Fill Out Your California De 305 Form

The California DE-305 form plays an essential role in the probate process for individuals dealing with the estate of a decedent who has left behind real property of modest value, specifically property valued at $55,425 or less. This form, officially titled "Affidavit Re Real Property of Small Value," is used to affirm that the decedent’s estate does not require formal administration under California law. To complete the form accurately, a declarant must provide crucial information, such as the decedent’s name, date of death, and details about the property in question, including its legal description and Assessor’s Parcel Number. Additionally, it is necessary to include proof that at least six months have passed since the decedent's death, as well as documentation indicating that all known debts and expenses related to the decedent have been settled. The form also requires confirmation that the declarant is a successor of the decedent, which establishes their legal right to the property. An inventory and appraisal of the property must accompany the DE-305 form, affirming that the property's value aligns with the small estate exception. Completing this form accurately allows individuals to facilitate the transfer of the decedent's property without a lengthy court process, simplifying what can often be a complex and emotional undertaking.

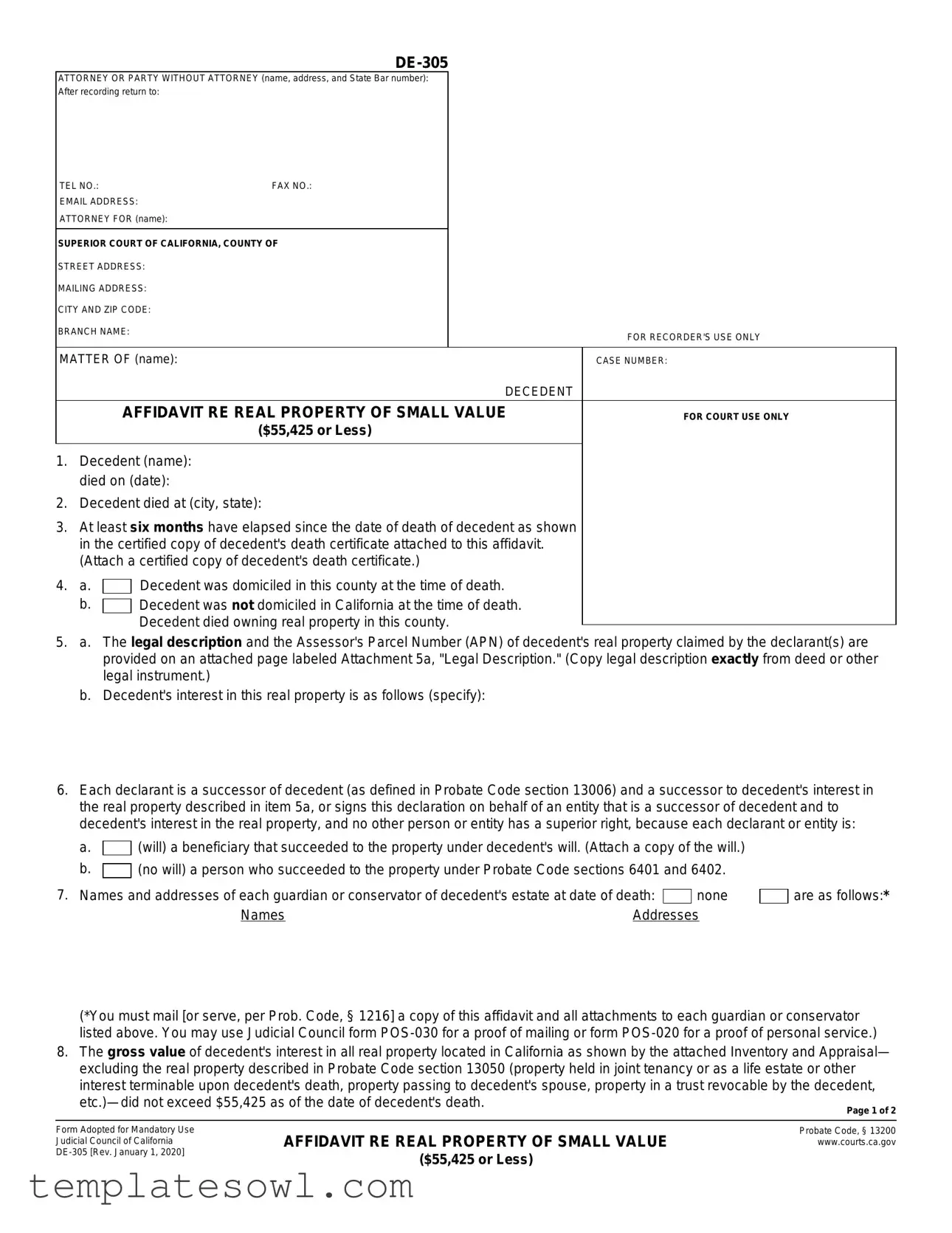

California De 305 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (name, address, and State Bar number):

After recording return to:

TEL NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

||

STREET ADDRESS: |

|

|

|

MAILING ADDRESS: |

|

|

|

CITY AND ZIP CODE: |

|

|

|

BRANCH NAME: |

|

|

FOR RECORDER'S USE ONLY |

|

|

|

|

|

|

|

|

MATTER OF (name): |

|

|

CASE NUMBER: |

|

|

DECEDENT |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE |

FOR COURT USE ONLY |

||

|

($55,425 or Less) |

|

|

1.Decedent (name): died on (date):

2.Decedent died at (city, state):

3.At least six months have elapsed since the date of death of decedent as shown in the certified copy of decedent's death certificate attached to this affidavit. (Attach a certified copy of decedent's death certificate.)

4.a.

Decedent was domiciled in this county at the time of death.

Decedent was domiciled in this county at the time of death.

b. Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

5.a. The legal description and the Assessor's Parcel Number (APN) of decedent's real property claimed by the declarant(s) are provided on an attached page labeled Attachment 5a, "Legal Description." (Copy legal description exactly from deed or other legal instrument.)

b.Decedent's interest in this real property is as follows (specify):

6.Each declarant is a successor of decedent (as defined in Probate Code section 13006) and a successor to decedent's interest in the real property described in item 5a, or signs this declaration on behalf of an entity that is a successor of decedent and to decedent's interest in the real property, and no other person or entity has a superior right, because each declarant or entity is:

a. (will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

(will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

b. (no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

(no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

7. Names and addresses of each guardian or conservator of decedent's estate at date of death: |

|

none |

|

are as follows:* |

|

|

|

||||

Names |

Addresses |

|

|

||

(*You must mail [or serve, per Prob. Code, § 1216] a copy of this affidavit and all attachments to each guardian or conservator listed above. You may use Judicial Council form

8.The gross value of decedent's interest in all real property located in California as shown by the attached Inventory and Appraisal— excluding the real property described in Probate Code section 13050 (property held in joint tenancy or as a life estate or other interest terminable upon decedent's death, property passing to decedent's spouse, property in a trust revocable by the decedent,

Form Adopted for Mandatory Use Judicial Council of California

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

MATTER OF (Name):

DECEDENT

CASE NUMBER:

9.An Inventory and Appraisal of all of decedent's interests in real property in California is attached. The appraisal was made by a probate referee appointed for the county in which the property is located. (You must prepare the Inventory on Judicial Council forms

10.No proceeding is now being or has been conducted in California for administration of decedent's estate.

11.Funeral expenses, expenses of last illness, and all known unsecured debts of the decedent have been paid. (NOTE: You may be personally liable for decedent's unsecured debts up to the fair market value of the real property and any income you receive from it.)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME)* |

|

|

|

|

(SIGNATURE OF DECLARANT) |

Date: |

|

|

|

||

|

|

|

|

|

|

(TYPE OR PRINT NAME)* |

|

|

(SIGNATURE OF DECLARANT) |

||

|

|

|

|

|

SIGNATURE OF ADDITIONAL DECLARANTS ATTACHED |

*A declarant claiming on behalf of a trust or other entity should also state the name of the entity that is a beneficiary under the decedent's will, and declarant's capacity to sign on behalf of the entity (e.g., trustee, Chief Executive Officer, etc.).

NOTARY ACKNOWLEDGMENT |

(NOTE: No notary acknowledgment may be affixed as a rider (small strip) to this page. If addi- |

|

tional notary acknowledgments are required, they must be attached as |

||

|

||

|

|

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA, COUNTY OF (specify):

On (date): |

, before me (name and title): |

personally appeared (name(s)): |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the instrument in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the |

|

(NOTARY SEAL) |

||

State of California that the foregoing paragraph is true and correct. |

|

|

||

WITNESS my hand and official seal. |

|

|

||

|

|

|

|

|

(SIGNATURE OF NOTARY PUBLIC) |

|

|

||

|

|

|

|

|

(SEAL) |

|

|

||

|

|

|

|

CLERK'S CERTIFICATE |

I certify that the foregoing, including any attached notary acknowledgments and any attached legal description of the property (but excluding other attachments), is a true and correct copy of the original affidavit on file in my office. (Certified copies of this affidavit do not include the

(1) death certificate, (2) will, or (3) inventory and appraisal. See Probate Code section 13202.)

Date: |

Clerk, by |

, Deputy |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

Page 2 of 2

For your protection and privacy, please press the Clear This Form button after you have printed the form.

Print this form

Save this form

Clear this form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The California DE-305 form serves as an affidavit regarding the real property of a decedent with a total value of $55,425 or less. |

| Governing Law | This form is governed by California Probate Code, specifically sections 13200 and 13006. |

| Eligibility Criteria | Only successors to a decedent's interest in real property can file this form, as defined in California Probate Code. |

| Attachment Requirement | A certified copy of the decedent's death certificate must be attached to the DE-305 form. |

| Property Valuation | The form requires that the gross value of the decedent's real property does not exceed $55,425 at the time of death. |

| Inventory Requirement | An Inventory and Appraisal that is prepared on Judicial Council forms DE-160 and DE-161 must be attached. |

| No Ongoing Administration | No proceedings for the administration of the decedent's estate should be occurring in California. |

| Debt Settlement | The form requires confirmation that all known unsecured debts, funeral expenses, and expenses of the last illness have been paid. |

| Notary Requirement | A notary public must acknowledge the signatures on the DE-305 form, ensuring the identity of the signatories is verified. |

Guidelines on Utilizing California De 305

Completing the California DE-305 form requires careful attention to detail. This affidavit is essential for establishing a claim to real property of small value. Here are the steps to fill out this form correctly:

- Provide your name, address, and contact information in the designated fields for Attorney or Party Without Attorney.

- Fill in the name of the decedent and the date of their death.

- Indicate the location (city and state) where the decedent passed away.

- Confirm that at least six months have passed since the decedent's death and attach a certified copy of the death certificate.

- State whether the decedent was domiciled in California at the time of their death.

- Include the legal description and the Assessor's Parcel Number (APN) of the decedent's real property in section 5a on an attached page labeled Attachment 5a, "Legal Description."

- Describe the decedent's interest in the real property in section 5b.

- Declare that each signer is a successor of the decedent, specifying whether a will exists or if the claim is under Probate Code sections 6401 and 6402.

- If applicable, list the names and addresses of any guardian or conservator involved with the decedent’s estate at the time of death.

- Calculate the gross value of the decedent’s real property interests in California, ensuring it does not exceed $55,425.

- Attach an Inventory and Appraisal form, ensuring it is completed by a probate referee.

- Indicate whether any estate administration proceedings have been initiated in California.

- Confirm that all funeral expenses and known unsecured debts of the decedent have been settled.

- Sign and date the affidavit, ensuring to include the type or print name under the signatures.

- If representing an entity, include the name of the entity and the declarant's role.

- Complete the notary acknowledgment section, verifying the identity of the signers.

Following these steps will help ensure you meet the requirements for submitting the form. Double-check all information for accuracy and completeness to avoid delays in processing.

What You Should Know About This Form

What is the purpose of the DE-305 form?

The DE-305 form, also known as the Affidavit Re Real Property of Small Value, is used in California to transfer real property ownership when the value of the property is $55,425 or less. This form serves as a legal declaration affirming that the person filing it has the right to claim the property following a decedent's death. It is especially useful for avoiding a lengthy probate process for smaller estates.

What are the eligibility requirements to file the DE-305 form?

To be eligible to file the DE-305 form, you must meet several criteria. Firstly, at least six months must have passed since the decedent's death. Additionally, the decedent must have been domiciled in California. You must also be a successor to the decedent's interest in the property, which can include being a beneficiary under the decedent’s will or being an heir under the intestate succession laws. It's essential that there are no ongoing proceedings for probate of the estate.

What documents need to be included with the DE-305 form?

When filing the DE-305, you are required to attach a certified copy of the decedent's death certificate. You must also include a legal description of the property, which should be copied exactly from the deed or other legal document. Additionally, an Inventory and Appraisal form must be attached to show the value of the property being claimed. This appraisal needs to be conducted by a probate referee.

What should I do if there are debts or expenses related to the decedent?

Before filing the DE-305 form, all known unsecured debts, funeral expenses, and expenses from the decedent’s last illness need to be settled. Under California law, you could be personally liable for these debts up to the fair market value of the property you inherit. It’s advisable to keep detailed records of all such expenses and payments to avoid future complications.

Is notarization required for the DE-305 form?

Yes, the DE-305 form requires notarization. This means that you need to have the document signed in the presence of a notary public, who will verify your identity and the signatures on the document. Ensure that the notarization is done correctly according to California law, as improper notarization can lead to delays or rejection of your filing.

What should I do after submitting the DE-305 form?

After submitting the DE-305 form, it is important to maintain a copy of the filed document for your records. Follow up with the court to ensure that the affidavit has been properly recorded. If you included the appropriate legal descriptions and other required documents, you can begin the process of claiming the property in your name. Always consult with a legal professional if you have any concerns or questions regarding your situation.

Common mistakes

Filling out the California DE-305 form can be straightforward, but many people make common mistakes that can lead to delays or complications. One frequent oversight is failing to provide a certified copy of the decedent’s death certificate. This document is a required attachment, and without it, the affidavit may be rejected. It's crucial to ensure that this important document is included.

An additional error involves inaccuracies in the legal description of the property. Section 5a of the form explicitly states that the legal description must be copied exactly from the deed or other legal instrument. Many individuals paraphrase or make assumptions about the details, leading to discrepancies that can cause legal issues. Always verify this information and attach the correct legal description to avoid problems.

Another common mistake is not addressing the successor status properly. Section 6 highlights that each declarant must clearly state their relationship to the decedent either as a beneficiary under the will or pursuant to specific sections of the Probate Code. Misunderstandings or omissions here can lead to disputes over property rights later. Ensure that all declarants are aware of their roles and complete this section accurately.

Many people underestimate the importance of notifying all guardians or conservators listed in the section concerning the decedent's estate. Not providing this information, or failing to serve copies of the affidavit to the relevant parties, can result in legal repercussions. Be proactive in sending the necessary documents to avoid any challenges down the line.

Another common error occurs in reporting the gross value of the decedent's interest in real property. When filling out Section 8, it is critical to ensure that the total value does not exceed the $55,425 threshold specified. Miscalculations can be costly. Take your time to accurately assess this value and consult resources if needed.

Also, many individuals neglect to prepare or attach the required Inventory and Appraisal. Section 9 indicates that this document is essential and must be completed correctly. Failing to include this can delay the processing of the affidavit. Seek assistance from a probate referee to ensure proper completion of this inventory.

People sometimes forget to check if any estate administration proceedings are currently in progress in California. Section 10 requires a clear declaration of this status. Not answering this question accurately could raise red flags and complicate the process. Always double-check whether any legal proceedings are pending.

Lastly, individuals often overlook the necessity of providing accurate identification and signatures. Each declarant must ensure that they sign in the correct capacity and state any relevant entity names if acting on behalf of a trust or corporation. Errors in this area can lead to the form being deemed incomplete. Attention to detail here is essential to finalize the affidavit correctly.

Documents used along the form

The California DE-305 form is an essential document for handling real estate matters when a decedent's property is valued at $55,425 or less. This form provides a streamlined way for heirs or beneficiaries to assert their rights to the property without going through a lengthy probate process. However, it's often accompanied by several other important forms and documents that help clarify the situation and ensure everything is legally compliant. Below are six commonly used forms related to the DE-305.

- Death Certificate: A certified copy of the decedent's death certificate is required to confirm the date of death. This document provides legal proof of death and establishes the timeline for the estate administration process.

- Will: If the decedent left behind a will, a copy must be attached to the DE-305. This document outlines the decedent's wishes regarding their assets and provides important context for how the property should be distributed.

- Inventory and Appraisal (DE-160 and DE-161): These forms detail all of the decedent's interests in real property located in California. They include a professional appraisal of the property, which is essential for showing the property value does not exceed the threshold of $55,425.

- Proof of Mailing (POS-030) or Personal Service (POS-020): When notifying guardians or conservators of the decedent’s estate, proof of mailing or service must be provided. This ensures that all parties are informed and have the opportunity to respond.

- Notary Acknowledgment: A notary public must acknowledge the signatures on the DE-305. This step is crucial because it confirms the identities of the signers and adds an extra layer of trust to the document.

- Clerk's Certificate: This certificate is provided by the court clerk and affirms that the DE-305 is a true and correct copy of the original document filed with the court. This certification is often necessary for any legal proceedings involving the property.

Accompanying the DE-305 with these related documents helps streamline the process of claiming a property and ensures compliance with California probate law. Being organized and thorough can make a significant difference in successfully navigating the complexities of estate matters.

Similar forms

The California DE-305 form, known as the Affidavit Regarding Real Property of Small Value, serves a specific purpose in the probate process. It allows heirs or successors to claim real property valued at $55,425 or less without going through a lengthy probate process. Several other legal documents share similarities with this form. Here are six such documents and how they are similar:

- California DE-310 - This is the Affidavit for Collection of Personal Property. Like the DE-305, it simplifies the transfer process, allowing heirs to collect personal property without formal probate if the total value does not exceed a specified limit.

- California DE-114 - This form is used for an Order to Show Cause for Change of Name. It requires a simple declaration similar to the DE-305, where the petitioner must confirm specific criteria to receive approval from the court.

- California DE-161 - The Inventory and Appraisal form assists in reporting the value of an estate's assets. Both DE-305 and DE-161 require detailed property descriptions and ensure that the value of the estate is accurately represented.

- California DE-220 - The Petition for Probate is a more comprehensive document, but it also initiates the probate process. Both documents address property ownership and the heirs' rights, although DE-220 starts a formal proceeding.

- California Form POS-030 - This Proof of Service form may be used in conjunction with the DE-305 to confirm that all relevant parties have been notified regarding the affidavit. Both forms emphasize the importance of proper notification in legal proceedings.

- California HC-100 - The Petition for Posthumous Birth Certificate is used to establish a child's rights to inherit. Like the DE-305, it requires proof of relationships and specific documentation to formalize claims regarding property or estates.

Dos and Don'ts

When filling out the California DE 305 form, it’s essential to approach the process with care. Below is a list of things you should and shouldn’t do:

- Do ensure accuracy: Carefully check all entries for any mistakes. Accurate information is crucial.

- Don’t leave blank spaces: Fill out every required field. If a question doesn’t apply to you, indicate that clearly.

- Do attach necessary documents: Include the death certificate and any additional attachments as required.

- Don’t forget signatures: Make sure all declarants have signed where necessary, as missing signatures can lead to delays.

- Do use clear and legible handwriting: Whether typing or writing, clarity makes the form easier to read and reduces errors.

- Don’t overlook the inventory requirement: Ensure you attach the inventory and appraisal as specified in the instructions.

- Do keep copies: Before submitting the form, make copies for your records. This is helpful for future reference.

Taking these steps will help facilitate a smoother process while filing the DE 305 form, ultimately making it easier for you during this challenging time.

Misconceptions

- Misconception 1: The DE-305 form can be used for any property value.

- Misconception 2: You don’t need to attach the decedent's death certificate.

- Misconception 3: The DE-305 can be filed at any time after the decedent's death.

- Misconception 4: Filing the DE-305 eliminates all debts of the decedent.

- Misconception 5: No appraisal is necessary for the property.

- Misconception 6: The form can be signed by anyone claiming a right to the property.

This form specifically applies only to real property valued at $55,425 or less. Higher-value properties require different legal procedures.

A certified copy of the decedent's death certificate must be attached to the DE-305 form to validate the claim.

You must wait at least six months after the decedent's death before filing this form. This helps ensure that any claims against the estate can be addressed.

The form does not absolve the decedent’s debts. All known unsecured debts, as well as funeral expenses, must be paid before proceeding.

An Inventory and Appraisal of the decedent's property is required. This must be conducted by a probate referee to ensure accuracy.

Only designated successors of the decedent can sign the DE-305. This ensures that all claims are legitimate and recognized under the law.

Key takeaways

The California DE-305 form is a crucial document used to affirm ownership of real property for individuals who have lost a loved one. Here are some key takeaways that can help in filling out and using this form.

- Understand the Purpose: The DE-305 is specifically designed for situations where the decedent's real property is valued at $55,425 or less.

- Check the Eligibility: Since it is meant for small estates, ensure that the total gross value of the decedent's property does not exceed the threshold amount.

- Gather Required Documents: A certified copy of the decedent's death certificate is mandatory and should be attached to the form.

- Identify Ownership: Clarify how the decedent owned the property, whether as part of a will or through succession laws, and provide necessary documentation.

- Inventory and Appraisal: Attach an Inventory and Appraisal of the decedent's interest in the property, as prepared by a probate referee.

- Complete All Sections: Ensure you fill in every section of the form accurately, including the legal descriptions and assessor's parcel number of the property.

- Notify Interested Parties: If applicable, all guardians or conservators of the decedent's estate at the time of death must be notified about the affidavit.

- Consider Debts: It is important to note that all known debts of the decedent must be settled before proceeding with the DE-305.

- Signatures are Essential: All declarants must provide their signatures on the form, confirming the truthfulness of the information provided.

- Notarization Required: The form must be notarized before submission, verifying the identities of those who signed.

Filling out the California DE-305 form correctly not only helps in the legal transfer of property but also ensures that the wishes of the decedent are honored without unnecessary complications.

Browse Other Templates

Seller Closing Checklist - Keep all documentation organized to streamline the closing process.

2016 R&D Tax Credit Application,PA Research and Development Tax Credit Form,Research and Development Expenditure Report,PA R&D Expenditures Application,Revitalization and Development Tax Credit Form,Commonwealth R&D Tax Credit Submission,2017 Researc - Returning applicants should confirm prior applications do not reflect any discrepancies.