Fill Out Your Capitec Bank Opening Form

The Capitec Bank Opening form plays a crucial role in the account opening process for new clients. This form is essential for establishing the residential address of applicants who cannot provide the required documentation. Each section of the form gathers important information, beginning with a declaration where the declarant identifies themselves by full name and South African ID number. A complete physical address, including postal code, of the declarant is needed to ensure the information is accurate. The form continues with details about the applicant, capturing their name and ID number, along with their residential address and postal code. It requires the declarant to specify their relationship to the applicant, a detail that helps further confirm residency. To substantiate the information provided, the declarant must attach relevant documentation that verifies their residence. The form culminates in signatures from both the declarant and the sales consultant assisting with the application, ensuring that all parties involved are accountable. Additionally, for internal records, fields are provided for the branch manager's signature and details about the consultant assigned to the client’s case.

Capitec Bank Opening Example

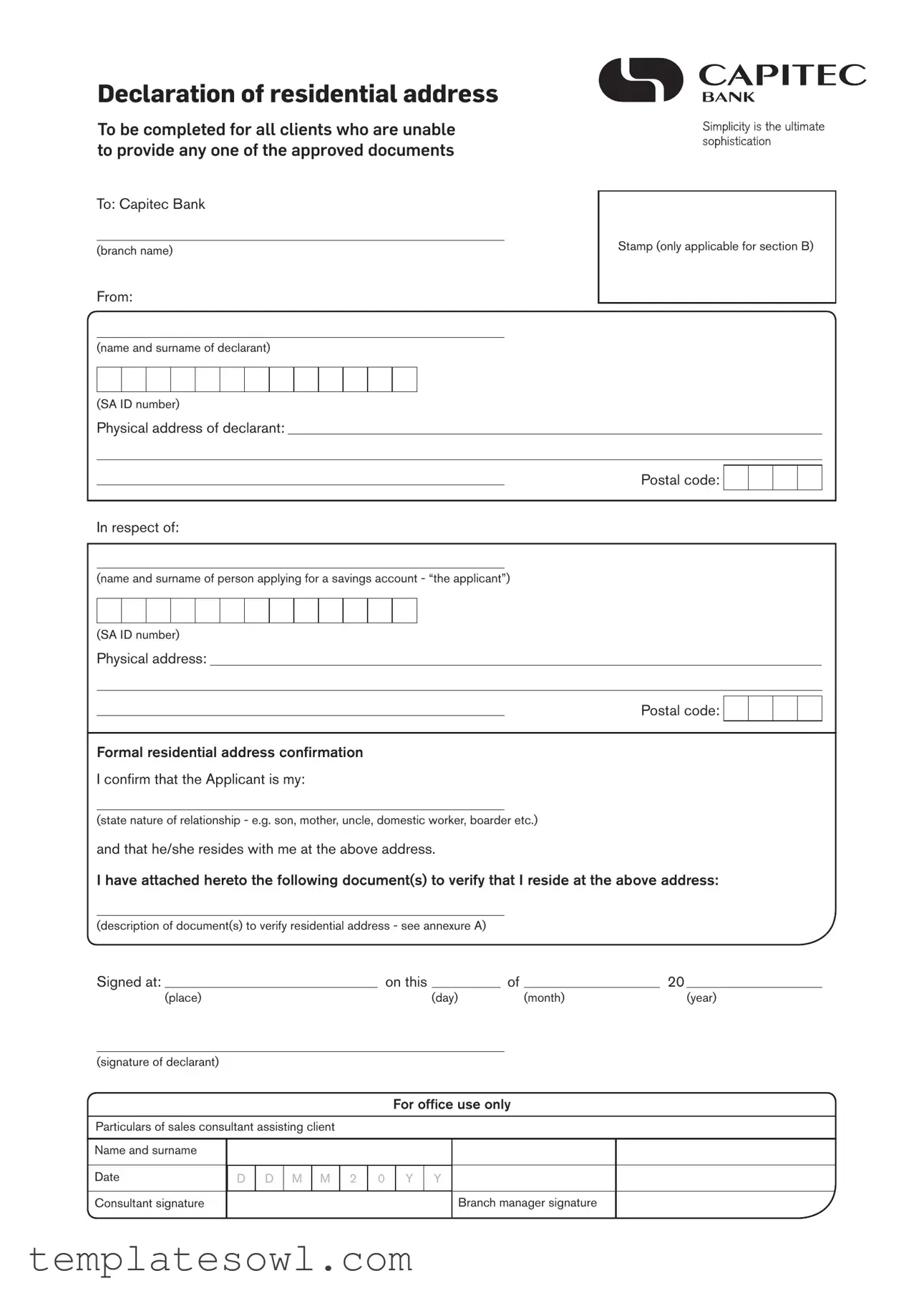

DECLARATION OF RESIDENTIAL ADDRESS

To be completed for all clients who are unable to provide any one of the approved documents

To: Capitec Bank

(branch name)

From:

(name and surname of declarant)

(SA ID number)

Physical address of declarant:

Stamp (only applicable for section B)

Postal code:

In respect of:

(name and surname of person applying for a savings account - “the applicant”)

(SA ID number)

Physical address:

Postal code:

Formal residential address confirmation

I confirm that the Applicant is my:

(state nature of relationship - e.g. son, mother, uncle, domestic worker, boarder etc.)

and that he/she resides with me at the above address.

I have attached hereto the following document(s) to verify that I reside at the above address:

(description of document(s) to verify residential address - see annexure A)

Signed at: |

|

|

|

|

|

|

|

on this |

|

|

|

of |

|

|

20 |

|

|

||||

|

|

(place) |

|

|

|

|

|

|

|

|

(day) |

|

|

|

(month) |

|

|

(year) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(signature of declarant) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

For office use only |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Particulars of sales consultant assisting client |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Name and surname |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

D |

D |

M |

M |

2 |

|

0 |

Y |

Y |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consultant signature |

|

|

|

|

|

|

|

|

|

|

|

Branch manager signature |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used to confirm the residential address of individuals applying for a savings account at Capitec Bank. |

| Applicable Parties | Both the declarant and the applicant must complete the form. The declarant verifies the applicant's residential address. |

| Required Information | Important details include the names, South African ID numbers, physical addresses, and relationship between the declarant and applicant. |

| Supporting Documentation | Declarants must attach documents confirming their own residential address. A list of approved documents can be found in Annexure A. |

| Signature Requirement | The form requires the signature of the declarant, along with the name of a sales consultant and branch manager for office use. |

| Submission Details | Once completed, the form must be submitted to Capitec Bank at the designated branch as indicated at the top of the form. |

| Governing Law | This form operates under South African banking regulations, ensuring compliance with local legal standards. |

Guidelines on Utilizing Capitec Bank Opening

Once you have the form, it's essential to proceed carefully to ensure all necessary details are correctly filled out. This is important for a smooth application process. Below are the steps to help you complete the Capitec Bank Opening form effectively.

- Clearly write your full name and surname at the top of the form in the section for the declarant.

- Enter your SA ID number directly below your name.

- Provide your physical address, ensuring it is complete and accurate.

- Type in your postal code associated with your physical address.

- For the applicant's details, write the name and surname of the person applying for the savings account.

- Include the applicant’s SA ID number below their name.

- Fill in the applicant’s physical address and postal code.

- State your relationship to the applicant clearly in the specified area (e.g. son, mother, etc.).

- List the documents attached to verify your residential address in the appropriate section.

- Sign and date the form at the bottom where indicated, providing the place, day, month, and year.

- Your signature should be placed under the declaration you've completed.

- Leave the "For office use only" section blank; it will be filled out by the bank's staff.

What You Should Know About This Form

1. What is the purpose of the Capitec Bank Opening form?

This form is used to declare the residential address of a person applying for a savings account at Capitec Bank. It is particularly important for clients who cannot provide the standard documents required to confirm their residential address. Completing this form helps ensure that Capitec Bank has accurate information for identification and record-keeping purposes.

2. Who needs to complete this form?

The form must be completed by all clients applying for a savings account who are unable to supply one of the approved documents that verify their residential address. This can include parents, guardians, or other individuals who live with the applicant and can confirm their address.

3. What information is required in the form?

The form collects several key pieces of information. You will need to provide the full names and South African ID numbers of both the declarant and the applicant. The physical address and postal code of the declarant, as well as the applicant’s information, must also be included. Additionally, you must state your relationship to the applicant and list the documents attached to verify the address.

4. What types of documents can be attached to verify the residential address?

You should include any relevant documents that establish your residential address. Examples include utility bills, lease agreements, or official correspondence that includes both your name and address. It is essential to ensure that these documents are current and legible to support your declaration.

5. Where should the form be submitted?

Once completed, the Capitec Bank Opening form should be submitted to the appropriate branch of Capitec Bank where the applicant intends to open their savings account. Ensure that all necessary signatures are included, particularly from the declarant and any consulting staff members assisting with the application.

6. Is there a specific format for signing the form?

The declarant must provide their signature in the designated area on the form. In addition, the consultant who assists with the application, as well as the branch manager, will also need to sign the form for office use. Remember to include the date and the place of signing, along with your name and ID number for clarity.

7. What happens if the form is not completed correctly?

If the form is not filled out accurately or completely, it may delay the account opening process. Capitec Bank may request additional information or documents. To ensure a smooth application, carefully review all details before submitting the form. Providing accurate information helps expedite the process and prevents any potential issues.

Common mistakes

Filling out the Capitec Bank Opening form requires attention to detail. One common mistake is providing incomplete information. Each section must be filled out completely, including the applicant's full name and SA ID number. Omitting any one of these details can lead to delays in processing the application.

Another frequent error is failing to provide the correct residential address. It’s essential to ensure that both the physical address and postal code are accurate. Incorrect information can cause issues in account verification and may require resubmission of the form.

People also often underestimate the importance of the relationship declaration section. Specifying the relationship to the applicant is crucial. Stating “friend” instead of detailing the nature of the relationship, such as “family friend,” may cause confusion, impacting the application’s legitimacy.

Lastly, not attaching the required documents can be a significant mistake. The form requests confirmation of the residential address through supporting documents. Skipping this step undermines the application and halts the process entirely. Make sure to double-check that all required attachments are included before submission.

Documents used along the form

When opening an account with Capitec Bank, several forms and documents may be required in addition to the Capitec Bank Opening form. These documents help verify identity, address, and other essential information. Below is a list of commonly used forms and documents in this process.

- Proof of Identity: A government-issued ID such as a South African ID book, smart ID card, or valid passport is required to establish the identity of the applicant.

- Proof of Residential Address: Acceptable documents might include utility bills, bank statements, or lease agreements. This serves as evidence of the applicant's current residence.

- Income Verification: Recent pay slips or tax returns may be requested to confirm the applicant's income. This is particularly important for assessing creditworthiness.

- Employment Details: A letter from the employer detailing the applicant's position, salary, and duration of employment may be necessary to provide additional employment verification.

- Declaration of Financial History: This document summarizes the applicant's financial history, including any previous banking relationships or outstanding debts.

- Minor Consent Form: If the account is being opened for a minor, a consent form signed by the parent or guardian is typically required.

- Tax Compliance Declaration: Applicants may need to confirm their tax compliance status to ensure adherence to legal requirements.

- Signature Verification Form: This is required to ensure that the signature on the account opening form matches that of the applicant's ID document.

Gathering the appropriate forms and documents expedites the account opening process. Each document plays a crucial role in ensuring compliance with regulatory standards and protecting both the bank and the customer.

Similar forms

- Bank Account Opening Form: This form is similar to the Capitec Bank Opening form as it collects essential details from clients wishing to open a bank account. Information such as personal identification, physical address, and contact information are key similarities.

- Residential Address Verification Form: Just like the Capitec Bank form, this document is used to confirm the residency of an applicant. It often requires proof of residence and a declaration about the applicant’s living situation.

- Affidavit of Residency: An affidavit provides a legal declaration of an individual’s residence, echoing the verification aspect of the Capitec Bank form. This document typically includes sworn statements from those confirming the applicant’s address.

- Proof of Address Submission Form: This form is used to submit proof of an address, like utility bills or lease agreements. It serves a similar purpose to the Capitec form by establishing the applicant's physical location for banking records.

Dos and Don'ts

When filling out the Capitec Bank Opening form, keep these tips in mind:

- Make sure to use clear and legible handwriting.

- Double-check all personal information before submitting.

- Provide accurate details for the applicant's relationship with the declarant.

- Include the correct physical address, including the postal code.

- Attach any required documents to confirm the residential address.

Avoid the following common mistakes:

- Do not leave any fields blank unless they are not applicable.

- Avoid using nicknames or initials; use full names instead.

- Do not forget to sign and date the declaration.

- Avoid submitting the form without verifying that all information is correct.

- Do not provide false information, as it may lead to issues with your application.

Misconceptions

- Misconception: All clients need to provide their own proof of residence. Many people believe they must provide personal proof of residence to open an account. However, the form allows a declarant to confirm the applicant's address if the applicant cannot provide the necessary documentation.

- Misconception: Only immediate family members can be a declarant. While many may think only close relatives can certify someone's address, the form explicitly includes a range of relationships. This can include domestic workers, boarders, or others residing at the same address.

- Misconception: The declaration must be signed in front of a notary. Some assume that a notarized signature is required for validity. In fact, the form does not mandate notarization, so the declaration is sufficient as signed by the declarant.

- Misconception: The documents required to verify the address are extensive. Many think that a long list of documents is needed. In reality, the form specifies that only a few approved documents are necessary, which simplifies the process.

- Misconception: The application cannot proceed without a complete set of documents. It is a common belief that incomplete applications will lead to immediate rejection. However, as long as the declaration form is filled correctly, the application process can still continue while additional documentation is gathered.

- Misconception: The physical address must always match the ID document. Some people think that the address on their ID must match exactly with the address provided in the form. The focus is on confirming the residence through the declarant, not strict alignment with ID details.

- Misconception: This form only applies to certain types of accounts. Individuals may believe that this declaration is limited to specific types of savings accounts. In fact, it applies to all clients opening a savings account and is a standard part of the account opening process for Capitec Bank.

Key takeaways

When filling out and using the Capitec Bank Opening form, there are several key points to keep in mind. Understanding these will make the process smoother and ensure all necessary information is accurately provided.

- Know the Purpose: This form is essential for clients who cannot present any of the approved documents for verifying their residential address.

- Accurate Information: Double-check that all personal details, such as your name, surname, and South African ID number, are written correctly to avoid processing delays.

- Complete All Sections: Ensure that every part of the form is filled out, especially the declaration of your residential address. Any missing details could lead to rejection.

- Relationship Disclosure: Clearly state the nature of your relationship with the applicant. This helps the bank understand the context of the declaration.

- Document Verification: Attach valid documents that prove your residential address. This is crucial, as the bank will rely on these for confirming residency.

- Date and Signature: Don’t forget to sign the form and include the specific date and location. Incomplete signature details may result in the form being considered invalid.

- Consultant’s Role: Be aware that the sales consultant assisting you will also need to sign the form. Their signature validates your application further.

By following these guidelines, you can ensure a smoother experience when navigating the Capitec Bank Opening form.

Browse Other Templates

Fr-500 New Business Registration Form - Section I gathers essential business information such as the business name and address.

Uhc Global Claims Address - Understanding the correct use of this form can lead to more efficient claims management.

Difference Between Series 70 and 80 1911 - Completing this form ensures compliance with regulations.