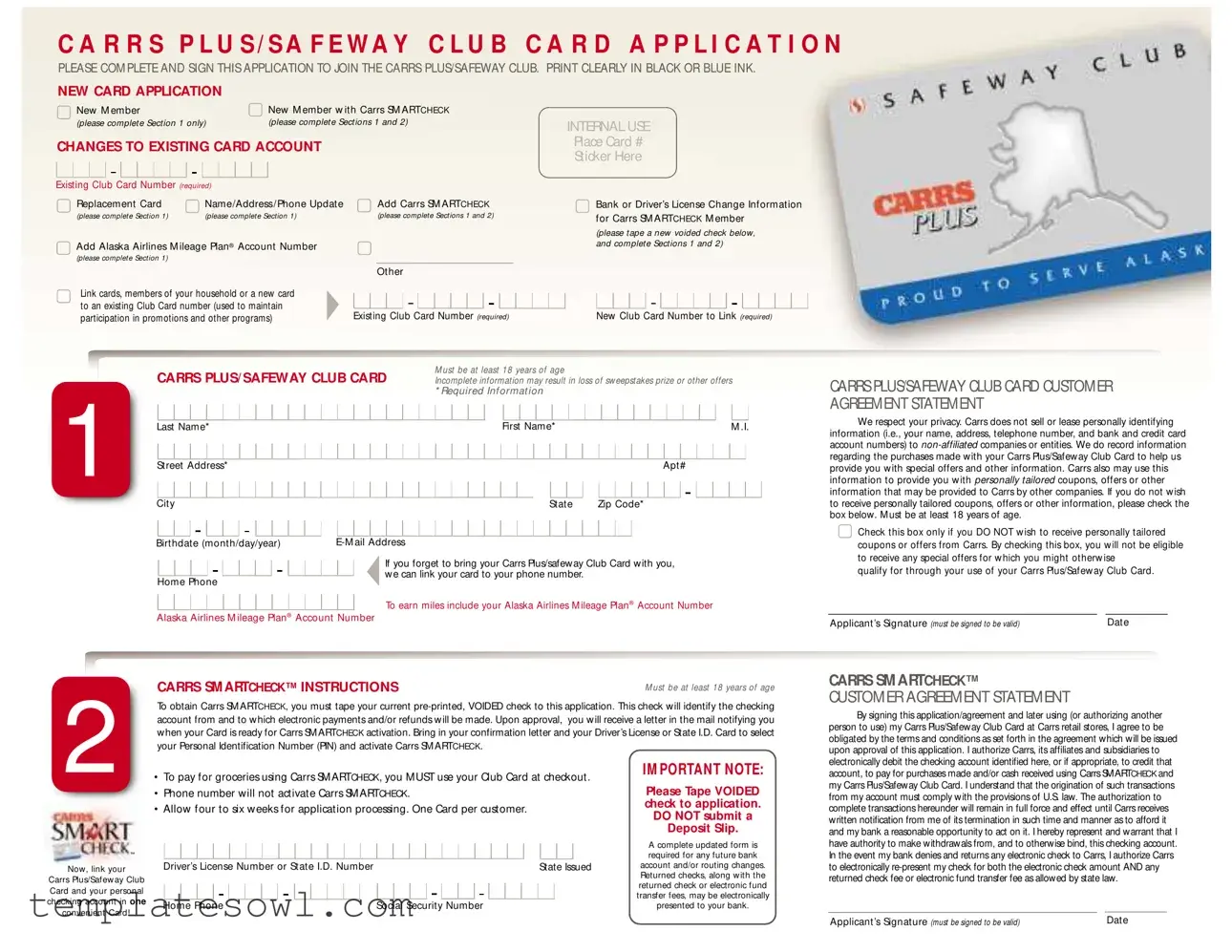

Fill Out Your Carrs Safeway Club Card Form

The Carrs Safeway Club Card form serves as a vital entry point for customers looking to benefit from exclusive promotions and offers. This application allows both new members and those updating their existing accounts to join the Carrs Plus/Safeway Club. It requires applicants to provide critical information such as their name, address, birthdate, and email, all written clearly in black or blue ink. Specific sections cater to various needs, including new memberships, account changes, and linking to an Alaska Airlines Mileage Plan Account. For customers opting for Carrs SMARTCHECK, there are additional instructions, such as taping a voided check and selecting a personal identification number upon activation. The form emphasizes customer privacy, assuring applicants that their personal details will not be sold or leased to outside entities. Those who do not wish to receive tailored promotions can opt out, though doing so may impact their eligibility for certain offers. Notably, participants must be at least 18 years of age to apply, underscoring the guideline to protect both the customer and the organization. Understanding these elements is crucial for anyone seeking to maximize their shopping experience at Carrs and Safeway locations.

Carrs Safeway Club Card Example

C A R R S P L U S / S A F E W A Y C L U B C A R D A P P L I C A T I O N

PLEASE COM PLETE AND SIGN THIS APPLICATION TO JOIN THE CARRS PLUS/SAFEWAY CLUB. PRINT CLEARLY IN BLACK OR BLUE INK.

NEW CARD APPLICATION

New M ember |

New M ember w ith Carrs SM ARTCHECK |

|

(please complet e Sect ion 1 only) |

(please complet e Sect ions 1 and 2) |

INTERNAL USE |

|

|

CHANGES TO EXISTING CARD ACCOUNT |

Place Card # |

|

Sticker Here |

||

|

Existing Club Card Number (required)

Replacement Card |

Name/Address/Phone Update |

|

|

Add Carrs SM ARTCHECK |

|||||||||||||

(please complet e Sect ion 1) |

(please complet e Sect ion 1) |

|

|

(please complet e Sect ions 1 and 2) |

|||||||||||||

Add Alaska Airlines M ileage Plan¨ Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(please complet e Sect ion 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|||||||||||||

Link cards, members of your household or a new card |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

to an existing Club Card number (used to maintain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Existing Club Card Number (required) |

|||||||||||||||||

participation in promotions and other programs) |

|||||||||||||||||

Bank or DriverÕs License Change Information for Carrs SM ARTCHECK M ember

(please t ape a new voided check below, and complet e Sect ions 1 and 2)

New Club Card Number to Link (required)

CARRS PLUS/ SAFEWAY CLUB CARD |

M ust be at least 18 years of age |

Incomplete information may result in loss of sw eepstakes prize or other offers |

|

|

* Required Inf ormat ion |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name* |

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name* |

|

|

|

|

|

|

|

|

|

|

M .I. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt# |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code* |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birthdate (month/day/year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you forget to bring your Carrs Plus/safeway Club Card with you, |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

we can link your card to your phone number. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To earn miles include your Alaska Airlines M ileage Plan¨ Account Number |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Alaska Airlines M ileage Plan¨ Account Number |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

CARRSPLUS/SAFEWAY CLUB CARD CUSTOMER AGREEMENT STATEMENT

We respect your privacy. Carrs does not sell or lease personally identifying information (i.e., your name, address, telephone number, and bank and credit card account numbers) to

Check this box only if you DO NOT w ish to receive personally tailored coupons or offers from Carrs. By checking this box, you w ill not be eligible to receive any special offers for w hich you might otherw ise

qualify for through your use of your Carrs Plus/Safew ay Club Card.

ApplicantÕs Signature (must be signed to be valid) |

Date |

2

CARRS SM ARTCHECK™ INSTRUCTIONS |

M ust be at least 18 years of age |

To obtain Carrs SM ARTCHECK, you must tape your current

CARRS SM ARTCHECK™

CUSTOMER AGREEMENT STATEMENT

By signing this application/agreement and later using (or authorizing another person to use) my Carrs Plus/Safeway Club Card at Carrs retail stores, I agree to be obligated by the terms and conditions as set forth in the agreement which will be issued upon approval of this application. I authorize Carrs, its affiliates and subsidiaries to electronically debit the checking account identified here, or if appropriate, to credit that

ª

Now, link your

Carrs Plus/Safew ay Club Card and your personal checking account in one convenient Card!

¥ To pay for groceries using Carrs SMARTCHECK, you MUST use your Club Card at checkout .

¥Phone number will not activate Carrs SMARTCHECK.

¥Allow four to six weeks for application processing. One Card per customer.

DriverÕs License Number or State I.D. Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Issued |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone |

Social Security Number |

|||||||||||||||||||||||||||||||

I M PORTAN T N OTE:

Please Tape VOIDED check to application.

DO NOT submit a

Deposit Slip.

A complete updated form is required for any future bank account and/or routing changes. Returned checks, along w ith the returned check or electronic fund transfer fees, may be electronically presented to your bank.

account, to pay for purchases made and/or cash received using Carrs SMARTCHECK and my Carrs Plus/Safeway Club Card. I understand that the origination of such transactions from my account must comply with the provisions of U.S. law. The authorization to complete transactions hereunder will remain in full force and effect until Carrs receives written notification from me of its termination in such time and manner as to afford it and my bank a reasonable opportunity to act on it. I hereby represent and warrant that I have authority to make withdrawals from, and to otherwise bind, this checking account. In the event my bank denies and returns any electronic check to Carrs, I authorize Carrs to electronically

ApplicantÕs Signature (must be signed to be valid) |

Date |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Requirement | Applicants must be at least 18 years old to fill out the Carrs Safeway Club Card application. |

| Information Accuracy | Providing incomplete or inaccurate information may result in the loss of eligibility for promotions or sweepstakes prizes. |

| Personal Information Protection | Carrs commits to not selling or leasing personal information to non-affiliated entities. |

| Linking Card to Phone Number | If a member forgets their card, the club card can be linked to their phone number for easier access. |

| Alaska Airlines Mileage Plan | Members can earn miles by including their Alaska Airlines Mileage Plan account number on the application. |

| SMARTCHECK Activation | To activate Carrs SMARTCHECK, applicants must tape a voided check to the application for identification purposes. |

| Special Offers Eligibility | Opting out of tailored offers prevents eligibility for certain special promotions linked to the Carrs Club Card. |

| State-Specific Requirements | Certain states may have additional laws governing electronic fund transfers; applicants should check local regulations. |

| Authorization of Transactions | Applicants authorize Carrs to debit their checking account for purchases made with Carrs SMARTCHECK. |

Guidelines on Utilizing Carrs Safeway Club Card

After you have gathered the necessary information and materials, including a voided check if you are applying for the Carrs SMARTCHECK feature, proceed with filling out the Carrs Safeway Club Card form. This will allow you to join the club and access various offers and promotions. Follow the steps below to complete the application accurately.

- Read the Form Instructions: Begin by carefully reading the instructions on the form. Ensure you understand what information is required.

- Select Your Application Type: Mark the appropriate option based on your application type: "New Member," "New Member with Carrs SMARTCHECK," or any changes needed for an existing account.

- Provide Personal Information: Fill in your last name, first name, and middle initial. Make sure to print clearly in either black or blue ink.

- Enter Your Address: Include your street address, apartment number (if applicable), city, state, and zip code.

- Input Birthdate: Write your birthdate in the requested format (month/day/year).

- List Your Contact Details: Provide your email address and home phone number. This is essential for receiving information related to your membership.

- Complete Alaska Airlines Mileage Plan Information: If applicable, include your Alaska Airlines Mileage Plan account number to earn miles.

- Signature and Date: At the bottom of the form, sign your name and include the date. Your signature confirms that you agree to the terms outlined in the form.

- Attach Voided Check: If you are applying for Carrs SMARTCHECK, tape a current pre-printed, VOIDED check to the application. Do not submit a deposit slip.

- Review Your Application: Double-check all the information you provided to ensure that it is correct and complete. Incomplete information may delay the processing of your application.

Once you have filled out the form completely, you can submit it according to the provided instructions. This will initiate your membership and link your card to any associated benefits you wish to enroll in.

What You Should Know About This Form

What is the Carrs Safeway Club Card and how do I obtain one?

The Carrs Safeway Club Card is a loyalty card that offers members special discounts, coupons, and promotions at Carrs retail stores. To obtain one, you need to complete the application form. You can sign up as a new member or update existing information if you already have a card. Remember to provide all required details clearly and accurately. Once your application is processed, you’ll receive your card in the mail, granting you access to all the perks of membership.

Can I link my Carrs Safeway Club Card to my phone number?

Yes, you can link your Carrs Safeway Club Card to your phone number for convenience. If you forget to bring your physical card with you during your shopping trip, simply provide your phone number at the checkout. This allows the cashier to access your account and apply any discounts or offers that are associated with your card.

What should I do if I need to update my personal information?

If you need to update your personal information such as your name, address, or phone number, you can do so by completing the relevant sections of the application form. Make sure you have your existing Club Card number handy, as it’s required for these types of changes. Once you submit the updated form, your new information will be processed and reflected in your account.

Is there an age requirement to apply for the Carrs Safeway Club Card?

Yes, you must be at least 18 years of age to apply for the Carrs Safeway Club Card. This age limit ensures that members are legally able to enter into agreements and fully benefit from the offers provided. If you're not yet 18, you will need to wait until you reach that age to enroll.

How secure is my personal information on the Carrs Safeway Club Card?

Your privacy is important. Carrs does not sell or lease your personal information, such as your name, address, or banking details, to outside companies. They only record information related to your purchases to tailor promotions and special offers to you. If you prefer not to receive personalized offers, you can opt out in the application form.

Common mistakes

Filling out the Carrs Safeway Club Card form can feel straightforward, but there are common mistakes that many applicants make. Avoiding these errors can ensure that your application is processed smoothly and you can enjoy the benefits of membership.

One frequent issue occurs when applicants fail to provide all required information. The form clearly marks certain fields with an asterisk, indicating they must be completed. Omitting details like your last name, birthdate, or zip code can delay your application or even result in disqualification from promotions and offers.

Another mistake involves not printing clearly. The instructions specify using black or blue ink, yet some applicants write too lightly or in a way that's hard to decipher. When information cannot be accurately read, it might lead to errors in setting up your account, which could prevent you from accessing your benefits or result in account setup delays.

Many people also neglect to review their contact information. Providing an incorrect email address or phone number can make it difficult for Carrs to reach you regarding your application status or to send important information about offers and promotions. Double-checking this information is a critical step for proper communication.

Additionally, some applicants overlook the signature requirement. The application must be signed to be valid, and this signature not only acknowledges your agreement to the terms but also authorizes Carrs to process your application. Without a signature, your application could be thrown out entirely, wasting your time and effort.

It's also common for individuals to skip the instruction about providing a voided check if applying for the Carrs SMARTCHECK. Taping a voided check to the application is essential for setting up your electronic payment system. Failing to include this step can hold up the activation of your account.

Some applicants mistakenly think they can use any form of identification instead of a driver's license or state ID. The instructions specify that one of these forms of ID is necessary to activate Carrs SMARTCHECK. Submitting other types of identification will not fulfill this requirement, so it's crucial to follow the guidelines precisely.

Lastly, many applicants do not allow for the processing time. The form states that you should allow four to six weeks for your application to be processed. Rushing to contact customer service before this time may not only be unnecessary but can lead to frustration if you don't receive immediate responses.

Documents used along the form

The Carrs Safeway Club Card form is an essential document for joining the Carrs Plus/Safeway Club. There are several other forms and documents that may accompany this application to assist in various processes. Below is a brief overview of those related documents.

- Alaska Airlines Mileage Plan Sign-Up Form: This document allows new members to link their Alaska Airlines account to the Carrs Safeway Club Card. Members can earn miles on their purchases, so providing the account number is necessary for integration.

- Replacement Card Request Form: For members who need a new card due to loss or damage, this form facilitates the process. It requires details about the existing account and ensures continuity of membership benefits.

- Personal Information Update Form: Changes to personal details like address, telephone number, or email can be submitted with this form. It helps maintain accurate customer records for better service and targeted offers.

- CARRS SMARTCHECK Application: This form connects the Carrs Plus/Safeway Club Card to a member's checking account for electronic checks. It requires a voided check to process transactions seamlessly.

- Privacy Preferences Opt-Out Form: If a member does not wish to receive personalized offers or communications, this form allows them to opt-out. It ensures that members can control their privacy choices effectively.

Each of these documents plays a crucial role in enhancing the member experience with Carrs Plus/Safeway Club. Completing them accurately can lead to better service, rewards, and tailored promotions.

Similar forms

Membership Application Form: Similar in purpose, both require personal details for membership in a rewards program. Information such as name, address, and contact details is provided by the applicant.

Loyalty Card Registration: Like the Carrs Safeway Club Card, loyalty card registrations typically ask for personal information to tailor offers and rewards to the user.

Credit Card Application: This document often collects similar identifying information, such as name, address, and social security number, to assess eligibility for credit.

Bank Account Application: Applicants provide personal details to open an account. The check requirement in the Carrs application is akin to notifying the bank of account preferences.

Subscription Service Registration: Subscriptions may require name and address details, just like the club card form, to maintain accurate records for services rendered.

Online Account Creation: Similar in function, both forms require users to create an account with personal information to access benefits, promotions, or services.

Health Insurance Enrollment Form: Health insurance forms gather personal data and consent for processing, resembling how personal information is handled in the club card application.

Utility Service Application: Utility applications often include personal information to establish service, much like the requirements of the Carrs card application.

Travel Rewards Program Enrollment: These programs collect user data to customize offers and accumulate rewards points, paralleling the intent of the Carrs Safeway Club Card.

Dos and Don'ts

When filling out the Carrs Safeway Club Card form, consider the following guidelines:

- Print clearly using black or blue ink. This helps ensure that your information is easily read and processed.

- Provide all required information. Missing details could delay your application or affect your eligibility for offers.

- Sign the application. Your signature is necessary for the form to be valid.

- If using Carrs SMARTCHECK, tape your voided check securely to the application. This verifies your checking account for transactions.

- Double-check your contact information. Accurate details, like your email and phone number, ensure you receive important updates.

- Keep a copy of your completed application. This can be helpful for reference in case you need to follow up later.

Also, be mindful of these things to avoid mistakes:

- Do not leave any required fields blank. Incomplete applications may be rejected or delayed.

- Avoid using a deposit slip instead of a voided check for SMARTCHECK. Only voided checks are accepted.

- Do not forget to check the box if you do not wish to receive special offers. This may affect your eligibility for promotions.

- Refrain from using a pen color other than black or blue; other colors can lead to issues in processing your form.

- Do not submit sensitive information, like your Social Security Number, unless absolutely necessary.

- Don't assume your application has been processed until you receive written confirmation. Verify to avoid misunderstandings.

Misconceptions

Misconception 1: You need to pay a fee to join the Carrs Safeway Club.

This is not true. Joining the Carrs Safeway Club is completely free. There are no fees associated with applying for or obtaining the membership card.

Misconception 2: The club card is only useful for discounts on groceries.

While the primary benefit is indeed grocery discounts, the club card also allows members to earn rewards points, which can be redeemed for other services, such as travel miles with Alaska Airlines.

Misconception 3: I can use my phone number instead of the physical card every time.

Although you can link your card to your phone number, using the physical card at checkout is required when using Carrs SMARTCHECK. This linkage helps ensure the accurate application of rewards and offers.

Misconception 4: My personal information will be sold to third parties.

This is a common concern, but it is unfounded. Carrs does not sell or lease your personal information to other companies. They only use your data to provide special offers tailored to you, unless you opt out.

Misconception 5: I can fill out the form with any type of ink.

It's specified that the application must be completed in black or blue ink only. Using the correct ink ensures the form is processed without delays.

Key takeaways

Here are some key takeaways about filling out and using the Carrs Safeway Club Card form:

- Ensure that you complete and sign the application when applying for the Carrs Plus/Safeway Club.

- Use black or blue ink to fill out the form clearly. This helps avoid any confusion when processing your application.

- Provide accurate personal information, including your last name, first name, address, and date of birth. Missing information could hinder your application.

- Make sure to include a valid email address. This allows Carrs to send you important updates and offers.

- If you want to link your card to your phone number, remember that forgetting your card does not mean you will miss out on savings.

- For Carrs SMARTCHECK, you must attach a pre-printed, voided check to the application. This identifies your checking account for transactions.

- Be aware that you must be at least 18 years of age to apply for the Carrs Plus/Safeway Club Card.

- Check the box if you prefer not to receive tailored offers. However, this means you might miss special deals.

Browse Other Templates

Primary Care Rate Enrollment Form - The document aims to streamline the process of receiving support for qualified healthcare providers.

What Age Can You Legally Move Out in Florida - Understanding the implications of emancipation is necessary.

Donor Profile - Primary phone number for the individual donor’s contact.