Fill Out Your California Scratchers Form

The California Scratchers form serves as a crucial tool for individuals looking to claim their lottery winnings from Scratchers tickets. Claimants must provide detailed information, including their name, address, date of birth, and Social Security Number or Tax Identification Number, ensuring accurate identification and tax reporting. When submitting a claim, the original ticket must be attached, with the ticket number clearly noted. There are different processes depending on the prize amount, as prizes of $599 or less can be cashed at participating retailers. For larger winnings, claimants must submit this form directly to the California Lottery. The form outlines essential instructions, such as stapling the ticket and providing a valid signature that matches the one on the ticket. Moreover, clarity regarding tax implications is provided, indicating that federal taxes will be withheld for U.S. citizens and resident aliens, while a higher rate applies to non-U.S. citizens. Timely processing of claims, typically within eight weeks, depends on the completeness of the submitted information. Through transparency in rules, privacy notices, and demographic inquiries, the California Lottery aims to create a streamlined, responsible claiming experience for all players.

California Scratchers Example

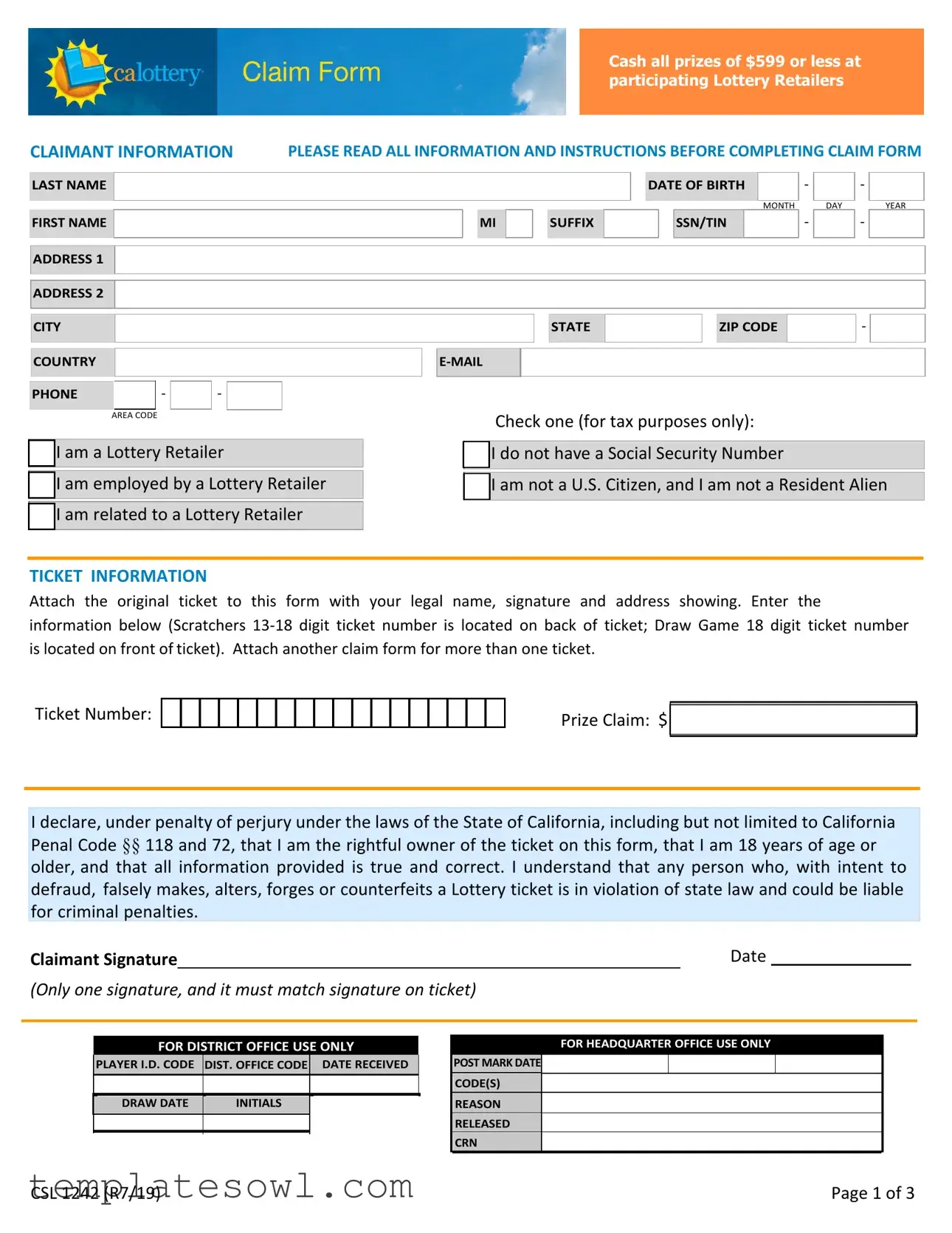

Cash all prizes of $599 or less at participating Lottery Retailers

CLAIMANT INFORMATION PLEASE READ ALL INFORMATION AND INSTRUCTIONS BEFORE COMPLETING CLAIM FORM

LAST NAME

FIRST NAME

ADDRESS 1 |

ADDRESS 2

CITY

COUNTRY

|

|

|

|

|

|

DATE OF BIRTH |

|

- |

|

- |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

DAY |

|

YEAR |

MI |

|

|

SUFFIX |

|

|

|

|

SSN/TIN |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

- |

PHONE |

|

- |

|

- |

|

|

|

|

|

|

AREA CODE |

|

|

|

I am a Lottery Retailer

I am a Lottery Retailer

I am employed by a Lottery Retailer

I am employed by a Lottery Retailer

I am related to a Lottery Retailer

I am related to a Lottery Retailer

Check one (for tax purposes only):

I do not have a Social Security Number

I do not have a Social Security Number

I am not a U.S. Citizen, and I am not a Resident Alien

I am not a U.S. Citizen, and I am not a Resident Alien

TICKET INFORMATION

Attach the original ticket to this form with your legal name, signature and address showing. Enter the

information below (Scratchers

Ticket Number:

Prize Claim: $

I declare, under penalty of perjury under the laws of the State of California, including but not limited to California Penal Code §§ 118 and 72, that I am the rightful owner of the ticket on this form, that I am 18 years of age or older, and that all information provided is true and correct. I understand that any person who, with intent to defraud, falsely makes, alters, forges or counterfeits a Lottery ticket is in violation of state law and could be liable for criminal penalties.

Claimant Signature |

|

Date |

(Only one signature, and it must match signature on ticket)

FOR DISTRICT OFFICE USE ONLY

PLAYER I.D. CODE |

DIST. OFFICE CODE |

|

DATE RECEIVED |

|

|

|

|

|

|

DRAW DATE |

|

INITIALS |

|

|

|

|

|

|

|

|

|

|

|

|

FOR HEADQUARTER OFFICE USE ONLY

POST MARK DATE

CODE(S)

REASON

RELEASED

CRN

CSL 1242 (R7/19) |

Page 1 of 3 |

PRIZE PAYMENT INFORMATION

Failure to provide your original signed ticket with date of birth, legal name, complete address (including apartment or space number, city, state, zip code), email and phone number may delay or prevent the California State Lottery (Lottery) from processing your prize claim. Claims submitted to Lottery Headquarters for processing are paid by check and mailed from the California State Controller's Office. Processing time, once claim is received and verified, is approximately 8 weeks. If you have questions, contact the Lottery at

Lottery prizes are not subject to California state income tax. The Lottery is required by federal tax law to withhold federal taxes of 24% for U.S. citizens and resident aliens.

Tickets, transactions, purchases, claims and prize payments are subject to federal and state law and California Lottery regulations, policies and procedures. Copies of regulations are available at Lottery District Offices and on our website at www.calottery.com. Tickets failing validation are void.

INSTRUCTIONS

1.Print your legal name, street address, city, state, and zip code on the back of the ticket.

2.Sign your name on the back of the original ticket.

3.Complete the Claimant Information and Ticket Information sections on the first page of thisform.

4.Sign the first page of this form with ink. (ONLY ONE SIGNATURE IS PERMITTED)

5.Staple your original ticket to the front of this form.

KEEP A COPY OF THIS FORM AND A COPY OF THE FRONT AND BACK OF THE TICKET.

Deliver the completed claim form with original ticket to any Lottery District Office. Location and directions can be found at www.calottery.com.

OR, MAIL THIS CLAIM FORM, AT YOUR OWN RISK, WITH THE ORIGINAL TICKET STAPLED ON THE FRONT, TO: California Lottery, 730 North 10th Street, Sacramento, CA

Call

PRIVACY NOTICE

The Information Practices Act of 1977 (Cal. Civ. Code

The Claimant Information requested on this form will be used to validate and process your claim in accordance with the California State Lottery Act of 1984 (Gov. Code §8880 et seq.). The Lottery requests a player's social security or

tax identification number (SSN/TIN) for tax withholding and reporting purposes, pursuant to Internal Revenue Code

§§6011, 6041, 6109, 3402, and the regulations enacted thereunder.

The Claimant Information you provide may be disclosed to various state and federal government agencies, including but not limited to: the State Controller's Office, Franchise Tax Board, Health and Welfare Agency, and the Internal Revenue Service. It will not be disclosed to members of the public.

You have the right to access your personal information maintained by the Lottery by contacting the California Lottery, 700 North 10th Street, Sacramento, CA

Purpose and Relevancy of Information Collected: Information is collected to validate and process a claim and for purposes of sales, marketing, research, security investigation, legal review, surveys, and strategic planning as related to the operations of the Lottery. By submitting this claim, you consent and agree to such use, and waive any and all legal claims, known or unknown, related to the specified uses set forth herein. The California Lottery is subject to public disclosure laws that allow access to certain governmental records. Your full name, the name and location of the retailer who sold you the winning ticket, the date you won, and the amount of your winnings, including your gross and net installment payments, are matters of public record and are subject to disclosure. The Lottery will not disclose any other personal or identifying information without your permission unless legally required to do so. No information will be collected or accepted from known minors. You may be asked to participate in a press conference.

CSL 1242 (R7/19) |

Page 2 of 3 |

VOLUNTARY DEMOGRAPHIC INFORMATION

By volunteering to answer the following questions, you will help the Lottery know more about its players. The voluntary information that you provide regarding your ethnicity, household income, gender, and household composition will be used only by the Lottery to conduct internal demographic analyses (which may be completed by agents and contractors).

Which of the following do you consider yourself to be?

(Check all that apply)

African American

African American

Asian

Asian

Hispanic

Hispanic

White

White

Other (Specify)

Other (Specify)

Annual Household Income

Under $30,000

Under $30,000

$30,000 TO $49,999

$30,000 TO $49,999  $50,000 TO $99,999

$50,000 TO $99,999

$100,000 TO $149,999

$100,000 TO $149,999

$150,000 or more

$150,000 or more

Number of People in Household

(including yourself):

Gender

Female

Female

Male

Male

Nonbinary

Nonbinary

CSL 1242 (R7/19) |

Page 3 of 3 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Prize Amount Limit | Prizes of $599 or less can be cashed at participating Lottery Retailers. |

| Claim Form Requirements | The original ticket must be attached to the claim form, showing the claimant's legal name, signature, and address. |

| Processing Time | Once the claim is received and verified, processing takes approximately 8 weeks. |

| Tax Withholdings | Federal tax withholdings: 24% for U.S. citizens, 30% for non-U.S. citizens. |

| California Governing Laws | California Penal Code §§ 118 and 72, and California State Lottery Act of 1984 (Gov. Code §8880 et seq.). |

| Privacy Notice Compliance | Personal information collected is used to validate and process claims, and may be disclosed to certain government agencies. |

Guidelines on Utilizing California Scratchers

Completing the California Scratchers claim form properly is essential for a smooth process. It helps to ensure that your claim is processed efficiently and without delay. Follow these steps carefully to fill out the form correctly.

- Print your legal name, street address, city, state, and zip code on the back of the winning ticket.

- Sign your name on the back of the original ticket.

- Complete the Claimant Information section on the first page of the form. This includes providing your last name, first name, address, city, state, zip code, date of birth, Social Security Number or Tax Identification Number, email, and phone number.

- Fill out the Ticket Information section on the first page with the ticket number and prize claim amount.

- Sign the first page of the form with ink. Remember, only one signature is permitted, and it must match the signature on the ticket.

- Staple your original ticket to the front of this form.

- Make copies of this completed form and both sides of the ticket for your records.

- Deliver the completed claim form with the original ticket to any Lottery District Office. If you prefer, you may mail it (at your own risk) to California Lottery, 730 North 10th Street, Sacramento, CA 95811-0336.

What You Should Know About This Form

What is the California Scratchers form used for?

The California Scratchers form is used to claim prizes won on California Scratchers tickets. If you have won a prize of $599 or less, you can cash it in at participating Lottery Retailers. For larger prizes, you will need to complete this form, attach your original ticket, and submit it for processing to receive your winnings.

How do I fill out the Claimant Information section?

To complete the Claimant Information section, provide your last name, first name, date of birth, address (including apartment or space number), city, state, ZIP code, email, and phone number. Make sure your information is complete and accurate, as it may affect the processing of your claim.

What happens if I fail to include my original ticket?

Your claim will be delayed or possibly rejected if you do not attach your original signed ticket to the form. The ticket must show your legal name and signature, along with your complete address. The original ticket is essential for verifying your claim.

What is the processing time for my claim?

Once your claim is received and verified by the California Lottery, processing typically takes about 8 weeks. Ensure all information is accurate to avoid delays in receiving your payout.

Are lottery winnings subject to taxes?

Lottery prizes are not subject to California state income tax. However, the federal government requires that 24% be withheld for U.S. citizens and resident aliens. Non-U.S. citizens will have a 30% withholding on their winnings. Understanding these tax implications is vital when claiming your prize.

Can I claim winnings for multiple tickets at once?

Yes, if you have winnings from multiple tickets, you must attach another claim form for each ticket. Make sure to provide the necessary ticket numbers and prize claims on each form to avoid confusion during processing.

Where do I send my completed claim form?

You can deliver your completed claim form and original ticket to any Lottery District Office or mail it at your own risk to the California Lottery at 730 North 10th Street, Sacramento, CA 95811-0336. Remember, it is important to staple the original ticket to the front of the claim form before sending it.

What should I do if I have questions about the claim process?

If you have questions, you can contact the Lottery’s customer service at 1-800-LOTTERY (568-8379) during regular business hours, which is Monday through Friday. They can provide guidance and assist you with the claim process.

What privacy concerns should I be aware of?

Your personal information collected through the Scratchers form is used to process your claim according to California law. While your name and details about your win may become public record, your other personal information will be kept confidential. You have the right to access your specific personal information held by the Lottery.

Common mistakes

Filling out the California Scratchers claim form can be straightforward, but there are common mistakes that can lead to delays in processing. One mistake involves neglecting to read the instructions thoroughly. Without understanding the specific requirements for each section, claimants may fill out the form incorrectly, leading to complications.

Another frequent error is providing incomplete personal information. The Claimant Information section requires detailed information including a full legal name, accurate address, and contact details. Omissions or inaccuracies in this section may result in claims being postponed or rejected.

Failing to attach the original ticket is a critical mistake. The form clearly states that the original ticket must be attached with the claimant's signature and date of birth displayed. Submitting a copy or an unclear ticket may prevent the claim from being processed.

Incorrectly filling in the Ticket Information section adds another layer of potential problems. Claimants must ensure they enter the correct ticket number and prize amount. Any errors in this critical area can lead to delays and confusion during verification.

Some individuals mistakenly sign the form in a manner that does not match their ticket signature. Since only one signature is permitted, it is essential that the signature on the claim form and the one on the back of the ticket match exactly. Discrepancies here can raise suspicions and complicate the claim process.

Another common pitfall occurs when claimants fail to keep a copy of the submitted documents. Keeping a duplicate of the completed claim form and ticket can be beneficial if questions arise later regarding the claim.

Many claimants overlook the deadline for submitting the claim. It is important to be aware that claims must be filed within a specific time frame. Missing this deadline can result in forfeiture of the prize.

Additionally, some people underestimate the importance of providing their Social Security Number or Tax Identification Number for tax purposes. Forgetting to complete this section can cause delays in processing or result in a higher tax withholding on winnings.

Finally, disregarding the submission instructions can lead to complications. Whether opting to mail the claim or deliver it in person, following the outlined steps is crucial for ensuring proper handling. By avoiding these mistakes, claimants can facilitate a smoother process when claiming their winnings.

Documents used along the form

When filling out a California Scratchers claim form, there are several other forms and documents that may be required or helpful to ensure a smooth process. Here’s a brief overview of each one.

- Multiple Ownership Claim Form: Used by groups of players sharing prizes, typically for winnings of $1,000,000 or more. This form helps to document the ownership of the winning ticket among multiple claimants.

- Claim Form for Lottery Retailers: Specifically designed for individuals who work for or own a lottery retailer. This document verifies their employment status when claiming a prize.

- IRS W-2G Form: This tax form reports gambling winnings. If your prize exceeds a certain amount, the Lottery may issue this form for tax purposes.

- Single Ticket Claim Form: If you are claiming a prize for a single ticket without the need for a Scratchers form, this is the simplified form to facilitate that process.

- Tax Identification Requirements: Documentation that can include your Social Security Number or Tax Identification Number. This is necessary for tax reporting related to your winnings.

- Privacy Notice Acknowledgment: A document informing claimants about how their personal information will be handled and shared in relation to their claims.

- Identity Verification Documents: Items such as a driver's license or passport may be needed to confirm your identity when claiming a larger prize.

- Registered Agent Form: Used if a third party is claiming the prize on behalf of the actual ticket holder, ensuring the appropriate authorizations are in place.

- Financial Disclosure Form: Occasionally required to provide financial background, especially for significant prizes to ensure responsible spending.

Having these documents ready can expedite the claim process and help ensure that all required information is submitted correctly. Always check the latest guidelines by visiting California's Lottery website or contacting their customer service for specifics related to your claim.

Similar forms

The California Scratchers form is designed for individuals claiming lottery prizes. Similar documents serve various purposes in different contexts, often requiring personal information and verification. Below are nine documents that share similarities with the California Scratchers form, along with explanations of those similarities:

- W-2 Form: Employees use this form to report income and taxes to the IRS, requiring personal information like the individual's name, address, and Social Security number, which parallels the information requirement in the Scratchers form.

- IRS Form 1040: This individual income tax return form entails detailed personal data and income information akin to how the Scratchers form requires claimants to verify their identity and claim prize data.

- State Tax Return: Similar to the federal return, state tax forms solicit personal and income specifics to ensure compliance with state tax laws, reflecting the Scratcher's form requirements for tax information.

- Voter Registration Form: This document necessitates personal information and proof of residency, mirroring the identification requirements on the Scratchers form despite a different purpose.

- Passport Application: Applicants for a passport must provide extensive personal details and verified identification, like the Scratchers form that corroborates the lottery ticket ownership.

- Driver’s License Application: Much like the Scratchers form, this application requires personal and residency information, ensuring that the identity of the applicant is verified.

- Bank Account Opening Form: When opening a new bank account, individuals must disclose personal information and identification documents, reflecting the verification process in the Scratchers claim.

- Health Insurance Enrollment Form: This form collects extensive personal information and demographic data, similar to the voluntary demographic section found on the Scratchers form for lottery claims.

- Mortgage Application: Information provided in a mortgage application covers personal details and financial history, similar to the financial disclosures required when claiming lottery prizes.

Dos and Don'ts

When filling out the California Scratchers form, here are seven important do's and don'ts to keep in mind:

- Do print your legal name clearly on the form.

- Do provide a complete address with apartment or space number, if applicable.

- Do sign your name on the back of the original ticket.

- Do staple your original ticket to the front of the claim form.

- Don’t forget to include your date of birth and Social Security Number if applicable.

- Don’t submit a claim form without the original ticket attached.

- Don’t ignore the processing time; it may take approximately eight weeks.

Misconceptions

When it comes to the California Scratchers claim form, many people have misunderstandings. Here are some common misconceptions:

- You need to be a U.S. Citizen to claim your prize. Many believe that only U.S. citizens can collect winnings. In reality, non-U.S. citizens can claim prizes, but there may be different tax implications.

- Only big prizes need a claim form. Some think that claim forms are required only for large winnings. However, any prize over $599 requires completion of this form.

- You can claim without your original ticket. Some believe they can claim prizes just by having a copy of the ticket. You must submit the original ticket with your claim to process it.

- It takes no time to process claims. Many assume that claims are processed immediately. In fact, processing typically takes about 8 weeks once received by the Lottery.

- All winnings are subject to California state tax. Some people think they have to pay state taxes on their winnings. The truth is, California does not tax lottery winnings, but federal taxes apply.

- Only winners can submit the claim form. Many believe that only the ticket holder can submit the claim. However, if you have legal permission from the winner, you can submit the claim on their behalf.

- Privacy is not protected when you claim your prize. Some worry that personal information is freely shared. The Lottery has laws in place to protect your personal information, but some details may still be public.

- Winning the lottery makes you ineligible for assistance programs. A common concern is that winning will affect eligibility for government programs. The amount you win may have implications, but it doesn’t automatically disqualify you.

- You can fill out the form however you want. Some people think they can set their own rules for completing the form. It's crucial to follow the provided instructions to avoid delays in processing your claim.

Understanding these points can help ensure that your claim process goes smoothly. Always refer to the official California Lottery site if you have further questions or uncertainties.

Key takeaways

When it comes to claiming your winnings from California Scratchers, it's essential to follow the guidelines thoroughly. Here are some key takeaways that will help you navigate the process smoothly:

- Claim Retailers for Small Prizes: You can cash all prizes of $599 or less directly at participating lottery retailers. This gives you an immediate way to enjoy your winnings without additional paperwork.

- Original Ticket is Necessary: Always attach the original ticket to your claim form. Ensure your legal name, signature, and address are visible on the ticket. This step is crucial for verifying your claim.

- Deadline and Processing Times: Once you've submitted your claim, processing can take approximately eight weeks. If you’re mailing your claim, be aware that it is sent at your own risk.

- Tax Implications: While California lottery winnings are not subject to state income tax, federal taxes are withheld. This means 24% for U.S. citizens and resident aliens, and 30% for non-U.S. citizens.

By keeping these points in mind, you can navigate the process of claiming your California Scratchers prizes with confidence. Make sure to double-check your information and reach out to the lottery for any questions along the way!

Browse Other Templates

Modesto Security Registration Form,Modesto Alarm Registration Document,Modesto Surveillance Permit Application,Modesto Alarm User Registration,Modesto Home Safety Permit,Modesto Alarm System Registration,Modesto Emergency Alarm Permit,Modesto Alarm L - The form is designed for both residential and commercial properties.

Child Support per Child - The final weekly support amount is influenced by both parents’ contributions and needs, emphasizing collaboration.

Abc 227 - Specific licensing details, including license and receipt numbers, need to be included.