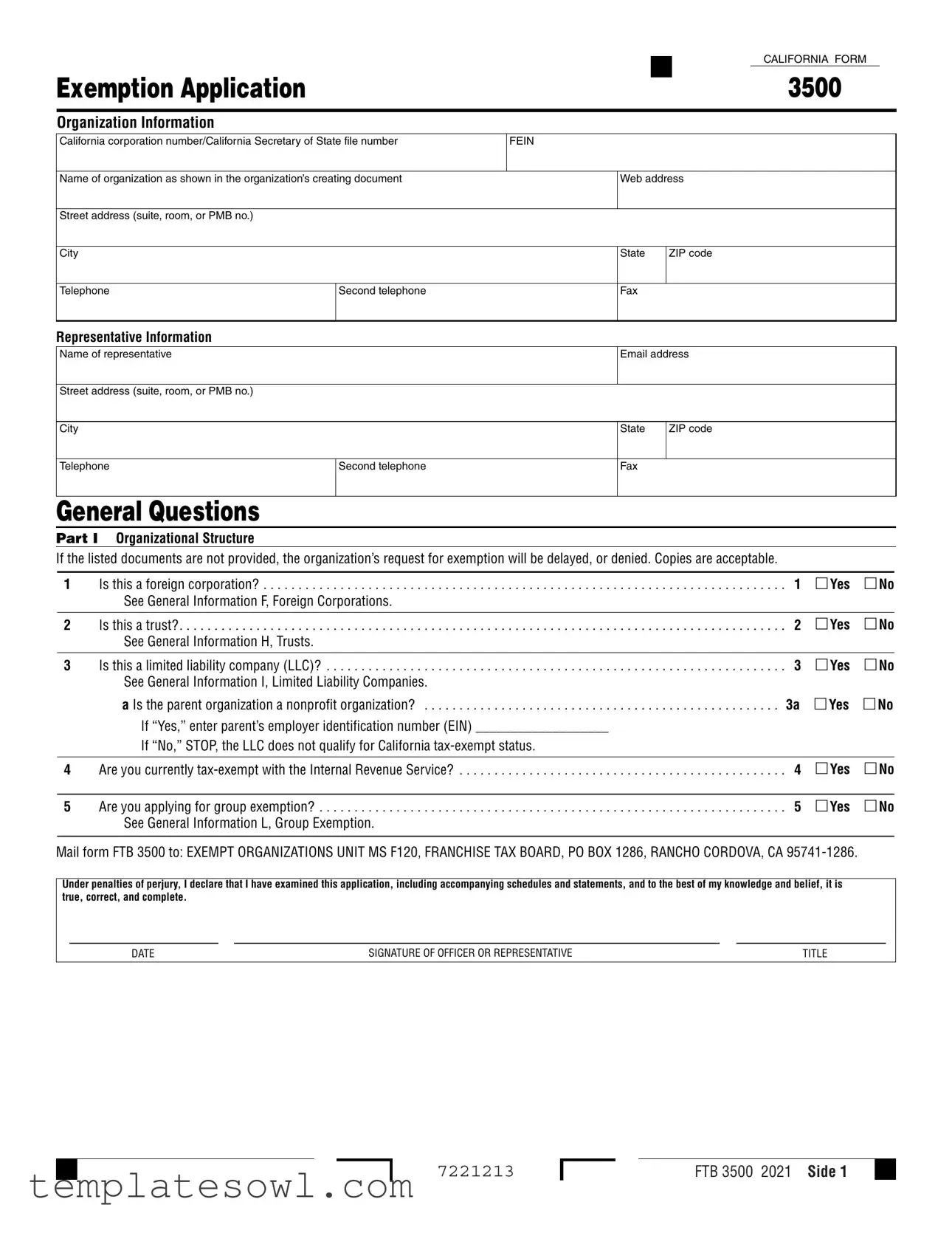

Fill Out Your California 3500 Form

The California 3500 form is a critical document for organizations seeking tax-exempt status in the state. This form allows various entities, including nonprofit organizations and trusts, to apply for exemption under California law. Proper completion of the California 3500 is essential, as inadequate or incorrect information can lead to delays or even denial of the application. The form requires detailed organizational information, such as the entity's California corporation number, Federal Employer Identification Number (FEIN), and contact details. Additionally, organizations must answer specific questions regarding their structure, purpose, and current tax-exempt status with the IRS, if any. Financial details, a thorough narrative of past and planned activities, and information about officers and directors are also crucial sections of the form. By maintaining clarity and accuracy throughout this process, organizations can better position themselves to gain the exemption needed to further their mission and serve the community effectively.

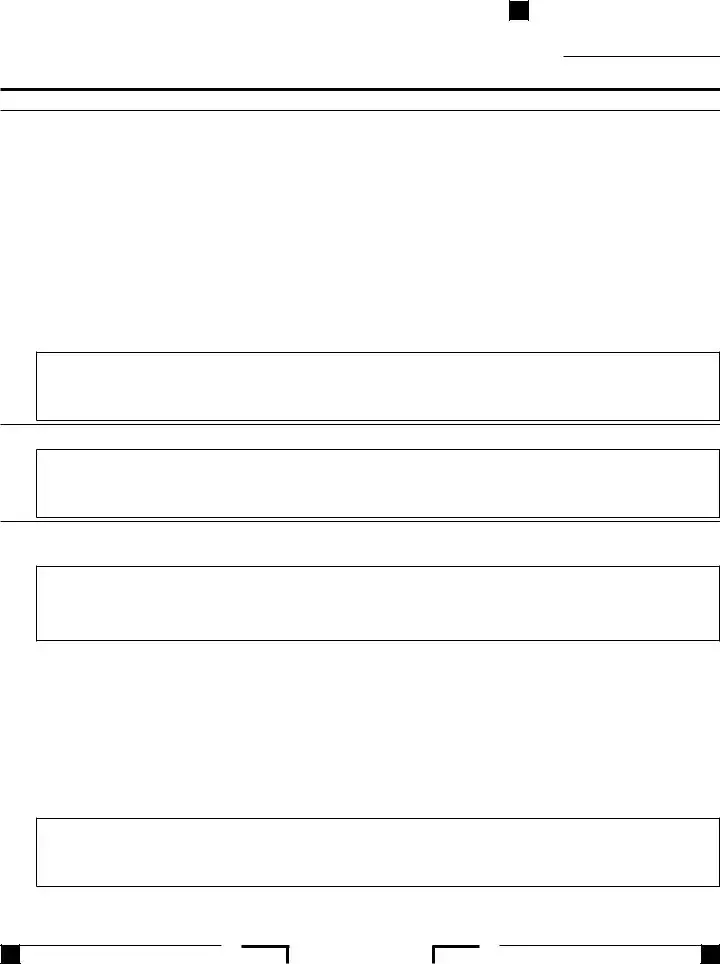

California 3500 Example

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

|

|

|

|

|

|

|

|

|||

Exemption Application |

|

|

|

|

3500 |

|

|||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Organization Information |

|

|

|

|

|

|

|

||

California corporation number/California Secretary of State file number |

FEIN |

|

|

|

|

|

|||

|

|

|

|

|

|||||

Name of organization as shown in the organization’s creating document |

|

Web address |

|||||||

|

|

|

|

|

|

|

|

|

|

Street address (suite, room, or PMB no.) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

City |

|

|

|

State |

|

ZIP code |

|||

|

|

|

|

|

|

|

|

|

|

Telephone |

|

Second telephone |

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative Information |

|

|

|

|

|

|

|

||

Name of representative |

|

Email address |

|||||||

|

|

|

|

|

|

|

|

||

Street address (suite, room, or PMB no.) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

City |

|

|

|

State |

|

ZIP code |

|||

|

|

|

|

|

|

|

|

|

|

Telephone |

|

Second telephone |

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Questions |

|

|

|

|

|

|

|

||

Part I |

Organizational Structure |

|

|

|

|

|

|

|

|

If the listed documents are not provided, the organization’s request for exemption will be delayed, or denied . Copies are acceptable .

1 |

.Is this a foreign corporation? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

.□. .Yes. . 1 |

□No |

|

|

See General Information F, Foreign Corporations . |

|

|

|

|

2 |

Is this a trust? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

□Yes |

□No |

|

|

See General Information H, Trusts . |

|

|

|

|

3 |

Is this a limited liability company (LLC)? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

.□. Yes. . . |

□. .No |

|

|

See General Information I, Limited Liability Companies . |

|

|

|

|

a Is the parent organization a nonprofit organization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . □. .Yes. . .□. No. . . . . . .

If “Yes,” enter parent’s employer identification number (EIN) ___________________

If “No,” STOP, the LLC does not qualify for California

4 Are you currently

5 Are you applying for group exemption? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . □. . Yes. . . . □. 5No See General Information L, Group Exemption .

Mail form FTB 3500 to: EXEMPT ORGANIZATIONS UNIT MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA, CA

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

DATE |

SIGNATURE OF OFFICER OR REPRESENTATIVE |

TITLE |

7221213

FTB 3500 2021 Side 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II Narrative of Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 |

Was the organization’s California |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . □. Yes. . |

. |

.□. No. . . . . 1 |

||||||||||

|

If “No,” the organization may qualify to file form FTB 3500A, Submission of Exemption Request . For more information, get form FTB 3500A . |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Enter the California Revenue and Taxation Code (R&TC) section that best fits the organization’s purpose/activity |

|

|

|

|

|

|

|

|

|

|

|

||||

|

See the Exempt Classification Chart on page 6 |

. . . . . . . . . . . . . . . . . . . . . |

. . R&TC. . . . Section. . . . 23701. . . . |

. . 2 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3 |

Enter the date the organization formed |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . ./ . |

. . |

. / . . |

. . . . . . 3 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mm / |

dd |

/ |

|

yyyy |

|||||

4What is the organization’s annual accounting period ending?

(must end on the last day of the calendar or fiscal year) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 . . . . . / . . . . . . . . .

mm / dd

5What is the primary purpose of the organization?

|

|

|

|

|

|

|

6 |

Is the organization currently conducting, or plan to conduct activities? |

. 6. . |

□. .Yes. . . □. No |

|||

|

If “Yes,” enter the date the activities began, or will begin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . /. |

. . |

. ./ |

|||

|

mm / |

dd |

|

/ |

yyyy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 FTB 3500 2021

7222213

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

||

Part II Narrative of Activities (continued)

7Describe the organization’s past, present, and planned activities below. Do not merely refer to or repeat the language in the organizational document . List each activity separately, in the order of importance based on the relative time and other resources devoted to the activity. Indicate the percentage of time for each activity. Each description should include a:

a Detailed description of the activity, including its purpose and how it furthers the organization’s exempt purpose . b Detailed description of when the activity was or will be initiated .

c Detailed description of where and by whom the activity will be conducted .

7223213

FTB 3500 2021 Side 3

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

||

Part III Financial Data

1a Has the organization filed the Form 199, California Exempt Organization Annual Information Return, for the current

and prior years? |

1a □Yes |

□No |

b Has the organization filed the FTB 199N, California |

. . . □1bYes |

□No |

We will review information reported on previously filed Form 199 to determine exemption eligibility. If the FTB 199Ns were filed or no returns were filed, attach a detailed income and expense statement for the current year and three previous years . If you are not yet active, attach a proposed budget covering the next four years .

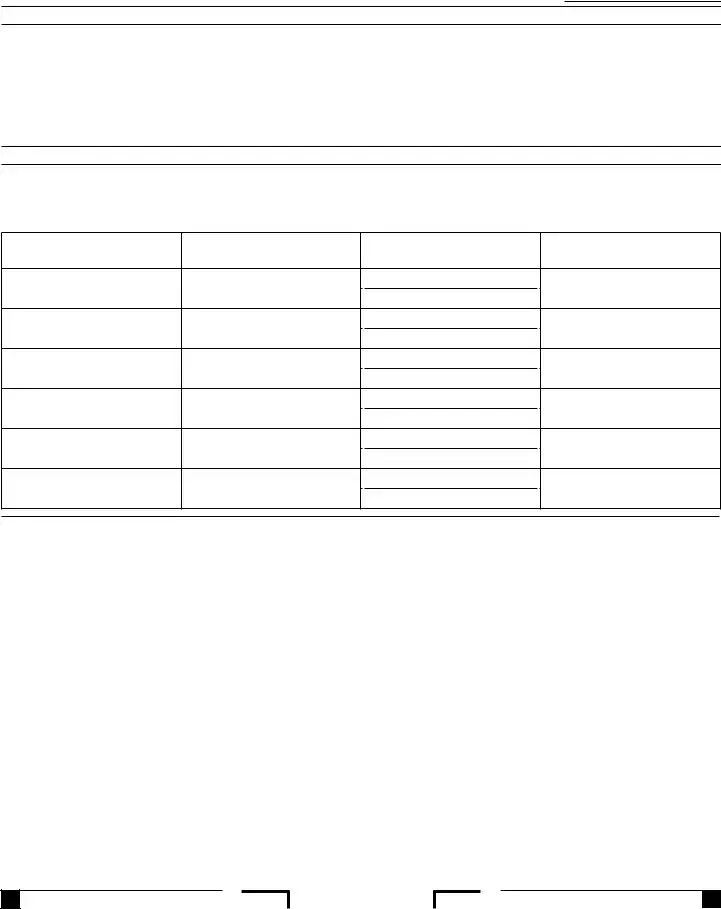

Part IV Officers, Directors, and Trustees

1List names, titles, and mailing addresses of all officers, directors, and trustees whether or not compensation is or will be paid . For each person listed, state their total annual compensation, or proposed compensation, for all services to the organization, whether as an officer, employee, or other position . Use actual figures, if available . Enter “none” if no compensation is or will be paid . If additional space is needed, attach a separate sheet .

Name

Title

Mailing Address

Compensation Amount (annual actual or estimated)

2Will any incorporator, founder, board member or other person(s) or entity:

|

a Share any facilities with the organization? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. a. |

. □. Yes. . |

. .□. No |

|||||||

|

b Rent, sell, or transfer property to this organization? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

b |

□Yes |

□No |

|||||||

|

c Be compensated for services other than performing as a board member or employee? |

. |

c |

□Yes |

□No |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Part V |

History |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. . . . . |

||||||||

1 Has the organization been issued any previous California ID number? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. .□. Yes. . |

. □. .No. |

|||||||||

|

|

|

|

|

|

|

|

|

||||

2 |

Was this organization’s exemption previously revoked by the Internal Revenue Service? |

. □. .Yes. . |

. □. No. . 2 |

|||||||||

|

If “Yes,” enter date revoked |

|||||||||||

|

|

|

|

mm |

/ |

|

dd |

/ |

|

yyyy |

|

|

Part VI |

Fund Raising |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1 |

Does or will the organization participate in |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . |

. |

. |

. .□. .Yes. □. 1No. . |

||||||

|

If “Yes,” check all the |

|

|

|

|

|

|

|

|

|||

|

□ Mail solicitations |

□ Phone solicitations |

|

|

|

|

|

|

|

|

||

|

□ Email solicitations |

□ Accept donations on the organization’s website |

|

|

|

|

|

|

|

|

||

|

□ Personal solicitations |

□ Receive donations from another organization’s website |

|

|

|

|

|

|||||

|

□ Vehicle, boat, plane, or similar donations |

□ Government grant solicitations |

|

|

|

|

|

|

|

|

||

|

□ Foundation grant solicitations |

□ Other - Attach description |

|

|

|

|

|

|

|

|

||

Side 4 FTB 3500 2021

7224213

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part VII Specific Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Does the organization conduct any gaming activities (bingo, raffles, etc .) . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . |

. |

. . |

. |

. . |

. |

|

1 □Yes □No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Does the organization lease property from others? |

. . . . . . . . . . . . . . . . . . |

. . |

. . . . . |

. . . |

. |

. |

. |

. |

. . |

|

. . .□. Yes. . . . |

□. . No. 2 |

||

|

If “Yes,” attach copy of lease agreement . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Does the organization lease property to others? |

. . . . . . . . . . . . . . . . . . . . . . . |

. |

. |

. |

. |

. |

. |

. . □. Yes. . . |

.□. No |

|||||

|

If “Yes,” attach copy of lease agreement . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Does or will the organization publish, sell, or distribute any literature? . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . . |

. . . |

. |

. . |

. |

. . |

. |

. |

4 □Yes |

□No |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Does or will the organization own, or have rights in music, literature, tapes, artworks, choreography, scientific discoveries, |

|

|

|

|

|

|

. . □. Yes. . . |

.□. No |

||||||

|

or other intellectual property? |

. . . . . . . . . . . . . . . . . . . . . . . |

. |

. |

. |

. |

. |

. |

|||||||

6Does or will the organization accept contributions of real property, conservation easements, closely held securities, intellectual

property such as patents, trademarks, and copyrights, works of music or art licenses, royalties, automobiles, boats, planes, or

other vehicles, or collectibles of any type? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . □. Yes. . . .□. No. . . . . . .

7Does or will the organization operate outside of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .□. Yes. . . □. .No. . . . . . .

7225213

FTB 3500 2021 Side 5

Organization name: __________________________ |

Corp number/CA SOS file number: |

Schedule 1

Section A R&TC Section 23701a – Labor, agricultural, or horticultural organization

1 Are any services to be performed for members? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . .□. Yes. . . . □. . No If “Yes,” explain .

2 |

Is the organization formed as a cooperative? |

|

|

If “Yes,” provide a copy of the federal exemption letter showing exemption under IRC Section 501(c)(5) |

2 □Yes □No |

Section B R&TC Section 23701b – Fraternal societies, orders, or associations, etc. (Lodge system with benefits)

Operating under the lodge system means carrying on activities under a form of organization that comprises local branches called lodges, chapters, or the like, that are largely

1 Is the organization a college fraternity or sorority or a chapter of a college fraternity or sorority? . . . . . . . . . . . . . . . . . . . . . . . 1 □Yes □No

If “Yes,” college fraternities and sororities generally qualify as organizations described in R&TC Section 23701g .

For more information, get FTB Pub 1077, Guidelines for Social and Recreational Organizations . If R&TC Section 23701g appears to apply, do not complete Section B . Go to Section G on Schedule 3, Social and recreational organization .

2Does the organization operate, or plan to operate under the lodge system or for the exclusive benefit of the members of

|

the lodge system? |

. . . . . 2 |

□Yes |

□No |

|

|

|

|

|

|

|

3 |

Is the organization a subordinate of a national or state level organization? |

. . . . 3. |

. □. .Yes. . |

. □. No |

|

|

If “Yes,” attach a certificate signed by the secretary of the parent organization certifying that the subordinate is a duly |

|

|

|

|

|

constituted body operating under the jurisdiction of the parent body. |

|

|

|

|

|

|

|

|

|

|

4 |

Is the organization a parent or grand lodge? |

. . . . . 4 |

□Yes |

□No |

|

|

|

|

|

|

|

5Describe the types of benefits (life, sick, accident, or other benefits) paid, or to be paid, to members .

Section L R&TC Section 23701l – Fraternal beneficiary societies, orders, or associations, etc. (Lodge system with no benefits)

Operating under the lodge system means carrying on activities under a form of organization that comprises local branches (called lodges, chapters, or the like) that are largely

1 Is the organization a college fraternity or sorority, or a chapter of a college fraternity or sorority? . . . . . . . . . . . . . . . 1. . □. .Yes. . . □No

If “Yes,” college fraternities and sororities generally qualify as organizations described in R&TC Section 23701g .

For more information, get FTB Pub 1077, Guidelines for Social and Recreational Organizations . If R&TC Section 23701g appears to apply, do not complete Section L . Go to Section G on Schedule 3, Social and recreational organization .

2Does the organization operate or plan to operate under the lodge system or for the exclusive benefit of the members of

|

a lodge system? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . |

.□. .Yes. . . |

□No |

|

|

|

|

|

|

|

3 |

Is the organization a subordinate of a national or state level organization? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . 3. |

. □. .Yes. . . □. No |

||

|

|

|

|

|

|

4 |

Is the organization a parent or grand lodge? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

□Yes |

□No |

|

Side 6 FTB 3500 2021

7226213

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

||

Schedule 2

Section D R&TC Section 23701d – Religious, charitable, scientific, literary, or educational organization

1Check the box(es) below that best describes the organization .

□ Charitable |

□ Educational |

□ Credit Counseling |

□ Synagogue |

□ School |

□ Testing for public safety |

□ Church |

□ Literary |

□ Hospital, Medical Center |

□ Temple |

□ Scientific |

□ Qualified sports organization |

□ Mosque |

□ Religious |

□ Prevent cruelty to children or animals |

2Has the organization received or expect to receive 10% or more of its assets from any organization or group of affiliated organizations (affiliated through stockholding, common ownership, or otherwise), any individuals, or members of a family

|

group (brother or sister whether whole or half blood, spouse/RDP, ancestor or lineal descendant)? |

2 |

□Yes |

□No |

|

|

|

|

|

3 |

Does the organization attempt to influence legislation? |

3. . . |

□. Yes. . . . |

□. . No |

4Does the organization support or oppose candidates in political campaigns in any way? . . . . . . . . . . . . . . . . . . . . 4. . □. Yes. . . .□. No.

5Does the organization hold, or plan to hold, 10% or more of any class of stock or 10% or more of the total combined

|

voting power of stock in any corporation? |

. 5. . |

.□. .Yes. |

□No |

|

|

|

|

|

|

|

6 |

a |

Does the organization operate as a church, mosque, synagogue, or temple? |

.6a. . |

.□. .Yes |

□No |

|

|

If “Yes,” complete Schedule 2A, Churches . |

|

|

|

|

b |

Is the organization’s main function to provide hospital or medical care? |

6b |

□Yes |

□No |

|

|

If “Yes,” complete Schedule 2B, Hospitals . |

|

|

|

|

c |

Is the organization a credit counseling organization? |

6c |

□Yes |

□No |

|

|

If “Yes,” complete Schedule 2C, Credit Counseling Organizations . |

|

|

|

7227213

FTB 3500 2021 Side 7

Organization name: __________________________ |

Corp number/CA SOS file number: |

Schedule 2A – Churches

Complete Schedule 2A only if the organization answered “Yes” to Specific Section D, Question 6a .

1Check the box that best describes the organization .

|

□Church □Mosque □Synagogue |

□Temple |

|

2 |

Has a place of worship been established? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . □. Yes. . . .□. No |

|

|

If “Yes,” at what address? Who is the legal owner of the property? Other property use? |

||

|

If “No,” explain where religious services are held . |

||

|

|

|

|

|

|

|

|

|

|

|

|

3 Does the organization have a regular congregation or conduct religious services on a regular basis?. . . . . . . . . . . . . . . . . . . . 3 □Yes □No If “Yes,” how many usually attend the regular worship services? How often are religious services held?

If “No,” explain .

4Explain the background and training of the religious leaders .

5Will income be received from incorporators, ministers, officers, directors, or their families? . . . . . . . . . . . . . . . . . . . . □. Yes. . . .□. No5 If “Yes,” explain, including dollar amounts received .

|

|

|

6 |

Will any founder, member, or officer take a vow of poverty? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .□. Yes. . . □. .No |

|

|

If “Yes,” explain . |

|

|

|

|

|

|

|

|

|

|

7Will any founder, member, or officer transfer personal assets to this organization, like a home, automobile, furnishings,

business, or recreational assets, etc ., that will be made available for the personal use of the donors? . . . . . . . . . . . . . . . □. .Yes. . 7□No If “Yes,” explain .

Side 8 FTB 3500 2021

Schedule 2A Churches continued

7228213

|

|

|

|

Organization name: __________________________ |

Corp number/CA SOS file number: |

||

Schedule 2A – Churches (continued)

8Will any founder, member, or officer assign or donate income to the organization that will be used to pay their own personal salary, living allowance, or that will result in any other personal benefit (such as food, medical expenses, clothing,

|

insurance, etc .)? |

8 □Yes □No |

|

If “Yes,” explain . |

|

|

|

|

|

|

|

|

|

|

9 |

Does the organization have a written creed, statement of faith, or summary of beliefs? |

9 □Yes □No |

|

If “Yes,” explain . |

|

|

|

|

|

|

|

|

|

|

10 |

Do the religious leaders conduct baptisms, weddings, funerals, etc .? |

10. . . .□Yes □No |

|

If “Yes,” explain . |

|

|

|

|

|

|

|

|

|

|

11 |

Does the organization ordain, commission, or license ministers or religious leaders? |

11 □Yes □No |

|

If “Yes,” describe . |

|

|

|

|

|

|

|

7229213

FTB 3500 2021 Side 9

Organization name: __________________________ |

Corp number/CA SOS file number: |

Schedule 2B – Hospitals

Complete Schedule 2B only if the organization answered “Yes” to Specific Section D, Question 6b . Attach a statement to explain any answers .

1 |

Are all the doctors in the community eligible for staff privileges? |

1 □Yes □No |

|

If “No,” give the reasons why and explain how the medical staff is selected . |

|

2a Does or will the organization provide medical services to all individuals in the community who can pay for themselves

or have private health insurance? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. . . □. Yes. . . □. .No. . . . . . .

If “No,” explain .

bDoes or will the organization provide medical services to all individuals in the community who participate in

Medicare? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . □. Yes. . . .□. No. . . . . . .

If “No,” explain .

3a Does or will the organization require persons covered by Medicare or Medicaid to pay a deposit before receiving

|

|

services? |

3a |

□Yes |

□No |

|

|

If “Yes,” explain . |

|

|

|

|

b Does the same deposit requirement, if any, apply to all other patients? |

3b |

□Yes |

□No |

|

|

|

If “No,” explain . |

|

|

|

4 |

a |

Does or will the organization maintain a |

4a |

□Yes |

□No |

|

|

If “No,” explain why the organization does not maintain a |

|

|

|

|

|

services provided . |

|

|

|

|

b |

Does the organization have a policy on providing emergency services to persons without apparent means to pay? . . . . |

4b. . |

□Yes |

□No |

|

|

If “Yes,” provide a copy of the policy. |

|

|

|

cDoes the organization have any arrangements with police, fire, and voluntary ambulance services for the delivery

|

|

or admission of emergency cases? |

. . . |

.□. Yes. . 4c □No |

|

|

|

If “Yes,” describe the arrangements, including whether they are written or oral agreements . If written, submit copies of |

|

|

|

|

|

all such agreements . |

|

|

|

5 |

a |

Does the organization provide for a portion of the organization’s services and facilities to be used for charity patients? . . . |

5a |

□Yes |

□No |

|

|

If “Yes,” answer question 5b through question 5e . |

|

|

|

|

b |

Explain the organization’s policy regarding charity cases, including how the organization distinguishes between charity |

|

|

|

|

|

care and bad debts . Submit a copy of the written policy. |

|

|

|

|

c |

Provide data on the organization’s past experience in admitting charity patients, including the amounts expended for |

|

|

|

|

|

treating charity care patients and types of services provided to charity care patients . |

|

|

|

|

d |

Describe any arrangements with federal, state, or local governments or government agencies for paying for the cost |

|

|

|

|

|

of treating charity care patients . Submit copies of any written agreements . |

|

|

|

|

e |

Does the organization provide services on a sliding fee schedule depending on financial ability to pay? |

5e |

□Yes |

□No |

|

|

If “Yes,” submit the sliding fee schedule . |

|

|

|

6 |

a |

Does or will the organization carry on a formal program of medical training or medical research? |

6a |

□Yes |

□No |

|

|

If “Yes,” describe such programs, including the type of programs offered, the scope of such programs, and affiliations |

|

|

|

|

|

with other hospitals or medical care providers with which the organization carries on the medical training or research |

|

|

|

|

|

programs . |

|

|

|

|

b |

Does or will the organization carry on a formal program of community education? |

. . . |

.□. Yes6b |

□No |

|

|

If “Yes,” describe such programs, including the type of programs offered, the scope of such programs, and affiliations |

|

|

|

|

|

with other hospitals or medical care providers with which the organization offers community education programs . |

|

|

|

Schedule 2B Hospitals continued

Side 10 FTB 3500 2021

7229213

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The California Form 3500 is used by organizations seeking tax-exempt status in California. It serves as an application for exemption under the California Revenue and Taxation Code. |

| Governing Law | This form is governed by Section 23701 of the California Revenue and Taxation Code, which outlines qualifications for tax-exempt organizations. |

| Eligibility Criteria | To qualify, organizations must provide specific documents detailing their structure and purpose. Failure to submit these may result in delays or denial of the request. |

| Submission Process | Completed forms should be mailed to the Exempt Organizations Unit of the Franchise Tax Board in Rancho Cordova, California. Attention to correct submission is crucial for processing. |

| Information Requirement | Applicants must disclose detailed financial data, including past and planned activities, and identify all officers and trustees, along with their compensation details. |

| IRS Tax-Exempt Status | If an organization is already tax-exempt at the federal level, it must include this information in the application, which can influence state-level exemption. |

| Consequences of Inaccuracy | Providing inaccurate information can lead to penalties, including the potential denial of tax-exempt status. Accuracy is emphasized throughout the application process. |

Guidelines on Utilizing California 3500

After gathering the necessary information, you can begin filling out the California Form 3500, which is essential for organizations seeking exemption status. Follow these steps carefully to ensure a complete and accurate submission.

- Start by providing the Organization Information. Fill in the California corporation number or California Secretary of State file number, FEIN, name of the organization, web address, street address (including suite or room number), city, state, ZIP code, and telephone numbers.

- Complete the Representative Information section with the representative's name, email address, street address, city, state, ZIP code, and telephone numbers.

- In Part I: Organizational Structure, answer questions regarding the type of organization. Indicate whether it is a foreign corporation, trust, or LLC. If applicable, specify if the parent organization is a nonprofit.

- State whether you are currently tax-exempt with the Internal Revenue Service, and indicate if you are applying for group exemption.

- Proceed to Part II: Narrative of Activities. Indicate if the organization's California tax-exempt status was previously revoked and enter the relevant California Revenue and Taxation Code section. Also, provide the date of the organization’s formation and the annual accounting period ending.

- Describe the primary purpose of the organization and whether it is currently conducting activities. If so, note the starting date for these activities.

- Detail the organization’s past, present, and planned activities, including a description of the activity's purpose, timing, and location.

- In Part III: Financial Data, state whether the organization has filed Form 199 and/or FTB 199N for the current and prior years. If not yet active, attach a proposed budget for the next four years.

- List names, titles, and mailing addresses of all officers, directors, and trustees in Part IV: Officers, Directors, and Trustees. Provide their total annual compensation as well.

- Check the questions in Part V: History regarding previous California ID numbers or if the exemption has been revoked by the IRS.

- Proceed to Part VI: Fund Raising and check whether the organization participates in fundraising activities. If yes, check all applicable fundraising programs.

- Answer questions in Part VII: Specific Activities about any gaming activities, leases, and the publication or distribution of literature.

- Carefully review all entered information to ensure it is complete and correct. Finally, sign and date the form, along with the title of the officer or representative.

- Mail the completed form to the address provided: EXEMPT ORGANIZATIONS UNIT MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA, CA 95741-1286.

What You Should Know About This Form

What is the California Form 3500?

The California Form 3500 is an application used by organizations to apply for tax-exempt status in California. This form is essential for nonprofits, foreign corporations, trusts, and limited liability companies that wish to be recognized as tax-exempt under California law. Completing this form accurately is crucial for the organization to avoid delays or denial of their exemption request.

Who needs to fill out Form 3500?

Any organization seeking tax-exempt status in California must complete Form 3500. This includes but is not limited to nonprofit corporations, trusts, foreign corporations, and limited liability companies (LLCs). If an organization does not fall into one of these categories or does not meet the necessary requirements, they should not submit the application.

What information is required to complete Form 3500?

Form 3500 requires a variety of details. This includes the organization's name, address, contact information, organizational structure, a narrative of activities, financial data, and details about officers and directors. The organization must also provide copies of any relevant documents. Failing to provide required documents can result in delays.

How does an organization prove its tax-exempt status?

To establish tax-exempt status, the organization must demonstrate that its mission aligns with the criteria set forth in the California Revenue and Taxation Code. This typically involves outlining the organization’s activities and explaining how they further the exempt purposes. Stability in financial reporting and compliance with previous tax filings also bolsters the application.

What if the organization is already tax-exempt with the Internal Revenue Service?

If an organization holds tax-exempt status from the IRS, they can indicate this on the Form 3500. Obtaining federal tax-exempt status is a vital step that can significantly support the application for state-level tax exemption. However, the organization must still comply with California-specific requirements to obtain exemption in the state.

What are the consequences of providing false information on Form 3500?

Falsifying information on Form 3500 can lead to severe repercussions, including legal penalties, revocation of tax-exempt status, and potential criminal charges. The form includes a declaration stating that the information is true and complete to the best of the signer's knowledge, thus emphasizing the importance of honesty in the application process.

Where should Form 3500 be mailed once completed?

Once the organization has filled out Form 3500, it should be mailed to the Exempt Organizations Unit at the Franchise Tax Board. The address is P.O. Box 1286, Rancho Cordova, CA 95741-1286. Ensuring that the form reaches the correct department is vital for timely processing and review.

How long does it take to process Form 3500?

The processing time for Form 3500 can vary based on a number of factors, including the completeness of the application and the current workload of the Franchise Tax Board. Generally, organizations should anticipate several weeks to a few months for their application to be reviewed. It’s advisable to follow up if there are delays beyond the expected time frame.

Common mistakes

Filling out the California Exemption Application Form 3500 can be a straightforward process, but many applicants make common mistakes that can lead to delays or denials. One significant error is failing to provide the necessary documentation. The instructions clearly indicate that copies of foundational documents are acceptable. However, if these documents are omitted, the review of the application will be hindered. Making sure to include all required documents is crucial for a smooth process.

Another frequent mistake occurs in the response to questions regarding the organization’s structure. For example, some applicants answer "No" to whether the organization is a foreign corporation, even when it is. Inaccurate responses in this section can result in a denial of tax-exempt status. It's essential to double-check each answer against the organization's actual status to ensure accuracy.

Additionally, applicants often overlook the narrative section where they must detail their activities. A common pitfall is providing vague descriptions or failing to outline past and present activities adequately. Each activity should be described in detail, including its purpose, and how it supports the organization's exempt purpose. Neglecting this detail can lead to misunderstandings and weaken the case for exemption.

Many also mistakenly skip over the financial data section. A complete financial history, including whether the organization has filed the required annual information returns, must be included. Omitting this information signals to the reviewer that the organization may not be compliant with state regulations. Always ensure that this section is filled out and backed by relevant records.

Lastly, the signature can be a minor but impactful detail. The form requires a signature from an authorized person. Some applicants forget to sign or do not include the title of the signer which can complicate the validation of the application. Always make sure the appropriate representative signs the form and includes their title for proper authorization, thus preventing any unnecessary processing delays.

Documents used along the form

The California Form 3500 is vital for organizations seeking tax exemption in the state. However, it often appears alongside other important forms and documents, each playing a significant role in the application process. Understanding these documents can help streamline the journey towards obtaining tax-exempt status.

- Form 3500A: This form, Submission of Exemption Request, is for organizations that have not had their tax-exempt status previously revoked. It provides a simplified application process for organizations that qualify.

- IRS Form 1023: Organizations use this form to apply for federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Approval of this application is necessary for California tax exemption.

- IRS Form 990: This is the annual return that tax-exempt organizations must file, providing the IRS and the public with financial information about the organization’s activities, governance, and revenue.

- California Form 199: Known as the California Exempt Organization Annual Information Return, this form allows organizations to report their financial activities and is essential for maintaining tax-exempt status in California.

- California Form 199N: This e-Postcard is a simplified form that small tax-exempt organizations can submit to the California Franchise Tax Board. It is shorter than Form 199 and is designed for organizations with gross receipts under a certain limit.

- Bylaws: These are the rules that govern an organization’s internal operations. Providing bylaws with the exemption application can demonstrate the organization's structure and operational guidelines.

- Mission Statement: This document outlines the purpose and objectives of the organization. Including a mission statement helps convey the organization’s ultimate goals to the tax authorities.

- Financial Statements: Detailed financial statements for the current and previous years are often required. This includes income and expense reports to provide a clear picture of the organization’s financial health.

- Lease Agreements: If the organization leases property, submitted copies of lease agreements are crucial. They help clarify the organization's operational space and commitments.

In summary, while the California Form 3500 serves as the primary application for tax-exempt status, a host of accompanying forms and documents are equally essential. Gathering these items beforehand ensures that the application process is thorough, which can ultimately lead to a quicker approval. Navigating this process may appear daunting, but understanding each document's purpose makes it more manageable.

Similar forms

- IRS Form 1023 - Application for Recognition of Exemption Under Section 501(c)(3): This form is submitted to the IRS to apply for federal tax-exempt status. Similar to Form 3500, it requires detailed information about the organization’s structure, activities, and governance.

- IRS Form 1024 - Application for Recognition of Exemption Under Section 501(a): Used by organizations other than 501(c)(3) entities, this form shares similarities in requesting detailed information about the organization to grant federal tax-exempt status.

- California Form FTB 199 - California Exempt Organization Annual Information Return: This annual information return evaluates an exempt organization's ongoing compliance with California tax laws, akin to the narrative and financial data required in Form 3500.

- California Form FTB 199N - California e-Postcard: A simpler alternative to FTB 199, this form is for smaller exempt organizations. Like Form 3500, it aims to verify the organization’s exempt status.

- IRS Form 990 - Return of Organization Exempt from Income Tax: Nonprofits use this form to report financial information to the IRS. Both forms emphasize transparency and compliance with tax regulations.

- California Form 3500A - Submission of Exemption Request: Like Form 3500, this form is for organizations that are eligible for exemption under specific circumstances, simplifying the application process.

- California Biennial Statement: Nonprofit organizations can use this to report changes in their status every two years. It serves a similar purpose in maintaining regulatory compliance as the California 3500 form.

- California Secretary of State Statement of Information (Form SI-100): This document requires organizations to provide basic information about their operations. Both it and Form 3500 help maintain up-to-date records with state authorities.

Dos and Don'ts

When filling out the California 3500 form, there are several best practices to consider for a smooth application process. Here’s a list of what to do and what to avoid:

- Do review the instructions thoroughly before starting to fill out the form.

- Don’t leave any required fields blank; all pertinent information must be provided.

- Do ensure that the organization’s name matches exactly with the name in its creating document.

- Don’t use abbreviations or nicknames that are not officially recognized in documents.

- Do verify that your organization qualifies for the exemption you’re applying for.

- Don’t forget to include any necessary supporting documents; missing paperwork can delay your request.

- Do indicate if your organization has previously been tax-exempt and provide relevant details.

- Don’t submit the form without carefully proofreading for errors or omissions.

- Do keep a copy of your completed form and any supporting documents for your records.

- Don’t send your application to an incorrect address; mail it to the Exempt Organizations Unit as specified.

Misconceptions

Understanding the California Form 3500 can be complicated. Here are some common misconceptions that those seeking to fill out this important document may have:

- Misconception 1: The form is only for nonprofit organizations.

- Misconception 2: All applications are approved automatically.

- Misconception 3: Copies of documents cannot be submitted.

- Misconception 4: You can apply for exemption at any time without repercussions.

- Misconception 5: Only current organizations need to file.

- Misconception 6: Completion of the 3500 is straightforward and doesn't require detailed information.

- Misconception 7: You don’t need to report past activities if the organization has not been active.

- Misconception 8: There is no penalty for mistakes on the form.

While many nonprofits use the 3500, it is also applicable to certain other entities seeking tax-exempt status in California.

Approval is not guaranteed. Applications may be delayed or denied if all required documents are not submitted.

It is acceptable to submit copies of required documents, but they must be legible and complete.

Timing matters. Organizations need to be mindful that delays in submitting the application could affect their tax-exempt status.

Organizations that were previously active but are now inactive may still need to complete the form for past activities.

Completing the form requires comprehensive details about the organization’s structure, activities, and finances.

All organizations must provide a narrative of activities, even if no activities have occurred recently.

Errors, omissions, or false statements may lead to penalties, including denial of the exemption application.

Clear understanding of these misconceptions can help organizations navigate the process more effectively. It is essential to approach the completion of Form 3500 with care and diligence to ensure the best chance of receiving the desired exemption status.

Key takeaways

Here are key takeaways regarding the California 3500 Form, used for exemption applications:

- Organization Information: Start by accurately filling out your organization’s name, address, and identification numbers. This includes the California corporation number or Secretary of State file number and the Federal Employer Identification Number (FEIN).

- Representative Details: Include complete contact information for the designated representative. This person acts on behalf of the organization during the application process.

- Submit Required Documents: Ensure all relevant documents are attached. Incomplete submissions will delay or deny the request for exemption.

- Clarify Organizational Structure: Answer questions about the type of organization, whether it is a trust or LLC, and if it holds tax-exempt status with the IRS.

- Narrative of Activities: Clearly outline both current and planned activities of the organization. Be specific; include frequency, participant details, and the significance of these activities to your exempt status.

- Provide Financial Data: Include financial statements for the current year and the previous three years. If the organization is new, attach a proposed budget for the next four years.

- List Organizational Leaders: Note the names, titles, and compensation of all officers and trustees. This transparency is essential for maintaining compliance with state regulations.

- Avoid Gaming Activities Without Disclosure: If your organization participates in gaming, such as raffles or bingo, indicate this where required. Failure to disclose can affect your exemption status.

Browse Other Templates

Florida Divorce Financial Affidavit - This form requires detailed information about your current income and deductions to establish your net income.

Ca Reg 262 - It's important to acknowledge the terms of the sale in this document.