Fill Out Your Cac 2 Form

The CAC 2 form plays a crucial role in the contributions to training funds directed by the California Apprenticeship Council, an entity dedicated to enhancing apprenticeship opportunities across the state. When filling out this form, it's essential to understand that each job site requires a separate submission, where contractors must diligently list the specific occupations related to that site. Along with the form, a consolidated check made out to the California Apprenticeship Council can be submitted for multiple job sites or occupations, simplifying the payment process. Notably, there are some limitations on training fund contributions for federal public works projects, particularly concerning non-apprenticeable occupations such as utility technicians. Timeliness is key, as contributions are due on the 15th of every month. To ensure the successful submission and processing of payments, all required fields must be completed in clear type or black and blue ink. Important details sought on the form include the contractor's name and address, license number, and specifics about the project and job site, including the types of workers involved and the hours contributed. Moreover, if any apprentices were employed, it's necessary to detail their apprenticeship program and the number of hours worked. This form is more than just a document; it represents a commitment to workforce development and the empowerment of diverse trades through structured training programs.

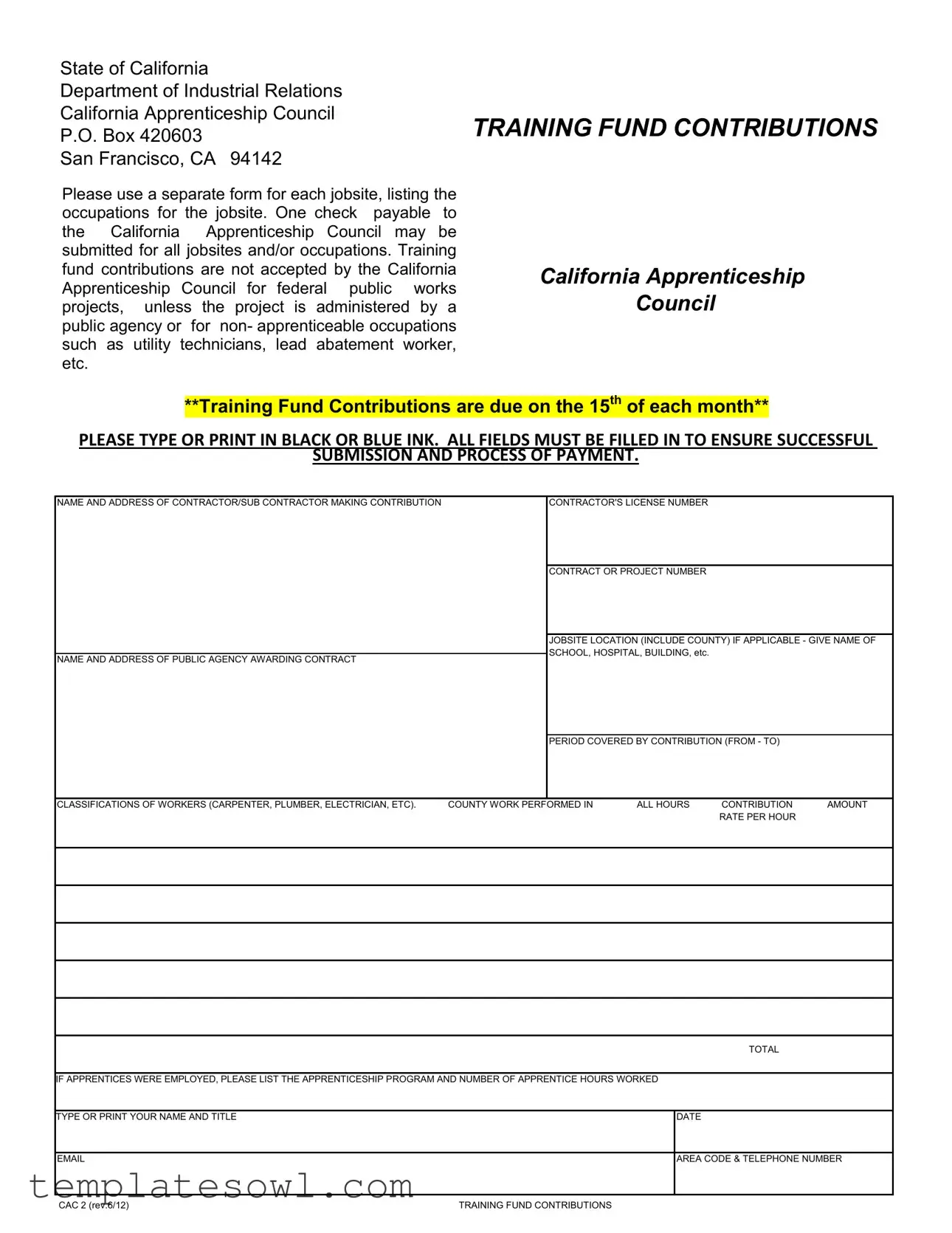

Cac 2 Example

State of California

Department of Industrial Relations

California Apprenticeship Council

P.O. Box 420603

San Francisco, CA 94142

Please use a separate form for each jobsite, listing the occupations for the jobsite. One check payable to the California Apprenticeship Council may be submitted for all jobsites and/or occupations. Training fund contributions are not accepted by the California Apprenticeship Council for federal public works projects, unless the project is administered by a public agency or for non- apprenticeable occupations such as utility technicians, lead abatement worker, etc.

TRAINING FUND CONTRIBUTIONS

California Apprenticeship

Council

**Training Fund Contributions are due on the 15th of each month**

PLEASE TYPE OR PRINT IN BLACK OR BLUE INK. ALL FIELDS MUST BE FILLED IN TO ENSURE SUCCESSFUL

SUBMISSION AND PROCESS OF PAYMENT.

NAME AND ADDRESS OF CONTRACTOR/SUB CONTRACTOR MAKING CONTRIBUTION

NAME AND ADDRESS OF PUBLIC AGENCY AWARDING CONTRACT

CONTRACTOR'S LICENSE NUMBER

CONTRACT OR PROJECT NUMBER

JOBSITE LOCATION (INCLUDE COUNTY) IF APPLICABLE - GIVE NAME OF SCHOOL, HOSPITAL, BUILDING, etc.

PERIOD COVERED BY CONTRIBUTION (FROM - TO)

CLASSIFICATIONS OF WORKERS (CARPENTER, PLUMBER, ELECTRICIAN, ETC). |

COUNTY WORK PERFORMED IN |

ALL HOURS |

CONTRIBUTION |

AMOUNT |

|

|

|

RATE PER HOUR |

|

|

|

TOTAL |

|

|

|

IF APPRENTICES WERE EMPLOYED, PLEASE LIST THE APPRENTICESHIP PROGRAM AND NUMBER OF APPRENTICE HOURS WORKED |

||

|

|

|

TYPE OR PRINT YOUR NAME AND TITLE |

|

DATE |

|

|

|

|

AREA CODE & TELEPHONE NUMBER |

|

|

|

|

CAC 2 (rev.6/12) |

TRAINING FUND CONTRIBUTIONS |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Authority | The Cac 2 form is governed by California state law, specifically under the regulations of the California Apprenticeship Council. |

| Purpose | This form is used for submitting training fund contributions for apprenticeship programs at various job sites. |

| Submission Deadline | Contributions must be submitted by the 15th of each month to ensure compliance. |

| Multiple Job Sites | Contractors must use a separate form for each job site, even if a single check accompanies multiple submissions. |

| Payment Instructions | One check payable to the California Apprenticeship Council can cover all jobs and occupations listed. |

| Non-Acceptable Contributions | Training fund contributions cannot be accepted for federal public works projects unless managed by a public agency. |

| Required Information | All fields on the form must be filled out completely to ensure successful processing of the contribution. |

| Apprentice Hours | If apprentices were employed, the specific apprenticeship program and the number of hours worked must be listed on the form. |

| Contact Information | Contractors must provide their contact name, title, date, and email with their telephone number when submitting the form. |

Guidelines on Utilizing Cac 2

To fill out the CAC 2 form, ensure all information is completed thoroughly. Carefully follow each step, as accuracy is crucial for processing. Gather all required details before you start, and keep your focus on providing clear and precise information.

- Begin by filling in the name and address of your organization in the designated field.

- Next, enter the name and address of the public agency that awarded the contract.

- Provide the contractor's license number in the appropriate space.

- Input the contract or project number associated with your work.

- Fill out the jobsite location, including the county for accurate representation.

- If applicable, include the name of related establishments, such as a school or hospital.

- Indicate the period covered by the contribution, specifying the start and end dates.

- List the classifications of workers involved in the project, such as Carpenter, Plumber, or Electrician.

- Document the county where work was performed.

- State the total hours worked during the reporting period.

- Input the contribution amount you are reporting.

- Provide the rate per hour for contributions.

- Calculate and enter the total contribution amount.

- If apprentices were employed, list their apprenticeship program and the number of apprentice hours worked.

- Type or print your name and title at the bottom of the form.

- Write the date on which you completed the form.

- Include your email address for any correspondence.

- Finally, provide your area code and telephone number.

Once you have completely filled out the form, double-check all information for accuracy before submitting it. Ensuring that every field is correctly filled in promotes a smooth processing of your payment.

What You Should Know About This Form

What is the purpose of the Cac 2 form?

The Cac 2 form is used to report training fund contributions to the California Apprenticeship Council. It ensures compliance with state requirements for apprenticeship programs. Each jobsite needs a separate form, but one check can cover all sites and occupations listed.

What details must be included on the Cac 2 form?

It's essential to fill out all fields completely. Required information includes the contractor's or subcontractor's name and address, the public agency awarding the contract, the contractor’s license number, project number, jobsite location, and a breakdown of worker classifications. Additionally, you must indicate the contribution amount and list any apprentices, including their hours worked.

When are contributions due?

Training fund contributions are due on the 15th of each month. Timely submission is crucial for processing payments and ensuring compliance with state regulations.

Are there any restrictions on contributions for federal public works projects?

Yes, the California Apprenticeship Council does not accept training fund contributions for federal public works projects unless the project is managed by a public agency. Contributions are also not accepted for non-apprenticeable occupations, such as utility technicians and lead abatement workers.

Can I submit a single payment for multiple job sites?

Yes, you can submit one check for multiple job sites and occupations. However, each jobsite must have its own separate Cac 2 form. Make sure to indicate all relevant details for each site on its respective form.

Common mistakes

Completing the CAC 2 form can be straightforward, but several common mistakes can lead to delays or rejections. One significant error is not filling in all required fields. Each section of the form is necessary for proper processing. If any field is left incomplete, submissions can be returned, requiring extra time and effort to resolve.

Another frequent mistake occurs with the contractor's license number. Failing to include this information or providing an incorrect number can cause serious issues. This number is essential for verifying the contractor’s credentials, so double-check it before submitting.

Inaccurate or missing project details is also a common problem. This includes details such as the project number, location, and agency awarding the contract. Without accurate information, the council may struggle to process your contribution correctly, which can lead to unnecessary complications.

Some individuals neglect to confirm the deadlines for training fund contributions. Remember, contributions are due on the 15th of each month. If payments are submitted late, they can be disallowed or require further follow-up, complicating the process.

Lastly, using the wrong ink color or handwriting illegibly can pose a problem. The instructions specifically state to type or print in black or blue ink. Using other colors can create issues for clarity and legibility. Submitting forms that are difficult to read may lead to misunderstandings and processing delays.

Documents used along the form

When submitting the CAC 2 form, several other forms and documents may be required to ensure compliance with regulations and to facilitate accurate reporting. Below are important documents often used in conjunction with the CAC 2 form.

- Apprenticeship Agreement: This document outlines the terms between the apprentice and the employer. It includes details about training goals, work obligations, and duration of the apprenticeship.

- Certificate of Completion: Issued at the end of an apprenticeship program, this certificate verifies that the apprentice has completed all required training and earned the necessary skills.

- Employer's Record of Apprenticeship: A detailed record maintained by the employer documenting the training and progress of apprentices during their programs. This is crucial for compliance and audits.

- Weekly Progress Reports: These reports help track the apprentice's development and performance on the job. They typically include hours worked, tasks completed, and any challenges faced.

- Contribution Payment Receipt: Proof of payment for training fund contributions. This document confirms that the required fees have been submitted by the contractor.

- Jobsite Daily Logs: This is a record of daily activities at the job site, documenting who worked, types of work performed, and hours worked. These logs support claims made in the CAC 2 form.

- Federal and State Compliance Certificates: These certificates demonstrate compliance with labor laws, safety regulations, and training standards required for public works projects.

- Occupational Safety Training Certification: Proof that workers have completed the necessary safety training related to their specific occupations. This is essential for maintaining workplace safety.

- Project Completion Report: A summary of the project’s outcomes, including the work completed and the performance of apprentices. This document is important for final evaluations and audits.

By properly completing and submitting these documents along with the CAC 2 form, contractors can ensure smooth processing and compliance with the California Apprenticeship Council's requirements. Careful attention to these details helps maintain efficient communication and oversight throughout the apprenticeship process.

Similar forms

The CAC 2 form is a crucial document used in conjunction with apprenticeship programs in California. Several other forms share similarities in their purpose and structure. Below is a list of five documents that resemble the CAC 2 in various ways:

- Form 1099-MISC: Like the CAC 2, Form 1099-MISC is used to report payments made to individuals for services rendered. Both forms require detailed information on the parties involved, specify amounts, and must be submitted by a certain deadline to ensure compliance with regulatory requirements.

- W-2 Form: The W-2 Form is similar in that it reports compensation for services. Both the W-2 and the CAC 2 require accurate listing of job classifications and amounts. Each form is pivotal for maintaining transparency and accountability in financial transactions.

- Request for Qualifications (RFQ): An RFQ gathers information from potential contractors or subcontractors, akin to how the CAC 2 requests contractor information. Both documents serve to ensure that the necessary qualifications and contributions are clearly documented prior to project commencement.

- Payroll Report: Similar to the CAC 2, a Payroll Report lists details about employees’ hours and wages. Each serves the purpose of tracking and validating contributions and expenditures related to the workforce, although the Payroll Report is submitted more frequently.

- Contractor Registration Form: This form is required to verify the contractor’s credentials, much like how the CAC 2 verifies contributions and related job information. Both documents collect identifying details about the contractor and ensure lawful operation within defined parameters.

Understanding these similarities can help streamline compliance and ensure accurate reporting across various documentation related to contracting and financial contributions in California.

Dos and Don'ts

When filling out the CAC 2 form, keep these important dos and don'ts in mind:

- Do use a separate form for each jobsite.

- Do type or print in black or blue ink.

- Do fill in all fields completely to ensure smooth processing.

- Do include the correct contractor's license number.

- Do submit one check for all jobsites and/or occupations.

- Don't leave any fields blank; incomplete forms may be rejected.

- Don't forget to list the classifications of workers.

- Don't write in pencil; it may not be legible.

- Don't miss the deadline; contributions are due on the 15th of each month.

By following these guidelines, you can help ensure that your form is filled out correctly and processed without delay.

Misconceptions

The Cac 2 form is essential for contractors participating in California's apprenticeship programs. However, several misconceptions might lead to confusion or errors in the submission process. Here are eight common misunderstandings:

- All fields are optional. Some may believe that they can skip sections of the form. In reality, every field must be filled out completely to ensure successful submission.

- Payment is only required for certain job sites. Many assume that payments are needed only for specific projects. Instead, a contribution is required for each jobsite, regardless of size or scope.

- Training fund contributions can be made anytime. A false notion exists that contributions can be submitted at one's leisure. Contributions are due by the 15th of each month and must be submitted on time to avoid penalties.

- Contributions are the same for all classifications. It might be thought that the contribution rate is uniform across different job classifications. However, each classification may have a different rate that should be considered carefully.

- Electronic submission is allowed. Some may think they can submit the Cac 2 form digitally. Currently, the form must be printed, filled out, and sent by mail to the California Apprenticeship Council.

- No need for contractor's license number. There is a misconception that the contractor's license number can be omitted. This number is vital and must be included for proper identification.

- Only apprenticeable occupations require contributions. It is often believed that only certain job roles need contributions. The requirement applies widely, but constraints exist for non-apprenticeable occupations such as utility technicians.

- Project numbers can be left blank. Some may think that leaving the project number blank will not affect submission. This information is crucial for tracking and record-keeping, so it must not be omitted.

Correcting these misconceptions is vital to avoid delays or issues with the submission of the Cac 2 form. Understanding the requirements ensures that contributions are made accurately and on time.

Key takeaways

Filling out the CAC 2 form is essential for those involved in California's apprenticeship programs. Here are some key takeaways to help you navigate the process:

- Each jobsite requires a separate form. Be sure to list the specific occupations related to that jobsite.

- You can submit one check for all jobsites and occupations. This simplifies the payment process.

- Contributions towards training funds are not accepted for federal public works projects, except for certain cases as stated in the instructions.

- Contributions are due by the 15th of each month. Timely submission is vital to avoid complications.

- Complete every field on the form. Leaving information blank may lead to delays or rejection of your submission.

- Clearly print or type information using black or blue ink. This increases the legibility of your form and ensures proper processing.

Following these guidelines will help you complete the CAC 2 form accurately and efficiently. Your attention to detail will support the ongoing success of apprenticeship programs.

Browse Other Templates

Transcript Retrieval Request,Academic Record Request Form,Official Transcript Order,Student Transcript Application,Transcript Delivery Request,Bluefield College Transcript Form,Transcription Request Document,Educational Record Request Form,Transcript - Clearly print your name to prevent any errors in processing.

Corporate Ownership Disclosure,Voting Stock Ownership Schedule,Majority Stake Reporting Form,Equity Ownership Profile,Stakeholder Information Sheet,Significant Owners Schedule,Ownership Interest Report,Corporate Equity Holder Disclosure,Voting Power - Schedule G gathers information on entities and individuals owning a significant portion of a corporation's voting stock.

Texas Resale Certificate Online - This form is a powerful part of a business's structure that enables effective inventory management.