Fill Out Your Car Loan Application Form

When applying for a car loan, understanding the application form is vital for a smooth and successful process. This essential document collects personal information such as your name, address, and contact details to establish your identity. It also asks for employment details, including your employer's name, job title, and income, which help lenders assess your financial stability. Additionally, the form touches on your housing situation—whether you own or rent your home—and requests information about your monthly expenses. It's important to specify the type of vehicle you intend to buy, whether new or used, and to declare the desired loan amount and down payment. Inclusion of co-signer details or bankruptcy history can influence your approval chances, as lenders weigh these factors to determine risk. The application also contains provisions for permission to access your credit report, hold harmless agreements, and outlines the fees involved in the loan processing. Understanding these elements prepares you for filling out the form accurately and sets the stage for your financing journey.

Car Loan Application Example

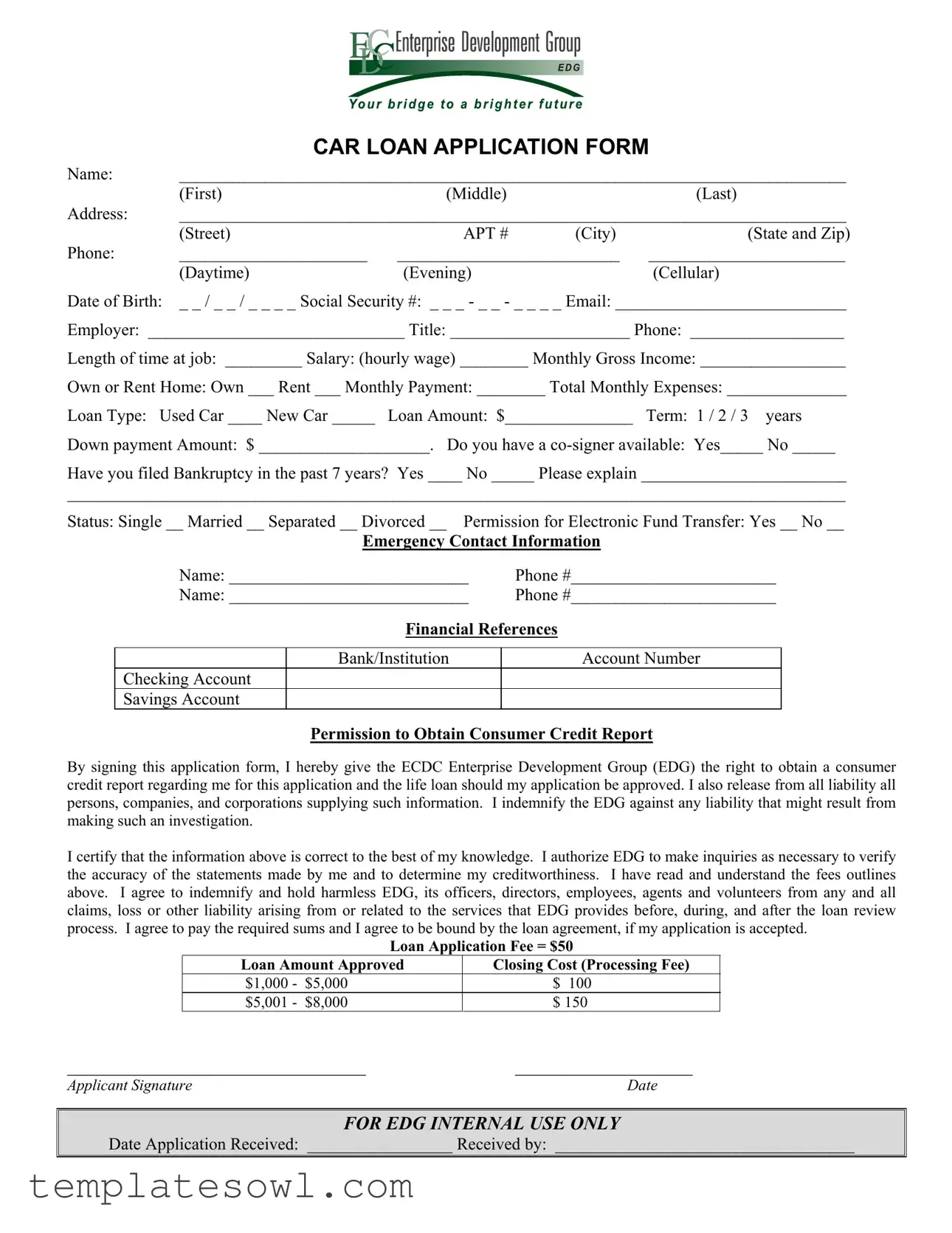

CAR LOAN APPLICATION FORM

Name: |

______________________________________________________________________________ |

|||

|

(First) |

(Middle) |

|

(Last) |

Address: |

______________________________________________________________________________ |

|||

|

(Street) |

APT # |

(City) |

(State and Zip) |

Phone: |

______________________ |

__________________________ |

_______________________ |

|

|

(Daytime) |

(Evening) |

|

(Cellular) |

Date of Birth: |

_ _ / _ _ / _ _ _ _ Social Security #: _ _ _ - _ _ - _ _ _ _ Email: ___________________________ |

|||

Employer: ______________________________ Title: _____________________ Phone: __________________

Length of time at job: _________ Salary: (hourly wage) ________ Monthly Gross Income: _________________

Own or Rent Home: Own ___ Rent ___ Monthly Payment: ________ Total Monthly Expenses: ______________

Loan Type: Used Car ____ New Car _____ Loan Amount: $_______________ Term: 1 / 2 / 3 years

Down payment Amount: $ ____________________. Do you have a

Have you filed Bankruptcy in the past 7 years? Yes ____ No _____ Please explain ________________________

___________________________________________________________________________________________

Status: Single __ Married __ Separated __ Divorced __ Permission for Electronic Fund Transfer: Yes __ No __

Emergency Contact Information

Name: ____________________________ |

Phone #________________________ |

|

Name: ____________________________ |

Phone #________________________ |

|

|

Financial References |

|

|

|

|

|

Bank/Institution |

Account Number |

Checking Account |

|

|

Savings Account |

|

|

Permission to Obtain Consumer Credit Report

By signing this application form, I hereby give the ECDC Enterprise Development Group (EDG) the right to obtain a consumer credit report regarding me for this application and the life loan should my application be approved. I also release from all liability all persons, companies, and corporations supplying such information. I indemnify the EDG against any liability that might result from making such an investigation.

I certify that the information above is correct to the best of my knowledge. I authorize EDG to make inquiries as necessary to verify the accuracy of the statements made by me and to determine my creditworthiness. I have read and understand the fees outlines above. I agree to indemnify and hold harmless EDG, its officers, directors, employees, agents and volunteers from any and all claims, loss or other liability arising from or related to the services that EDG provides before, during, and after the loan review process. I agree to pay the required sums and I agree to be bound by the loan agreement, if my application is accepted.

|

Loan Application Fee = $50 |

|

|

Loan Amount Approved |

Closing Cost (Processing Fee) |

|

$1,000 - $5,000 |

$ 100 |

|

$5,001 - $8,000 |

$ 150 |

________________________________ |

___________________ |

|

Applicant Signature |

Date |

|

FOR EDG INTERNAL USE ONLY

Date Application Received: _________________ Received by: ___________________________________

FOR EDG INTERNAL USE ONLY

Approval Documentation

Checklist of Documents Submitted with Application

1.Car Loan Application _____

2.Car Loan Application Fee (payment receipt) _____

3.*Applicant’s (2) Forms of I.D. One of them must show status _____

4.Applicant’s (2) Pay Stubs _____

5.

More Forms Collected Internally for Loan Decision

6.Applicant’s Credit Report _____

7.Credit Evaluation Form _____

8.Interest Matrix Form _____

9.Debt Ratio Form (less than 50%) _____

Loan Amount Approved: $_________________ Term: ______ Interest: ______%

Loan Officer Approval: __________________________ Date: ______________

*Example:

*****************************************************************************

FOR EDG INTERNAL USE ONLY

Approval Documentation

Checklist of Documents Collected for Disbursement 10.Review Documents Collected for Approval

11.Purchase Order Showing Required Down Payment Amount (From Dealer) _____

12.Vehicle Appraisal Value (KBB, From Dealer) _____

13.Vehicle Mechanical Check (Form Available) _____

14.Vehicle CarFax Report (From Dealer) _____

16.Closing Cost (Payment Receipt) _____

17.Guarantee of Lien Perfection Form (Form Available) _____

18.Car Key ____

19.Electronic Funds Transfer Form With Void Check (Form Available) _____

20.Signed & Notarized Loan Agreement (Provided by Loan Officer) _____

21.Amortization Payment Schedule (Loan Officer Submits This) _____

Portfolio Manager’s Initials: ______ Date: ________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Applicant Information | The car loan application form requires personal details such as name, address, date of birth, and Social Security number. |

| Contact Numbers | Applicants must provide three types of phone numbers: daytime, evening, and cellular for effective communication. |

| Employment Details | Information regarding employment, including employer name, job title, length of employment, and salary, is mandatory. |

| Property Status | Applicants indicate their housing situation by stating whether they own or rent their home, along with the associated monthly payment. |

| Loan Specifics | The form requests details about the type of car loan (used or new), desired loan amount, loan term, and down payment amount. |

| Bankruptcy History | Applicants must disclose whether they have filed for bankruptcy in the past seven years, with space provided for explanations. |

| Co-signer Option | The application inquires if the applicant has a co-signer available, which can affect the approval process and terms. |

| Electronic Fund Transfer Permission | Applicants need to consent to electronic fund transfers, which simplifies payment processes if approved for the loan. |

| Fees and Charges | A $50 loan application fee is required, along with a closing cost based on the approved loan amount, ranging from $100 to $150. |

| Governing Law | The applicable state laws govern the car loan process, affecting terms and consumer rights, which vary by jurisdiction. |

Guidelines on Utilizing Car Loan Application

Once you have everything gathered, filling out the Car Loan Application form is straightforward. Ensure that all information is accurate to avoid any delays. Read through the entire form carefully before starting to fill it out. Follow these steps to complete the application.

- Write your Name in the designated fields: First, Middle, and Last name.

- Fill in your Address: Street, Apartment number, City, State, and Zip code.

- Provide your Phone numbers: Daytime, Evening, and Cellular.

- Enter your Date of Birth in the specified format (MM/DD/YYYY).

- Input your Social Security Number in the correct format (XXX-XX-XXXX).

- Include your Email address.

- Indicate your Employer's name and your Job Title.

- Provide your employer's Phone number.

- State your Length of time at the job and your Salary.

- List your Monthly Gross Income.

- Check whether you Own or Rent your home, and provide your Monthly Payment.

- Enter your Total Monthly Expenses.

- Select the Loan Type: Used Car or New Car.

- Specify the Loan Amount you are applying for.

- Choose the Term for the loan: 1, 2, or 3 years.

- Input your Down Payment Amount.

- Indicate whether you have a Co-signer available.

- Answer if you have filed Bankruptcy in the past 7 years and provide an explanation if necessary.

- Mark your Status: Single, Married, Separated, or Divorced.

- Indicate whether you permit Electronic Fund Transfer.

- Fill in the Emergency Contact Information: Names and phone numbers.

- List your Financial References including Bank/Institution and Account Numbers.

- Review the Permission to Obtain Consumer Credit Report section and sign.

- Write in the Loan Application Fee and Estimated Closing Costs.

- Sign and date the application form at the bottom.

What You Should Know About This Form

What information do I need to provide in the Car Loan Application form?

In the Car Loan Application form, you will need to provide several key pieces of information. First, you will fill out your personal details, including your name, address, phone numbers, date of birth, social security number, and email. Next, employment information must be included, such as your employer's name, job title, and length of time at the job. You should also state your monthly gross income and whether you own or rent your home. Additionally, indicate the type of loan you are seeking, the amount, term, and down payment. Finally, you must answer questions related to co-signers and bankruptcy history.

How will my credit report be used during the application process?

Your credit report plays a crucial role in the loan approval process. By signing the application, you allow the lender, ECDC Enterprise Development Group (EDG), to obtain your consumer credit report. This report helps the lender assess your creditworthiness, meaning they will look at your credit history to determine how responsible you have been with past loans and debts. Good credit may improve your chances of approval and can potentially lead to better loan terms.

What fees should I expect when applying for a car loan?

When applying for a car loan, you should be aware of a couple of key fees. First, there is an application fee of $50. If your loan application is approved, you will also encounter closing costs that vary based on the approved loan amount. For example, closing costs are generally around $100 for loans between $1,000 and $5,000 and $150 for loans between $5,001 and $8,000. Be sure to review these fees carefully, as they can affect your overall budget for the loan.

Can I apply for a car loan if I have a bankruptcy on my record?

Yes, you can apply for a car loan even if you have filed for bankruptcy in the past. However, the lender may ask you to provide details about your bankruptcy, including the circumstances surrounding it and how long ago it occurred. Your overall credit history, including the bankruptcy, will be a factor in determining your creditworthiness. It’s essential to be honest on your application and provide any required explanations regarding past financial troubles.

Do I need a co-signer for the car loan?

A co-signer is not always necessary but may be required in certain situations. If your requested loan amount exceeds $8,000 and you are making a down payment of less than 20%, the lender may require a co-signer. A co-signer can help secure the loan by lending their creditworthiness to your application. If you do not have a co-signer available, it may still be possible to apply for a loan, but approval could be more challenging.

Common mistakes

Filling out a car loan application form can seem straightforward at first glance, but many applicants make key mistakes that could affect their chances of approval. One common mistake is failing to provide complete and accurate personal information. Each section of the application, from your name to your Social Security number, is essential. Leaving blanks or entering incorrect details may lead to delays or even denials. Always double-check that your data is accurate before submission.

Another frequent error involves the financial details section. Applicants often underestimate their monthly expenses or incorrectly state their income. Whether it’s rounding down your monthly salary or miscalculating how much you're spending on bills, these inaccuracies can misrepresent your financial situation. Being transparent and precise about your financial standing is crucial, as lenders rely on this information to assess your ability to repay the loan.

Some individuals neglect to consider the implications of having a co-signer. If you check “yes” for a co-signer but don’t have one lined up, your application can be rejected. It’s vital to have arrangements in place before applying. Additionally, if your co-signer has poor credit history, it could negatively impact your application. Thorough preparation in this area can make a substantial difference in the outcome.

Finally, many applicants overlook the importance of signing and dating the application. Even small omissions, like leaving out a signature, can render an application incomplete. This detail might seem trivial, but it carries significant weight. Always ensure that you've signed and dated your application, confirming that all provided information is truthful and that you agree to the terms outlined.

Documents used along the form

When applying for a car loan, it's essential to gather all necessary documents to facilitate a smooth approval process. Each form plays a critical role in assessing your financial situation and ensuring you meet the lender's requirements. Here’s a list of other forms and documents that are often needed alongside your Car Loan Application.

- Car Loan Application Fee Payment Receipt: This document confirms that you have paid the necessary fee to process your application, which typically ranges from $50.

- Two Forms of Identification: Complete identification is required. This could include a driver’s license, passport, or social security card, with one form indicating your current immigration status.

- Two Recent Pay Stubs: These serve to validate your income, confirming your employment and earnings history.

- Co-Signer Documents: If applicable, co-signer documentation is crucial, especially if you're requesting more than $8,000 and have less than a 20% down payment.

- Credit Report: A comprehensive credit report will assist the lender in evaluating your creditworthiness, providing a snapshot of your financial health.

- Credit Evaluation Form: This internal form allows the lender to analyze your credit situation in detail, including your previous loan history and payment habits.

- Interest Matrix Form: This document helps assess the interest rates that may apply to your loan, depending on your credit profile and the loan amount requested.

- Debt Ratio Form: Completing this form ensures your debts do not exceed 50% of your income, a factor that lenders consider crucial in the approval process.

- Purchase Order From Dealer: Following loan approval, this form demonstrates the required down payment amount, confirming your commitment to the purchase.

Having these documents prepared in advance can significantly streamline your car loan application process. Don't hesitate to consult with a professional for guidance on these requirements. Being proactive can save time and alleviate stress as you work towards acquiring your new vehicle.

Similar forms

- Mortgage Application Form: Like the car loan application, this document collects essential personal information, employment details, and financial status to evaluate eligibility for a home loan.

- Personal Loan Application Form: This form requests similar information as the car loan application, including income, creditworthiness, and purpose of the loan, helping lenders assess risk and repayment capacity.

- Credit Card Application: While primarily focused on credit limits and spending habits, it also requires personal identification and financial background, paralleling aspects found in car loan applications.

- Lease Application: This document gathers information regarding an applicant’s personal and financial situation, similar to a car loan application, particularly concerning income verification and rental history.

- Business Loan Application: This form collects data about business ownership, revenue, and financial history, akin to the methods in the car loan application used to determine loan eligibility and amount.

- Student Loan Application: It features inquiries about personal identification, financial circumstances, and educational pursuits, which resemble the income and identification details required in a car loan application.

- Home Equity Loan Application: This document assesses the borrower’s equity in their property while requiring similar financial disclosures and identifications as the car loan application.

- Small Business Credit Application: Gathered information in this form focuses on both personal and business financials, reflecting the same careful scrutiny as seen in car loan applications.

- Secured Loan Application: This form involves a detailed examination of personal finance and collateral, mirroring the structured approach of the car loan application in determining risk and approval.

Dos and Don'ts

When filling out a car loan application form, careful attention to detail can significantly improve your chances of approval. Here are some important dos and don’ts to keep in mind.

- Do: Provide accurate personal information. Ensure that your name, address, and contact details are complete and correct.

- Do: Disclose your financial situation honestly. List your monthly income, expenses, and any existing debts accurately.

- Do: Include all necessary documentation. Attach forms of identification and pay stubs as required by the application.

- Do: Check your credit report before applying. Understanding your credit status can prepare you for any issues that may arise.

- Don't: Leave any sections blank. Incomplete applications may get rejected instantly.

- Don't: Provide false information. This can lead to denial of the loan or even legal consequences.

- Don't: Ignore the loan terms and conditions. Read everything carefully to understand your obligations.

- Don't: Submit your application hastily. Take time to review all your answers before you sign and submit.

By following these guidelines, you can navigate the application process more effectively. Take your time and ensure every detail is well thought out. This approach will enhance your likelihood of securing the loan you need.

Misconceptions

- Misconception 1: The application form is overly complicated.

- Misconception 2: A co-signer is always required for loan approval.

- Misconception 3: Providing my Social Security number is optional.

- Misconception 4: My employment status does not impact loan approval.

- Misconception 5: Once I submit the application, I cannot make changes.

Many individuals believe that the car loan application form is too complex to understand. In reality, while there are multiple sections to fill out, each part is clearly defined. Gathering the necessary information beforehand can make the process smoother.

Some applicants may think that without a co-signer, they cannot obtain a loan. However, a co-signer is only necessary under specific circumstances, such as when requesting larger amounts or having a limited credit history.

There is a common belief that sharing a Social Security number is not mandatory. This is incorrect. The lender requires this information to assess the applicant's creditworthiness and identity accurately.

Many applicants assume that employment status has no relevance. In truth, consistent employment and sufficient income are crucial factors in the approval process. Lenders use this information to ensure that applicants can manage their loan payments.

Some people believe that the form is final upon submission. This is a misunderstanding. If any information changes before the loan decision, you can contact your lender to update your application. Open communication is encouraged to ensure accuracy.

Key takeaways

When filling out a Car Loan Application form, certain key considerations can enhance the process and improve your chances of approval. Here are some important takeaways:

- Always provide accurate personal information, including name, address, and Social Security number. Incorrect details can delay the approval process.

- Be transparent about your employment status and income. Accurate financial details are critical since lenders assess your ability to repay the loan.

- Indicate whether you own or rent your home. This information helps lenders gauge your financial stability and commitment.

- Choose the appropriate loan type. Decide between a used or new car loan before submitting your application.

- If applicable, secure a co-signer to improve your chances of approval, especially for larger loans.

- Read all terms regarding fees and conditions carefully, including the loan application fee and any potential closing costs.

- Authorize the lender to obtain your credit report. This step is essential for assessing your creditworthiness.

By paying attention to these details, you can streamline the application process and enhance your likelihood of obtaining the car loan you need.

Browse Other Templates

GAP Cancellation Form,GAP Refund Request,GAP Termination Request,Cancellation of GAP Coverage,GAP Policy Cancellation Form,Guaranteed Asset Protection Cancellation Notice,Request for GAP Cancellation,GAP Refund Application,Cancellation Request for GA - Please ensure all sections of the FP7209 form are completed before submission.

Nj St-50 - Calculate any applicable penalty and interest based on late payments or inaccuracies.