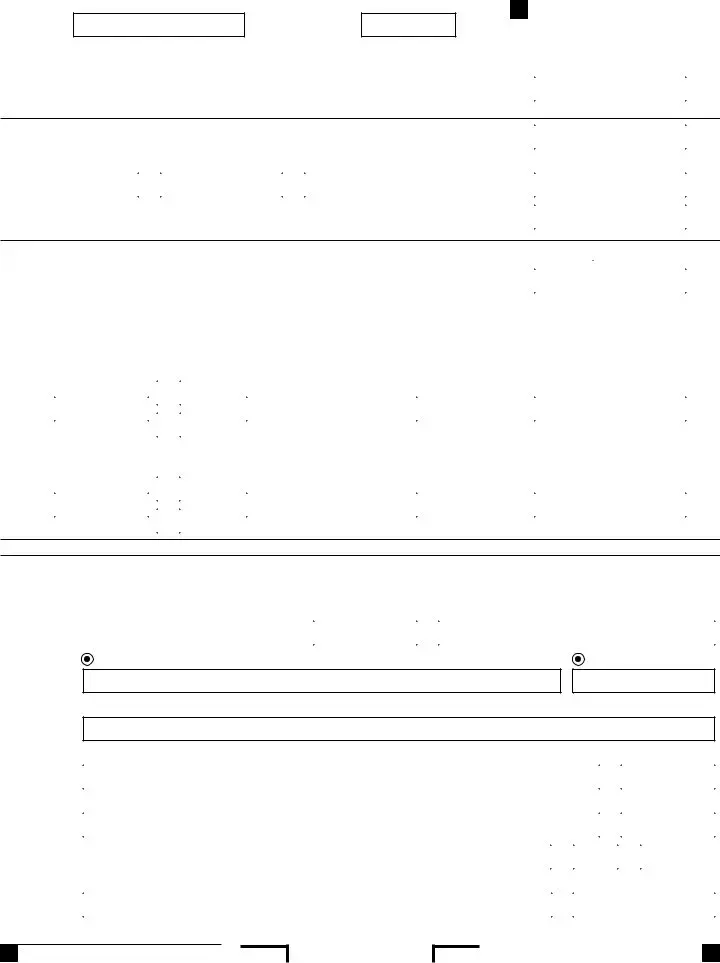

Fill Out Your Ca 540 Form

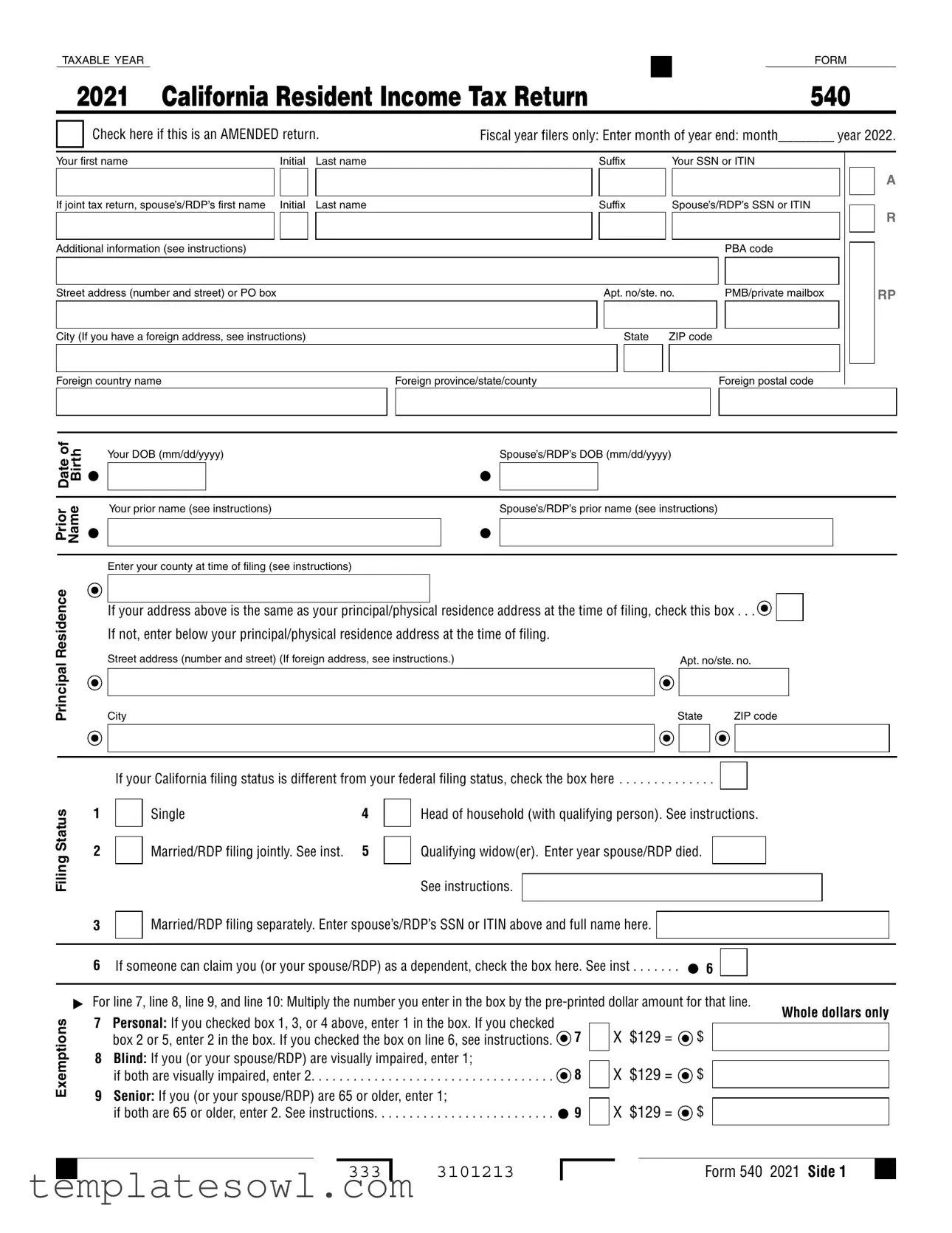

The California Resident Income Tax Return Form 540 is a critical document for individuals and couples filing their state income taxes. Designed specifically for California residents, this form simplifies the process of reporting income, claiming deductions, and calculating tax liabilities. It includes essential information such as personal details, social security numbers, and filing status, whether single, married, or head of household. The form also captures exemptions for dependents, allowing taxpayers to reduce their taxable income significantly. Furthermore, California residents need to report both their federal adjusted gross income and any necessary adjustments specific to California tax law. This ensures that all state-specific credits and taxes—whether for mental health services or additional contributions to special funds—are accurately applied. Filing Form 540 correctly not only meets legal obligations but can also lead to potential refunds or reduced tax liabilities, making it an essential part of financial planning for residents of the Golden State.

Ca 540 Example

TAXABLE YEAR |

|

|

FORM |

|

|||

|

|

|

|

2021 California Resident Income Tax Return |

540 |

||

Check here if this is an AMENDED return.

Your first name |

|

Initial |

|

Last name |

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

|

Initial |

|

Last name |

|

|

|

|

|

Additional information (see instructions)

Street address (number and street) or PO box

City (If you have a foreign address, see instructions)

Foreign country name

of |

|

Your DOB (mm/dd/yyyy) |

|||

Date Birth |

• |

||||

|

|

|

|||

|

|

|

|||

Prior Name |

|

|

Your prior name (see instructions) |

||

• |

|

|

|||

|

|||||

|

|

Enter your county at time of filing (see instructions) |

|||

Fiscal year filers only: Enter month of year end: month________ year 2022.

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

R |

|||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PBA code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no/ste. no. |

|

PMB/private mailbox |

|

|

|

RP |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign province/state/county |

|

|

|

Foreign postal code |

|

|

|

|

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s DOB (mm/dd/yyyy)

•

Spouse’s/RDP’s prior name (see instructions)

•

Principal Residence

Filing Status

If your address above is the same as your principal/physical residence address at the time of filing, check this box . . .

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.

Street address (number and street) (If foreign address, see instructions.) |

|

Apt. no/ste. no. |

|

||

|

|

|

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . .

1 |

|

Single |

4 |

|

Head of household (with qualifying person). See instructions. |

|

|

|||

2 |

|

|

5 |

|

|

|

|

|

|

|

|

Married/RDP filing jointly. See inst. |

|

Qualifying widow(er). Enter year spouse/RDP died. |

|

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

3 |

|

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here. |

|

|

|

|

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

. . . . . . .6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst |

• 6 |

|

|

|

|

|

|

Exemptions

▶ For line 7, line 8, line 9, and line 10: Multiply the number you enter in the box by the |

Whole dollars only |

||||||

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked |

|

|

|

|

|

||

7 |

|

X $129 = |

$ |

|

|

||

|

|

|

|||||

|

box 2 or 5, enter 2 in the box. If you checked the box on line 6, see instructions. |

|

|

|

|||

8 |

Blind: If you (or your spouse/RDP) are visually impaired, enter 1; |

8 |

|

X $129 = |

$ |

|

|

|

|

|

|||||

|

if both are visually impaired, enter 2 |

|

|

|

|||

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; |

• 9 |

|

X $129 = |

$ |

|

|

|

|

|

|||||

|

|

|

|||||

|

if both are 65 or older, enter 2. See instructions |

|

|

|

|||

333

3101213

Form 540 2021 Side 1

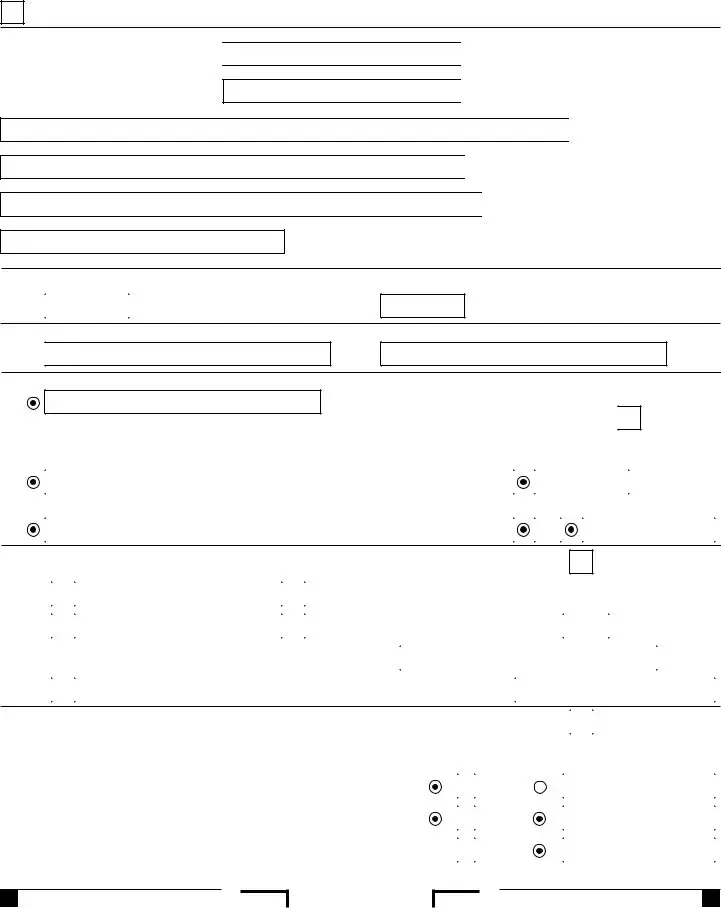

Your name: |

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

||

|

|

|

|

Exemptions

10 Dependents: Do not include yourself or your spouse/RDP.

|

Dependent 1 |

Dependent 2 |

First Name |

|

|

Last Name |

|

|

SSN. See |

• |

• |

instructions. |

||

Dependent’s |

|

|

relationship |

|

|

to you |

|

|

Dependent 3

•

. . . . . . . . . . . . . . . . . . . . . .Total dependent exemptions |

. . . . . . |

. . . . . . . . . . . • 10 |

|

X $400 = |

$ |

||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 |

. . . 11. . . . |

$ |

||||||

12 State wages from your federal |

• 12 |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|

|

||||

|

Form(s) |

|

|

|

|

|

|||

13 |

Enter federal adjusted gross income from federal Form 1040 or |

. . . 13 |

|

||||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), |

|

. • 14 |

|

|||||

|

|

||||||||

|

Part I, line 27, column B |

. . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

|

|||

|

|

|

|

|

|||||

15Subtract line 14 from line 13. If less than zero, enter the result in parentheses.

Income |

|

See instructions |

. 15 |

|

||

16 |

Part I, line 27, column C |

. • 16 |

|

|||

Taxable |

California adjustments – additions. Enter the amount from Schedule CA (540), |

|

|

|||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. • 17 |

{ |

|||

|

18 |

Enter the |

{ |

Your California itemized deductions from Schedule CA (540), Part II, line 30; OR |

||

|

|

larger of |

Your California standard deduction shown below for your filing status: |

|

||

|

|

|

• Single or Married/RDP filing separately |

$4,803 |

||

|

|

|

• Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . |

$9,606 |

||

|

|

|

|

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions |

• 18 |

|

19Subtract line 18 from line 17. This is your taxable income.

If less than zero, enter  19

19

31 Tax. Check the box if from: |

|

Tax Table |

|

|

Tax Rate Schedule |

|

|

|

|

|

|

|

|

• |

|

FTB 3800 |

• |

|

. . . . . . . . .FTB 3803 |

• 31 |

|

|

32Exemption credits. Enter the amount from line 11. If your federal AGI is more than

Tax |

|

$212,288, see instructions |

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . . |

32 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . |

. . . . . . . . |

33 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

34 |

Tax. See instructions. Check the box if from: • |

|

|

Schedule |

|

|

. .FTB 5870A |

• 34 |

|||||||

|

|

35 |

Add line 33 and line 34 |

|

|

|

|

|

|

|

|

|

|

|

. |

35 |

|

|

|

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . |

|||||

Credits |

40 |

Nonrefundable Child and Dependent Care Expenses Credit. See instructions |

|

|

. |

• 40 |

|||||||||||

|

|

. |

. . . . |

. . . . . . . |

|||||||||||||

Special |

43 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

. . .and amount |

• 43 |

|||

44 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

and amount |

• 44 |

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 Form 540 2021 |

333 |

3102213 |

|

|

|

|

|

|||||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

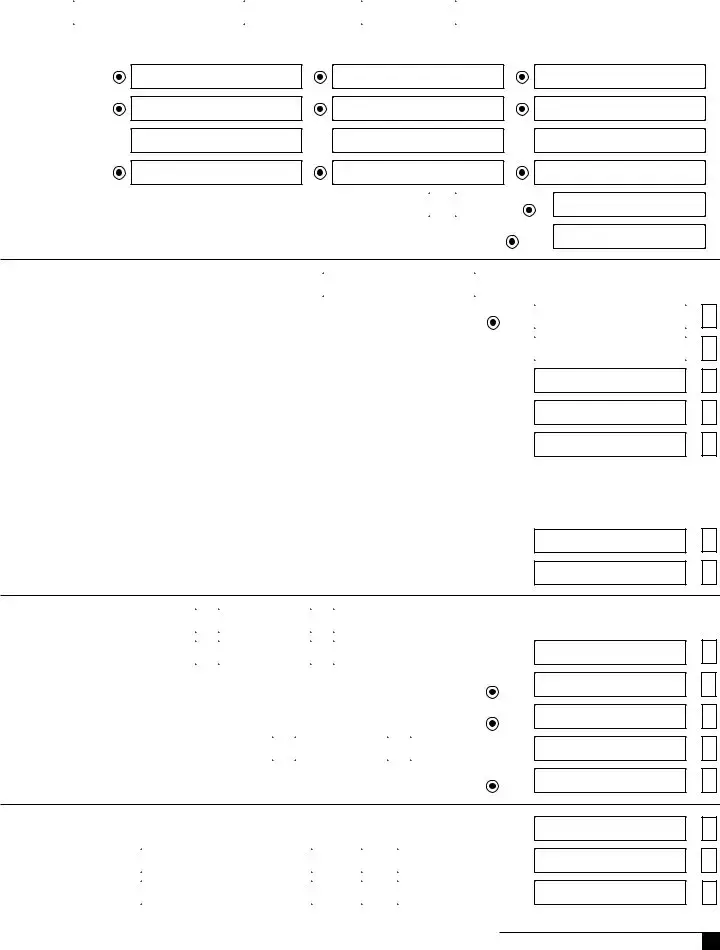

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

Credits |

45 |

. . . . . . . . . . . . . .To claim more than two credits. See instructions. Attach Schedule P (540) |

|

|

|

|

||||||||||||||

46 |

Nonrefundable Renter’s Credit. See instructions |

|

|

|

• 46 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

Special |

. . . |

. . . . |

|

|||||||||||||||||

47 |

Add line 40 through line 46. These are your total credits |

|

|

|

|

47 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

. . . |

. . . . |

|

|

|

|

|

|

||||||||||||

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

|

|

|

|

48 |

|

|

|

|

|

||||||||

|

. . . |

. . . . |

|

|

|

|

|

|

||||||||||||

|

61 |

Alternative Minimum Tax. Attach Schedule P (540) |

|

|

|

• 61 |

|

|

|

|

||||||||||

|

. . . |

. . . . |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

Taxes |

62 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mental Health Services Tax. See instructions |

. . . |

. . . . |

• 62 |

|

|

|

|

|||||||||||

63 |

Other taxes and credit recapture. See instructions |

|

|

|

• 63 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

Other |

. . . |

. . . . |

|

|||||||||||||||||

64 |

Excess Advance Premium Assistance Subsidy (APAS) repayment. See instructions |

• 64 |

|

|

|

|

||||||||||||||

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

65 |

Add line 48, line 61, line 62, line 63, and line 64. This is your total tax |

. . . . . . . . . . |

. . . |

. . . . |

• 65 |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

71 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .California income tax withheld. See instructions |

. . . |

. . . . |

• 71 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

72 |

. . . . . . . . . . . . . . . . .2021 CA estimated tax and other payments. See instructions |

. . . |

. . . . |

• 72 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

73 |

. . . . . . . . . . . . . . . . . . . . .Withholding (Form |

. . . |

. . . . |

• 73 |

|

|

|

|

|||||||||||

Payments |

75 |

Earned Income Tax Credit (EITC) |

|

|

|

|

|

|

|

|

• |

75 |

|

|

|

|

|

|||

. . . . . |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

|

|

|

|

||||||||

|

74 |

Excess SDI (or VPDI) withheld. See instructions |

. . . |

. . . . |

• |

74 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . .76 Young Child Tax Credit (YCTC). See instructions |

. . . |

. . . . |

• 76 |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

77 |

. . . . . . . . . . . . . . . . . . . .Net Premium Assistance Subsidy (PAS). See instructions |

. . . |

. . . . |

• 77 |

|

|

|

|

|||||||||||

|

78 |

Add line 71 through line 77. These are your total payments. |

|

|

|

|

78 |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Tax |

|

See instructions |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

.. .. .. . •. . .91. . . |

. . . |

. . . . |

|

|

|

|

|

|

|||||

91 |

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Use Tax. Do not leave blank. See instructions |

|

|

|

|

|

00 |

|

|||||||||||||

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

If line 91 is zero, check if: |

|

No use tax is owed. |

|

|

|

You paid your use tax obligation directly to CDTFA. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

92 If you and your household had |

• |

|

|

|

|

|

|

|

|||||||||||

Penalty |

|

See instructions. Medicare Part A or C coverage is qualifying health care coverage |

|

|

|

|

|

|

|

|||||||||||

ISR |

|

If you did not check the box, see instructions. |

. . . • 92 |

|

|

|

|

|

|

|

. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Individual Shared Responsibility (ISR) Penalty. See instructions |

|

|

|

|

|

|

|

00 |

|

||||||||||

|

|

|

|

|

|

|||||||||||||||

Due |

93 |

Payments balance. If line 78 is more than line 91, subtract line 91 from line 78 |

|

93 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

Tax/Tax |

94 |

Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 |

|

94 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|||||||||||||||

Overpaid |

95 |

Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92, |

|

96 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

|

subtract line 93 from line 92 |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

|

|

|

|

|

||||||

|

96 |

subtract line 92 from line 93 |

. . . . . . . . . . . . . . . . . |

. . |

. . |

. |

. . . . . . . . . . |

. . . |

. . . . |

|

95 |

|

|

|

|

|

||||

|

Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, then |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

333

3103213

Form 540 2021 Side 3

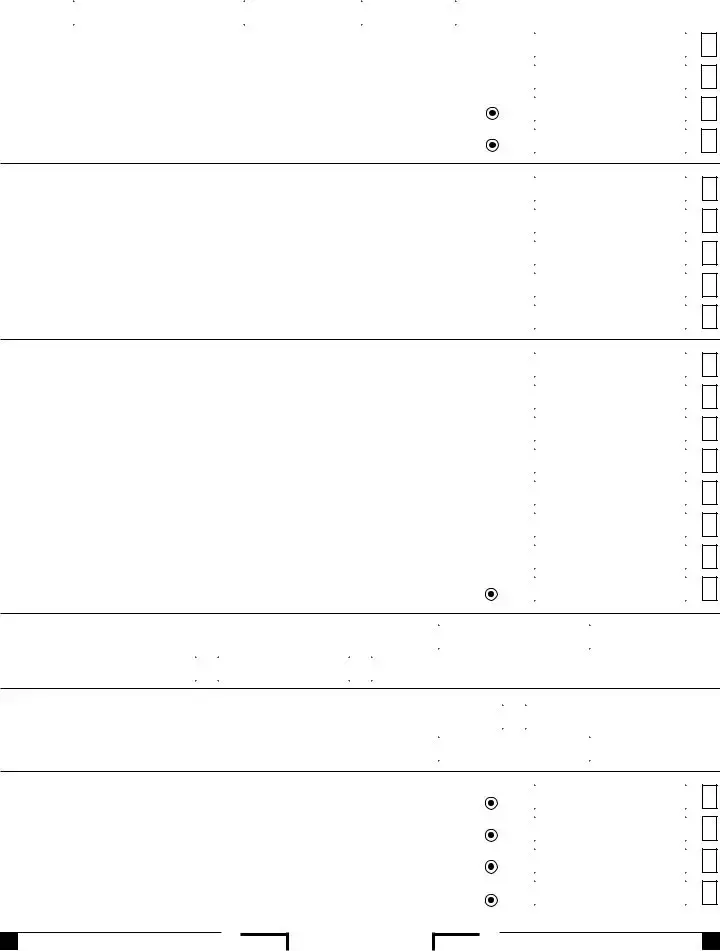

|

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Due |

97 Overpaid tax. If line 95 is more than line 65, subtract line 65 from line 95 |

|

|

|

97 |

|

|

|

||||||||||

|

|

|

|

|

|

|||||||||||||

Tax/Tax |

. . . . |

. . . .. |

• |

|

|

|

||||||||||||

98 |

Amount of line 97 you want applied to your 2022 estimated tax |

|

|

98 |

|

|

|

|||||||||||

|

|

|

|

|

||||||||||||||

Overpaid |

. . . . |

. . . |

|

|

|

|||||||||||||

|

|

|

|

|

||||||||||||||

100 |

Tax due. If line 95 is less than line 65, subtract line 95 from line 65 |

|

.. |

• |

100 |

|

|

|

||||||||||

. . . . |

. . . |

|

|

|

||||||||||||||

|

|

99 |

Overpaid tax available this year. Subtract line 98 from line 97 |

. . . . |

. . . |

99 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

California Seniors Special Fund. See instructions |

|

|

|

. |

• 400 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Alzheimer’s Disease and Related Dementia Voluntary Tax Contribution Fund |

|

. |

• 401 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Rare and Endangered Species Preservation Voluntary Tax Contribution Program |

|

. |

• 403 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Breast Cancer Research Voluntary Tax Contribution Fund |

|

. |

• 405 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Firefighters’ Memorial Voluntary Tax Contribution Fund |

|

. |

• 406 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Emergency Food for Families Voluntary Tax Contribution Fund |

|

. |

• 407 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Peace Officer Memorial Foundation Voluntary Tax Contribution Fund |

|

. |

• 408 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

California Sea Otter Voluntary Tax Contribution Fund |

|

|

|

. |

• 410 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Contributions |

|

California Cancer Research Voluntary Tax Contribution Fund |

|

. |

• 413 |

|

|||||||||||

|

|

. . . . |

. . . |

|

||||||||||||||

|

|

Protect Our Coast and Oceans Voluntary Tax Contribution Fund |

|

. |

• |

424 |

|

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

. . . . |

. . . |

|

|

|

||||||||||||

|

|

|

School Supplies for Homeless Children Voluntary Tax Contribution Fund |

. . . . |

. . . . |

• |

422 |

|

|

|

||||||||

|

|

|

State Parks Protection Fund/Parks Pass Purchase |

|

|

|

. |

• 423 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Keep Arts in Schools Voluntary Tax Contribution Fund |

|

|

|

. |

• 425 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund |

|

. |

• 431 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Senior Citizen Advocacy Voluntary Tax Contribution Fund |

|

. |

• 438 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund |

|

. |

• 439 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Rape Kit Backlog Voluntary Tax Contribution Fund |

|

|

|

. |

• 440 |

|

|||||||||

|

|

|

. . . . . . . . . . . . |

. . . . |

. . . |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Schools Not Prisons Voluntary Tax Contribution Fund |

|

|

|

. |

• 443 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Suicide Prevention Voluntary Tax Contribution Fund |

|

|

|

. |

• 444 |

|

|||||||||

|

|

|

. . . . . . |

. . . . . . . . . . . . |

. . . . |

. . . |

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Mental Health Crisis Prevention Voluntary Tax Contribution Fund |

|

. |

• 445 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

California Community and Neighborhood Tree Voluntary Tax Contribution Fund |

|

. |

• 446 |

|

|||||||||||

|

|

|

. . . . |

. . . |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

110 Add code 400 through code 446. This is your total contribution |

|

. |

• 110 |

|

|

|||||||||||

|

|

. . . . |

. . . |

|

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 4 Form 540 2021 |

333 |

|

3104213 |

|

|

|

|

|

|

|

|

|||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

Your name:

Your SSN or ITIN:

Amount You Owe

111AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

. |

00 |

Pay Online – Go to ftb.ca.gov/pay for more information. |

|

|

|

Interest and Penalties

Refund and Direct Deposit

112 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Interest, late return penalties, and late payment penalties |

112 |

|

. |

00 |

||||

113 |

Underpayment of estimated tax. |

|

|

|

|

|

|

||

|

Check the box: • |

|

FTB 5805 attached • |

|

|

• 113 |

|

. |

|

|

|

|

FTB 5805F attached |

|

00 |

||||

|

|

|

|

|

|||||

114 |

Total amount due. See instructions. Enclose, but do not staple, any payment |

114 |

|

. |

00 |

||||

|

|

||||||||

115REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 99. See instructions.

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

. |

00 |

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions. Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

• Routing number |

• Type |

• Account number |

|

• 116 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below: |

|

|

|

|||||||

|

• Routing number |

• Type |

• Account number |

|

• 117 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature |

Date |

Spouse’s/RDP’s signature (if a joint tax return, both must sign) |

||

|

|

|

|

|

|

|

|

|

|

Your email address. Enter only one email address. |

|

|

Preferred phone number |

|

Sign Here

It is unlawful to forge a spouse’s/ RDP’s signature.

Joint tax return? (See instructions)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if |

|

|

|

|

• PTIN |

|

||

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

• Firm’s FEIN |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? See instructions . . . . . . .• |

|

Yes |

|

|

|

No |

|

|

Print Third Party Designee’s Name |

|

Telephone Number |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

333

3105213

Form 540 2021 Side 5

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CA 540 form is used by California residents to file their state income tax returns. |

| Filing Requirements | It must be filed by individuals whose annual income exceeds certain thresholds set by California law. |

| Filing Status Options | Choices for filing status include Single, Married/RDP Filing Jointly, Head of Household, and more. |

| Tax Year | The form is specific to the 2021 tax year and should be filed accordingly. |

| Dependent Information | Taxpayers can claim exemptions for dependents, which can affect the overall tax liability. |

| Amended Returns | An individual can check a box on the form to indicate that they are filing an amended return. |

| Governing Laws | The CA 540 is governed by the California Revenue and Taxation Code Section 17041. |

Guidelines on Utilizing Ca 540

Filling out the California Form 540 can seem complex, but breaking it down into manageable steps makes it easier. This form is essential for California residents when filing their state income taxes. Follow the step-by-step guide to accurately complete the form and ensure you provide all the necessary information.

- Begin by indicating if this is an amended return. Check the box if it applies.

- Fill in your personal information:

- First name, middle initial, and last name.

- If filing jointly, also provide your spouse's or RDP’s first name, middle initial, and last name.

- Provide your street address, including city, state, and ZIP code. If you have a foreign address, enter that instead.

- Enter your date of birth in the format mm/dd/yyyy.

- Next, fill in your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, provide your spouse's or RDP’s SSN or ITIN and date of birth.

- Check the box if your current address is the same as your physical residence at the time of filing.

- Select your filing status from the five options, including Single, Married/RDP filing jointly, or Head of Household.

- Indicate any dependents you may have by entering their names and Social Security Numbers.

- For each exemption, enter the corresponding number and perform the calculations to find the exemption amounts.

- Document your state wages from your W-2 forms and enter your federal adjusted gross income.

- Complete the calculations for California adjustments related to your income.

- Determine your total income and then subtraction for California itemized deductions or standard deductions.

- Calculate your taxable income by subtracting your deductions from your total income.

- Follow the instructions to calculate your tax amount based on the taxable income.

- List any credits you are eligible for and calculate the total credits.

- Subtract your total credits from your tax amount to get the total tax owed.

- Detail any payments, such as California income tax withheld and estimated taxes already paid.

- If applicable, fill in the sections about the Individual Shared Responsibility Penalty.

- Proceed with the amounts you owe or the refund you expect over the course of the calculations provided.

- Review your information carefully, ensuring everything is accurate.

- Sign and date the return, including your email address and preferred phone number, and submit it as instructed.

Once you’ve completed the form, it will be ready for submission to the appropriate tax authorities. Be sure to double-check all entries for accuracy, and remember to keep a copy for your records. Understanding each step helps demystify the process, and gathering all necessary documents ahead of time will make the experience smoother.

What You Should Know About This Form

What is the CA 540 form?

The CA 540 form is the California Resident Income Tax Return for individuals. It is used by residents of California to report their income and calculate their state tax obligations. This form encompasses a variety of sections where taxpayers input personal information, income details, exemptions, deductions, and credits. It is essential for accurately assessing the amount owed or the refund due for the tax year.

Who must file the CA 540 form?

Individuals who are considered residents of California and earn income during the tax year must file the CA 540 form. This includes those earning wages, salaries, and self-employment income, as well as interest, dividends, and other forms of income. If you have a spouse and file jointly, you must also include your spouse's income. Additionally, if you are claimed as a dependent by someone else, specific conditions may affect your filing requirements.

What information is needed to complete the CA 540 form?

To complete the CA 540 form, taxpayers will need personal identification details, such as their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Additionally, information regarding income from various sources, including W-2 forms and other income statements, is required. Taxpayers also need to provide details about exemptions, deductions—such as standard or itemized deductions—and any applicable credits. It is advisable to have all relevant tax documents on hand before starting the form.

What are exemptions, and how do they affect my tax return?

Exemptions reduce your taxable income, which consequently lowers your overall tax liability. The CA 540 form allows for various exemptions based on personal and dependent status. Generally, each exemption equates to a set dollar amount that decreases your taxable earnings. For example, you may claim exemptions for yourself, your spouse, or dependents. Accurately listing exemptions is crucial for optimizing your tax return outcome.

How do I determine my filing status?

Your filing status is primarily determined by your marital status and whether you can claim any dependents. The CA 540 form outlines five categories: Single, Married/RDP Filing Jointly, Married/RDP Filing Separately, Head of Household, and Qualifying Widow(er). Understanding your status will guide you in completing tax calculations correctly and will also influence the deductions available to you.

What happens if I make a mistake on my CA 540 form?

If an error is made on your CA 540 form, you can file an amended return using the same form, marked as amended. This corrects inaccuracies and updates your taxable income or deductions. It is important to address any mistakes promptly, as errors can affect your tax liability and could lead to penalties or delayed refunds. Always double-check your calculations and ensure that all information provided is correct before submission.

Common mistakes

Filling out the California Form 540 can seem straightforward but many taxpayers still make mistakes that can lead to delays or incorrect assessments. One common mistake is failing to check the appropriate boxes regarding filing status. Errors in choosing between options like "Single," "Married/RDP filing jointly," or "Head of Household" can significantly alter the tax owed. Each status can have different implications for tax brackets and exemptions, affecting the total liability.

Another frequent error involves not providing accurate Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs). These numbers are crucial for the California Franchise Tax Board to accurately process the return. Missing or incorrect SSNs can result in delays in processing the tax return or, in some cases, disqualification from certain credits.

Many taxpayers also misunderstand the exemption claims on the form. The instructions specify how to calculate exemptions for dependents and personal allowances, yet omitting or miscalculating these figures is all too common. For instance, if you're eligible for two personal exemptions but only claim one, you risk paying more than necessary. Properly counting and multiplying the exemptions can lower the taxable income significantly.

People sometimes fail to report all income sources. California requires that all sources of state income be reported, not just what is shown on W-2 forms. For example, income from freelance work or investments often gets overlooked, leading to underreported earnings. Being comprehensive in income declarations helps avoid potential reassessments or penalties.

The fourth mistake relates to the error in calculating the taxable income. After inputting adjusted gross income, taxpayers sometimes miscalculate by not taking into account pertinent deductions. Whether using itemized deductions or the standard deduction, missteps here can lead to inaccurate taxable income figures. This is critical as it serves as the foundation for tax calculations.

Fifth, overlooking the information regarding credits is another mistake. Tax credits can directly reduce the amount owed, yet many individuals neglect to claim available credits such as the Nonrefundable Child and Dependent Care Expenses Credit. Not recognizing these opportunities can result in higher tax payments than necessary.

Finally, taxpayers often forget to sign the form or incorrectly complete the direct deposit information for any refunds. Signatures affirm the truthfulness of the return and direct deposits help expedite repayments. A missing signature or incorrect bank information could lead to unnecessary processing delays or complications in receiving refunds.

Documents used along the form

When completing the California Resident Income Tax Return (Form CA 540), it is important to be aware of several accompanying forms and documents that may be necessary to support your filing. These documents provide additional information that can help to clarify your financial situation and ensure accurate tax processing. Below is a list of various forms often used in conjunction with the CA 540.

- Form 540 Schedule CA: This form is used to report California adjustments to your income. It helps clarify any discrepancies between your federal and state income, reflecting specific deductions, credits, or taxable income specific to California.

- Form W-2: Issued by your employer, this form reports your annual wages and the taxes withheld from your paychecks. It's essential for calculating your taxable income and determining any possible refund or amount owed.

- Form 1099: If you received income from sources other than employment (e.g., freelance work or interest), these forms document that income. You may receive multiple 1099 forms, depending on your financial activities throughout the year.

- Form 540X: Should you need to amend your original CA 540 filing, Form 540X is the appropriate document. This form allows you to make corrections to previously submitted tax returns.

- Schedule D (Form 540): If you had capital gains or losses from the sale of assets, this form is necessary to compute your gains. It summarizes all transactions contributing to your capital situation during the tax year.

- Form 8889: If you contributed to a Health Savings Account (HSA), this form is required to calculate your deductions and report any distributions related to qualified medical expenses.

- Form FTB 5805: This form is applicable if you underpaid your estimated tax throughout the year. It helps you calculate any penalties for underpayment and ensures compliance with California tax laws.

- Form 3506: If you are eligible, this form allows you to claim the California Earned Income Tax Credit (CalEITC). This credit can provide significant financial benefits to qualifying individuals and families.

- Form FTB 3853: This form is relevant for anyone who received premium tax credits for health insurance coverage under the Affordable Care Act. It assesses the amount your coverage affects your taxes.

The use of these forms and documents facilitates a smoother tax filing experience, ensuring you accurately report your income and claims. Gathering these papers ahead of time can prevent delays and potential issues with the Franchise Tax Board. Proper attention to detail can save time and possibly enhance your understanding of your tax obligations and benefits.

Similar forms

Form 1040: This is the standard federal income tax form used for individual taxpayers in the United States. Like the CA 540, it collects personal information, state of residence, and filing status.

Form 1040-SR: Designed for seniors, this federal form is similar in structure to the CA 540, with sections for income, deductions, and credits. It simplifies tax reporting for individuals over 65.

California Form 541: This is a tax return for partnerships but shares similar sections, including income reporting and deductions, making it a counterpart in the way it gathers taxpayers' financial information.

California Form 100: This corporation tax return is analogous to the CA 540 in that it encompasses similar elements like income, deductions, and credits, tailored specifically for corporate entities.

California Form 8879: This form acts as an e-signature document for tax returns, comparable to the consent section found in the CA 540 where individuals sign to affirm the information is accurate.

Schedule CA (540): This is a supplemental form that accompanies the CA 540. It details adjustments to federal income, showcasing another layer of tax calculation similar to what is found directly on the CA 540.

Form 8862: The application for the Earned Income Credit, this form requires similar dependent information as the CA 540, particularly regarding eligibility for credits based on dependents.

Form 8880: This is the Credit for Qualified Retirement Savings Contributions form. It aligns with the CA 540’s treatment of credits and deductions for retirement savings, allowing both forms to capture similar financial details.

Form 8889: This form is for Health Savings Accounts (HSAs). It collects similar data regarding contributions and deductions, similar to personal exemptions and deductions found in the CA 540.

Dos and Don'ts

When filling out the CA 540 form, you should keep several best practices in mind to ensure accuracy. Additionally, it's important to be aware of common pitfalls to avoid. Here’s a list to help you.

- Do fill in all required fields completely and accurately.

- Do double-check your Social Security Number (SSN) and spouse’s SSN for correctness.

- Do use whole dollars only when entering income and deductions.

- Do review the instructions provided to ensure you understand each section.

- Do sign and date the form before submitting it.

- Don't leave any mandatory fields blank.

- Don't estimate amounts; always enter precise figures.

- Don't submit the form without checking for spelling mistakes or calculation errors.

- Don't forget to attach any necessary schedules or documents, if required.

- Don't use an outdated version of the form.

Misconceptions

- Misconception 1: The CA 540 form is only for high-income earners.

- Misconception 2: You cannot amend a CA 540 form after submission.

- Misconception 3: All types of income are taxed equally.

- Misconception 4: I don't need to file if I didn't earn a lot.

- Misconception 5: I can file the CA 540 form without any supporting documentation.

- Misconception 6: Filing late is always OK as long as I pay the tax owed eventually.

- Misconception 7: My federal tax return is enough for California filing.

- Misconception 8: I won't receive a refund if I have any taxable income.

- Misconception 9: Once I submit the CA 540, I can't track its status.

This form is designed for all California residents who earn income, regardless of the amount. Both low- and high-income individuals need to file.

You can amend your tax return by filing an amended CA 540 form. This helps if you discover errors or need to update your information.

California has different tax rates for various types of income, including wages, capital gains, and interest. The rates may differ based on your total income level.

Filing may still be required, depending on your filing status, age, and income level. Always check the guidelines to see if you are required to file.

You typically need to include supporting documents, such as W-2 forms and other income statements. These documents verify your income and withholdings.

Filing late can result in penalties and interest. It's best to file on time, even if you can’t pay the full amount owed.

The CA 540 form is specific to California tax laws. You must complete this form separately, even if you've filed your federal return.

Even if you have taxable income, you may still qualify for a refund based on deductions, credits, or if too much tax was withheld.

You can check the status of your CA 540 return through the California Franchise Tax Board's website after a certain processing period.

Key takeaways

- The CA 540 form is used to report California resident income for the tax year 2021.

- Ensure all personal information, including Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), is accurate.

- If filing a joint return, both partners must provide their names and identifying information.

- Determine your filing status accurately as it affects your tax obligations. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Calculate exemptions for yourself, your spouse, and dependents. The total exemption amount will impact your taxable income.

- Be mindful of adjustments to income. Some adjustments may either increase or decrease your taxable income.

- If you anticipate owing tax, be prepared to make estimated payments or set aside funds before submitting your form.

- Utilize direct deposit options for refunds, ensuring routing and account numbers are correct to avoid delays.

Browse Other Templates

Child Care Licensing Michigan - The child's preferred hospital for emergency treatment can also be noted, if applicable.

What Is a Caregiver Affidavit - This affidavit does not grant legal custody to the caregiver.