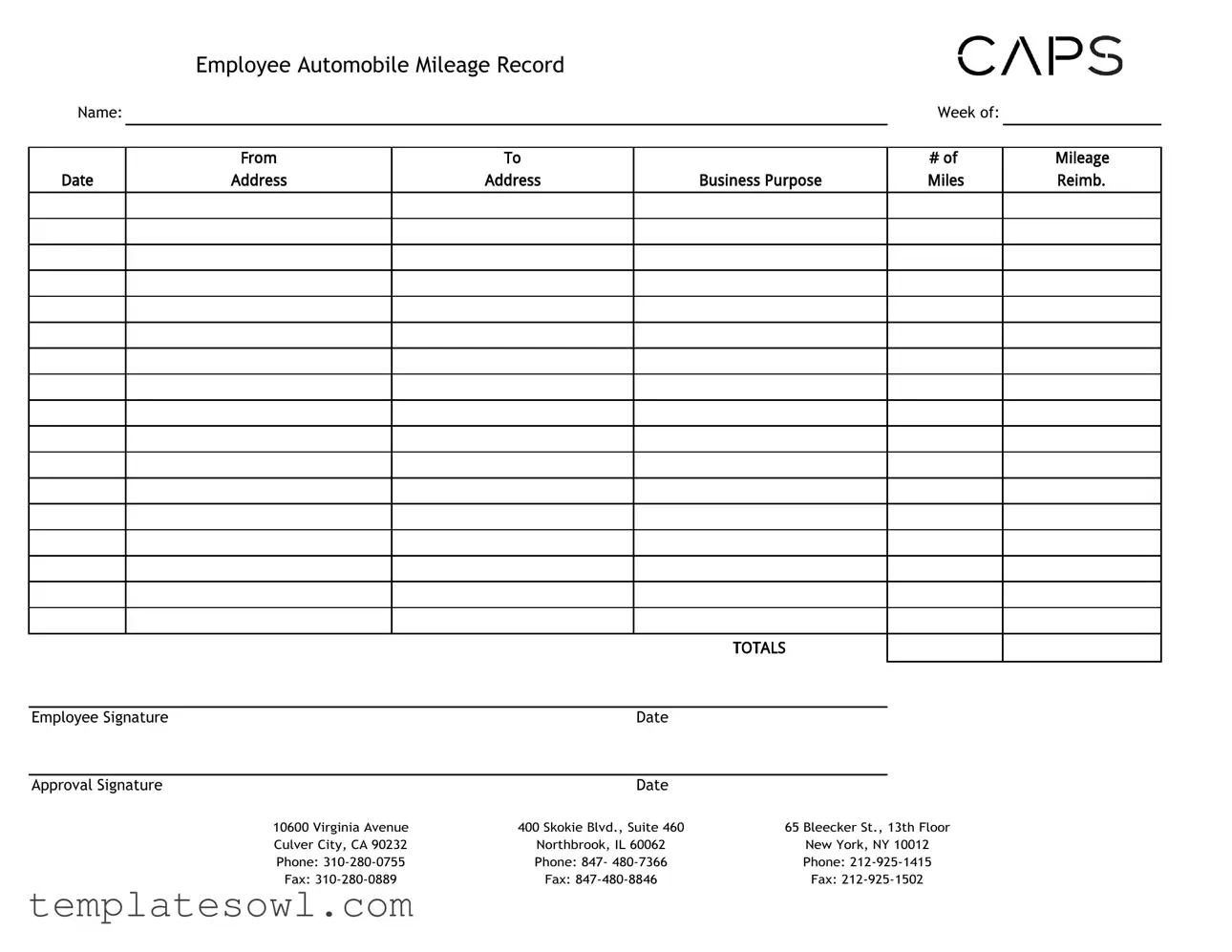

Fill Out Your Caps Form

The Caps form is essential for tracking employee automobile mileage accurately. It allows employees to record their weekly travel data, ensuring they provide necessary details, such as their name, the specific week in question, and addresses for both the origin and destination. This form is vital for reimbursement purposes, as it requires the employee to state the business purpose of each trip. Important sections include spaces for signatures from both the employee and their approving supervisor, which authenticate the entries made. The detailed addresses provided for various offices, including locations in Culver City, Northbrook, and New York, ensure clarity and accuracy when compiling records. By maintaining precise mileage logs, organizations can streamline their reimbursement processes and ensure compliance with federal regulations. The Caps form plays a critical role in fostering transparent communication regarding travel-related expenses, benefiting both employees and employers. Furthermore, having a structured format helps eliminate confusion and reduces the risk of errors in financial accountability.

Caps Example

Employee Automobile Mileage Record

Name: |

|

Week of: |

|

|

|

'DWH

)URP

$GGUHVV

7R

$GGUHVV

%XVLQHVV3XUSRVH

RI 0LOHV

0LOHDJH 5HLPE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

727 |

$ |

/6 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approval Signature |

Date |

|

|

|

|

|

|

|

|

|

|

10600 Virginia Avenue |

400 Skokie Blvd., Suite 460 |

|

|

|

|

|

|

|

65 Bleecker St., 13th Floor |

||

Culver City, CA 90232 |

Northbrook, IL 60062 |

|

|

|

|

|

|

|

New York, NY 10012 |

||

Phone: |

Phone: 847- |

|

|

|

|

|

|

|

Phone: |

||

Fax: |

Fax: |

|

|

|

|

|

|

|

Fax: |

||

Form Characteristics

| Fact Title | Details |

|---|---|

| Name of the Form | Employee Automobile Mileage Record |

| Applicable States | California, Illinois, New York |

| Purpose | To record and document an employee's mileage for business purposes. |

| Contact Information | Available through three offices: Culver City, CA; Northbrook, IL; New York, NY. |

Guidelines on Utilizing Caps

Once you have the Caps form in hand, it’s important to ensure all information is accurately documented. Completing this form helps to keep precise records of your mileage, which may be relevant for reimbursements or other business purposes. Follow these steps to fill it out correctly.

- At the top of the form, fill in your Name.

- In the designated area, indicate the Week of for which you are reporting your mileage.

- For the section labeled From Address, enter the address you are starting your trip from.

- Next, in the To Address field, provide the destination address for your trip.

- State the Business Purpose of Miles. Be clear and concise about the reason for your travel.

- Document the number of miles driven in the Mileage section.

- Sign the form in the Employee Signature area and include the Date of signing.

- An additional approval signature is required. Have your supervisor sign in the Approval Signature section and enter the Date of approval.

- At the bottom of the form, you will see three addresses. Depending on your location, use the appropriate contact information to submit your form.

What You Should Know About This Form

What is the purpose of the Caps form?

The Caps form, specifically the Employee Automobile Mileage Record, serves to document the miles employees drive for business purposes. It is an essential tool for tracking expenses related to travel, ensuring that employees are reimbursed accurately for their work-related driving.

How should I fill out the Caps form?

To complete the Caps form, begin by writing your name and the week for which you are reporting mileage at the top of the document. Next, record each trip's details, including the starting address, destination address, and the total miles driven. Be sure to sign and date the form at the bottom. This information will help facilitate the reimbursement process.

Who needs to approve the Caps form?

The Caps form requires an approval signature from a designated authority within your organization. Typically, this might be your supervisor or a manager responsible for overseeing travel expenses. Their approval ensures that the details provided are verified and in accordance with company policy.

Where do I submit the completed Caps form?

After filling out and obtaining the appropriate signatures, submit the completed form to your accounting or human resources department. Depending on your organization’s procedures, this might be done electronically or as a physical document.

What information do I need to provide for business travel?

When documenting business travel, include the addresses of your starting location and your destination, as well as the total miles traveled for each trip. You should also note the purpose of the trip, as this context can be helpful for reimbursement reviews and record-keeping.

What should I do if I forgot to record my mileage on the Caps form?

If you forget to record mileage, it is important to reconstruct your travel as soon as possible. Gather any evidence you can, such as emails or calendar entries, to confirm your trips. You can then fill out the Caps form with this information. Depending on company policies, you may need to explain the oversight during the approval process.

Common mistakes

Filling out the Caps form can seem straightforward, but mistakes are common and can lead to delays or issues with reimbursement. One significant error is neglecting to include the employee's full name. This detail is crucial for ensuring that the mileage record can be correctly attributed to the right individual.

Another frequent mistake involves omitting the week of mileage reporting. Without this information, it is challenging to verify and process the records efficiently. Make sure to specify the exact week for which the mileage is being claimed.

Inaccurate addresses can create confusion. Individuals should ensure that both the starting and ending addresses are correct and clearly stated. Any errors in addresses could result in discrepancies when calculating mileage.

Some may forget to indicate the purpose of mileage. Clearly explaining the business purpose for the trips helps justify the claims. This additional context can simplify the approval process.

The total mileage must be calculated accurately. Failing to add up the miles correctly is an oversight that can affect reimbursement amounts. Take the time to check this detail, as even a small error can lead to significant discrepancies.

Many people overlook the need for signatures on the form. Both the employee and the approver must sign and date the form to validate the record. Without these signatures, the form may be considered incomplete.

Submitting the wrong form version can complicate matters. Ensure you are using the most recent version of the Caps form. Outdated forms might not be accepted, causing delays in processing your mileage reimbursement.

Inconsistent formatting within the form can also lead to confusion. Using a standard format throughout makes the document easier to read and process. Avoid mixing different styles and ensure that the information is presented uniformly.

Finally, failing to keep a copy of the submitted form is a mistake that can lead to future complications. Keeping a personal record of the submission can safeguard against potential disputes or questions regarding mileage claims.

By being mindful of these common errors, individuals can improve their chances of completing the Caps form accurately and efficiently, facilitating a smoother reimbursement process.

Documents used along the form

The Caps form is commonly used to track employee automobile mileage for business purposes. Alongside this form, several other documents may be required to ensure record-keeping is thorough and compliant. Below is a list of forms and documents that may accompany the Caps form.

- Mileage Reimbursement Request: This form is submitted by employees to request reimbursement for mileage incurred during work-related travel.

- Travel Authorization Form: Employees complete this form prior to traveling for business to obtain approval and outline expected expenses.

- Expense Report: This document summarizes all expenses related to business activities and is used to request reimbursement for various costs, including mileage.

- Vehicle Registration and Insurance Documents: Copies of these documents may be required to verify that the vehicle used for business purposes is properly insured and registered.

- Employee Travel Policy: This policy outlines the company's guidelines regarding travel, expense reporting, and reimbursement processes.

- Receipts for Fuel Expenses: Employees should keep receipts for fuel purchases, which may be needed to support reimbursement claims.

- Annual Mileage Summary: This report aggregates an employee’s total mileage for business purposes over the year for tax and accounting purposes.

- Accident Report Form: If an accident occurs while on a work trip, this form needs to be filled out to document the incident for company records.

- IRS Form 2106: This is a tax form used by employees to deduct work-related expenses, including mileage, on their tax returns.

- Driver's License Copy: A copy of the employee's valid driver’s license may be required to ensure they are legally permitted to operate a vehicle.

Proper use of these documents not only streamlines the reimbursement process but also helps maintain compliance with company policies and tax regulations.

Similar forms

-

Expense Report: Like the Caps form, an expense report is used to document business-related expenditures. Employees detail specific costs incurred while performing their job duties. Both documents require an employee's signature and supervisor approval. This promotes accountability and ensures proper documentation for reimbursement.

-

Time Sheet: A time sheet records the hours worked by employees, much like the Caps form tracks mileage. Each document is essential for accurate payroll processing. Just as approval signatures are needed on the Caps form, time sheets may also require supervisor verification.

-

Travel Authorization Form: This form is similar to the Caps form as it authorizes travel expenses related to business. Employees detail their planned travel, including mileage. Both forms necessitate approval to ensure that costs align with company policies.

-

Reimbursement Request Form: This document serves a similar purpose, allowing employees to seek reimbursement for out-of-pocket expenses incurred during work activities. Whereas the Caps form centers specifically on mileage, the reimbursement request may cover a broader range of expenses, enhancing financial oversight and transparency.

Dos and Don'ts

When filling out the Caps form, it is crucial to be meticulous in your approach to ensure accuracy and compliance. Here are four recommendations to consider, splitting them into actions to take and actions to avoid.

- Double-check your information to avoid mistakes. Ensure that your name and other personal details are correct before submission.

- Provide accurate mileage records. Each entry should be clear and reflective of actual distances traveled.

- Include all required signatures. Ensure both the employee and approval signatures are present to validate the form.

- Submit the form on time. Adhering to deadlines is essential for processing and reimbursement.

In contrast, here are several common pitfalls to avoid when completing the Caps form:

- Do not forget to include dates for each trip recorded; this information is vital for clarity.

- Avoid estimating distances instead of using actual mileage. Estimates can lead to complications in reimbursement.

- Do not leave blank spaces on the form. Completing every section is necessary to avoid delays.

- Resist the urge to submit incomplete forms. Ensure that all required information is filled out before you turn it in.

Misconceptions

Misconceptions surrounding the Caps form can lead to confusion and errors in record-keeping. Understanding these misconceptions can enhance compliance and ensure accuracy in filing. Below are seven common misconceptions:

- The Caps form is only for employees driving for work purposes. Many believe that mileage tracking applies solely to employees using their vehicles for business tasks. In reality, the form is applicable for any mileage accrued in relation to work-related activities.

- One can submit the form without approvals. Some individuals think they can submit a mileage record independently. However, approval signatures are a necessary part of the process to ensure the accuracy and legitimacy of the reported mileage.

- All mileage is reimbursed at the same rate. A common assumption is that the same reimbursement rate applies to all types of vehicle use. Different rates may exist based on organizational policies or specific circumstances.

- It is acceptable to estimate mileage. Some individuals might feel it's acceptable to provide estimates. Accurate reporting is crucial, as estimates could lead to discrepancies and potential audit issues.

- There is no deadline for submitting the Caps form. A misconception exists that submissions can be made at any time. However, timely submissions are often required within a specified period to streamline processing and reimbursements.

- The Caps form is only for full-time employees. Some believe that only full-time employees need to complete the form. In truth, part-time employees who incur work-related mileage must also document their travel.

- Once submitted, the Caps form is set in stone. A misunderstanding exists regarding the immutability of submitted forms. Modifications may be permitted if errors arise, provided that they are made within the organization's guidelines.

Key takeaways

When filling out the Caps form for employee automobile mileage, keep these key takeaways in mind:

- Accurate Entries: Ensure that all information, including your name and applicable addresses, is completed accurately to prevent any delays in processing.

- Consistent Mileage Records: Maintain a consistent record of mileage for each week. It’s essential for employee reimbursement and accountability.

- Signatures Are Crucial: Remember to obtain the necessary approvals by securing both your signature and the approval signature before submission.

- Submit Timely: Submit the completed form promptly to ensure timely reimbursement and proper reconciliation of company expenses.

These steps will help streamline the process and reduce the likelihood of issues arising during reimbursement. Keep a copy of your mileage record for your records as well, just in case you need to refer back to it later.

Browse Other Templates

El Pollo Loco Job Application Pdf - Discuss any limitations in work schedule clearly.

Motor Vehicle Maine - Complete the seller’s mailing address fully.