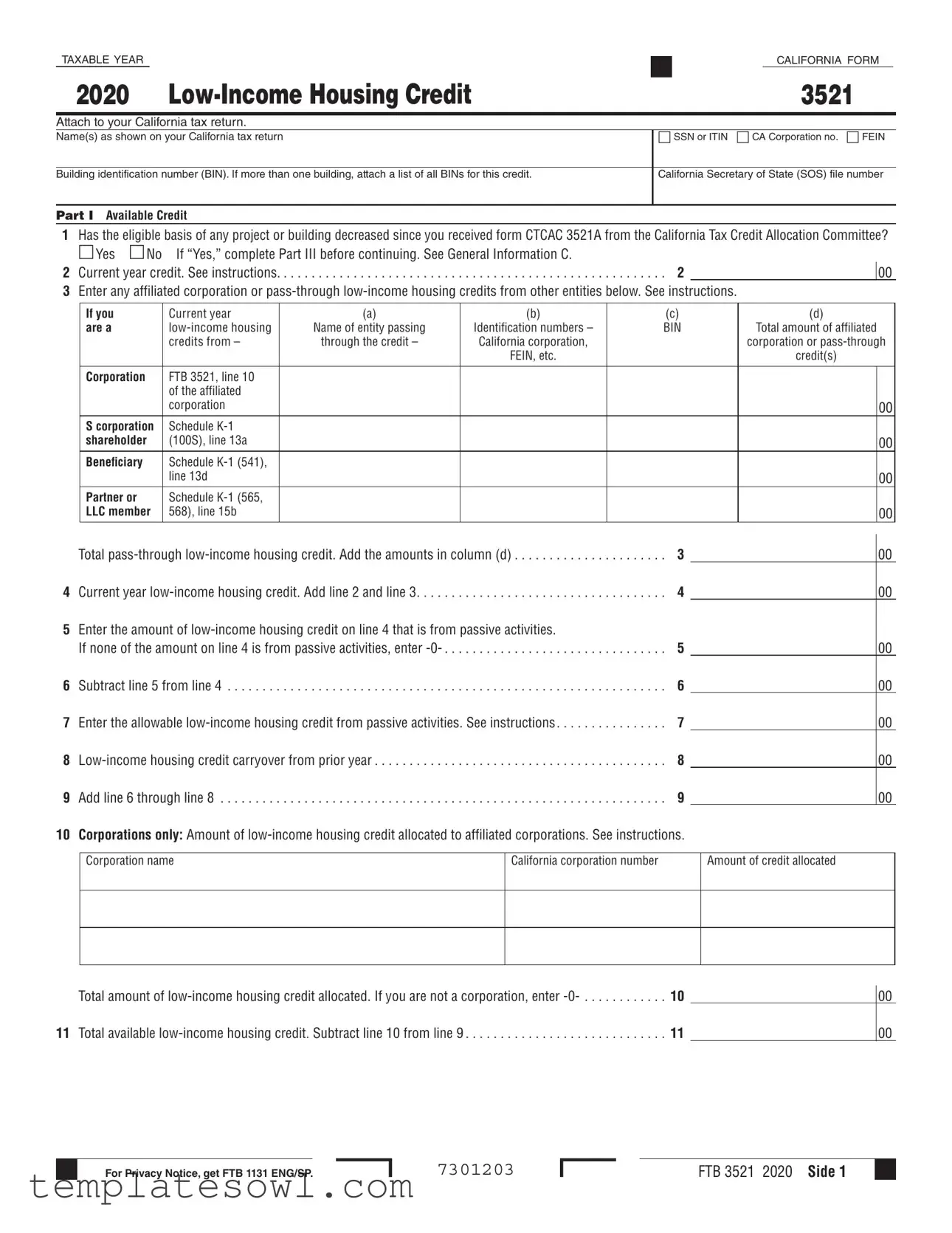

Fill Out Your California 3521 Form

The California Form 3521, widely recognized for its role in claiming the Low-Income Housing Credit, is an important document for individuals and entities involved in low-income housing projects. This form is required to be attached to a California tax return, and it helps taxpayers determine the amount of credit they can claim for the current taxable year. It includes sections that address available credits, affiliated corporation contributions, and carryover computations for future use. The form begins with a series of questions to establish the eligible basis of a project or building and whether there have been any decreases since the last reporting. Additionally, taxpayers may report any pass-through low-income housing credits received from affiliated entities, as well as calculate their overall credit available. Specific instructions guide users on how to complete each section, ensuring that they accurately account for the contributions and any applicable carryovers. Only those who have had changes in their project’s basis will need to complete the basis recomputation section, which requires further details about the building's service date and eligible basis calculations. Understanding these components is crucial for anyone seeking to maximize their benefits from the Low-Income Housing Credit in California.

California 3521 Example

TAXABLE YEARCALIFORNIA FORM

2020 |

3521 |

Attach to your California tax return. |

|

Name(s) as shown on your California tax return |

□ SSN or ITIN □ CA Corporation no. □ FEIN |

Building identification number (BIN). If more than one building, attach a list of all BINs for this credit.

California Secretary of State (SOS) file number

Part I Available Credit

1Has the eligible basis of any project or building decreased since you received form CTCAC 3521A from the California Tax Credit Allocation Committee?

□Yes □No If “Yes,” complete Part III before continuing. See General Information C. |

|

2 Current year credit. See instructions. . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . 2 |

00 |

3Enter any affiliated corporation or

If you |

Current year |

(a) |

(b) |

(c) |

(d) |

|

are a |

Name of entity passing |

Identification numbers – |

BIN |

Total amount of affiliated |

||

|

credits from – |

through the credit – |

California corporation, |

|

corporation or |

|

|

|

|

FEIN, etc. |

|

credit(s) |

|

Corporation |

FTB 3521, line 10 |

|

|

|

|

|

|

of the affiliated |

|

|

|

|

|

|

corporation |

|

|

|

|

00 |

S corporation |

Schedule |

|

|

|

|

|

shareholder |

(100S), line 13a |

|

|

|

|

00 |

Beneficiary |

Schedule |

|

|

|

|

|

|

line 13d |

|

|

|

|

00 |

Partner or |

Schedule |

|

|

|

|

|

LLC member |

568), line 15b |

|

|

|

|

00 |

Total

4 Current year

5Enter the amount of

If none of the amount on line 4 is from passive activities, enter

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . 6

7Enter the allowable

8

9 Add line 6 through line 8 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . . 9

10Corporations only: Amount of

Corporation name |

California corporation number |

Amount of credit allocated |

00

00

00

00

00

00

00

Total amount of

11 Total available

00

00

|

|

|

7301203 |

|

|

|

For Privacy Notice, get FTB 1131 ENG/SP. |

FTB 3521 2020 Side 1 |

|

||

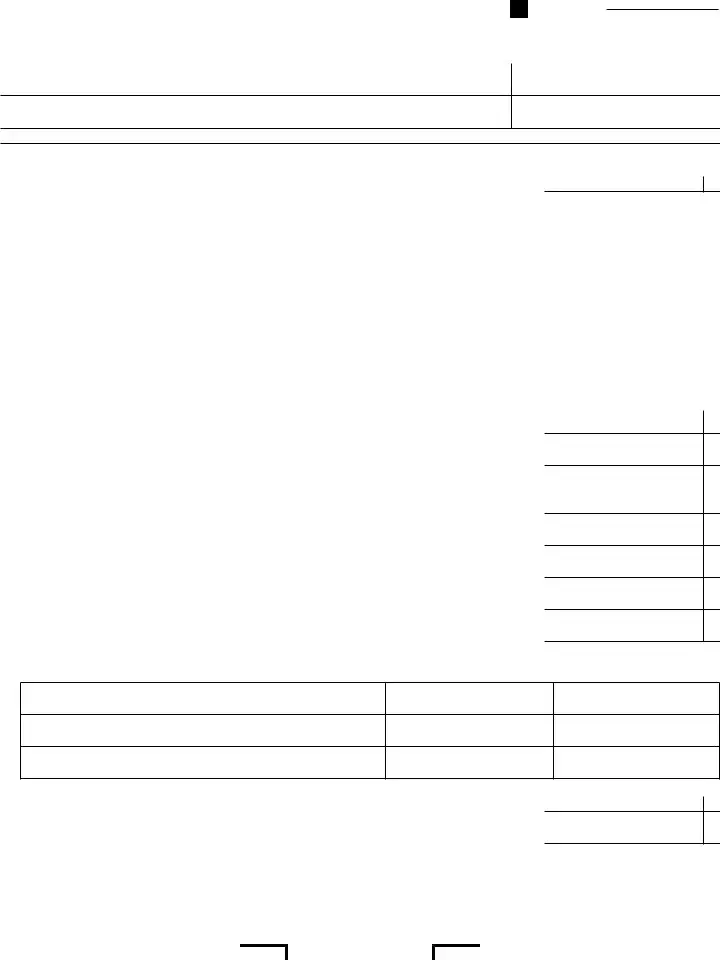

Part II Carryover Computation

12a Credit claimed. Enter the amount of the credit claimed on the current year tax return.

See instructions. . . . . . . . . . . . . . . . . . 對 . |

. . . . . . . . . . . . . . . .12a |

(Do not include any assigned credit claimed on form FTB 3544, |

Part B.) |

12b Total credit assigned. Enter the total amount from form FTB 3544, Part A, column (g).

If you are not a corporation, enter

13 Credit carryover available for future years. Add line 12a and line 12b, subtract the result from line 11 . . 13

00

00

00

Part III Basis Recomputations. Complete this part only if the basis in a project or building has decreased. Use additional sheets if necessary.

14Date building was placed in service (month/year) . . . . .

15 BIN . . . . . . . . . . . . . . . . . 對 . . . . .

16Eligible basis of building. See General Information C . . . .

17

18Qualified basis of

by line 17 . . . . . . . . . . . . . . . . . 對 . . .

19Applicable percentage. See General Information B . . . . .

20Multiply line 18 by line 19. See Specific Line Instructions for Part I, line 2 . . . . . . . . . . . . . . . . . 對 . .

14

15

16

17

18

19

20

(a)

Building 1

(b)

Building 2

(c)

Total

|

Side 2 FTB 3521 2020 |

7302203 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The California Form 3521 is used to calculate the Low-Income Housing Credit for the tax year. |

| Governing Laws | The form is governed by California Revenue and Taxation Code Section 17058, which outlines the Low-Income Housing Credit program. |

| Submission Requirement | This form must be attached to the California tax return and is specific to the taxpayer's identification numbers. |

| Part III Requirement | Completion of Part III is necessary only if there has been a decrease in the eligible basis of any project after receiving Form CTCAC 3521A. |

Guidelines on Utilizing California 3521

Completing the California 3521 form involves providing essential information that relates to your low-income housing credit. It is important to gather all necessary details beforehand to ensure a smooth filling process. The completion of this form is essential as it allows you to report and claim the available tax credits for your projects effectively.

- TAXABLE YEAR: Fill in the year for which you are claiming the low-income housing credit at the top of the form.

- Name(s): Enter your name(s) as they appear on your California tax return.

- Identification Numbers: Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), California Corporation number, or Federal Employer Identification Number (FEIN) in the appropriate boxes.

- Building Identification Number (BIN): Enter your building identification number. If there are multiple buildings, attach a separate list with all BINs for this credit.

- California SOS File Number: Include your Secretary of State file number, if applicable.

- Has the eligible basis decreased?: Answer "Yes" or "No" to the question regarding any change in the eligible basis since you received form CTCAC 3521A. If yes, complete Part III before proceeding.

- Current Year Credit: Follow the instructions provided to compute your current year credit and enter the amount on line 2.

- Affiliated Credit Entries: If applicable, enter the details for affiliated corporations or pass-through credits in the designated sections, filling out the entity's name, identification numbers, and total amount of credits.

- Total Pass-Through Credit: Calculate the total pass-through low-income housing credit and enter it in line 3.

- Current Year Low-Income Housing Credit: Add the amounts from line 2 and line 3, and record the sum on line 4.

- Passive Activities: Indicate any amount from line 4 that originates from passive activities on line 5. If there are none, simply enter “-0-.”

- Allowable Credit Calculation: Subtract the passive activity amount from line 4 and record the result on line 6.

- Low-Income Housing Credit Carryover: Enter any carryover amounts from previous years on line 8.

- Total Available Credit: Add lines 6, 7, and 8 together, and place the result on line 9.

- Allocated Credits (Corporations Only): If applicable, record the low-income housing credit amounts allocated to affiliated corporations on line 10. If you are not a corporation, enter “-0-.”

- Final Credit Calculation: Subtract line 10 from line 9 to determine your total available low-income housing credit and enter this amount on line 11.

- Credit Claimed: Report the credit claimed on your current year tax return on line 12a.

- Total Credit Assigned: Document any total amount from form FTB 3544, Part A, column (g) on line 12b. If not applicable, enter “-0-.”

- Future Year Carryover Calculation: Add lines 12a and 12b, then subtract this total from line 11, placing the final figure on line 13.

- Part III (if applicable): If applicable, complete Part III regarding basis recomputations for any projects or buildings with decreased basis.

What You Should Know About This Form

What is California Form 3521?

California Form 3521 is the Low-Income Housing Credit form used by taxpayers who are eligible for tax credits related to affordable housing projects. This form must be attached to a California tax return and provides a mechanism for reporting various aspects of the low-income housing credit claimed for the tax year.

Who needs to file Form 3521?

Any taxpayer who has claimed a low-income housing credit in the state of California must file Form 3521. This includes individuals, corporations, and partnerships that own or invest in qualifying low-income housing projects. It ensures proper reporting and allocation of credits received during the taxable year.

What information is required on Form 3521?

The form requires a variety of information including your name or business name, Social Security Number (SSN) or Employer Identification Number (EIN), and a unique Building Identification Number (BIN) for each project. Additionally, it involves calculations regarding the eligible basis and the current year credits, including any credits carried over from previous years.

How do I determine the current year low-income housing credit?

To find the current year low-income housing credit, combine the amounts reported on line 2 and line 3 of the form. Line 2 reflects the current year credit, while line 3 involves any affiliated credits from other entities. Subtract any passive activity amounts to arrive at a precise total for the current year credit.

What should I do if my project's eligible basis has decreased?

If the eligible basis of your project or building has decreased since receiving Form CTCAC 3521A, complete Part III of Form 3521. This part will require a recalculation of credits based on the new lower basis, ensuring correct reporting and compliance with California tax regulations.

Can I carry over unused credits to future years?

Yes, any unused credits can often be carried over to future years. In Part II of Form 3521, you will enter the credit claimed for the current year and any total credits assigned. The form will help you calculate the amount available for carryover, which can be used to offset future tax liabilities.

Where do I submit Form 3521?

Form 3521 must be attached to your California state tax return, which is typically submitted to the Franchise Tax Board. Ensure that you keep copies of all related documentation for your records in case of future audits or inquiries.

Common mistakes

Filling out the California 3521 form can be a straightforward process, but many people make common mistakes that can lead to delays or errors in tax credits. Understanding these pitfalls is essential for ensuring that the application is completed correctly.

One of the most frequent errors involves incomplete identification information. Applicants often forget to include their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This information is crucial as it directly ties the credit to the correct taxpayer.

Another common mistake is failing to accurately report the building identification number (BIN). If you own more than one building, not attaching a list of all BINs can result in a denial of credits. Each building needs proper identification for the credit allocation process.

Many individuals do not fully understand the need for updating if the eligible basis of any project has decreased. If you answer 'Yes' to this question in Part I, it's imperative to complete Part III, which details necessary recomputations of the basis. Ignoring this can lead to incorrect calculations of available credits.

A frequently overlooked section is line 3, which asks for credits from affiliated corporations or pass-through entities. Not reporting these correctly can understate the total credits available. Completeness in this area can significantly enhance your total credit claim.

Some people mistakenly enter a total for line 4 without considering whether any of the amounts came from passive activities. If you do not have any credits from passive activities, it is essential to enter -0- on line 5 accurately. Failing to do so can alter the calculations unfavorably.

Line 10, meant for corporations to report credits allocated to affiliated corporations, often confuses individuals who do not operate as corporations. If you are not a corporation, you should not leave this line blank but instead enter -0-. Misinterpretation here can result in an incorrect total.

Clearly, errors can occur when individuals do not carefully follow the instructions provided for each line item. Reading and understanding the guidelines is crucial for ensuring that all necessary information is included and accurately reported.

Lastly, failing to double-check calculations is a recurring error. Numbers in different sections of the form must correlate accurately. A simple miscalculation can lead to delays in credit approval or, worse, rejection of your claim altogether.

By being aware of these common mistakes, taxpayers can take the necessary precautions to navigate the California 3521 form with confidence and clarity. Proper preparation and attention to detail can lead to a smoother process and a successful outcome.

Documents used along the form

The California Form 3521 is primarily used to claim the Low-Income Housing Credit. It often accompanies other forms and documents that are essential for accurate tax reporting. Below is a list of additional forms that may be required, each serving a distinct purpose in the tax preparation process.

- California Form 3544: This form is used for assignment of tax credits. If you decide to transfer any credits to another party, this form will facilitate that process. It details the credits being assigned and must be completed carefully to ensure proper credit allocation.

- Schedule K-1: This document is used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. You will receive a K-1 from any entity that you share ownership with, which outlines your proportion of income that may affect your tax liability.

- California Form 540: This is the standard California resident income tax return form. You will file this form to report your overall income, including any low-income housing credits you are claiming, and to calculate your tax obligation.

- Partnership Return (Form 565): If your housing project is managed through a partnership, this form is crucial. It reports the partnership's income and expenses, providing transparency for the income that will eventually be passed through to partners.

- California Corporation Tax Return (Form 100): Corporations that deal with low-income housing credits will need to file this form. It captures the corporation's taxable income and identifies the applicable credits, including those passed through from partnerships.

- IRS Form 8586: This is the federal version of the Low-Income Housing Credit form. While focusing on federal taxes, it provides critical information that supports your California credit claim and ensures that necessary data aligns across state and federal filings.

When preparing your tax documents, ensure that you gather all necessary forms and supporting documentation. Accuracy is crucial to prevent delays or issues with your tax filings. Each form plays a vital role in the overall tax landscape, particularly for low-income housing projects.

Similar forms

-

California Form 3508: This form is used for the Paycheck Protection Program (PPP) loan forgiveness application. Like the California Form 3521, which deals with low-income housing credits, Form 3508 also considers the financial benefits directed toward specific economic objectives, primarily focusing on the retention of employees and the economic impact on local communities.

-

California Form 3522: This form relates to the Low-Income Housing Tax Credit and is filed to claim credits for specific housing projects. Its similarity with Form 3521 lies in both forms aiming to provide tax relief for housing initiatives, thus facilitating affordable housing construction and rehabilitation.

-

California Schedule K-1 (Form 541): Used by partnerships and S corporations, this form reports income, deductions, and credits to be passed through to partners or shareholders. Similar to Form 3521, it allows tax credits related to specific investments, including low-income housing, to be reported and deducted by individuals who contribute to those entities.

-

Form 8839: This form serves to apply for the adoption tax credit. Both Form 8839 and Form 3521 provide avenues for claiming tax benefits, with a focus on furthering specific social objectives, such as supporting families and affordable living spaces.

-

California Form 588: This form is used for the withholding on the sale of California real estate. Like Form 3521, it requires specific identification of the property involved and aims to ensure proper taxation on transactions that can impact the availability of affordable housing.

-

Form 8901: This form relates to the claims for the qualified rehabilitation expenditures tax credit. Both Form 8901 and Form 3521 support initiatives aimed at enhancing housing quality through tax incentives while adhering to regulations under federal and state tax systems.

-

California Form 540: This is the California Resident Income Tax Return form. Like Form 3521, Form 540 includes sections where residents can report credits and deductions related to their financial activities, including housing credits, thereby reflecting the overall tax responsibility of the individual.

Dos and Don'ts

When completing the California 3521 form for the Low-Income Housing Credit, it’s essential to ensure that the process is smooth and efficient. Here are nine key dos and don'ts to guide you:

- Do carefully review the form instructions before you start filling it out. Understanding the requirements will help you avoid mistakes.

- Do ensure that your name and taxpayer identification numbers (SSN or ITIN) match exactly as they appear on your California tax return.

- Do double-check all numbers and calculations. Mistakes in your figures can delay processing and could impact your credit.

- Do include any additional building identification numbers if you are working with multiple properties. Attach a list if necessary.

- Do keep copies of all documents you submit. This documentation is crucial for future reference.

- Don’t skip the sections that may not seem applicable at first glance. Each part serves a purpose and skipping ahead could lead to issues.

- Don’t forget to report the amount of low-income housing credit allocated to affiliated corporations if you are a corporation.

- Don’t leave any fields blank unless instructed to do so, as this can raise red flags during the review process.

- Don’t rush through the form. Taking your time can save you the headache of correcting errors later.

Approaching the California 3521 form with care can significantly impact your tax experience, ensuring you receive the benefits you’re entitled to without unnecessary delays.

Misconceptions

Understanding the California Form 3521, a critical document related to the Low-Income Housing Credit, often leads to confusion. This arises from some common misconceptions that can affect how individuals and organizations approach its completion. This list breaks down four prevalent misconceptions and clarifies each one.

- Misconception 1: The form applies only to newly constructed properties.

- Misconception 2: Credit can only be claimed if the project is fully completed.

- Misconception 3: The form is uniform for all taxpayers.

- Misconception 4: Once submitted, the form cannot be amended.

Many believe that the California Form 3521 is exclusively for newly built low-income housing. In reality, it applies to both new constructions and existing buildings that meet eligibility requirements for low-income housing credits. This broader scope allows various projects to benefit from the credits, fostering a more diverse approach to affordable housing.

Another common myth is that the low-income housing credit is only accessible when a project is completely finished. Contrary to this belief, credits can often be claimed during various stages of a project's development, as long as the eligibility criteria are met at those stages. Therefore, stakeholders should maintain awareness of credit opportunities throughout the development process.

Some assume that the California Form 3521 is a one-size-fits-all document. However, the requirements can differ significantly based on whether an individual or corporation is filing. Specific details, such as affiliated credits and tax identification numbers, vary in each case, necessitating a tailored approach to completing the form.

Lastly, there is a belief that submitted forms are final and cannot be revised. In fact, if discrepancies arise after submission, taxpayers can amend their forms as needed. Understanding this process can alleviate stress related to mistakes and help ensure the accurate reporting of information regarding low-income housing credits.

Key takeaways

- The California 3521 form is essential for claiming the Low-Income Housing Credit. Ensure it is attached to your California tax return for successful processing.

- Complete all relevant sections accurately, including your identification information and the building identification number (BIN). If claiming credits from multiple buildings, list all BINs as required.

- Before proceeding, confirm whether the eligible basis of your project has decreased. If it has, be sure to complete Part III of the form as it requires specific information regarding the basis recalculations.

- Calculate the credit carefully by adding up the current year credit and any pass-through credits from affiliated entities. This total affects your tax obligations and potential future carryovers.

Browse Other Templates

Rate of Respiration Virtual Lab Answer Key - Document your findings to illustrate the carbon cycle's function in aquatic systems.

Certificate of Good Standing Nys - Review the form for accuracy before submission to the Department of State.