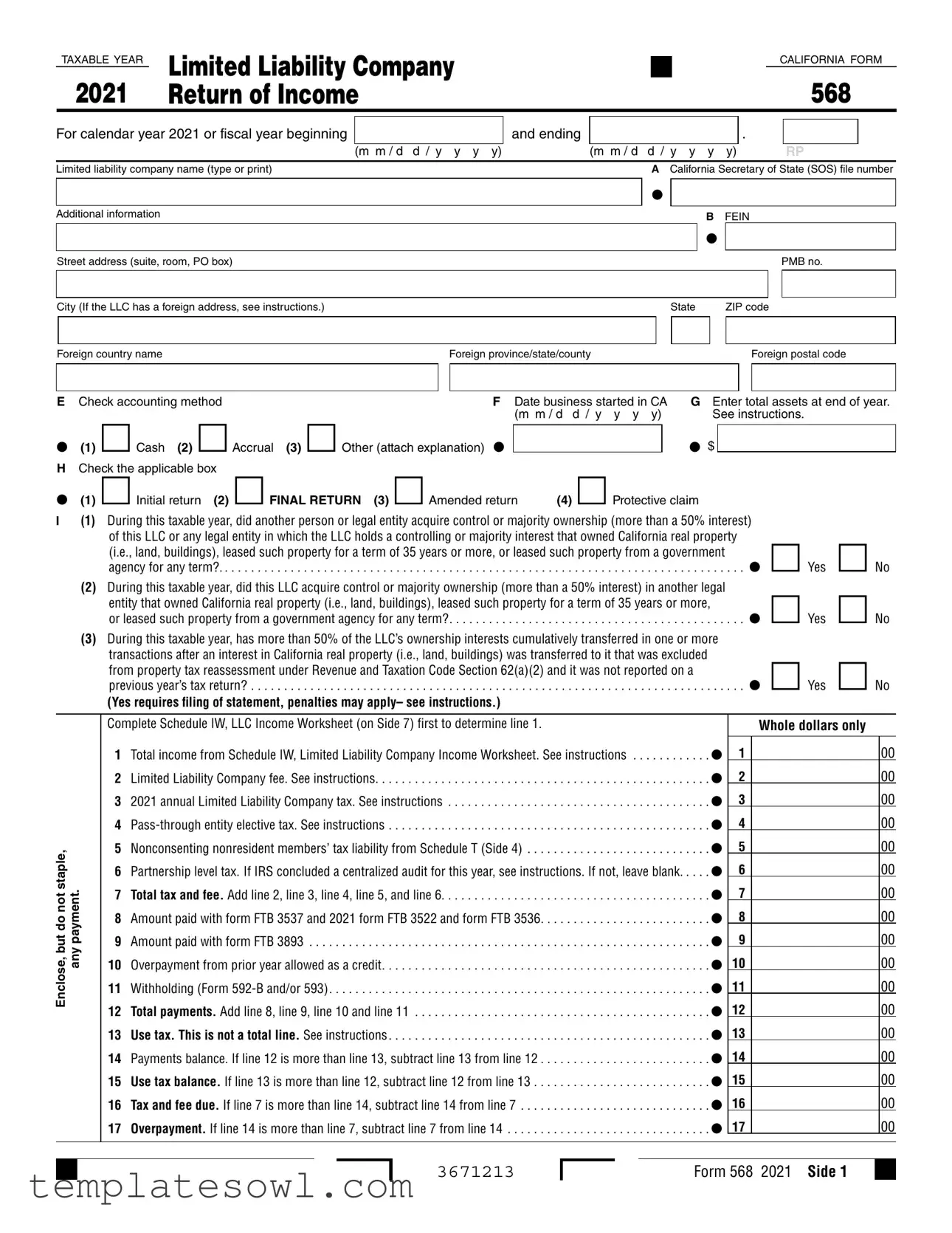

Fill Out Your Ca 568 Form

The California Form 568 serves as a crucial document for Limited Liability Companies (LLCs) operating in California. This form, officially titled "Return of Income," must be filed by LLCs to report their income, calculate applicable fees, and fulfill tax obligations for a given taxable year. It includes essential sections for identifying the LLC, including its name, California Secretary of State file number, and federal employer identification number (FEIN). Additionally, the form prompts users to check their accounting method and disclose critical financial data like the total assets at year-end. It also addresses ownership changes and any impacts on property tax reassessment exemptions. The calculation of the total tax and fees owed requires input from various schedules, allowing LLCs to report income, deductions, and tax credits accurately. Other relevant sections are designed to capture information about member distribution and compliance with withholding requirements. Failing to file this form or providing inaccurate information can result in penalties, making it vital for LLCs to understand all components of Form 568 thoroughly.

Ca 568 Example

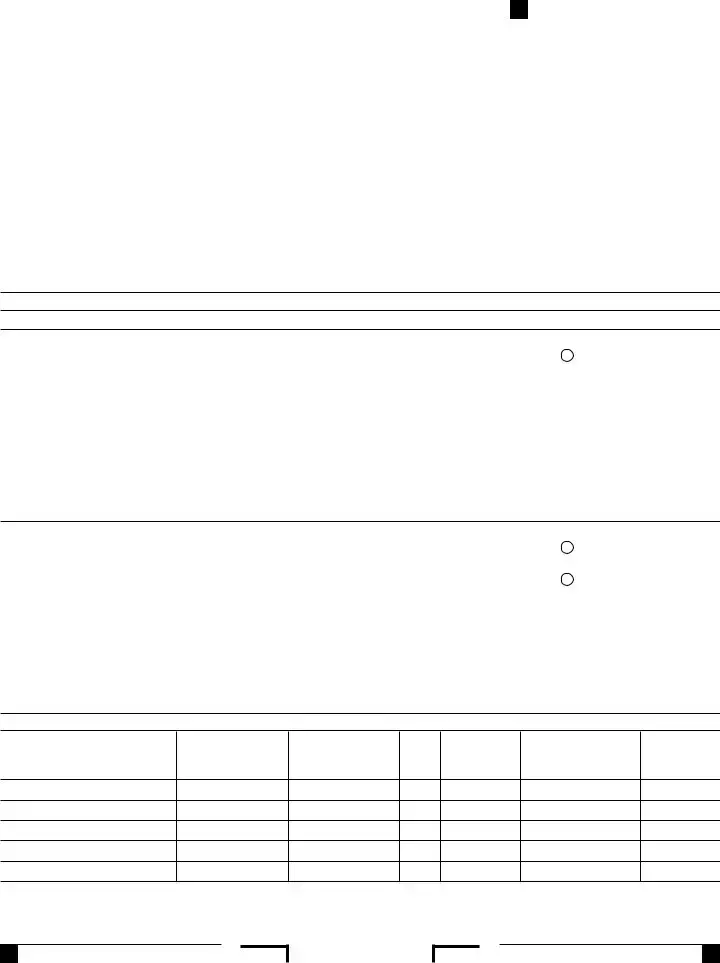

TAXABLE YEAR |

Limited Liability Company |

|

|

CALIFORNIA FORM |

|

||||

2021 |

|

568 |

||

Return of Income |

|

|||

For calendar year 2021 or fiscal year beginning

(m m / d d / y y y y)

and ending

.

(m m / d d / y y y y)

RP

Limited liability company name (type or print) |

|

|

|

|

A |

California Secretary of State (SOS) file number |

||||||||||||

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Additional information |

|

|

|

|

|

|

|

|

|

B |

FEIN |

|||||||

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

||

Street address (suite, room, PO box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If the LLC has a foreign address, see instructions.) |

State |

|

|

|

ZIP code |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

Foreign province/state/county |

|

|

|

|

|

|

|

Foreign postal code |

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E Check accounting method |

|

|

F Date business started in CA |

G Enter total assets at end of year. |

||||||||||||||

• (1) □Cash (2) □Accrual |

(3) □Other (attach explanation) • |

(m m / d d / y y y y) |

|

|

|

See instructions. |

||||||||||||

|

|

|

|

• |

$ |

|

|

|

|

|

|

|||||||

H Check the applicable box |

□FINAL RETURN (3) □Amended return |

(4) □Protective claim |

• (1) □Initial return (2) |

I(1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this LLC or any legal entity in which the LLC holds a controlling or majority interest that owned California real property

(i.e., land, buildings), leased such property for a term of 35 years or more, or leased such property from a government |

• □ Yes |

agency for any term? |

|

(2) During this taxable year, did this LLC acquire control or majority ownership (more than a 50% interest) in another legal |

• □ Yes |

entity that owned California real property (i.e., land, buildings), leased such property for a term of 35 years or more, |

|

or leased such property from a government agency for any term? |

|

(3) During this taxable year, has more than 50% of the LLC’s ownership interests cumulatively transferred in one or more |

|

transactions after an interest in California real property (i.e., land, buildings) was transferred to it that was excluded |

• □ Yes |

from property tax reassessment under Revenue and Taxation Code Section 62(a)(2) and it was not reported on a |

|

previous year’s tax return? |

|

(Yes requires filing of statement, penalties may apply– see instructions.) |

|

□ No

□ No

□ No

Enclose, but do not staple, any payment.

Complete Schedule IW, LLC Income Worksheet (on Side 7) first to determine line 1.

1 |

Total income from Schedule IW, Limited Liability Company Income Worksheet. See instructions |

• |

2 |

Limited Liability Company fee. See instructions |

• |

3 |

2021 annual Limited Liability Company tax. See instructions |

• |

4 |

• |

|

5 |

Nonconsenting nonresident members’ tax liability from Schedule T (Side 4) |

• |

6 |

Partnership level tax. If IRS concluded a centralized audit for this year, see instructions. If not, leave blank |

• |

7 |

Total tax and fee. Add line 2, line 3, line 4, line 5, and line 6 |

• |

8 |

Amount paid with form FTB 3537 and 2021 form FTB 3522 and form FTB 3536 |

• |

9 |

Amount paid with form FTB 3893 |

• |

10 |

Overpayment from prior year allowed as a credit |

• |

11 |

Withholding (Form |

• |

12 |

Total payments. Add line 8, line 9, line 10 and line 11 |

• |

13 |

Use tax. This is not a total line. See instructions |

• |

14 |

Payments balance. If line 12 is more than line 13, subtract line 13 from line 12 |

• |

15 |

Use tax balance. If line 13 is more than line 12, subtract line 12 from line 13 |

• |

16 |

Tax and fee due. If line 7 is more than line 14, subtract line 14 from line 7 |

• |

17 |

Overpayment. If line 14 is more than line 7, subtract line 7 from line 14 |

• |

|

Whole dollars only |

|

1 |

|

00 |

2 |

|

00 |

3 |

|

00 |

4 |

|

00 |

5 |

|

00 |

6 |

|

00 |

7 |

|

00 |

8 |

|

00 |

9 |

|

00 |

10 |

|

00 |

11 |

|

00 |

12 |

|

00 |

13 |

|

00 |

14 |

|

00 |

15 |

|

00 |

16 |

|

00 |

17 |

|

00 |

3671213

Form 568 2021 Side 1

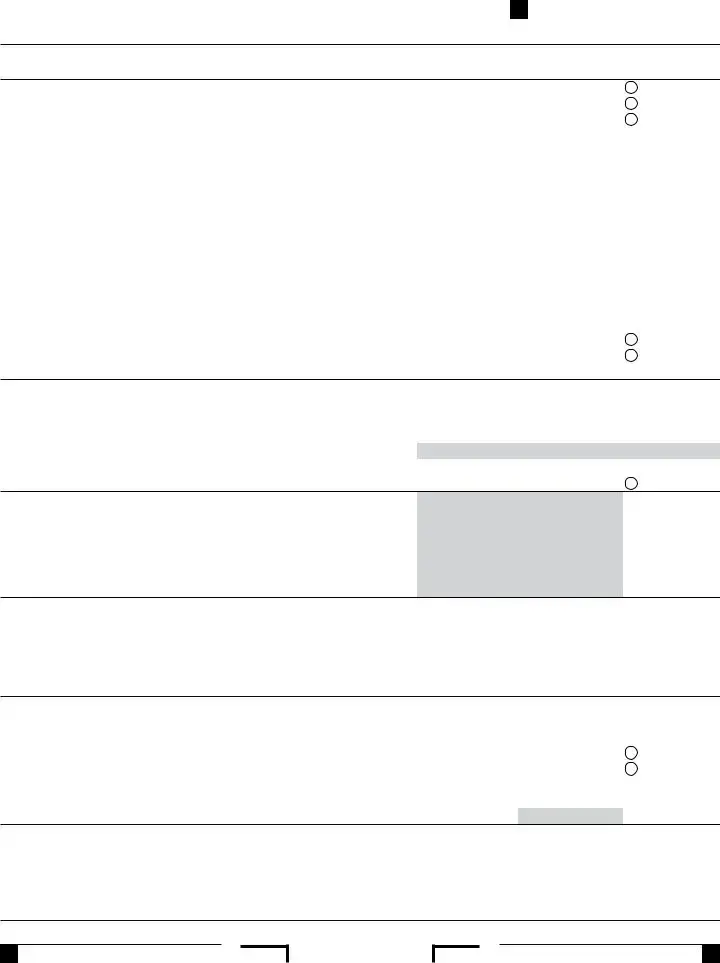

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Whole dollars only |

|

|

|

|

||||||

|

|

|

|

|

. . . . . . • |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 Amount of line 17 to be credited to 2022 tax or fee |

. . . |

. . . |

18 |

|

|

|

|

|

|

|

|

|

00 |

|

||

|

|

19 Refund. If the total of line 18 is less than line 17, subtract the total from line 17 |

• 19 |

|

|

|

|

|

|

|

. 00 |

|

||||||

|

|

|

|

|

. . . . . . • |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 Penalties and interest. See instructions |

. . . |

. . . |

20 |

|

|

|

|

|

|

|

|

|

00 |

|

||

|

|

21 Total amount due. Add line 15, line 16, line 18, and line 20, then subtract line 17 from the result. . |

• 21 |

|

|

|

|

|

|

|

. 00 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J Principal business activity code (Do not leave blank) |

. . . . . . |

. . . . . . . . . |

. . |

• |

|

|

|

|

|

|

|

|

|

|

||||

|

Business activity ________________________ Product or service _____________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

K Enter the maximum number of members in the LLC at any time during the year. For multiple member LLCs, attach a |

|

• |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

California Schedule |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

||||

L |

Is this LLC an investment partnership? See General Information O |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

M |

(1) |

Is this LLC apportioning or allocating income to California using Schedule R? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

If “No,” was this LLC registered in California without earning any income sourced in this state during the taxable year? . |

. . |

• |

□ Yes |

□ No |

|

|||||||||||

N Was there a distribution of property or a transfer (for example, by sale or death) of an LLC interest during the taxable year? . |

. . |

• □ Yes |

□ No |

|

||||||||||||||

P |

(1) |

Does the LLC have any foreign |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

Does the LLC have any domestic |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(3) |

Were Form 592, Form |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

Q Are any members in this LLC also LLCs or partnerships? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||||

R |

Is this LLC under audit by the IRS or has it been audited in a prior year? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

S |

Is this LLC a member or partner in another multiple member LLC or partnership? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

|

If “Yes,” complete Schedule EO, Part I. |

|

|

|

|

|

|

□ Yes □ No |

|

|||||||||

T |

Is this LLC a publicly traded partnership as defined in IRC Section 469(k)(2)? |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|||||||||||

U |

(1) |

Is this LLC a business entity disregarded for tax purposes? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||

|

(2) |

If “Yes,” see instructions and complete Side 1, Side 2, Side 3, Schedule B, Side 5, and Side 7, if applicable. Are there |

|

• □ Yes □ No |

|

|||||||||||||

|

|

credits or credit carryovers attributable to the disregarded entity? |

. . . . . . |

. . . . . . . . . |

. . |

|

||||||||||||

|

(3) |

If “Yes” to U(1), does the disregarded entity have total income derived from or attributable to California that is less than |

|

|

|

□ |

|

□ |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

the LLC’s total income from all sources? |

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

Yes |

|

|

No |

|

|||

V |

Has the LLC included a Reportable Transaction, or Listed Transaction within this return? |

|

|

|

|

• □ Yes □ No |

|

|||||||||||

|

(See instructions for definitions). If “Yes,” complete and attach federal Form 8886 for each transaction. . . |

. . . . . . |

. . . . . . . . . |

. . |

|

|||||||||||||

W Did this LLC file the Federal Schedule |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

||||||||||||

X |

Is this LLC a direct owner of an entity that filed a federal Schedule |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

Y |

Does the LLC have a beneficial interest in a trust or is it a grantor of a Trust? |

. . . . . . |

. . . . . . . . . |

. . |

• □ Yes |

□ No |

|

|||||||||||

|

If “Yes,” attach schedule of trusts and federal identification numbers. |

|

|

|

|

|

|

□ |

|

□ |

|

|

|

|

||||

Z |

Does this LLC own an interest in a business entity disregarded for tax purposes? |

|

|

|

|

• |

Yes |

No |

|

|||||||||

. . . . . . |

. . . . . . . . . |

. . |

|

|

|

|

|

|

||||||||||

|

If “Yes,” complete Schedule EO, Part II. |

|

|

|

|

• □ Yes □ No |

|

|||||||||||

AA Is any member of the LLC related (as defined in IRC Section 267(c)(4)) to any other member of the LLC? |

. . . . . . |

. . . . . . . . . |

. . |

|

||||||||||||||

BB Is any member of the LLC a trust for the benefit of any person related (as defined in IRC Section 267(c)(4)) |

|

• □ Yes □ No |

|

|||||||||||||||

|

to any other member? |

. . . . . . |

. . . . . . . . . |

. . |

|

|||||||||||||

(continued on Side 3)

Side 2 Form 568 2021

3672213

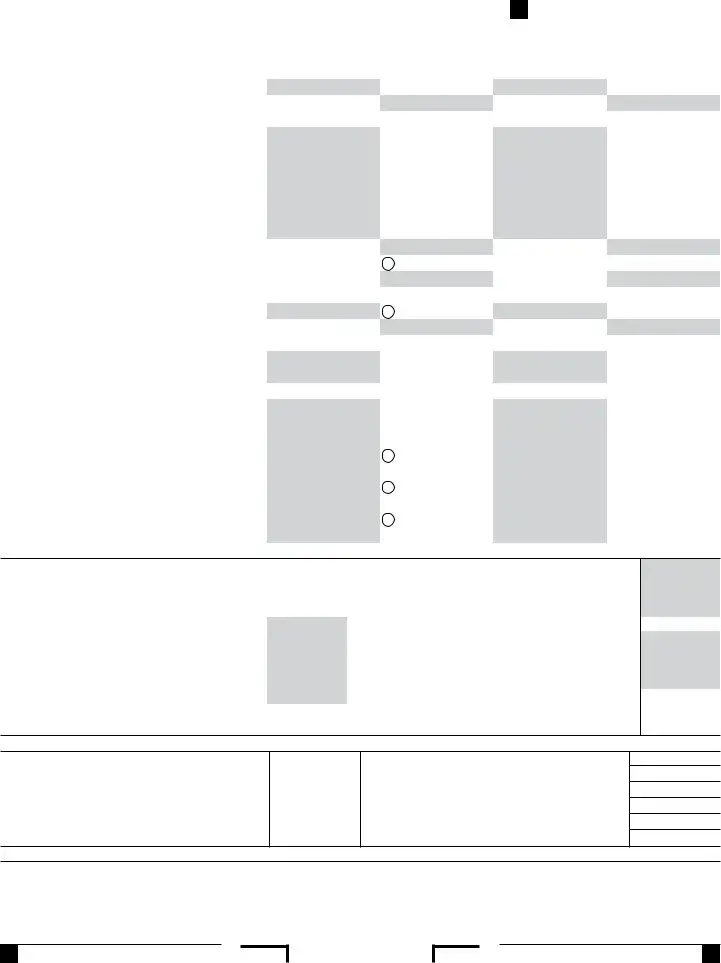

(continued from Side 2) |

|

|

|

|

|

|

|

|

|

□ |

Yes |

□ |

No |

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

CC |

(1) |

|

|

|

|

|

|

|

|

|

|

|||||||||

Is the LLC deferring any income from the disposition of assets? (see instructions) . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

|

|

||||||||||||

|

(2) |

. . . . . . . .If “Yes,” enter the year of asset disposition |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

|

|

|

|

|

|

||||

DD |

□ |

|

□ |

|

|

|

□ |

|

|

□ |

|

|

|

|||||||

Is the LLC reporting previously deferred Income from: |

|

|

|

|

|

|

|

|

|

|

||||||||||

• |

|

Installment Sale |

• |

IRC §1031 • |

IRC §1033 |

• |

|

|

|

|

||||||||||

|

(see instructions) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

Other |

|||||||||||||||

EE “Doing business as” name. See instructions: |

. . . . . |

• _____________________________________________________________________ |

||||||||||||||||||

FF |

(1) |

Has this LLC operated as another entity type such as a Corporation, S Corporation, General Partnership, |

□ |

|

|

□ |

|

|

||||||||||||

|

|

Limited Partnership, or Sole Proprietorship in the previous five (5) years? |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

Yes |

|

|

No |

||||||||

|

(2) |

If “Yes”, provide prior FEIN(s) if different, business name(s), and entity type(s) for prior returns |

|

|

|

|

|

|

|

|

||||||||||

|

|

filed with the FTB and/or IRS (see instructions): _________________________________________________________________________________ |

||||||||||||||||||

GG |

(1) |

|

|

|

|

|

|

|

|

|

|

□ |

Yes |

□ |

No |

|||||

Has this LLC previously operated outside California? |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

□ |

|||||||||||

|

(2) |

|

|

|

|

|

|

|

|

|

|

□ |

Yes |

No |

||||||

|

Is this the first year of doing business in California?. |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

. . . . • |

|

□ |

||||||||||

HH Is the LLC a section 721(c) partnership, as defined in Treasury Regulations Section |

□ |

|

Yes |

|

No |

|||||||||||||||

|

|

|

|

|

||||||||||||||||

II |

At any time during the tax year, were there any transfers between the LLC and its members subject to the |

. . . . . . □ Yes |

□ No |

|||||||||||||||||

|

disclosure requirements of Regulations section |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . . . |

. . . . . . . |

. . . . . . . |

|||||||||||||

JJ |

Check if the LLC: (1) |

• Aggregated activities for IRC Section 465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(2) |

• Grouped activities for IRC Section 469 passive activity purposes |

|

|

|

|

□ |

|

□ |

|

|||||||||

KK (1) Has this business entity previously filed an unclaimed property Holder Remit Report with the State Controller’s Office? |

Yes |

No |

||||||||||||||||||

. . . . .• |

|

|

|

|

|

|||||||||||||||

|

(2) If “Yes,” when was the last report filed? (mm/dd/yyyy) • ________________ (3) Amount last remitted ◾ $____________________ . _______ |

|

|

|||||||||||||||||

Single Member LLC Information and Consent — Complete only if the LLC is disregarded. |

|

|

• Federal TIN/SSN |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Sole Owner’s name (as shown on owner’s return) |

|

|

|

|

|

FEIN/CA Corp no./CA SOS File no. |

|

|

|

|

|

|

|

|||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address, City, State, and ZIP Code

•What type of entity is the ultimate owner of this SMLLC? See instructions. Check only one box:

• (1) Individual |

• (2) C Corporation |

• (3) |

•(4) Estate/Trust • (5) Exempt Organization

Member’s Consent Statement: I consent to the jurisdiction of the State of California to tax my LLC income and agree to file returns and pay tax as may be required by the Franchise Tax Board.

Signature ▶ |

|

|

|

|

Date |

|

|

|

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for |

||||||

|

1131 to locate FTB 1131 |

||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, |

||||||

|

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||

Sign |

Signature |

|

Date |

|

|

||

of authorized |

|

|

|

||||

Here |

member or |

|

|

Telephone |

|||

|

manager ▶ |

|

|

|

|

• |

|

|

Authorized member or manager’s email address (optional) |

|

|

||||

|

Paid |

Date |

Check if |

PTIN |

|||

|

preparer’s |

|

|

|

|||

|

|

• |

|||||

Paid |

signature ▶ |

|

|||||

Preparer’s |

|

|

|

|

|

Firm’s FEIN |

|

Use Only |

Firm’s name (or yours, |

|

|

• |

|||

|

if |

|

|

|

|||

|

|

|

|

Telephone |

|||

|

and address |

|

|

||||

|

|

|

|

|

|

• |

|

|

May the FTB discuss this return with the preparer shown above (see instructions)?. . . . . . . . . . . • • Yes • No |

|

|||||

|

|

|

|

|

|

|

|

3673213

Form 568 2021 Side 3

Schedule A Cost of Goods Sold

1 |

. . . . . . . . . . . . . . . . .Inventory at beginning of year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

1 |

|

00 |

||

2 |

Purchases less cost of items withdrawn for personal use |

. . . . . . . . . . . . . . . . . . |

2 |

|

00 |

|||

3 |

Cost of labor |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

3 |

|

00 |

|

4 |

Additional IRC Section 263A costs. Attach schedule |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

4 |

|

00 |

||

5 |

Other costs. Attach schedule |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

5 |

|

00 |

||

6 |

Total. Add line 1 through line 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

6 |

|

00 |

||

7 |

Inventory at end of year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . |

7 |

|

00 |

||

8 |

Cost of goods sold. Subtract line 7 from line 6. Enter here and on Schedule B, line 2 |

. . . . . . . . . . . . . . . . . . |

8 |

|

00 |

|||

9 |

a |

Check all methods used for valuing closing inventory: |

|

|

|

|

||

|

|

(1) • Cost |

(2) • Lower of cost or market as described in Treas. Reg. Section |

(3) • Write down of “subnormal” goods as |

||||

|

|

described in Treas. Reg. Section |

(4) • Other. Specify method used and attach explanation ___________________________ |

|||||

|

b |

Check this box if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 . |

. . . . . . . . . • |

|||||

|

c |

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to the LLC? |

. . . . . . . . . • Yes • No |

|||||

dWas there any change (other than for IRC Section 263A purposes) in determining quantities, cost, or valuations between opening

and closing inventory? If “Yes,” attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • Yes • No

Schedule B Income and Deductions

Caution: Include only trade or business income and expenses on line 1a through line 22 below. See the instructions for more information.

|

1 |

. . . . .a Gross receipts or sales $ ____________ b Less returns and allowances $ ____________ . |

c Balance |

|

2 |

Cost of goods sold (Schedule A, line 8) |

. . . . . . . . |

|

3 |

GROSS PROFIT. Subtract line 2 from line 1c |

. . . . . . . . |

|

4 |

Total ordinary income from other LLCs, partnerships, and fiduciaries. Attach schedule |

. . . . . . . . |

Income |

5 |

Total ordinary loss from other LLCs, partnerships, and fiduciaries. Attach schedule |

. . . . . . . . |

7 |

Total farm loss. Attach federal Schedule F (Form 1040) |

. . . . . . . . |

|

|

6 |

Total farm profit. Attach federal Schedule F (Form 1040) |

. . . . . . . . |

|

8 |

Total gains included on Schedule |

. . . . . . . . |

|

9 |

Total losses included on Schedule |

. . . . . . . . |

|

10 |

Other income. Attach schedule |

. . . . . . . . |

|

11 |

Other loss. Attach schedule |

. . . . . . . . |

|

12 |

Total income (loss). Combine line 3 through line 11 |

. . . . . . . . |

|

13 |

Salaries and wages (other than to members) |

. . . . . . . . |

|

14 |

Guaranteed payments to members |

. . . . . . . . |

|

15 |

Bad debts |

. . . . . . . . |

Deductions |

16 |

Deductible interest expense not claimed elsewhere on return |

. . . . . . . . |

19 |

Retirement plans, etc |

. . . . . . . . |

|

|

17 |

a Depreciation and amortization. Attach form FTB 3885L $ _________________ |

|

|

|

b Less depreciation reported on Schedule A and elsewhere on return $ _________________ |

c Balance |

|

18 |

Depletion. Do not deduct oil and gas depletion |

. . . . . . . . |

|

20 |

Employee benefit programs |

. . . . . . . . |

|

21 |

Other deductions. Attach schedule |

. . . . . . . . |

|

22 |

Total deductions. Add line 13 through line 21 |

. . . . . . . . |

|

23 |

Ordinary income (loss) from trade or business activities. Subtract line 22 from line 12 |

. . . . . . . . |

Schedule T Nonconsenting Nonresident Members’ Tax Liability. Attach additional sheets if necessary.

• |

|

1c |

|

00 |

|

|

|||

• |

|

2 |

|

00 |

• |

|

3 |

|

00 |

• |

|

4 |

|

00 |

• |

|

5 |

|

00 |

• |

|

6 |

|

00 |

• |

|

7 |

|

00 |

• |

|

8 |

|

00 |

• |

|

9 |

|

00 |

• |

|

10 |

|

00 |

• |

|

11 |

|

00 |

• |

|

12 |

|

00 |

• |

|

13 |

|

00 |

|

14 |

|

00 |

|

• |

|

15 |

|

00 |

• |

|

16 |

|

00 |

• |

|

17c |

|

00 |

|

|

18 |

|

00 |

|

|

19 |

|

00 |

• |

|

20 |

|

00 |

|

21 |

|

00 |

|

• |

|

22 |

|

00 |

• |

|

23 |

|

00 |

(a)

Member’s name

(b)

SSN, ITIN,

or FEIN

(c)

Distributive

share of income

(d)

Tax

rate

(e)

Member’s

total tax due

(see instructions)

(f)

Amount withheld by this LLC on this member – reported on Form

(g)

Member’s

net tax due

Total the amount of tax due. Enter the total here and on Side 1, line 4. If less than zero enter |

________________ |

Side 4 Form 568 2021

3674213

Schedule K Members’ Shares of Income, Deductions, Credits, etc.

Income (Loss)

Deductions

Analysis Other Information Alternative Minimum Credits Tax (AMT) Items

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

(b) |

|

(c) |

|

|

(d) |

|

|

|

|

Distributive share items |

|

|

|

|

|

Amounts from |

|

California |

Total amounts using |

|||||||

|

|

|

1 |

• federal K (1065) |

adjustments |

• |

California law |

||||||||||||

1 |

Ordinary income (loss) from trade or business activities |

. |

|

|

|

|

|||||||||||||

2 |

Net income (loss) from rental real estate activities. Attach federal Form 8825 |

2 |

|

|

|

|

|

• |

|

|

|||||||||

3 |

a |

Gross income (loss) from other rental activities |

. . . . . . . . . . . . . . |

. . . . |

. |

3a |

|

|

|

|

|

• |

|

|

|||||

|

b Less expenses. Attach schedule. . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

3b |

|

|

|

|

|

|

|

|

|||||

|

c Net income (loss) from other rental activities. Subtract line 3b |

|

3c |

|

|

|

|

|

• |

|

|

||||||||

|

|

from line 3a |

. . . . . . |

. . . . . . . . |

. . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

|

|

|

|

|

|

|

|||

4 |

Guaranteed payments |

a Services. . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4a |

|

|

|

|

|

|

|

|

||||

|

b |

Capital |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4b |

|

|

|

|

|

|

|

|

||

|

c |

Total |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

4c |

|

|

|

|

|

• |

|

|

||

5 |

Interest income |

. . . . . . . . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

5 |

|

|

|

|

|

• |

|

|

||

6 |

Dividends |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

6 |

|

|

|

|

|

• |

|

|

|||

7 |

Royalties |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

7 |

|

|

|

|

|

• |

|

|

|||

8 |

Net |

. |

8 |

|

|

|

|

|

• |

|

|

||||||||

9 |

Net |

. |

9 |

|

|

|

|

|

• |

|

|

||||||||

10 |

a |

Total gain under IRC Section 1231 (other than due to casualty or theft) . |

10a |

|

|

|

|

|

• |

|

|

||||||||

|

b Total loss under IRC Section 1231 (other than due to casualty or theft) . |

10b |

|

|

|

|

|

• |

|

|

|||||||||

11 |

a |

Other portfolio income (loss). Attach schedule . |

. . . . . . . . . . . . . . |

. . . . |

. |

11a |

|

|

|

|

|

• |

|

|

|||||

|

b Total other income. Attach schedule |

. . . . . . . . . . . . . . |

. . . . |

. |

11b |

|

|

|

|

|

• |

|

|

||||||

|

c Total other loss. Attach schedule . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

11c |

|

|

|

|

|

|

|

|

|||||

12 |

Expense deduction for recovery property (IRC Section 179). Attach schedule |

12 |

|

|

|

|

|

|

|

|

|||||||||

13 |

a |

Charitable contributions. See instructions. Attach schedule |

. |

13a |

|

|

|

|

|

|

|

|

|||||||

|

b |

Investment interest expense |

. . . . . . . . . . . . . . |

. . . . |

. |

13b |

|

|

|

|

|

• |

|

|

|||||

|

c |

1 Total expenditures to which IRC Section 59(e) election may apply . |

. |

13c1 |

|

|

|

|

|

|

|

|

|||||||

|

|

2 Type of expenditures |

|

|

|

|

|

13c2 |

|

|

|

|

|

|

|

|

|||

|

d Deductions related to portfolio income |

. . . . . . . . . . . . . . |

. . . . |

. |

13d |

|

|

|

|

|

|

|

|

||||||

|

e |

Other deductions. Attach schedule. |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

13e |

|

|

|

|

|

• |

|

|

||||

15 |

a |

. . . . .Withholding on LLC allocated to all members |

. . . . . . . . . . . . . . . |

. . . . |

. |

15a |

|

|

|

|

|

|

|

|

|||||

|

b |

. . . . . . . . . . . . . . |

. . . . |

. |

15b |

|

|

|

|

|

|

|

|

||||||

|

c Credits other than the credit shown on line 15b related to rental real |

|

15c |

|

|

|

|

|

|

|

|

||||||||

|

|

estate activities. Attach schedule . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

|

|

|

|

|

|

|

|

|||||

|

d Credits related to other rental activities. Attach schedule |

. |

15d |

|

|

|

|

|

|

|

|

||||||||

|

e Nonconsenting nonresident members’ tax paid by LLC |

. |

15e |

|

|

|

|

|

|

|

|

||||||||

|

f Other credits. Attach schedule . . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

15f |

|

|

|

|

|

• |

|

|

|||||

17 |

a |

. . . . .Depreciation adjustment on property placed in service after 1986 |

. |

17a |

|

|

|

|

|

|

|

|

|||||||

|

b Adjusted gain or loss |

. . . . . . . . . . . . . . |

. . . . |

. |

17b |

|

|

|

|

|

|

|

|

||||||

|

c Depletion (other than oil and gas) . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

17c |

|

|

|

|

|

|

|

|

|||||

|

d Gross income from oil, gas, and geothermal properties |

. |

17d |

|

|

|

|

|

|

|

|

||||||||

|

e Deductions allocable to oil, gas, and geothermal properties |

. |

17e |

|

|

|

|

|

|

|

|

||||||||

|

f Other alternative minimum tax items. Attach schedule |

. |

17f |

|

|

|

|

|

|

|

|

||||||||

18 |

a |

. . . . . . . . . . . . . . |

. . . . |

. |

18a |

|

|

|

|

|

|

|

|

||||||

|

b |

Other |

. . . . . . . . . . . . . . |

. . . . |

. |

18b |

|

|

|

|

|

• |

|

|

|||||

|

c |

Nondeductible expenses |

. . . . . . . . . . . . . . |

. . . . |

. |

18c |

|

|

|

|

|

|

|

|

|||||

19 |

a |

Distributions of money (cash and marketable securities) |

. |

19a |

|

|

|

|

|

• |

|

|

|||||||

|

b Distribution of property other than money |

. . . . . . . . . . . . . . |

. . . . |

. |

19b |

|

|

|

|

|

• |

|

|

||||||

20 |

a |

Investment income |

. . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

20a |

|

|

|

|

|

|

|

|

|

|

b |

Investment expenses |

. . . . . . . . . . . . . . |

. . . . |

. |

20b |

|

|

|

|

|

|

|

|

|||||

|

c Other information. See instructions |

. . . . . . . . . . . . . . |

. . . . |

. |

20c |

|

|

|

|

|

|

|

|

||||||

21 |

a |

Total distributive income/payment items. Combine lines 1, 2, 3c |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

and 4c through 11c. From the result, subtract the sum of lines 12 |

|

|

|

|

|

|

|

• |

|

|

|||||||

|

|

through 13e |

. . . . . . . . . . |

. . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . |

. |

21a |

|

|

|

|

|

|

|

||

|

b |

Analysis of |

|

(a) |

|

(b) Individual |

|

|

(c) |

|

(d) |

|

(e) |

|

|

(f) |

|||

|

|

members: |

Corporate |

|

i. Active |

ii. Passive |

|

Partnership |

|

Exempt Organization |

Nominee/Other |

|

LLC |

||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

Members |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3675213

Form 568 2021 (REV

Schedule L Balance Sheets. See instructions before completing Schedules L,

|

|

|

|

Beginning of taxable year |

|

End of taxable year |

||

|

|

Assets |

|

(a) |

(b) |

(c) |

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

2 |

. . . . . . . . . . .a Trade notes and accounts receivable |

|

|

|

|

|

|

|

|

b |

Less allowance for bad debts |

( |

) |

|

( |

) |

|

3 |

Inventories |

|

|

|

|

|

• |

|

4 |

. . . . . . . . . . . . . . . . . . . .U.S. government obligations |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

||

6 |

Other current assets. Attach schedule |

|

|

|

|

|

• |

|

7 |

a |

Loans to partners |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . .b Mortgage and real estate loans |

|

|

|

|

|

|

|

8 |

Other investments. Attach schedule |

|

|

|

|

|

• |

|

9 |

. . . . . . . . .a Buildings and other depreciable assets |

|

|

|

|

|

|

|

|

b |

Less accumulated depreciation |

( |

) |

• |

( |

) |

• |

10 |

a |

Depletable assets |

|

|

|

|

|

|

|

b |

Less accumulated depletion |

( |

) |

|

( |

) |

|

11 |

Land (net of any amortization) |

|

|

• |

|

|

• |

|

12 |

. . . . . . . . . . .a Intangible assets (amortizable only) |

|

|

|

|

|

|

|

|

b |

Less accumulated amortization |

( |

) |

|

( |

) |

|

13 |

Other assets. Attach schedule |

|

|

|

|

|

• |

|

14 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total assets |

|

|

|

|

|

|

|

|

Liabilities and Capital |

|

|

|

|

|

|

|

15 |

Accounts payable |

|

|

|

|

|

• |

|

16 |

Mortgages, notes, bonds payable in less than 1 year. . |

|

|

|

|

|

• |

|

17 |

. . . . . . . . . . .Other current liabilities. Attach schedule |

|

|

|

|

|

|

|

18 |

All nonrecourse loans |

|

|

• |

|

|

• |

|

19 |

a |

Loans from partners |

|

|

|

|

|

|

|

b Mortgages, notes, bonds payable in 1 year or more |

|

|

• |

|

|

• |

|

20 |

Other liabilities. Attach schedule |

|

|

|

|

|

• |

|

21 |

Members’ capital accounts |

|

|

• |

|

|

• |

|

22 |

. . . . . . . . . . . . . . . . . . . . . .Total liabilities and capital |

|

|

|

|

|

|

|

Schedule

1 |

. .Net income (loss) per books |

. . . . . . . . . . . . . . . |

. |

|

2 |

Income included on Schedule K, line 1 through line 11c |

• |

|

|

3 |

not recorded on books this year. Itemize |

|

||

. . . . . .Guaranteed payments (other than health insurance) |

. |

|

||

4 |

Expenses recorded on books this year not included on |

|

|

|

|

Schedule K, line 1 through line 13e. Itemize: |

|

|

|

|

a Depreciation |

$ ______________ |

|

|

|

b Travel and entertainment |

$ ______________ |

|

|

|

c Annual LLC tax |

$ ______________ |

|

|

|

d Other |

$ ______________ |

|

|

5 |

. .e Total. Add line 4a through line 4d. |

. . . . . . . . . . . . . . . |

• |

|

. .Total of line 1 through line 4e |

. . . . . . . . . . . . . . . |

. |

|

|

6Income recorded on books this year not included on Schedule K, line 1 through line 11c. Itemize:

a |

$ ______________ |

|

|

b Other |

$ ______________ |

• |

|

. . . . . . . . . .c Total. Add line 6a and line 6b |

. . . . . . . . . . . . . . . . |

|

7Deductions included on Schedule K, line 1 through line 13e

|

not charged against book income this year. Itemize: |

|

|

|

|

a Depreciation |

$ ______________ |

|

|

|

b Other |

$ ______________ |

• |

|

8 |

. . . . . . . . . .c Total. Add line 7a and line 7b |

. . . . . . . . . . . . . . . . |

|

|

. . . . . . . . . .Total. Add line 6c and line 7c . . |

. . . . . . . . . . . . . . . . |

. |

|

|

9 |

Income (loss) (Schedule K, line 21a.) Subtract line 8 from line 5. |

|||

Schedule

1 |

Balance at beginning of year |

|

|

5 |

Total of line 1 through line 4 |

• |

2 |

Capital contributed during year |

|

6 |

Distributions: a Cash |

||

|

a Cash |

• |

|

|

b Property |

• |

|

. . . . . . . . . . . . . . . . .b Property |

• |

|

. . . . . . . . . . . . . . . . . . . . . .7 Other decreases. Itemize |

• |

|

3 |

. . . . . . . . . . . . . . . . .Net income (loss) per books . . |

• |

|

8 |

. . .Total of line 6 and line 7 |

|

4 |

. . . . . . . . . . . . . . . . .Other increases. Itemize |

|

. . .9 Balance at end of year. Subtract line 8 from line 5 |

|

||

Schedule O Amounts from Liquidation used to Capitalize a Limited Liability Company. (Complete only if initial return box is checked on Side 1, Question H.)

Name of entity liquidated (if more than one, attach a schedule) _____________________________________________________________________________

Type of entity: • (1) C Corporation • (2) S Corporation |

• (3) Partnership • (4) Limited Partnership • (5) Sole Proprietor |

• (6) Farmer |

|

|

|

||

Entity identification number(s): FEIN __________________ SSN or ITIN __________________ CA Corp. No. _________________ CA SOS File No. |

|

||

Amount of liquidation gains recognized to capitalize the LLC . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • |

___________________ |

|

Side 6 Form 568 2021

3676213

Schedule IW Limited Liability Company (LLC) Income Worksheet

Enter your California income amounts on the worksheet. All amounts entered must be assigned for California law differences. Use only amounts that are from sources derived from or attributable to California when completing lines

See instructions on page 14 of the Form 568 Booklet for more information on how to complete Schedule IW.

1 |

a Total California income from Form 568, Schedule B, line 3. See instructions |

• |

1a |

|

b Enter the California cost of goods sold from Form 568, Schedule B, line 2 and from federal |

|

|

|

Schedule F (Form 1040) (plus California adjustments) associated with the receipts |

• |

|

|

assigned to California on lines 1a and 4 |

1b |

|

2 |

a If the answer to Question U(1) on Form 568 Side 2, is “Yes”, include the gross income of this |

• |

|

|

disregarded entity that is not included in lines 1 and 8 through 16 |

2a |

|

|

b Enter the cost of goods sold of disregarded entities associated with the receipts assigned to |

• |

|

|

California on line 2a |

2b |

|

3 |

a LLC’s distributive share of ordinary income from |

• |

3a |

bEnter the LLC’s distributive share of cost of goods sold from other

|

|

associated with the receipt assigned to California on line 3a (see Schedule |

• |

|

|

|

|

|

|

Table 3, line 1a) |

3b |

|

|

||

|

c |

Enter the LLC’s distributive share of deductions from other |

• |

|

|

|

|

|

|

the receipt assigned to California on line 3a (see Schedule |

3c |

|

|

||

4 |

. . . . . . . . . . . . . . .Add gross farm income from federal Schedule F (Form 1040). Use California amounts |

• |

4 |

|

|

|

|

5 |

. . . . . . . . . . . . . . . . . . . . . .Enter the total of other income (not loss) from Form 568, Schedule B, line 10 |

• |

5 |

|

|

|

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter the total gains (not losses) from Form 568, Schedule B, line 8 |

• |

6 |

|

|

|

|

7 |

Add line 1a through line 6 |

. . . |

. . . |

. . . . . . . . . . . . |

• 7 |

||

8 |

California rental real estate |

• |

|

|

|

|

|

|

a |

Enter the total gross rents from federal Form 8825, line 18a |

8a |

|

|

|

|

|

b |

Enter the total gross rents from all Schedule |

• |

8b |

|

|

|

|

c |

Add line 8a and line 8b |

. . . |

. . . |

. . . . . . . . . . . . |

• 8c |

|

9 |

Other California rentals. |

|

|

|

|

|

|

|

a |

Enter the amount from Schedule K (568), line 3a |

• |

9a |

|

|

|

|

b |

Enter the amount from all Schedule |

• |

9b |

|

|

|

|

c |

Add lines 9a and 9b |

. . . |

. . . |

. . . . . . . . . . . . |

• 9c |

|

10 |

California interest. Enter the amount from Form 568, Schedule K, line 5 |

. . . |

. . . |

. . . . . . . . . . . . |

• 10 |

||

11 |

California dividends. Enter the amount from Form 568, Schedule K, line 6 |

. . . |

. . . |

. . . . . . . . . . . . |

• 11 |

||

12 |

California royalties. Enter the amount from Form 568, Schedule K, line 7 |

. . . |

. . . |

. . . . . . . . . . . . |

• 12 |

||

13 |

California capital gains. Enter the capital gains (not losses) included in the amounts from Form 568, |

|

|

|

• 13 |

||

|

Schedule K, lines 8 and 9 |

. . . |

. . . |

. . . . . . . . . . . . |

|||

14 |

California 1231 gains. Enter the amount of total gains (not losses) from Form 568, Schedule K, line 10a . |

. . . |

. . . |

. . . . . . . . . . . . |

• 14 |

||

15 |

Other California portfolio income (not loss). Enter the amount from Form 568, Schedule K, line 11a |

. . . |

. . . |

. . . . . . . . . . . . |

• 15 |

||

16 |

Other California income (not loss) not included in line 5. Enter the amount from Form 568, Schedule K, line 11b |

• 16 |

|||||

17 |

Total California income. Add lines 7, 8c, 9c, 10, 11, 12, 13, 14, 15, and 16. Line 17 may not be a negative number. |

• 17 |

|||||

|

Enter here and on Form 568, Side 1, line 1. If less than zero enter |

. . . |

. . . |

. . . . . . . . . . . . |

|||

3677213

Form 568 2021 Side 7

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Purpose | The CA Form 568 is used for reporting income by Limited Liability Companies (LLCs) in California. |

| Filing Requirement | All LLCs conducting business in California must file this form, regardless of income level. |

| Governing Law | The form is governed by the California Revenue and Taxation Code. |

| Annual Tax | LLCs are subject to an annual tax, which must be reported on this form. |

| Fees and Penalties | Filers may incur penalties for late submission or incorrect information on the form. |

| Member Identification | Form 568 requires details about LLC members and their respective ownership interests. |

| Reporting Period | The form is typically filed for the calendar year ending December 31, or for an alternate fiscal year. |

| Electronic Filing | LLCs have the option to file Form 568 electronically through the California Franchise Tax Board's website. |

| Deadline | The usual deadline for filing Form 568 is March 15 for calendar-year filers. |

Guidelines on Utilizing Ca 568

The California Form 568 serves as a tax return for limited liability companies (LLCs) and requires several pieces of information to ensure accurate reporting. Completing the form involves entering specific details about your LLC's finances and activities for the taxable year. Make sure you have all relevant documentation ready before you start filling out the form.

- Identify Your LLC Information: Fill in your LLC's name as registered with the California Secretary of State, the file number, and your Federal Employer Identification Number (FEIN).

- Provide Your Address: Input the street address, city, state, and ZIP code. If your LLC has a foreign address, refer to the specific instructions provided.

- Select Your Accounting Method: Tick the box indicating your accounting method (cash, accrual, or other).

- Report Assets and Income: Enter the total assets at the end of the year and complete the income details based on information from Schedule IW (Income Worksheet).

- Select Return Type: Indicate whether this is an initial, final, amended return, or protective claim by checking the appropriate box.

- Disclose Ownership Changes: Answer the questions regarding ownership changes during the taxable year, and provide necessary details if applicable.

- Calculate Taxes and Fees: Fill out all required lines for the Limited Liability Company fee, annual tax, and other tax-related items.

- Detail Payments: Report any payments made in relation to previous tax filings.

- Member Information: If applicable, detail any members of the LLC along with their respective shares of income and deductions.

- Sign and Date the Form: Ensure that the authorized member or manager signs and dates the form. Include contact information as needed.

Once you've filled out the form, review it carefully for accuracy. Double-check your calculations and ensure all required documents are attached before submitting it to the California Franchise Tax Board. If you have any specific questions or uncertainties while completing the form, consulting with a tax professional may provide additional clarity.

What You Should Know About This Form

What is the CA 568 form and who needs to file it?

The CA 568 form is the Limited Liability Company (LLC) Return of Income for California. If you have a limited liability company operating in California, this form is required to report your income. All LLCs that do business in California or have income sourced from California must file this return, regardless of whether they are classified as a single-member or multi-member LLC.

What are the key sections of the CA 568 form?

The form consists of various sections, including information about the LLC's name, address, federal employer identification number (FEIN), and accounting method. You'll also report your total income and various taxes and fees applicable to the LLC, such as the annual LLC tax and any nonconsenting nonresident members’ tax liability. It's important to complete all relevant sections accurately to avoid potential penalties.

Are there any penalties for not filing the CA 568 form on time?

Yes, there are penalties for failing to file the form on time. If your LLC does not file the CA 568, you may incur a late penalty, which is a percentage of the taxes due. Additionally, there may be interest charges applied to any unpaid tax. It's crucial to meet the filing deadlines to avoid these penalties.

What supporting documents should accompany the CA 568 form?

When filing your CA 568, you should enclose, but not staple, any payment if you owe taxes. Additionally, complete and attach Schedule IW, where you will derive the LLC's total income for the year. Depending on your LLC's situation, you may also need to attach other relevant schedules or forms, such as Schedule T for nonconsenting nonresident members’ tax liability.

Is there a fee associated with filing the CA 568 form?

Yes, there is an annual LLC tax that must be paid along with the CA 568 form. For most LLCs, this fee is a flat rate due annually, regardless of income. Additionally, if your LLC’s total income exceeds a certain threshold, you may also be required to pay a limited liability company fee based on your total income amount. Be sure to check the current fee structure for the most accurate information.

Common mistakes

Filling out the California Form 568 can be a daunting task, especially for those unfamiliar with the intricacies of tax forms. One common mistake occurs when individuals neglect to accurately indicate the taxable year for which they are filing. This simple oversight can lead to complications down the line, making it difficult for the Franchise Tax Board to process the return correctly.

Another frequent error is failing to check the appropriate accounting method. Many are unsure whether to select cash, accrual, or another method. This choice affects the income reported and may lead to significant compliance issues if not correctly filled out.

A substantial number of filers also forget to include a California Secretary of State file number. This crucial piece of information verifies their LLC's registration and omitting it may result in rejection of the form. Similarly, neglecting to enter the LLC’s Federal Employer Identification Number (FEIN) is another common mistake. This number is important for identification purposes and should not be overlooked.

Individuals frequently miss filling in the total assets at the end of the year. This information is vital for determining the LLC's financial health and the requirement for certain tax calculations. Leaving this field blank sends a signal that the form is incomplete.

Compounding issues can occur when individuals incorrectly check multiple boxes regarding ownership changes. Specifically, accurately reporting whether another entity acquired majority ownership or if the LLC acquired other entities is crucial. Misrepresentations can lead to unnecessary penalties or legal ramifications.

Additionally, not including a payment when required can lead to penalties, stressing the importance of double-checking calculations before submission. Ensuring that all amounts are entered correctly in the payment section, and validating total payments versus taxes due is essential.

Another prevalent oversight relates to members’ shares of income and deductions. Filers often neglect to report the accurate distributive share for each member, leaving essential financial details unaccounted for. This error can jeopardize not only the LLC’s compliance but also its members’ tax responsibilities.

Lastly, forgetting to sign and date the document is a simple yet significant mistake. An unsigned form is deemed invalid and can result in delays or additional scrutiny from tax authorities. It is crucial to ensure that responsible parties have reviewed the form to confirm its accuracy and completeness.

Documents used along the form

The California Form 568, which serves as a declaration of income for Limited Liability Companies (LLCs), is often accompanied by several other forms and documents. Understanding these additional documents can help provide a more comprehensive picture of business reporting requirements and obligations in California.

- Schedule K-1 (568): This form is used to report each member's share of the LLC's income, deductions, and credits. Each member receives a separate K-1, which details their individual tax liabilities and obligations based on the income generated by the LLC.

- Schedule T: This document outlines the tax liabilities specifically for nonconsenting nonresident members of the LLC. It specifies the income share, applicable tax rates, and any amounts withheld by the LLC on behalf of its nonresident members.

- Schedule IW (Limited Liability Company Income Worksheet): Necessary for the calculation of total income, this worksheet helps determine the LLC's income line on the Form 568. Accurate completion of this form ensures that any income reported aligns with the overall tax obligations of the LLC.

- Form 592-B: Designed for withholding on California-source income paid to nonresident members, this form outlines the amount that the LLC has withheld on behalf of these members for tax purposes.

- Form FTB 3537: This is a payment form for the estimated fee of $800 that LLCs owe to the California Franchise Tax Board. This fee is due even if the LLC has not generated any income during the year.

By utilizing these forms in conjunction with the California Form 568, LLCs can ensure compliance with state tax laws while effectively reporting the necessary financial information. Proper documentation is an essential aspect of running a smooth and legally compliant business operation in California.

Similar forms

Form 1065: This form is the U.S. Return of Partnership Income. Like the CA 568, it reports income, deductions, gains, and losses from partnerships, ensuring that members receive correct K-1 information for tax reporting.

Form 1120: The U.S. Corporation Income Tax Return shares similarities with the CA 568 in that it is used by corporations to report their income, deductions, and tax liability. Both forms ensure that respective entities comply with tax obligations.

Form 1120S: This is the U.S. Income Tax Return for an S Corporation. It parallels the CA 568 by providing a way for S Corporations to report their income and losses, which pass through to shareholders in a similar manner to LLC owners.

Form 8832: The entity classification election form allows LLCs to elect to be treated as a corporation or partnership for federal tax purposes. Like the CA 568, it addresses how income and taxation are determined based on entity structure.

Form 941: The Employer's Quarterly Federal Tax Return is comparable to the CA 568 as both forms are utilized to report income, payroll taxes, and contributions. They ensure compliance with tax obligations related to employment.

Form 990: This is the return for organizations exempt from income tax, like certain LLCs. Similar to the CA 568, it requires detailed reporting on income and expenditures, ensuring transparency and accountability of funds.

Schedule C (Form 1040): This is used by sole proprietors to report income or loss from a business. Both the CA 568 and Schedule C serve a purpose in reporting business income and expenses.

Schedule K-1 (Form 1065): This schedule reports each partner's share of income, deductions, and credits. Similar to the CA 568, it provides essential information that members of an LLC need for their own tax filings.

Schedule R: This is used to report the apportionment of income for multi-state corporations. Like the CA 568, it addresses how income is allocated and taxed based on the business's operational footprint.

Dos and Don'ts

When filling out the CA 568 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are four recommendations on what to do and what to avoid:

- Do: Double-check all entered information for accuracy to avoid errors that could delay processing.

- Do: Ensure that the total income is calculated correctly by first completing the necessary worksheets, such as Schedule IW.

- Do: Use whole dollar amounts only, as specified in the instructions, to prevent any unnecessary complications.

- Do: Attach all required schedules and additional documentation, as omitted materials can lead to penalties.

- Don’t: Leave any questions unanswered, particularly those marked as required; incomplete forms can cause rejections.

- Don’t: Staple your payment or any documents to the form, as this could result in processing issues.

- Don’t: Assume previous year’s figures are still correct; each taxable year may have different requirements and calculations.

- Don’t: Ignore the instructions, as following them closely is crucial for proper compliance with California tax regulations.

Misconceptions

- Misconception 1: The CA 568 form is only for multi-member LLCs.

- Misconception 2: Filing the CA 568 form guarantees a tax refund.

- Misconception 3: Only LLCs engaged in business must file the CA 568 form.

- Misconception 4: The form is due only once a year.

- Misconception 5: There are no penalties for late submissions of the CA 568 form.

- Misconception 6: The CA 568 form is complicated and difficult to complete.

- Misconception 7: LLCs that operate outside California do not need to file the CA 568.

- Misconception 8: Filing the CA 568 form is not necessary if the LLC had no income.

- Misconception 9: The CA 568 form is the only tax document LLCs need to worry about.

The CA 568 form is applicable to both single-member and multi-member LLCs in California. Single-member LLCs are also required to file this form to report their income and fees.

Filing the CA 568 form does not guarantee a refund. It simply reports income and fees, and any potential refund would depend on the overall tax situation of the LLC.

All LLCs registered in California must file the CA 568 form, regardless of whether they conducted business or generated income during the tax year.

The CA 568 form is typically due annually, but any changes in ownership, significant financial transactions, or qualifying events may necessitate additional filings or notifications.

Late submissions can result in penalties. It is important to file the form on time to avoid any additional charges from the state.

While the form does require specific information, many resources and instructions are available to help guide individuals through the process.

LLCs that are registered in California or doing business in California must file the CA 568, regardless of where their primary operations exist.

Even if an LLC has no income, it is still required to file the CA 568 form to report its status and any applicable fees.

LLCs may be required to file additional forms, such as federal tax returns or other state-specific documents, depending on their activities and structure.

Key takeaways

The CA 568 form is essential for filing the annual return of income for Limited Liability Companies (LLCs) that operate in California. Completing this form correctly ensures compliance with state tax regulations.

When filling out the CA 568, attention to detail is crucial. Ensure that the LLC's name, California Secretary of State file number, and Federal Employer Identification Number (FEIN) are accurately provided, as errors can lead to processing delays.

Understanding the accounting method used by your LLC—whether cash, accrual, or other—is necessary. Choose the appropriate box on the form and attach explanations for any methods used that differ from the standard.

Be prepared to answer several yes/no questions related to ownership and property control. These inquiries can affect your LLC's tax obligations and require thorough review to avoid costly penalties.

Filling out the income and deductions sections accurately is vital. Calculate total income carefully using the Schedule IW and ensure all deductions claimed align with your LLC’s activities.

If applicable, include Schedule T to report any nonconsenting nonresident members' tax liabilities. This ensures that all LLC members' obligations are accounted for within your tax return.

Finally, remember to sign and date the form. Unless the form is signed, it may face delays. An unsigned return is considered incomplete, potentially leading to penalties and further complications.

Browse Other Templates

HL7 Interface Documentation,Syngo Dynamics Technical Guide,Dynamics Interface Manual,Siemens HL7 Specifications,Syngo Imaging Configuration Guide,Siemens Healthcare Interface Protocol,Dynamics Software Guidelines,Syngo System Interface Reference,Siem - Siemens recommends regular reviews of clinical phrases for user customization.

How Do I Get My Transcript - This form ensures you receive your educational records accurately.

LLC Amendments Form,Oklahoma LLC Update Document,Articles of Organization Amendment,Public Benefit LLC Amendment,LLC Name Change Application,Oklahoma Business Structure Revision,Form for Amending LLC Articles,Oklahoma Limited Liability Company Amendm - The registered agent must have a physical address in Oklahoma.