Fill Out Your California Llc 1 Form

The California LLC-1 form plays a crucial role for those looking to establish a Limited Liability Company in the state. This form is essential for filing Articles of Organization and requires various pieces of information to be submitted accurately. First, it specifies the limited liability company's name, which must include an identifier such as "LLC." Business addresses, both for the designated office and mailing purposes, are mandatory, ensuring that the state has up-to-date contact information. Another critical component is the designation of a registered agent for service of process. This can be either an individual or a corporation operating within California. Control and management structure also need to be defined, with options to choose from a single manager, multiple managers, or member-managed. Furthermore, the LLC-1 requires a purpose statement that outlines the lawful activities the LLC will undertake. Importantly, filers must affirm that the provided information is correct and that they are authorized to file on behalf of the company. When completed, this form not only initiates the legal recognition of the LLC but also sets the groundwork for its compliance obligations within California's regulatory framework.

California Llc 1 Example

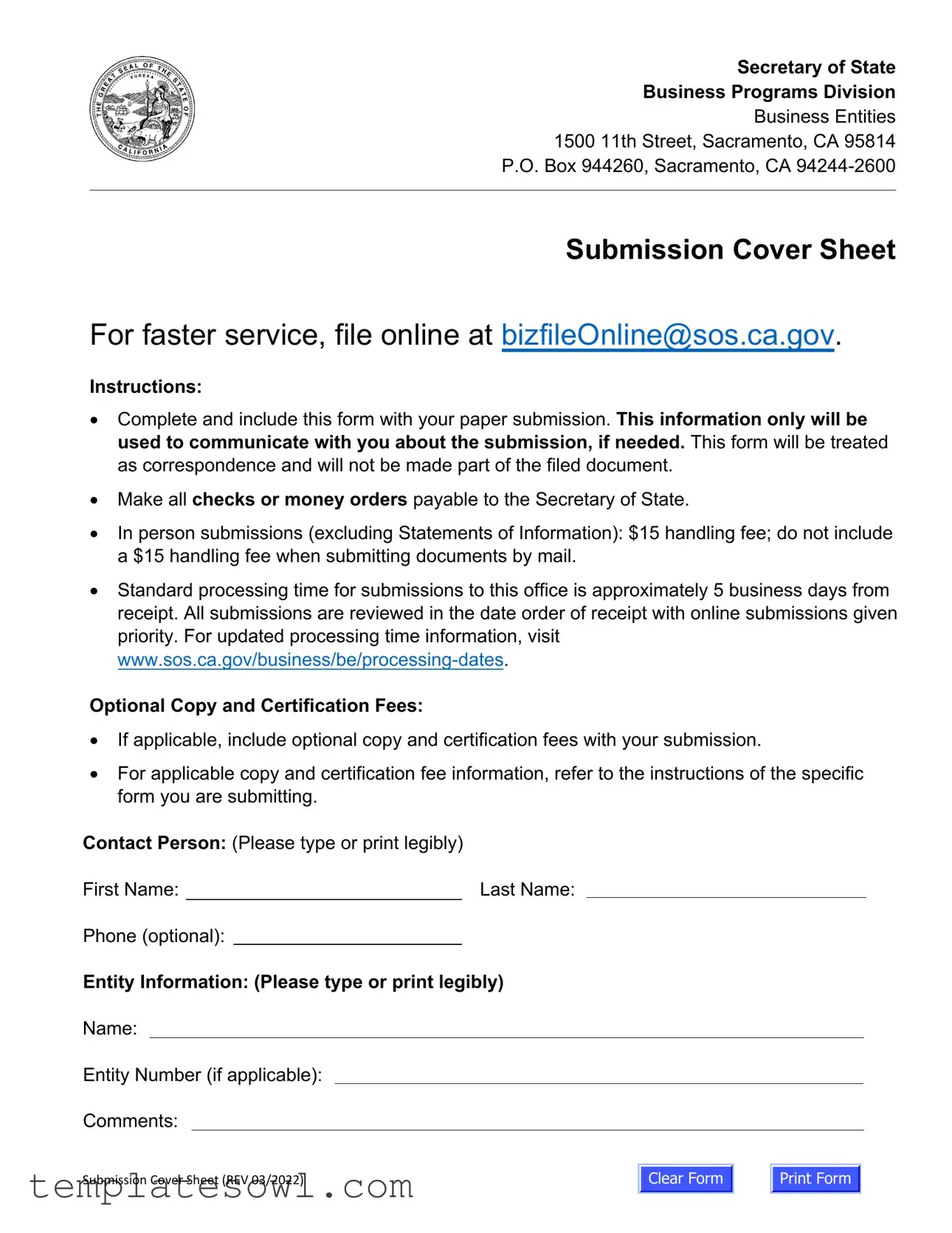

Secretary of State

Business Programs Division

Business Entities

1500 11th Street, Sacramento, CA 95814

P.O. Box 944260, Sacramento, CA

Submission Cover Sheet

For faster service, file online at bizfileOnline@sos.ca.gov.

Instructions:

•Complete and include this form with your paper submission. This information only will be used to communicate with you about the submission, if needed. This form will be treated as correspondence and will not be made part of the filed document.

•Make all checks or money orders payable to the Secretary of State.

•In person submissions (excluding Statements of Information): $15 handling fee; do not include a $15 handling fee when submitting documents by mail.

•Standard processing time for submissions to this office is approximately 5 business days from receipt. All submissions are reviewed in the date order of receipt with online submissions given priority. For updated processing time information, visit

Optional Copy and Certification Fees:

•If applicable, include optional copy and certification fees with your submission.

•For applicable copy and certification fee information, refer to the instructions of the specific form you are submitting.

Contact Person: (Please type or print legibly)

First Name: |

|

Last Name: |

Phone (optional):

Entity Information: (Please type or print legibly)

Name:

Entity Number (if applicable):

Comments:

Submission Cover Sheet (REV 03/2022)

Clear Form

Print Form

Secretary of State |

|

|

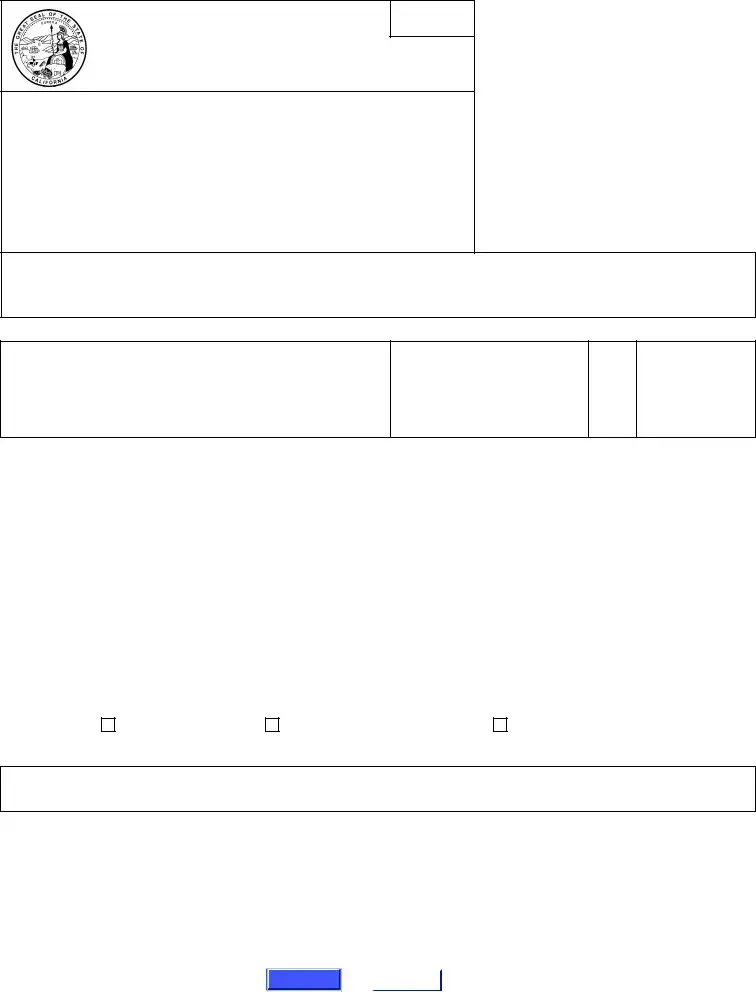

Articles of Organization

Limited Liability Company (LLC)

Filing Fee – $70.00

Certification Fee (Optional) – $5.00

Note: LLCs may have to pay minimum $800 tax to the California Franchise

Tax Board each year. For more information, go to https://www.ftb.ca.gov.

This Space For Office Use Only

1.Limited Liability Company Name (Must contain an LLC identifier such as LLC or L.L.C. “LLC” will be added, if not included.)

2.Business Addresses

a. Initial Street Address of Designated Office in California - Do not enter a P.O. Box |

City (no abbreviations) |

State |

Zip Code |

|

|

CA |

|

b. Initial Mailing Address of LLC, if different than item 2a |

City (no abbreviations) |

State |

Zip Code |

3.Service of Process (Must provide either Individual OR Corporation.)

INDIVIDUAL – Complete Items 3a and 3b only. Must include agent’s full name and California street address.

a. California Agent's First Name (if agent is not a corporation) |

|

Middle Name |

Last Name |

|

Suffix |

|

|

|

|

|

|

|

|

b. Street Address (if agent is not a corporation) - Do not enter a P.O. Box |

City (no abbreviations) |

|

State |

Zip Code |

||

|

|

|

|

CA |

|

|

CORPORATION – Complete Item 3c. Only include the name of the registered agent Corporation. |

|

|

|

|

||

|

|

|

|

|

||

c. California Registered Corporate Agent’s Name (if agent is a corporation) – Do not complete Item 3a or 3b |

|

|

|

|

||

|

|

|

|

|

|

|

4. Management (Select only one box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

The LLC will be managed by: |

|

|

|

|

|

|

One Manager |

More than One Manager |

All LLC Member(s) |

|

|

||

|

|

|

|

|

|

|

5.Purpose Statement (Do not alter Purpose Statement)

The purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the California Revised Uniform Limited Liability Company Act.

6.By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized by California law to sign.

Additional signatures set forth on attached pages, if any, are incorporated herein by reference and made part of this Form

_____________________________________________________________ __________________________________________________________

Organizer sign here

Clear Form

Print your name here

|

2022 California Secretary of State |

|

Print Form |

||

bizfileOnline.sos.ca.gov |

||

|

||

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Governing Law | The California Revised Uniform Limited Liability Company Act governs the LLC-1 form. |

| Filing Fee | To submit the LLC-1 form, a filing fee of $70 is required. |

| Submission Method | Online submission is available for faster service through the designated electronic portal. |

| Processing Time | The standard processing time for submissions is approximately 5 business days. |

| Tax Requirement | Each year, LLCs in California may owe a minimum tax of $800 to the Franchise Tax Board. |

| Service of Process | Each LLC must designate an individual or corporation in California for service of process. |

Guidelines on Utilizing California Llc 1

Filling out the California LLC 1 form is an essential step for establishing a limited liability company in the state. Once you have completed the form, ensure that it is submitted alongside any necessary fees. The submission process typically takes around five business days. If you’re in a hurry, online filing is available for quicker processing.

- Obtain the Form: Download or print the California LLC 1 form from the Secretary of State’s website.

- Complete the Submission Cover Sheet: Fill in your contact information, including your first and last name, and optionally provide a phone number.

- Enter Entity Information: Provide the name of your LLC. Ensure it includes an identifier like "LLC" or "L.L.C." If you have an entity number, include that as well.

- Fill in Business Addresses: Specify the initial street address of your LLC's designated office in California, ensuring not to use a P.O. Box. Include the city, state, and zip code. If your mailing address differs, provide that information in the next line.

- Designate Service of Process: Choose either an individual or a corporation as your agent. If choosing an individual, fill in their first, middle, and last names, along with the street address (no P.O. Box) including city, state, and zip code. If selecting a corporation, just include the name of the registered corporate agent.

- Select Management Structure: Indicate whether your LLC will be managed by one manager, more than one manager, or all LLC members by marking the appropriate box.

- Include Purpose Statement: Write the purpose of the LLC as outlined on the form, without alteration.

- Sign the Form: The organizer must sign the form, confirming the accuracy of the provided information. If there are additional signatures, ensure they are included on attached pages.

- Prepare for Submission: Make sure to include payment for the filing fee of $70. Optional certification fees of $5 may also be submitted if desired. For mail submissions, ensure no handling fee is included. If filing in person, there’s a $15 handling fee.

- Submit the Form: Send the completed form and payment to the Secretary of State's office address provided on the form. Consider filing online for faster processing.

What You Should Know About This Form

What is the purpose of the California LLC 1 form?

The California LLC 1 form, also known as the Articles of Organization, is necessary for establishing a Limited Liability Company (LLC) in California. This form provides essential information about your LLC, such as its name, business address, and management structure. Completing this form is crucial to legally registering your LLC and gaining the benefits that come with it, such as limited liability protection and operational flexibility.

What fees are associated with filing the California LLC 1 form?

Filing the California LLC 1 form incurs a filing fee of $70. Additionally, if you choose to request a certification of your documents, an optional fee of $5 applies. Keep in mind that LLCs in California are also subject to a minimum annual tax of $800, which should be paid to the California Franchise Tax Board. It’s important to factor in these costs when planning your business expenses.

What is the standard processing time for the California LLC 1 form?

Typically, the processing time for submissions of the California LLC 1 form is approximately 5 business days from the date of receipt. However, those who submit their filings online will have their documents prioritized. To stay updated on processing times, you can visit the California Secretary of State's website, where current information is regularly posted.

Is it possible to submit the California LLC 1 form online?

Yes, you can file the California LLC 1 form online for quicker service. For online submissions, go to the California Secretary of State’s business filing website. However, ensure that you complete and include the Submission Cover Sheet as part of your filing. This helps streamline the process and allows the Secretary of State to communicate with you regarding your submission if necessary.

Common mistakes

Completing the California LLC-1 form is a crucial step in establishing a Limited Liability Company. However, many people encounter challenges that can lead to mistakes during this process. One of the common errors is failing to include the proper LLC identifier in the company name. The name must contain "LLC" or "L.L.C." If this identifier is omitted, the state will automatically add "LLC" to the end of the name, which may not reflect the owner’s intended brand accurately.

Another frequent mistake is incorrect address information. Applicants often enter either a P.O. Box for the designated office street address or abbreviate the city name. The instructions clearly state that a P.O. Box is not permitted and city names must be written out completely. Incorrect addresses can lead to delays in the processing of documents and hinder communication with state agencies.

Providing inaccurate information for the service of process is also a significant misstep. Some applicants may complete this section incorrectly by not providing the full name or proper address for the designated agent. It is essential to list either an individual or a corporation accurately as the service agent. Any inaccuracies can result in problematic legal notifications and missed deadlines.

Many individuals also overlook the management structure selection on the form. They may forget to check a box indicating whether the LLC will be managed by one manager, multiple managers, or all members. If this section is left unmarked or filled incorrectly, it can lead to confusion regarding the management responsibilities and obligations within the company.

Finally, neglecting to sign the form can halt the entire process. Individuals sometimes forget that their signature is a declaration under penalty of perjury, affirming that all provided information is accurate and that they are authorized to submit the form. This essential step is sometimes overlooked, which may delay the filing or require resubmission, further complicating the establishment of the LLC.

Documents used along the form

When forming a Limited Liability Company (LLC) in California, several important documents and forms complement the California LLC-1 form. Each of these documents serves a specific purpose in the formation and ongoing compliance of the LLC. Below is a list of common forms and documents that are utilized alongside the LLC-1.

- LLC-12: Statement of Information - This form must be filed within 90 days of filing the LLC-1. It provides updated information about the LLC, including the addresses, management structure, and contact details.

- LLC-4/7: Articles of Organization Amendment - If there are changes to the LLC's name or management structure, this form is used to amend the original Articles of Organization.

- Form 568: Limited Liability Company Return of Income - LLCs are required to file this form annually to report their income, deductions, and to determine any taxes owed to the California Franchise Tax Board.

- LLC-5: Certificate of Dissolution - If the LLC needs to be dissolved, this form is filed to formally close the business and limit ongoing tax liabilities.

- LLC-1A: Application for Reservation of Name - This form can be filed prior to forming the LLC to reserve a specific name for the entity, ensuring that it remains available when the LLC is officially formed.

- Operating Agreement - Although not filed with the state, this internal document outlines the management structure and operating procedures of the LLC, serving as a guideline for operations and member relationships.

- Employer Identification Number (EIN) Application - It is necessary for tax purposes and hiring employees. The EIN is obtained by completing Form SS-4 with the IRS.

Understanding the various forms and documents involved in starting and managing a California LLC is crucial for compliance and operation. It ensures that the LLC meets all state requirements and can operate smoothly within the legal framework. Each document plays a role in the overall governance and financial responsibility of the business.

Similar forms

- Certificate of Formation: Similar to the California LLC-1 form, the Certificate of Formation initiates the creation of a business entity. This document outlines basic information about the entity, such as its name and address, much like the LLC-1.

- Articles of Incorporation: Used for corporations, this document serves a purpose similar to the LLC-1 form in establishing a corporate entity. It details the corporate name, purpose, and registered agent, akin to the information required for an LLC.

- Statement of Information: This document is required for LLCs and corporations to provide updated information about management and business addresses. Just as the LLC-1 collects essential information for initial setup, the Statement of Information keeps official records current.

- Operating Agreement: While not required for filing, this document sets out the management structure of an LLC. Similar to how the LLC-1 indicates management style, the Operating Agreement details roles and responsibilities among members.

- Foreign LLC Registration: When an LLC wants to operate in a different state, it must file a similar registration document in that jurisdiction. This process mirrors the initial filing of the LLC-1 to register an LLC with the state of California.

- Bylaws: Like the Operating Agreement, bylaws govern the internal management of a corporation. Both documents play crucial roles in defining governance, although the bylaws pertain to corporations and not LLCs.

- Certificate of Good Standing: This document confirms an entity's compliance with state regulations. It serves a similar purpose to the information collected in the LLC-1 by showing that the business is properly registered and operating legally.

- Application for Employer Identification Number (EIN): After filing the LLC-1, businesses usually need to obtain an EIN from the IRS. This document serves as a distinct identifier for the entity in a manner paralleling the initial registration process of the LLC-1.

Dos and Don'ts

When filling out the California LLC-1 form, there are essential dos and don'ts to keep in mind. These simple guidelines can ensure a smoother process and the successful submission of your LLC registration.

- Do type or print legibly to ensure clarity in your submission.

- Do make sure the LLC name includes an identifier, such as "LLC" or "L.L.C."

- Do include accurate addresses for both the designated office and the mailing address.

- Do provide complete and correct information for your service of process agent, either an individual or corporation.

- Don’t submit payment in cash; use checks or money orders made out to the Secretary of State.

- Don’t alter the Purpose Statement; it must remain as provided in the instructions.

Following these guidelines will help ensure your LLC registration is processed without unnecessary complications. Remember, accuracy and attention to detail are key!

Misconceptions

Understanding the California LLC-1 form is essential for anyone looking to establish a limited liability company in the state. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- Filing the form guarantees automatic approval. Many believe that simply submitting the LLC-1 form will automatically result in the creation of their LLC. In reality, the state must review and approve the application before the LLC is officially formed.

- All submissions are processed equally. Some think that all forms are processed in the order they are received. While this is true for paper submissions, online submissions are prioritized, which can affect processing times.

- The filing fee is the only cost involved. There is a common belief that the $70 filing fee is all you need to pay. However, new LLCs must also pay a minimum yearly tax of $800 to the California Franchise Tax Board.

- A P.O. Box can be used as the business address. It is a misconception that you can list a P.O. Box for the business address. The California LLC-1 form requires a physical street address for the designated office.

- The purpose of the LLC is flexible and can be altered. Some individuals believe they can modify the purpose statement on the form. In fact, the purpose statement provided in the LLC-1 must remain as it is and cannot be changed.

Being aware of these misconceptions can help ensure a smoother process when forming an LLC in California.

Key takeaways

The California LLC-1 form is essential for establishing a Limited Liability Company within the state. Here are important takeaways to consider when filling out and using this form:

- Filing Fee: A fee of $70.00 is required to file the LLC-1 form, in addition to any applicable certification fees.

- Optional Fees: If desired, one can request optional copy and certification services for a fee of $5.00.

- Submission Methods: The form can be filed online for faster processing or mailed to the Secretary of State’s office.

- Address Requirements: Include a physical street address for the designated office; P.O. Boxes are not acceptable.

- Agent Information: The form requires the identification of a California agent for service of process, who can be either an individual or a corporation.

- Management Structure: Clearly indicate whether the LLC will be managed by one manager, multiple managers, or all members.

- Purpose Statement: The purpose statement must remain unchanged and simply state that the LLC is allowed to engage in any lawful activity.

- Processing Time: Expect a standard processing time of about five business days from the date of receipt.

- Penalties: Ensure accurate information, as signing under penalty of perjury entails legal accountability for the provided details.

These takeaways will assist in the successful completion and submission of the California LLC-1 form, ensuring all requirements are met for a valid application.

Browse Other Templates

West Virginia Tax Liability Compromise Form,WV Tax Settlement Proposal,West Virginia Offer to Settle Tax Debt,WV State Tax Compromise Application,West Virginia Taxpayer Relief Agreement,WV Tax Forgiveness Submission,Offer to Compromise Tax Obligation - Documentation supporting disclosures on forms 433-A and/or 433-B must accompany the CD-3 offer.

Bill of Sale Template Uk - The “New Keeper Supplement” serves as proof of ownership for the buyer.