Fill Out Your Ca 20 48 02 99 Form

The CA 20 48 02 99 form is a significant endorsement within commercial auto insurance policies. Designed to provide clarity and specificity to liability coverage, this form identifies individuals or organizations included as "insureds" under the policy. It operates under business auto, garage, motor carrier, and truckers coverage forms, offering essential modifications without altering the core coverage itself. Importantly, the endorsement is effective from the policy’s inception date unless otherwise specified. This means that any designated individual or organization named in the schedule gains access to liability coverage, provided they meet the conditions outlined in the policy's "Who Is An Insured" provision. Therefore, understanding this endorsement is critical for businesses to ensure all relevant parties are adequately protected in the event of an incident. A thorough review of the form and its implications can help prevent coverage gaps and ensure compliance with insurance requirements.

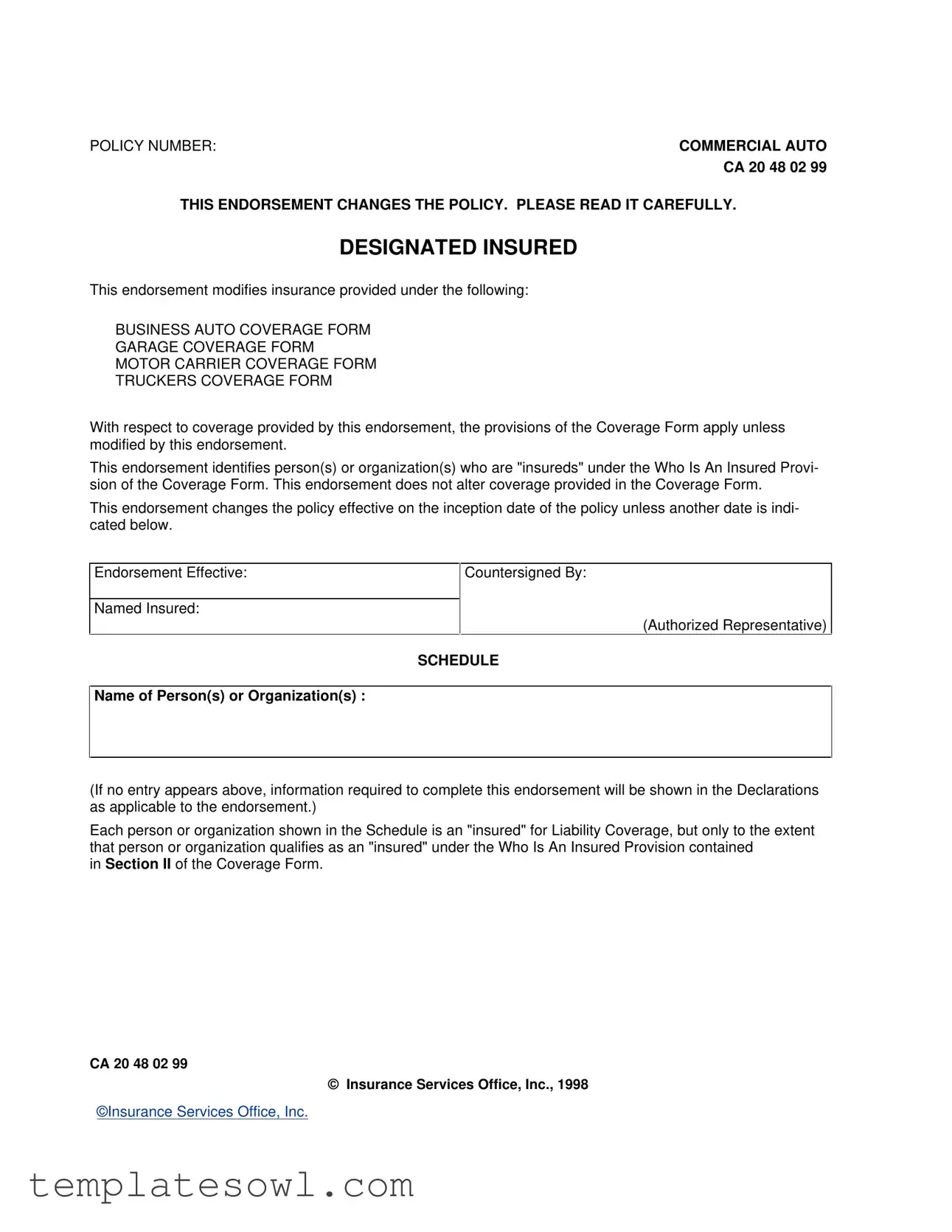

Ca 20 48 02 99 Example

POLICY NUMBER:COMMERCIAL AUTO

CA 20 48 02 99

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

DESIGNATED INSURED

This endorsement modifies insurance provided under the following:

BUSINESS AUTO COVERAGE FORM

GARAGE COVERAGE FORM

MOTOR CARRIER COVERAGE FORM

TRUCKERS COVERAGE FORM

With respect to coverage provided by this endorsement, the provisions of the Coverage Form apply unless modified by this endorsement.

This endorsement identifies person(s) or organization(s) who are "insureds" under the Who Is An Insured Provi- sion of the Coverage Form. This endorsement does not alter coverage provided in the Coverage Form.

This endorsement changes the policy effective on the inception date of the policy unless another date is indi- cated below.

Endorsement Effective:

Named Insured:

Countersigned By:

(Authorized Representative)

SCHEDULE

Name of Person(s) or Organization(s) :

(If no entry appears above, information required to complete this endorsement will be shown in the Declarations as applicable to the endorsement.)

Each person or organization shown in the Schedule is an "insured" for Liability Coverage, but only to the extent that person or organization qualifies as an "insured" under the Who Is An Insured Provision contained

in Section II of the Coverage Form.

CA 20 48 02 99

© Insurance Services Office, Inc., 1998

©Insurance Services Office, Inc.

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Type | This form pertains to commercial auto insurance and modifies coverage under Business Auto, Garage, Motor Carrier, and Truckers Coverage Forms. |

| Insured Identification | The endorsement identifies specific individuals or organizations as "insureds" under the policy, providing clarity about who is covered. |

| Endorsement Effective Date | The changes specified by this endorsement take effect on the policy's inception date unless another date is indicated within the document. |

| Governing Law | The CA 20 48 02 99 form is subject to state-specific laws on insurance contracts, including but not limited to the regulations outlined in the relevant state code. |

Guidelines on Utilizing Ca 20 48 02 99

Completing the CA 20 48 02 99 form is an important step to ensure that the necessary parties are properly covered under your insurance policy. Careful attention to detail will help in filling out the form correctly. Once filled out, this form will be submitted as part of your insurance documentation.

- Clearly write your POLICY NUMBER at the top of the form.

- Find the section labeled "Endorsement Effective." Enter the date when this endorsement will take effect.

- In the "Named Insured" section, provide the name of the individual or organization that holds the policy.

- Locate the "Countersigned By" area. Have an authorized representative sign their name here.

- Proceed to the "SCHEDULE" section. List the name(s) of the person(s) or organization(s) you wish to designate as insureds under this policy. If there are multiple names, ensure each is clearly provided.

- Double-check all entries for accuracy. Ensure all names and dates are correct before finalizing the form.

- After verification, keep a copy for your records and submit the completed form to your insurance provider as instructed.

What You Should Know About This Form

What is the purpose of the CA 20 48 02 99 form?

The CA 20 48 02 99 form is an endorsement that modifies the insurance coverage under specific types of commercial auto policies. It identifies the individuals or organizations that are considered “insureds” for liability coverage. This endorsement does not change the coverage provided in the underlying policy but rather clarifies who is protected under that coverage.

Who qualifies as an "insured" under this endorsement?

According to the endorsement, “insureds” are defined as individuals or entities listed in the endorsement’s schedule. They must meet the criteria established in the “Who Is An Insured” provision found in Section II of the relevant coverage form. Essentially, only those explicitly mentioned in the endorsements or declarations will be regarded as insureds.

When does this endorsement take effect?

This endorsement is effective on the date the policy begins unless a different effective date is specified in the endorsement itself. This means that coverage protections outlined in the endorsement commence immediately or at the designated time of the policy's inception.

Does the CA 20 48 02 99 form change my existing coverage?

No, this endorsement does not alter the existing coverage within the underlying policy. Instead, it supplements the policy by clarifying who qualifies for liability coverage without impacting the Terms and Conditions of the original coverage form.

What types of coverage does this endorsement apply to?

The CA 20 48 02 99 form applies specifically to several types of commercial auto coverage forms, including the Business Auto Coverage Form, Garage Coverage Form, Motor Carrier Coverage Form, and Truckers Coverage Form. Each of these coverage forms adheres to the same criteria for the definition of insureds as outlined in the endorsement.

Is it necessary to complete the endorsement schedule?

The endorsement schedule must be completed to effectively identify the persons or organizations that will be considered insureds under the policy. If the schedule is left blank, the information required to complete it will typically be provided in the policy's Declarations section, making proper completion important for clarity.

Can this form be used with any auto insurance policy?

This endorsement is specifically designed for use with particular commercial auto insurance policies. It is not intended for personal auto insurance policies or other non-commercial forms. If you are uncertain whether this endorsement is applicable to your policy, consulting with your insurance provider is recommended.

Who has the authority to sign this endorsement?

An authorized representative must countersign the endorsement to make it valid. This signature serves to confirm the endorsement’s implementation and ensures the changes are officially recognized within the policy documentation.

Common mistakes

Completing the CA 20 48 02 99 form can be straightforward, but there are common mistakes that people make that can cause complications. One frequent error is failing to clearly identify the designated insured. It's essential to ensure that the name of the person or organization is accurately entered in the designated field. Omitting or misspelling this information can lead to coverage issues later on.

Another common mistake is neglecting to indicate the effective date of the endorsement. The form should specify when the changes to the policy begin. Not providing this date can result in confusion about when the coverage starts, which is crucial for both the insurer and the insured.

Individuals may also forget to review the "Who Is An Insured Provision." This section outlines the criteria for someone to be recognized as an insured under the coverage form. If individuals do not comprehend these terms, they might assume coverage exists when it does not, leading to potential liability problems down the line.

Additionally, some people tend to overlook the necessity for an authorized representative's signature. The "Countersigned By" section must be completed. Without this signature, the endorsement may not be fully executed, which could invalidate the changes made in the policy.

People might also make the mistake of leaving fields blank. If certain information is not applicable, it is still advisable to mark a field as "N/A" instead of leaving it blank. This practice helps avoid confusion and clarifies that no information was overlooked.

Lastly, many individuals do not keep a copy of the completed form for their records. Retaining a copy is important for future reference and can help resolve any disputes that may arise regarding the coverage. Documentation acts as a safeguard in understanding the terms and coverage provisions of the policy.

Documents used along the form

When dealing with insurance matters, especially in the realm of commercial auto coverage, several documents often accompany the CA 20 48 02 99 form. Each document serves a specific purpose and helps clarify the terms, conditions, or coverage offered under the insurance policy. Below is a list of these crucial documents.

- Declarations Page: This document outlines the specifics of your insurance coverage. It provides essential information like the policyholder's name, address, coverage limits, and the types of coverage included in the insurance policy.

- Coverage Form: This is the main document that details the different types of coverage provided under the policy. It includes primary terms and conditions, laid out to inform the insured about what is and isn't covered.

- Endorsement Forms: These forms modify or add to the coverage provided in the primary policy. They can specify additional insureds, coverage limits, exclusions, or other changes based on the insured's needs.

- Claims Forms: When a loss occurs, this document is used to report and initiate the claims process. It outlines the information needed to support the claim and helps the insurer evaluate it efficiently.

- Exclusionary Endorsements: These documents specify what is not covered under the policy. Understanding these exclusions is essential, as they can significantly impact the coverage available to the insured.

- Service Agreements: Often accompanying commercial auto policies, these agreements detail the services provided by the insurer or agents, such as claims handling or risk management services.

Each of these documents plays a vital role in ensuring that policyholders understand their coverage and obligations. Familiarity with this documentation can help individuals and organizations navigate the complexities of their insurance policies more effectively.

Similar forms

The CA 20 48 02 99 form, known as the designated insured endorsement, has similarities with several other insurance forms. Each serves to modify or clarify certain coverage aspects provided under various types of auto insurance policies. Here are nine documents related to the CA 20 48 02 99 form, along with their similarities:

- Business Auto Coverage Form (BACF): Like the CA 20 48 02 99, the BACF provides general liability coverage for businesses using vehicles. It also identifies who is covered under the policy.

- Garage Coverage Form (GCF): This form is similar as it addresses coverage for businesses that operate in a garage setting, including liability for vehicles that are in the custody of the insured.

- Motor Carrier Coverage Form (MCCF): Similar to the CA 20 48 02 99, this form provides coverage for businesses that transport goods and clarifies liability for insured parties.

- Truckers Coverage Form (TCF): This document is comparable as it focuses on transportation risks and defines who qualifies as an insured under the policy.

- Personal Auto Policy (PAP): While primarily for personal vehicle use, this form shares similarities in identifying insured persons and outlining coverage specifics.

- Commercial General Liability Form (CGL): Though different in focus, the CGL form also outlines who is insured and the types of coverage provided, echoing the purpose of the CA 20 48 02 99.

- Non-Owned Auto Liability Coverage Form (NOALCF): This form addresses liability for vehicles that are not owned by the insured, similar to how the CA 20 48 02 99 designates insured parties.

- Hired Auto Liability Coverage Form (HALCF): Like the CA 20 48 02 99, this form covers vehicles rented or hired and defines insured entities under specific conditions.

- Endorsements for Additional Insureds: Many endorsements clarify who is considered an insured under particular policies, reflecting the CA 20 48 02 99’s function of naming specific persons or organizations.

Dos and Don'ts

When completing the CA 20 48 02 99 form, it is crucial to approach the task with care. Here’s a concise guide on what to do and what to avoid.

- Do read the entire form carefully before filling it out.

- Do ensure that the policy number is accurate and clearly stated.

- Do provide the correct names of the insured persons or organizations in the designated area.

- Do check if any additional information is referenced in the Declarations section.

- Do sign and date the form where prompted.

- Don’t leave any required fields blank; incomplete information can lead to delays.

- Don’t alter the form in any way; use it as it is provided.

- Don’t forget to review the "Who Is An Insured" provision for clarity on coverage.

- Don’t submit the form without ensuring it is countersigned by an authorized representative.

Misconceptions

Misconceptions about the CA 20 48 02 99 form can lead to confusion regarding its purpose and implications. Here are four common misunderstandings:

- This form offers new coverage options. Many believe that the CA 20 48 02 99 introduces additional coverage not found in other policy forms. In reality, it simply modifies existing coverage by identifying additional insured parties without expanding the overall policy scope.

- All listed individuals automatically receive full coverage. Some think that including a person or organization on the form grants them comprehensive protection. However, coverage is contingent upon whether those individuals meet the criteria outlined in the "Who Is An Insured" provision of the original policy.

- This endorsement changes the terms of the policy. A common misconception is that the CA 20 48 02 99 alters the fundamental terms of the insurance policy. Instead, it functions as an addition to, or clarification of, the original terms already established in the business auto coverage forms.

- The form is optional for the insurer. Some people assume that using this endorsement is at the insurer's discretion. In fact, if the endorsement is attached to a policy, it becomes a binding part of the contract that both parties must adhere to.

Key takeaways

The CA 20 48 02 99 form serves an essential function in commercial auto insurance policies. Understanding how to properly fill out and utilize this endorsement can have significant implications for coverage and liability. Below are key takeaways regarding this form:

- Designated Insured Status: The form allows specific individuals or organizations to be recognized as "insureds" under the coverage, clarifying who is entitled to protection under the policy.

- No Alteration of Coverage: While the form identifies additional insured parties, it does not change the actual coverage provided in the original coverage forms.

- Effective Date: The endorsement takes effect on the policy's inception date unless a different date is specified. This ensures that coverage is in place from the start of the policy period.

- Proper Completion: It is critical to accurately fill in the name of each person or organization in the designated space, as this determines who qualifies for liability coverage.

- Review the Provisions: Users should familiarize themselves with the "Who Is An Insured" provision in Section II of the Coverage Form, as it outlines the criteria that must be met for coverage to apply to the insured parties listed on the form.

Being meticulous with this form not only protects the designated parties but also helps avoid potential disputes regarding insurance coverage in the event of a claim.

Browse Other Templates

Sbi Personal Loan Application Form - Consider seeking assistance if you're uncertain about any part of the application.

Qr7 Form - Failure to report correctly may lead to severe legal consequences.

Marriott Explore Program - Beneficiaries should review eligibility requirements to ensure they qualify for the $600 annual credit.