Fill Out Your Ca3916 Uk Form

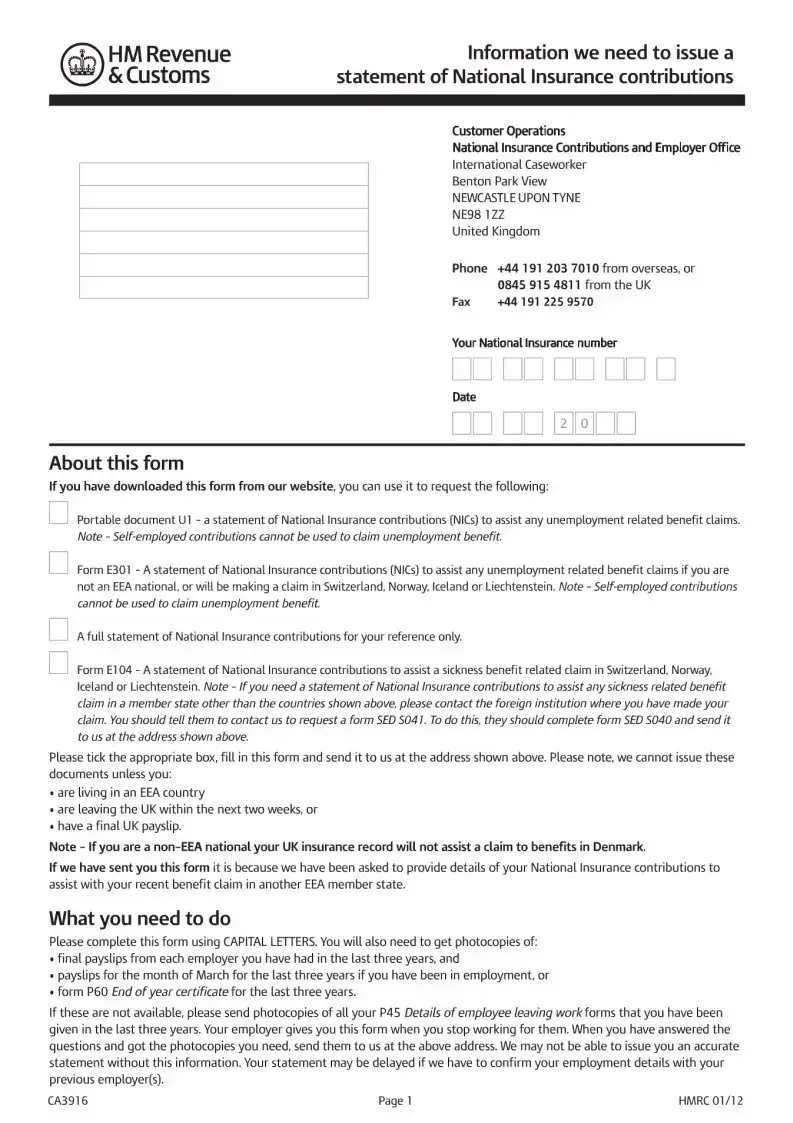

The CA3916 UK form is a crucial document for individuals seeking to obtain a statement of their National Insurance contributions (NICs), especially when applying for employment-related benefits abroad. This form serves multiple purposes: it facilitates the issuance of the Portable Document U1 for unemployment claims, allows access to the E301 form for non-EEA nationals, and provides statements for sickness-related claims in specific countries. Individuals completing the form must provide their personal information, including their National Insurance number, residency status in the UK, and employment history. Important documentation, such as final payslips, P60s, or P45s from the last three years, must accompany the submission. This is necessary for the accurate calculation of NICs and to prevent delays in processing. Whether relocating within the EEA or filing claims in countries like Switzerland, Norway, Iceland, or Liechtenstein, understanding the requirements of the CA3916 form is essential for a smooth application process. Careful attention to detail and adherence to the guidelines will ensure that applicants receive the information they require for their benefit claims.

Ca3916 Uk Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CA3916 form is used to request a statement of National Insurance contributions (NICs) for claims related to unemployment benefits. |

| Eligibility Requirements | You must be living in an EEA country or leaving the UK within two weeks to qualify for this document. |

| Self-Employment Note | Self-employed contributions do not count towards claims for unemployment benefits. |

| Contact Information | For inquiries, the form provides a specific contact number: +44 191 203 7010 from overseas and 0845 915 4811 from the UK. |

| Final Payslips | Applicants need to provide photocopies of final payslips from all employers over the last three years. |

| Associations with EEA | Form E301 is specifically for non-EEA nationals claiming benefits in certain countries, including Switzerland and Norway. |

| Processing Delay | Delays may occur if additional employment verification is necessary, which can prolong the issuing of the statement. |

| Data Accuracy | An accurate statement cannot be issued without complete information, including photocopies of necessary documents. |

| Submission Requirement | Completed forms must be sent to the designated address at HM Revenue & Customs for processing. |

| Use of Capitals | All responses on the form should be filled out in capital letters to ensure clarity and avoid errors. |

Guidelines on Utilizing Ca3916 Uk

Once you have ready the necessary information and documents, it's time to fill out the Ca3916 UK form. Be sure to take your time to ensure accuracy. Having the correct details will help avoid delays in processing your request.

- Write your National Insurance number at the top of the form.

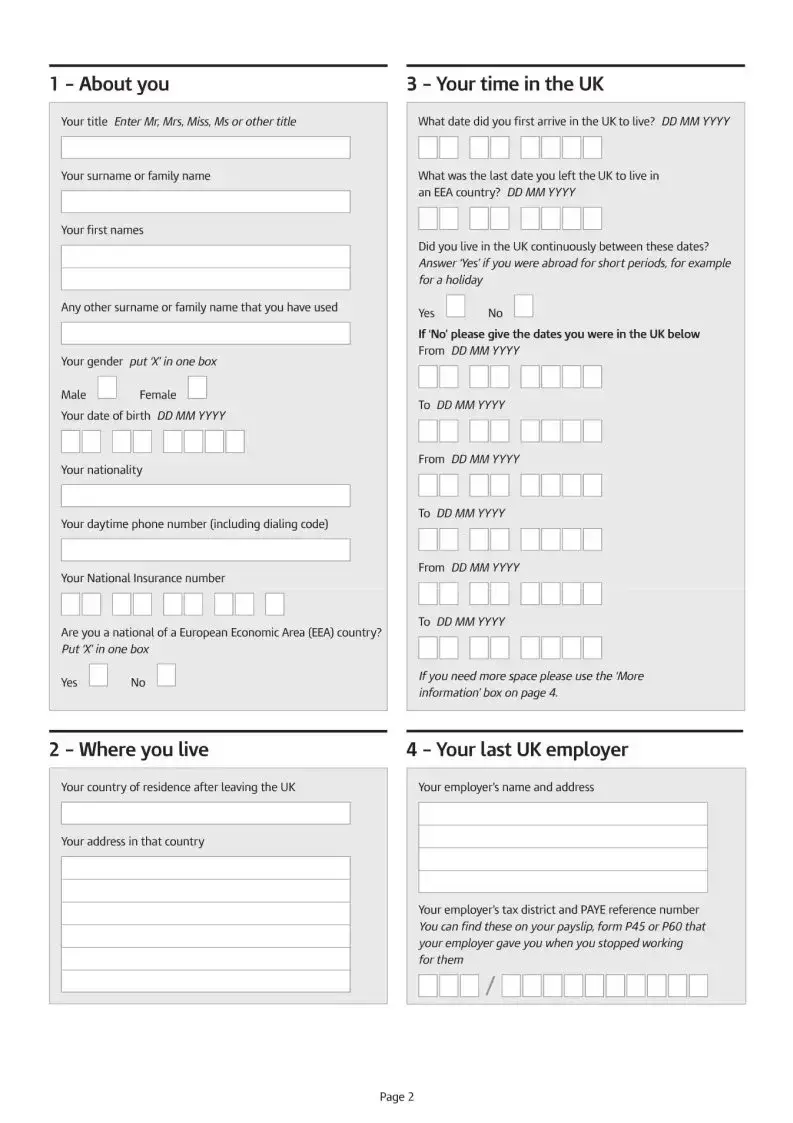

- In section 1, provide your personal details. Enter your title, surname, and first names.

- Fill in your date of birth and select your gender.

- Indicate your nationality and provide your daytime phone number, including the dialing code.

- Answer the question regarding your residency in the UK, providing dates where applicable.

- In section 2, specify your country of residence after leaving the UK.

- Provide the name and address of your last UK employer in section 4.

- Include your employer's tax district and PAYE reference number, which can be found on your payslip or P60.

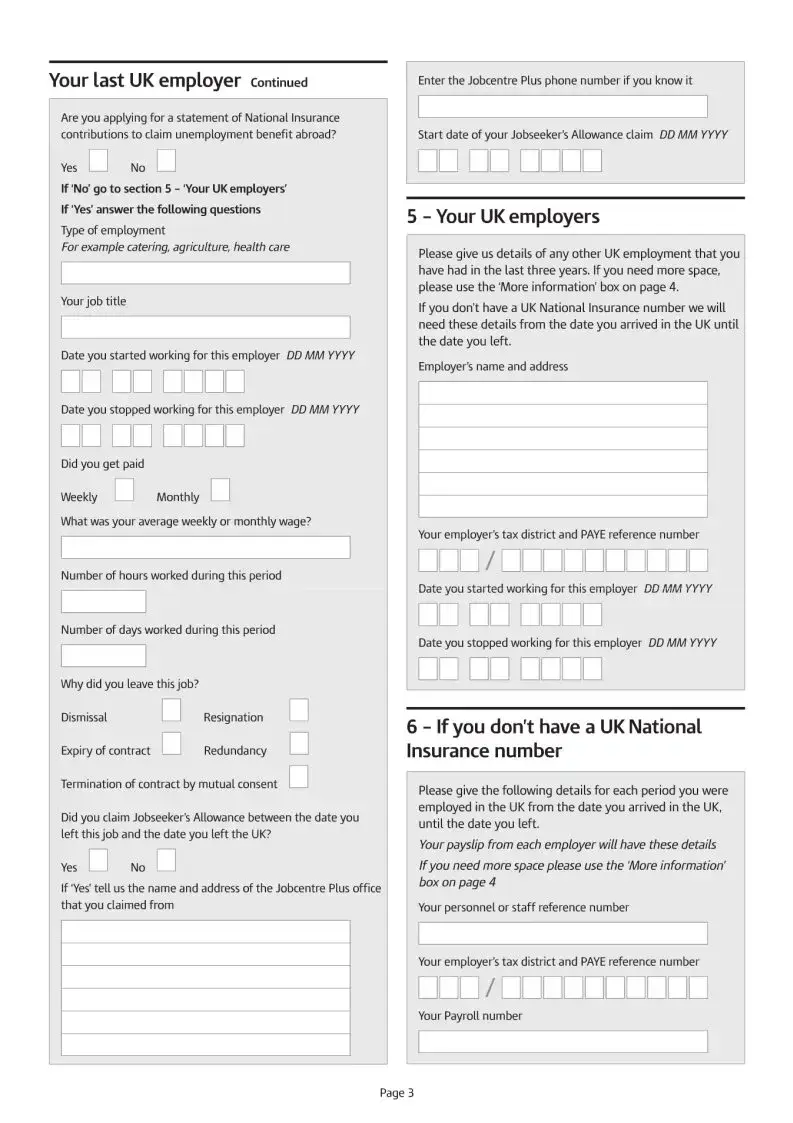

- Indicate whether you are applying for a statement of National Insurance contributions for unemployment benefit abroad.

- For section 5, list any other UK employers you have had in the last three years, detailing your start and stop dates and the nature of your employment.

- If applicable, include information about any Jobseeker's Allowance claims you made after leaving your job.

- Complete section 6 if you do not have a UK National Insurance number, providing details of each period of employment in the UK.

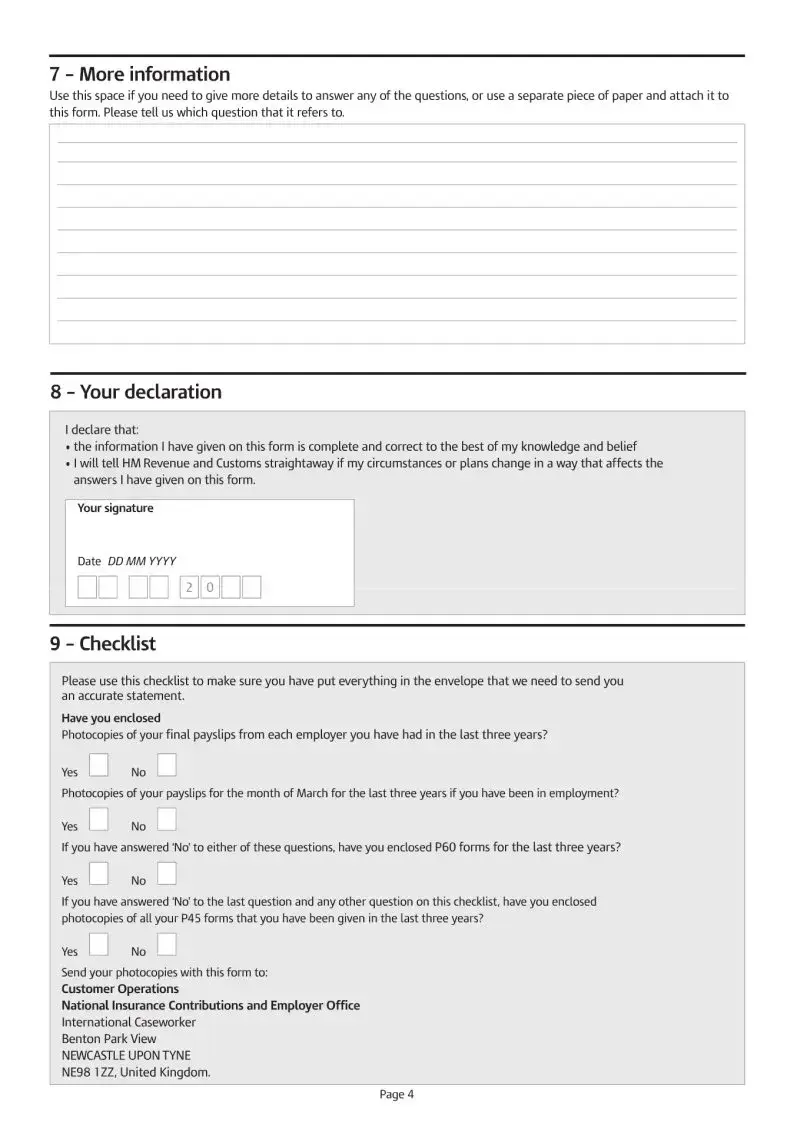

- Use section 7 for any additional information or clarifications related to your responses.

- Check that all sections are completed in CAPITAL LETTERS and ensure all photocopies of required documents are attached.

- Finally, send the completed form and all photocopied documents to the appropriate HM Revenue & Customs address.

What You Should Know About This Form

What is the Ca3916 UK form used for?

The Ca3916 form is primarily designed for individuals seeking a statement of their National Insurance contributions (NICs). This document is essential for assisting with claims related to unemployment benefits or sickness benefits, especially in EEA countries or Switzerland. Additionally, the form can facilitate requests for documents like Portable Document U1 or Form E301, which further support unemployment-related claims. It cannot, however, be used for claims based on self-employed contributions.

Who can use the Ca3916 form?

This form is available to individuals who have lived in the UK and are now residing in an EEA country or those who are planning to leave the UK soon. Furthermore, it is applicable for EEA nationals or those who have worked in the UK and need documentation supporting their benefit claims in other EEA member states. Specifically, it cannot be utilized by non-EEA nationals to claim benefits in Denmark with their UK insurance record.

What information do I need to provide when completing the Ca3916 form?

To complete the Ca3916 form, you will need to provide personal details, including your full name, National Insurance number, nationality, and information about your employment history in the UK. This includes the names and addresses of your employers, the duration of your employment, and your pay frequency. You'll also need to submit photocopies of your final payslips, P60 forms, and any relevant P45 forms over the last three years to substantiate your claim.

Can I apply for a statement of National Insurance contributions if I am not currently in the UK?

Yes, you can apply for a statement even if you are not in the UK, provided you meet specific criteria. You must either be living in an EEA country, plan to leave the UK within two weeks, or possess a final UK payslip. If these conditions are satisfied, you can successfully submit the form from abroad.

What should I do if I do not have all the required documents?

If you lack the necessary documents, such as P60s or final payslips, you must gather any available documentation that can verify your employment. This includes sending photocopies of P45 forms from the last three years. It’s crucial to provide as much information as possible since the absence of required documents may lead to delays in processing your request or an inaccurate statement.

What happens after I submit the Ca3916 form?

After submitting the form, HM Revenue & Customs (HMRC) will review the information provided and verify any employment details with your previous employers if necessary. The processing time may vary depending on the completeness of your request and whether additional information is required. You will receive a statement of your National Insurance contributions once your application is processed.

Where should I send the completed Ca3916 form?

You should send the completed form to the following address: Customer Operations, National Insurance Contributions and Employer Office, International Caseworker, Benton Park View, Newcastle upon Tyne, NE98 1ZZ, United Kingdom. If you are sending it from overseas, be sure to check for appropriate postal guidelines to ensure successful delivery.

How can I contact HMRC for assistance regarding the Ca3916 form?

If you have questions or require assistance with the Ca3916 form, you can contact HMRC directly. Call +44 191 203 7010 from overseas or 0845 915 4811 if you are in the UK. You may also use fax at +44 191 225 9570 for additional correspondence. For any specific queries, it’s best to have your National Insurance number and other relevant details at hand during your call.

Common mistakes

Filling out the CA3916 UK form can be confusing. One common mistake is not using capital letters as instructed. This requirement helps ensure clarity. Any deviation from this might cause the form to be misread or delayed.

Another mistake involves providing incomplete or incorrect information about employment history. All previous employers, including their names and addresses, must be accurately listed. Missing information can lead to delays in processing the request.

A third frequent error is failing to include necessary documents. The form requires supporting documents like payslips or P60 forms for the last three years. Not attaching these copies can prevent your statement from being issued.

The fourth mistake is not checking multiple times for accuracy. People often overlook small errors in their names, dates, or phone numbers. These mistakes can lead to complications down the line.

Many individuals mistakenly assume they do not need to answer all sections of the form. Every question must be addressed to ensure that HM Revenue & Customs has a complete picture of your situation.

Some users forget to sign and date the form before submitting it. This essential step confirms that the information provided is accurate and that you agree with the statements made.

Another common issue is not understanding the instructions about living in the UK. If someone has been abroad, they should clearly state the periods they were away. Misrepresenting this information may result in a denial of the claim.

Finally, people often neglect to keep a copy of the completed form and documents sent. This record is crucial for future reference and in case any problems arise.

Documents used along the form

The CA3916 UK form is designed to assist individuals in obtaining a statement of National Insurance contributions that can help in claiming unemployment-related benefits. In addition to this form, several other documents may be required or useful in related processes. Below is a list of several documents often used alongside the CA3916 UK form, each followed by a brief description.

- Form U1: This document provides a statement of National Insurance contributions specifically to assist with unemployment-related claims in other countries. It is especially relevant for individuals who have worked in the UK and are seeking benefits abroad.

- Form E301: Similar to Form U1, this statement aids individuals who are not EEA nationals in claiming unemployment benefits in Switzerland, Norway, Iceland, or Liechtenstein. It ensures that all necessary contributions are accounted for.

- Form E104: This form is used to verify National Insurance contributions when applying for sickness-related benefits outside the UK. It helps facilitate claims in countries such as Switzerland and Norway.

- P60 End of Year Certificate: This document summarizes the total wages and deductions, including National Insurance contributions, for the entire tax year. It serves as official proof of contributions made during employment.

- P45 Details of Employee Leaving Work: Provided by an employer when an employee leaves their job, this form details the employee's earnings and tax contributions during their time of employment. It is necessary for establishing work history and contributions.

- Form SED S041: When an individual needs to request a statement of National Insurance contributions for claims outside specified countries, this form must be completed and sent to HMRC for assistance.

These documents, along with the CA3916 UK form, provide valuable assistance for individuals navigating the complexities of benefit claims and verifying contributions. It is essential to gather the necessary information beforehand to ensure a smooth and effective process.

Similar forms

- Form U1: This document is used to request a statement of National Insurance contributions similar to the CA3916 form. It assists individuals in claiming unemployment benefits across different European countries.

- Form E301: Like the CA3916, this form provides information on National Insurance contributions. It is specifically for those who are not EEA nationals but need to claim benefits in countries like Switzerland, Norway, Iceland, or Liechtenstein.

- Form E104: This document serves a similar purpose by supplying a statement of National Insurance contributions to help with healthcare benefits abroad, aligning with the information requested in the CA3916.

- Form SED S041: This alternative is provided for cases requiring a statement for sickness-related claims in countries other than those covered in the CA3916 form. It demonstrates the interconnectedness of these documents.

- Form SED S040: A precursor to the SED S041, this form helps initiate the process for requesting a statement of National Insurance contributions, similar in function to the CA3916.

- Form P60: Although primarily an end-of-year certificate, the P60 offers information about pay and National Insurance contributions, much like the data requested in the CA3916 form.

Dos and Don'ts

When filling out the CA3916 UK form, there are specific practices to follow to ensure your submission is successful. Here’s a concise list of things you should do and avoid:

- Do use only CAPITAL LETTERS when completing the form. This guarantees clarity and reduces potential mistakes.

- Do gather the necessary photocopies of your final payslips, P60s, or P45s from the last three years before submitting the form. Incomplete information can delay processing.

- Do double-check all dates and details. Errors in your information can lead to complications and delays in receiving your National Insurance statement.

- Do send the completed form to the address provided in the instructions. This ensures it reaches the correct department for processing.

- Don't forget to provide your National Insurance number. Omitting this key detail can hinder the processing of your application.

- Don't submit the form without clearly indicating whether you are an EEA national or not. This information critically affects your claim.

- Don't leave any required boxes blank. If a question does not apply to you, indicate this clearly rather than omitting it.

- Don't wait until the last minute to send your form. It’s best to allow ample time for processing, especially if you need the information for a benefit claim.

Misconceptions

- Misconception 1: The Ca3916 form is not necessary for anyone not claiming benefits.

- Misconception 2: Self-employed contributions can be used to claim unemployment benefits.

- Misconception 3: I don’t need to provide payslips or P60 forms if I've already filled out the Ca3916.

- Misconception 4: The form can be completed without knowing specific employment details.

- Misconception 5: Anyone can apply for the National Insurance statement regardless of their current residency.

This form is essential for those applying for various types of unemployment-related benefits. If you have worked in the UK and plan to make a claim abroad, having a detailed statement of your National Insurance contributions is crucial.

This is incorrect. According to the guidelines, self-employed National Insurance contributions do not qualify you for unemployment benefits. Only contributions from employment can be considered.

Providing necessary documentation is mandatory. The HMRC requires final payslips and P60 forms to accurately process your claim. Without these, your request may be delayed.

This is misleading. The Ca3916 requires information about your employment history, including start and end dates, employer details, and National Insurance numbers. Incomplete forms may delay processing.

To be eligible, you must be living in an EEA country, leaving the UK shortly, or possessing a final UK payslip. If these conditions aren’t met, the application may not be accepted.

Key takeaways

Understanding the CA3916 UK form is crucial for successfully requesting a statement of National Insurance contributions. Here are some key takeaways:

- The Purpose of the Form: This form allows individuals to request a statement of National Insurance contributions to support unemployment or sickness benefit claims in certain countries.

- Eligibility Requirements: Only residents living in an EEA country or those leaving the UK within two weeks can submit this form. A final UK payslip may also qualify.

- Documentation Required: Applicants need photocopies of their final payslips, P60 forms, or P45 details from the past three years to complete their requests.

- Clear Instructions Necessary: The form must be filled out using capital letters. Providing accurate employment details is vital; otherwise, the statement's issuance may be delayed.

- Contact Information: If assistance is needed, individuals can reach out to HM Revenue & Customs using the provided phone or fax numbers in the instructions.

Browse Other Templates

Power of Attorney for Buying Property in India - Having an attorney simplifies the logistics of managing bank affairs without direct presence.

New York Sales Tax Exemption Certificate,Official Government Occupancy Tax Exemption Form,ST-129 Tax Exemption Application,Hotel Occupancy Exemption Certificate,State and Local Sales Tax Waiver Form,Government Employee Hotel Tax Exemption,Tax Exempti - It is important to ensure that the hotel staff understands how to handle the ST-129 for it to be effectively utilized.