Fill Out Your Ca Resale Form

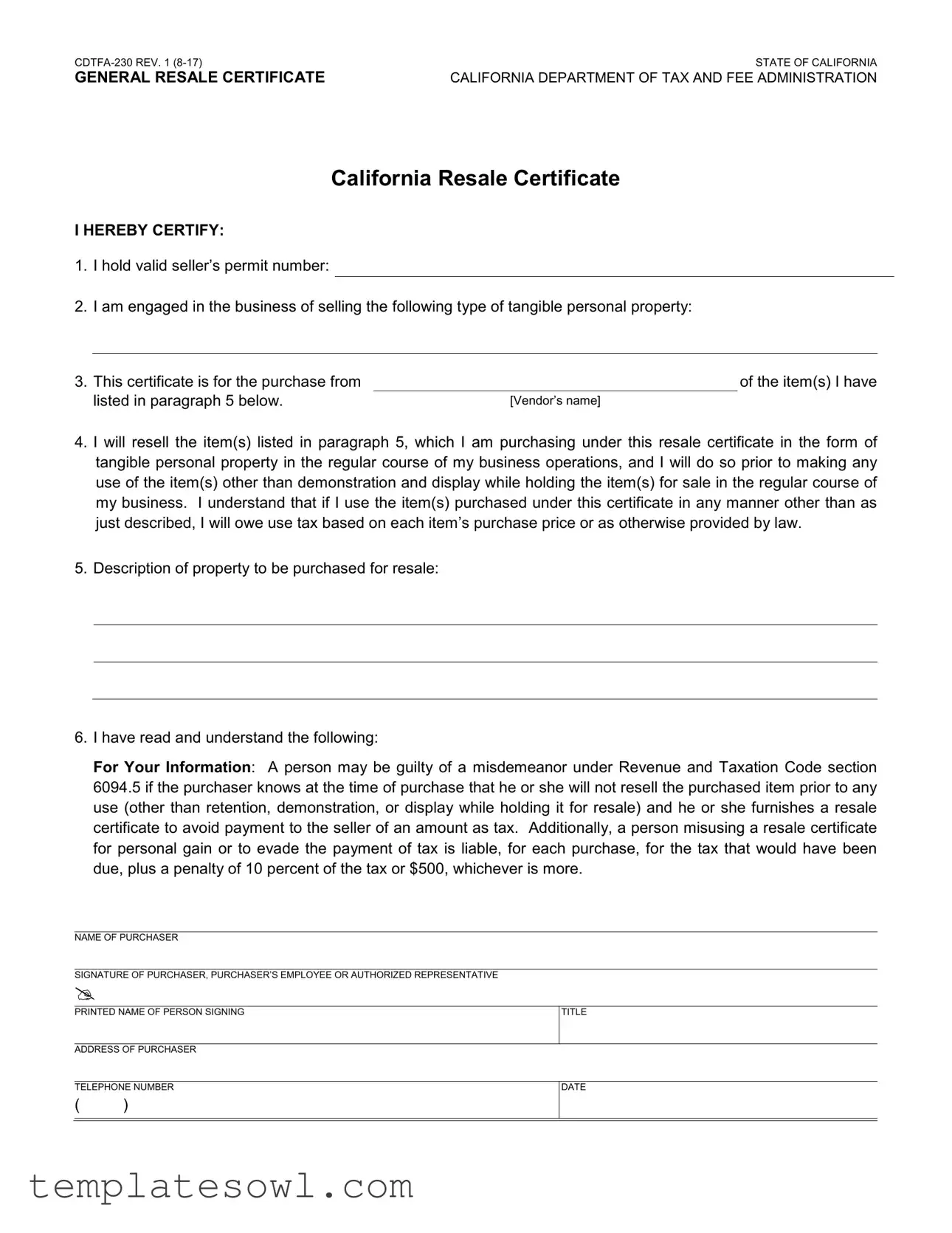

The California Resale Certificate (CDTFA230 REV. 1) serves as an essential tool for businesses engaged in the sale of tangible personal property. Businesses utilize this form to certify their intent to resell items they purchase, thereby exempting them from immediate sales tax obligations. The certificate requires several key pieces of information, including the seller’s permit number and a description of the property being purchased for resale. It establishes that the purchaser is involved in regular business operations and intends to resell the specified items before using them in any way beyond display or demonstration. Importantly, misuse of the resale certificate can result in serious repercussions, including fines and tax liabilities. The form necessitates a signature from the purchaser or an authorized representative, which further emphasizes the responsibility that accompanies its use. Understanding the implications of this certificate is crucial for compliance with state tax regulations and for ensuring proper business practices in the resale marketplace.

Ca Resale Example

CDTFA230 REV. 1 (817) |

STATE OF CALIFORNIA |

GENERAL RESALE CERTIFICATE |

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

CALIFORNIA RESALE CERTIFICATE

I HEREBY CERTIFY:

1.I hold valid seller’s permit number:

2.I am engaged in the business of selling the following type of tangible personal property:

3. This certificate is for the purchase from |

|

of the item(s) I have |

listed in paragraph 5 below. |

[Vendor’s name] |

|

4.I will resell the item(s) listed in paragraph 5, which I am purchasing under this resale certificate in the form of tangible personal property in the regular course of my business operations, and I will do so prior to making any use of the item(s) other than demonstration and display while holding the item(s) for sale in the regular course of my business. I understand that if I use the item(s) purchased under this certificate in any manner other than as just described, I will owe use tax based on each item’s purchase price or as otherwise provided by law.

5.Description of property to be purchased for resale:

6.I have read and understand the following:

FOR YOUR INFORMATION: A person may be guilty of a misdemeanor under Revenue and Taxation Code section 6094.5 if the purchaser knows at the time of purchase that he or she will not resell the purchased item prior to any use (other than retention, demonstration, or display while holding it for resale) and he or she furnishes a resale certificate to avoid payment to the seller of an amount as tax. Additionally, a person misusing a resale certificate for personal gain or to evade the payment of tax is liable, for each purchase, for the tax that would have been due, plus a penalty of 10 percent of the tax or $500, whichever is more.

NAME OF PURCHASER

SIGNATURE OF PURCHASER, PURCHASER’S EMPLOYEE OR AUTHORIZED REPRESENTATIVE

PRINTED NAME OF PERSON SIGNING

TITLE

ADDRESS OF PURCHASER

TELEPHONE NUMBER

()

DATE

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The California Resale Certificate allows purchasers to buy items tax-free if they intend to resell those items. |

| Governing Law | This form is governed by the California Revenue and Taxation Code, specifically section 6094.5. |

| Use Restrictions | Items purchased under this certificate must be resold in their original form, with exceptions for demonstration and display purposes. |

| Seller's Permit | The purchaser must have a valid seller's permit number to utilize this resale certificate. |

| Misuse Consequences | Misusing this certificate can lead to misdemeanor charges and liability for tax and penalties. |

| Required Information | Purchasers must provide the vendor's name and a description of the property they intend to purchase for resale. |

| Signature Requirement | The form must be signed by the purchaser, employee, or authorized representative confirming the information is accurate. |

| Date of Issue | The form must include the date of issue to ensure compliance with the most current regulations. |

Guidelines on Utilizing Ca Resale

Filling out the California Resale Certificate form can seem straightforward, but accuracy is essential. This document will require your careful attention to detail, ensuring all necessary information is provided. Follow these steps to properly complete the form.

- Obtain the form: Download the California Resale Certificate (CDTFA-230) from the California Department of Tax and Fee Administration website.

- Provide your seller’s permit number: In the first field, write your valid seller’s permit number. This confirms you are authorized to make purchases for resale.

- Describe your business: In the second field, indicate the type of tangible personal property your business sells.

- Vendor information: Fill in the vendor's name from whom you are purchasing the items listed below.

- Explain your intent: Clearly state that you will resell the items listed in section five without using them for any purpose other than demonstration or display while they are available for sale.

- Item description: In the fifth field, provide a detailed description of the property you intend to purchase for resale.

- Acknowledge reading the statement: Familiarize yourself with the legal consequences outlined in the form and acknowledge that you have read and understood them.

- Sign the form: The purchaser or an authorized representative must sign the form. Make sure to include a printed name.

- Include your title and address: Fill in the title of the person signing, your address, and your telephone number. This ensures easy contact if necessary.

- Insert the date: Lastly, fill in the date when the form is signed.

Following these steps will help ensure that your California Resale Certificate is accurately completed. Remember, any incorrect information could lead to complications or penalties, so take your time and double-check your entries.

What You Should Know About This Form

What is the purpose of the CA Resale Certificate?

The CA Resale Certificate allows businesses to purchase goods without paying sales tax if they plan to resell those items. It is a document that certifies you will use the purchased items in the regular course of your business operations. By providing this certificate to vendors, you can avoid paying sales tax upfront.

Who can use a CA Resale Certificate?

Any business that holds a valid seller’s permit in California can use the CA Resale Certificate. You must be engaged in selling tangible personal property. This certificate is particularly useful for retailers, wholesalers, and other businesses that routinely buy products for resale.

What information is required on the CA Resale Certificate?

You need to fill out your valid seller's permit number, provide details about the type of goods you are selling, specify the vendor's name from whom you are purchasing the items, and describe the property you intend to buy for resale. Additionally, the certificate requires your name, signature, title, address, and telephone number.

What happens if I do not resell the items purchased under this certificate?

If you fail to resell the items and use them for personal use or any purpose other than demonstration or display, you will owe use tax on those items. This tax will be based on the purchase price or as outlined by law. It’s important to understand this before using the resale certificate.

Can I use the CA Resale Certificate for items I plan to use myself?

No, the CA Resale Certificate is intended solely for items you plan to resell. Using the certificate for personal purchases or any items that will not be resold can lead to penalties and tax liabilities. It's crucial to ensure that the items will be merchandise for sale in your business.

What are the penalties for misusing the resale certificate?

Misusing the CA Resale Certificate can result in serious consequences, including civil and criminal penalties. If you knowingly misuse the certificate to evade tax, you may be charged with a misdemeanor. You can also face a tax liability along with a penalty of either 10% of the due tax or $500, whichever is higher.

Is there a specific time frame for reselling items purchased with this certificate?

While there is no strict time frame outlined, the expectation is that you will resell the items in a timely manner as part of your regular business operations. It's best practice to resell items as soon as you are able to minimize the risk of being assessed for use tax.

How do I fill out the CA Resale Certificate correctly?

To fill out the form correctly, ensure you provide your valid seller’s permit number, the description of the items, and complete all required fields. After completing the form, all necessary parties should sign to validate it. Make sure to keep a copy for your records, as you may need to present it upon request.

Common mistakes

When filling out the California Resale Certificate (CDTFA-230), mistakes can lead to penalties or the invalidation of the certificate. One common error is not providing a valid seller’s permit number. This number is essential and verifies that the business is legally allowed to resale goods. If this section is left blank or filled in incorrectly, the certificate may not be accepted.

Another mistake people often make is failing to accurately describe the property they intend to purchase. This description should be specific and include the types of items that will be resold. A vague description could raise questions about the legitimacy of the resale certificate and may lead to complications in tax reporting.

Many individuals overlook the importance of understanding the terms outlined in the certificate. Section 4 specifies that items must be resold without any significant usage other than display or demonstration. Ignoring this can result in unforeseen tax liabilities if the item is used for personal purposes before being sold.

Providing incorrect vendor details is also a frequent mistake. The name of the vendor from whom the goods are purchased must be included. If this information is inaccurate or missing, it could complicate any potential audits and create issues for both the purchaser and the vendor.

Lastly, signatures can be a point of failure. It's crucial that the certificate is signed by the purchaser or an authorized representative. If the signature is missing or comes from someone who isn’t authorized, it could invalidate the resale certificate. Care should be taken to ensure that all required fields are filled out correctly to avoid future complications.

Documents used along the form

The California Resale Certificate (CDTFA-230) plays a critical role in the context of sales transactions involving the resale of tangible personal property. Various other forms and documents are often used in conjunction with this certificate to ensure compliance with state regulations and facilitate smooth business operations. Understanding these supplementary documents can enhance one's grasp of the legal landscape surrounding sales tax and resale activities.

- Seller's Permit: This permit authorizes businesses to collect sales tax on behalf of the state. It is generally required for anyone engaged in selling tangible personal property within California.

- Purchase Order (PO): A document issued by a buyer to a seller, indicating the details of a desired purchase, including quantities and prices. It serves as a formal agreement and can aid in inventory management.

- Invoice: This document itemizes a transaction between the buyer and seller, detailing the products sold, quantities, prices, taxes, and total amount due. It provides essential records for both accounting and tax purposes.

- Sales Tax Return: A form that businesses must file to report their sales tax collections to the state. It typically summarizes sales and tax liabilities for a specific reporting period.

- Supplier Agreement: A contract outlining the terms and conditions between a supplier and a retailer. This agreement can establish pricing, delivery terms, and other key operational details.

- Return Policy Document: A description of the conditions under which customers may return purchased items. This document enhances customer satisfaction and can also address tax handling on returned items.

- Use Tax Certificate: This form is necessary when tangible personal property is purchased without the payment of sales tax. It allows the buyer to report and pay the required use tax on those goods.

- Exemption Certificate: This certificate is utilized when a sale is exempt from sales tax (e.g., sale to a nonprofit organization). It requires proper documentation to substantiate the tax-exempt status of the purchase.

- Bill of Lading: A document issued by a carrier to acknowledge receipt of cargo for shipment. It serves as a critical piece of evidence in shipping transactions.

Each of these documents complements the California Resale Certificate by addressing different facets of business transactions, from sales tax obligations to operational agreements. Familiarity with these forms and their purposes can assist business owners and employees in navigating the complexities of sales in a compliant manner.

Similar forms

- California Seller’s Permit: Just like the California Resale Certificate, a seller’s permit allows a business to sell tangible goods. It verifies that the seller has registered with the state and is authorized to collect sales tax from customers.

- Exempt Use Certificate: This document is used when a buyer purchases items that will not be resold but used in a way that is tax-exempt. Similar to the resale certificate, it provides proof of tax-exempt status.

- Certificate of Exemption: This document certifies that certain purchases are exempt from sales tax. It is similar in that it identifies the nature of the purchase and the legal basis for exemption, just like the resale certificate does for resale purchases.

- Purchase Order: A purchase order is a document issued by a buyer to a seller, requesting products or services. Like the resale certificate, it specifies the items being purchased, although it does not specifically address tax-exemption.

- Vendor Invoice: A vendor invoice is a statement from a seller to a buyer detailing items sold and the amount due. It is similar in that it documents a transaction, but it does not include the tax-exempt information that a resale certificate does.

- Wholesale Agreement: This type of agreement outlines the terms of purchasing goods in bulk for resale. It is similar because it involves buying items intended for resale, but it typically details pricing and terms rather than tax-exempt status.

Dos and Don'ts

When filling out the California Resale Certificate (CDTFA-230), it is essential to be thorough and accurate. Here are ten guidelines to help you navigate the process effectively:

- Provide your seller's permit number: It is crucial to include a valid seller’s permit number at the top of the form.

- Clearly describe your business: Specify the type of tangible personal property you sell. Being precise helps prevent future disputes.

- Identify the vendor: Always write the name of the vendor from whom you are purchasing the items listed.

- List all items for resale: In paragraph 5, include a thorough description of all items you intend to resell.

- Understand your tax obligations: Know that using the items for anything aside from resale may result in incurring use tax.

There are also a few things to avoid while completing the form:

- Don't misrepresent your intentions: Avoid providing false statements about reselling items, as this could lead to legal penalties.

- Don’t rush the completion: Take your time to ensure that all fields are correctly filled out. Inaccuracies can complicate transactions.

- Don’t forget to sign the form: Ensure that the purchaser, employee, or authorized representative signs the document.

- Don’t omit your contact information: Always include your phone number and address to facilitate communication.

Following these guidelines will help ensure that the California Resale Certificate is filled out correctly and efficiently, minimizing the risk of complications or misunderstandings in the future.

Misconceptions

Understanding the California Resale Certificate can help businesses ensure compliance and avoid unnecessary penalties. Here are five common misconceptions about the Ca Resale form:

- A resale certificate can be used for any purchase. This is incorrect. The resale certificate is intended only for items intended for resale in the regular course of business. It does not apply to items for personal use.

- Having a seller’s permit guarantees all purchases are tax-exempt. This is a misunderstanding. A seller’s permit allows a business to collect sales tax, but each individual purchase must still qualify for resale to be tax-exempt.

- Once I complete the resale certificate, I can use the items for any purpose. That is misleading. The certificate permits resale only, meaning any personal use can incur use tax penalties. Proper adherence is crucial.

- Misuse of the resale certificate has no serious consequences. This is false. Misusing the certificate can lead to severe penalties, including tax liabilities that include a 10% penalty or $500, whichever is greater.

- I can verbally confirm my intent to resell instead of providing a resale certificate. This is incorrect. Written certification is required to prove intent to resell. Verbal confirmations do not hold legal weight.

These points clarify the main misconceptions regarding the California Resale Certificate. Understanding the appropriate use of this certificate is essential for maintaining legal compliance and financial integrity in conducting business.

Key takeaways

Here are the key takeaways for filling out and using the CA Resale Form:

- Seller's Permit: Ensure you have a valid seller’s permit number. This is necessary to complete the form.

- Type of Business: Clearly specify the type of tangible personal property your business sells.

- Vendor Information: Include the name of the vendor from whom you are purchasing the items.

- Intended Use: Confirm that you will resell the items in the regular course of business before using them in any other way.

- Tax Implications: Be aware that using the items for anything other than resale may result in owing use tax.

- Property Description: Provide a detailed description of the property you are purchasing for resale.

- Legal Consequences: Understand that knowingly misusing the resale certificate can lead to misdemeanor charges.

- Potential Penalties: Misusing the certificate may result in tax liability and a penalty of 10 percent of the tax owed or $500.

- Signature Requirement: The form must be signed by the purchaser or an authorized representative, with their printed name included.

Always keep a copy of the completed form for your records.

Browse Other Templates

Form 108 Missouri - Documentation like a trade-in receipt may enhance the application process.

Where Can You Find a Msds - Identifying potential health effects helps workers mitigate risks related to exposure.

What Is a Vehicle Lien - It is crucial for all involved to maintain communication regarding contract performance and expectations.