Fill Out Your Capital One Direct Deposit Form

When it comes to seamless financial transactions, the Capital One Direct Deposit form plays a pivotal role. This form is designed for individuals who wish to have their paychecks or other recurring payments deposited directly into their bank accounts. It simplifies the process, allowing for secure and timely deposits without the need for physical checks. Key components of the form include spaces for multiple bank accounts, allowing you to designate the bank name, account number, routing number, and whether the deposit is going into a checking or savings account. You can even specify the amount or percentage that should be allocated to each account, giving you control over your finances. Furthermore, the form includes a section where you grant authorization to your employer or payer, ensuring they can initiate the deposits as well as any necessary corrections for erroneous entries. By signing the form, you also acknowledge that this authorization supersedes any previous directives. Importantly, the authorization remains in effect until you provide written notice to terminate it, giving you peace of mind with its continuity. Overall, the Capital One Direct Deposit form streamlines how you manage your incoming funds, making it a critical document for anyone looking to optimize their banking experience.

Capital One Direct Deposit Example

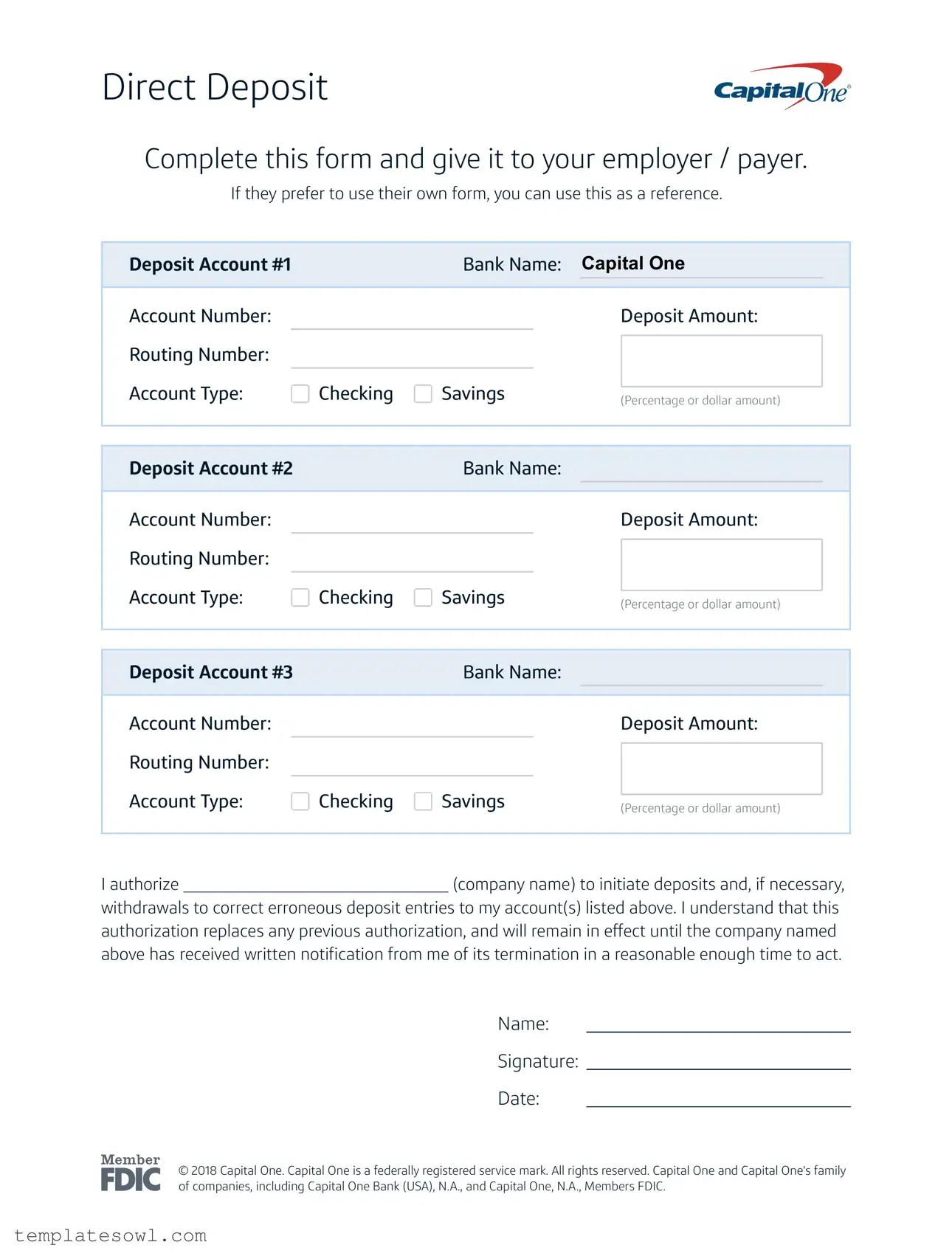

Direct Deposit

Complete this form and give it to your employer / payer.

If they prefer to use their own form, you can use this as a reference.

Deposit Account #1 |

Bank Name: Capital One |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

Deposit Account #2 |

Bank Name: |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

Deposit Account #3 |

Bank Name: |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

I authorize _______________________________ (company name) to initiate deposits and, if necessary,

withdrawals to correct erroneous deposit entries to my account(s) listed above. I understand that this authorization replaces any previous authorization, and will remain in effect until the company named above has received written notification from me of its termination in a reasonable enough time to act.

Name: ____________________________

Signature: ____________________________

Date: ____________________________

© 2018 Capital One. Capital One is a federally registered service mark. All rights reserved. Capital One and Capital One's family of companies, including Capital One Bank (USA), N.A., and Capital One, N.A., Members FDIC.

Form Characteristics

| Fact Name | Description |

|---|---|

| Usage | This form allows individuals to set up direct deposit with their employer or payer. It may serve as a reference if the payer opts to use their own form. |

| Multiple Deposits | Individuals can designate up to three different deposit accounts, which can include multiple banks and account types. |

| Authorization | The form requires a signature and name authorization to permit the company to deposit funds and make corrections if needed. |

| Effectiveness | This authorization remains effective until the individual provides written notice of termination to their employer or payer. |

| Applicable Laws | Direct deposit agreements are generally governed by federal banking laws and applicable state laws, which may vary by state. |

Guidelines on Utilizing Capital One Direct Deposit

Once you have the Capital One Direct Deposit form, you will need to fill it out accurately and completely. This form will help you set up direct deposits with your employer or payer. Follow these steps carefully to ensure that your information is entered correctly.

- Start by writing the name of your employer or payer in the space provided for company name.

- For the first deposit account, fill in the following information:

- Bank Name: Enter "Capital One".

- Account Number: Write your Capital One account number.

- Deposit Amount: Specify the amount to be deposited or enter the percentage if applicable.

- Routing Number: Include your Capital One routing number.

- Account Type: Select either "Checking" or "Savings".

- If you wish to set up additional deposit accounts, repeat the previous step for Deposit Account #2 and Deposit Account #3, replacing the respective fields with the correct information for each account.

- Review the authorization statement and complete the following fields:

- Name: Fill in your name.

- Signature: Sign the form.

- Date: Write the date you are signing the form.

- Once all information is filled in, submit the form to your employer or payer.

What You Should Know About This Form

What is the Capital One Direct Deposit form used for?

The Capital One Direct Deposit form is used to authorize your employer or payer to deposit funds directly into your Capital One account. By completing this form, you provide the necessary account details, ensuring that your paychecks or other payments arrive in your chosen account without delay.

How do I fill out the Capital One Direct Deposit form?

To complete the form, fill in your Capital One account number, routing number, and select whether the account type is checking or savings. You can designate up to three accounts for deposit, specifying the deposit amount or percentage for each. Finally, provide your name, signature, and date at the bottom of the form.

Can I use this form if my employer has their own direct deposit form?

Yes, you can use the Capital One Direct Deposit form as a reference if your employer prefers to use their own form. Ensure that your account information is provided accurately on whichever form is used, to avoid any issues with payment processing.

What should I do if I need to change my direct deposit information?

If you need to change your direct deposit information, complete a new Capital One Direct Deposit form with the updated details and submit it to your employer or payer. This new form will replace any previous authorization. Make sure to notify them in writing to allow sufficient time for the changes to take effect.

Is there a waiting period to start receiving direct deposits after submitting the form?

There may be a waiting period for your direct deposit to begin after you submit the completed form. This timeframe can vary depending on your employer or payer. It is advisable to confirm with them when the direct deposit will commence once the form has been submitted.

What happens if there is an error with my direct deposit?

When you authorize your employer to deposit funds directly, you also allow them to initiate withdrawals to correct any erroneous deposits. This is specified in the form, protecting both you and your employer should an error occur with the payment entries.

What do I do if I want to stop direct deposits to my account?

To terminate your direct deposit authorization, you must provide written notice to your employer or payer. Make sure to give them adequate time to process this request, as specified in the form. Until they confirm the termination, any existing authorizations will remain valid.

Common mistakes

Filling out the Capital One Direct Deposit form seems straightforward, but many stumble over common mistakes that can delay or complicate getting your funds deposited swiftly. Let's take a closer look at seven of these frequent pitfalls.

First and foremost, incomplete information is a major issue. People often forget to fill in mandatory fields such as the bank name, routing number, or account number. Missing these details can lead to significant delays or even failed transactions. Ensure every section is complete to avoid unnecessary headaches down the line.

Another common mistake is mixing up the account types. Filling in the account as a checking account when it’s actually a savings account—or vice versa—can confuse the bank and may result in deposits going to the wrong account. Double-checking this detail can save you from potential future complications.

Additionally, many individuals misunderstand how to specify the amount to be deposited. Whether you want a fixed dollar amount or a percentage should be clearly indicated. Omitting this detail or failing to clarify can cause your employer or payer to process your deposits incorrectly, leading to frustration.

Next, some people forget about the significance of providing accurate routing numbers. The routing number is critical as it identifies your bank and directs the funds to the right place. A simple transposition of digits can create a cascade of confusion, causing your funds to go astray. Verify your routing number before submitting the form.

Don't overlook the need for a signature. Failing to sign the form is an easy mistake that can have big consequences. Your authorization is essential for completing the direct deposit process, so ensure that you sign and date the form appropriately.

Furthermore, not informing your employer about the use of the form is often an oversight. Make sure to provide your employer or payer with the completed document. Sometimes, people assume their employers will check in with them, but proactive communication can smooth out the process and address any concerns straight away.

Lastly, remember to review your prior authorizations. This new form replaces any previous direct deposit authorizations, so it’s important to ensure you are clear about what you are agreeing to. Take a moment to understand what this new authorization means for your deposits moving forward.

By avoiding these seven common mistakes, you can help ensure that your Capital One Direct Deposit form is filled out correctly, leading to a smoother, more efficient banking experience. Small attention to detail can make all the difference in getting your funds deposited without a hitch.

Documents used along the form

The Capital One Direct Deposit form is vital for setting up automatic deposits to your bank account. However, several other documents can accompany it during the enrollment process. Below is a list that describes these forms and their purposes.

- W-4 Form: This form is used by employees to indicate their tax situation. It helps employers withhold the correct amount of federal income tax from each paycheck.

- Bank Statement: A current bank statement may be required to verify your account information, including the account number and routing number.

- Employment Verification Letter: This document confirms your employment status and may be requested to complete the direct deposit setup process.

- Authorization for Direct Deposit: Some employers provide their own direct deposit form. This form often includes similar information as the Capital One form but may have specific employer requirements.

- Direct Deposit Change Request Form: If you are updating your direct deposit information, this form allows you to request the changes with your employer.

- Pay Schedule: Employers may provide a pay schedule that outlines the deposit dates. This helps employees know when to expect their funds.

- Identification Document: A valid ID, such as a driver's license or passport, may be needed to verify your personal information during the setup of direct deposits.

Having these documents ready can streamline the direct deposit enrollment process and ensure that all necessary information is accurately submitted.

Similar forms

- W-4 Form: The W-4 form is used by an employee to inform their employer about their tax withholding preferences. Like the Capital One Direct Deposit form, it requires personal information and authority given to the employer to act on behalf of the employee.

- Direct Deposit Authorization Form: Similar to the Capital One Direct Deposit form, a Direct Deposit Authorization Form provides account details where payments should be deposited. It also typically includes authorization for future deposits and corrections to erroneous transactions.

- Payroll Deduction Authorization Form: This form allows employees to authorize their employer to deduct specific amounts from their paycheck for various purposes, such as retirement contributions. Both this form and the Capital One Direct Deposit form require explicit authorization and specific account information.

- Change of Direct Deposit Form: This document allows employees to change existing direct deposit details. Just like the Capital One form, it includes bank routing and account numbers and requires official authorization from the employee for processing.

- Bank Account Application Form: The application form opens a new bank account and typically collects personal information similar to that found in the Capital One Direct Deposit form. Both documents require identification, account numbers, and a signature for authorization.

Dos and Don'ts

When completing the Capital One Direct Deposit form, consider the following dos and don'ts to ensure accuracy and efficiency.

- Do: Provide accurate routing numbers for each account to avoid payment delays.

- Do: Specify the correct account type, either checking or savings, for each deposit account.

- Do: Double-check your account numbers to prevent any mistakes.

- Do: Sign and date the form to authorize deposits and potential corrections.

- Don't: Leave any sections blank, as incomplete forms may be rejected.

- Don't: Use a different bank name unless you are submitting for a separate financial institution.

- Don't: Forget to notify your employer if you need to terminate the authorization.

- Don't: Assume that your previous authorizations are still valid; always provide updated information.

Misconceptions

Understanding the Capital One Direct Deposit form is important for anyone looking to set up direct deposits with their employer or another payer. However, several misconceptions exist regarding this form. Here are four common misunderstandings:

- All employers accept the Capital One Direct Deposit form. Many employers have their own direct deposit forms. While you can use the Capital One form as a reference, it's essential to check with your employer to see if they require a specific format.

- You need to fill out all three deposit accounts listed. The form includes space for three accounts, but you are not obligated to use them all. If you only want to set up one account for direct deposit, that is perfectly acceptable. Simply leave the extra accounts blank.

- Once submitted, the direct deposit will begin immediately. There may be a delay before your deposits start. After submitting the form, your employer or payer needs time to process it. This means you may not see your first direct deposit in your account right away.

- You cannot change your direct deposit information after submitting the form. You can modify your direct deposit details at any time, but you will need to notify your employer in writing. It’s essential to provide this notification in a timely manner to avoid any interruptions in your deposits.

By clarifying these misconceptions, you can better navigate the direct deposit setup process and ensure your payments are received smoothly and efficiently.

Key takeaways

When filling out the Capital One Direct Deposit form, consider the following key takeaways to ensure a smooth process:

- Complete and Accurate Information: Fill in all required fields, including your bank account number and routing number, to avoid delays.

- Employer/Payer Submission: Submit the completed form to your employer or payer directly. If they have their own form, use this as a reference.

- Multiple Accounts: You may specify up to three different accounts for direct deposit. Ensure that each account's details are correctly filled out.

- Deposit Amounts: Indicate whether you want a specific dollar amount or a percentage of your payment deposited into each account.

- Authorization: You must authorize your employer to initiate deposits. This is achieved by entering the company name in the designated field.

- Revoking Authorization: Understand that you can revoke authorization at any time by providing written notice to your employer. Ensure you give them reasonable time to process the change.

- Date and Signature: Don’t forget to sign and date the form. Your signature indicates your agreement to the terms.

- Form Retention: Keep a copy of the completed form for your records. This can help if discrepancies arise later.

- Timing: Allow sufficient time for your first deposit to take effect, as it may not be immediate.

- Check with Capital One: If you're unsure about your account details, contact Capital One for assistance before submitting the form.

Filling out the Direct Deposit form accurately and completely ensures that your funds reach you promptly and securely.

Browse Other Templates

What Bank Information to Give to Employer Canada - The total number of cheques deposited must also be indicated on the slip.

Beneficiary Designation Change Form,Beneficiary Update Document,Policy Beneficiary Modification Form,Life Insurance Beneficiary Revision Form,Insured's Beneficiary Change Request,Beneficiary Assignment Adjustment Form,Primary and Contingent Beneficia - Notification from the insurance company will confirm the acceptance of your changes.

Dod Telework Policy - Incompatible versions of PDF readers may prevent document visibility.