Fill Out Your Capital Blue Cross Provider Appeal Form

Filing an appeal with Capital Blue Cross can feel overwhelming, especially if you're navigating the complexities of healthcare claims. The Capital Blue Cross Provider Appeal form is designed to make the process clearer and more efficient for those challenging a claim or denial of service. In order to effectively submit an appeal, it’s critical to understand that you have 180 days from the initial decision to request a review. The form requires essential member information, such as your name, date of birth, and identification numbers, alongside detailed information about the disputed claim or service. You’ll need to indicate the reasons for your appeal and provide supporting documentation to reinforce your case. If you wish for someone else to assist with your appeal, there’s a section for designating a representative, ensuring that they can advocate on your behalf throughout the process. With attention to these details, you will be well on your way to submitting a compelling appeal to Capital Blue Cross.

Capital Blue Cross Provider Appeal Example

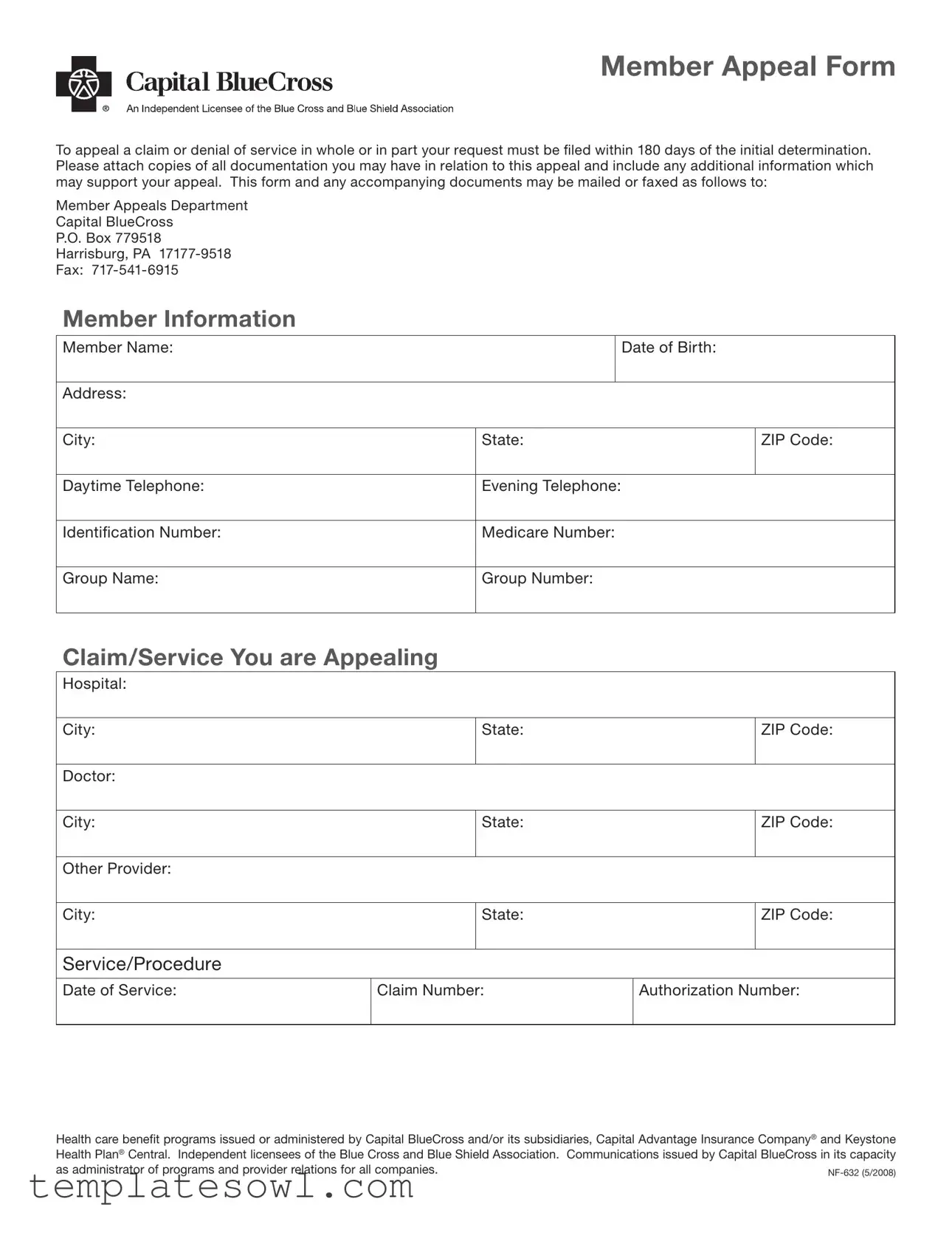

Member Appeal Form

To appeal a claim or denial of service in whole or in part your request must be iled within 180 days of the initial determination. Please attach copies of all documentation you may have in relation to this appeal and include any additional information which may support your appeal. This form and any accompanying documents may be mailed or faxed as follows to:

Member Appeals Department

Capital BlueCross

P.O. Box 779518

Harrisburg, PA

Fax:

Member Information

Member Name: |

|

|

Date of Birth: |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City: |

State: |

|

ZIP Code: |

|

|

|

|

|

|

Daytime Telephone: |

Evening Telephone: |

|

|

|

|

|

|

|

|

Identiication Number: |

Medicare Number: |

|

|

|

|

|

|

|

|

Group Name: |

Group Number: |

|

|

|

|

|

|

|

|

Claim/Service You are Appealing

Hospital:

City: |

State: |

ZIP Code: |

|

|

|

Doctor: |

|

|

|

|

|

City: |

State: |

ZIP Code: |

|

|

|

Other Provider: |

|

|

|

|

|

City: |

State: |

ZIP Code: |

|

|

|

Service/Procedure

Date of Service: |

Claim Number: |

Authorization Number: |

|

|

|

Health care benefit programs issued or administered by Capital BlueCross and/or its subsidiaries, Capital Advantage Insurance Company® and Keystone Health Plan® Central. Independent licensees of the Blue Cross and Blue Shield Association. Communications issued by Capital BlueCross in its capacity as administrator of programs and provider relations for all companies.

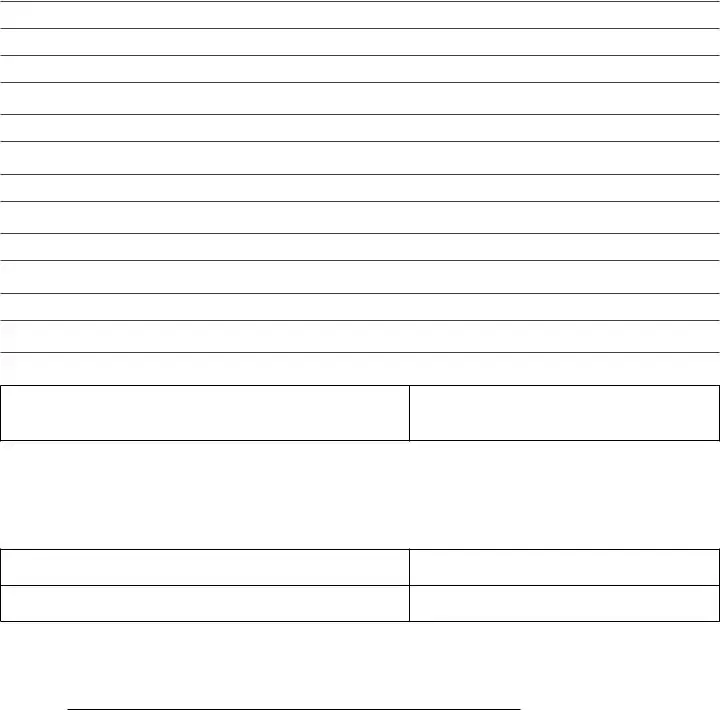

Reason for the Appeal

Member Signature:

Date:

If appointing someone to ile the appeal on your behalf and to represent you during the course of the appeal, your representative must complete this portion:

Authorization of Designated Appeals Representative

Subscriber:

Todays Date:

Subscriber ID Number:

Group Number:

Section

To be completed by the Member:

I authorizeto act as my representative in connection with my complaint, grievance, or appeal with Capital BlueCross, or Keystone Health Plan® Central. I authorize this individual to make any request; to present or elicit evidence; to obtain information; and to receive any notice in connection with my complaint, grievance, or appeal. I understand that personal health information related to my claim may be disclosed to my representative in the course of the complaint, grievance, or appeal.

I agree that the representative will act on my behalf regarding my complaint, grievance, or appeal. I understand that:

1.I will not be able to ile my own complaint, grievance, or appeal concerning these same services, nor will any other representative I appoint, unless this consent is rescinded in writing.

2.I have a right to rescind this consent at any time. My legal representative also has the right to rescind this consent at any time.

I have read this consent or have had it read to me and it has been explained to my satisfaction. I understand this information, and grant my consent for my representative to ile a complaint, grievance, and appeal on my behalf.

Member Name: |

|

|

Date of Birth: |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City: |

State: |

|

ZIP Code: |

|

|

|

|

|

|

Daytime Telephone: |

Evening Telephone: |

|

|

|

|

|

|

|

|

Signature of Member: |

|

|

Date: |

|

|

|

|

|

|

Section

To be completed by the Representative:

I, |

|

|

hereby accept the above referenced |

|

|

|

|||

appointment. I am a/an |

|

|

of the Member and will |

|

(STATUS OR RELATIONSHIP TO THE PARTY, E.G. RELATIVE, ATTORNEY, FRIEND) advocate on their behalf in regards to the complaint, grievance, or appeal.

Signature of Representative:

Name of Representative: |

|

|

Date: |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

City: |

State: |

|

ZIP Code: |

|

|

|

|

|

|

Daytime Telephone: |

Evening Telephone: |

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Number | NF-632 (5/2008) |

| Submission Deadline | Requests must be filed within 180 days of the initial determination. |

| Mailing Address | Member Appeals Department, Capital BlueCross, P.O. Box 779518, Harrisburg, PA 17177-9518 |

| Fax Number | 717-541-6915 |

| Required Documentation | All relevant documents must be attached to support the appeal. |

| Authorization Requirement | A representative must complete the designated section to act on behalf of the member. |

| Member's Right to Rescind | Members have the right to rescind their authorization for a representative at any time. |

| Governing Laws | Health care benefit programs are governed by state and federal laws, including those applicable in Pennsylvania. |

Guidelines on Utilizing Capital Blue Cross Provider Appeal

After you gather all necessary information, you are ready to fill out the Capital Blue Cross Provider Appeal form. It is essential to provide accurate details, as this will help in processing your appeal effectively. Follow these steps to ensure everything is completed correctly.

- Start by locating the Member Information section at the top of the form.

- In this section, fill in your Member Name, Date of Birth, Address, City, State, and ZIP Code.

- Next, provide both Daytime Telephone and Evening Telephone numbers.

- Include your Identification Number and, if applicable, your Medicare Number.

- Fill in the Group Name and Group Number if you are part of a group plan.

- Move on to the Claim/Service You are Appealing section.

- Provide the names and details for the Hospital, Doctor, and any Other Provider involved, including their City, State, and ZIP Code.

- Enter the Date of Service, Claim Number, and Authorization Number for the appeal.

- Next, you need to articulate the Reason for the Appeal. Take care to be clear and concise.

- At the bottom of this section, sign and date the form under Member Signature.

- If you have someone representing you, they must complete the Authorization of Designated Appeals Representative section.

- Your representative must sign, as well, to indicate their acceptance of the appointment.

- Finally, ensure all information is accurate before mailing or faxing the form to the Member Appeals Department at Capital BlueCross.

Once you have submitted your form and all related documents, be prepared to wait for a response from Capital Blue Cross. They will review your appeal and get back to you with their decision. Stay positive, and take care of yourself during this time.

What You Should Know About This Form

What is the purpose of the Capital Blue Cross Provider Appeal form?

The Capital Blue Cross Provider Appeal form is designed for members who wish to challenge a claim denial or a decision regarding a healthcare service. It allows members to formally appeal their case and provide necessary documentation to support their claims. This process is essential for ensuring that members receive the benefits they are entitled to under their healthcare plans.

How long do I have to file an appeal?

You have 180 days from the date of the initial determination to file your appeal. This time limit is crucial, as submitting your appeal after this period may result in a rejection. Be sure to gather all relevant documentation and submit your appeal promptly to avoid missing this deadline.

What information do I need to include on the appeal form?

When completing the appeal form, you should include your member information such as your name, date of birth, address, and identification number. You'll also need to provide details about the claim or service being appealed, including the claim number, date of service, and names of any providers involved. Make sure to attach any supporting documentation to strengthen your appeal.

Can someone else file an appeal on my behalf?

Yes, you can appoint a representative to file an appeal on your behalf. To do this, you must complete the Authorization of Designated Appeals Representative section of the form. This allows your chosen representative to act on your behalf during the appeal process, including accessing personal information related to your case.

How do I submit my appeal form?

You may submit your completed appeal form and any accompanying documents either by mail or fax. If mailing, send it to the Member Appeals Department at Capital BlueCross, P.O. Box 779518, Harrisburg, PA 17177-9518. Alternatively, you can fax your documents to 717-541-6915.

What should I do if I need to rescind my representative’s appointment?

If you wish to rescind your representative’s appointment, you must do so in writing. This can be done at any time, and it's important to communicate this decision clearly to both your representative and Capital Blue Cross to avoid any confusion regarding your appeal.

What happens if my appeal is denied?

If your appeal is denied, you will receive a notice explaining the reason for the denial. You may also be provided with additional options, such as requesting a further internal review or seeking external review, depending on the circumstances of your claim and the policies of Capital Blue Cross.

Can I appeal if I missed the 180-day deadline?

If you miss the 180-day deadline, options may be limited. However, you should still contact Capital Blue Cross to discuss your situation. They may be able to provide guidance or consider exceptional circumstances that could allow for a late appeal.

What if I have additional questions about the appeal process?

If you have more questions about the appeal process, it is best to reach out directly to Capital Blue Cross customer service. They can provide detailed information and support tailored to your specific situation and help clarify any aspects of the appeal form or procedures.

Common mistakes

Filling out the Capital Blue Cross Provider Appeal form accurately is crucial for a successful appeal. However, many individuals make common mistakes that can impede their claims. One frequent error is not paying attention to the 180-day deadline for filing an appeal. The appeal must be submitted within 180 days of the initial determination, and failing to do so can lead to an automatic denial of the appeal, regardless of its merit.

Another common mistake involves the omission of necessary documentation. It is vital to attach all relevant supporting documents with the appeal. This may include medical records and previous correspondence related to the claim. Without this documentation, the appeal is often incomplete, and the reviewing department may not have enough information to make an informed decision.

Inaccurate or incomplete personal information is another issue that may arise. Providing the correct member details, such as the identification number and address, is essential. Missing or incorrect data can lead to delays in processing the appeal or even misrouting to the wrong department.

When appointing a representative to act on behalf of the member, individuals sometimes neglect to properly complete the authorization section. This section must clearly specify the representative's name and relationship to the member. Additionally, including a signature from both the member and the representative is necessary to validate the authorization.

Many also fail to clearly outline the reason for the appeal. Detailed explanations help the reviewer understand the context and rationale behind the appeal. A vague or brief reason can create confusion, potentially detracting from the strength of the case presented.

Lastly, a common oversight involves submitting the appeal without a proper review. Ensuring that all sections of the form are filled out and that all necessary documents are attached can save time and prevent rejections. Taking the time to double-check the form can ultimately be beneficial in facilitating a smoother appeal process.

Documents used along the form

When dealing with healthcare claims and appeals, various documents work in conjunction with the Capital Blue Cross Provider Appeal form. These forms each play an important role in ensuring that appeals are clear and comprehensive. Here’s a look at some common forms you might encounter in this process.

- Member Appeal Form: This form allows members to officially appeal a claim denial. It serves as the primary document for submitting an appeal to Capital Blue Cross.

- Claim Information Form: This document collects detailed claim information, including dates of service and claim numbers. It helps clarify the specific details related to the service in question.

- Authorization of Designated Representative Form: If a member wishes to appoint someone to handle their appeal, this form is necessary. It outlines the authority given to the representative.

- Medical Records Release Form: Sometimes, medical records are needed for an appeal. This form grants permission for providers to release medical records related to the appeal.

- Additional Documentation Checklist: A simple checklist that helps ensure all necessary documents are collected and submitted along with the appeal form. This prevents delays in processing.

- Grievance Form: This form can be used to raise concerns or dissatisfaction with care or services received. While not directly an appeal, it can accompany an appeal to provide context.

- Billing Statement: A copy of the bill from the healthcare provider helps substantiate the appeal by showing exactly what charges are being disputed.

- Provider’s Letter of Medical Necessity: A letter from the healthcare provider explaining why the service was medically necessary. This can be crucial in supporting the appeal.

- Claims Payment Explanation: A document that explains how the claim was processed and why payment was denied, providing insight into what aspects need to be appealed.

- Follow-Up Communication Records: Maintaining records of any follow-up communications regarding the claim can be useful in demonstrating ongoing efforts to resolve the issue.

Utilizing these documents effectively can aid in a smoother appeal process. Each form and piece of documentation contributes to building a clear and compelling case for the appeal being made. Organizing these elements before submission enhances clarity and increases the chances of a favorable outcome.

Similar forms

- Grievance Form: Similar to the Capital Blue Cross Provider Appeal form, a grievance form allows members to formally express dissatisfaction with a service, treatment, or coverage decision made by the insurance provider. Like the appeal form, it must be submitted within a designated timeframe and requires specific details related to the case.

- Claim Denial Appeal Form: This document specifically focuses on appeals following a denied claim, akin to the Capital Blue Cross Provider Appeal form. It typically includes sections for personal information, claim details, and reasons for the appeal, ensuring relevant information is conveyed effectively.

- Medicare Appeal Form: Designed for Medicare beneficiaries, this form serves a function similar to the Capital Blue Cross Provider Appeal form. It allows members to challenge denials of coverage or payment, necessitating thorough documentation supporting the appeal argument.

- Insurance Complaint Form: This form captures complaints regarding service issues or provider interactions, sharing similarities with the appeals process outlined in the Capital Blue Cross Provider Appeal form. Both forms offer space for detailed explanations regarding the situations in question and require submission within a set timeframe.

- Authorization to Represent Form: This document allows a patient to designate someone to act on their behalf regarding their appeal or grievance. The process closely resembles that of the capital appeal form, concerning consent and representation.

- Internal Review Request Form: If members seek a further internal review of a decision, this form functions like the Capital Blue Cross Provider Appeal form. It prompts for specific case details and gives the insurance company a chance to reassess its prior determination.

- Request for Reimbursement Form: This type of form is similar in that it deals with issues related to coverage and payment. It allows members to request money back for services received that were not covered initially, resembling the appeal process of disputing financial decisions.

- Provider Feedback Form: Though focused more on the providers rather than the members, this form allows healthcare providers to voice dissatisfaction with insurance decisions. The feedback process often parallels the appeal process, seeking resolution and clarification similarly to the Capital Blue Cross Provider Appeal form.

Dos and Don'ts

When it comes to filling out the Capital Blue Cross Provider Appeal form, attention to detail can make all the difference. Here’s a handy list of what to do and what to avoid to ensure your appeal is processed smoothly and efficiently.

- Do: Submit your appeal within the 180-day timeframe set by Capital Blue Cross.

- Do: Attach all relevant documentation that supports your appeal.

- Do: Clearly provide your personal information, including your identification and group numbers.

- Do: Double-check your appeal for accuracy before submitting it.

- Do: Keep copies of everything you send for your own records.

- Do: Contact the Member Appeals Department if you have questions or need assistance.

- Don't: Wait until the last minute to file your appeal.

- Don't: Leave any sections of the form blank; incomplete forms can delay the process.

- Don't: Use unclear or vague language that could confuse the reviewer.

- Don't: Send your appeal without confirming the mailing address or fax number.

- Don't: Forget to sign the form; an unsigned appeal is not valid.

- Don't: Overlook the importance of submitting your appeal through certified mail if you want proof of delivery.

Misconceptions

Understanding the Capital Blue Cross Provider Appeal form is crucial for effectively navigating a claim denial. Here are seven common misconceptions that may lead to confusion:

- It’s not necessary to appeal within a certain timeframe. Many believe they can submit an appeal at any time. However, your appeal must be filed within 180 days of the initial determination to be considered.

- Documentation doesn’t matter in the appeal process. Some think that simply submitting the appeal form is enough. In reality, attaching all relevant documentation is essential. This includes any additional information that may support your case.

- Only the member can file an appeal. While members can file their own appeals, they can also appoint someone else to represent them. It’s important to fill out the Authorization of Designated Appeals Representative section to allow another individual to act on your behalf.

- All types of denials can be appealed. There may be a misconception that every denial is appealable. In fact, some denials are based on coverage exclusions that may not be eligible for appeal, so it's wise to check your policy details first.

- You won’t receive notice of your appeal status. Some believe their appeal goes into a black hole. In truth, you should expect to receive notifications throughout the process regarding the status of your appeal.

- The appeal can be made verbally. It’s a common misunderstanding that a phone call can suffice. Appeals must be submitted in writing using the appropriate forms to ensure they are formally recorded.

- The representative can make decisions on your behalf. While a representative can advocate for your case, they cannot make decisions regarding the outcome of the appeal. The final decision rests with Capital Blue Cross.

By clarifying these misconceptions, you can better prepare for the appeals process and increase your chances of a favorable outcome.

Key takeaways

Filling out and using the Capital Blue Cross Provider Appeal form effectively can make a significant difference in the appeal process. Here are some key takeaways:

- Timeliness is crucial: Make sure to submit your appeal within 180 days of the initial determination. Delays can result in the loss of your right to appeal.

- Attach necessary documentation: Include all relevant documents that support your appeal. This includes copies of past claims and any additional information that might help your case.

- Authorize a representative if needed: If you choose to have someone represent you in the appeal process, complete the necessary authorization section. This grants them the ability to act on your behalf.

- Carefully review the form: Ensure all fields are accurately filled out, including personal information and details about the claim or service you are appealing. Errors or missing information could delay your appeal.

By following these guidelines, you can navigate the appeal process more effectively and improve your chances of a successful outcome.

Browse Other Templates

California Unemployment Insurance - If responding by fax, there is no need to send back the paper form.

Dmv Transcript - Requesters are liable for proper and ethical use of the information received.