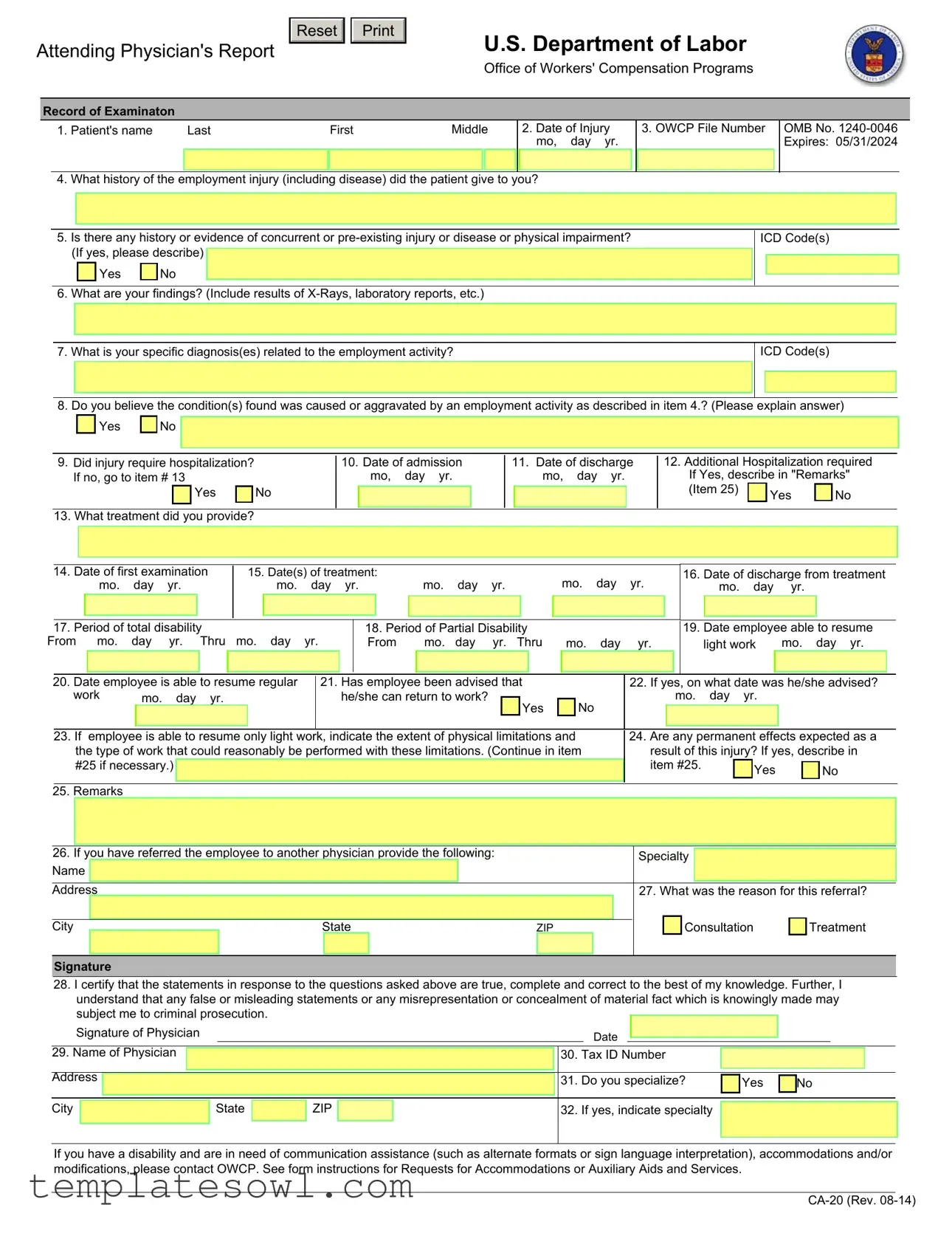

Fill Out Your Ca 20 Form

The CA-20 form, officially titled the Attending Physician's Report, serves a critical role in the process of worker's compensation under the U.S. Department of Labor's Office of Workers' Compensation Programs (OWCP). This form is designed for physicians to document essential medical findings and evaluations related to an employee's work-related injury or illness. Information captured on the CA-20 includes details such as the patient's name, the date of injury, and a history of the employment injury. Physicians use this form to provide specific diagnoses, treatment history, and any pre-existing conditions that may affect recovery. The form also allows physicians to comment on the nature of any disability, the extent of work limitations, and the prognosis for returning to either light or regular work. Additionally, the CA-20 requires the physician's certification that the information provided is accurate and complete, which underscores the importance of this document in the compensation process. Ultimately, the CA-20 is a crucial component that supports the payment of benefits related to wage loss or permanent disability for injured federal employees and others covered under the regulations of the OWCP.

Ca 20 Example

Attending Physician's Report

Reset

U.S. Department of Labor

Office of Workers' Compensation Programs

Record of Examinaton

1. Patient's name |

Last |

First |

Middle |

|

2. Date of Injury |

||

|

|

|

|

|

|

|

mo, day yr. |

|

|

|

|

|

|

|

|

4. What history of the employment injury (including disease) did the patient give to you?

3. OWCP File Number

OMB No.

5.Is there any history or evidence of concurrent or

Yes |

|

No |

6. What are your findings? (Include results of

ICD Code(s)

7. What is your specific diagnosis(es) related to the employment activity?

ICD Code(s)

8. Do you believe the condition(s) found was caused or aggravated by an employment activity as described in item 4.? (Please explain answer)

Yes |

|

No |

9.Did injury require hospitalization? If no, go to item # 13

Yes |

|

No |

|

13. What treatment did you provide?

10.Date of admission mo, day yr.

11.Date of discharge mo, day yr.

12.Additional Hospitalization required If Yes, describe in "Remarks"

(Item 25) |

Yes |

No |

|

|

|

14. Date of first examination |

|

15. Date(s) of treatment: |

|

mo. |

day |

yr. |

|

mo. |

day |

yr. |

|

|

|

16. Date of discharge from treatment |

||||||||||||||||||||||||||||||||||

|

|

|

|

mo. |

day |

yr. |

|

|

|

|

mo. |

day |

yr. |

|

|

|

|

|

|

|

mo. |

|

day |

|

yr. |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Period of total disability |

|

|

|

|

|

|

|

18. Period of Partial Disability |

|

|

|

|

|

|

|

|

|

|

|

19. Date employee able to resume |

||||||||||||||||||||||||||||

From |

mo. |

day |

yr. |

Thru |

mo. day |

yr. |

|

From |

|

mo. |

day |

yr. Thru |

|

mo. |

day |

|

yr. |

|

light work |

mo. day yr. |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

20. Date employee is able to resume regular |

|

21. Has employee been advised that |

|

|

|

|

|

|

22. If yes, on what date was he/she advised? |

|||||||||||||||||||||||||||||||||||||||

|

|

work |

|

mo. |

|

day |

yr. |

|

|

|

|

|

|

he/she can return to work? |

|

|

Yes |

|

|

No |

|

|

|

|

|

|

mo. |

day |

yr. |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. If |

employee is able to resume only light work, indicate the extent of physical limitations and |

|

|

24. Are any permanent effects expected as a |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

the type of work that could reasonably be performed with these limitations. (Continue in item |

|

|

|

|

result of this injury? If yes, describe in |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

#25 if necessary.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

item #25. |

|

|

|

Yes |

|

|

|

No |

|||||||||

|

|

25. Remarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. If you have referred the employee to another physician provide the following: |

|

|

|

|

|

|

|

Specialty |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. What was the reason for this referral? |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consultation |

|

|

Treatment |

|||||||||

|

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

28.I certify that the statements in response to the questions asked above are true, complete and correct to the best of my knowledge. Further, I understand that any false or misleading statements or any misrepresentation or concealment of material fact which is knowingly made may subject me to criminal prosecution.

Signature of Physician |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

29. Name of Physician |

|

|

|

|

|

|

|

30. |

Tax ID Number |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

31. |

Do you specialize? |

|

Yes |

|

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP |

|

|

|

32. |

If yes, indicate specialty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have a disability and are in need of communication assistance (such as alternate formats or sign language interpretation), accommodations and/or modifications, please contact OWCP. See form instructions for Requests for Accommodations or Auxiliary Aids and Services.

INSTRUCTIONS TO PHYSICIAN FOR COMPLETING ATTENDING PHYSICIAN'S REPORT

1.COMPLETE THE ENTRIES

2.IF DISABILITY HAS NOT TERMINATED, INDICATE IN ITEM 17; AND

3.SEND THE FORM AND YOUR BILL TO:

Office of Workers’ Compensation Programs

Division of Federal Employees’, Longshore and Harbor Workers’ Compensation

Federal Employees’ Compensation Act

PO Box 8311

London, KY

IMPORTANT: A medical report is required by the Office of Workers' Compensation Programs before payment of compensation for loss of wages or permanent disability can be made to the employee.

This information is required to obtain or retain a benefit (5 U.S.C. 8101, et seq.). If you have submitted a narrative medical report or a form

OWCP requires that medical bills, other than hospital bills, be submitted on the American Medical Association health insurance claim form, HCFA

INSTRUCTIONS FOR THE INJURED WORKER/ EMPLOYING AGENCY

Compensation for wage loss cannot be paid unless medical evidence has been submitted supporting disability for work during the period claimed. For claims based on traumatic injury and reported on Form

For payment of a schedule award the claimant must have a permanent loss or loss of function of one of the members of the body or organs enumerated in the regulations (20 C.F.R. 10.404). The attending physician must affirm that maximum medical improvement of the condition has been reached and should describe the functional loss and the resulting impairment in accordance with the American Association Guides to the Evaluation of Permanent Impairment.

Notice

Requests for Accommodations or Auxiliary Aids and Services

If you have a disability, federal law gives you the right to receive help from the OWCP in the form of communication assistance, accommodation(s) and/or modification(s) to aid you in the claims process. For example, we will provide you with copies of documents in alternate formats, communication services such as sign language interpretation, or other kinds of adjustments or changes to accommodate your disability. Please contact our office or your OWCP claims examiner to ask about this assistance.

Privacy Act Statement

In accordance with the Privacy Act of 1974, as amended (5 U.S.C. 552a), you are here by notified that: (1) The Federal Employees' Compensation Act, as amended and extended (5 U.S.C. 8101, et seq.) (FECA) is administered by the Office of Workers' Compensation Programs of the U. S .Department of Labor, which receives and maintains personal information on claimants and their immediate families. (2) Information which the Office has will be used to determine eligibility for and the amount of benefits payable under the FECA, and may be verified through computer matches or other appropriate means. (3) Information may be given to the Federal agency which employed the claimant at the time of injury in order to verify statements made, answer questions concerning the status of the claim, verify billing, and to consider issues relating to retention, rehire, or other relevant matters. (4) Information may also be given to other Federal agencies, other government entities, and to

Public Burden Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to this collection of information unless it displays a currently valid OMB control number. Public reporting burden for this collection of information is estimated to average 5 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The obligation to respond to this collection is required to obtain or retain a benefit under 5 U.S.C. 8101, et seq. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Office of Workers' Compensation Programs, Room

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CA-20 form is used to document an attending physician's assessment of an injured worker's condition in the context of the federal workers' compensation program. |

| Governing Law | The form is governed by the Federal Employees' Compensation Act (FECA), specifically 5 U.S.C. 8101 et seq. |

| Filing Entity | The completed CA-20 form is submitted to the Office of Workers' Compensation Programs (OWCP) under the Department of Labor. |

| Required Information | The form requires details such as the patient's name, injury date, medical history, diagnosis, and treatment. |

| Claims Processing | Medical evidence, including the CA-20 form, is essential for processing wage loss claims and providing permanent disability benefits. |

| Privacy Concerns | Completion of the CA-20 form involves the disclosure of personal information, consistent with the Privacy Act of 1974. |

| Duration Validity | The OMB control number on the form, 1240-0046, indicates it will expire on May 31, 2024. |

| Medical Reports | A narrative medical report may be required in addition to the CA-20 to adequately relate a worker's condition to their employment. |

| Referrals | If an injured worker is referred to another physician, the CA-20 allows for detailing the reason and providing that physician's information. |

| Compliance | Physicians are required to certify that their responses are true and complete, as misleading information can lead to criminal prosecution. |

Guidelines on Utilizing Ca 20

Completing the CA-20 form involves several important steps. This document is crucial for indicating the medical status of an employee following a work-related injury. A careful approach ensures accurate information is submitted to the Office of Workers' Compensation Programs.

- Enter Patient Information: Fill out the patient's name, including last, first, and middle names in the first section.

- Date of Injury: Specify the date of the injury using the month, day, and year format.

- Document History: Provide a detailed account of the history of the employment injury as given by the patient.

- Enter OWCP File Number: Include the Office of Workers' Compensation Programs file number, if available.

- Concurrent or Pre-existing Conditions: Indicate whether there is any history of concurrent or pre-existing injuries or diseases, and describe if applicable.

- Findings: Report your findings, including results from any X-Rays or laboratory reports, along with ICD codes.

- Specific Diagnosis: State your specific diagnosis or diagnoses related to the employment activity, including corresponding ICD codes.

- Condition Causation: Indicate if you believe the condition was caused or aggravated by employment activity and provide an explanation.

- Hospitalization Details: Answer whether the injury required hospitalization. If yes, provide dates of admission and discharge.

- Treatment Provided: List what treatment you provided to the patient.

- Date of First Examination: Fill in this date.

- Date(s) of Treatment: Specify the dates of treatment, including the date of discharge from treatment.

- Disability Periods: Note the periods of total and partial disability.

- Return to Work: Indicate the dates the employee is able to resume both light and regular work.

- Advisement of Return: State if the employee has been advised that they can return to work and the corresponding date.

- Physical Limitations: Describe any physical limitations if the employee can only resume light work.

- Permanent Effects: Indicate whether permanent effects are expected as a result of the injury and describe if applicable.

- Remarks: Add any additional notes or comments in the remarks section.

- Referral Information: If the employee was referred to another physician, fill in the specialty, name, address, and reason for referral.

- Physician Certification: Sign and date the form, certifying that the information is accurate to the best of your knowledge.

- Physician Details: Complete your name, tax ID number, and address.

After filling out the form, ensure it is submitted along with any necessary documentation. Timely submission is vital for processing any potential benefits for the injured worker. Take care to send the completed form along with your bill to the appropriate Office of Workers’ Compensation Programs address for review.

What You Should Know About This Form

What is the CA-20 form used for?

The CA-20 form, or Attending Physician's Report, is used in the context of worker's compensation claims in the United States. It provides essential medical information about an injured employee, detailing the extent of their injury, treatment, and whether the condition resulted from employment activities. This form aids in assessing eligibility for compensation benefits.

Who needs to complete the CA-20 form?

The CA-20 form must be completed by the attending physician of the injured employee. This physician should have a thorough understanding of the employee's medical condition, treatment history, and the impact of the injury on the employee’s ability to work.

What information is required on the CA-20 form?

The form includes multiple sections that collect various details. Key information includes the patient's name, date of injury, medical findings, diagnosis related to the injury, treatment provided, and any periods of disability. The physician is also required to certify that the information provided is true and complete.

How is the CA-20 form submitted?

The completed CA-20 form should be sent to the Office of Workers’ Compensation Programs (OWCP) along with the physician's bill for services rendered. The address for submission is included on the form itself, ensuring timely processing of the claim.

Is a CA-20 form required for all worker’s compensation claims?

A CA-20 form is specifically necessary for claims substantiated by medical evidence demonstrating a disability linked to work-related activities. If a claimant has already submitted a narrative medical report or a CA-16 form within the past 10 days, they may not need to submit the CA-20.

What happens if the information on the CA-20 form is inaccurate?

If inaccuracies are found, it can lead to delays in processing the claim or even denial of benefits. The physician completing the form should ensure that all information is correct and truthful to avoid potential criminal prosecution for false statements.

Can a physician provide additional documentation apart from the CA-20 form?

Yes, a physician may also provide a narrative medical report in addition to the CA-20 form. This is especially useful in describing the relationship between the employee’s work and their injury in greater detail, which could aid in the claims process.

What information is protected under the Privacy Act when submitting the CA-20 form?

Personal information collected on the CA-20 form is protected under the Privacy Act of 1974. This means information gathered will only be used to determine eligibility for compensation and may be shared with relevant parties to process the claim, such as healthcare providers and government agencies.

How does one request accommodations related to the CA-20 form?

Individuals needing communication assistance or accommodations due to a disability should contact the OWCP office or their claims examiner. Options may include receiving documents in alternate formats or obtaining sign language interpretation services.

Common mistakes

The CA-20 form, known as the Attending Physician's Report, plays a crucial role in the workers' compensation process. However, errors can occur when completing this form, which may cause delays or complications with claims. Several common mistakes can hinder the processing of the report. Awareness of these issues is vital for both physicians and patients.

One frequent mistake involves inaccurate patient information. Omitting or misreporting the patient's name, date of injury, or OWCP file number can lead to significant issues in claim processing. Ensure that all details are not only correct but also clearly printed to avoid misinterpretation.

Another error relates to the history of the employment injury. Failing to provide a comprehensive account of the injury can leave valuable gaps in understanding the case. It is essential for physicians to take the time to detail the information given by the patient concerning their injury or condition.

Concurrent or pre-existing conditions often go unreported. If a physician skips item six, questioning the presence of any concurrent or pre-existing injuries or diseases, they miss an opportunity to clarify the patient's medical history. Documenting such information accurately can be pivotal in determining cause and effect.

The diagnostic details are also critical. Item seven asks for specific diagnoses related to the employment activity. Neglecting to provide this information can lead to additional questions and delays. Providing precise and complete diagnoses ensures clarity in the report.

An often-overlooked aspect of the CA-20 form is accurately identifying whether the condition was caused or aggravated by employment. The corresponding explanation in item eight should be sufficiently detailed. Simply answering "yes" or "no" without elaboration can lead to ambiguity, resulting in delays.

It is also typical for physicians to overlook the hospitalization question. This item is crucial—if hospitalization occurred, it must be noted. Furthermore, omitting the treatment details provided in item 13 can hinder claims processing. Include the nature of the treatment and any follow-up care when applicable.

Another common mistake involves the documentation of the periods of disability. Items 17 and 18 require clear entries to ascertain the full picture of impairment. Failure to document these periods accurately can leave claims unresolved.

Lastly, signing and dating the form is not merely a formality. The physician’s signature signifies that the reports are true and complete. Omitting this step may result in immediate denial of the claim. Thus, ensuring that the CA-20 form is completely and correctly filled out is paramount.

In conclusion, attention to detail is crucial when completing the CA-20 form. By avoiding these common pitfalls, both physicians and patients can streamline the claims process and ensure fair evaluation of the case. Proper documentation not only simplifies the process but also fosters better communication regarding the patient's needs and entitlements.

Documents used along the form

The CA-20 form, known as the Attending Physician's Report, plays a crucial role in workers' compensation claims. Several other forms accompany it in processing claims and verifying necessary medical evidence. The following list outlines these commonly associated forms and documents.

- CA-1 Form: This form is used by employees to report a traumatic injury occurring in the workplace. It initiates the claim process for wage loss and medical benefits.

- CA-2 Form: Employees utilize this form to file a claim for occupational disease or illness. It requires detailed information about the nature of the condition and the work environment.

- CA-16 Form: This form serves as a request for medical treatment. It is provided to authorized medical facilities and ensures that injured workers receive prompt care without delay in compensation.

- Form OWCP-1500: This is the standard medical bill submission form used for non-hospital bills. Physicians may submit their charges using this form to obtain reimbursement for treatment provided.

- CA-7 Form: The CA-7 is utilized to apply for wage-loss compensation. Employees complete this form to claim benefits for lost earnings during their recovery period.

- CA-17 Form: This medical report is completed by a treating physician to provide details regarding an employee's condition and ability to work. It helps the OWCP determine the case's status and appropriate action.

- CA-27 Form: This form is necessary for claiming a schedule award for permanent impairment resulting from a work-related injury. It requires detailed medical documentation and evaluations.

- CA-20.2 Form: An extension of the CA-20, this form requests further diagnostic tests or treatment recommendations from the attending physician for ongoing cases.

- Form OWCP-5c: This form documents the physician's opinion on the employee's ability to return to work and the nature of any remaining disabilities.

- Form OWCP-43: This form is utilized to report the results of medical evaluations and treatment plans for employees undergoing rehabilitation services.

Understanding these documents helps streamline the claims process for employees, physicians, and claims administrators. Each form serves its unique function in delivering essential information needed to assess and approve workers' compensation claims efficiently.

Similar forms

The CA-20 form serves as an essential document within the workers' compensation process. Several other forms have similar purposes or functions within this context. Here are five documents comparable to the CA-20, along with explanations of how they are alike:

- CA-1 Form (Federal Employees' Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation): This form is used by federal employees to report traumatic injuries. Like the CA-20, it requires a detailed account of the injury and its impact on work capability, initiating the claims process.

- CA-2 Form (Federal Employees' Notice of Occupational Disease and Claim for Compensation): The CA-2 is similar in function, addressing claims related to occupational diseases. It also gathers information about how the illness affects the ability to work, similar to the CA-20’s focus on diagnosis and treatment.

- CA-16 Form (Authorization for Examination and/or Treatment): This form authorizes medical treatment for workers who have sustained injuries. It serves as an initial step for obtaining care, similar to the CA-20 that collects information on treatment already provided and its outcomes.

- OWCP-1500 (Health Insurance Claim Form): The OWCP-1500 is utilized by medical providers to submit claims for payment for services rendered to injured workers. Like the CA-20, it is geared towards the intersection of medical treatment and workers' compensation.

- Form OWCP-5 (Employee's Notice of Change in Condition): This document allows employees to report any changes in their medical condition that affect their ability to work. It complements the CA-20 by providing ongoing updates about an employee's health status and its implications for work capability.

Dos and Don'ts

When completing the CA-20 form, it's important to follow certain guidelines. Below is a list of do's and don'ts to help ensure the process goes smoothly.

- Do provide accurate information in all required fields.

- Do include specific details about the patient's injury and treatment.

- Do sign the form at the designated area to validate your statements.

- Do indicate any pre-existing conditions that might affect the patient's recovery.

- Do keep a copy of the form for your records after submission.

- Don't leave any mandatory fields blank; this could delay the processing of the claim.

- Don't submit the form without verifying all entries for accuracy.

- Don't use medical jargon that may confuse the claims process.

- Don't forget to send the form to the correct address for submission.

Misconceptions

The CA-20 form is an important document within the workers' compensation process but is often misunderstood. Below are several common misconceptions about the form along with clarifications.

- The CA-20 form is optional. Many believe that completing the CA-20 form is optional. In reality, it is a required document that must be submitted to substantiate an employee’s claim for compensation due to work-related injuries.

- Only severe injuries require the CA-20 form. Some people think that this form is only necessary for serious injuries. However, it is required for any workplace injury or illness, regardless of its severity.

- The CA-20 form can be completed by anyone. There is a misconception that any individual can fill out the form. The CA-20 must be completed by an attending physician who has evaluated the employee’s condition.

- Once submitted, the CA-20 form cannot be updated. Some individuals believe that the information submitted on the form is permanent. The form can be updated as new information becomes available or if the employee’s condition changes.

- The form only focuses on diagnosis. Another misconception is that the CA-20 is solely about diagnosing injuries. The form addresses various aspects, including the history of the injury, treatment provided, and the physician's opinion on work-related causation.

- Submitting a narrative report makes the CA-20 unnecessary. Some hold the belief that submitting a narrative medical report replaces the CA-20 requirement. While a narrative may complement the CA-20, it does not substitute for it in the claims process.

- There are no consequences for inaccurate information. Many fail to understand that providing false information on the CA-20 can lead to serious implications, including criminal prosecution. Accuracy is crucial for both the physician and the employee.

Key takeaways

The CA-20 form is a crucial document in the workers' compensation process, specifically for cases related to employment injuries. Here are some key takeaways regarding its completion and usage:

- Thorough Completion is Essential: Every section of the CA-20 form must be filled out accurately and completely. This includes documenting the patient's details, the nature of the injury, medical findings, treatment provided, and prognosis.

- Timely Submission: The form should be submitted promptly after it is completed by the attending physician. Delays can hinder the processing of the worker's compensation claim.

- Medical Evidence is Required: Medical documentation supporting the claim is critical. This means the attending physician's report should correlate with the patient's medical history and the injury's impact on the employee's work capabilities.

- Potential Referral to Specialist: If the attending physician believes further evaluation is necessary, they may refer the employee to another specialist. The reason for this referral needs to be clearly stated in the remarks section of the form.

Browse Other Templates

Set Up Direct Deposit - It is your responsibility to stay informed about the status of the direct deposit.

Free Farm Lease Agreement Forms to Print - Clear expectations regarding equipment and supplies contribute to effective farm operation.