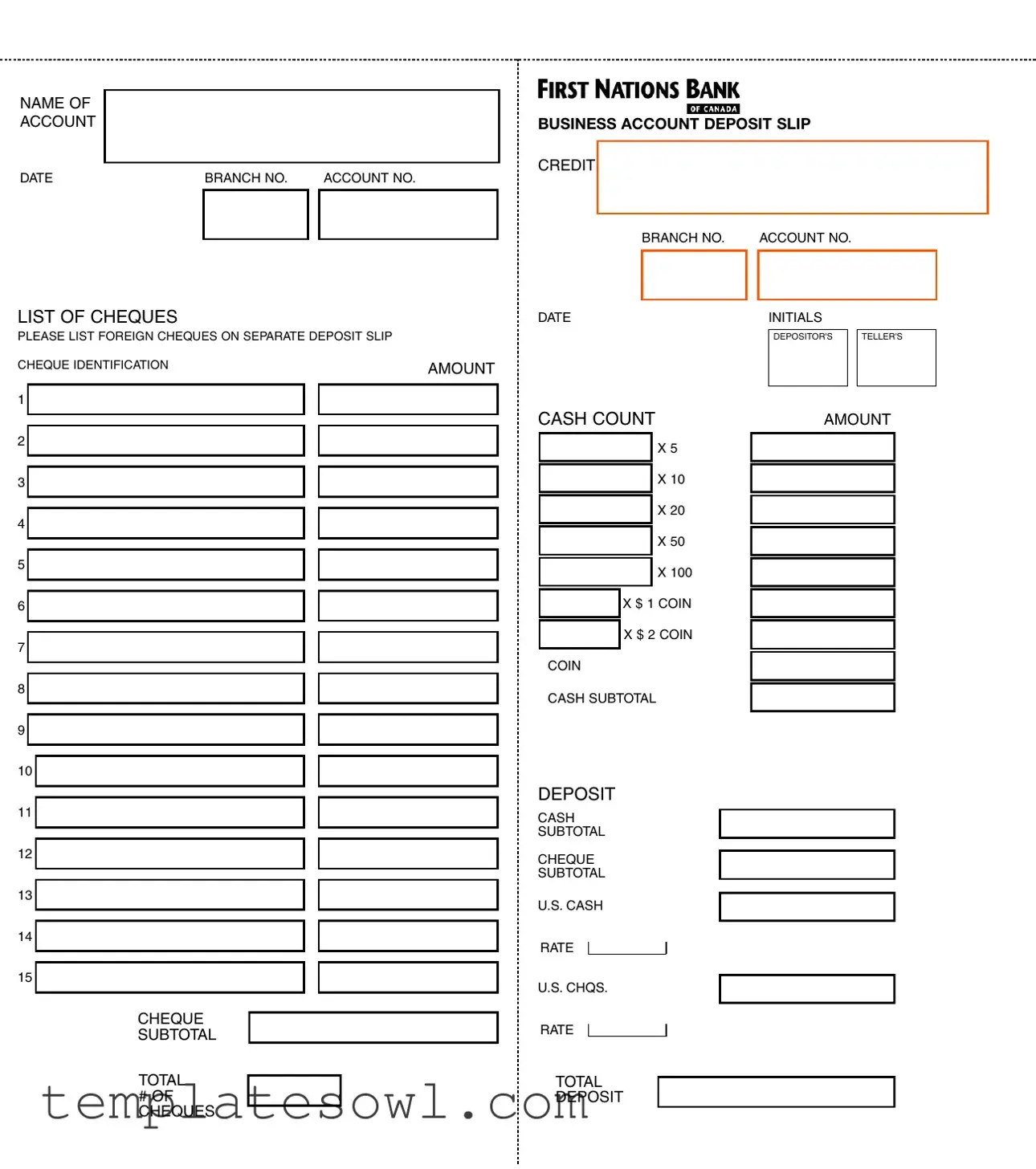

Fill Out Your Canada Deposit Slip Form

The Canada Deposit Slip is an essential document used primarily by individuals and businesses to facilitate the deposit of funds into their bank accounts. This form plays a key role in ensuring that deposits are processed accurately and efficiently at financial institutions across Canada. Each deposit slip includes critical sections for detailing the account holder's name, account number, and branch number. It allows users to break down their deposits, including a detailed listing of cheques being deposited, each with its respective identification and amount. For anyone dealing with foreign cheques, it's important to note that a separate deposit slip is required for those transactions. The form also incorporates sections for cash deposits, with specific breakdowns for various denominations, ensuring that both the teller and depositor can verify the cash count easily. As a comprehensive tool, the slip not only summarizes the total deposits but also includes rates for U.S. cash and cheques, making it an indispensable resource for accurate banking operations.

Canada Deposit Slip Example

NAME OF

ACCOUNT

DATE |

BRANCH NO. |

|

ACCOUNT NO. |

|

|

|

|

|

|

|

|

LIST OF CHEQUES

PLEASE LIST FOREIGN CHEQUES ON SEPARATE DEPOSIT SLIP

CHEQUE IDENTIFICATION |

AMOUNT |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

CHEQUE

SUBTOTAL

TOTAL

#OF CHEQUES

BUSINESS ACCOUNT DEPOSIT SLIP

CREDIT

|

BRANCH NO. |

|

ACCOUNT NO. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

|

|

INITIALS |

|

||

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR'S |

|

TELLER'S |

|

|

|

|

|

|

|

CASH COUNTAMOUNT

X 5

X 10

X 20

X 50

X 100

X $ 1 COIN

X $ 2 COIN

COIN

CASH SUBTOTAL

DEPOSIT

CASH

SUBTOTAL

CHEQUE

SUBTOTAL

U.S. CASH

RATE

U.S. CHQS.

RATE

TOTAL

DEPOSIT

Form Characteristics

| Fact Name | Description |

|---|---|

| Name of Account | The deposit slip requires the name of the account holder for identification purposes. |

| Date | The date field indicates when the deposit is being made. This helps in record-keeping and reference. |

| List of Cheques | Depositors must list each cheque being deposited, ensuring accuracy in the submitted amount. |

| Branch Information | The form includes branch numbers and account numbers, which are essential for processing the deposit correctly. |

Guidelines on Utilizing Canada Deposit Slip

Completing the Canada Deposit Slip form is essential for ensuring your deposits are processed smoothly and accurately. By providing clear and precise information, you help the bank handle your transaction efficiently. This guide will walk you through the necessary steps to complete the form correctly.

- Begin with your account details: Write your NAME OF ACCOUNT at the top of the form. Next, fill in the DATE, the BRANCH NO., and your ACCOUNT NO..

- List your cheques: In the section titled LIST OF CHEQUES, write down the cheque identification numbers and amounts of each cheque. If you have foreign cheques, remember to list them on a separate deposit slip.

- Calculate the subtotal: Add up the amounts of the cheques you've listed. Record this total in the CHEQUE SUBTOTAL field.

- Enter deposit information: If this is a business account, fill out the BUSINESS ACCOUNT DEPOSIT SLIP section by reaffirming your BRANCH NO., ACCOUNT NO., and DATE.

- Initial your deposit: Sign or place your initials in the INITIALS DEPOSITOR'S section.

- Teller's section: Leave space for the teller's initials and cash count, which they will complete. This may include details on the amounts of various denominations.

- Itemize cash: In the CASH COUNT area, indicate how many of each denomination you are depositing (such as $5, $10, $20, and so on). Add up these amounts for the CASH SUBTOTAL.

- Calculate totals: Sum the amounts in the CASH SUBTOTAL and CHEQUE SUBTOTAL to get your TOTAL DEPOSIT. If dealing with foreign currencies, apply their respective rates in their sections.

After completing the form, ensure all details are accurate to avoid any delays. Then, present it to the teller with the corresponding cash and cheques. This attention to detail will lead to a smooth deposit process.

What You Should Know About This Form

What is a Canada Deposit Slip?

A Canada Deposit Slip is a form that individuals or businesses use to deposit funds into their bank accounts in Canada. It lists the details of the deposit, including cash and cheques, to ensure accurate processing by the bank. This form helps keep your records straight and provides a clear breakdown of your deposit.

Where can I obtain a Canada Deposit Slip?

You can typically find Canada Deposit Slips at your local bank branch. Additionally, many banks allow customers to download the form from their official website. It's a good idea to keep a few extra slips on hand for future deposits.

What information do I need to fill out on the deposit slip?

You'll need to provide several key pieces of information. Begin with your account name and number. You'll also enter the date, branch number, and details of the cheques you are depositing. For each cheque, include a brief identification and the amount. If you have cash to deposit, make sure to include the cash count as well.

Can I deposit foreign cheques using a Canada Deposit Slip?

Yes, you can deposit foreign cheques, but you need to use a separate deposit slip for these. The process for foreign cheques may differ, so be sure to check with your bank for specific instructions regarding fees and processing times.

What should I know about cheque identification?

Cheque identification allows you to track and reference the cheques you're depositing. You need to provide a brief description for each cheque, which could include the cheque number or the name of the issuer. This helps ensure that your account is credited accurately.

How do I total my deposits on the slip?

The slip provides separate sections for cash and cheque sub-totals. After listing all your deposits, simply add the amounts together to calculate the total deposit. It's crucial to double-check your math to ensure everything matches what you expect to see in your account.

What are the cash count denominations I need to be aware of?

The cash count section will typically ask you to report various denominations, such as $1, $5, $10, $20, $50, and $100 bills. There is also space to record any coins that you may be depositing, like $1 and $2 coins. Being thorough here helps ensure an accurate total.

What if I make a mistake on my deposit slip?

If you make an error, it’s best to start a new slip to avoid confusion. Cross out the mistake clearly and write the correct information right next to it. However, if using a new slip isn't feasible, ensure to explain the mistake to your teller, who can assist you further.

How do I know if my deposit has been successful?

Once you submit your deposit slip, you should receive a receipt from the teller, acknowledging your deposit. Keep this receipt for your records. Usually, you can also check your account balance online or via your bank’s app to confirm that the funds were credited properly.

Common mistakes

Filling out the Canada Deposit Slip form might seem straightforward, but mistakes can easily occur. One common error is neglecting to include the date on the form. This detail is crucial, as it helps to establish when the deposit was made. Without a date, the transaction may cause confusion for both the depositor and the banking institution.

Another frequent mistake involves omission in the name of the account. Not clearly specifying the account name can lead to deposits being directed to the wrong location, potentially resulting in additional delays and complications. Ensuring that the name is written correctly and legibly is essential.

People often fail to check the branch number against their bank documents. It is easy to transpose numbers or select the incorrect branch. This mistake can lead to complications in processing your deposit, and in some instances, deposits may be delayed or returned.

When it comes to the account number, accuracy is paramount. Individuals can easily duplicate digits, mistakenly insert the wrong numbers, or forget to include necessary zeros. Each of these errors can affect the deposit's success, making careful verification essential for accuracy.

Inadequate listing of checks can also pose problems. It is crucial to list each check amount correctly, ensuring that all are included in the list of cheques. Skipping this step or failing to identify foreign checks on separate deposit slips can complicate transactions and delay the processing time.

Another common oversight is failing to sum the cheque subtotal accurately. This number must reflect the correct total of all listed cheques, as it affects overall account balances. Inaccurate calculations may lead to discrepancies that could require further verification.

Many individuals overlook confirming their initials with the depositor's after completing the form. Adding their initials is important, as it can serve as verification of the deposit details. This small step can prove crucial in situations where discrepancies arise later.

Lastly, individuals often miss reviewing the total deposit amount before submitting the deposit slip. It is vital to ensure that all amounts, including cash and cheques, are accurately totaled. Careful review can prevent potential errors and ensure timely processing of the deposit.

Documents used along the form

The Canada Deposit Slip is essential for managing deposits in a bank account, particularly for businesses or individuals with multiple cheques. It helps ensure that all deposits are accurately recorded and credited to the appropriate account. Alongside this deposit slip, several other documents may assist in the banking process and contribute to effective financial management.

- Withdrawal Slip: This document is used when you want to withdraw cash from your bank account. It records the amount withdrawn and ensures that the transaction is verified by the bank.

- Cheque Book Register: This is a ledger where you track the cheques issued and received. It helps monitor your account balance and ensures that all transactions are accurately accounted for.

- Deposit Receipt: After making a deposit, the bank provides a receipt. This serves as proof of the transaction, confirming the amount deposited and the method used.

- Direct Deposit Authorization Form: If you receive payments directly into your bank account, this form allows employers or service providers to deposit funds automatically. It simplifies the income receipt process.

- Bank Statement: A monthly statement that shows all transactions during that period, including deposits, withdrawals, and fees. Reviewing these statements regularly helps keep track of your financial activity.

Each of these documents plays a vital role in ensuring smooth banking operations, enhancing your financial management, and providing peace of mind regarding your transactions. Proper record-keeping of these forms will ensure that your banking experience remains efficient and error-free.

Similar forms

The Canada Deposit Slip form is quite similar to a few other financial documents. Here’s a look at five of them:

- Bank Deposit Slip: Like the Canada Deposit Slip, a bank deposit slip is used to deposit funds into a bank account. It includes fields for the depositor's name, account number, and details about the funds being deposited.

- Withdrawal Slip: This document serves the opposite function of a deposit slip. A withdrawal slip allows a depositor to take out money from their account instead of putting it in. It also requires information like the account number and amount to be withdrawn.

- Check Deposit Slip: A check deposit slip is specifically used for depositing checks. Similar to the Canada Deposit Slip, it lists each check with details like amount and check number, helping ensure accuracy in processing the deposit.

- Cash Deposit Slip: This form is used for depositing cash. Just like with the Canada Deposit Slip, it includes the total amount of cash being deposited and may require the listing of coin denominations for clarity.

- Foreign Currency Deposit Slip: When depositing foreign currency, this slip is used to document the deposit. It shares similarities with the Canada Deposit Slip in that it records the total deposit amount and any checks or currency being exchanged.

Dos and Don'ts

When filling out the Canada Deposit Slip form, follow these guidelines to ensure accuracy and efficiency in your banking process. Here are some things you should and shouldn't do:

- Do use the full name as it appears on the account.

- Do write the date clearly.

- Do double-check the branch number and account number for correct entry.

- Do list all cheques in the designated area, including their identification and amounts.

- Do keep foreign cheques on a separate deposit slip.

- Don't leave any fields blank; fill in all required information.

- Don't forget to total the amounts for cash and cheques accurately.

- Don't use different ink colors; stick to one ink color for clarity.

- Don't submit the form without your initials and ensure all information is legible.

Misconceptions

Many people hold misconceptions about the Canada Deposit Slip form. Here are four common myths and the facts that clarify them:

- It Can Only Be Used for Canadian Cheques: Some believe this form is exclusively for Canadian cheques. In reality, the form can be used for foreign cheques too, as long as they are listed on a separate deposit slip.

- Filling it Out is Optional: Some individuals think that filling out the deposit slip is not necessary. However, accurately completing the slip is essential for a smooth transaction and for record-keeping purposes.

- It is Only for Personal Accounts: A lot of people assume that the Canada Deposit Slip is limited to personal accounts. This is not true; it also applies to business accounts, which require the same level of detail.

- It Does Not Require Dates: Another misconception is that dates are irrelevant on the deposit slip. In fact, the date is important for identifying when the deposit was made. It helps maintain accurate records for both the bank and the account holder.

Key takeaways

Filling out the Canada Deposit Slip form requires attention to detail. Here are key takeaways to ensure accuracy and efficiency:

- Complete personal information: Fill in the name of the account, date, branch number, and account number clearly. This information identifies where the deposit will be credited.

- List all cheques: Each cheque must be recorded in the list provided. Include amounts for up to 15 cheques, ensuring that foreign cheques are on a separate slip.

- Verify totals: Calculate the subtotal for the cheques accurately. This step helps in avoiding errors during the transaction.

- Identify cash counts: The cash section requires accurate counts of different denominations. Include values for $1, $2 coins, as well as bills of $5, $10, $20, $50, and $100.

- Summarize deposits: Clearly state the cash subtotal, cheque subtotal, and total deposit at the end of the slip to confirm the total amount being deposited.

- Ensure signatures: The slip must be signed by both the depositor and the teller. This confirms acceptance of the deposit and serves as verification.

Browse Other Templates

Background Check Referral,Applicant Fingerprint Verification,Criminal Background Assessment,Employment Background Screening,Fingerprint Submission Form,HR Background Investigation Form,Personnel Background Check,Fingerprint Clearance Application,Pre- - This process includes checks for any history relating to teaching credentials or licenses.

Adopting Adults - Applicants must include a valid photo ID with their submission.