 form without providing a reason for the change. This is incorrect. You must explain why the payroll information is being amended as part of the submission.

Many individuals underestimate the importance of signing the BWC 7578 form. Without a signature, the Bureau cannot process the form. This step is essential to ensure accuracy and compliance.

Key takeaways

When filling out and using the BWC 7578 form, there are several key points to consider. Proper completion and submission of this form is vital to ensure compliance with Ohio workers' compensation laws.

- Complete the form fully. Provide a reason for any changes made to the payroll information.

- Report any supplemental coverage under the correct National Council on Compensation Insurance (NCCI) classification and manual type code.

- Submit the form through one of the following methods: online via your policy page, fax to 614-719-5313, or mail to the BWC Mail Processing Center in Columbus, OH.

- Signature and date are mandatory. The Bureau of Workers' Compensation (BWC) cannot process the form without a signature.

- Be aware of the penalties for misrepresentation. Misstating payroll can result in severe financial consequences as outlined in the Ohio Revised Code.

These steps help ensure that employers fulfill their workers' compensation requirements accurately, avoiding potential legal issues down the line.

Browse Other Templates

Assessment Evaluation Form,Environment Quality Rating Sheet,Childcare Assessment Tool,Early Childhood Evaluation Scale,Facility Observation Checklist,Learning Environment Rating Form,Child Development Assessment Sheet,Space and Interaction Rating Gui - Overall, the Score Sheet functions as a catalyst for better educational and developmental practices in early childhood settings.

Modesto Security Registration Form,Modesto Alarm Registration Document,Modesto Surveillance Permit Application,Modesto Alarm User Registration,Modesto Home Safety Permit,Modesto Alarm System Registration,Modesto Emergency Alarm Permit,Modesto Alarm L - Submitting false information on the permit may have consequences.

Nebraska Worker Injury Report,First Occupational Injury Form,Nebraska Work-Related Injury Notification,Workers' Compensation Incident Report,Employer Injury Reporting Form,Employee Injury Incident Submission,Occupational Illness Notification Form,Cla - Employers are encouraged to train staff on properly completing the NWCC 1 to avoid common pitfalls.