Fill Out Your Ca 1 Form

The CA-1 form is an essential document for federal employees who experience a traumatic injury while on duty. It is designed to formally report the injury and file a claim for continued pay and compensation. This form requires the employee to provide crucial details such as their name, contact information, Social Security number, date of birth, and specifics regarding the injury, including the place, date, time, and nature of the incident. Additionally, employees must specify the cause of the injury and certify that it was not due to misconduct or intoxication. Alongside the employee's information, a witness statement and a section for the employer to complete are integral parts of the CA-1 form. The employer must provide details about the employee's duty station, work schedule, and the circumstances surrounding the injury's occurrence. The form also stipulates the continuation of pay for up to 45 days if filed within a specified time frame. The completion of the CA-1 form initiates the process for potential benefits available under the Federal Employees' Compensation Act (FECA), which can include medical care and compensation for wage loss. Understanding the requirements and implications of the CA-1 form helps employees navigate their responsibilities and entitlements effectively in the aftermath of a workplace injury.

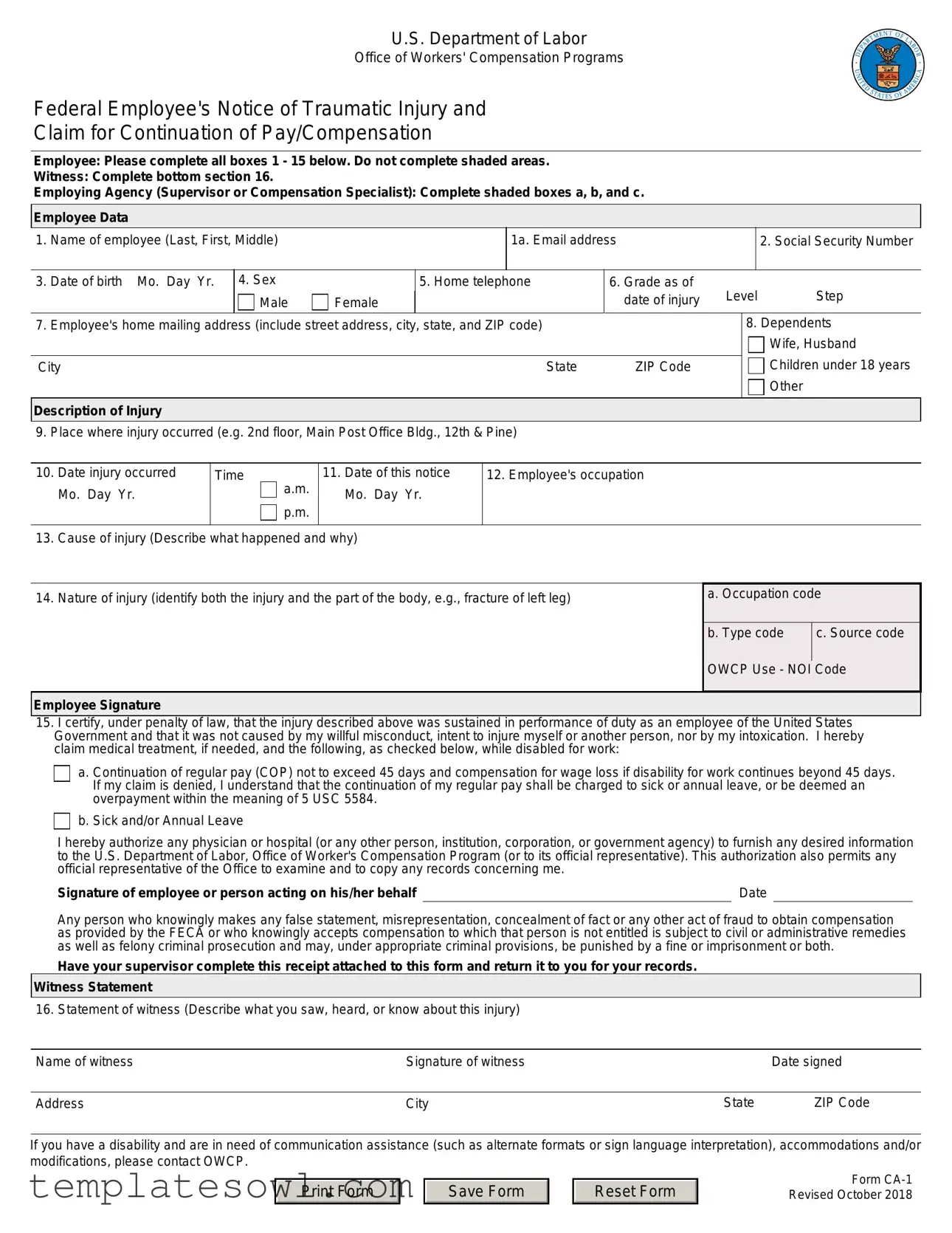

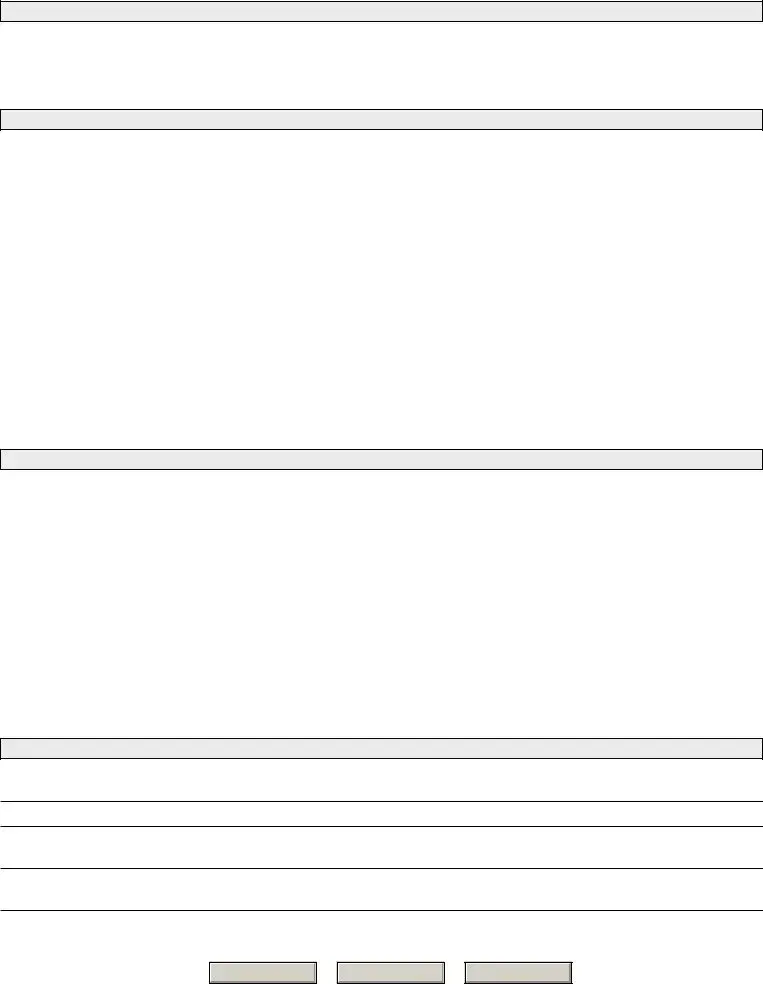

Ca 1 Example

U.S. Department of Labor

Office of Workers' Compensation Programs

Federal Employee's Notice of Traumatic Injury and

Claim for Continuation of Pay/Compensation

Employee: Please complete all boxes 1 - 15 below. Do not complete shaded areas.

Witness: Complete bottom section 16.

Employing Agency (Supervisor or Compensation Specialist): Complete shaded boxes a, b, and c.

Employee Data

1. Name of employee (Last, First, Middle)

1a. Email address

2. Social Security Number

3. |

Date of birth Mo. Day Yr. |

4. Sex |

|

5. Home telephone |

|

6. Grade as of |

Level |

Step |

|

|

|

Male |

Female |

|

|

date of injury |

|||

7. |

Employee's home mailing address (include street address, city, state, and ZIP code) |

|

|

|

8. Dependents |

||||

|

|

|

|

|

|

|

|

|

Wife, Husband |

|

|

|

|

|

|

|

|

Children under 18 years |

|

City |

|

|

|

State |

ZIP Code |

|

|

||

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

Description of Injury |

|

|

|

|

|

|

|

|

|

9. Place where injury occurred (e.g. 2nd floor, Main Post Office Bldg., 12th & Pine)

10. |

Date injury occurred |

Time |

a.m. |

11. Date of this notice |

12. Employee's occupation |

|

Mo. Day Yr. |

|

Mo. Day Yr. |

|

|

|

|

p.m. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Cause of injury (Describe what happened and why) |

|

|||

14. Nature of injury (identify both the injury and the part of the body, e.g., fracture of left leg)

a. Occupation code

b. Type code |

c. Source code |

OWCP Use - NOI Code

Employee Signature

15.I certify, under penalty of law, that the injury described above was sustained in performance of duty as an employee of the United States Government and that it was not caused by my willful misconduct, intent to injure myself or another person, nor by my intoxication. I hereby claim medical treatment, if needed, and the following, as checked below, while disabled for work:

a. Continuation of regular pay (COP) not to exceed 45 days and compensation for wage loss if disability for work continues beyond 45 days. If my claim is denied, I understand that the continuation of my regular pay shall be charged to sick or annual leave, or be deemed an overpayment within the meaning of 5 USC 5584.

b. Sick and/or Annual Leave

I hereby authorize any physician or hospital (or any other person, institution, corporation, or government agency) to furnish any desired information |

|

to the U.S. Department of Labor, Office of Worker's Compensation Program (or to its official representative). This authorization also permits any |

|

official representative of the Office to examine and to copy any records concerning me. |

|

Signature of employee or person acting on his/her behalf |

Date |

Any person who knowingly makes any false statement, misrepresentation, concealment of fact or any other act of fraud to obtain compensation as provided by the FECA or who knowingly accepts compensation to which that person is not entitled is subject to civil or administrative remedies as well as felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine or imprisonment or both.

Have your supervisor complete this receipt attached to this form and return it to you for your records.

Witness Statement

16. Statement of witness (Describe what you saw, heard, or know about this injury)

Name of witness |

Signature of witness |

|

Date signed |

|

|

|

|

Address |

City |

State |

ZIP Code |

If you have a disability and are in need of communication assistance (such as alternate formats or sign language interpretation), accommodations and/or modifications, please contact OWCP.

Print Form

Save Form

Reset Form

Form

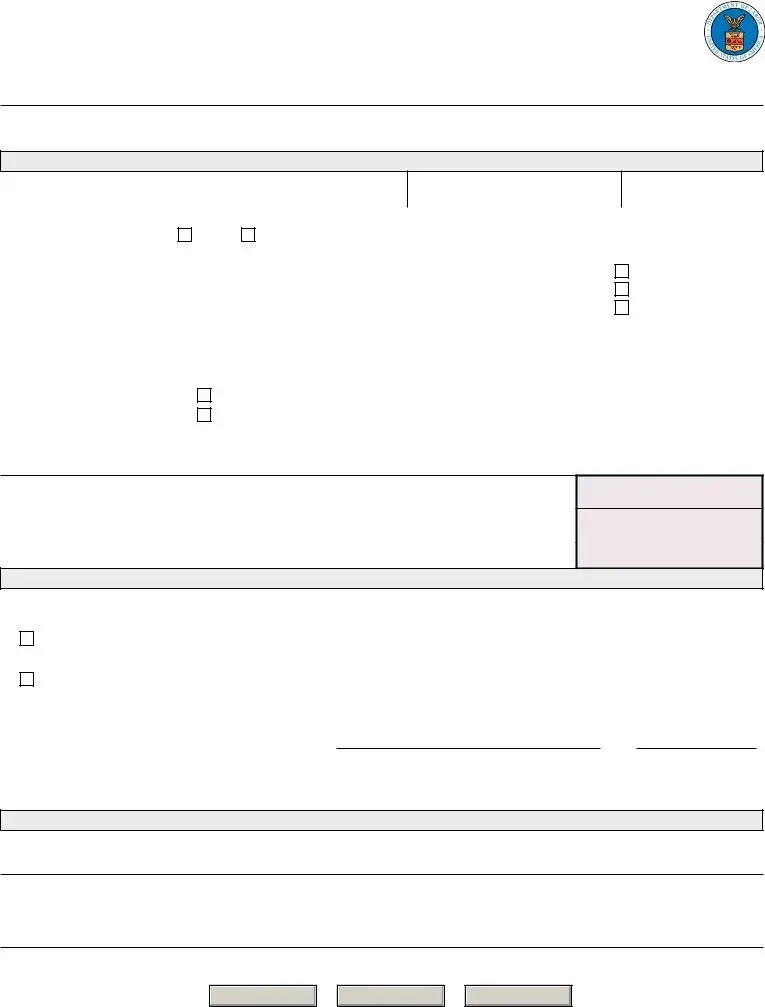

Official Supervisor's Report: Please complete information requested below:

Supervisor's Report

17. Agency name and address of reporting office (include street address, city, state, and ZIP code)

OWCP Agency Code

OSHA Site Code

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18. |

Employee's duty station (include street address, city, state and ZIP code) |

|

City |

|

|

|

|

|

State |

ZIP Code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

19 Employee's retirement coverage |

|

CSRS |

FERS |

|

Other, (identify) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Regular |

From: |

a.m. |

|

To: |

a.m. |

21. Regular |

|

Sun. |

Mon. |

Tues. |

Wed. |

Thurs. |

Fri. |

Sat. |

|||||

|

work |

p.m. |

|

p.m. |

|

work |

|

|||||||||||||

|

hours |

|

|

|

|

schedule |

|

|

|

|

|

|

|

|

|

|

||||

22. |

Date of Injury |

|

23. Date notice received |

|

|

|

24. Date stopped work |

|

|

|

|

|

a.m. |

|

||||||

|

Mo. Day Yr. |

|

|

Mo. Day Yr. |

|

|

|

|

|

|

Mo. Day Yr. |

|

|

Time: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

p.m. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

25. |

Date pay stopped |

26. Date 45 day period began |

|

27. Date returned to work |

|

|

|

|

a.m. |

|

||||||||||

|

Mo. Day Yr. |

|

|

Mo. Day Yr. |

|

|

|

|

|

|

Mo. Day Yr. |

|

|

Time: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

p.m. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

28. |

Was employee injured in performance of duty? |

|

Yes |

|

No (If "No," explain) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

29. |

Was injury caused by employee's willful misconduct, intoxication, or intent to injure self or another? |

|

Yes (If "Yes," explain) |

No |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

30. |

Was injury caused by third party? |

|

31. Name and address of third party (include street address, city, state, and ZIP code) |

|

|

|||||||||||||||

|

|

|

No (If "No," go |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

to Item 32,) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

32. Name and address of physician first providing medical care (include street address, city, state, ZIP code) |

33. First date medical |

Mo. Day |

Yr. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

care received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|

34.Do medical reports |

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

show employee is |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

disabled for work? |

|

|

||

35. Does your knowledge of the facts about this injury agree with statements of the employee and/or witnesses? |

Yes |

No (If "No," explain)

No (If "No," explain)

36. If the employing agency controverts continuation of pay, state the reason in detail.

37.Pay rate when employee stopped work Per

Signature of Supervisor and Filing Instructions

38.A supervisor who knowingly certifies to any false statement, misrepresentation concealment of fact, etc. in respect of this claim may also be subject to appropriate felony criminal prosecution.

I certify that the information given above and that furnished by the employee on the reverse of this form is true to the best of my knowledge with the following exception:

Name of supervisor (Type or print)

Signature of supervisor |

Date |

|

|

Supervisor's Title |

Office phone |

|

|

39. Filing instructions |

No lost time and no medical expense: Place this form in employee's medical folder |

|

No lost time, medical expense incurred or expected: forward this form to OWCP |

|

Lost time covered by leave, LWOP, or COP: forward this form to OWCP |

|

First Aid Injury |

|

|

|

|

|

|

|

Form |

|

|

|

|

|

Revised October 2018 |

Print Form |

|

Save Form |

|

Reset Form |

|

|

|

Page 2 |

Instructions for Completing Form

Complete all items on your section of the form. If additional space is required to explain or clarify any point, attach a supplemental statement to the form. Some of the items on the form which may require further clarification are explained below.

Employee (or person acting on the employees' behalf)

1a) Email address |

14) Nature of injury |

Injured workers should provide an email address when completing this form. Pursuant to policy established by the Department of Labor, Office of Workers' Compensation Programs (OWCP), Division of Federal Employees' Compensation, email communication on case specific inquiries is not allowed due to security concerns. However, obtaining claimant email addresses at the point of filing will allow OWCP to share general,

13) Cause of injury

Describe in detail how and why the injury occurred. Give appropriate details (e.g.: If you fell, how far did you fall and in what position did you land?)

Give a complete description of the condition(s) resulting from your injury. Specify the right or left side if applicable (e.g., fractured left leg: cut on right index finger).

15) Election of COP/Leave

If you are disabled for work as a result of this injury and filed

Supervisor

As the time the form is received, complete the receipt of notice of |

33) First date medical care received |

|

injury and give it to the employee. In addition to completing |

The date of the first visit to the physician listed in Item 31. |

|

Items 17 through 39, the supervisor is responsible for obtaining |

||

the witness statement in Item 16 and for filling in the proper codes |

36) If the employing agency controverts continuation of |

|

in shaded boxes a, b, and c on the front of the form. If medical |

||

expense or lost time is incurred or expected, the completed form |

pay, state the reason in detail. |

|

should be sent to OWCP within 10 working days after is received. |

COP may be controverted (disputed) for any reason; however, |

|

The supervisor should also submit any other information or |

||

the employing agency may refuse to pay COP only if the |

||

evidence pertinent to the merits of this claim. |

controversion is based upon one of the nine reasons given |

|

If the employing agency controverts COP, the employee should |

below: |

|

be notified and the reason for controversion explained to him or |

a) The disability was not caused by a traumatic injury. |

|

her. |

||

|

||

17) Agency name and address of reporting office |

b) The employee is a volunteer working without pay or for |

|

nominal pay, or a member of the office staff of a former |

||

|

||

The name and address of the office to which correspondence |

President; |

|

from OWCP should be sent (if applicable, the address of the |

c) The employee is not a citizen or a resident of the United |

|

personnel or compensation office). |

||

18) Duty station street address and zip code |

States or Canada; |

|

d) The injury occurred off the employing agency's premises and |

||

|

||

The address and zip code of the establishment where the |

the employee was not involved in official "off premise" duties; |

|

employee actually works. |

e) The injury was proximately caused by the employee's willful |

|

|

||

19) Employers Retirement Coverage. |

misconduct, intent to bring about injury or death to self or |

|

another person, or intoxication; |

||

Indicate which retirement system the employee is covered under. |

f) The injury was not reported on Form |

|

|

||

30) Was injury caused by third party? |

following the injury; |

|

|

||

A third party is an individual or organization (other than the |

g) Work stoppage first occurred 45 days or more following |

|

the injury; |

||

injured employee or the Federal government) who is liable for |

||

the injury. For instance, the driver of a vehicle causing an |

h) The employee initially reported the injury after his or her |

|

accident in which an employee is injured, the owner of a |

||

employment was terminated; or |

||

building where unsafe conditions cause an employee to fall, and |

||

a manufacturer whose defective product causes an employee's |

i) The employee is enrolled in the Civil Air Patrol, Peace Corps, |

|

injury, could all be considered third parties to the injury. |

||

Youth Conservation Corps, Work Study Programs, or other |

||

|

||

32) Name and address of physician first providing medical |

similar groups. |

|

|

||

care |

|

|

The name and address of the physician who first provided |

|

|

medical care for this injury. If initial care was given by a nurse |

|

|

or other health professional (not a physician) in the employing |

|

|

agency's health unit or clinic, indicate this on a separate sheet |

|

|

of paper. |

|

Print Form

Save Form

Reset Form

Form

Revised October 2018

Page 3

Instructions for Completing Form

Employing Agency - Required Codes

Box a (Occupation Code), Box b (Type Code),OWCP Agency Code Box c (Source Code), OSHA Site Code

The Occupational Safety and Health Administration (OSHA) requires all employing agencies to complete these items when reporting an injury. The proper codes may be found in OSHA Booklet 2014, "Recordkeeping and Reporting Guidelines."

This is a

Benefits for Employees under the Federal Employees' Compensation Act (FECA)

The FECA, which is administered by the Office of Workers' Compensation Programs (OWCP), provides the following benefits for

(1) Continuation of pay for disability resulting from traumatic,

(2) Payment of compensation for wage loss after the expiration

of COP, if disability extends beyond such point, or if COP is not payable. If disability continues after COP expires, Form

(3)Payment of compensation for permanent impairment of certain organs, members, or functions of the body (such as loss or loss of use of an arm or kidney, loss of vision, etc.), or for serious defringement of the head, face, or neck.

(4)Vocational rehabilitation and related services where directed by OWCP.

(5)All necessary medical care from qualified medical providers. The injured employee may choose the physician who provides initial medical care. Generally, 25 miles from the place of injury, place of employment, or employee's home is a reasonable distance to travel for medical care.

An employee may use sick or annual leave rather than LWOP while disabled. The employee may repurchase leave used for approved periods. Form

is made to use leave.

For additional information, review the regulations governing the administration of the FECA (Code of Federal Regulations, Chapter 20, Part 10) or pamphlet

Privacy Act

In accordance with the Privacy Act of 1974, as amended (5 U.S.C. 552a), you are hereby notified that: (1) The Federal Employees' Compensation Act, as amended and extended (5 U.S.C. 8101, et seq.) (FECA) is administered by the Office of Workers' Compensation Programs of the U.S. Department of Labor, which receives and maintains personal information on claimants and their immediate families.

(2) Information which the Office has will be used to determine eligibility for and the amount of benefits payable under the FECA, and may be verified through computer matches or other appropriate means. (3) Information may be given to the Federal agency which employed the claimant at the time of injury in order to verify statements made, answer questions concerning the status of the claim, verify billing, and to consider issues relating to retention, rehire, or other relevant matters. (4) Information may also be given to other Federal agencies, other government entities, and to

(7) Disclosure of the claimant's social security number (SSN) or tax identifying number (TIN) on this form is mandatory. The SSN and/or TIN), and other information maintained by the Office, may be used for identification, to support debt collection efforts carried on by the Federal government, and for other purposes required or authorized by law. (8) Failure to disclosure all requested information may delay the processing of the claim or the payment of benefits, or may result in an unfavorable decision or reduced level of benefits.

Note: This notice applies to all forms requesting information that you might receive from the Office in connection with the processing and adjudication of the claim you filed under the FECA.

Receipt of Notice of Injury

This acknowledges receipt of Notice of Injury sustained by (Name of injured employee)

Which occurred on (Mo. Day, Yr.)

At (Location)

Signature of Official Superior |

Title |

Date (Mo. Day, Yr.) |

*U.S. GPO:

Print Form

Save Form

Reset Form

Form

Revised October 2018

Page 4

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CA-1 form serves as a notification of traumatic injury and a claim for continuation of pay or compensation for federal employees injured while performing their duties. |

| Filing Requirements | Employees must complete all sections of the form (1-15) but avoid filling shaded areas. It mandates that the form is filed within 30 days of the injury to qualify for benefits. |

| Witness Statement | A designated section (Item 16) allows for a witness to provide details about the incident. This corroborative information is crucial for validating the claim. |

| Supervisor Responsibilities | The employing agency’s supervisor is responsible for filling out specific shaded boxes and providing relevant details regarding the incident and the employee's status. |

| Duration of Benefits | Continuation of pay may last up to 45 calendar days; afterward, employees may claim further compensation if warranted due to ongoing disability. |

| Governing Law | This form is governed under the Federal Employees' Compensation Act (FECA), which outlines the benefits and procedures for employees injured in the line of duty. |

Guidelines on Utilizing Ca 1

If you find yourself needing to fill out the CA-1 form, it’s important to follow a clear step-by-step approach. This form is used to notify the U.S. Department of Labor about a work-related injury and your request for continuation of pay or compensation. Taking your time to fill it out correctly will help in the processing of your claim.

- Start with your personal information: In box 1, write your full name (Last, First, Middle).

- Provide your email address: Fill in your email address in box 1a.

- Fill out your Social Security Number: Enter it in box 2.

- Date of birth: Complete box 3 by entering your birth date.

- Indicate your sex: Mark Male or Female in box 4.

- Home telephone: Fill in your home phone number in box 5.

- Your job details: Complete box 6 by specifying your grade and step as of the injury date.

- Provide your home mailing address: Fill out box 7 with your complete address, including ZIP code.

- List your dependents: Include information in box 8.

- Describe where the injury occurred: Write that detail in box 9.

- Document the dates: Enter the date of your injury in box 10 and the date of this notice in box 11.

- Occupation: Fill in your job title in box 12.

- Explain the cause of the injury: Provide a detailed description in box 13.

- Detail the nature of your injury: Explain the injury and affected body parts in box 14.

- Sign and date: Certify the accuracy of your information by signing in box 15, then include the date.

- Witness information: If available, have a witness complete box 16 by describing what they observed.

- Supervisor’s section: Make sure your supervisor completes the necessary shaded boxes and returns the form.

After you've filled out the form, ensure that it’s submitted as directed. Your supervisor will need to validate the injury report, so keep communication open. It’s also a good idea to maintain copies of everything for your records. This proactive approach will help streamline the process as you move forward with your claim.

What You Should Know About This Form

What is the CA-1 form and why do I need it?

The CA-1 form is the Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation. If you're a federal employee and suffer a traumatic injury while on duty, this form is crucial. It allows you to report the injury and claim compensation or continuation of your pay while you're unable to work. Completing this form promptly ensures that you receive the benefits you're entitled to under the Federal Employees' Compensation Act.

How do I complete the CA-1 form?

Filling out the CA-1 form involves providing key information in several sections. Start by entering your personal details, including your name, social security number, and contact information. Then, describe the injury in detail: the time and place it occurred, the cause, and the nature of the injury itself. Make sure to sign the form to certify that the injury was sustained while performing your duties. Don't forget to have your supervisor fill out the necessary sections at the end of the form before submitting it.

What happens if I miss the deadline for submitting the CA-1 form?

Submitting the CA-1 form in a timely manner is essential. You need to file it within 30 days of the injury. If the form is submitted late, you may lose your right to claim benefits, including continuation of pay. If you find yourself in this situation, it’s crucial to explain the circumstances surrounding the delay. However, acting quickly can prevent potential complications, so don’t hesitate to file as soon as possible.

What should I do if my claim is denied?

If your claim for continuation of pay is denied, you have options. First, you should receive a formal explanation of why your claim was not approved. Understanding this will help you determine the best course of action. You may need to provide additional information or documentation supporting your claim. If necessary, consider filing an appeal or consulting with an expert to guide you through the process. Stay proactive; responding to the denial quickly can significantly impact your outcome.

Do I need a witness to complete the CA-1 form?

A witness statement is important but not mandatory for completing the CA-1 form. However, having one strengthens your claim. The witness should describe what they saw or know about the injury. Along with your details, this statement can provide clarity and support to your account of the incident, increasing the chances of your claim being approved.

Common mistakes

When filling out Form CA-1, several common mistakes can lead to complications in the claims process. Being aware of these errors can help ensure smoother navigation through the paperwork involved in reporting workplace injuries.

One common mistake is neglecting to fill out all required fields. The form has specific boxes from 1 to 15 that must be completed. Each detail adds crucial context for the claim. Omitting information, even something as seemingly minor as an email address, can trigger delays in processing. Always aim to provide complete and accurate details in every section.

Another frequent issue arises with the description of the cause of the injury. Clarity is key. Instead of vague phrases, specific details about how the injury occurred are necessary. For instance, instead of just writing “I fell,” specify how you fell, the distance, and the circumstances leading to the incident. This comprehensive approach provides a clearer picture for those reviewing your claim.

Incorrectly identifying the nature of the injury is another mistake to watch for. Be sure to mention not only the injury itself but also the specific part of the body affected. If you fractured your left leg, accurately state this instead of simply mentioning “leg.” This level of detail can significantly influence the evaluation of your claim.

Many individuals also fail to indicate their decision regarding continuation of pay (COP). If you are disabled due to the injury and file the CA-1 within thirty days, you might be entitled to COP for up to 45 days. Not checking the appropriate box may lead to misunderstandings about your compensation rights, which can adversely affect your financial situation.

In addition, errors in signing the form can be detrimental. It's imperative to ensure that you sign at the designated spot in Section 15. A missing signature could lead to an outright rejection of your claim, setting back the entire process. Similarly, all dates need to be correctly filled out, especially concerning when the injury occurred and when the claim is being made.

Another misstep can be failing to provide adequate details in the witness statement section. If there were witnesses to your injury, their statements can significantly strengthen your claim. Ensure that this section is filled out thoroughly and accurately, as the perspective of observers can add credibility to your documentation.

Finally, not submitting the form promptly can lead to complications. The law sets certain timeframes for filing a claim; for instance, the CA-1 must typically be filed within 30 days of the injury. Delays can result in lost pay or denial of benefits altogether. Timeliness is vital in securing the compensation you deserve.

By avoiding these common mistakes when filling out Form CA-1, you can enhance the likelihood of a successful claim process, allowing you to focus on your recovery without unnecessary hurdles.

Documents used along the form

The CA-1 form is used by federal employees to report a traumatic injury that occurred while on duty and to claim continuation of pay or compensation. When filing a CA-1, there are several other forms and documents that may often be necessary to support the claim effectively. Below is a list of these commonly used forms and documents.

- CA-7: Claim for Compensation - This form is used to claim compensation for wage loss due to a work-related injury after the continuation of pay period ends. It requires medical evidence to support the claim.

- CA-7b: Application for Leave Buy Back - Employees fill out this form to request the repurchase of annual or sick leave used during a period of disability covered by the CA-1.

- CA-2: Notice of Occupational Disease - This form is for federal employees who suffer from an occupational disease caused by their work environment. It helps claim benefits under the Federal Employees' Compensation Act (FECA).

- CA-16: Authorization for Examination and/or Treatment - Employers use this form to authorize medical treatment for an injured worker, facilitating immediate medical care and documentation for the claim.

- OWCP-5: Employee’s Request for Information - This document is used by the injured employee to gather additional information on their claim status or request details from the Office of Workers' Compensation Programs.

- Form SF-66-D: Medical Folder - This form is utilized to document an employee’s medical records related to their injury and is crucial for tracking treatment and recovery.

- Witness Statements - Written accounts from individuals who witnessed the incident provide additional context to the CA-1 claim, enhancing its credibility.

Utilizing these forms and documents alongside the CA-1 helps ensure a complete and thorough submission, facilitating a smoother claims process under the Federal Employees' Compensation Act.

Similar forms

- Form CA-2: This form serves as a request for continuation of pay and compensation for an occupational disease. Like the CA-1, it collects detailed information about the incident, however, it focuses on non-traumatic injuries resulting from work-related exposure over time, rather than a one-time event.

- Form CA-7: The CA-7 is used to file for compensation after the continuation of pay (COP) period has ended. It is similar to CA-1 in that it requires specific details about the injury and the impact on the employee’s ability to work, but focuses on long-term compensation.

- Form CA-7b: This is an application to request compensation for the employee's leave used during disability. Similar to CA-1, it requires information about the injury's impact on earnings, ensuring a smooth transition from short-term to long-term compensation claims.

- Form OWCP-1500: Commonly used in medical billing, this form is similar in terms of collecting details but focuses on medical treatment received. Both forms require comprehensive injury descriptions but serve different purposes; OWCP-1500 is for medical providers while CA-1 is for injured employees.

- Form CA-16: The CA-16 is a request for authorization of medical treatment for a work-related injury but must be completed by the employer. It shares similarities with the CA-1 in terms of injury verification but relates specifically to medical treatment authorization rather than injury reporting.

- Form CA-15: Used for notice of a claim for death benefits, the CA-15 shares similarities with CA-1 in the requirement for detailed information about the incident and individuals involved, but it pertains to claims following a fatal work-related injury.

- Form DOL-1: Known as the "Employee's Claim for Compensation," this form resembles the CA-1 in its purpose of documenting a worker's claim for compensation, yet it is generally for state-based claims rather than federal claims under the FECA.

- Form OWCP-123: This is a request for reinstatement of benefits after a claim has been denied. While both this form and CA-1 collect relevant injury information, OWCP-123 is focused on rectifying a previous claim outcome rather than reporting an initial injury.

Dos and Don'ts

Do's and Don'ts for Filling Out the CA-1 Form

- Do complete all boxes from 1 to 15. Ensure no fields are left empty.

- Do provide detailed descriptions of the injury and incident in sections 13 and 14.

- Do sign and date the form when you finish filling it out to validate your claims.

- Do include your email address in box 1a for future communication regarding your claim.

- Don't complete any shaded areas on the form, as they are designated for agency use only.

- Don't submit the form late; file within 30 days of the injury to ensure continuation of pay.

- Don't leave any sections blank; if you need extra space, attach a supplemental statement.

- Don't misrepresent details about the injury, as false statements can lead to denial of your claim.

- Don't forget to have your supervisor complete the bottom section and return it to you.

Misconceptions

- Misconception #1: The CA-1 form is only for serious injuries.

- Misconception #2: Completing the CA-1 form is optional.

- Misconception #3: The CA-1 form must be filled out immediately after the injury occurs.

- Misconception #4: All injuries need to have a witness to file a CA-1 form.

- Misconception #5: Completing the CA-1 form guarantees compensation.

This isn’t true. The CA-1 form can be used for any traumatic injury, regardless of severity. Even minor injuries that occur during work should be reported using this form to ensure proper documentation and potential compensation.

Completing the CA-1 form is not optional if you want to claim benefits. It is critical to file this form to access continuation of pay or compensation due to a work-related injury. Failing to submit it can jeopardize your ability to receive benefits.

While it’s important to report an injury as soon as possible, you have up to 30 days to submit the CA-1 form. However, you’ll want to submit it promptly to avoid any complications with your claim.

A witness is helpful but not required for filing the CA-1 form. The injured employee can file the claim based on their account of the incident. Gathering witness statements can strengthen your case, but it is not a mandatory step.

Filing the form is just the first step in the process. It does not guarantee compensation as each claim is reviewed individually. The claim might be approved or denied based on various factors, including provided documentation and evidence.

Key takeaways

- Complete every required box from 1 to 15 on the CA-1 form. Shaded sections should not be filled out by the employee.

- Include your email address in box 1a. This ensures you can receive timely information.

- Clearly describe the cause of the injury in box 13. Details can help your claim.

- Clearly state the nature of the injury in box 14. Mention the specific body part affected.

- Sign the form in box 15, certifying that the injury occurred while on duty.

- Make sure to file the CA-1 form within 30 days of the injury to be eligible for continuation of pay.

- Be aware that continuation of pay (COP) lasts for a maximum of 45 days following the injury.

- Understand that COP will not affect your sick or annual leave balance.

- Keep a copy of the completed CA-1 form for your records.

- Request a witness statement in section 16 if someone observed the incident. Their testimony may support your claim.

- Instruct your supervisor to complete their section promptly, including all required codes.

- If your claim is contested, your agency must provide a detailed reason for the denial.

Browse Other Templates

Hired and Non Owned Auto Endorsement Iso Form - All listed insureds must meet specific definitions in the coverage form.

Osha Fire Prevention Plan Template - Indicate any limitations in communication capabilities at the Fire Command Station.