Fill Out Your Capital One Wire Transfer Form

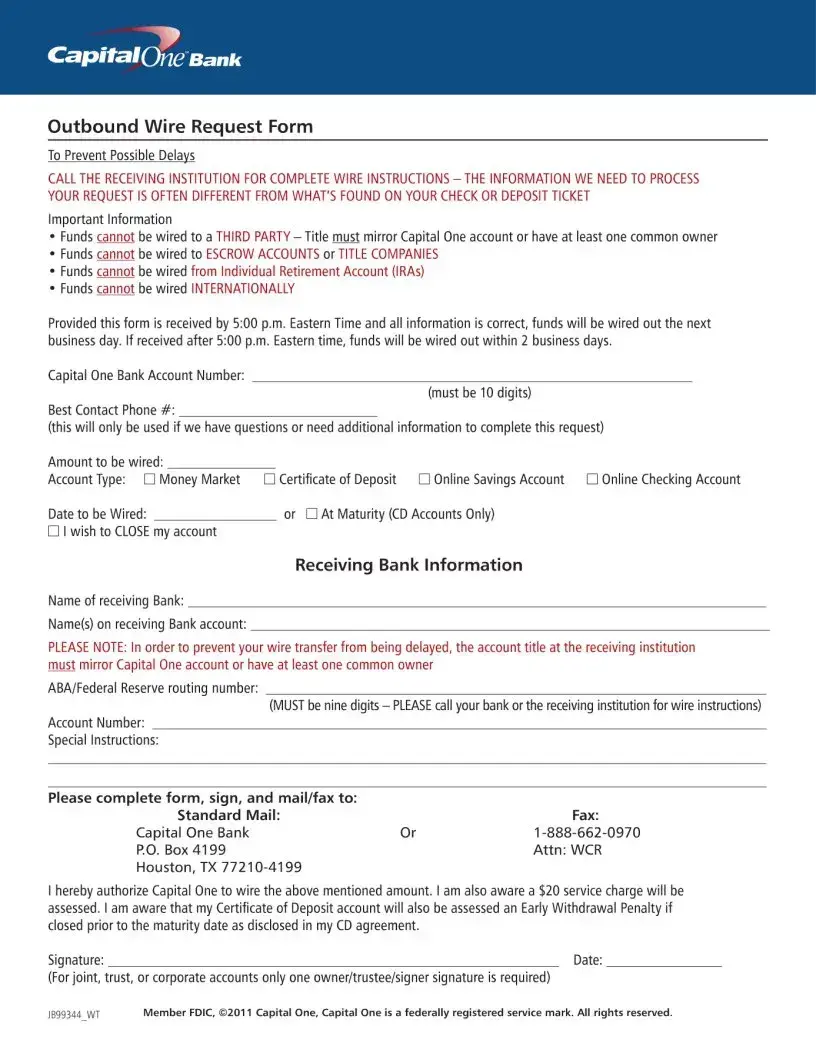

The Capital One Wire Transfer form is essential for customers looking to send money from their Capital One accounts. This form allows you to request an outbound wire transfer, ensuring that your transaction is processed smoothly. It's important to fill out all applicable sections accurately. You can easily do this by clicking on the fields and typing in the required information. Remember, handwritten forms can lead to delays, so it's advisable to complete it digitally. The completed form should be sent via standard mail or fax to the designated Capital One address. Additionally, it’s crucial to gather the right wire instructions from the receiving institution, as the information needed can differ significantly from what's printed on checks or deposit slips. Keep in mind that funds cannot be sent to third parties, escrow accounts, or individual retirement accounts, and international wire transfers are also not permitted. Understanding these key aspects will help you navigate the wire transfer process without unnecessary hiccups.

Capital One Wire Transfer Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Outbound Wire Request Form is used to initiate wire transfers from a Capital One account. |

| Submission Method | Completed forms must be sent via mail or fax to Capital One at the designated address or number. |

| Timing of Transfers | If received by 5:00 p.m. Eastern Time, funds will transfer the next business day; otherwise, it may take two business days. |

| Transfer Restrictions | Wires cannot be sent to third parties, escrow accounts, title companies, or from IRAs, nor can they be international. |

| Title Requirements | The title on the receiving account must match the Capital One account, or at least one owner must be the same. |

| Service Charge | A service charge of $20 applies for processing wire transfers. |

Guidelines on Utilizing Capital One Wire Transfer

Completing the Capital One Wire Transfer form requires careful attention to detail. The information you provide must be accurate to ensure the timely processing of your request. After filling out the required sections, you will need to return the form to Capital One via mail or fax.

- Obtain the Outbound Wire Request Form from Capital One.

- Type the required information in each section of the form. Avoid handwritten entries to prevent delays.

- In the Capital One Bank Account Number field, enter your 10-digit account number.

- Provide your Best Contact Phone #. This will only be used if Capital One has questions regarding the transfer.

- In the Amount to be wired field, specify the dollar amount you wish to transfer.

- Select the proper Account Type from the options given: Money Market, Certificate of Deposit, Online Savings Account, or Online Checking Account.

- If applicable, indicate the Date to be Wired or choose "At Maturity" for CD accounts.

- For the Receiving Bank Information, enter the name of the receiving bank and the name(s) on the account.

- Fill in the ABA/Federal Reserve routing number, ensuring it is nine digits. Verify this with the receiving institution.

- Provide any Special Instructions if needed.

- Review the authorization section. Confirm understanding about the $20 service charge and any penalties, if closing a CD account.

- Sign and date the form.

- Send the completed form to Capital One via mail or fax.

What You Should Know About This Form

What is the Capital One Wire Transfer form used for?

The Capital One Wire Transfer form is used to request the transfer of funds from a Capital One account to another institution. It is essential for clients who need to move money quickly and securely. The form requires specific information to ensure that the wire transfer is processed correctly.

How do I fill out the Capital One Wire Transfer form?

To fill out the form, you need to enter the required information in the designated fields. It's recommended to do this electronically rather than by hand to avoid potential delays. Handwritten submissions often result in errors, which can lead to processing issues. Ensure that you complete all applicable sections before submitting the form.

What is the procedure for submitting the wire transfer request?

Once the form is completed, it can be submitted either by mail or by fax. The mailing address is Capital One Bank, P.O. Box 4199, Attn: WCR, Houston, TX 77210-4199. If you choose to fax the form, use the number 1-888-662-0970. Make certain you do this before the 5:00 p.m. Eastern time deadline for timely processing.

What information is required to complete the form?

The form requires your Capital One account number, the amount to be wired, the account type, the date for the transfer, and detailed information about the receiving bank, such as the bank's name and the ABA routing number. It's important that the name on the receiving account matches the name on your Capital One account or that there is at least one common owner.

Are there any restrictions on wire transfers?

Yes, there are specific restrictions. Funds cannot be wired to third parties, escrow accounts, or title companies. Additionally, transfers cannot be made from Individual Retirement Accounts (IRAs) or for international wire transfers. These rules are in place to ensure compliance with banking regulations.

What happens if I submit the form after the 5:00 p.m. Eastern Time deadline?

If the form is submitted after 5:00 p.m. Eastern Time, the funds will not be wired out the same business day. Instead, they will be processed within two business days. Submitting the form on time is essential to ensure a prompt transfer of funds.

Is there a fee associated with the wire transfer?

Yes, there is a $20 service charge for processing the wire transfer. Additionally, if you are closing a Certificate of Deposit account before its maturity date, you may incur an Early Withdrawal Penalty as outlined in your CD agreement. This information should be considered when planning your wire transfer.

Common mistakes

Filling out the Capital One Wire Transfer form can seem straightforward, but several common mistakes can cause delays in processing. Attention to detail is crucial to ensure a smooth transfer.

One frequent error is providing an incorrect Capital One Bank Account Number. The account number must consist of exactly ten digits. Omitting a number or including an incorrect digit can lead to processing issues. Double-check this information carefully before submission.

Another mistake involves the ABA/Federal Reserve routing number. This number is essential for directing the funds to the correct receiving bank. It must contain nine digits. If you enter an incorrect routing number, the wire transfer may fail or be significantly delayed. Contact the receiving institution for verification.

Some individuals mistakenly try to wire funds to a third party. All wire transfers must mirror the title on the Capital One account. If there is no common owner between accounts, the transfer cannot proceed. Ensure that the recipient's account details align with your account to avoid denial.

Wire transfers can also be held up due to incomplete receiving bank information. When filling out the form, ensure you include the name of the receiving bank and the names on the receiving bank account. Incomplete information can stall the entire process.

Another common oversight is failing to check the date the funds are to be wired. Funds requested after 5:00 p.m. Eastern Time will not be processed until the next business day or within two business days. Mark the date carefully to reflect your timing needs.

Individuals often overlook the contact phone number section as well. Providing a contact number is vital. This number may be used by Capital One for questions or additional information required to complete the request. A missing contact number can lead to confusion and further delays.

Lastly, not acknowledging the service charge can lead to surprises. Capital One charges a $20 fee for wire transfers. If you do not account for this fee, it may affect your total amount transferred. Awareness of this charge is essential to ensure that the desired amount reaches the recipient.

Documents used along the form

When utilizing the Capital One Wire Transfer form, there are several other documents you may need to complete the transaction efficiently. Each of these documents serves a unique purpose, ensuring that the wire transfer process runs smoothly and without delay. Below is a list of commonly associated forms.

- Wire Transfer Confirmation Receipt: After submitting the Outbound Wire Request Form, a confirmation receipt is often provided by your bank. This document contains details about the transaction, such as the amount wired, the date and time of the transaction, and the reference number to track the transfer.

- Account Verification Form: Some institutions may require an account verification form to ensure that the sender's account information is accurate. This form often includes personal identification details and may need to be submitted alongside the wire transfer request.

- Signature Authorization Form: If the account has multiple signers, a signature authorization form may be necessary. This document lists all authorized individuals who can initiate transfers and may need to be on file at your bank for validation purposes.

- Receiving Bank Wire Instructions: To prevent errors, it’s crucial to obtain and have on hand the receiving institution's wire instructions. This document outlines specific requirements from the receiving bank, including the ABA number and account title, which must align with your Capital One account information.

- Transfer Fee Disclosure: Banks typically provide a transfer fee disclosure document, detailing any fees associated with completing the wire transfer. Understanding these fees is important for budgeting the total amount to be wired.

Having these documents prepared and understood can facilitate a smoother transaction process. Remember, keeping all necessary paperwork organized will save time and may help avoid any potential delays during your wire transfer journey.

Similar forms

Bank Account Opening Form: Similar to the wire transfer form, this document requires personal information and account details to be filled out completely. Both forms emphasize the importance of accuracy to prevent delays in processing.

Loan Application Form: Like the wire transfer form, the loan application gathers specific financial details from the applicant. Each needs precise information to proceed, and any discrepancies can lead to delays.

Direct Deposit Authorization Form: This document allows for the automatic deposit of funds into a bank account. Both forms require clear instructions to prevent the risk of errors and ensure timely processing.

Authorization to Release Information Form: This form permits a bank to share account details with authorized parties. In both cases, permission must be granted, often requiring signatures for verification.

Account Closure Request Form: This document is used when a customer wishes to close an account. Both forms entail specific instructions that need to be followed to effectively process the request.

Change of Address Request Form: Much like the wire transfer form, this document ensures that a bank has current contact details. Both require clear, accurate information to avoid disruptions in service.

Account Verification Form: This form verifies account ownership and details. Similar to the wire transfer form, it requires detailed information and is crucial for preventing potential issues.

Credit Card Application Form: This document collects personal and financial data to determine eligibility for a credit card. Both require meticulous attention to prevent processing delays.

Investment Account Transfer Form: Used to transfer investment accounts, this form parallels the wire transfer form in information required to authorize the movement of funds between accounts securely.

Beneficiary Designation Form: This document allows account holders to name beneficiaries. Like the wire transfer form, it necessitates precise instructions and signatures to be effective and valid.

Dos and Don'ts

When filling out the Capital One Wire Transfer form, there are important do’s and don’ts that you should keep in mind to ensure a smooth and efficient process. Here is a concise list of actions to consider:

- Do complete all applicable sections by simply clicking in the field and typing your information.

- Do ensure that the title on the receiving account matches your Capital One account or has at least one common owner.

- Do contact the receiving institution for complete wire instructions before completing the form.

- Do verify that the ABA/Federal Reserve routing number is nine digits long as this is crucial for processing.

- Don't use a handwritten form, as this may lead to unnecessary delays in processing your request.

- Don't attempt to wire funds to third parties, escrow accounts, title companies, or from Individual Retirement Accounts (IRAs).

By adhering to these guidelines, you can facilitate a successful wire transfer while avoiding common pitfalls that may lead to delays or complications. Always prioritize accuracy and clarity in your transactions.

Misconceptions

Understanding the Capital One Wire Transfer form is crucial to ensuring a smooth transaction. However, several misconceptions can create confusion. Here are four common misunderstandings regarding the form and the wire transfer process:

- Misconception 1: Handwritten forms are acceptable.

- Misconception 2: Funds can be sent to anyone.

- Misconception 3: There are no transfer restrictions based on account types.

- Misconception 4: The transfer will always be completed the same day.

Many believe that handwritten forms can be used without issue. In reality, completing the form electronically is highly recommended. Handwritten entries can lead to mistakes, increasing the chances of delays in processing your request.

There is a common belief that funds can be wired to any third party. In fact, the rules are strict. The name on the receiving account must either exactly match the name on your Capital One account or share at least one common owner. This policy helps prevent fraud and misdirected funds.

Some people think that any account can be used for wire transfers. However, certain accounts, like Individual Retirement Accounts (IRAs) and those for international transfers, are explicitly prohibited from sending funds via wire. Understanding these restrictions is essential for compliance.

It's easy to assume that once the form is submitted, the transfer will occur immediately. However, if the form is received after 5:00 p.m. Eastern Time, processing will extend to the next business day or potentially longer. Timeliness depends on proper submission and adherence to set timeframes.

By clarifying these misconceptions, individuals can approach their wire transfers with greater confidence and efficiency. It is always advisable to double-check the form details and procedures to avoid unnecessary complications.

Key takeaways

Here are key takeaways for completing and using the Capital One Wire Transfer form:

- Complete All Sections: Fill in all applicable fields by clicking and typing. Avoid handwritten forms to minimize delays.

- Submit Method: Return the completed form via standard mail or fax.

- Deadlines Matter: Submit the form by 5:00 p.m. Eastern Time for a next-business-day wire transfer.

- Check Requirements: Call the receiving institution to get correct wire instructions; this information may differ from what is on your check or deposit ticket.

- No Third Party Transfers: Funds cannot be wired to a third party. The account titles must match or share at least one owner.

- Restrictions Apply: Funds cannot be wired to escrow accounts, title companies, or from Individual Retirement Accounts (IRAs).

- No International Transfers: This service is only available for domestic transfers.

- Be Aware of Fees: A $20 service charge will be applied for each wire transfer.

- Account Closure Notice: If closing an account, be aware of penalties for early withdrawal from Certificate of Deposit accounts.

- Signature Required: Sign the form to authorize the wire transfer. Only one signature is necessary for joint, trust, or corporate accounts.

Browse Other Templates

Adp Flex Direct - Keep a copy of the completed form and attached receipts for your records.

Download D1 Form - Fill out previous licence details as required in the application.