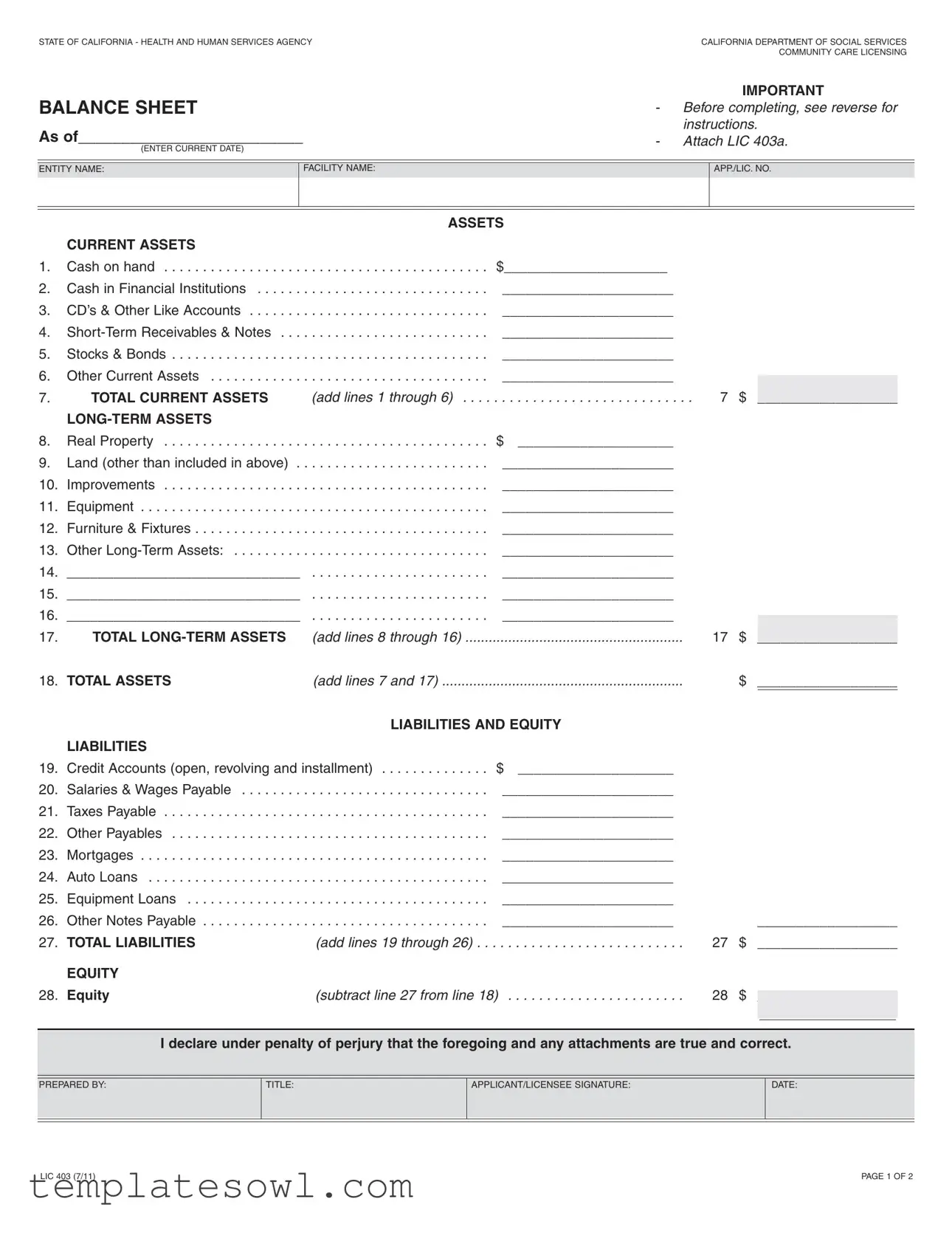

Fill Out Your California Balance Sheet Form

The California Balance Sheet form, officially known as the LIC 403, is a crucial document for individuals and entities involved in providing community care services. This form allows applicants and licensees to disclose their financial position by summarizing their assets, liabilities, and equity. It includes sections for both current and long-term assets, providing a clear breakdown of cash on hand, investments, and property, among other financial elements. Current assets encompass liquid funds, short-term receivables, and any other property that can easily be converted to cash. In contrast, long-term assets include real estate, equipment, and furniture. On the liabilities side, the form requires reporting on various debts and payables, covering everything from credit accounts to mortgages. The final step involves calculating equity, which represents the entity’s net worth by subtracting total liabilities from total assets. Thorough completion of the LIC 403 is essential, as this information supports the application process and must be accompanied by a supplemental schedule, the LIC 403a, to ensure accuracy and detail. Adhering to the form's requirements will help facilitate smoother processing and compliance with California's regulatory standards.

California Balance Sheet Example

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY |

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES |

|

COMMUNITY CARE LICENSING |

|

|

|

|

IMPORTANT |

|

BALANCE SHEET |

- |

Before completing, see reverse for |

|||

As of__________________________ |

|

instructions. |

|||

- |

Attach LIC 403a. |

||||

(ENTER CURRENT DATE) |

|||||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

ENTITY NAME: |

|

FACILITY NAME: |

|

APP./LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

1. |

Cash on hand |

. . . . . . . . . . . . . . . . . . . . . . . |

$_____________________ |

|

|

|

|

|

2. |

Cash in Financial Institutions |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

3. |

CD’s & Other Like Accounts |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

4. |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

||

5. |

Stocks & Bonds |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

6. |

Other Current Assets |

|

______________________ |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

||||

7. |

TOTAL CURRENT ASSETS |

(add lines 1 through 6) . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . . 7 |

$ |

|

__________________ |

|

|

|

|

|

|

|

|

|

|

8. |

Real Property |

. . . . . . . . . . . . . . . . . . . . . . . |

$ |

____________________ |

|

|

|

|

9. |

Land (other than included in above) . . |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

10. |

Improvements |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

11. |

Equipment |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

12. |

Furniture & Fixtures |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

13. |

Other |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

14. |

______________________________ |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

15. |

______________________________ |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

16. |

______________________________ |

|

______________________ |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

||||

17. |

TOTAL |

(add lines 8 through 16) |

17 |

$ |

|

__________________ |

|

|

18. |

TOTAL ASSETS |

(add lines 7 and 17) |

|

$ |

__________________ |

|

||

|

|

LIABILITIES AND EQUITY |

|

|

|

|

||

|

LIABILITIES |

|

|

|

|

|

|

|

19. |

Credit Accounts (open, revolving and installment) |

$ |

____________________ |

|

|

|

|

|

20. |

Salaries & Wages Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

21. |

Taxes Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

22. |

Other Payables |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

23. |

Mortgages |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

24. |

Auto Loans |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

25. |

Equipment Loans |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

26. |

Other Notes Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

__________________ |

|

||

27. |

TOTAL LIABILITIES |

(add lines 19 through 26) |

. . . . . . . . . . . . . . . . . . . . . . 27 |

$ |

__________________ |

|

||

|

EQUITY |

|

|

|

|

|

|

|

28. |

Equity |

(subtract line 27 from line 18) |

28 |

$ |

|

|

|

|

__________________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare under penalty of perjury that the foregoing and any attachments are true and correct.

PREPARED BY:

TITLE:

APPLICANT/LICENSEE SIGNATURE:

DATE:

LIC 403 (7/11) |

PAGE 1 OF 2 |

BALANCE SHEET

GENERAL INFORMATION: To complete the Balance Sheet LIC 403, first complete the LIC 403a, Balance Sheet Supplemental Schedule. The LIC 403a is a worksheet to be used in compiling the detailed information which is then totaled and displayed on the Balance Sheet, LIC 403. Submit the LIC 403a attached to the LIC 403.

Each applicant/licensee (sole proprietorship, partnership or corporation) must submit a LIC 403, and a LIC 403a. Information to be reported is to disclose all the entity’s assets and liabilities, not just those related to the operation of the care facility.

FOR SOLE PROPRIETORSHIPS - For a facility operated by a husband or wife individually, information reported must pertain to both, such as individual credit card balances which are listed either solely under one name or under both the husband and wife, and which may be unrelated to the facility’s actual operation or the person who will actually operate the facility.

FOR GENERAL PARTNERS - In addition to financial statements for the partnership, each general partner must file a personal Balance Sheet, LIC 403, accompanied with a LIC 403a, to reflect their individual financial position.

Information shown on the LIC 403 and LIC 403a is subject to verification. Additional documentation may be requested to support any or all of the Balance Sheet amounts reported.

INSTRUCTIONS: Include the required information at the top of this form to identify: 1) current date for the Balance Sheet, 2) entity name, (this is the sole proprietorship, partner, partnership or corporate name for whom the information is being reported) 3) facility name and 4) application/license number. Transfer the totals from the worksheet LIC 403a to the corresponding lines on the LIC 403. Below is a brief description of the type of information to be contained on each line.

ASSETS

Line #

1.Cash on hand, not deposited in a financial institution.

2.Cash in checking accounts.

3.CD’s, savings account(s) and all other like accounts.

4.Revenues receivable and all

5.Stocks, bonds or other securities.

6.Other current assets readily converted to cash, such as the cash surrender value of whole life insurance policies.

7.Add the amounts on lines 1 through 6 and enter here.

8.Real property is buildings, land and structures.

9.Land (developed or undeveloped) not already included on line 8.

10.Improvements to real property or leasehold improvements as appropriate.

11.Business or personal equipment, (other than that being leased).

12.Business or personal furniture and fixtures, as appropriate, (other than that being leased).

17.Add the amounts reported on lines 8 through 16 and enter here.

18.Add the amounts on line 7 and line 17 and enter here.

LIABILITIES

19.Credit Accounts (Open, Revolving and Installment).

20.Salaries, wages, bonuses and other benefits payable.

21.Federal, state or local income, sales or payroll taxes.

22.Other notes or payables not included above.

23.Current balances for all of the outstanding mortgages.

24.Vehicle loans.

25.Loans payable for furniture and equipment.

26.Other

27.Add the amounts on lines 19 through 26 and enter here.

EQUITY

28.The equity is the difference between your total assets and total liabilities. Subtract line 27 from line 18 and enter here.

SIGNATURE BLOCK

The name of the preparer is to be printed in the space provided. The applicant or licensee is required to sign this form attesting to the financial information. Failure to sign, date and attest to the accuracy of the information reported on the Balance Sheet (LIC 403) shall constitute

LIC 403 (7/11) |

PAGE 2 OF 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The California Balance Sheet form is governed by California Health and Safety Code Section 1501.5. |

| Purpose | This form is used to provide a financial overview of a community care facility's assets, liabilities, and equity. |

| Current Assets | Includes liquid assets such as cash, short-term receivables, and marketable securities owned by the facility. |

| Long-Term Assets | Encompasses real property, equipment, and other assets that are not expected to be liquidated within a year. |

| Liabilities | Consists of any outstanding debts, including loans, payables, and obligations that the facility owes. |

| Equity Calculation | Equity is calculated by subtracting total liabilities from total assets, indicating the facility's net worth. |

| Required Attachments | The LIC 403a must be attached. It serves as a supplemental schedule detailing the financial information reported. |

Guidelines on Utilizing California Balance Sheet

Filling out the California Balance Sheet form is a straightforward process that helps ensure all relevant financial information about your entity is accurately reported. This step is crucial for compliance with California's regulations. Below are the steps to efficiently complete the form for submission.

- Write the current date at the top of the form.

- Enter your entity name, which should reflect the sole proprietorship, partnership, or corporate name.

- Fill in the facility name where applicable.

- Provide the application/license number corresponding to your entity.

- Complete the Current Assets section by filling out lines 1 to 6, specifying amounts for cash, accounts, and other assets.

- Calculate and write the TOTAL CURRENT ASSETS on line 7 by adding up the amounts from lines 1 through 6.

- Proceed to the Long-Term Assets section (lines 8 to 16) and enter the appropriate amounts for real property, land, and other long-term assets.

- Calculate the TOTAL LONG-TERM ASSETS on line 17 by totaling the amounts from lines 8 through 16.

- Add the TOTAL ASSETS on line 18 by combining the totals from lines 7 and 17.

- Complete the Liabilities section (lines 19 to 26) by entering the relevant amounts for credit accounts, taxes, and loans.

- Calculate and write the TOTAL LIABILITIES on line 27 by adding amounts from lines 19 to 26.

- Determine your Equity by subtracting total liabilities (line 27) from total assets (line 18) and write the result on line 28.

- Print the name of the preparer in the designated space and ensure the applicant/licensee signs and dates the form to confirm the accuracy of the information.

Upon completing the Balance Sheet, ensure that you attach the necessary documents as outlined in the instructions. This will help facilitate a streamlined review of your financial disclosures.

What You Should Know About This Form

What is the purpose of the California Balance Sheet form?

The California Balance Sheet form is designed to help applicants and licensees disclose their financial position. This form captures both assets and liabilities related to a care facility. By completing it, the individual demonstrates financial transparency. Accurate reporting ensures that the licensing process is fair and thorough.

Who needs to submit the California Balance Sheet form?

Every applicant or licensee, whether they operate as a sole proprietorship, partnership, or corporation, must submit the California Balance Sheet form, known as LIC 403, along with the supplemental schedule, LIC 403a. This applies to both individuals running facilities independently, and partners in a general partnership. It's crucial that all personal assets and liabilities are included for a comprehensive view of the financial health.

What kind of information should be included in the form?

The form requires detailed reporting of all assets and liabilities. Current assets like cash, stocks, and accounts receivable should be reported. Long-term assets include real property, equipment, and furniture. On the liabilities side, credit accounts, payables, and loans must be disclosed. This thorough documentation provides a clear picture of the facility's finances.

What happens if I do not complete the form correctly?

Failure to complete the California Balance Sheet form accurately may lead to non-compliance. If the applicant does not sign, date, or attest to the information’s accuracy, the report may be rejected. This highlights the importance of careful completion. Taking the time to review and ensure accuracy can prevent setbacks in the licensing process.

Can I submit additional documents with the form?

Yes, additional documentation may be requested to support any figures reported on the California Balance Sheet. Including relevant papers can strengthen the submission. If financial details are particularly complex, providing extra context can aid in the review process. Being prepared with support documentation helps clarify your financial picture.

Common mistakes

Filling out the California Balance Sheet form can be a straightforward task, but many people slip up along the way. One common error occurs when the applicant forgets to include the current date at the top of the form. This date is crucial as it establishes the timeframe for the financial information provided. Without it, the document may face delays or even rejection.

Another frequent mistake is failing to accurately report the entity name and facility name. People often confuse these two crucial pieces of information. The entity name refers to the legal name of the person or organization, while the facility name pertains specifically to the care facility in question. If these names do not match the information registered with the licensing authority, it can lead to complications during the review process.

Many applicants also overlook the importance of entering precise numbers for current and long-term assets. It is easy to miscalculate totals or omit certain assets altogether. Ensure that every asset, from cash and accounts to real estate and equipment, is accounted for on the appropriate line. Double-check your math to avoid discrepancies that could trigger additional scrutiny.

Moreover, individuals sometimes neglect to include required attachments, such as the LIC 403a. This supplemental schedule offers a detailed breakdown of the financial situation and is essential for a complete application. When omitted, it may lead the reviewers to question your commitment to transparency and thoroughness.

Another area of concern is the liabilities section. Applicants might mistakenly report liabilities that belong to another entity or person, rather than those directly associated with the facility. For example, including personal debts can skew the financial picture. Ensure that only relevant liabilities are reported to give a clear and accurate view of your financial standing.

Furthermore, some people fail to sign and date the form. This step may seem minor, but without the applicant's signature, the Balance Sheet cannot be considered valid. The signature serves as a declaration of the truthfulness of the report, and without it, the document risks rejection.

Finally, applicants often forget to list all long-term assets comprehensively. This includes not just property and equipment, but also any assets like vehicles or unique property that may play a role in the operation of the facility. Ensuring thoroughness in this section is vital, as omissions can lead to further inquiry and potential issues with compliance.

Documents used along the form

The California Balance Sheet form, also known as LIC 403, is a vital document for applicants and licensees in the state’s health and human services sector. This document serves to present a clear picture of an entity's financial status by listing all current and long-term assets, liabilities, and equity. Along with the Balance Sheet form, several other forms and documents are often required for a comprehensive financial report and analysis. Below is a list of these related documents.

- LIC 403a - Balance Sheet Supplemental Schedule: This worksheet accompanies the Balance Sheet and provides detailed information on the entity’s assets and liabilities. It is essential for compiling the data required for the LIC 403.

- LIC 200 - Application for a Community Care Facility License: This application form is necessary for obtaining a license to operate a community care facility in California. It collects information about the applicant and the facility.

- LIC 500 - Personnel Report: This report details the employees working at the facility and their roles. It is used to ensure compliance with staffing regulations and quality of care standards.

- LIC 308 - Designation of Facility Administrator: This form identifies the individual responsible for managing the community care facility. It is crucial for compliance with licensing requirements.

- LIC 404 - Financial Disclosure Statement for Community Care Facilities: This statement outlines the financial history of an applicant or licensee, including funding sources, to ensure transparency and accountability.

- LIC 9224 - Caregiver Background Check Disclosure: This disclosure is part of the process to ensure that all caregivers meet state requirements and have no disqualifying criminal histories.

- LIC 9108 - Incident Report Form: This form is used to report significant incidents or changes in a facility, which may affect the welfare of residents and the facility’s compliance status.

- LIC 402 - Facility Sketch: A visual representation of the facility layout, this form helps licensing officials assess safety measures during inspections.

- LIC 630 - Adult Residential Facility Semi-Annual Report: This report provides an overview of the facility's operation and financial standing for review by the licensing authority.

- LIC 915 - Facility Evaluation Report: This document summarizes the findings of inspections conducted by regulatory bodies to ensure ongoing adherence to licensing regulations.

Each of these documents plays a critical role in the licensing process and ongoing compliance for community care facilities in California. They work together to provide a complete view of the facility's operational and financial integrity. It is important for applicants and licensees to maintain accurate records and ensure all required forms are completed and submitted accordingly.

Similar forms

- Financial Statement: Similar to the California Balance Sheet, a financial statement summarizes an entity's financial position, detailing assets, liabilities, and equity. Both documents serve the purpose of providing a snapshot of financial health.

- Statement of Assets and Liabilities: This document lists all assets and liabilities, similar to how the California Balance Sheet organizes financial data. Both report the economic resources owned and owed by an entity.

- Income Statement: While the California Balance Sheet focuses on the entity’s resources at a specific time, an income statement outlines revenue and expenses over a period. Together, they provide a comprehensive view of financial performance.

- Statement of Cash Flows: This document tracks the flow of cash in and out of an entity, complementing the California Balance Sheet by monitoring liquidity. Both help stakeholders assess financial stability.

- Net Worth Statement: This statement provides individuals with a breakdown of their personal financial position much like the California Balance Sheet does for organizations. Both indicate how assets measure up against liabilities.

- Corporate Balance Sheet: For corporations, this document serves the same function as the California Balance Sheet by listing assets, liabilities, and equity. Both are essential for understanding the financial viability of a business.

- Personal Financial Statement: Similar to the California Balance Sheet, this document outlines an individual's assets and liabilities. Both illustrate the overall financial picture, aiding in personal financial planning.

Dos and Don'ts

When filling out the California Balance Sheet form, adherence to specific guidelines will help ensure accuracy and compliance. Here is a list of recommended practices:

- Do gather all your financial documents before starting to fill out the form.

- Do provide accurate current dates and entity names at the top of the form.

- Do include all relevant assets and liabilities, not just those related to the care facility.

- Do double-check your calculations for total current and long-term assets.

- Do appropriately label any attachments, including the LIC 403a, to support your figures.

- Don't leave any spaces blank; if information does not apply, write “N/A” instead.

- Don't forget to sign and date the form to verify the accuracy of your information.

- Don't mix personal finances with your facility finances unless they are specifically required.

- Don't underestimate the value of detailed documentation; additional paperwork might be requested.

Misconceptions

- Misconception 1: The Balance Sheet Form Only Reports Financials Related to the Facility's Operations.

- Misconception 2: Only the Facility Owner Needs to Submit the Balance Sheet.

- Misconception 3: The Balance Sheet Does Not Require Verification of Information.

- Misconception 4: The Completed Form Can Be Submitted Without a Signature.

This is not true. The California Balance Sheet form requires reporting of all assets and liabilities, regardless of their relation to the care facility. This means individuals must disclose personal finances and any relevant accounts that may not directly reflect the operation of the facility.

In fact, all applicants or licensees, whether operating as a sole proprietorship, partnership, or corporation, must submit the Balance Sheet. For partnerships, each general partner is required to file a personal Balance Sheet in addition to the partnership's financials.

This is misleading. The information reported on the Balance Sheet is subject to verification. Applicants must be prepared to provide additional documentation to support the amounts listed on their forms, ensuring transparency and accuracy.

This is incorrect. The balance sheet must be signed and dated by the applicant or licensee. Failing to do so may lead to non-compliance, resulting in the rejection of the submitted report.

Key takeaways

When filling out the California Balance Sheet form, there are some important details to keep in mind. Here are ten key takeaways to help guide you through the process.

- Understand the purpose: The Balance Sheet captures the financial health of your facility, showcasing all assets and liabilities.

- Mandatory attachments: Always attach the LIC 403a, which serves as a detailed supplemental worksheet.

- Clarify entity information: Provide the current date, entity name, facility name, and application/license number at the top of the form.

- Document all assets: Include not just operational assets but also personal ones that might relate to the entity.

- Differentiate between types: Separate current and long-term assets clearly to ensure accurate reporting.

- Include all liabilities: List all credit accounts and outstanding debts, regardless of their direct connection to the facility.

- Verify calculations: Double-check your total assets against liabilities to ensure equity is accurately reflected.

- Signature required: The form must be signed and dated by the applicant or licensee to validate the information provided.

- Personal items count: For sole proprietorships, personal debts such as credit card balances need to be accounted for, especially if they involve both partners.

- Accuracy is crucial: Any inaccuracies or omissions can lead to non-compliance issues, so thoroughness is key.

By keeping these takeaways in mind, you can navigate the Balance Sheet form more confidently and ensure all necessary information is accurately represented.

Browse Other Templates

Vita Flex Fsa - A photocopy of this form can be used for additional claims if needed.

Indiana Wh-3 - Employers must ensure that all counties where tax was withheld are listed on the form.