Fill Out Your Calculation Disposable Form

When navigating the complexities of financial obligations, particularly in the context of bankruptcy, the Calculation of Your Disposable Income form, often referred to as Form B 22C2, serves as an essential tool. This form plays a critical role in the Chapter 13 bankruptcy process, helping filers determine their disposable income after accounting for allowable deductions. It requires the identification of both debtors, along with their case number, contributing to the accurate processing of their records. An accurate and complete submission is paramount, as both spouses must share responsibility for the information they provide if they are filing together. The form necessitates previous financial records, particularly the Chapter 13 Statement of Current Monthly Income and Calculation of Commitment Period, to guide filers through various categories of deductions, including living expenses outlined by the IRS. By classifying necessary expenses into defined categories like housing, transportation, and healthcare, filers can align their reported income with legal standards. With detailed instructions and the ability to attach additional pages if necessary, this form not only emphasizes clarity but also upholds the importance of honesty in financial disclosures—all crucial for a smooth bankruptcy process.

Calculation Disposable Example

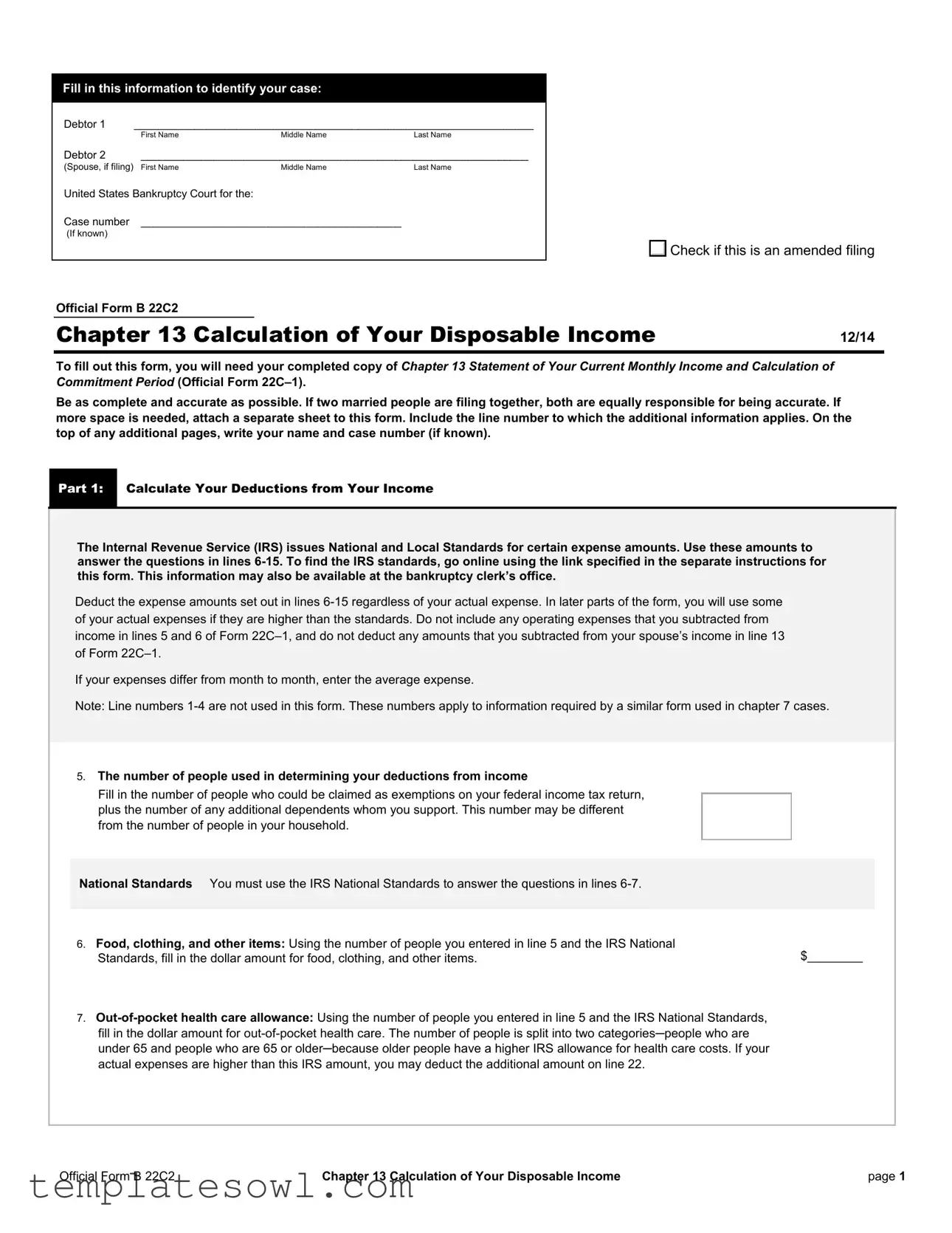

Fill in this information to identify your case:

Debtor 1 |

__________________________________________________________________ |

||

|

First Name |

Middle Name |

Last Name |

Debtor 2 |

________________________________________________________________ |

||

(Spouse, if filing) |

First Name |

Middle Name |

Last Name |

United States Bankruptcy Court for the: ______________________ District of __________

Case number ___________________________________________

(If known)

Official Form B 22C2

Check if this is an amended filing

Check if this is an amended filing

Chapter 13 Calculation of Your Disposable Income |

12/14 |

|

|

To fill out this form, you will need your completed copy of Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period (Official Form

Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for being accurate. If more space is needed, attach a separate sheet to this form. Include the line number to which the additional information applies. On the top of any additional pages, write your name and case number (if known).

Part 1: Calculate Your Deductions from Your Income

The Internal Revenue Service (IRS) issues National and Local Standards for certain expense amounts. Use these amounts to answer the questions in lines

Deduct the expense amounts set out in lines

If your expenses differ from month to month, enter the average expense.

Note: Line numbers

5.The number of people used in determining your deductions from income

Fill in the number of people who could be claimed as exemptions on your federal income tax return, plus the number of any additional dependents whom you support. This number may be different from the number of people in your household.

National Standards You must use the IRS National Standards to answer the questions in lines

6.Food, clothing, and other items: Using the number of people you entered in line 5 and the IRS National

Standards, fill in the dollar amount for food, clothing, and other items. |

$________ |

7.

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 1 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

People who are under 65 years of age

7a. |

||

7b. |

Number of people who are under 65 |

X ______ |

|

|

|

7c. |

Subtotal. Multiply line 7a by line 7b. |

$______________ |

|

|

|

|

|

|

People who are 65 years of age or older |

|

|

|

||

|

|

|

7d. |

||

7e. |

Number of people who are 65 or older |

X ______ |

|

|

|

7f. |

Subtotal. Multiply line 7d by line 7e. |

$______________ |

|

|

|

Copy line

$___________

7c here

Copy line

7f here + $__________

7g. Total. Add lines 7c and 7f |

$___________ |

|

|

Local |

You must use the IRS Local Standards to answer the questions in lines |

|

Standards |

||

|

||

|

|

Copy total

here.........7g. $________

Based on information from the IRS, the U.S. Trustee Program has divided the IRS Local Standard for housing for bankruptcy purposes into two parts:

Housing and utilities – Insurance and operating expenses

Housing and utilities – Mortgage or rent expenses |

|

|

To answer the questions in lines |

|

|

specified in the separate instructions for this form. This chart may also be available at the bankruptcy clerk’s office. |

|

|

8. Housing and utilities – Insurance and operating expenses: Using the number of people you entered in line 5, fill in |

$_______ |

|

the dollar amount listed for your county for insurance and operating expenses. |

|

|

|

|

|

9. Housing and utilities – Mortgage or rent expenses: |

|

|

9a. Using the number of people you entered in line 5, fill in the dollar amount |

$__________ |

|

listed for your county for mortgage or rent expenses. |

|

|

|

|

|

9b. Total average monthly payment for all mortgages and other debts secured by |

|

|

your home. |

|

|

To calculate the total average monthly payment, add all amounts that are |

|

|

contractually due to each secured creditor in the 60 months after you file for |

|

|

bankruptcy. Next divide by 60. |

|

|

Name of the creditor

Average monthly payment

______________________________________ |

$__________ |

______________________________________ |

$__________ |

______________________________________ |

+ $__________ |

9b.Total average monthly payment |

$__________ |

9c. Net mortgage or rent expense. |

|

|

Copy line |

─ $____________ |

Repeat this amount |

9b here |

on line 33a. |

Subtract line 9b (total average monthly payment) from line 9a (mortgage or rent |

$____________ |

Copy 9c here |

expense). If this number is less than $0, enter $0. |

|

|

10.If you claim that the U.S. Trustee Program’s division of the IRS Local Standard for housing is incorrect and affects the calculation of your monthly expenses, fill in any additional amount you claim.

Explain why: ________________________________________________________________

________________________________________________________________

$________

$________

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 2 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

11.Local transportation expenses: Check the number of vehicles for which you claim an ownership or operating expense.

0. Go to line 14.

1. Go to line 12.

2 or more. Go to line 12.

12.Vehicle operation expense: Using the IRS Local Standards and the number of vehicles for which you claim the operating

expenses, fill in the Operating Costs that apply for your Census region or metropolitan statistical area. |

$_______ |

|

13.Vehicle ownership or lease expense: Using the IRS Local Standards, calculate the net ownership or lease expense for each vehicle below. You may not claim the expense if you do not make any loan or lease payments on the vehicle. In addition, you may not claim the expense for more than two vehicles.

Vehicle 1 |

Describe |

_______________________________________________________________________ |

||

|

Vehicle 1: |

|

|

|

|

|

_______________________________________________________________________ |

||

|

|

|

|

|

13a. Ownership or leasing costs using IRS Local Standard |

13a. |

$____________ |

||

|

|

|

|

|

13b. Average monthly payment for all debts secured by Vehicle 1. Do not include costs for leased vehicles.

To calculate the average monthly payment here and on line 13e, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

Name of each creditor for Vehicle 1

Average monthly payment

Copy13b |

Repeat this amount |

_________________________________ $_____________ |

─ $___________ on line 33b. |

here |

13c. Net Vehicle 1 ownership or lease expense

Subtract line 13b from line 13a. If this number is less than $0, enter $0. 13c.

$___________

Copy net Vehicle 1 |

|

expense here |

$_______ |

Vehicle 2 |

Describe |

_______________________________________________________________________ |

|||

|

|

Vehicle 2: |

|

|

|

|

|

|

________________________________________________________________________ |

||

|

|

|

|

|

|

13d. |

Ownership or leasing costs using IRS Local Standard |

13d. |

$___________ |

||

13e. |

Average monthly payment for all debts secured by Vehicle 2. |

|

|

||

|

Do not include costs for leased vehicles. |

|

|

||

Name of each creditor for Vehicle 2

Average monthly payment

_________________________________ $_____________ |

Copy here ─ $___________ |

Repeat this amount |

on line 33c. |

13f. Net Vehicle 2 ownership or lease expense |

Copy net Vehicle 2

Subtract line 13e from 13d. If this number is less than $0, enter $0. |

13f. |

$__________

expense here

$_______

14.Public transportation expense: If you claimed 0 vehicles in line 11, using the IRS Local Standards, fill in the Public Transportation expense allowance regardless of whether you use public transportation.

15.Additional public transportation expense: If you claimed 1 or more vehicles in line 11 and if you claim that you may also deduct a public transportation expense, you may fill in what you believe is the appropriate expense, but you may not claim more than the IRS Local Standard for Public Transportation.

$_______

$_______

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 3 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||||

|

|

First Name |

Middle Name |

Last Name |

|

|

|

|

|

|

|

|

|

Other Necessary |

In addition to the expense deductions listed above, you are allowed your monthly expenses for the |

Expenses |

following IRS categories. |

16.Taxes: The total monthly amount that you actually pay for federal, state and local taxes, such as income taxes, self- employment taxes, social security taxes, and Medicare taxes. You may include the monthly amount withheld from your pay for these taxes. However, if you expect to receive a tax refund, you must divide the expected refund by 12 and subtract that number from the total monthly amount that is withheld to pay for taxes.

Do not include real estate, sales, or use taxes.

17.Involuntary deductions: The total monthly payroll deductions that your job requires, such as retirement contributions, union dues, and uniform costs.

Do not include amounts that are not required by your job, such as voluntary 401(k) contributions or payroll savings.

18.Life insurance: The total monthly premiums that you pay for your own term life insurance. If two married people are filing together, include payments that you make for your spouse’s term life insurance.

Do not include premiums for life insurance on your dependents, for a

19.

Do not include payments on past due obligations for spousal or child support. You will list these obligations in line 35.

20.Education: The total monthly amount that you pay for education that is either required:

as a condition for your job, or

for your physically or mentally challenged dependent child if no public education is available for similar services.

21.Childcare: The total monthly amount that you pay for childcare, such as babysitting, daycare, nursery, and preschool. Do not include payments for any elementary or secondary school education.

22.Additional health care expenses, excluding insurance costs: The monthly amount that you pay for health care that is required for the health and welfare of you or your dependents and that is not reimbursed by insurance or paid by a health savings account. Include only the amount that is more than the total entered in line 7.

Payments for health insurance or health savings accounts should be listed only in line 25.

23.Optional telephones and telephone services: The total monthly amount that you pay for telecommunication services for you and your dependents, such as pagers, call waiting, caller identification, special long distance, or business cell phone service, to the extent necessary for your health and welfare or that of your dependents or for the production of income, if it is not reimbursed by your employer.

Do not include payments for basic home telephone, internet or cell phone service. Do not include

24.Add all of the expenses allowed under the IRS expense allowances. Add lines 6 through 23.

Additional Expense |

These are additional deductions allowed by the Means Test. |

Deductions |

Note: Do not include any expense allowances listed in lines |

|

$_______

$_______

$_______

$_______

$_______

$_______

$_______

+$________

$________

25.Health insurance, disability insurance, and health savings account expenses. The monthly expenses for health insurance, disability insurance, and health savings accounts that are reasonably necessary for yourself, your spouse, or your dependents.

Health insurance

Disability insurance

Health savings account

Total

Do you actually spend this total amount?

No. How much do you actually spend?

Yes

$__________

$__________

+$__________

$__________

$__________

Copy total here |

$________ |

26.Continuing contributions to the care of household or family members. The actual monthly expenses that you will continue to pay for the reasonable and necessary care and support of an elderly, chronically ill, or disabled member of your household or member of your immediate family who is unable to pay for such expenses.

27.Protection against family violence. The reasonably necessary monthly expenses that you incur to maintain the safety of you and your family under the Family Violence Prevention and Services Act or other federal laws that apply.

By law, the court must keep the nature of these expenses confidential.

$_______

$_______

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 4 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

28.Additional home energy costs. Your home energy costs are included in your

If you believe that you have home energy costs that are more than the home energy costs included in the

You must give your case trustee documentation of your actual expenses, and you must show that the additional amount claimed is reasonable and necessary.

29.Education expenses for dependent children who are younger than 18. The monthly expenses (not more than $156.25* per child) that you pay for your dependent children who are younger than 18 years old to attend a private or public elementary or secondary school.

You must give your case trustee documentation of your actual expenses, and you must explain why the amount claimed is reasonable and necessary and not already accounted for in lines

* Subject to adjustment on 4/01/16, and every 3 years after that for cases begun on or after the date of adjustment.

30.Additional food and clothing expense. The monthly amount by which your actual food and clothing expenses are higher than the combined food and clothing allowances in the IRS National Standards. That amount cannot be more than 5% of the food and clothing allowances in the IRS National Standards.

To find a chart showing the maximum additional allowance, go online using the link specified in the separate instructions for this form. This chart may also be available at the bankruptcy clerk’s office.

You must show that the additional amount claimed is reasonable and necessary.

31.Continuing charitable contributions. The amount that you will continue to contribute in the form of cash or financial instruments to a religious or charitable organization. 11 U.S.C. § 548(d)3 and (4).

Do not include any amount more than 15% of your gross monthly income.

32.Add all of the additional expense deductions. Add lines 25 through 31.

Deductions for Debt Payment

33.For debts that are secured by an interest in property that you own, including home mortgages, vehicle loans, and other secured debt, fill in lines 33a through 33g.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

|

|

|

|

|

|

Average monthly |

|

|

|

|

|

|

|

payment |

|

Mortgages on your home |

|

|

|

|

|

||

33a. Copy line 9b here |

|

|

|

|

$___________ |

|

|

|

|

|

|

|

|

||

Loans on your first two vehicles |

|

|

|

|

|||

33b. Copy line 13b here |

|

|

|

|

$___________ |

|

|

33c. Copy line 13e here |

|

|

|

|

$___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of each creditor for other |

|

Identify property that secures |

|

|

Does payment |

|

|

secured debt |

|

the debt |

|

|

include taxes |

|

|

|

|

|

|

|

or insurance? |

|

|

|

|

|

|

|

qNo |

$___________ |

|

|

|

|

|

|

|

||

33d. ____________________________ _____________________________ |

|

|

qYes |

|

|||

|

|

|

|

||||

|

|

|

|

|

qNo |

$___________ |

|

33e. ____________________________ _____________________________ |

|

|

qYes |

|

|||

|

|

|

|

|

qNo |

+ $___________ |

|

33f. _____________________________ _____________________________ |

|

|

Yes |

|

|||

|

|

|

|

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

Copy total |

33g. Total average monthly payment. Add lines 33a through 33f |

|

|

|

$___________ |

|||

|

|

here |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$_______

$_______

$_______

+_________

$___________

$_______

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 5 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

34.Are any debts that you listed in line 33 secured by your primary residence, a vehicle, or other property necessary for your support or the support of your dependents?

No. Go to line 35.

Yes. State any amount that you must pay to a creditor, in addition to the payments listed in line 33, to keep possession of your property (called the cure amount). Next, divide by 60 and fill in the information below.

Name of the creditor |

Identify property that |

Total cure |

|

Monthly cure amount |

|

|

secures the debt |

amount |

|

|

|

__________________________ |

__________________ |

$__________ |

÷ 60 = |

$___________ |

|

__________________________ |

__________________ |

$__________ |

÷ 60 = |

$___________ |

|

__________________________ |

__________________ |

$__________ |

÷ 60 = + $___________ |

|

|

|

|

|

|

|

Copy |

|

|

|

|

|

|

|

|

|

Total |

$___________ |

total |

|

|

|

|

|

here |

$_______

35.Do you owe any priority claimssuch as a priority tax, child support, or alimony that are filing date of your bankruptcy case? 11 U.S.C. § 507.

No. Go to line 36.

Yes. Fill in the total amount of all of these priority claims. Do not include current or ongoing priority claims, such as those you listed in line 19.

Total amount of all

36.Projected monthly Chapter 13 plan payment

Current multiplier for your district as stated on the list issued by the Administrative Office of the United States Courts (for districts in Alabama and North Carolina) or by the Executive Office for United States Trustees (for all other districts).

x

To find a list of district multipliers that includes your district, go online using the link specified in the separate instructions for this form. This list may also be available at the bankruptcy clerk’s office.

past due as of the

$______________ ÷ 60

$______________

______

$_______

|

|

Copy |

|

$______________ |

total |

Average monthly administrative expense |

|

here |

37. Add all of the deductions for debt payment. Add lines 33g through 36.

$_______

$_______

Total Deductions from Income

38.Add all of the allowed deductions.

Copy line 24, All of the expenses allowed under IRS expense allowances

Copy line 32, All of the additional expense deductions.......................................................

Copy line 37, All of the deductions for debt payment..........................................................

Total deductions........................

$______________

$______________

+$______________

$______________

Copy total

here

$_______

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 6 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

Part 2: Determine Your Disposable Income Under 11 U.S.C. § 1325(b)(2)

39. Copy your total current monthly income from line 14 of Form |

|

Statement of Your Current Monthly Income and Calculation of Commitment Period |

$_______ |

40.Fill in any reasonably necessary income you receive for support for dependent children. The monthly average of any child support payments, foster care payments, or disability payments for a dependent child, reported in Part I of Form

41.Fill in all qualified retirement deductions. The monthly total of all amounts that your employer withheld from wages as contributions for qualified retirement plans, as specified in 11 U.S.C. § 541(b)(7) plus all required repayments of loans from retirement plans, as specified in 11 U.S.C. § 362(b)(19).

42.Total of all deductions allowed under 11 U.S.C. § 707(b)(2)(A). Copy line 38 here ...............

$____________

$____________

$____________

43.Deduction for special circumstances. If special circumstances justify additional expenses and you have no reasonable alternative, describe the special circumstances and their expenses. You must give your case trustee a detailed explanation of the special circumstances and documentation for the expenses.

|

Describe the special circumstances |

|

Amount of expense |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

43a. ______________________________________________________ |

$___________ |

|

|

|

|

|

43b. ______________________________________________________ |

$___________ |

|

|

|

|

|

|

|

|

|

||

|

43c. ______________________________________________________ |

+ $___________ |

|

|

|

|

|

|

|

|

Copy 43d |

+$_____________ |

|

|

|

|

$___________ |

|

||

|

43d.Total. Add lines 43a through 43c |

|

here |

|

||

|

........................................................................ |

|

|

|

|

Copy total |

|

|

|

|

|

||

44. Total adjustments. Add lines 40 through 43d |

|

|

$_____________ |

|||

|

|

here |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45.Calculate your monthly disposable income under § 1325(b)(2). Subtract line 44 from line 39.

–$______

$_______

Part 3: Change in Income or Expenses

46.Change in income or expenses. If the income in Form

Form

22C─1

22C─2

22C─1

22C─2

22C─1

22C─2

22C─1

22C─2

Line |

|

Reason for change |

|

Date of change |

|

|

|

|

|

____ |

_______________________________ |

____________ |

____ |

_______________________________ |

____________ |

____ |

_______________________________ |

____________ |

____ |

_______________________________ |

____________ |

Increase or decrease?

Increase

Decrease

Increase

Decrease

Increase

Decrease

Increase

Decrease

Amount of change

$____________

$____________

$____________

$____________

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 7 |

Debtor 1 |

_______________________________________________________ |

Case number (if known)_____________________________________ |

||

|

First Name |

Middle Name |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

Part 4: |

Sign Below |

|

|

|

|

|

|

|

|

By signing here, under penalty of perjury you declare that the information on this statement and in any attachments is true and correct.

___________________________________________________ |

__________________________________ |

Signature of Debtor 1 |

Signature of Debtor 2 |

Date _________________ |

Date _________________ |

MM / DD / YYYY |

MM / DD / YYYY |

|

|

Official Form B 22C2 |

Chapter 13 Calculation of Your Disposable Income |

page 8 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Title | The form is officially called "Chapter 13 Calculation of Your Disposable Income" (Official Form B 22C2). |

| Filing Requirement | This form is required for individuals filing for Chapter 13 bankruptcy in the United States. |

| Amended Filings | A checkbox indicates if the submission is an amended filing. |

| Income Basis | Calculations are based on the individual's current monthly income and IRS standards. |

| IRS Standards | Both National and Local IRS Standards must be followed for expense deductions. |

| Joint Filers | Married couples filing together share equal responsibility for the accuracy of the information provided. |

| Additional Spaces | Extra sheets can be attached for additional information if space on the form is insufficient. |

| Transport Expenses | Specific vehicle operation and ownership expenses must be calculated based on the IRS Local Standards. |

| Dependent Considerations | Only the number of exemptions and dependents claimed on tax returns are relevant for deductions. |

| Additional Deductions | Additional expense deductions include health insurance, education costs, and charitable contributions. |

Guidelines on Utilizing Calculation Disposable

Completing the Calculation Disposable form is a necessary step in accurately reporting your financial situation as part of a Chapter 13 bankruptcy case. Ensure that you gather all relevant financial documents, including your Chapter 13 Statement of Your Current Monthly Income, before starting. This form requires detailed entries about your deductions from income and expenses, and accuracy is essential. If additional space is required, attach separate sheets as needed.

- Provide your personal information at the top of the form. Fill in your first name, middle name, and last name in the designated fields under "Debtor 1." If filing jointly, complete the same for "Debtor 2." Write the district and case number, if known.

- Indicate whether this is an amended filing by checking the appropriate box.

- In Part 1, calculate your deductions. Begin by entering the number of people in line 5 who qualify as exemptions on your federal tax return.

- Refer to the IRS National Standards for lines 6 and 7. Enter the amount for food, clothing, and other items based on the number from line 5.

- For out-of-pocket health care, fill in the amounts for individuals under 65 and for those 65 or older, as applicable. Calculate and record the subtotals for each age group.

- Copy the subtotal amounts from lines 7c and 7f to line 7g and add them together to find your total health care allowance.

- Answer questions regarding housing and utilities by using the IRS Local Standards for lines 8 and 9. Enter the amounts for insurance, operating expenses, and mortgage or rent expenses as appropriate.

- Continue to lines 11 through 15 by entering the vehicle information required for transportation expenses according to how many vehicles you claim.

- Complete the remaining lines for necessary expenses, including taxes, involuntary deductions, life insurance, court-ordered payments, education, childcare, health care expenses, public transportation, and optional telecommunications costs.

- After documenting all necessary expense deductions, proceed to add lines 6 through 23 to obtain the total deductions allowed under IRS expense allowances.

- Fill in sections for additional expense deductions from lines 25 through 31, detailing any necessary costs that exceed standard deductions.

- Finally, complete the section regarding deductions for debt payments. Enter the average monthly payments for secured debts, including homes and vehicles, and sum these amounts.

What You Should Know About This Form

What is the purpose of the Calculation Disposable form?

The Calculation Disposable form helps you determine your disposable income when filing for Chapter 13 bankruptcy. It collects detailed information about your income and expenses, allowing the court to assess your ability to repay debts. This process ensures that your repayment plan is fair and feasible based on your financial situation.

How should I fill out the personal information section?

In the personal information section, provide the full names of all debtors involved in the filing. If you are filing jointly with a spouse, include their information as well. This is important for the court to identify your case accurately. Make sure to also include the district of your bankruptcy court and any case number if you know it.

What deductions can I claim on this form?

You can claim various IRS National and Local Standards for expenses on the form. For example, you can include costs for food, clothing, housing, utilities, and health care. If your actual expenses exceed the standard amounts, you may deduct the higher amounts in later parts of the form, ensuring an accurate calculation of your disposable income.

What if my expenses vary month to month?

If your expenses fluctuate, you should calculate the average for those months and enter that amount. This ensures that you provide a consistent picture of your financial situation. You are also allowed to use additional sheets if you need more space to document your expenses thoroughly while making sure to reference the corresponding line number.

Why is it important to accurately report my expenses?

Accurate reporting of your expenses is crucial because it affects the court’s decision regarding your repayment plan. Inaccuracies could lead to complications in your case or even affect the discharge of your debts. Therefore, it’s essential to be truthful and complete when filling out the Calculation Disposable form.

Common mistakes

When completing the Calculation Disposable form, it is essential to pay close attention to the details, as mistakes can lead to significant inaccuracies in your bankruptcy filing. Here are eight commonly made errors:

1. Inaccurate Information on Identifying Information: Many filers overlook the importance of accurately entering their names and case number. This information must align with prior filings or documents to avoid any processing delays or confusion. Simple typos can open the door to complications in your case.

2. Misunderstanding Exemption Calculations: When filling in the number of people used to determine deductions, it's common for filers to mistakenly include individuals who are not eligible dependents. Make sure you only count those who can truly be claimed as exemptions on your tax return to ensure proper accuracy.

3. Incorrect Use of IRS Standards: Many individuals fail to consult the updated IRS National and Local Standards for expenses. Each standard has specific guidelines, and failing to use the correct figures in lines 6-15 could mean missing out on eligible deductions, potentially skewing your disposable income calculation.

4. Ignoring Average Expenses: Some filers assume that they should report the maximum each month for variable expenses. However, it is more accurate to provide the average expense for fluctuating costs, such as groceries or utilities, across several months. This brings a more realistic perspective to your financial situation.

5. Omitting Additional Pages: If more space is necessary to provide explanations or additional expenses, be sure to attach a separate sheet and refer to the corresponding line numbers. Neglecting to do so might leave important deductions unaccounted for.

6. Miscalculating Transportation Expenses: When entering vehicle operation and ownership expenses, remember to clearly differentiate between the number of vehicles you own and how many you claim. Errors in this section can lead to inflated claims or missing out on valid deductions.

7. Confusing Necessary and Optional Expenses: Many people mistakenly classify optional expenses as necessary, especially regarding telecommunication services. Ensure that all listed expenses are required for your income generation or essential for the health and welfare of you or your dependents.

8. Failing to Provide Justifications for Additional Costs: If you are claiming expenses like additional food or education for dependents, it’s crucial to articulate why these costs are reasonable and necessary. Standard forms require some justification to support these claims, and not including adequate explanations might lead to disallowance.

By avoiding these common pitfalls, one can ensure a smoother experience when filing the Calculation Disposable form, ultimately aiding in the timely resolution of a bankruptcy case.

Documents used along the form

In the process of filing for Chapter 13 bankruptcy, several forms and documents are essential to support your case. These documents provide crucial information regarding your income, expenses, and financial obligations. Completeness and accuracy are key, as they directly impact your financial outcomes. Below is a list of forms frequently used alongside the Calculation of Disposable Income form.

- Chapter 13 Statement of Your Current Monthly Income (Form 22C-1): This form details your current monthly income, which is essential for calculating your disposable income. It helps the court understand your financial situation and assess your ability to repay debts.

- List of Creditors (Matrix or Mailing List): This document contains the names and addresses of all your creditors. It is required to notify them of your bankruptcy filing and ensure that all debts are addressed in the proceedings.

- Schedules: A to J: These forms include detailed accounts of your assets, liabilities, income, and expenses. They provide a comprehensive view of your financial status and are critical in establishing your repayment plan.

- Plan of Reorganization: This document outlines how you intend to repay your debts over the course of your Chapter 13 bankruptcy. It needs to be filed with the court for approval and reflects your payment intentions.

- Proof of Income: You must provide pay stubs, tax returns, or other proof of income to validate your financial situation. This documentation is vital to support the figures you enter in your forms.

- Tax Returns: Typically, you will need to submit copies of your tax returns for the past two years. These documents offer additional insights into your financial history and help determine your income levels.

Completing these forms accurately is a vital step in your Chapter 13 bankruptcy process. Prepare these documents with care, as they form the backbone of your case. Inaccuracies can lead to delays or complications in your bankruptcy proceedings, impacting your ability to achieve a fresh financial start.

Similar forms

- Chapter 7 Means Test Calculation: Similar to the Calculation of Disposable form, this document evaluates income and expenses to determine if a debtor qualifies for Chapter 7 bankruptcy relief. It requires detailed financial information, just like Form B 22C2.

- Chapter 13 Plan: This document outlines a repayment plan for individuals with regular income. It parallels the disposable income form since it requires an accurate calculation of monthly income and necessary expenses for a feasible repayment plan.

- Schedule I: Your Income: Used in bankruptcy filings, this schedule details all sources of income. Like the Calculation Disposable form, it is vital for determining disposable income that may affect repayment capacity.

- Schedule J: Your Expenses: This schedule complements Schedule I by itemizing monthly expenses. Both documents work together to provide a clear picture of financial standing, essential for evaluating a debtor's ability to repay under Chapter 13.

- Official Form 22C-1: Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period: This form is necessary for calculating current monthly income and assessing the commitment period, aligning closely with the goals of the Calculation Disposable form.

- Form B 22A: Chapter 7 Statement of Your Current Monthly Income: This form fulfills a similar role for Chapter 7 cases, calculating disposable income and allowing the debtor to establish eligibility for filing under Chapter 7.

- Form B 22C-2: Calculation of Your Disposable Income for Chapter 13: While it may seem redundant, this form specifically targets the calculation of disposable income for Chapter 13, mirroring the procedural intent of the Calculation Disposable form.

- Application to Pay the Filing Fee in Installments: While focused on payment options, this application similarly requires detailed financial information about income and expenses, impacting disposable income calculations and the debtor's overall financial picture.

Dos and Don'ts

- Do provide complete and accurate information in all fields.

- Do use the IRS National and Local Standards when calculating expenses.

- Do include only applicable expenses, ensuring they are relevant to your situation.

- Do double-check all calculations to avoid mistakes that could affect your case.

- Don’t omit any required fields, as this could delay processing.

- Don’t include expenses previously deducted in other forms; maintain clarity in reporting.

- Don’t make assumptions about amounts; always refer to the current IRS standards.

- Don’t attach additional information without labeling it clearly with the corresponding line number.

Misconceptions

- Only one person can fill out the form. Many believe that only the primary debtor is responsible for the Calculation Disposable form. In fact, both spouses must provide accurate information if they file jointly.

- Actual expenses always determine deductions. Some think that they can only use their actual expenses for deductions. The form allows the use of IRS National and Local Standards instead, even if your actual expenses differ.

- This form is only for Chapter 7 filings. A common belief is that the Calculation Disposable form is relevant only for Chapter 7 cases. However, it is essential for those filing under Chapter 13 as well.

- All expenses are automatically deductible. Many assume that all listed expenses are deductible without question. In reality, you must follow guidelines and show that the expenses are reasonable and necessary.

- Only household members count as exemptions. Some people misunderstand that only those living in the house count for exemptions. You can include dependents whom you support even if they don't live with you.

- You don’t need previous forms to fill out this one. There is a misconception that this form stands alone. It actually requires information from the Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period.

- Local Standards are optional. Many individuals think that using Local Standards is optional. However, it's required for filling out specific parts of the form concerning expenses.

- Expenses for public transportation are only for those who use it. It's commonly believed that only those who actively use public transportation can claim this expense. But the form states that all filers can list this expense if they decide to claim it.

Key takeaways

Understanding how to accurately complete and utilize the Calculation Disposable form is essential for individuals filing under Chapter 13. Here are key takeaways that can help guide the process:

- Include Accurate Information: Ensure that all personal information, including names and case numbers, is filled out correctly at the beginning of the form. This helps identify your case accurately.

- Use IRS Standards for Deductions: Follow the IRS National and Local Standards for allowable expenses. These standards provide specific dollar amounts for various categories like food, clothing, and health care that should be used in calculations.

- Document Variability in Expenses: For expenses that change monthly, it is important to enter the average expense. Keep track of fluctuations, as your actual expenses may impact what you can deduct.

- Joint Filers Have Shared Responsibility: If two individuals are filing together, both are responsible for the accuracy of the information. Make sure to communicate and cross-check details to avoid discrepancies.

- Complete Additional Sections if Necessary: If there’s a need for additional space or information, attach separate sheets. Make sure to label any attachment with your name and case number for ease of reference.

Browse Other Templates

How to Fill Out a 1040 - Refer to IRS guidelines for any additional details or clarifications.

Forbarance - Error-free documentation submission can facilitate a smoother and faster review process by Wells Fargo.