Fill Out Your California 3522 Form

The California 3522 form, known as the LLC Tax Voucher, plays a crucial role in helping limited liability companies (LLCs) comply with state tax obligations. Each year, LLCs that conduct business in California or possess articles of organization must submit an annual tax payment of $800. This requirement applies to both newly formed LLCs and those that are registered with the California Secretary of State. To ensure a smooth process, payment can be made electronically through various convenient methods, such as tax preparation software, online through Web Pay, or via credit card. It is important to meet the tax payment deadline, which falls on the 15th day of the 4th month after the beginning of the LLC's taxable year to avoid penalties and interest. Certain exceptions apply, granting exemptions for specific types of LLCs, such as small businesses owned by deployed service members. Furthermore, the form has distinct requirements for those operating a Series LLC and provides guidance on how to properly complete and submit the voucher. Understanding the nuances of the California 3522 form is essential for compliance and financial planning for all LLCs doing business in the Golden State.

California 3522 Example

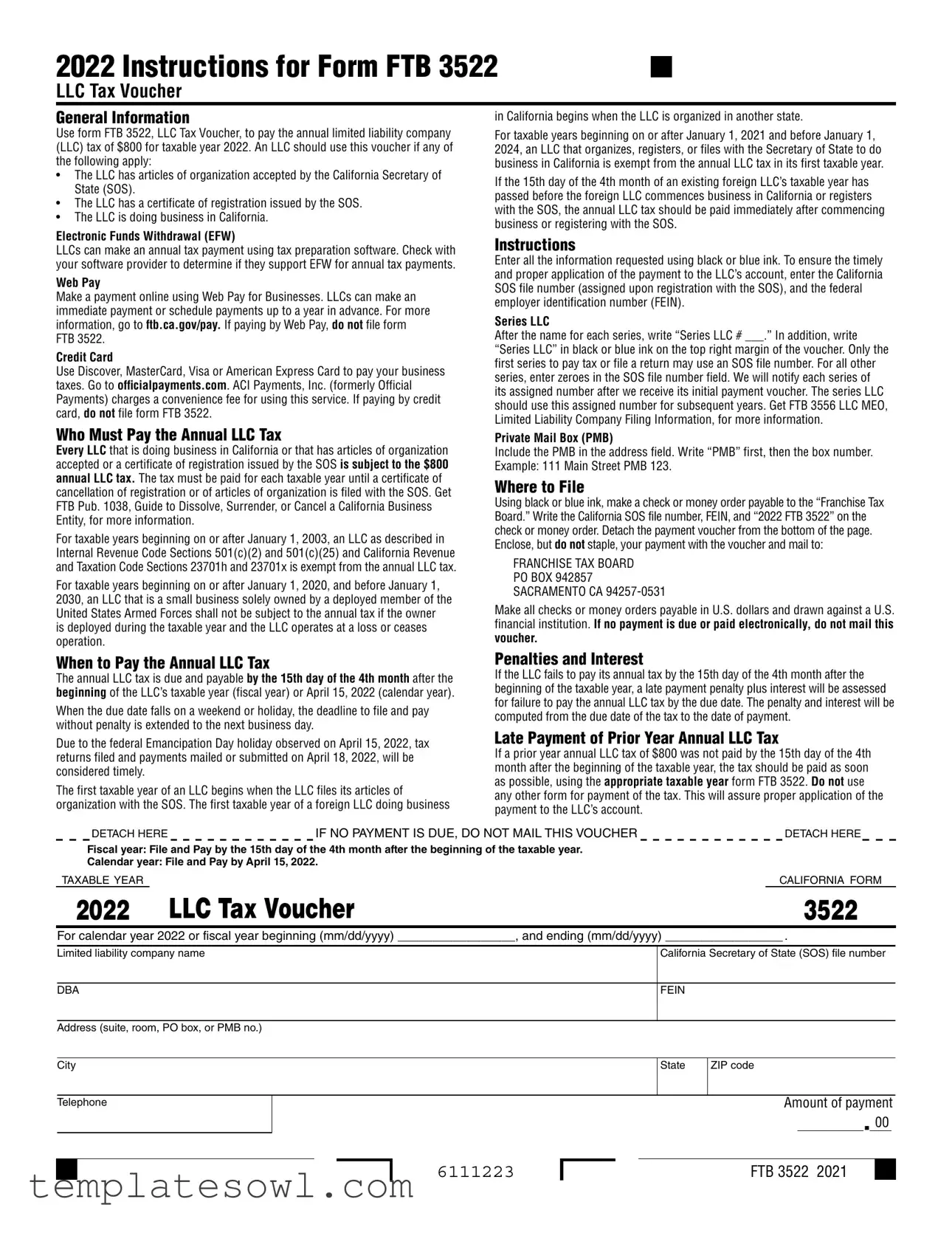

2022 Instructions for Form FTB 3522

LLC Tax Voucher

General Information

Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2022. An LLC should use this voucher if any of the following apply:

•The LLC has articles of organization accepted by the California Secretary of State (SOS).

•The LLC has a certificate of registration issued by the SOS.

•The LLC is doing business in California.

Electronic Funds Withdrawal (EFW)

LLCs can make an annual tax payment using tax preparation software. Check with your software provider to determine if they support EFW for annual tax payments.

Web Pay

Make a payment online using Web Pay for Businesses. LLCs can make an immediate payment or schedule payments up to a year in advance. For more information, go to ftb.ca.gov/pay. If paying by Web Pay, do not file form FTB 3522.

Credit Card

Use Discover, MasterCard, Visa or American Express Card to pay your business taxes. Go to officialpayments.com. ACI Payments, Inc. (formerly Official Payments) charges a convenience fee for using this service. If paying by credit card, do not file form FTB 3522.

Who Must Pay the Annual LLC Tax

Every LLC that is doing business in California or that has articles of organization accepted or a certificate of registration issued by the SOS is subject to the $800 annual LLC tax. The tax must be paid for each taxable year until a certificate of cancellation of registration or of articles of organization is filed with the SOS. Get FTB Pub. 1038, Guide to Dissolve, Surrender, or Cancel a California Business Entity, for more information.

For taxable years beginning on or after January 1, 2003, an LLC as described in Internal Revenue Code Sections 501(c)(2) and 501(c)(25) and California Revenue and Taxation Code Sections 23701h and 23701x is exempt from the annual LLC tax.

For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business solely owned by a deployed member of the United States Armed Forces shall not be subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation.

When to Pay the Annual LLC Tax

The annual LLC tax is due and payable by the 15th day of the 4th month after the beginning of the LLC’s taxable year (fiscal year) or April 15, 2022 (calendar year).

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely.

The first taxable year of an LLC begins when the LLC files its articles of organization with the SOS. The first taxable year of a foreign LLC doing business

in California begins when the LLC is organized in another state.

For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year.

If the 15th day of the 4th month of an existing foreign LLC’s taxable year has passed before the foreign LLC commences business in California or registers with the SOS, the annual LLC tax should be paid immediately after commencing business or registering with the SOS.

Instructions

Enter all the information requested using black or blue ink. To ensure the timely and proper application of the payment to the LLC’s account, enter the California SOS file number (assigned upon registration with the SOS), and the federal employer identification number (FEIN).

Series LLC

After the name for each series, write “Series LLC # ___.” In addition, write “Series LLC” in black or blue ink on the top right margin of the voucher. Only the first series to pay tax or file a return may use an SOS file number. For all other series, enter zeroes in the SOS file number field. We will notify each series of its assigned number after we receive its initial payment voucher. The series LLC should use this assigned number for subsequent years. Get FTB 3556 LLC MEO, Limited Liability Company Filing Information, for more information.

Private Mail Box (PMB)

Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Where to File

Using black or blue ink, make a check or money order payable to the “Franchise Tax Board.” Write the California SOS file number, FEIN, and “2022 FTB 3522” on the check or money order. Detach the payment voucher from the bottom of the page. Enclose, but do not staple, your payment with the voucher and mail to:

FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA

Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution. If no payment is due or paid electronically, do not mail this voucher.

Penalties and Interest

If the LLC fails to pay its annual tax by the 15th day of the 4th month after the beginning of the taxable year, a late payment penalty plus interest will be assessed for failure to pay the annual LLC tax by the due date. The penalty and interest will be computed from the due date of the tax to the date of payment.

Late Payment of Prior Year Annual LLC Tax

If a prior year annual LLC tax of $800 was not paid by the 15th day of the 4th month after the beginning of the taxable year, the tax should be paid as soon as possible, using the appropriate taxable year form FTB 3522. Do not use any other form for payment of the tax. This will assure proper application of the payment to the LLC’s account.

DETACH HERE |

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER |

DETACH HERE |

Fiscal year: File and Pay by the 15th day of the 4th month after the beginning of the taxable year. |

|

|

Calendar year: File and Pay by April 15, 2022. |

|

|

TAXABLE YEAR |

|

CALIFORNIA FORM |

2022 |

LLC Tax Voucher |

3522 |

For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) _________________, and ending (mm/dd/yyyy) _________________ .

Limited liability company name

DBA

California Secretary of State (SOS) file number

FEIN

Address (suite, room, PO box, or PMB no.)

City

Telephone

State |

ZIP code |

Amount of payment

. 00

6111223

FTB 3522 2021

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | Form FTB 3522 is used to pay the annual limited liability company (LLC) tax of $800 for the taxable year 2022. |

| Eligibility | An LLC must use this form if it has articles of organization accepted by the California Secretary of State, a certificate of registration issued, or is doing business in California. |

| Payment Methods | LLCs may pay using Electronic Funds Withdrawal, Web Pay, or credit card options. If using Web Pay or a credit card, do not file Form FTB 3522. |

| Due Date | The annual LLC tax is due on April 15, 2022, or by the 15th day of the 4th month after the start of the LLC's taxable year. |

| Governing Laws | California Revenue and Taxation Code Sections 17941 and 17942 govern the payment of the annual LLC tax. |

| Penalties | Late payments incur penalties and interest, calculated from the due date to when payment is made. |

| Exemptions | Exemptions exist for certain LLCs, including those with deployments that operate at a loss or cease operations if under specific conditions. |

Guidelines on Utilizing California 3522

To complete the California Form 3522, follow these concise steps. Ensure you have all necessary information ready. Fill in the form carefully, as accurate information is crucial for timely processing.

- Obtain the California Form 3522. This can be downloaded from the California Franchise Tax Board (FTB) website.

- Using black or blue ink, enter the **taxable year** for your LLC in the designated space. Confirm whether it’s for the calendar year or a fiscal year.

- Fill in your **limited liability company (LLC) name** and any **doing business as (DBA)** name, if applicable.

- Write your **California Secretary of State (SOS) file number**. This number was assigned when you registered your LLC.

- Provide your **Federal Employer Identification Number (FEIN**). If you do not have a FEIN, enter 000-00-0000.

- In the address field, include your mailing address. If you have a Private Mail Box (PMB), write “PMB” first, followed by the box number.

- Enter your **city**, **state**, and **ZIP code** in the appropriate fields.

- Clearly state the **amount of payment**. Confirm that the amount is $800, to cover the annual LLC tax.

- Detach the payment voucher from the bottom of the form.

- Make your check or money order payable to the **“Franchise Tax Board”**. Write your SOS file number, FEIN, and “2022 FTB 3522” on the check or money order.

- Enclose the payment with the voucher, but do not staple them together.

- Mail the payment voucher and check to the address provided:

**FRANCHISE TAX BOARD**

**PO BOX 942857**

**SACRAMENTO CA 94257-0531**

After submitting the form, keep a copy for your records. If you pay electronically using Web Pay or a credit card, do not submit Form 3522. Ensure your payment is made by the deadline to avoid penalties.

What You Should Know About This Form

What is the purpose of the California 3522 form?

The California 3522 form, known as the LLC Tax Voucher, is used to pay the annual limited liability company (LLC) tax of $800 for the taxable year 2022. If your LLC is registered with the California Secretary of State or is doing business in California, this form is necessary to fulfill your tax obligation.

Who needs to file the California 3522 form?

Any LLC that has articles of organization accepted by the California Secretary of State or has a certificate of registration issued by the Secretary of State must file this form. This includes LLCs operating in California. The $800 tax applies until you file a certificate of cancellation, regardless of business activity.

When is the payment due for the annual LLC tax?

The payment is due by the 15th day of the 4th month after the start of your taxable year. For most calendar year LLCs, this means your payment is due by April 15, 2022. If the due date falls on a weekend or holiday, you can pay on the next business day without facing penalties.

What happens if I miss the payment deadline?

If the annual LLC tax is not paid on time, the LLC faces a penalty in addition to interest on the overdue amount. The late fee will be calculated from the original due date until the payment is made. It's crucial to pay on time to avoid these extra costs.

Can I pay the LLC tax online?

Yes, you can make your payment online through Web Pay for Businesses. This allows for immediate or scheduled payments. If you choose to pay online, you do not need to file the California 3522 form.

Are there any exemptions from the annual LLC tax?

Yes, certain LLCs may be exempt from the $800 tax. For instance, LLCs categorized under specific sections of the Internal Revenue Code may qualify for exemption. Additionally, if the LLC is a small business solely owned by a deployed service member and operates at a loss during the taxable year, it may also be exempt.

How do I fill out the California 3522 form correctly?

Make sure to use black or blue ink when filling out the form. Enter the California Secretary of State file number and the federal employer identification number (FEIN) accurately. If applicable, write “Series LLC” and the series number on the form. Double-check all entries for accuracy to ensure proper processing.

Where should I send the completed form?

After completing the voucher and checking all information, mail it with your payment (check or money order) to the Franchise Tax Board at the specified address. Make your check payable to the “Franchise Tax Board” and include essential numbers on it, such as your SOS file number and FEIN.

What if no payment is due?

If no payment is due, you don’t need to mail the voucher. It is specifically for those making a payment. Ensure you review your LLC’s obligations and whether a payment is needed.

Common mistakes

Filling out the California 3522 form can be straightforward, but mistakes can easily happen. One common error is failing to include the California Secretary of State (SOS) file number and the federal employer identification number (FEIN). These identifiers are crucial for the processing of your payment. If these numbers are omitted, the payment may not be correctly applied to your LLC’s account, leading to potential penalties.

Another mistake involves using the wrong ink color. The instructions specify to use black or blue ink. Using other colors can lead to confusion or misinterpretation of the form. Ensuring the right ink is used contributes to a smoother processing experience.

Some people forget to write "Series LLC" on the top right margin of the voucher when filing for a Series LLC. Each series of a Series LLC must adhere to specific filing rules, including marking the form properly. Skipping this step can result in complications in filing and payments.

Moreover, incorrectly entering the payment amount is another frequent oversight. Double-check that the payment amount reflects the annual $800 tax as required. Errors in the payment amount can trigger delays or miscalculations in processing your tax obligations.

In addition, failing to include your Private Mail Box (PMB) correctly can cause issues. Remember to write "PMB" first, followed by the box number. Incorrectly formatted address details may lead to the processing center not being able to reach the LLC or worse, the payment may be misdirected.

Lastly, some individuals mail the form even if they have made their payment electronically. If you pay via Web Pay or credit card, do not file form FTB 3522. Filing the form when payment isn’t necessary clogs the processing system and can cause unnecessary confusion regarding your tax status.

Documents used along the form

The California 3522 form, known as the LLC Tax Voucher, is an essential document for Limited Liability Companies (LLCs) operating in California. In addition to this form, various other documents and forms may be used to ensure compliance with state regulations and obligations. Below is a list of related forms that are often utilized in conjunction with the California 3522.

- California Form 568: This is the Limited Liability Company Return of Income. LLCs are required to file this form annually to report their income, deductions, and other financial information to the state. It helps determine the LLC’s tax liabilities beyond the annual tax.

- California Form 3522 Instructions: The instructions for completing Form 3522 provide detailed guidance on how to accurately fill out the LLC tax voucher. Understanding these instructions helps avoid common errors that could result in penalties or miscalculations.

- California Form 3556: This form is used to report Limited Liability Company MEO (Miscellaneous Entity Operations) information. It includes various operational details that may be required in conjunction with the annual tax payment.

- Certificate of Dissolution: LLCs that choose to cease operations must file this certificate with the California Secretary of State. It officially dissolves the LLC and may relieve the company of future tax obligations.

- Request for Taxpayer Identification Number (Form W-7): If an LLC needs to obtain a Taxpayer Identification Number (TIN) or an Employer Identification Number (EIN), it must complete this form. A TIN or EIN is necessary for filing taxes and conducting business activities.

- FTB Publication 1038: This publication serves as a guide for LLCs intending to dissolve, surrender, or cancel their registration in California. It provides important information about the process and necessary steps to ensure compliance.

Completing and submitting the appropriate forms ensures that an LLC adheres to California’s tax regulations and fulfills its obligations as a business entity. Understanding the roles of these documents can facilitate a smoother filing process and help maintain compliance with state laws.

Similar forms

The California Form FTB 3522, known as the LLC Tax Voucher, bears similarities to several other documents associated with business entity tax payments in California. The following is a list of documents that share common elements with Form FTB 3522:

- California Form 568: This is the Limited Liability Company Return of Income. Like Form FTB 3522, it is used by LLCs to report income and calculate taxes owed, though Form 568 addresses overall tax obligations rather than solely payment of the annual tax.

- California LLC Articles of Organization (Form LLC-1): This document is filed to officially create an LLC in California. It indicates establishing an LLC, leading to requirements, such as the payment of the annual LLC tax using FTB 3522.

- California Franchise Tax Board Form FTB 701: This is the application for a Certificate of Registration for foreign LLCs. It helps ensure compliance with California regulations, similar to how the FTB 3522 ensures tax payment compliance for LLCs operating within the state.

- California Form 100S: This is the California S Corporation Franchise Tax Return. Both forms serve as tax reporting for businesses and establish tax obligations for entities detected doing business in California.

- California Statement of Information (Form LLC-12): This form is required to provide updated information about an LLC. It does not involve direct taxes like Form FTB 3522 but maintains compliance with state requirements related to official business status.

- California Form 3520: This is the Annual Tax Return for LLCs taxed as corporations. LLCs operating under this option also need to file Form 3522 to resolve their respective annual tax obligations.

- California Form 540: This is the California Resident Income Tax Return. While focused on individual taxpayers, the form indicates the tax obligations of individuals who may also have ownership interests in LLCs, necessitating an understanding of the LLC tax payments made via Form FTB 3522.

Dos and Don'ts

When filling out the California 3522 form, attention to detail is crucial. Here are some key do's and don'ts to keep in mind:

- Do use black or blue ink to fill out the form.

- Do include the California Secretary of State (SOS) file number and the federal employer identification number (FEIN).

- Do write "PMB" first when including a Private Mail Box (PMB) in the address field.

- Do ensure that the payment is enclosed but not stapled to the voucher.

- Don't forget to sign and date the voucher before mailing it.

- Don't file the form if you are paying through Web Pay or by credit card, as these methods do not require submission of the 3522 form.

- Don't mail the form if no payment is due or if payment has already been made electronically.

- Don't ignore deadlines; ensure payment is made by the 15th day of the 4th month for fiscal years or by April 15 for calendar years to avoid penalties.

By following these guidelines, you can help ensure a smooth and efficient filing process for the California 3522 form.

Misconceptions

Misunderstandings about the California 3522 form can lead to confusion about responsibilities. Here are eight common misconceptions, explained clearly.

- Only newly formed LLCs need to submit Form 3522. All LLCs doing business in California or having accepted articles of organization must submit this form, regardless of when they were formed.

- Paying via Web Pay means you still need to file Form 3522. If you make a payment through Web Pay, you do not need to file Form 3522.

- All LLCs pay the same amount regardless of revenue. While the standard annual tax is $800, certain exemptions apply, impacting the amount owed.

- An LLC can ignore the annual tax if it operates at a loss. Even if an LLC operates at a loss, it may still be required to pay the $800 annual tax unless exempted under specific conditions.

- Payments must always be made by check or money order. Credit card payments are accepted through officialpayment.com, but this method does not require filing Form 3522.

- The due date is the same for all LLCs. The due date depends on whether an LLC follows a calendar or fiscal year, impacting when payment is due.

- Once Form 3522 is submitted, no follow-up is necessary. LLCs may face penalties for late payment or failure to follow up if their situation changes.

- The first taxable year is fixed. The start of an LLC's taxable year can change based on when it files articles of organization or registers to do business in California.

Understanding these points helps clarify the responsibilities surrounding Form 3522 and the annual LLC tax in California.

Key takeaways

When filling out and using the California 3522 form, keep the following key points in mind:

- Purpose of the Form: This form is used to pay the annual $800 tax for limited liability companies (LLCs) operating in California.

- Eligibility: Complete the form if your LLC has articles of organization accepted by the California Secretary of State, is registered, or is conducting business in California.

- Payment Options: LLCs can pay online using Web Pay, with tax software supporting electronic funds withdrawal, or by credit card. Remember to skip filing the form if paying via Web Pay or credit card.

- Due Date: The annual tax is due on the 15th day of the 4th month after your LLC’s taxable year begins or by April 15, 2022, for calendar year filers. Deadline extensions apply for weekends and holidays.

- Filing Instructions: Make sure to fill out the form with black or blue ink, providing both the California SOS file number and the federal employer identification number (FEIN) accurately.

- Penalties for Late Payment: If the tax isn't paid by the due date, penalties and interest will apply, so aim to submit your payment on time.

- Special Exemptions: Some LLCs, such as those owned by deployed military members or certain exempt organizations, may qualify for a tax exemption based on specific criteria.

By following these takeaways, LLCs can navigate the California 3522 form process smoothly and meet their tax obligations efficiently.

Browse Other Templates

Registrar Gmu - Applicants must graduate from a Virginia Community College System college or Richard Bland College with an Associate's degree.

Fictitious Business Name Renewal Form,Fictitious Name Permit Renewal Notification,California Fictitious Name Update Application,Permit Renewal for Fictitious Medical Practice,Fictitious Name Permit Hold Release Form,California Fictitious Name Mainten - The applicant must print or type their name and provide their signature and license number.

Kaiser Fmla - Authorization can support applications for FMLA or disability certifications.