Fill Out Your California De 4 Form

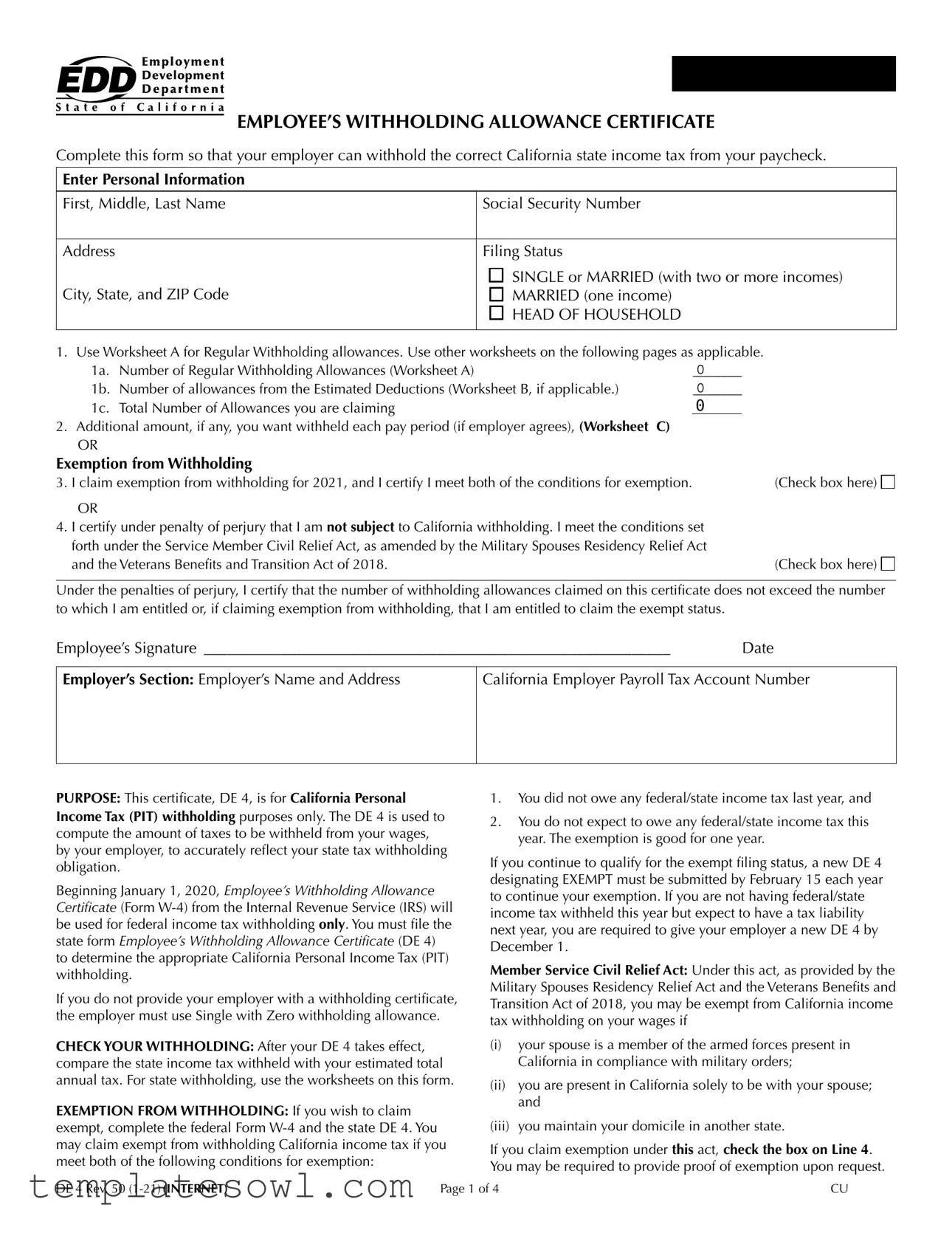

The California DE 4 form, officially known as the Employee’s Withholding Allowance Certificate, plays a crucial role in ensuring that your employer withholds the correct amount of state income tax from your paycheck. When you complete this form, you provide personal information, including your name, address, and Social Security number, as well as your filing status—options include single, married, or head of household. This form allows you to claim withholding allowances based on your individual circumstances, which can include factors like the number of dependents or deductions you expect to claim. Should you wish to have an additional amount withheld, you can specify that as well. Importantly, individuals may also claim exemption from withholding under specific conditions, such as not owing state income tax in the previous year and not expecting to owe in the current year. If you do not submit a DE 4 to your employer, they are required to withhold at the highest rate, which could lead to over-withholding on your income. This guide will navigate through the intricacies of the DE 4, helping you understand its purpose and how to use it effectively to meet your tax obligations.

California De 4 Example

Clear Form

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Complete this form so that your employer can withhold the correct California state income tax from your paycheck.

Enter Personal Information |

|

First, Middle, Last Name |

Social Security Number |

|

|

Address |

Filing Status |

City, State, and ZIP Code |

SINGLE or MARRIED (with two or more incomes) |

MARRIED (one income) |

|

|

HEAD OF HOUSEHOLD |

|

|

1. |

Use Worksheet A for Regular Withholding allowances. Use other worksheets on the following pages as applicable. |

||||

|

1a. |

Number of Regular Withholding Allowances (Worksheet A) |

0 |

|

|

|

1b. |

Number of allowances from the Estimated Deductions (Worksheet B, if applicable.) |

0 |

|

|

|

1c. |

Total Number of Allowances you are claiming |

|

0 |

|

2. |

Additional amount, if any, you want withheld each pay period (if employer agrees), (Worksheet C) |

|

|

||

|

OR |

|

|

|

|

Exemption from Withholding |

|

|

|||

3. I claim exemption from withholding for 2021, and I certify I meet both of the conditions for exemption. |

|

(Check box here) |

|||

OR

4.I certify under penalty of perjury that I am not subject to California withholding. I meet the conditions set forth under the Service Member Civil Relief Act, as amended by the Military Spouses Residency Relief Act

and the Veterans Benefits and Transition Act of 2018. |

(Check box here) |

Under the penalties of perjury, I certify that the number of withholding allowances claimed on this certificate does not exceed the number to which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status.

Employee’s Signature ____________________________________________________________ |

Date |

Employer’s Section: Employer’s Name and Address

California Employer Payroll Tax Account Number

PURPOSE: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Beginning January 1, 2020, Employee’s Withholding Allowance Certificate (Form

If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.

CHECK YOUR WITHHOLDING: After your DE 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this form.

EXEMPTION FROM WITHHOLDING: If you wish to claim exempt, complete the federal Form

1.You did not owe any federal/state income tax last year, and

2.You do not expect to owe any federal/state income tax this year. The exemption is good for one year.

If you continue to qualify for the exempt filing status, a new DE 4 designating EXEMPT must be submitted by February 15 each year to continue your exemption. If you are not having federal/state income tax withheld this year but expect to have a tax liability next year, you are required to give your employer a new DE 4 by December 1.

Member Service Civil Relief Act: Under this act, as provided by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act of 2018, you may be exempt from California income tax withholding on your wages if

(i)your spouse is a member of the armed forces present in California in compliance with military orders;

(ii)you are present in California solely to be with your spouse; and

(iii)you maintain your domicile in another state.

If you claim exemption under this act, check the box on Line 4. You may be required to provide proof of exemption upon request.

DE 4 Rev. 50 |

Page 1 of 4 |

CU |

The California Employer’s Guide (DE 44) (edd.ca.gov/pdf_pub_ctr/de44.pdf) provides the income tax withholding tables. This publication may be found by visiting Payroll Taxes - Forms and Publications (edd.ca.gov/Payroll_Taxes/Forms_and_ Publications.htm). To assist you in calculating your tax liability, please visit the Franchise Tax Board (FTB) (ftb.ca.gov).

If you need information on your last California Resident Income Tax Return (FTB Form 540), visit the FTB (ftb.ca.gov).

NOTIFICATION: The burden of proof rests with the employee to show the correct California income tax withholding. Pursuant to section

Title 22, California Code of Regulations (CCR) (govt.westlaw. com/calregs/Search/Index), the FTB or the EDD may, by special direction in writing, require an employer to submit a Form

PENALTY: You may be fined $500 if you file, with no reasonable basis, a DE 4 that results in less tax being withheld than is properly allowable. In addition, criminal penalties apply for willfully supplying false or fraudulent information or failing to supply information requiring an increase in withholding. This is provided by section 13101 of the California Unemployment Insurance Code (leginfo.legislature. ca.gov/faces/codes.xhtml) and section 19176 of the Revenue and Taxation Code (leginfo.legislature.ca.gov/faces/ codes).xhtml).

DE 4 Rev. 50 |

Page 2 of 4 |

WORKSHEETS

INSTRUCTIONS — 1 — ALLOWANCES*

When determining your withholding allowances, you must consider your personal situation:

—Do you claim allowances for dependents or blindness?

—Will you itemize your deductions?

—Do you have more than one income coming into the household?

Do not claim the same allowances with more than one employer. Your withholding will usually be most accurate when all allowances are claimed on the DE 4 filed for the highest paying job and zero allowances are claimed for the others.

MARRIED BUT NOT LIVING WITH YOUR SPOUSE: You may check the “Head of Household” marital status box if you meet all of the following tests:

(1)Your spouse will not live with you at any time during the year;

(2)You will furnish over half of the cost of maintaining a home for the entire year for yourself and your child or stepchild who qualifies as your dependent; and

(3)You will file a separate return for the year.

HEAD OF HOUSEHOLD: To qualify, you must be unmarried or legally separated from your spouse and pay more than 50% of the costs of maintaining a home for the entire year for yourself and your dependent(s) or other qualifying individuals. Cost of maintaining the home includes such items as rent, property insurance, property taxes, mortgage interest, repairs, utilities, and cost of food. It does not include the individual’s personal expenses or any amount which represents value of services performed by a member of the household of the taxpayer.

WORKSHEET A |

REGULAR WITHHOLDING ALLOWANCES |

|

|

|

|

|

|

|

|

(A) |

Allowance for yourself — enter 1 |

|

(A) |

|

(B) |

Allowance for your spouse (if not separately claimed by your spouse) — enter 1 |

(B) |

|

|

(C) |

Allowance for blindness — yourself — enter 1 |

|

(C) |

|

(D) |

Allowance for blindness — your spouse (if not separately claimed by your spouse) — enter 1 |

(D) |

|

|

(E) |

Allowance(s) for dependent(s) — do not include yourself or your spouse |

(E) |

|

|

(F) |

Total — add lines (A) through (E) above and enter on line 1a of the DE 4 |

(F) |

0 |

|

INSTRUCTIONS — 2 — (OPTIONAL) ADDITIONAL WITHHOLDING ALLOWANCES

If you expect to itemize deductions on your California income tax return, you can claim additional withholding allowances. Use Worksheet B to determine whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances. Use last year’s FTB Form 540 as a model to calculate this year’s withholding amounts.

Do not include deferred compensation, qualified pension payments, or flexible benefits, etc., that are deducted from your gross pay but are not taxed on this worksheet.

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

WORKSHEET B |

ESTIMATED DEDUCTIONS |

Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income not subject to withholding.

1. |

Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the schedules in the FTB Form 540 |

1. |

|

|

2. |

Enter $9,202 if married filing joint with two or more allowances, unmarried head of household, or qualifying widow(er) |

|

|

|

|

with dependent(s) or $4,601 if single or married filing separately, dual income married, or married with multiple employers |

– |

2. |

|

3. |

Subtract line 2 from line 1, enter difference |

= |

3. |

0 |

4. |

Enter an estimate of your adjustments to income (alimony payments, IRA deposits) |

+ |

4. |

|

5. |

Add line 4 to line 3, enter sum |

= |

5. |

0 |

6. |

Enter an estimate of your nonwage income (dividends, interest income, alimony receipts) |

– |

6. |

|

7. |

If line 5 is greater than line 6 (if less, see below [go to line 9]); |

|

|

|

|

Subtract line 6 from line 5, enter difference |

= |

7. |

0 |

8. |

Divide the amount on line 7 by $1,000, round any fraction to the nearest whole number |

|

8. |

0 |

|

enter this number on line 1b of the DE 4. Complete Worksheet C, if needed, otherwise stop here. |

|

|

|

9. |

If line 6 is greater than line 5; |

|

|

|

|

Enter amount from line 6 (nonwage income) |

|

9. |

|

10. |

Enter amount from line 5 (deductions) |

|

10. |

0 |

11. |

Subtract line 10 from line 9, enter difference. Then, complete Worksheet C. |

|

11. |

0 |

*Wages paid to registered domestic partners will be treated the same for state income tax purposes as wages paid to spouses for California PIT withholding and PIT wages. This law does not impact federal income tax law. A registered domestic partner means an individual partner in a domestic partner relationship within the meaning of section 297 of the Family Code. For more information, please call our Taxpayer Assistance Center at

DE 4 Rev. 50 |

Page 3 of 4 |

WORKSHEET C |

ADDITIONAL TAX WITHHOLDING AND ESTIMATED TAX |

|

|

|

|

|

|

|

|

1. |

Enter estimate of total wages for tax year 2021. |

1. |

|

|

2. |

Enter estimate of nonwage income (line 6 of Worksheet B). |

2. |

|

|

3. |

Add line 1 and line 2. Enter sum. |

|

3. |

0 |

4. |

Enter itemized deductions or standard deduction (line 1 or 2 of Worksheet B, whichever is largest). |

4. |

|

|

5. |

Enter adjustments to income (line 4 of Worksheet B). |

5. |

|

|

6. |

Add line 4 and line 5. Enter sum. |

|

6. |

0 |

7. |

Subtract line 6 from line 3. Enter difference. |

7. |

0 |

|

8. |

Figure your tax liability for the amount on line 7 by using the 2021 tax rate schedules below. |

8. |

|

|

9. |

Enter personal exemptions (line F of Worksheet A x $136.40). |

9. |

0 |

|

10. |

Subtract line 9 from line 8. Enter difference. |

10. |

0 |

|

11. |

Enter any tax credits. (See FTB Form 540). |

|

11. |

|

12. |

Subtract line 11 from line 10. Enter difference. This is your total tax liability. |

12. |

0 |

|

13.Calculate the tax withheld and estimated to be withheld during 2021. Contact your employer to request the amount that will be withheld on your wages based on the marital status and number of withholding allowances you will claim for 2021. Multiply the estimated amount to be withheld by the number of pay

|

periods left in the year. Add the total to the amount already withheld for 2021. |

13. |

|

14. |

Subtract line 13 from line 12. Enter difference. If this is less than zero, you do not need to have additional |

|

0 |

|

taxes withheld. |

14. |

|

15. |

Divide line 14 by the number of pay periods remaining in the year. Enter this figure on line 2 of the DE 4. |

15. |

|

NOTE: Your employer is not required to withhold the additional amount requested on line 2 of your DE 4. If your employer does not agree to withhold the additional amount, you may increase your withholdings as much as possible by using the “single” status with “zero” allowances. If the amount withheld still results in an underpayment of state income taxes, you may need to file quarterly estimates on Form

THESE TABLES ARE FOR CALCULATING WORKSHEET C AND FOR 2021 ONLY

SINGLE PERSONS, DUAL INCOME

MARRIED WITH MULTIPLE EMPLOYERS

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$8,932 |

1.100% |

$0 |

$0.00 |

$8,932 |

$21,175 |

2.200% |

$8,932 |

$98.25 |

$21,175 |

$33,421 |

4.400% |

$21,175 |

$367.60 |

$33,421 |

$46,394 |

6.600% |

$33,421 |

$906.42 |

$46,394 |

$58,634 |

8.800% |

$46,394 |

$1,762.64 |

$58,634 |

$299,508 |

10.230% |

$58,634 |

$2,839.76 |

$299,508 |

$359,407 |

11.330% |

$299,508 |

$27,481.17 |

$359,407 |

$599,012 |

12.430% |

$359,407 |

$34,267.73 |

$599,012 |

$1,000,000 |

13.530% |

$599,012 |

$64,050.63 |

$1,000,000 |

and over |

14.630% |

$1,000,000 |

$118,304.31 |

UNMARRIED HEAD OF HOUSEHOLD

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$17,876 |

1.100% |

$0 |

$0.00 |

$17,876 |

$42,353 |

2.200% |

$17,876 |

$196.64 |

$42,353 |

$54,597 |

4.400% |

$42,353 |

$735.13 |

$54,597 |

$67,569 |

6.600% |

$54,597 |

$1,273.87 |

$67,569 |

$79,812 |

8.800% |

$67,569 |

$2,130.02 |

$79,812 |

$407,329 |

10.230% |

$79,812 |

$3,207.40 |

$407,329 |

$488,796 |

11.330% |

$407,329 |

$36,712.39 |

$488,796 |

$814,658 |

12.430% |

$488,796 |

$45,942.60 |

$814,658 |

$1,000,000 |

13.530% |

$814,658 |

$86,447.25 |

$1,000,000 |

and over |

14.630% |

$1,000,000 |

$111,524.02 |

MARRIED PERSONS

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$17,864 |

1.100% |

$0 |

$0.00 |

$17,864 |

$42,350 |

2.200% |

$17,864 |

$196.50 |

$42,350 |

$66,842 |

4.400% |

$42,350 |

$735.19 |

$66,842 |

$92,788 |

6.600% |

$66,842 |

$1,812.84 |

$92,788 |

$117,268 |

8.800% |

$92,788 |

$3,525.28 |

$117,268 |

$599,016 |

10.230% |

$117,268 |

$5,679.52 |

$599,016 |

$718,814 |

11.330% |

$599,016 |

$54,962.34 |

$718,814 |

$1,000,000 |

12.430% |

$718,814 |

$68,535.45 |

$1,000,000 |

$1,198,024 |

13.530% |

$1,000,000 |

$103,486.87 |

$1,198,024 |

and over |

14.630% |

$1,198,024 |

$130,279.52 |

If you need information on your last California Resident Income Tax Return, FTB Form 540, visit (FTB) (ftb.ca.gov).

The DE 4 information is collected for purposes of administering the PIT law and under the authority of Title 22, CCR, section

DE 4 Rev. 50 |

Page 4 of 4 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The DE 4 form is used for California state income tax withholding from employee wages. |

| Governing Law | California Revenue and Taxation Code section 18624 governs the use of the DE 4 form. |

| Withholding Allowances | Employees claim their withholding allowances using Worksheet A to determine the correct tax withholding. |

| Exemption Conditions | To claim exemption from withholding, one must not have owed federal/state income tax the previous year and not expect to owe this year. |

| Military Exemption | Under the Service Member Civil Relief Act, exempt status may be claimed if the employee's spouse is in the military and stationed in California. |

| Penalties for Incorrect Filing | There are penalties, including fines of up to $500, for filing inaccurate DE 4 information that results in less tax being withheld. |

| Updating Information | Employees must submit a new DE 4 by February 15 each year to maintain exempt status if they continue to qualify. |

| Impact of Not Submitting | If an employee does not submit the DE 4, employers will withhold taxes at a default rate of "Single with Zero allowances." |

| Worksheets Overview | The DE 4 includes several worksheets (A, B, C) designed to help employees accurately calculate their withholding allowances. |

Guidelines on Utilizing California De 4

Completing the California DE 4 form is an important step to ensure appropriate state income tax withholding from your paycheck. The following steps will guide you through the process of filling out this form accurately. It is essential to approach the form with your specific financial situation in mind, as this will influence the information you provide.

- Start by entering your personal information at the top of the form. This includes your first, middle, and last name, Social Security Number, address, city, state, and ZIP code.

- Next, select your filing status by checking the appropriate box: “Single or Married (with two or more incomes),” “Married (one income),” or “Head of Household.”

- Proceed to Worksheet A to determine the number of regular withholding allowances you are entitled to claim. Enter the number of allowances claimed on line 1a.

- If applicable, complete Worksheet B to calculate any additional allowances based on your estimated deductions. Enter this number on line 1b.

- Sum the total allowances from lines 1a and 1b and enter the total on line 1c.

- On line 2, specify any additional amount you want withheld from each paycheck, if your employer agrees.

- Check the appropriate box on line 3 if you wish to claim exemption from withholding, and ensure you meet the specified conditions. Alternatively, if you are a service member’s spouse claiming exemption, check the box on line 4.

- Sign and date the form at the bottom, ensuring the accuracy of the information provided under penalty of perjury.

- Lastly, provide your employer’s name and address along with the California Employer Payroll Tax Account Number in the employer’s section of the form.

What You Should Know About This Form

What is the purpose of the California DE 4 form?

The California DE 4 form, or Employee’s Withholding Allowance Certificate, is used to help employers determine the correct amount of state income tax to withhold from employees' paychecks. It ensures that the withholding accurately reflects the employee's personal tax situation, considering factors such as filing status, number of allowances, and additional withholding preferences. Without a completed DE 4 form, employers must automatically withhold taxes assuming a single filing status with zero allowances, which may not accurately represent an employee's tax obligation.

How do I complete the DE 4 form?

To fill out the DE 4 form, employees should start by providing personal information, including their name, Social Security number, and address. They must select their filing status from the options provided, such as single, married with one income, or head of household. Next, employees will need to calculate their regular withholding allowances using Worksheet A. Potential additional allowances may be calculated from estimated deductions using Worksheet B. If applicable, employees can designate additional amounts to be withheld each pay period or claim an exemption from withholding if they meet specific criteria. Finally, the form should be signed and dated before submission to the employer.

What happens if I don't submit a DE 4 form?

If an employee fails to submit a DE 4 form, their employer is required to withhold taxes based on a single filing status with zero allowances. This means more tax could be taken out than necessary, leading to a larger refund at tax time (or a tax bill if the individual ends up owing taxes). However, this situation can also result in under-withholding for employees who have additional income sources, ultimately causing tax liability issues later on. It is crucial for employees to complete and submit the DE 4 as accurately as possible to avoid these potential challenges.

What if I claim exemption from withholding?

Employees can claim exemption from California income tax withholding if they meet two conditions: they did not owe any federal or state income tax last year and they do not expect to owe any income tax this year. If eligible, they should check the appropriate box on the DE 4. This exemption lasts for one year, meaning employees must submit a new DE 4 each year by February 15 to maintain their exempt status. If an employee claims exempt status but expects to owe taxes the following year, they must provide a new form by December 1 to avoid penalties.

Common mistakes

Filling out the California DE 4 form correctly is crucial for ensuring that the correct amount of state income tax is withheld from your paycheck. Unfortunately, many individuals make common mistakes when completing this form, which can lead to under-withholding or over-withholding of taxes. Here are five mistakes to watch out for.

One frequent error occurs in the filing status selection. Taxpayers often misidentify their status as “Single” or “Married” when they have additional factors that qualify them as “Head of Household.” This mistake can significantly affect the withholding allowances and overall tax liability. If you have dependents and provide more than half of their support, it’s essential to select the correct status to avoid problems later.

Inaccurate calculations of withholding allowances represent another common pitfall. Many individuals fail to use the worksheets included with the DE 4 form to determine their total allowances. This can lead to claiming an incorrect number of allowances. It’s important to systematically go through each worksheet, especially Worksheet A for regular withholding allowances, to ensure that all eligible factors, such as dependents and deductions, are accounted for.

Many people also neglect to consider the impact of multiple income sources. If you or your spouse have more than one job, under-withholding may occur. It is critical to avoid claiming the same allowances on more than one DE 4 form. Instead, claim all allowances on the form submitted to the employer with the highest pay. This approach helps ensure that taxes are withheld accurately across all income.

Another mistake often made is failing to update the form after major life changes, such as marriage or the birth of a child. Changes in marital status or dependents can alter withholding needs significantly. Individuals should review their DE 4 form and, if necessary, submit a new one to their employer to reflect any changes. Keeping the form current is vital for managing tax liabilities effectively.

Finally, some taxpayers incorrectly assume they can simply claim exemption from withholding without meeting the necessary criteria. To qualify for an exemption, you must meet specific requirements, such as not having owed any taxes in the previous year and not expecting to owe any taxes in the current year. Misunderstanding or misrepresenting your eligibility for exemption can have serious repercussions, including under-withholding penalties.

By paying close attention to these common mistakes when filling out the California DE 4 form, individuals can help ensure their state tax withholding accurately reflects their financial situation, thereby avoiding unwanted surprises during tax season.

Documents used along the form

The California DE 4 form, formally known as the Employee’s Withholding Allowance Certificate, is a significant document for managing state income tax withholding. It allows employees to inform their employers about their tax allowances so that the correct amount of California state income tax is withheld from their paychecks. Several other forms may be used in conjunction with the DE 4 to ensure proper tax management and compliance.

- Form W-4: This federal form allows employees to determine their federal income tax withholding. As of January 1, 2020, it is used solely for federal purposes, while the DE 4 addresses California state tax withholding.

- California Form 540: This is the California Resident Income Tax Return. Taxpayers file this annually to report their income and determine their tax liability to the state. It includes information that may assist in completing the DE 4.

- Form 540-ES: This is the Estimated Tax for Individuals form. It is used by taxpayers to pay estimated income taxes quarterly. If an employee believes that their withholding will not cover their tax liability, they may choose to file this form.

- DE 44: This form is the California Employer’s Guide. It provides employers with the necessary guidelines for withholding tax, including the tables that relate to the DE 4 allowances. Employers can gain insights into correctly managing withholdings based on the DE 4 information.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Independent contractors and freelancers often receive this form. It can also impact an individual’s tax liability and how they manage withholding with their DE 4 form.

Each of these documents serves a critical role in ensuring that tax obligations are met accurately and timely. Understanding them can help employees and employers manage their tax withholding more effectively and avoid any potential penalties from under-withholding or misreporting. Familiarity with these forms can also clarify the overall tax process within California.

Similar forms

- Form W-4 - This federal form is used by employees to determine the amount of federal income tax withheld from their paychecks. Like the DE 4, it allows individuals to claim allowances based on personal circumstances.

- State W-4 - Similar to the DE 4, this form is used in various states to determine state income tax withholding. It functions similarly by allowing employees to claim allowances and specify additional withholdings.

- Form 540 - This is the California Resident Income Tax Return form. It uses information from the DE 4 to finalize tax liability based on income and deducted tax throughout the year.

- Form 540-ES - This form is for paying estimated taxes. Individuals who do not have sufficient taxes withheld may use this to estimate tax obligations, similar to what the DE 4 does for withholding calculations.

- Form 1099 - Issued to independent contractors, this form details income earned outside of regular employment. Like the DE 4, it informs individuals about tax obligations but in a different employment context.

- Form 1098-T - Used by educational institutions, this form reports tuition payments. It does not directly relate to withholding but interacts with tax credits derived from education expenses, just as the DE 4 interacts with withholding allowances.

- Form 1095-A - This form provides information about health insurance coverage under the Affordable Care Act. While it serves a different purpose, both forms require accurate reporting of personal circumstances for tax accuracy.

- Schedule C - This form is used by sole proprietors to report income or loss from a business. It directly affects tax calculations like the DE 4 informs withholding amounts based on income levels.

- Schedule A - Used for itemized deductions, this schedule allows taxpayers to report their deductible expenses. It complements the DE 4’s objectives by providing a pathway to reduce taxable income.

- Form 941 - This is the Employer’s Quarterly Federal Tax Return. Employers use it to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks, aligning with the DE 4’s purpose in determining withholding amounts.

Dos and Don'ts

When filling out the California DE 4 form, it's essential to ensure accuracy and compliance. Here are some key do's and don'ts to help guide you through the process.

- Do review the instructions carefully.

- Do provide your Social Security number accurately.

- Do check the correct filing status that applies to you.

- Do claim only the number of allowances you are entitled to.

- Don't forget to sign and date the form.

- Don't claim exemptions unless you meet both criteria for doing so.

By adhering to these guidelines, you can help ensure that your state income tax withholding reflects your financial situation accurately. Remember, the correct withholding prevents surprises during tax season, making for a smoother financial experience.

Misconceptions

Understanding the California DE 4 form is essential for employees to manage their state income tax withholding properly. However, several misconceptions often arise regarding this form. Here are seven common myths, along with clarifications:

- Misconception 1: Everyone has to fill out the DE 4 form.

- Misconception 2: The DE 4 form is only for new employees.

- Misconception 3: Claiming more allowances means more money will be withheld.

- Misconception 4: If I claim exemption from withholding, I won’t have to pay taxes.

- Misconception 5: The DE 4 form is valid indefinitely.

- Misconception 6: I can submit multiple DE 4 forms to different employers.

- Misconception 7: Once I file my DE 4, I'm done with tax withholding.

Not everyone needs to complete this form. Only employees in California who want to adjust their state income tax withholding should fill it out. If an employee does not submit a DE 4, their employer will withhold taxes as if they were single with zero allowances.

This form can be submitted anytime. Existing employees may also update their withholding allowances if they experience changes in income or family status.

Actually, claiming more allowances typically leads to less tax being withheld from each paycheck. It's essential to understand how many allowances you are actually entitled to claim based on your situation.

Claiming exemption means that you believe you will not owe any state income tax this year. However, if circumstances change and you end up with a tax obligation, you will still need to pay your taxes at that point.

The exemption status is only valid for one year. If you want to keep your exemption, you must submit a new DE 4 by February 15 each year.

You should only submit one DE 4 form and claim all of your allowances there. Claiming the same allowances with multiple employers can lead to over-withholding.

Your withholding may need to be adjusted periodically based on changes in your personal circumstances, income, or tax law. It's good practice to review your withholding at least annually.

Key takeaways

Understanding how to fill out and use the California DE 4 form is essential for ensuring that your income tax withholding aligns with your financial situation. Here are some key takeaways:

- Personal Information is Key: Begin by accurately entering your personal details, including your name, Social Security number, and address. This information is crucial for your employer to process the form correctly.

- Determine Your Filing Status: You need to indicate your filing status on the form. Options include Single, Married (with two or more incomes), Married (one income), or Head of Household. Your filing status impacts the withholding allowances you may claim.

- Withholding Allowances Worksheets: Use Worksheet A to calculate your regular withholding allowances. Additional worksheets may also apply based on your specific circumstances, like estimated deductions or additional withholding.

- Claiming Exemptions: If you expect not to owe California state income tax for the current year, you can claim exemption. Ensure that you meet the eligibility criteria and submit the required paperwork annually to maintain this status.

- Check for Errors: After you submit the DE 4 form, monitor your paychecks. Compare the state income tax withheld with your estimated annual tax to ensure accuracy. If discrepancies arise, adjustments may be necessary.

- Follow Annual Requirements: If you claim exemption from withholding, a new DE 4 form must be submitted each year by February 15 to continue that exemption. It’s important to keep track of these deadlines.

- Impact of Multiple Incomes: If you have multiple sources of income or a working spouse, accurately calculate allowances to prevent under-withholding, which may lead to tax liabilities at year’s end.

- Sign and Date: Do not forget to sign and date the form before submission. This step confirms your declarations and is necessary for processing your request.

Paying attention to these details ensures not only compliance with tax regulations but also helps to manage your finances effectively throughout the year.

Browse Other Templates

Who Owns Mr Cooper - Be accurate when reporting monthly income contributions to household expenses.

Uncontested Divorce in Tn - Stay informed about the legal implications of each step in the uncontested divorce process.