Fill Out Your C 11 Form

The C-11 form is an essential tool for employers dealing with the aftermath of workplace injuries. This form is used to report any changes in the employment status of an injured employee, whether they return to work, discontinue working, or experience changes in their work hours or wages. It's important to file this report directly with the Chair of the Workers' Compensation Board as soon as any change occurs. Timeliness is key, as it helps keep everything clear and up-to-date for all parties involved. In addition to the Board, a copy must also be sent to your insurer. The C-11 requires specific information that includes details about the employee, the injury itself, dates of lost work time, and the nature of any changes to hours or wages. Accuracy is crucial because any false statements made in the reporting process can lead to serious legal consequences. You can submit the form through different channels, including mail, fax, or email. Keeping this form filled out correctly ensures that both the employer and employee are informed and protected throughout the workers' compensation process.

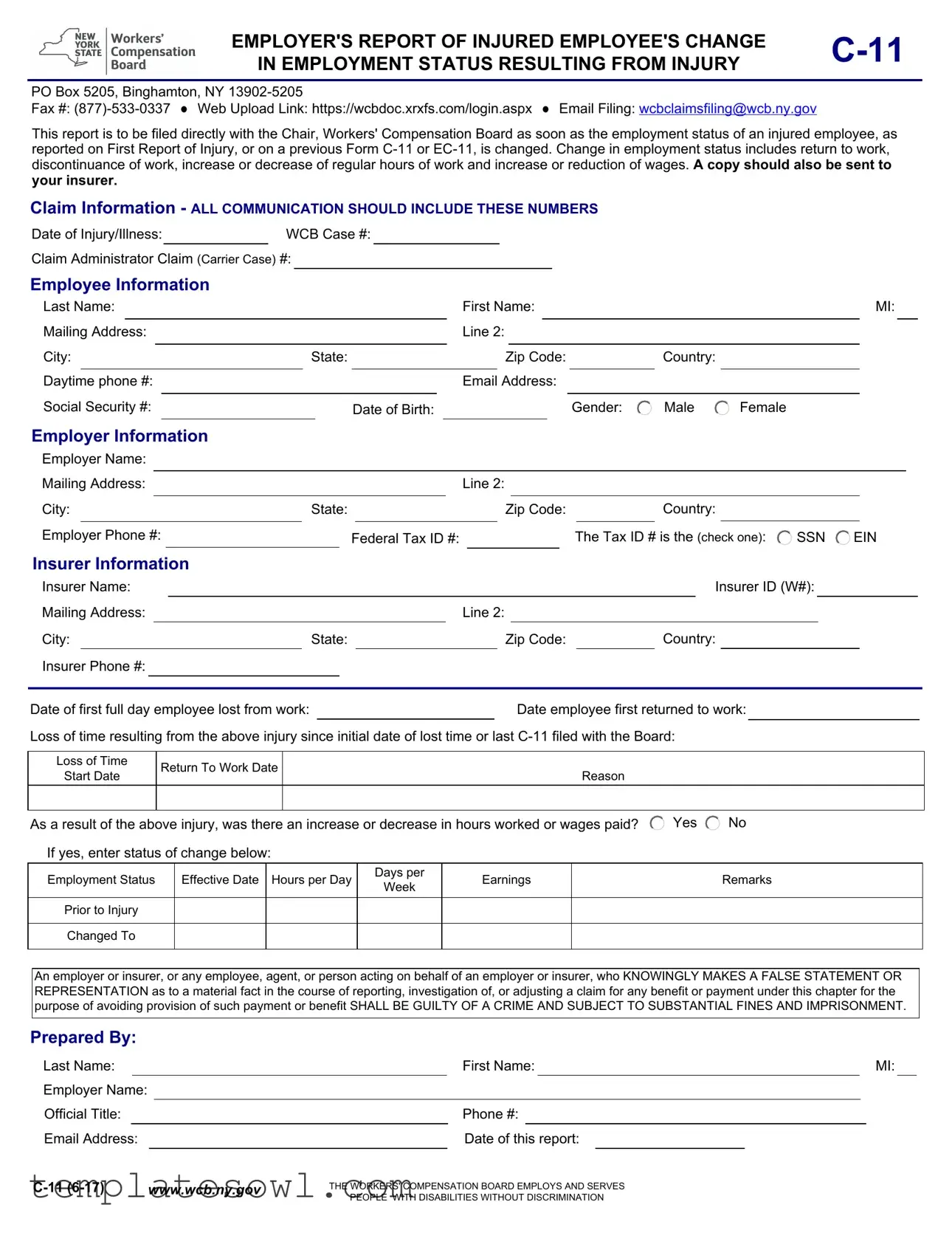

C 11 Example

EMPLOYER'S REPORT OF INJURED EMPLOYEE'S CHANGE |

|

IN EMPLOYMENT STATUS RESULTING FROM INJURY |

PO Box 5205, Binghamton, NY

Fax #:

This report is to be filed directly with the Chair, Workers' Compensation Board as soon as the employment status of an injured employee, as reported on First Report of Injury, or on a previous Form

Claim Information - ALL COMMUNICATION SHOULD INCLUDE THESE NUMBERS

Date of Injury/Illness: |

|

WCB Case #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Claim Administrator Claim (Carrier Case) #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Employee Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

|

MI: |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City: |

|

|

State: |

|

|

|

|

Zip Code: |

Country: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Daytime phone #: |

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Social Security #: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender: |

Male |

Female |

|

|

|

|

|

|

|

|

|

||||||||||||||||

Employer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Employer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

City: |

|

|

State: |

|

|

|

|

Zip Code: |

Country: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Employer Phone #: |

|

|

|

|

|

Federal Tax ID #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

The Tax ID # is the (check one): |

SSN |

EIN |

|

|

|||||||||||||||||||||||||

Insurer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Insurer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurer ID (W#): |

|

|

|

|

|

|

|

||||||||||||

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

City: |

|

|

|

State: |

|

|

|

|

|

Zip Code: |

|

Country: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Insurer Phone #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

Date of first full day employee lost from work: |

|

|

|

|

|

|

|

|

Date employee first returned to work: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Loss of time resulting from the above injury since initial date of lost time or last

Loss of Time

Start Date

Return To Work Date

Reason

As a result of the above injury, was there an increase or decrease in hours worked or wages paid?  Yes

Yes  No If yes, enter status of change below:

No If yes, enter status of change below:

Employment Status |

Effective Date |

Hours per Day |

Days per |

Earnings |

Remarks |

|

Week |

||||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Prior to Injury |

|

|

|

|

|

|

|

|

|

|

|

|

|

Changed To |

|

|

|

|

|

|

|

|

|

|

|

|

An employer or insurer, or any employee, agent, or person acting on behalf of an employer or insurer, who KNOWINGLY MAKES A FALSE STATEMENT OR REPRESENTATION as to a material fact in the course of reporting, investigation of, or adjusting a claim for any benefit or payment under this chapter for the purpose of avoiding provision of such payment or benefit SHALL BE GUILTY OF A CRIME AND SUBJECT TO SUBSTANTIAL FINES AND IMPRISONMENT.

Prepared By:

Last Name: |

|

|

|

|

First Name: |

|

|

MI: |

|||

Employer Name: |

|

|

|

|

|

|

|

|

|

|

|

Official Title: |

|

|

|

|

Phone #: |

|

|

|

|||

Email Address: |

|

|

|

Date of this report: |

|

|

|

|

|||

www.wcb.ny.gov |

THE WORKERS' COMPENSATION BOARD EMPLOYS AND SERVES |

|

|

||||||||

|

|

|

|

PEOPLE WITH DISABILITIES WITHOUT DISCRIMINATION |

|

|

|||||

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose of Form | The C-11 form is used to report changes in the employment status of an injured employee. This includes updates on return to work, changes in hours, and adjustments in wages. |

| Filing Requirement | It must be filed directly with the Chair of the Workers' Compensation Board as soon as there’s a change in an injured employee’s status. |

| Additional Copy | A copy of the form should also be sent to the employee's insurer for their records. |

| Communication Information | All communications related to the claim should include the WCB Case number, the claim administrator, and any other relevant identifier. |

| Insurer Details | The form requires specific information about the insurer, including their name and ID number, as well as their contact details. |

| False Reporting Penalty | Individuals who knowingly provide false information while reporting may face severe legal consequences, including fines and imprisonment. |

| Legal Governance | The C-11 form is governed by New York State Workers' Compensation law, ensuring compliance with state regulations regarding workplace injuries. |

Guidelines on Utilizing C 11

The C-11 form needs to be filled out accurately and submitted to report any changes in the employment status of an injured employee. This should be done as soon as any changes occur to ensure compliance with reporting requirements. Follow the steps below to complete the form effectively.

- Begin by entering the Date of Injury/Illness at the top of the form.

- Fill in the WCB Case # field.

- Provide the Claim Administrator Claim (Carrier Case) #.

- Complete the Employee Information section with the following details:

- Last Name

- First Name

- Middle Initial

- Mailing Address

- City

- State

- Zip Code

- Country

- Daytime Phone #

- Email Address

- Social Security #

- Date of Birth

- Gender: Male or Female

- Next, fill in the Employer Information section with:

- Employer Name

- Mailing Address

- City

- State

- Zip Code

- Country

- Employer Phone #

- Federal Tax ID # (indicate if it’s an SSN or EIN).

- Provide Insurer Information including:

- Insurer Name

- Insurer ID (W#)

- Mailing Address

- City

- State

- Zip Code

- Country

- Insurer Phone #

- Input the Date of first full day employee lost from work and the Date employee first returned to work.

- Document Loss of time by filling in:

- Loss of Time Start Date

- Return To Work Date

- Indicate if there was an increase or decrease in hours worked or wages paid by selecting Yes or No. If yes, enter the details of the change in the provided space.

- For any changes, provide the Employment Status Effective Date, Hours per Day, Days per Week, Earnings, and any Remarks.

- Complete the Prepared By section by providing:

- Last Name

- First Name

- Middle Initial

- Employer Name

- Official Title

- Phone #

- Email Address

- Date of this report

After filling out the form completely, submit it to the Workers' Compensation Board. Ensure that a copy of the form is also sent to your insurer. Keep a copy for your records to track the changes reported.

What You Should Know About This Form

What is the C-11 form and why is it important?

The C-11 form is an official report used by employers to inform the New York Workers' Compensation Board about changes in the employment status of an employee who has been injured. Its purpose is to provide up-to-date information regarding the working situation of the injured employee, including whether they have returned to work, discontinued work, or experienced changes in their hours or wages. Filing this report promptly helps ensure that the employee's benefits are adjusted accordingly and maintains compliance with legal requirements.

When should the C-11 form be filed?

The C-11 form should be filed as soon as there is a change in an injured employee's employment status. This includes situations where the employee returns to work, stops working, or experiences changes in their regular hours or rate of pay. Reporting these changes promptly is crucial for aligning benefits with the current employment situation and avoiding potential penalties for delayed reporting.

How can the C-11 form be submitted?

The C-11 form can be submitted in several ways: via mail to the Workers' Compensation Board at the provided address, by fax at the specified number, through email, or through their web upload system. Sending a copy directly to the employee’s insurer is also recommended to ensure that all parties involved are notified of the status change.

What information is required on the C-11 form?

To complete the C-11 form, you will need to provide specific information including the employee's full name, mailing address, and contact details, as well as the employer's identification information. Essential dates such as the date of injury, the date the employee lost and returned to work, and the amount of time lost due to the injury are necessary. Additionally, details regarding any changes in hours or wages must be reported.

What happens if the C-11 form is not filed?

Failing to file the C-11 form in a timely manner may result in complications for both the employer and the injured employee. This delay could lead to incorrect benefit payments or a backlog in claims processing. Furthermore, employers who neglect to report employment status changes could face penalties, including fines, due to non-compliance with required reporting laws.

Is there a penalty for providing false information on the C-11 form?

Yes, knowingly providing false information on the C-11 form can have serious consequences. If an employer, insurer, or any representative intentionally submits incorrect information to modify a claim, they may be guilty of a crime. This could result in substantial fines and potential imprisonment. Therefore, it is vital to ensure that all information reported on the form is accurate and truthful.

Who should fill out the C-11 form?

The C-11 form should be completed by the employer or an authorized representative. This could include the human resources department, a supervisor familiar with the employee's status, or an insurance claims administrator. Accuracy is key, so it is advised that the person filling out the form has a thorough understanding of the employee’s injury details and employment changes.

Common mistakes

Filling out the C-11 form accurately is crucial to ensure that the necessary changes in an injured employee’s employment status are properly documented. However, there are common mistakes that can lead to delays or complications in the processing of the report. Recognizing these pitfalls can make filling out the form easier and more efficient.

One frequent error is not providing complete employee information. Each section of the form requires thorough answers. If the employee’s last name, first name, mailing address, or other details are missing or incomplete, it can create confusion. This may result in the report being rejected or delayed, which can affect the employee’s benefits.

Another mistake arises when employers neglect to document the date of injury or illness accurately. This date is pivotal, as it sets the timeline for all subsequent claims and updates. If the wrong date is entered, discrepancies may occur in the worker's compensation process, leading to administrative difficulties.

Completing the section regarding changes in hours or wages can also pose challenges. Some individuals may incorrectly mark "Yes" or "No" without considering the specifics of the employment status change. Properly indicating whether there was an increase or decrease in hours worked or wages paid is essential, as this information significantly impacts the employee’s benefits. When unsure, it is better to clarify than to guess.

In some instances, employers might forget to send a copy of the C-11 form to their insurer. This oversight can lead to a lack of communication between parties involved, which is vital for managing claims effectively. It is important to remember that both the Workers' Compensation Board and the insurer need to have the same information for consistent processing.

Finally, not being mindful of the signatures and prepared by sections can result in the report being deemed incomplete. The last name, first name, and official title of the person preparing the document must be included clearly. This step assures accountability and allows for follow-up if there are questions or issues regarding the submitted form.

Documents used along the form

The C-11 form is essential for reporting changes in an injured employee's employment status. Several other forms may be necessary to support this process. Below is a list of commonly used documents that accompany the C-11 form.

- First Report of Injury: This form provides an initial overview of the injury or illness associated with the employee's claim. It includes details such as the date, cause, and nature of the injury, which are critical for processing the claim.

- EC-11 Form: This form is used to report the return of an employee to work after a disability related to their injury. It is typically filed after the C-11 to update the status of the employee's return.

- Employer's Report of Wage and Hour Changes: This document outlines any changes to the employee's wages or hours worked. It provides necessary details, especially when a change affects the compensation the employee receives.

- Insurer's Report of Claims: This report is submitted by the insurer to the Workers' Compensation Board. It summarizes claims data, including payments made and the status of the employee's recovery.

- Medical Reports or Evaluation Forms: These documents offer healthcare provider assessments of the employee's work-related injury. They help verify the extent of the injury and the employee's ability to return to work.

These documents work together to ensure that all relevant information is provided to the Workers' Compensation Board. Properly completing and submitting these forms helps facilitate the claim process for injured employees.

Similar forms

The C-11 form serves as an employer’s report to notify the Workers' Compensation Board about changes in an injured employee's employment status. This document shares some similarities with others that are also integral in documenting injury claims and employment changes. Here are five documents that are similar to the C-11 form:

- First Report of Injury: This form is used to report an injury or illness for the first time. Like the C-11, it requires detailed employee information and injury specifics, establishing the foundation for monitoring an injured worker's status.

- End of Employment Report (Form EC-11): When an injured employee ends their employment, this form must be filled out. It parallels the C-11 in that both documents communicate significant changes in employment status and require timely submission to the Workers' Compensation Board.

- Return to Work Form: This document is utilized to confirm that an employee has returned to their job. Similar to the C-11, it captures the change in the employee’s employment status and should be submitted promptly to help manage ongoing claims.

- Employee's Wage Statement: Employers must provide this to report any alterations in an employee’s wages due to an injury. Both this statement and the C-11 handle the impact of injuries on employee earnings and working hours, ensuring that compensation is adjusted accordingly.

- Workers' Compensation Claim Form: This is the initial form filed when seeking workers' compensation benefits. Like the C-11, it involves the reporting of essential details about the employee and their injury, forming part of the claim's overall documentation process.

It is crucial to ensure timely and accurate filings for all of these documents to maintain compliance and avoid potential legal issues or delays in benefits.

Dos and Don'ts

Filling out the C-11 form can be a straightforward process if you keep a few best practices in mind. Here are four things you should and shouldn’t do while completing this important document.

- Do ensure that all fields are filled out accurately. Double-check names, dates, and other critical information to avoid delays.

- Don't provide false information. Misrepresenting facts can lead to legal consequences, including fines or imprisonment.

- Do submit the form promptly. It is important to file the report as soon as the employment status of the injured employee changes.

- Don't forget to send a copy to your insurer. Keeping your insurer informed can facilitate smooth processing of claims.

By following these guidelines, you can help ensure that the process goes smoothly and that the injured employee's status is reported correctly.

Misconceptions

Misconceptions about the Form C-11 can lead to confusion and errors in reporting employment changes following an injury. Here are ten common misconceptions, along with clearer explanations:

- Filing the C-11 is optional. Many people believe that filing the C-11 form is not mandatory. However, it is required to report any changes in an injured employee's status as soon as possible.

- Only the employer needs to file the form. While the employer is responsible for filing, the injured employee should ensure that the necessary information is correct and up-to-date.

- The C-11 form only tracks return-to-work dates. In reality, this form captures a variety of employment changes, including discontinuance of work, changes in regular hours, and wage adjustments.

- Submitting the C-11 to the insurer is the only requirement. It is important that the C-11 form gets filed directly with the Workers' Compensation Board and a copy is sent to the insurer.

- All employment changes can be reported on the same form. Each instance of a change in employment status requires a new C-11 form for accurate tracking and records.

- The information on the C-11 form is kept confidential. While privacy is important, the information may be shared in investigations or claims adjustments.

- The form can be submitted at any time. This form must be filed as soon as the employment status changes, ensuring timely updates for the Workers' Compensation Board.

- Only major employment changes need to be reported. Any alteration in hours or wages, regardless of size, should be reported to avoid compliance issues.

- Providing false statements has no consequences. Knowing false reporting can result in serious legal ramifications, including fines and imprisonment.

- There is no deadline for submitting the C-11 form. Timeliness is crucial. Delays can complicate claims processing and may affect benefits.

Understanding the correct procedures associated with the C-11 form can ensure smoother management of workers' compensation claims and protect both employers and employees.

Key takeaways

Filling out and using the C-11 form correctly is crucial for maintaining compliance with the Workers' Compensation Board. Here are key takeaways to keep in mind:

- Submit Promptly: File the C-11 form as soon as an injured employee's employment status changes.

- Direct Submission: Send the completed form to the Chair of the Workers' Compensation Board.

- Include Claim Information: Ensure all communication features essential details like the Date of Injury and WCB Case Number.

- Employee Details: Accurately fill in the employee's personal information, including their Social Security Number and contact details.

- Change in Status: Clearly indicate if the employee has returned to work, stopped working, or had changes in hours or wages.

- Send Copies: Forward a copy of the C-11 form to the employer's insurance company as well.

- Record Keeping: Document the loss of time due to the injury and any changes in employment status thoroughly.

- Understand Consequences: Know that providing false information can lead to criminal charges and penalties.

- Preparation: Ensure all preparatory information fields are completed accurately, including the preparer's details.

- Accessibility: The Workers' Compensation Board is committed to serving people with disabilities without discrimination.

Adhering to these guidelines will facilitate a smoother claim process and foster communication between all parties involved.

Browse Other Templates

How to File Contempt of Court for Child Support in California - The FL-412 is part of a broader effort to enforce domestic safety measures.

Bankruptcy Proof of Claim Form - It is advisable for creditors to seek assistance when filling out the form if any aspect is unclear.