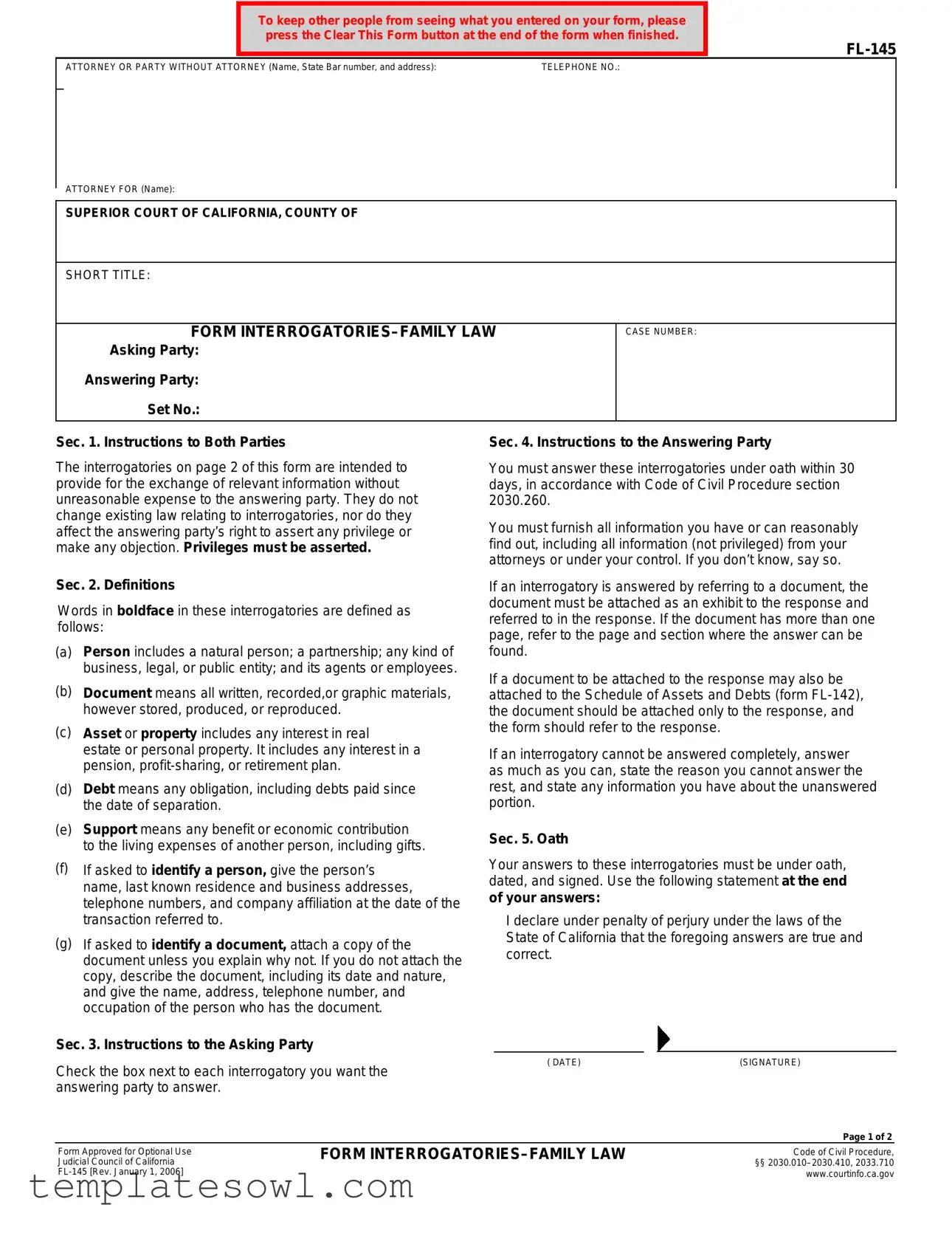

Fill Out Your California Fl 145 Form

The California FL-145 form serves as a crucial tool in family law cases, specifically designed to facilitate information exchange between parties involved. This form includes interrogatories, which are a series of questions that one party asks the other to gather relevant details without incurring excessive costs. Parties must provide their answers under oath and within a specific timeline, typically 30 days, following the guidelines outlined in the Code of Civil Procedure. The FL-145 form also defines key terms such as "person," "document," "asset," and "debt," ensuring clarity in the information requested. Both asking and answering parties play distinct roles in this process. The asking party selects the specific interrogatories while the answering party must provide complete and honest responses, attaching supporting documents when necessary. Failure to fully respond or asserting privileges must be done appropriately. Among the topics covered by the interrogatories are personal history, agreements regarding asset disposition, current income, and any claims for reimbursement. This comprehensive approach allows for a more thorough understanding of each party's circumstances, thus aiding in fair resolution of family law matters.

California Fl 145 Example

To keep other people from seeing what you entered on your form, please press the Clear This Form button at the end of the form when finished.

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address): |

TELEPHONE NO.: |

ATTORNEY FOR (Name):

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

SHORT TITLE:

FORM |

CASE NUMBER: |

|

Asking Party: |

|

|

Answering Party: |

|

|

Set No.: |

|

|

Sec. 1. Instructions to Both Parties |

Sec. 4. Instructions to the Answering Party |

|

The interrogatories on page 2 of this form are intended to |

You must answer these interrogatories under oath within 30 |

|

provide for the exchange of relevant information without |

days, in accordance with Code of Civil Procedure section |

|

unreasonable expense to the answering party. They do not |

2030.260. |

|

change existing law relating to interrogatories, nor do they |

You must furnish all information you have or can reasonably |

|

affect the answering party’s right to assert any privilege or |

||

make any objection. Privileges must be asserted. |

find out, including all information (not privileged) from your |

|

|

attorneys or under your control. If you don’t know, say so. |

|

Sec. 2. Definitions

Words in boldface in these interrogatories are defined as follows:

(a)Person includes a natural person; a partnership; any kind of business, legal, or public entity; and its agents or employees.

(b)Document means all written, recorded,or graphic materials, however stored, produced, or reproduced.

(c)Asset or property includes any interest in real

estate or personal property. It includes any interest in a pension,

(d)Debt means any obligation, including debts paid since the date of separation.

(e)Support means any benefit or economic contribution to the living expenses of another person, including gifts.

If an interrogatory is answered by referring to a document, the document must be attached as an exhibit to the response and referred to in the response. If the document has more than one page, refer to the page and section where the answer can be found.

If a document to be attached to the response may also be attached to the Schedule of Assets and Debts (form

If an interrogatory cannot be answered completely, answer as much as you can, state the reason you cannot answer the rest, and state any information you have about the unanswered portion.

Sec. 5. Oath

(f)If asked to identify a person, give the person’s name, last known residence and business addresses, telephone numbers, and company affiliation at the date of the transaction referred to.

(g)If asked to identify a document, attach a copy of the document unless you explain why not. If you do not attach the copy, describe the document, including its date and nature, and give the name, address, telephone number, and occupation of the person who has the document.

Sec. 3. Instructions to the Asking Party

Check the box next to each interrogatory you want the answering party to answer.

Your answers to these interrogatories must be under oath, dated, and signed. Use the following statement at the end of your answers:

I declare under penalty of perjury under the laws of the State of California that the foregoing answers are true and correct.

( DATE) |

(SIGNATURE) |

Page 1 of 2

Form Approved for Optional Use Judicial Council of California

FORM

Code of Civil Procedure,

§§

1.Personal history. State your full name, current residence address and work address, social security number, any other names you have used, and the dates between which you used each name.

2.Agreements. Are there any agreements between you and your spouse or domestic partner, made before or during your marriage or domestic partnership or after your separation, that affect the disposition of assets, debts, or support in this proceeding? If your answer is yes, for each agreement state the date made and whether it was written or oral, and attach a copy of the agreement or describe its contents.

3.Legal actions. Are you a party or do you anticipate being a party to any legal or administrative proceeding other than this action? If your answer is yes, state your role and the name, jurisdiction, case number, and a brief description of each proceeding.

4.Persons sharing residence. State the name, age, and relationship to you of each person at your present address.

5.Support provided others. State the name, age, address, and relationship to you of each person for whom you have provided support during the past 12 months and the amount provided per month for each.

6.Support received for others. State the name, age, address, and relationship to you of each person for whom you have received support during the past 12 months and the amount received per month for each.

7.Current income. List all income you received during

the past 12 months, its source, the basis for its computation, and the total amount received from each. Attach your last three paycheck stubs.

8.Other income. During the past three years, have you received cash or other property from any source not identified in item 7? If so, list the source, the date, and the nature and value of the property.

9.Tax returns. Attach copies of all tax returns and tax schedules filed by or for you in any jurisdiction for the past three calendar years.

10.Schedule of assets and debts. Complete the Schedule of Assets and Debts (form

11.Separate property contentions. State the facts that support your contention that an asset or debt is separate property.

12.Property valuations. During the past 12 months, have you received written offers to purchase or had written appraisals of any of the assets listed on your completed Schedule of Assets and Debts? If your answer is yes, identify the document.

13.Property held by others. Is there any property

held by any third party in which you have any interest or over which you have any control? If your answer is yes, indicate whether the property is shown on the Schedule of Assets and Debts completed by you. If it is not, describe and identify each such asset, state its present value and the basis for your valuation, and identify the person holding the asset.

14.Retirement and other benefits. Do you have an interest in any disability, retirement,

15.Claims of reimbursement. Do you claim the legal right to be reimbursed for any expenditures of your separate or community property? If your answer is yes, state all supporting facts.

16.Credits. Have you claimed reimbursement credits for payments of community debts since the date of separation? If your answer is yes, identify the source of payment, the creditor, the date paid, and the amount paid. State whether you have added to the debt since the separation.

17.Insurance. Identify each health, life, automobile, and disability insurance policy or plan that you now own or that covers you, your children, or your assets. State the policy type, policy number, and name of the company. Identify the agent and give the address.

18.Health. Is there any physical or emotional condition that limits your ability to work? If your answer is yes, state each fact on which you base your answer.

19.Children’s needs. Do you contend that any of your children have any special needs? If so, identify the child with the need, the reason for the need, its cost, and its expected duration.

20.Attorney fees. State the total amount of attorney fees and costs incurred by you in this proceeding, the amount paid, and the source of the money paid. Describe the billing arrangements.

21.Gifts. List any gifts you have made without the

consent of your spouse or domestic partner in the past 24 months, their values, and the recipients.

FORM |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

For your protection and privacy, please press the Clear This Form |

|

|

|

|

|

|

Save This Form |

|

Print This Form |

||

button after you have printed the form. |

|

|

|

||

|

|

|

|

|

|

Page 2 of 2

Clear This Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The FL-145 form is designed to facilitate the exchange of relevant information in family law cases, allowing parties to provide necessary details without incurring unreasonable expenses. |

| Timeframe for Responses | The answering party must respond to the interrogatories within 30 days, in accordance with the California Code of Civil Procedure section 2030.260. |

| Governing Laws | This form is governed by California Code of Civil Procedure, sections 2030.010 through 2030.410, as well as section 2033.710. |

| Types of Information Required | Interrogatories request various information, including personal history, agreements, current income, and property valuations, to facilitate a thorough understanding of each party's financial situation. |

| Oath and Verification | Respondents are required to declare under penalty of perjury that their answers are true and correct, ensuring the integrity of the information provided. |

Guidelines on Utilizing California Fl 145

Completing the California FL 145 form requires attention to detail and accuracy. Each response should be thoughtful, as this form plays a critical role in your family law proceedings. Begin by ensuring you have all necessary documentation and information on hand, as you will need to provide answers that are thorough and complete.

- Start by entering your name, state bar number (if applicable), and address at the top of the form under "ATTORNEY OR PARTY WITHOUT ATTORNEY."

- Include your telephone number and the name of the party you are representing under "ATTORNEY FOR."

- Fill in the "SHORT TITLE" and "CASE NUMBER" fields with the relevant descriptions connected to your case.

- Identify the "Asking Party" and "Answering Party" to clarify who is requesting the information and who will respond.

- Check the box next to each interrogatory you want the answering party to address.

- Under "Sec. 1. Instructions to Both Parties," make sure you understand the requirements for both the asking and answering parties.

- After reading the definitions in "Sec. 2," prepare to answer questions related to personal history, agreements, legal actions, and living arrangements, among others.

- In "Sec. 3," ensure all your answers are under oath. Use the provided statement to affirm the truthfulness of your responses. Include the date and your signature at the end of the document.

- Gather supporting documents, such as tax returns, paycheck stubs, or any agreements mentioned in your responses, to attach as exhibits if required.

- Double-check all completed sections and supporting documentation for accuracy and completeness.

- Lastly, if you wish to clear all entered information on the form for privacy, press the "Clear This Form" button before submitting or printing.

What You Should Know About This Form

What is the California FL 145 form?

The California FL 145 form is used in family law cases for exchanging information between parties. It includes a series of questions meant to gather relevant details regarding personal history, financial assets, debts, and support. The form aims to streamline the discovery process while ensuring parties have the necessary information to proceed with their cases.

Who needs to fill out the FL 145 form?

Both parties involved in a family law matter, such as divorce or child custody, are required to fill out the FL 145 form. It is essential for individuals seeking information from their spouse or domestic partner regarding financial and personal circumstances pertinent to the case.

What information is required on the FL 145 form?

The form asks for various types of information, including personal details, income sources, assets and debts, support provided or received, and any legal agreements made prior to or during the marriage. It also covers questions about children's needs and attorney fees incurred during the proceedings.

How long do I have to respond to the FL 145 form?

Responses to the FL 145 form must be completed under oath within 30 days of service. This timeframe is in accordance with Code of Civil Procedure section 2030.260. It is crucial to adhere to this timeline to ensure compliance with legal requirements.

What happens if I cannot answer a question on the FL 145 form?

If you cannot fully answer a question on the FL 145 form, you should provide as much information as possible. Clearly indicate the reasons for your incomplete answer and disclose any details you may have that relate to the unanswered portion. This approach demonstrates your good faith in complying with the request.

What should I do if I need to attach documents?

When requested to provide documentation, you must attach a copy of those documents to your responses. If the document has multiple pages, make sure to refer to the specific page and section in your answer. It is essential to clarify any documents that may also be included in other forms, such as the Schedule of Assets and Debts (FL-142).

Can I object to any of the questions on the FL 145 form?

Yes, you can assert any objections, including claims of privilege, regarding specific questions. If you decline to answer based on an objection, it is vital to clearly state your reasoning as this will allow the asking party to understand the basis of your refusal.

Is it necessary to have an attorney when filling out the FL 145 form?

While it’s not mandatory to have an attorney, consulting with one is advisable. An attorney can guide you through the process, ensure that you fulfill your obligations, and help you understand your rights, especially if complex issues arise.

What declarations must I include when submitting the FL 145 form?

At the end of your responses, you must include a declaration stating that your answers are true and correct under penalty of perjury. This declaration adds a level of seriousness to the information provided and verifies your commitment to the accuracy of your answers.

What should I do after completing the FL 145 form?

After you have completed the form, it is essential to carefully review all provided information for accuracy. Once satisfied, you should sign, date the form, and serve it to the other party involved. Don't forget to press the "Clear This Form" button for your privacy after finishing.

Common mistakes

When filling out the California FL 145 form, individuals often make mistakes that can lead to confusion or delays in the process. One common error is failing to provide complete personal information. It is crucial to include your full name, current residence, work address, social security number, and any other names used. Omissions can complicate the identification process, making it harder for the court to handle the case efficiently.

Another frequent mistake is not adhering to the specified deadlines. The answering party must respond under oath within 30 days. If this timeline is not respected, it may result in sanctions or unfavorable judgments. People sometimes underestimate the importance of timely completion and submission of the forms.

Many individuals also fail to attach necessary documents when referencing them in their answers. For example, if a question asks about previous agreements, the related documents should accompany the responses. Failure to do so can result in insufficient answers, which may weaken a case.

Moreover, expressing uncertainty when required information is not known can lead to errors. Rather than clearly stating what they don’t know, some individuals provide vague answers or leave sections blank. The form clearly instructs that it is acceptable to admit knowledge gaps, yet many overlook this aspect.

Another mistake concerns misinterpreting the definitions provided in the form. For instance, terms like asset or support may be broader than individuals realize. This can lead to incomplete disclosures of financial information, undermining the form's purpose of obtaining relevant data for the case.

Individuals should also check the appropriate boxes next to each interrogatory they want answered. Neglecting this step can result in incomplete information being provided, which can hinder the clarity of the responses. It is important to ensure all intended questions are clearly marked.

In addition, people often overlook the oath requirement. Answers must be dated and signed, accompanied by a statement declaring the veracity of the information. Failing to include this statement can render the form invalid or noncompliant.

Lastly, some individuals do not provide full details about the income received during the past 12 months or do not attach the last three pay stubs as required. This can affect the court’s understanding of an individual’s financial situation, leading to misinterpretations and potentially adverse outcomes.

Documents used along the form

The California FL-145 form, known as the Form Interrogatories for Family Law, is typically accompanied by various other forms and documents that facilitate the exchange of information during a family law proceeding. Below are key forms that are often used alongside FL-145, each serving a specific purpose in the legal process.

- FL-142: Schedule of Assets and Debts - This form requires parties to list their assets and debts, providing the court with a comprehensive overview of their financial situation. It supports the assertions made in FL-145 regarding property interests.

- FL-150: Income and Expense Declaration - This document outlines each party's income, expenses, and financial obligations. It aids in determining support payments and is usually required in divorce and support cases.

- FL-194: Declaration of Disclosure - Parties must complete this form to disclose their financial situation fully. This is critical in family law matters where division of property, support, and other financial issues are at stake.

- FL-310: Request for Order - This is used to seek court orders regarding child custody, visitation, support, or other family law issues. It moves the proceedings forward and allows parties to request specific judicial actions.

- FL-321: Child Custody and Visitation Application - If child custody and visitation rights are contested, this form outlines each parent’s requests regarding time with the child. It must be filed in conjunction with relevant financial disclosures.

- FL-135: Responsive Declaration to Motion - In response to a Request for Order, this form allows parties to state their objections or support for the motion. It serves as a necessary part of the back-and-forth communication with the court.

- FL-300: Notice of Motion - This form notifies the other party of a motion being filed and includes details about the hearing. It's critical for ensuring that both parties are informed and have an opportunity to respond.

- FL-147: Request for Interrogatories - Similar to FL-145, this document is a formal request for the opposing party to answer specific questions under oath, helping to gather more detailed information pertinent to the case.

- FL-150F: Child Support Standards Worksheet - This supplemental document calculates the estimated child support based on the parties' incomes and expenses, providing a detailed breakdown of how support payments should be determined.

- FL-313: Declaration for Default or Uncontested Dissolution - This form is used to finalize a divorce when one party does not respond. It includes necessary declarations to allow the court to proceed without opposition.

These documents work together with the FL-145 form to support the exchange of vital information in family law cases. By understanding their functions, parties can navigate the legal process more effectively and advocate for their interests.

Similar forms

- Form FL-142 (Schedule of Assets and Debts): Like FL-145, this form is utilized in family law cases. It requires both parties to disclose their financial assets and liabilities to foster transparency during legal proceedings. The aim is to ensure that both parties are aware of the financial landscape, similar to the information exchange encouraged by FL-145.

- Form FL-150 (Income and Expense Declaration): This document is also designed for financial disclosure. Just as FL-145 prompts parties to share detailed financial information under oath, FL-150 focuses on income and expenses, helping the court understand each party's financial situation for support determinations.

- Form FL-110 (Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act): While primarily addressing custody issues, this form requires parties to exchange information about their children’s welfare. Similar to FL-145, it emphasizes the importance of providing necessary information, ensuring that the best interests of the child are at the forefront.

- Form FL-145 (Request for Domestic Violence Restraining Order): Although focused on protection from abuse, this form also necessitates the disclosure of relevant facts and circumstances. In this sense, both forms emphasize the importance of thorough communication in legal proceedings.

- Form FL-158 (Child Support Information and Guidelines): This form outlines essential information regarding a party's financial situation, much like FL-145. Both require disclosure to support accurate calculations and decisions regarding financial obligations.

- Form FL-165 (Self-Represented Declaration): This document serves to provide background information to the court. Like FL-145, it operates under the premise that accurate and complete disclosure is vital for fair legal processes.

- Form FL-103 (Response to Petition): When responding to a petition, this form requires a party to provide information about their claims and defenses. Similar to FL-145, it fosters open communication between the parties involved.

- Form FL-120 (Petition for Dissolution of Marriage): As a foundational document in divorce cases, it outlines key issues, including finances. Just like FL-145, it ensures all necessary information is presented for the court’s consideration in family law cases.

Dos and Don'ts

When filling out the California FL 145 form, it is essential to ensure accuracy and attention to detail. Here are six important dos and don’ts to consider:

- Do answer all interrogatories truthfully and to the best of your knowledge.

- Do attach any required documents that are referenced in your responses, ensuring they are clearly labeled.

- Do sign and date your responses to affirm that they are true under penalty of perjury.

- Do clarify any limitations in your answers if you cannot provide complete information.

- Don’t leave any questions unanswered without a valid reason; if you don't know, simply state that.

- Don’t share sensitive personal information without taking necessary precautions for your privacy, like using the Clear This Form button when finished.

Misconceptions

Here are some common misconceptions about the California FL 145 form, along with clarifications for each:

- Misconception 1: The FL 145 form is only for divorce cases.

- Misconception 2: Answering the interrogatories is optional.

- Misconception 3: I can provide incomplete answers without consequences.

- Misconception 4: The interrogatories do not need to be signed.

- Misconception 5: Only the asking party can reference documents.

- Misconception 6: All information provided is confidential and won’t be shared.

- Misconception 7: You can only list assets, not debts.

- Misconception 8: The FL 145 form replaces attorney-client privilege.

This form can be used in various family law cases, including legal separations and child custody matters, not just divorces.

Respondents are required to answer the interrogatories under oath within a specified timeframe, usually 30 days.

If an interrogatory cannot be fully answered, the respondent must explain the inability to answer and provide any available information.

Each party must date and sign their answers, affirming their truthfulness under penalty of perjury.

Both parties must attach relevant documents when answering interrogatories, especially if the answers rely on those documents.

Responses to the interrogatories can be used in court proceedings and may be accessible to the other party, depending on the case.

Respondents must disclose both assets and debts as part of the information exchange required by the form.

The form does not override any legal privileges. Parties can assert privileges when applicable, protecting certain information from being disclosed.

Key takeaways

- Understanding the purpose: The FL-145 form is designed to facilitate the exchange of relevant information in family law cases, allowing both parties to provide necessary details without incurring unreasonable expenses.

- Important deadlines: Answers to the interrogatories must be completed within 30 days, ensuring timely communication between the asking and answering parties.

- Oath requirement: All responses must be made under oath, affirming their truthfulness and accuracy. Make sure to include the statement about the declaration under penalty of perjury at the end of your answers.

- Document references: If documenting your answers with other papers, attach them as exhibits and clearly refer to them in your responses. This helps maintain organization and clarity.

- Address the questions clearly: When answering the interrogatories, fully disclose all information you can gather. If you cannot answer a question completely, explain why and provide whatever details you do have.

- Privileged information: If certain information is protected by legal privilege, such rights should be asserted. Know what can be disclosed and what should remain confidential.

- Diverse source of questions: The form covers a wide range of topics—from personal information to financial details—ensuring that all relevant areas are addressed for accurate representation in legal proceedings.

- Completing the Schedule of Assets and Debts: In conjunction with the FL-145 form, you must complete the Schedule of Assets and Debts (form FL-142) to provide a comprehensive overview of financial situations.

- Privacy measures: To protect personal information, users are advised to clear the form after completing it. This simple step ensures that sensitive data is not inadvertently shared.

Browse Other Templates

Farfel's Farm & Dog Rescue - Make sure everyone in your household supports your decision to adopt.

Tiaa Revenue - Electronic Fund Transfers are not permitted for direct rollovers.

Guyana Visa - Follow the instructions clearly to ensure a smooth process.