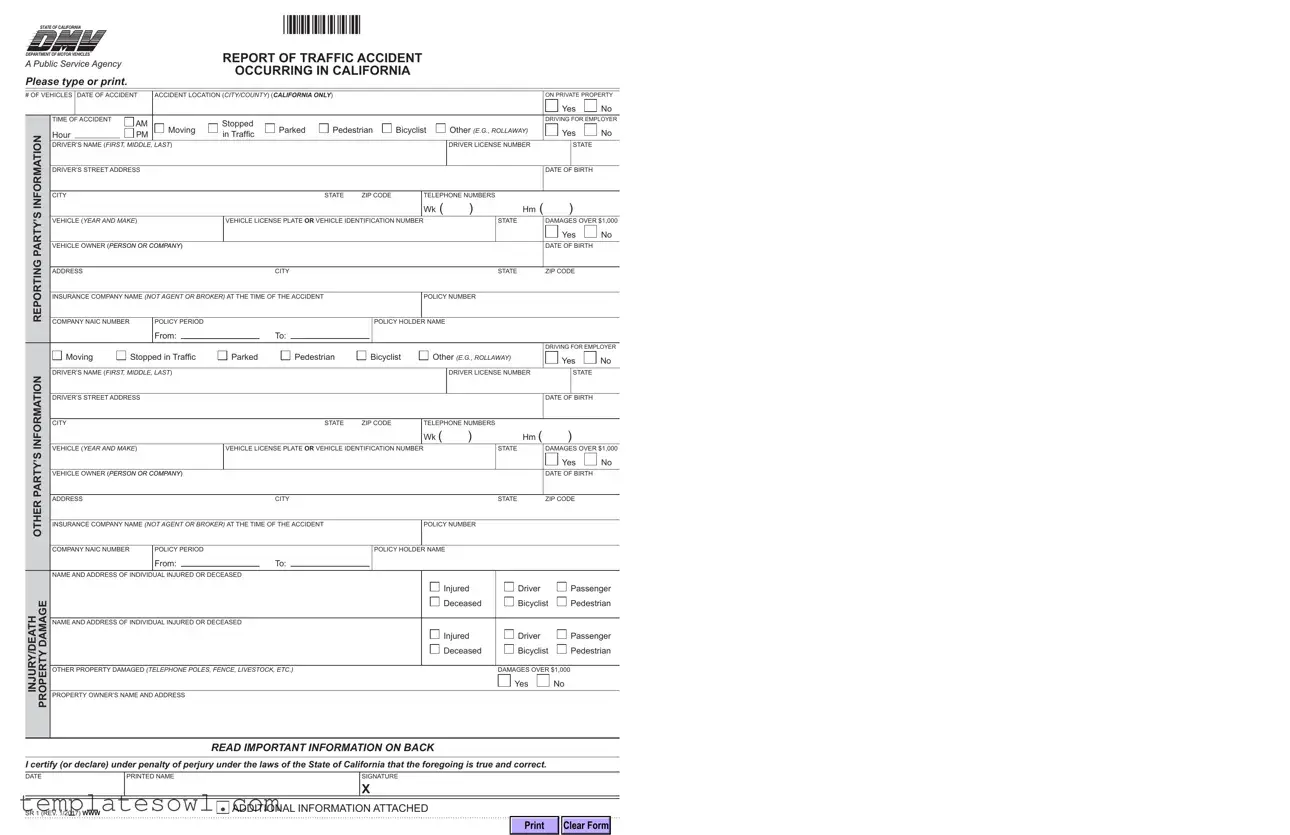

Fill Out Your Ca Dmv Sr1 Form

The California DMV SR1 form is a vital document designed for reporting traffic accidents that occur within the state. This form must be submitted within 10 days if there were any injuries, fatalities, or property damage exceeding $1,000. It captures crucial details about the incident, including the number of vehicles involved, the time and location of the accident, and the identities of the drivers and vehicle owners. The SR1 form also requires information regarding insurance coverage, ensuring that all parties involved maintain proper financial responsibility under California law. Furthermore, even if an accident is reported to law enforcement or an insurance company, submitting this form to the DMV remains necessary. Failing to do so could lead to a suspended driver's license. To fill out the SR1 form effectively, motorists are encouraged to include as much accurate information as possible, as this document will be used by insurance companies and law enforcement to assess liability and damages. Understanding the importance and requirements of the SR1 form is crucial for all California drivers, as it helps protect their rights and responsibilities after an accident.

Ca Dmv Sr1 Example

STATE OF CALIFORNIA

DEPARTMENT OF MOTOR VEHICLES®

A Public Service Agency

Please type or print.

*SR1*

REPORT OF TRAFFIC ACCIDENT

OCCURRING IN CALIFORNIA

# OF VEHICLES |

DATE OF ACCIDENT |

ACCIDENT LOCATION (CITY/COUNTY) (CALIFORNIA ONLY) |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIME OF ACCIDENT |

AM |

|

|

Stopped |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Moving |

Parked |

Pedestrian |

Bicyclist |

Other (E.G., ROLLAWAY) |

|||||||||||||

INFORMATION |

Hour |

|

|

PM |

in Traffic |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

DRIVER’S NAME (FIRST, MIDDLE, LAST) |

|

|

|

|

|

|

|

|

|

|

|

|

DRIVER LICENSE NUMBER |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

DRIVER’S STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

CITY |

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

TELEPHONE NUMBERS |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

PARTY’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wk ( |

) |

|

Hm ( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE (YEAR AND MAKE) |

|

|

|

VEHICLE LICENSE PLATE OR VEHICLE IDENTIFICATION NUMBER |

|

|

STATE |

|

|||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

|

VEHICLE OWNER (PERSON OR COMPANY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

REPORTING |

ADDRESS |

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

STATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

INSURANCE COMPANY NAME (NOT AGENT OR BROKER) AT THE TIME OF THE ACCIDENT |

|

|

|

|

|

|

POLICY NUMBER |

|

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

COMPANY NAIC NUMBER |

|

POLICY PERIOD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

POLICY HOLDER NAME |

|

|

|

|||||||

|

|

|

|

|

From: |

|

|

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Moving |

Stopped in Traffic |

|

Parked |

|

|

Pedestrian |

|

Bicyclist |

Other (E.G., ROLLAWAY) |

|

||||||||||

|

DRIVER’S NAME (FIRST, MIDDLE, LAST) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

DRIVER LICENSE NUMBER |

||||||||

DRIVER’S STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

CITY |

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

TELEPHONE NUMBERS |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wk ( |

) |

|

Hm ( |

PARTY’S |

VEHICLE (YEAR AND MAKE) |

|

|

|

VEHICLE LICENSE PLATE OR VEHICLE IDENTIFICATION NUMBER |

|

|

STATE |

|

||||||||||||

VEHICLE OWNER (PERSON OR COMPANY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

OTHER |

ADDRESS |

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

STATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

INSURANCE COMPANY NAME (NOT AGENT OR BROKER) AT THE TIME OF THE ACCIDENT |

|

|

|

|

|

|

POLICY NUMBER |

|

|||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

COMPANY NAIC NUMBER |

|

POLICY PERIOD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

POLICY HOLDER NAME |

|

|

|

|||||||

|

|

|

|

|

From: |

|

|

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME AND ADDRESS OF INDIVIDUAL INJURED OR DECEASED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

ON PRIVATE PROPERTY

Yes

Yes  No

No

DRIVING FOR EMPLOYER

Yes

Yes

No

No

STATE

DATE OF BIRTH

)

DAMAGES OVER $1,000

Yes

Yes

No

No

DATE OF BIRTH

ZIP CODE

DRIVING FOR EMPLOYER

Yes

Yes

No

No

STATE

DATE OF BIRTH

)

DAMAGES OVER $1,000

Yes

Yes

No

No

DATE OF BIRTH

ZIP CODE

INJURY/DEATH PROPERTY DAMAGE

NAME AND ADDRESS OF INDIVIDUAL INJURED OR DECEASED

OTHER PROPERTY DAMAGED (TELEPHONE POLES, FENCE, LIVESTOCK, ETC.)

PROPERTY OWNER’S NAME AND ADDRESS

Injured |

|

Driver |

Passenger |

|

Deceased |

|

Bicyclist |

Pedestrian |

|

Injured |

|

Driver |

Passenger |

|

Deceased |

|

Bicyclist |

Pedestrian |

|

|

DAMAGES OVER $1,000 |

|||

|

|

Yes |

|

No |

READ IMPORTANT INFORMATION ON BACK

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

DATE

PRINTED NAME

SIGNATURE

X

SR 1 (REV. 1/2017) WWW

ADDITIONAL INFORMATION ATTACHED

Clear Form

Clear Form

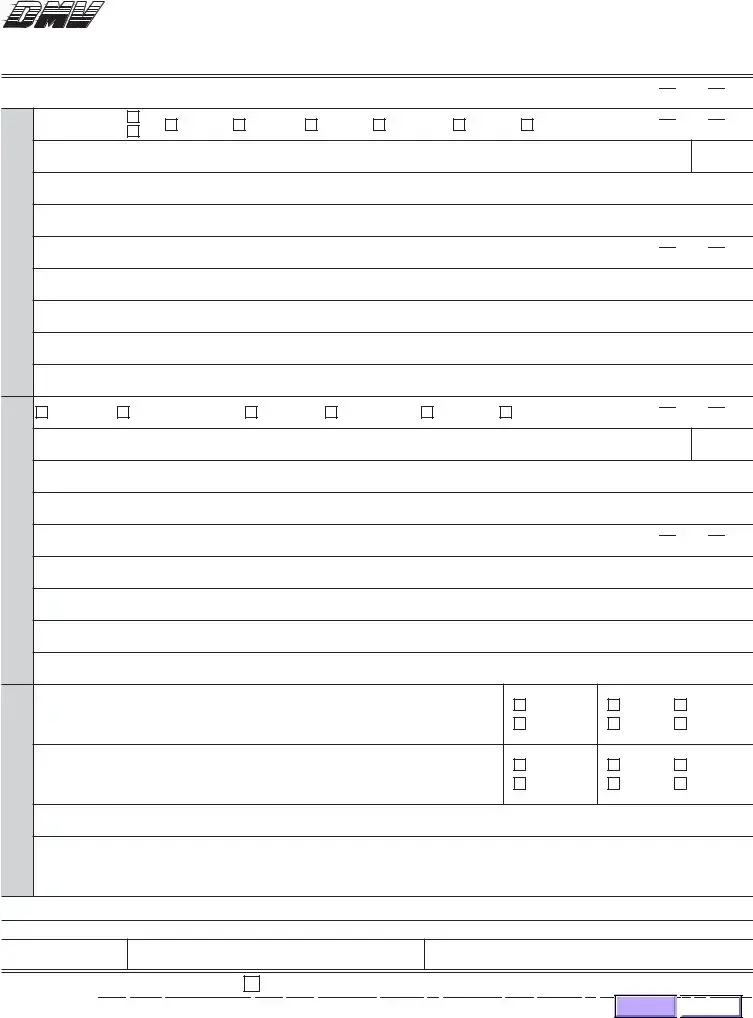

A |

YOUR |

CALIFORNIA INSURANCE INFORMATION |

|

DO NOT DETACH |

DMV FILE NUMBER |

|||||||

The Department may send this part to the insurance company indicated. If not fully completed, |

|

|

||||||||||

VEHICLE |

|

|

||||||||||

it will be assumed you were not insured for the accident and your license will be suspended. |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||

|

NAME OF INSURANCE COMPANY (NOT AGENT OR |

|

|

|

|

|

||||||

|

BROKER) THAT ISSUED THE LIABILITY POLICY |

|

|

|

|

|

||||||

|

COVERING THE OPERATION OF YOUR VEHICLE |

|

|

|

|

|

||||||

|

POLICY NUMBER |

|

POLICY PERIOD |

|

|

|

|

|

||||

|

|

|

|

From: |

To: |

|

|

|||||

I |

|

|

|

DRIVER LICENSE NUMBER |

||||||||

|

|

|

|

|

|

|

|

|

|

(DRIVER OF YOUR VEHICLE) |

||

N |

DATE OF ACCIDENT |

IN OR NEAR (CITY OR TOWN) (CALIFORNIA ONLY) |

|

|

|

|

|

|||||

S |

|

|

|

|

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE (YEAR AND MAKE) |

|

VEHICLE IDENTIFICATION NUMBER |

|

|

|

VEHICLE LICENSE PLATE NUMBER |

STATE |

|||||

R |

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

N |

DRIVER |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

OWNER |

|

|

|

|

ADDRESS |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FULL NAME OF POLICY HOLDER |

|

|

|

ADDRESS |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SR 1A (REV. 1/2017) WWW

If the policy was not in effect, this form must be completed and returned to DMV within 20 days.

The undersigned company advises that with respect to the reported accident, the policy reported on the reverse side:

WAS NOT IN EFFECT |

|

|

|

|

|

|

|

|||

Was not a liability policy |

Did not cover the vehicle/driver |

Number is not a company policy number |

||||||||

Policy Number |

|

|

|

Policy Period from |

|

to |

|

|||

Signature |

|

|

|

|

MAIL TO: |

|

|

|||

|

|

|

|

|

|

|||||

Title |

|

|

|

|

|

|

Department of Motor Vehicles |

|||

|

|

|

|

P.O. Box 942884 |

|

|

||||

|

|

|

|

|

|

|||||

Date

Sacramento, CA

SR 1A (REV. 1/2017) WWW

IMPORTANT INFORMATION

California law requires traffic accidents on a California street/highway or private property to be reported to the Department of Motor Vehicles (DMV) within 10 days if there was an injury, death or property damage in excess of $1,000. Untimely reporting could result in DMV suspending a driver license. Accidents involving vehicles not required to be registered such as an

The law requires the driver to file this SR 1 form with DMV regardless of fault. This report must be made in addition to any other report filed with a law enforcement agency, insurance company, or the California Highway Patrol (CHP) as their reports do not satisfy the filing requirement. An insurance agent, attorney, or other designated representative may file the report for the driver.

The law requires every driver and every owner of a motor vehicle to be “financially responsible” for any injury or damage resulting from operating or owning a motor vehicle. The minimum insurance level for “financial responsibility” is public liability and property damage coverage of $15,000 for injury or death of one person, $30,000 for injury or death of two or more persons and $5,000 property damage per accident. Comprehensive and collision insurance does not meet the legal requirement.

The California Vehicle Code (CVC) §1806 requires DMV to record accident information regardless of fault when individuals report accidents under the Financial Responsibility Law or if law enforcement agencies or CHP investigate and make a report.

WHEN COMPLETING THIS FORM...

Please print within the spaces and boxes on this form. If you need to provide additional information on a separate piece of paper(s) or you include a copy of any law enforcement agency report, please check the box to indicate ‘Additional Information Attached’. If you are the passenger reporting the accident, be sure to identify yourself by using the ‘other’ box and stating ‘passenger’ in the explanation.

•Write unk (for unknown) or none in any space or box when you do not have information on the other party involved.

•Give insurance information that is complete and which correctly and fully identifies the company that issued the policy.

•Place the correct National Association of Insurance Commissioners (NAIC) number for your insurance company in the boxes provided. The NAIC number should be located on your insurance ID card or you can contact your insurance agent or company for the information.

•Identify any person involved in the accident (driver, passenger, bicyclist, pedestrian, etc.) who you saw was injured or complained of bodily injury or know to be deceased.

•Record in the OTHER PROPERTY DAMAGED section any damage to telephone poles, fences, street signs, guard posts, trees, livestock, dogs, etc., meeting the filing requirement, including amount. This may require that you contact the owner of the property for an estimate of damages.

•Once you have completed this report, please mail it to:

Department of Motor Vehicles

Financial Responsibility

Mail Station J237

P.O. Box 942884

Sacramento, CA

DMV does not accept reports or take actions against

ADVISORY STATEMENT

The accident information on the SR 1 is required under the authority of Divisions 6 and 7 of the CVC. Failure to provide the information will result in suspension of the driving privilege. Except as made confidential by law (e.g., medical information) or exempted under the Public Records Act, the information is a public record, is regularly used by law enforcement agencies and insurance companies, and is open to public inspection. CVC §16005 limits the public record for SR 1 reports to accident involvement, but does allow persons with a proper interest (involved drivers, their employers, etc.) to receive specified information. Individuals may inspect or obtain copies of information contained in their records during regular office hours. The Financial Responsibility Unit Manager, 2570 24th Street, Sacramento, CA 95818 (telephone number:

SR 1 (REV. 1/2017) WWW

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The SR1 form is used to report traffic accidents occurring in California, especially when there are injuries, deaths, or property damage exceeding $1,000. |

| Governing Law | The form is governed by the California Vehicle Code (CVC) §1806, which mandates the reporting of traffic accidents under the Financial Responsibility Law. |

| Filing Timeline | Accident reports must be submitted to the DMV within 10 days from the date of the accident if there are injuries, fatalities, or property damage exceeding the specified threshold. |

| Insurance Requirements | California law requires drivers to have minimum insurance coverage: $15,000 for injury or death of one person, $30,000 for two or more persons, and $5,000 for property damage per accident. |

| Who Can File | The driver involved in the accident must file the SR1 form, but this responsibility can also be assigned to an insurance agent, attorney, or designated representative. |

| Additional Reporting | This report must be filed in addition to any reports submitted to law enforcement or insurance companies. Other reports do not satisfy the DMV filing requirement. |

| Consequences of Non-Compliance | Failure to report the accident or incomplete information may lead to the suspension of the driver's license. |

Guidelines on Utilizing Ca Dmv Sr1

Once you have gathered the necessary information about your accident, you can start filling out the CA DMV SR1 form. Make sure you provide accurate details to ensure that your report is processed without delays.

- Begin by entering the number of vehicles involved in the accident.

- Provide the date and time of the accident, including AM or PM.

- Fill in the accident location, specifying the city and county in California.

- In the driver's section, enter the full name of the driver involved (first, middle, last), along with their driver's license number.

- Complete the driver's street address, including city, state, and zip code.

- List the driver's telephone numbers for work and home.

- Provide the year and make of the vehicle involved, along with its license plate or vehicle identification number and state of registration.

- Identify the vehicle owner, whether a person or company, and include their reporting address, city, state, and insurance company name (not an agent or broker).

- Enter the insurance policy number, company NAIC number, policy period, and policyholder's name.

- If there was any injury or death involved, fill out the relevant information about the injured or deceased individuals, including name and address.

- Indicate whether you were driving for an employer and if there were damages over $1,000.

- Document any other property damaged and the owner's name and address.

- Read the important information on the back of the form.

- Certify the information by providing your printed name, signature, and the date.

After completing the form, mail it to the Department of Motor Vehicles at the address listed. Ensure that you send it within 10 days of the accident to comply with California law. Keep a copy for your records.

What You Should Know About This Form

What is the SR-1 Form and when must it be filed?

The SR-1 Form is a report that must be filed with the California Department of Motor Vehicles (DMV) after a traffic accident occurring in California. You are required to submit this form within 10 days if there is an injury, death, or if property damage exceeds $1,000. Filing this form is mandatory, regardless of who is at fault in the accident. Failure to submit the form on time may lead to the suspension of your driver’s license.

Who is responsible for filling out the SR-1 Form?

The driver involved in the accident is responsible for completing the SR-1 Form. However, it is also permissible for an insurance agent, attorney, or other designated representative to file it on behalf of the driver. The report must capture details about the incident, including the parties involved, injuries sustained, and property damage incurred.

What should I include in the SR-1 Form?

When completing the SR-1 Form, include specific details such as the date, time, and location of the accident. You will also need to provide information concerning all parties involved, including drivers, passengers, and witnesses. Ensure that you detail any injuries or property damage and provide insurance information accurately. If you run out of space, indicate that additional information is attached.

What happens if I don’t file the SR-1 Form?

If you do not file the SR-1 Form within the required timeframe, the DMV may suspend your driving privileges. Additionally, failing to file may limit your ability to pursue claims with your insurance company or in legal situations related to the accident. It’s crucial to adhere to this requirement to protect your rights and maintain your driving status.

Where do I send the completed SR-1 Form?

Once you have completed the SR-1 Form, you must mail it to the following address: Department of Motor Vehicles, Financial Responsibility Mail Station J237, P.O. Box 942884, Sacramento, CA 94284-0884. It is important to ensure that the form is sent within the 10-day window post-accident to avoid penalties.

Common mistakes

Completing the California DMV SR1 form can be straightforward, but common mistakes can delay processing and create complications. One prevalent mistake is failing to provide complete and accurate information about both drivers involved in the accident. For example, omitting a driver’s license number or address can result in the DMV not recognizing your report or assuming you were not insured.

Another frequent error is neglecting to include the correct insurance information. It’s essential to provide the name of the insurance company, the policy number, and the National Association of Insurance Commissioners (NAIC) number. If any of this information is incorrect or missing, it could lead to complications regarding coverage and financial responsibility after the accident.

People also often forget to check the appropriate boxes regarding injuries and property damage. If there was any injury or damages exceeding $1,000, failing to indicate this can lead the DMV to misclassify the severity of the accident, which could have further legal implications.

In addition, some may not attach additional information when necessary. If there’s not enough space on the form to provide all required details, it’s important to indicate that more information is attached. Failing to do this can lead to processing delays while DMV attempts to contact you for the missing data.

Another mistake involves not certifying the form correctly. At the bottom of the SR1, there is a section requiring the driver's signature. If this step is skipped, the DMV will return the form or may not accept the report, creating further delays in getting the form processed.

Lastly, individuals sometimes misjudge the urgency of filing the SR1 form, missing the 10-day deadline following the accident. Understanding the timeline is crucial; late submissions can lead to license suspension and unnecessary complications with insurance claims. Being mindful of these common mistakes ensures a smoother submission process and helps avoid complications in the aftermath of an accident.

Documents used along the form

The California DMV SR1 form is an essential document for reporting traffic accidents. When involved in a vehicle accident, several other forms may accompany the SR1 for various legal and insurance processes. Understanding these documents can help ensure proper compliance and facilitate communication between involved parties.

- SR1A Form: This form provides a declaration regarding the liability policy that was in effect at the time of the accident. If the policy was not active or did not cover the involved vehicle or driver, this form must be completed and submitted to the DMV within 20 days following the accident.

- Insurance Claim Form: This document is often submitted to the insurance company to initiate the claims process following an accident. It typically includes details about the accident, involved parties, and damages to support the claim for compensation.

- Police Report: A report filed by law enforcement after responding to the accident scene. This often includes witness statements, diagrams of the accident, and relevant details that can be crucial for insurance claims or legal proceedings.

- Witness Statement: A written account from individuals who observed the accident. These statements can provide additional context and support for claims filed with insurance or in court.

- DMV Accident Investigation Report: This report may be filed by law enforcement or the DMV if they conduct an investigation regarding the accident. It contains a record of findings, which can be essential for legal proceedings or insurance claims.

Being aware of these forms can streamline the necessary procedures following an accident. Completing and submitting the appropriate paperwork helps uphold legal requirements and ensures that all parties are adequately informed and protected.

Similar forms

DMV Report of Traffic Accident (SR 1A): Similar to the SR1 form, this document is submitted when a policy was not in effect during an accident. It clarifies the status of insurance coverage and must also be submitted within a specified timeframe.

Insurance Claim Form: This form initiates a claim with an insurance provider after an accident, documenting the parties involved and the details of damages. Both forms require similar information about the accident and individuals involved.

Police Accident Report: Created by law enforcement after an accident, it provides an official account of the incident. The SR1 form, although separate, is required in addition to this report for DMV records.

Victim Impact Statement: While this document allows individuals to voice the emotional effects of a crime, it shares the common purpose of capturing details essential for legal proceedings related to accidents.

Accident Liability Disclosure Form: This form is used in legal contexts to outline financial responsibility for damages. Similar to the SR1, it details the parties involved and circumstances surrounding the incident.

Notice of Intent to Sue: This document is served to notify others of potential legal action due to an accident. Both documents share the goal of establishing accountability following an incident.

Release of Liability Form: Often signed after a settlement, it signifies that the injured party will not pursue further claims. Like the SR1, it addresses issues of responsibility and documentation.

Subrogation Claim Form: Used by insurers to recover costs from responsible parties, this form also demands factual details about the accident, aligning with the documentation required by the SR1.

Personal Injury Claim Form: This formal request for damages details the injuries sustained due to the accident, similar to the SR1's function of documenting the event's impact.

Financial Responsibility Document: This shows proof of insurance or financial ability to cover damages from an accident. It serves a similar purpose of ensuring compliance with state financial responsibility laws, paralleling the SR1 form.

Dos and Don'ts

When filling out the California DMV SR1 form, it is important to follow certain guidelines to ensure that your submission is accurate and complete. Below is a list of things you should and shouldn't do.

- Do print all information clearly using capital letters.

- Do provide complete insurance details, including the policy number and company name.

- Do include any known injuries or damages, being as detailed as possible.

- Do submit the form within 10 days of the accident if it involved injuries or damages over $1,000.

- Don't leave any sections blank. Use "unk" or "none" if the information is unavailable.

- Don't forget to sign and date the form before submission.

- Don't confuse your own insurance provider's details with those of others involved in the accident.

- Don't submit the SR1 form without first checking for additional information that may be required.

Misconceptions

People often hold misconceptions about the California DMV SR1 form. Understanding the facts can help ensure compliance and protect driving privileges. Here are nine common misconceptions:

- The SR1 form is only for serious accidents. Many think this form is required only for significant accidents. However, it must be filled out for all accidents resulting in injury, death, or property damage exceeding $1,000.

- Only the driver at fault needs to file the SR1 form. This is not true. California law requires that the SR1 form be filed regardless of who is at fault in the accident.

- I can report the accident later than 10 days. Some believe that filing the report can be delayed. In reality, the form must be submitted to the DMV within 10 days to avoid potential suspension of driving privileges.

- If law enforcement is involved, I don’t need to file the form. This is a misconception. While police reports are necessary for law enforcement purposes, they do not replace the requirement to file the SR1 form with the DMV.

- My insurance will handle the report for me. Many drivers think their insurance company will file the SR1 form. While an insurance agent can help file it, the responsibility ultimately lies with the driver.

- This form only applies to my vehicle. Some people believe the SR1 is solely for their vehicle's report. In fact, it includes details about all vehicles involved and all parties affected in the accident.

- Accidents on private property don’t need to be reported. This is incorrect. If there's injury, death, or property damage over $1,000 involved, the SR1 form must still be submitted, regardless of the location.

- I can provide incomplete information on the form. Some think that missing details will not significantly impact the filing. The DMV requires complete and accurate information; failure to provide this could lead to penalties.

- Once submitted, the DMV will not follow up on the report. Many assume that the process ends with submission. However, the DMV may take action based on the report, especially if it reveals issues like uninsured drivers.

By understanding these misconceptions, drivers can better navigate the legal requirements surrounding traffic accidents in California. Being informed can help avoid unnecessary complications and protect your driving record.

Key takeaways

Here are key takeaways about filling out and using the California DMV SR1 form:

- Timely Reporting: Submit the SR1 form to the DMV within 10 days if there was an injury, death, or property damage exceeding $1,000.

- Mandatory Filing: All drivers must file this report regardless of who is at fault in the accident.

- Insurance Information: Provide complete and accurate insurance details, including the National Association of Insurance Commissioners (NAIC) number.

- Property Damage: Record any damage to property, including telephone poles or fences, in the designated section.

- Other Parties: Include information about all individuals and vehicles involved, even if you do not have complete details.

- Passenger Reporting: If you are a passenger reporting an accident, clearly state your role on the form.

- Submission Address: Mail the completed form to the Department of Motor Vehicles, Financial Responsibility Mail Station, P.O. Box 942884, Sacramento, CA 94284-0884.

- Consequences of Delay: Failing to report in time can lead to license suspension, so ensure submission is prompt.

Browse Other Templates

What to Bring to Behind the Wheel Test - Each category has a space for the number of errors recorded, making it easy to tally results.

Executor Deed Example - Executor Deeds can streamline the process of transferring real estate after someone passes away.

Daily to Do List Template - Plan study breaks and downtime to prevent burnout.